Gold World News Flash |

- The 5 year massive bull run in Gold and Gold Stocks continues

- GLD – Gold ETF Daily Chart

- Gold “the Most Important Reserve Asset”?

- GLD – Gold ETF Trading Signals

- If Deflation Wins, What Will Gold Stocks Do?

- Silent Crash: Dow Continues Slide vs. Gold

- Speculative Momentum Picking up the Slack for Crude and Gold

- Crude Oil Gains After Bullish Inventory Report, Gold Hits a new Record on Relentless

- Hourly Action In Gold From Trader Dan

- Market Commentary From Monty Guild

- In The News Today

- Ford Fiesta 1.8 Diesel Engine

- Greg McCoach: Preserving Your Precious Capital

- New Lower Low Prices

- .S. Mint Raises Premiums 33% to Shut Off Physical Demand

- The Rich Move to Metals

- Gold Daily RSI above 85

- Thoreau, Rico & Mortgage Fraud

- April Disconnect Part 2

- Dajin – Lithium, Potash and Gold

- LGMR: Gold Seen Outpacing at Fresh Dollar High as Global "Currency War" Intensifies

- Gold/Oil Ratio Against Equities

- Daily Dispatch: Notes from the Summit

- Are Gold Prices Too High for Investors?

- Grandich Client Crocodile Gold

- GoldSeek.com Radio Gold Nugget: Chris Powell & Chris Waltzek

- Market Outlook: It's Not, NOT a Growth Story

- Rosenberg: 'I Love Gold, But…'

- Rosenberg: 'I Love Gold, But…'

- Is Gold Set for a Pullback?

- High Court Judge Rules Paper Money “Almost Worthless”

- Chasing Tail-Risk with Gold – Ding Dong!

- The Incredible Two-Day Jump in US Treasure Debt

- A Hair-Trigger Alert for Bullion-Watchers

- $5,000 Gold Bandwagon Now Includes These 65 Analysts – Got Gold?

- Does A Dollar Crash Loom?

- Crude Oil Gains After Bullish Inventory Report, Gold Hits a new Record on Relentless

- Guest Post: Consumer Deleveraging = Commercial Real Estate Collapse

- Nine Bullish Arguments for Gold

- Some Questions (With Answers) About the Future Price of Gold

- $5,000 Gold Equates to $100 – $350 Silver – Here's Why!

| The 5 year massive bull run in Gold and Gold Stocks continues Posted: 06 Oct 2010 07:51 PM PDT Last August I penned an article predicting a massive five year bull run in gold and gold stocks. I outlined my reasoning and compared this 13 year period from 2001 to 2014 to the tech stock bull from 1986-1999. . In February of this year, I again wrote an article for Kitco.com explaining the 13 year Gold [...] |

| Posted: 06 Oct 2010 07:51 PM PDT |

| Gold “the Most Important Reserve Asset”? Posted: 06 Oct 2010 07:51 PM PDT Tim Iacono Apparently, after what's happened to the global financial system over the last few years, the world's central bankers have had a dramatic change in thinking about gold bullion, formerly known as the "barbarous relic". A metal once considered to be a remnant of a bygone era is now increasingly viewed [...] |

| GLD – Gold ETF Trading Signals Posted: 06 Oct 2010 07:51 PM PDT This 60 minute chart shows gold getting hit hard on Wednesday morning. Investors and traders around the globe were closing out positions and moving to cash. This high volume dumping of positions pulled virtually all investments lower and was the first tip-off that the market was in panic mode. One the dust [...] |

| If Deflation Wins, What Will Gold Stocks Do? Posted: 06 Oct 2010 07:51 PM PDT |

| Silent Crash: Dow Continues Slide vs. Gold Posted: 06 Oct 2010 07:49 PM PDT Tarek Saab submits: Rise in equities got ya bullish? Be cautious. Amidst the October push to 11,000, the Dow Jones Industrial Average has continued its calamitous descent against gold which began in 2001 and shows no signs of abating. The silent market crash is real, and the fall of this paper tiger is surreptitiously ferocious. As I wrote earlier this year, gold is not an investment. Gold is money - real money (see: Aristotle). Today, the rise in the Dow is being shown for what it really is - a crash - by that golden bedrock of monetary stability. Complete Story » |

| Speculative Momentum Picking up the Slack for Crude and Gold Posted: 06 Oct 2010 07:43 PM PDT courtesy of DailyFX.com October 06, 2010 04:08 PM Despite a reported tumble in fuel consumption in the US and an improvement in growth forecasts from the IMF, both crude and gold would extend their impressive rallies to new relative highs. Where do fundamentals end and speculative begin? North American Commodity Update Commodities - Energy Oil Closes Above $83 as the Dollar Slides and Global Growth Outlook Improves Crude Oil (LS Nymex) - $83.23 // $0.41 // 0.50% Where risk appetite withdrawals its support of oil’s advance, supply and demand factors look to take up the slack – and vice versa. The continuous US-based WTI futures contract rose for the fifth time in the past six days. Taking into account the pace of this advance, this is probably the most aggressive climb for the market since December. Furthermore, this rally has helped this benchmark pass the early-August $83 swing high and further confirm its 5-month high in the meantime. The persistence of ... |

| Crude Oil Gains After Bullish Inventory Report, Gold Hits a new Record on Relentless Posted: 06 Oct 2010 07:43 PM PDT courtesy of DailyFX.com October 06, 2010 10:51 PM Bullish enthusiasm continues to grip the financial markets, which once again buoyed crude oil and gold prices. With the U.S. jobs figure on tap for this Friday, we may be due for a bit of profit taking. Commodities – Energy Crude Oil Gains After Bullish Inventory Report Crude Oil (WTI) - $83.43 // $0.20 // 0.24% Commentary: Crude oil advanced for the fifth time in six sessions on Wednesday, on the back of a somewhat bullish U.S. crude oil inventory report. The government reported that crude oil inventories increased by 3.1 million barrels, gasoline inventories decreased 2.6 million barrels, distillate inventories decreased by 1.1 million barrels, and total petroleum inventories increased by 0.1 million barrels. We say the report was ‘somewhat bullish’ because the 5-year average for this date is for a 3.3 million barrel build in total petroleum inventories. Nevertheless, inventories remain 102 million barre... |

| Hourly Action In Gold From Trader Dan Posted: 06 Oct 2010 07:43 PM PDT View the original post at jsmineset.com... October 06, 2010 09:47 AM Dear CIGAs, The "78" floor on the USDX has now given way with the Dollar sinking into a handle of "77" in today's session. The results are becoming almost robotic – commodity prices move higher, gold and silver shoot north, bonds levitate upward and funny money pours into the US equities market as the stars line up in favor of further Quantitative Easing. I hope our monetary lords are pleased with their offspring for this little suckling baby will soon grow into a roaring beast devouring all the substance in the land. I do not believe history will be kind to Mr. Bernanke and company with the lone exception of Fed governor Thomas Hoenig, who has consistently been opposed to current FOMC policy and will be vindicated in his opposition to this madness. The Fed in its arrogance believes that is can somehow induce inflationary pressures into the economy and yet control it. This is akin to a 180 pound man grabbing a wi... |

| Market Commentary From Monty Guild Posted: 06 Oct 2010 07:43 PM PDT View the original post at jsmineset.com... October 06, 2010 10:21 AM Dear CIGA, THOSE WHO HOLD U.S. DOLLARS AS THEIR HOME CURRENCY HAVE MANY ATTRACTIVE INVESTMENT OPTIONS Over the last several years, we have pointed out in our commentaries many times that the U.S. dollar is due for long-term decline in price. Please visit www.guildinvestment.com for a complete archive of our commentaries to review the reasons that we have held, and continue to hold, this opinion. The following summarizes our opinions about some of the attractive opportunities U.S. dollar based investors have. 1. PROFIT FROM A DECLINING U.S. DOLLAR U.S. currency holders may diversify into commodities that are priced in dollars. As the U.S. dollar falls, the value of such commodities will rise. U.S. currency holders can shift their dollar cash and investments into stronger alternate currencies, which will move inversely to the dollar. As the dollar declines, these strong foreig... |

| Posted: 06 Oct 2010 07:43 PM PDT View the original post at jsmineset.com... October 06, 2010 10:55 AM Dear CIGAs, Note Mr. Fred’s pleasure with the gold price today. Jim Sinclair’s Commentary Bloomberg just put up a headline, "Time to Bust Open Fort Know." I can see it now. As the doors swing wide open to the applause of all the bureaucrats and talking heads a small mouse walks out of the empty nothingness. Jim Sinclair’s Commentary What raving BS. There is no NEW crisis, the old crisis never ended. It was papered over literally in April of 2009 when the FASB sold their souls. U.S. bank industry entering new crisis: analyst Whalen: Rising operating costs could force U.S. restructuring of big lenders By Ronald D. Orol, MarketWatch Oct. 6, 2010, 10:31 a.m. EDT WASHINGTON (MarketWatch) — The U.S. banking industry is entering a new crisis where operating costs are rising dramatically due to foreclosures and defaults, an analyst said in remarks prepared fo... |

| Posted: 06 Oct 2010 07:43 PM PDT View the original post at jsmineset.com... October 06, 2010 11:39 AM Dear CIGAs, This is a message to my friends in Great Britain. I wish to buy new or rebuilt Ford Fiesta 1.8 diesel engine. I am willing to pay in gold or worthless fiat paper of your choice. If you have any contacts to obtain this I would deeply appreciate it. My Dutton Amphibious car/boat engine has packed it in. The last sound to be heard was as if an elephant had exhaled. If you have or know of where one is available, please contact Editor Dan at [EMAIL="jsmineset@gmail.com"]jsmineset@gmail.com[/EMAIL] or [EMAIL="editor@jsmineset.com"]editor@jsmineset.com[/EMAIL].... |

| Greg McCoach: Preserving Your Precious Capital Posted: 06 Oct 2010 07:43 PM PDT Source: Brian Sylvester of The Gold Report 10/06/2010 Mining Speculator Newsletter Writer Greg McCoach is nothing if not outspoken. "The U.S. government is now getting to the point that it can no longer pay the interest on its Treasury Bill debt through normal means. Once this leaks out, the Fed will start creating money on top of money. It will become a total Ponzi scheme," he says. But Greg believes that same fiscal foolishness is creating opportunities in precious metals. In this exclusive interview with The Gold Report, Greg coaches you on how to preserve your capital with some junior mining stocks. The Gold Report: Greg, in your bio, it says you're also a bullion dealer. Please tell our readers about that side of your life. Greg McCoach: I got into this business in 1998. I had owned a commercial print and mail facility that I sold to a bigger fish and was looking at what I wanted to do with the rest of my career, when I happened to read J. Paul Getty's autobiogr... |

| Posted: 06 Oct 2010 07:43 PM PDT (Gold Sale!) Silver Stock Report by Jason Hommel, October 6th, 2010 The best thing about having honest employees is the honest accounting, which allows us to offer lower prices! We had a record business volume last month at the JH MINT! We also lowered a lot of overhead, and we are doing more with fewer and better employees. A lot of people are trading in gold for silver, and we are good sellers of silver, so we convince many people to buy silver, instead of gold. This has left us gold heavy recently. So, I decided to lower the prices over spot on all of our gold items for the lowest mark-up ever! We have 12 oz. of unique gold items offered at 2% over spot! Items like 5 of the 1 oz. "Universaro" gold coins, minted circa 1980 when the world thought the world might return to honest money. We also have 2 of the 1 oz. "California" gold coins, 3 Engelhard 1 oz. gold coins, a 1 oz. gold bar, and a few fractional gold coins. We have 40 Corona Gold coin... |

| .S. Mint Raises Premiums 33% to Shut Off Physical Demand Posted: 06 Oct 2010 07:43 PM PDT The US Mint is acting quickly to reduce extreme demand for American Silver Eagles. Just this week, the Mint declared that it would raise dealer premiums from $1.50 per ounce to $2.00, squeezing profit margins on the coins for dealers and making physical metals far more expensive than the spot price. Prices Change Globally Within hours of the announcement, prices for American Silver Eagles around the world jumped $.50 as dealers prepared to pay higher prices for future silver supplies. Similar to how gas stations raise prices before a change at the wholesale level, or how cigarette prices rise before a new tax, dealers have to allow the new price changes to set in before they actually do. In marketing, we'd call this "anchoring," or setting a new default price before a change to help ease the pain before consumers go to buy their next round of a certain product, or in this case, silver. The move from $1.50 over spot to $2.00 over spot is an effective nomin... |

| Posted: 06 Oct 2010 07:43 PM PDT Before this year, precious metals demand was mostly local, with a few large institutions and investment banks buying shorts on precious metals to mitigate any possible increase in price. However, as time goes on and investment banks around the global shutter their trading desks, big money is now moving into metals. So much big money is moving, in fact, that a number of investment banks are opening up new vaults to keep up with exploding demand. Major Moves into Metals JP Morgan was the first to reopen an underground vault in New York to cater to its wealthiest clientele. The company closed the vault in the 1990s when precious metals reached all time lows, but has since reopened it to make room for large buyers of gold to store their assets safely. A number of news agencies are now reporting that other banks such as the German Deutsche Bank and Barclay's will open new vaults in London to store precious metals amidst physical demand that hasn't been this high ... |

| Posted: 06 Oct 2010 07:43 PM PDT courtesy of DailyFX.com October 06, 2010 06:10 AM Daily Bars Prepared by Jamie Saettele Daily RSI is now above 85 as well as the November 2009 reading (intraday). An objective going forward remains 1405, which is the 100% extension of the 1048-1270 advance. The multi month channel line is at 1255 today. Only a drop below 1320 would begin to suggest a trend change.... |

| Thoreau, Rico & Mortgage Fraud Posted: 06 Oct 2010 07:43 PM PDT by Jim Willie CB October 6, 2010 home: Golden Jackass website subscribe: Hat Trick Letter Jim Willie CB, editor of the “HAT TRICK LETTER” Use the above link to subscribe to the paid research reports, which include coverage of critically important factors at work during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. Some significant events are in progress, extremely important developments in the grand pathogenesis that reflects the deep decay a... |

| Posted: 06 Oct 2010 07:43 PM PDT By Neil Charnock goldoz.com.au Gold now has an RSI reading of over 84 as I write this article; it is sitting just under US$1350 an ounce and it is very overbought. This is not to say it cannot get more overbought short term however it can indicate gold needs to take a breather very soon now. When fundamentals push additional cash flows along a trend the technicals will give way and reach extreme levels every time. We are more likely to see a price consolidation as that RSI cools off before it launches ahead again. Silver is agreeing with this scenario and so are the gold stocks. The AUD price of gold is currently $1377 which is well under the record highs reached in 2008 and the middle of this year. The Australian gold index is in power mode with the ASX – XGD nudging 8,000 today on a new break out. I have been saying that the Australian gold sector would play catch up one day and this is now coming to pass. I have screamed this from the WWW roof tops fo... |

| Dajin – Lithium, Potash and Gold Posted: 06 Oct 2010 07:43 PM PDT Richard (Rick) Mills Ahead of the Herd As a general rule, the most successful man in life is the man who has the best information The Puna plateau sits at an elevation of 4,000m, stretches for 1800 km along the Central Andes and attains a width of 350–400 km. The Puna covers a portion of Argentina, Chile and Bolivia and hosts an estimated 70 - 80% of global lithium brine reserves. The evaporate mineral deposits on the plateau - which may contain potash, lithium and boron - are formed by intense evaporation under hot, dry and windy conditions in an endorheic basin - endorheic basins are closed drainage basins that retain water and allow no outflow - precipitation and inflow water from the surrounding mountains only leaves the system by evaporation and seepage. The surface of such a basin is typically occupied by a salt lake or salt pan. Most of these salt lakes - called salars - contain brines which are capable of providing more than one potentially economic ... |

| LGMR: Gold Seen Outpacing at Fresh Dollar High as Global "Currency War" Intensifies Posted: 06 Oct 2010 07:43 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:40 ET, Weds 6 Oct. Gold Seen "Outpacing Drivers" at Fresh Dollar High as Global "Currency War" Intensifies THE PRICE OF GOLD rose to fresh Dollar records above $1350 an ounce early Wednesday, hitting its 16th new all-time high in 17 trading days at the London Fix this morning. Global stock markets also rose, as did major-economy government bonds, while the US Dollar slipped and commodities held flat.Silver prices touched their best level since 24 Sept. 1980 above $23 per ounce. "Gold is now outpacing its long-term drivers," says today's note from Walter de Wet at Standard Bank, pointing once more to low global interest rates and money-supply liquidity – but "not necessarily inflation – as the key factors pushing gold higher."The gold price has been rising much faster than liquidity [so] we are certainly more cautious with gold at these levels. Speculative length [in the derivatives market] is building, and sc... |

| Gold/Oil Ratio Against Equities Posted: 06 Oct 2010 07:43 PM PDT In my September 1st piece, I argued the importance of valuing Gold relative to Silver via the Gold/Silver ratio, concluding that gold will UNDERperfom silver despite its status in the limelight. Indeed, the G/S ratio has fallen 7% since the article, hitting a new 13-month low of 59.0. My case for "faster" gains in silver remain in place. So how about Gold/Oil ratio? Readers of my book and previous articles on the topic recall that the G/O index bears a highly negative correlation with risk appetite/stocks/market sentiment. The rationale being that when G/O ratio ceases to rise and begins to pull lower, it is a case of re-emerging energy prices relative to metals, usually reflecting improved appetite/higher growth/weak-US-based gains in energy prices. The converse case applies. The G/O ratio is especially valuable during the early stages of a rebound as it predicts deteriorating risk appetite and falling equities (2008 example) while a peak followed by an early stage decli... |

| Daily Dispatch: Notes from the Summit Posted: 06 Oct 2010 07:43 PM PDT October 05, 2010 | www.CaseyResearch.com Notes from the Summit Dear Reader, While one can never be sure about such things, I suspect this will be one of the most important editions of the Daily Dispatch we’ll ever send. I say that because I’ve just returned from our Casey’s Gold & Resource Summit, and my somewhat jetlagged brain is stuffed with information with the potential to change your world. A big claim, I know, but I sincerely believe it to be true. First and foremost, I need to restate the purpose of the conference. Namely, given gold's strong and long bull market, our primary mandate was to understand where we are in this gold bull market and how much higher gold could go. As importantly, we wanted to understand which fundamental factors would need to change in order to signal that the end of the bull market was nigh. With those overarching goals in mind, the summit faculty also addressed t... |

| Are Gold Prices Too High for Investors? Posted: 06 Oct 2010 07:43 PM PDT My co-editor Jared Levy and I were sitting in the audience at this year's 2010 Global Opportunities Summit in Las Vegas when gold hit a new record... Futures prices topped $1,300 an ounce, and Jared turned to me and said, "Now's the time to take some profits off the table." Friday saw gold for December delivery hit $1,319.70, another record, and traded as high as $1,322 at one point during the day. So what does this mean? Are gold prices too high? Will we see a correction? Or will gold continue its climb, and possibly hit $1,500 an ounce by the end of the year, as one analyst writes? I like gold, nearly at any price, for one specific reason: It always makes sense to allocate some portion of your investment portfolio to this precious metal, and hold it as a hedge against both currency and stock market fluctuations. But traders might see a different picture. Is the Gold Market Overheating? Traders might look at how gold prices have climbed 12% in the past 60 days, shoot... |

| Grandich Client Crocodile Gold Posted: 06 Oct 2010 07:43 PM PDT |

| GoldSeek.com Radio Gold Nugget: Chris Powell & Chris Waltzek Posted: 06 Oct 2010 07:00 PM PDT |

| Market Outlook: It's Not, NOT a Growth Story Posted: 06 Oct 2010 06:43 PM PDT David Goldman submits: Yesterday’s miserable ADP data blew up NASDAQ while the Dow eked out a small gain. The lesson? The recent rally was driven BOTH by fundamentals (strong corporate cash flows and balance sheets that benefit from low long-term interest rates) as well as the vain hope that the economy would start growing again. The tech sector’s improvement reflected the latter view. I don’t believe it, so I am staying away from tech stocks, financials, retailers and so forth. Quantitative easing, once again, won’t create economic growth. It will just reprice assets. In the Keynesian model, it is supposed to drive money out of safe-haven refuges (which have a negative real return) and into brick-and-mortar and, presumably job creation. What it does, in fact, is turn gold into a safe haven, and force an increase in the savings rate! That’s because prospective pensioners who thought they could retire with a 7% annuity are looking at a 4% annuity instead. They simply have to save more, and that’s bad for consumption. The cost of money isn’t the main obstacle to job creation. Obamacare and associated regulatory burdens are the big problem. Complete Story » |

| Rosenberg: 'I Love Gold, But…' Posted: 06 Oct 2010 06:40 PM PDT Edward Harrison submits: In David Rosenberg’s latest daily market commentary (.pdf), he showed some concern about the rally in gold and suggested near-tern caution. Rosenberg writes:

Complete Story » |

| Rosenberg: 'I Love Gold, But…' Posted: 06 Oct 2010 06:40 PM PDT Edward Harrison submits: In David Rosenberg’s latest daily market commentary (.pdf), he showed some concern about the rally in gold and suggested near-tern caution. Rosenberg writes:

Complete Story » |

| Posted: 06 Oct 2010 06:14 PM PDT Cullen Roche submits: Long time gold bull, David Rosenberg, is pulling in his horns. In yesterday morning’s note he said:

Complete Story » |

| High Court Judge Rules Paper Money “Almost Worthless” Posted: 06 Oct 2010 06:10 PM PDT In a recent High Court of Australia judgement on the Goods and Services Tax treatment of foreign currency transactions, I note with amusement Justice Dyson Heydon's statement that: "Apart from those rights [as legal tender], the pieces of paper had little value. They might have been used to stop an uneven table wobbling, or to jam shut a loose door, or to amuse small children, or to light a cigar. If the currency included coins, the coins might have been used to turn stiff screws or to lay on railway lines for the purpose of being flattened. But uses of that kind, which are very remote from their real purpose, would not prevent both the pieces of paper and the coins from being almost worthless." Before you rush to burn your money or flatten your coins, the judgement notes that "because the tokens are currency, the holder of the tokens can use them as a medium of exchange and as a store of economic value. Currency has value only because of the rights that attach to it." So relax, your paper money does have value. However, if you are concerned about what high inflation may do to the value of cash, you may wish to consider storing your surplus "economic value" in the form of legal tender bullion coins - sorry, tokens. Of course, I can't guarantee that precious metal prices will not fall, but at least you will always be able to use the coins to turn a stiff screw or two! |

| Chasing Tail-Risk with Gold – Ding Dong! Posted: 06 Oct 2010 06:03 PM PDT Okay, so Peta's breathless analysis – courtesy of some under-sexed sub-editor in Wapping, East London – is a little awry. (Market volatility in gold actually stands at a 5-year low.) But it's little wonder gold only pushed higher again on her hot market commentary, breaking to new all-time highs above $1350 an ounce just after she shared her insights with The Sun's 7.6 million readers. |

| The Incredible Two-Day Jump in US Treasure Debt Posted: 06 Oct 2010 06:02 PM PDT Things are getting so, so, so weird that I was locked inside the Mogambo Bunker Of Panic (MBOP), looking through the periscope to keep a vigilant watch for the social explosion outside that was coming, I figured, so, so soon, with my finger on the trigger of something fully loaded and reassuringly .45 caliber, and a slice of yummy pizza in my one free hand to keep my energy level up via the universal Magic Of The Pepperoni (MOTP). |

| A Hair-Trigger Alert for Bullion-Watchers Posted: 06 Oct 2010 06:01 PM PDT We want to pay very close attention to the rally in gold and silver right now, since a stall following such a dizzying climb could send bullion quotes into a 10% dive before most traders could react. We said here yesterday that silver in particular looks like it could use a rest; indeed, a key stock that Rick's Picks follows closely and in which we have a long position may already be anticipating it. |

| $5,000 Gold Bandwagon Now Includes These 65 Analysts – Got Gold? Posted: 06 Oct 2010 06:00 PM PDT |

| Posted: 06 Oct 2010 05:40 PM PDT |

| Crude Oil Gains After Bullish Inventory Report, Gold Hits a new Record on Relentless Posted: 06 Oct 2010 05:30 PM PDT courtesy of DailyFX.com October 06, 2010 10:51 PM Bullish enthusiasm continues to grip the financial markets, which once again buoyed crude oil and gold prices. With the U.S. jobs figure on tap for this Friday, we may be due for a bit of profit taking. Commodities – Energy Crude Oil Gains After Bullish Inventory Report Crude Oil (WTI) - $83.43 // $0.20 // 0.24% Commentary: Crude oil advanced for the fifth time in six sessions on Wednesday, on the back of a somewhat bullish U.S. crude oil inventory report. The government reported that crude oil inventories increased by 3.1 million barrels, gasoline inventories decreased 2.6 million barrels, distillate inventories decreased by 1.1 million barrels, and total petroleum inventories increased by 0.1 million barrels. We say the report was ‘somewhat bullish’ because the 5-year average for this date is for a 3.3 million barrel build in total petroleum inventories. Nevertheless, inventories remain 102 million barre... |

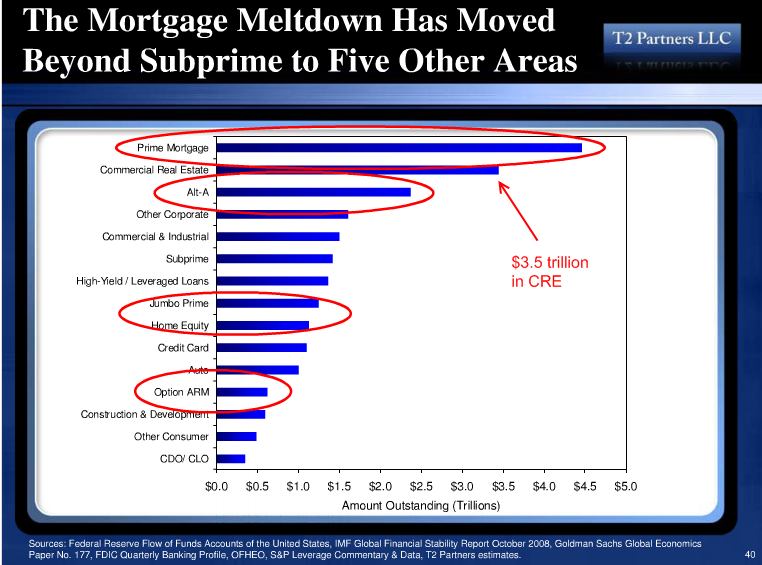

| Guest Post: Consumer Deleveraging = Commercial Real Estate Collapse Posted: 06 Oct 2010 05:20 PM PDT Submitted by Jim Quinn of The Burning Platform Consumer Deleveraging = Commercial Real Estate Collapse There is a Part 2 to the story of Consumer Deleveraging that will play out over the next decade. Consumers will deleverage because they must. They have no choice. Boomers have come to the shocking realization that you can’t get wealthy or retire by borrowing and spending. As consumers buy $500 billion less stuff per year, retailers across the land will suffer. To give some perspective on our consumer society, here are a few facts:

Despite the ongoing recession and the fact that consumers must reduce their spending over the next decade, irrationally exuberant retail CEOs continue their death march of store openings. Below are announced expansion plans for some major retailers:

Retailers expanding into an oversaturated retail market in the midst of a Depression, when anyone without rose colored glasses can see that Americans must dramatically cut back, are committing a fatal mistake. The hubris of these CEOs will lead to the destruction of their companies and the loss of millions of jobs. They will receive their fat bonuses and stock options right up until the day they are shown the door.

All of the happy talk from the Wall Street Journal, CNBC and the other mainstream media about commercial real estate bottoming out is a load of bull. It seems these highly paid “financial journalists” are incapable of doing anything but parroting each other and looking in the rearview mirror. Sound analysis requires you to look at the facts, make reasonable assumptions about the future and report the likely outcome. Based on this criteria, there is absolutely no chance that commercial real estate has bottomed. There are years of pain, writeoffs and bankruptcies to go.

Let’s look at some facts about the commercial real estate market and then assess the future:

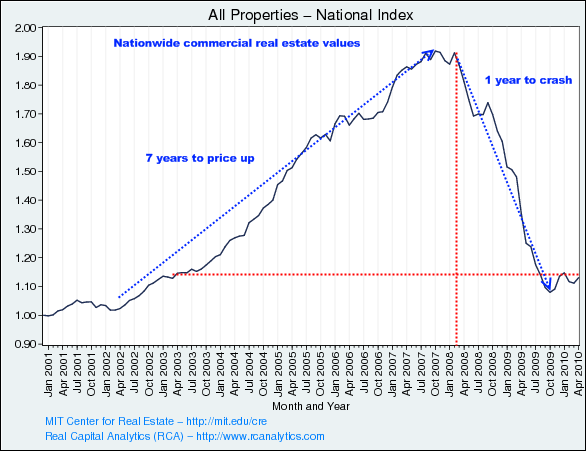

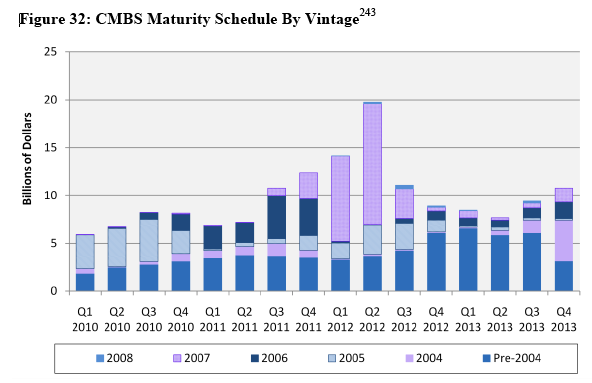

Do these facts lead you to believe that the commercial real estate sector has bottomed, as stated in the Wall Street Journal? The Federal Reserve realized the danger of a commercial real estate collapse to the banking system over a year ago. They have encouraged banks to extend and pretend. The website www.MyBudget360.com describes in detail what has occurred: What has happened is the Fed has allowed this shadow monetization of the debt and banks let borrowers roll over CRE debt without even making payments in many cases! Think of an empty shopping mall. There is no buyer for this in the current market. So why would a bank want to foreclose on the borrower? Instead, they pretend the asset is worth $10 million while the borrower makes no payment and the Fed keeps funneling money into the banking system. In the end, the value of the dollar gets crushed and you end up bailing out the banking system. Commercial real estate has collapsed even harder than residential real estate. This market is enormous in terms of actual debt. There is no official bailout on the books but it is occurring through a slow and deliberate process. Banks know that they are essentially insolvent and they are dumping this junk onto the taxpayer. This grim story began between 2004 and 2007. The horrifying ending will be written between 2011 and 2014. Commercial real estate loans for office buildings, malls, apartment buildings and hotels usually have 5 to 7 year terms. If you thought the debt induced bubble in real estate only affected residential real estate, you are badly mistaken. Before the boom, a normal year would see $100 billion in commercial real estate transactions. Between 2004 and 2007 there were $1.4 trillion of deals done, with 2007 reaching a peak of $522 billion of commercial real estate deals. Shockingly, the Wall Street banks, run by MBA geniuses, loaned developers a half trillion dollars at the very peak in the market. Sounds familiar. Thank God the taxpayer has bailed these Einsteins out so they could live to make more bad loans and collect big fat bonuses.

Commercial real estate prices rose 90% between 2001 and 2007, driven by the loose monetary policies of the Fed and complete lack of risk management on the part of the banks making the loans. Knuckle dragging mouth breather developers built malls, apartments, offices and hotels with abandon as billions of dollars rained down on them from Wall Street. The consumer delusion of debt financed wealth led to the developer delusion that 100% occupancy and increasing rents for all eternity were guaranteed. Commercial real estate prices have dropped 42% in just over a year. This means that the $6 trillion value of all the commercial real estate in the country has dropped to $3.5 trillion. The debt remained in place. The billions in debt issued in 2003 – 2005 is coming due between 2010 and 2012. The underlying assets are worth billions less than the debt that must be refinanced. Commercial loan payments by owners can only be made from cash flow generated by rental income. A key requirement in generating rental income is tenants. Let’s examine the current state of vacancy rates for offices, shopping malls and rental properties. The current office vacancy rate of 17.5% is the highest since 1993 and is just below the all-time high 18.7% in 1992. The WSJ has concluded, with no data or analysis, that the vacancy rate has bottomed. As the employment data proves, companies are not hiring employees. New companies are not being formed. Government mandates and regulations regarding healthcare and uncertainty about taxes will keep the formation of new small companies at a minimum. Conglomerates continue to ship jobs overseas. Part 2 of this Depression will drive more companies out of business. Office vacancies will remain at record levels for the next five years.

Mall vacancies between 9% and 11% are at record levels. There is absolutely no chance that these vacancy rates decline over the next few years. With consumers deleveraging, wages stagnant, unemployment high, and retail oversaturation, there are thousands of retail stores destined to close up shop. Ghost malls are in our future. They will come in handy as homeless shelters and soup kitchens. Mall developers will be defaulting in record numbers.

Apartment vacancy rates peaked at 11% in 2009, the highest level in history. With millions of vacant homes and millions of available rental units, rental rates will stay low for years. The cashflow of apartment developers will under stress and will lead to more loan defaults.

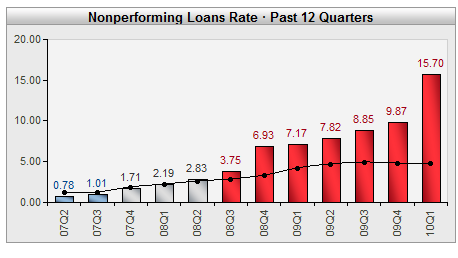

Based upon the current rising delinquency rates of 15.7% for commercial real estate loans and 9.05% for CMBS, there is no bottom in sight. Only raging mindless optimists like Larry Kudlow could ignore the facts and conclude that all is well in commercial real estate world. Banks pretending that the loans on their books aren’t worth 40% to 50% less, while also pretending that borrowers with negative cash flow can make loan payments, is not a solution. It is a Federal Reserve encouraged fraud. Allowing loans to be rolled over with no hope of ever being repaid will only prolong the pain and delay the inevitable.

The facts are that hundreds of billions in commercial loans are coming due, with a peak not being reached until 2013. If banks were to properly account for the true value of these loans, hundreds of regional banks would be forced to fail. This is unacceptable to government authorities. They will insist that the fantasy continue. Banks and real estate developers will pretend to be solvent, hoping the economy will miraculously repair itself and eventually make them whole. I understand these bank CEOs and delusional developers also believe in Santa Claus, the Easter Bunny, and the Efficient Market theory. It seems our entire financial system is based upon debt, fantasy, fraud, and delusion.

|

| Nine Bullish Arguments for Gold Posted: 06 Oct 2010 05:05 PM PDT |

| Some Questions (With Answers) About the Future Price of Gold Posted: 06 Oct 2010 05:05 PM PDT |

| $5,000 Gold Equates to $100 – $350 Silver – Here's Why! Posted: 06 Oct 2010 05:05 PM PDT More than 108 respected economists, academics, analysts and market commentators are of the firm opinion that gold will go to $2,500 and beyond before the parabolic peak is reached. In fact, the majority (75) think a price of $5,000 or more -even as high as $15,000 - is actually more likely! As such, just imagine what is in store for silver given its historical price relationship with gold! Words: 1361 |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment