Gold World News Flash |

- Jim Rogers Oct. 4: Economy Goes Up Gold Goes Up Economy Goes Down Gold Goes Up

- Verizon, AT&T and Disruptive White Space

- Warning: Second American Revolution Coming

- [Audio] King World News Interview: Ben Davies: Part II , The World Monetary Earthquake - The ...

- JAMES TURK CHARTS GOLD, SILVER, AND THE DOLLAR

- Doubt growing about central bank gold reserves

- Gold Hedging Against Tail Risk

- A Peck of Gold

- For week ending 01 October 2010

- Grandich Client Silver Quest Resources Presentation

- Gold and Silver - It Could Well Be a Whole New Ballgame!

- Connecting the Dots of Chinese Gold and Currency Reserves

- Byron King Plays Gold, Silver and REEs

- Hourly Action In Gold From Trader Dan

- Could Foreclosure Fraud Cause Another Banking Meltdown?

- The Day Securitized Debt On Mortgages Died

- The Rally Looks Tired

- Gold Bullish above 1300

- This past week in gold - Oct 04, 2010

- Gold Market Update - Oct 04, 2010

- How to Make $75,000 a Year Doing Absolutely Nothing

- Silver Market Update - Oct 04, 2010

- Alder Resources and Colombian Gold

- LGMR: Gold Slips with Euro as Israel Joins Japan in FX Intervention

- Crude Oil Unchanged After 2-Week Surge, Gold Holds Record Levels on Long-Term Concern

- Gold Seeker Closing Report: Gold and Silver End Barely Lower

- Thoughts on the Greater Depression

- British Pound Sterling GBP Currency Trend Forecast into Mid 2011

- A Market for Long-Term Investors

- Investors see silver lining in economic gloom

- ‘Gold looks positive, to hit $1405 by year end’

| Jim Rogers Oct. 4: Economy Goes Up Gold Goes Up Economy Goes Down Gold Goes Up Posted: 04 Oct 2010 09:23 PM PDT |

| Verizon, AT&T and Disruptive White Space Posted: 04 Oct 2010 06:34 PM PDT Tom Evslin submits: "Go white space," is the advice Horace Greeley would give if he were alive today. This supersedes previous advice given to Dustin Hoffmann to go into plastics just before his first romantic encounter with Mrs. Robinson as well as Greeley's earlier advice to go west. Use of the "TV white space" will be the new wild west in many ways; there should be a gold rush of innovation. "White space" is radio spectrum that used to be reserved for TV use. Some has been freed up by over-the-air TV shifting to digital broadcasting which needs less spectrum; some – particularly in rural areas – never was used for TV and now pretty clearly won't be. In a decision two weeks ago, the Federal Communications Commission (FCC) made it practical for this valuable idle resource to be used WITHOUT OWNERS OF TRANSMITTERS BEING LICENSED. This is a big deal. It will lead to enormous innovation; it gives American companies a valuable sandbox to innovate in; and it will also result in much better use of the available radio frequencies. Complete Story » |

| Warning: Second American Revolution Coming Posted: 04 Oct 2010 05:46 PM PDT Warning: Another revolution will cost investors 20% more lossesYes, big warning, the Second American Revolution will extract painful austerity, not the "happy days are here again" future touted by tea-baggers. For years it'll be impossible for most of America's 95 million investors to develop a successful investment or logical retirement strategy.Why? Political chaos will translate into extreme volatility and a highly unpredictable stock market. Result: Wall Street will lose another 20% of the value of your retirement portfolio in the next decade, just as Wall Street did the last decade. So if you think you're "mad as hell" now, "you ain't seen nuthin' yet!" Here's the timeline: Stage 1: The Dems just put the nail in their coffin by confirming they are wimps, refusing to force the GOP to filibuster the Bush tax cuts for America's richest. Stage 2: The GOP takes over the House, expanding its war to destroy Obama with its new policy of "complete gridlock," even "shutting down government." Stage 3: Obama goes lame-duck. Stage 4: The GOP wins back the White House and Senate in 2012. Health care returns to insurers. Free market financial deregulation returns. Stage 5: Under the new president, Wall Street's insatiable greed triggers the catastrophic third meltdown of the 21st century Shiller predicted, with defaults on dollar-denominated debt. Stage 6: The Second American Revolution explodes into a brutal full-scale class war rebelling against the out-of-touch, out-of-control greedy conspiracy-of-the-rich now running America. Stage 7: Domestic class warfare is compounded by Pentagon's prediction that by 2020 "an ancient pattern of desperate, all-out wars over food, water, and energy supplies would emerge" worldwide and "warfare is defining human life." More Here.. |

| [Audio] King World News Interview: Ben Davies: Part II , The World Monetary Earthquake - The ... Posted: 04 Oct 2010 05:19 PM PDT |

| JAMES TURK CHARTS GOLD, SILVER, AND THE DOLLAR Posted: 04 Oct 2010 05:15 PM PDT These factors are reflected in the above charts, which paint a clear picture – gold and silver are in uptrends with no sign of a top. We can therefore conclude that those factors driving the precious metals higher for the past several years will continue for the foreseeable future. The outlook for gold and silver remains very bullish. |

| Doubt growing about central bank gold reserves Posted: 04 Oct 2010 05:08 PM PDT In a wide-ranging interview about the financial markets, Robin Griffiths, market strategist for Cazenove Capital Management, tells Eric King of King World News that central banks probably don't have the gold they claim to have. The interview is 13 minutes long and you can listen to it here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/10/2_Robin_Griffiths.html |

| Gold Hedging Against Tail Risk Posted: 04 Oct 2010 05:05 PM PDT |

| Posted: 04 Oct 2010 05:00 PM PDT |

| For week ending 01 October 2010 Posted: 04 Oct 2010 04:24 PM PDT Technically Precious with Merv Nine weeks of consistent upside action. It can’t continue for much longer before something gives. Gold is once more becoming the talk of the town (or the financial columnists). That by itself is a warning of impending collapse. What do I think? See below. GOLD LONG TERM The long term can be dispensed very quickly. Gold continues to move well above its positive sloping moving average line. The long term momentum indicator continues to move higher inside its positive zone and above its positive sloping trigger line. The volume indicator continues to push higher into new high territory and above its positive sloping trigger line. Finally, the long term P&F chart remains in a bullish trend. What more is there to say? The long term rating at this time remains BULLISH. INTERMEDIATE TERM Looking at the short term chart (next section) we see an intermediate term up trending channel which covers the gold price action for the ... |

| Grandich Client Silver Quest Resources Presentation Posted: 04 Oct 2010 04:24 PM PDT |

| Gold and Silver - It Could Well Be a Whole New Ballgame! Posted: 04 Oct 2010 04:24 PM PDT The most recent COT (Commitment of Traders) report (chart courtesy Cotpricecharts.com), shows the ‘net short’ position of commercial gold traders to be at its highest level since December 18th 2009 (purple bar at far right). In the past whenever the number rose to the level of the last three weeks (300,000 see table at left), a correction soon followed. Not so much because of the large number of short positions (because these will eventually have to be covered), but because of the large number of long positions (blue-grey vertical bars), representing gold that is held for the most part by hedge funds. Many of these hedge funds use computer generated trading programs which kick in with a domino effect. Once a few begin to take profits, they all try to exit at the same time. At the present time the price of gold does not seem to be intimidated by the large COT “net short’ ... |

| Connecting the Dots of Chinese Gold and Currency Reserves Posted: 04 Oct 2010 04:24 PM PDT Bill Bonner here at The Daily Reckoning is one of those guys who, for some reason, figures that we (represented, apparently, by me) are smart enough to "connect the dots," when some of us (again, me as "everyman") are obviously not smart enough to engage in such mental gymnastics. For example, as the gold-bug, Austrian school of economics, gun nut, paranoid, lunatic, greedy lowlife that I am, I am instantly alerted to buy more gold when he writes, "Gold makes up only 1.7% of China's foreign exchange reserves. Many analysts believe China is targeting a 10% figure. If so, it would have to buy every ounce the world produces for two and a half years. Or, if it relies on only its own production – China is the world's largest producer – it would take nearly 20 years of steady accumulation to reach the 10% level." '"Wow!" I said to myself! The problem for me is that China's annual production of gold is, obviously, relatively fixed in the short run and, due to depletion of a finite resource... |

| Byron King Plays Gold, Silver and REEs Posted: 04 Oct 2010 04:24 PM PDT Source: Brian Sylvester of The Gold Report 10/04/2010 Some people speak softly and suppress their opinions. Newsletter Writer Byron King is not one of those people. "We have to quit screwing around. We have to get back to basics, back to capital investments and making things—important things. Great countries mine metals and minerals," he says. In this exclusive interview with The Gold Report, Byron shares several precious metals companies that are making important things and some juniors that are well on their way. The Gold Report: Byron, you are the editor of Agora Financial's large-cap newsletter Outstanding Investments and small-cap newsletter Energy and Scarcity Investor, both of which deal with resource sector investments and play the upstream extraction technology that goes into those sectors. But you also write for Whiskey and Gunpowder. Where does that fit into the mix? Byron King: Whiskey and Gunpowder is a free newsletter from Agora Financial featuring select ... |

| Hourly Action In Gold From Trader Dan Posted: 04 Oct 2010 04:24 PM PDT |

| Could Foreclosure Fraud Cause Another Banking Meltdown? Posted: 04 Oct 2010 04:24 PM PDT View the original post at jsmineset.com... October 04, 2010 08:35 AM (Courtesy of Greg Hunter of www.USAWatchdog.com) Dear CIGAs, This weekend, Bank of America became the latest lender to delay all foreclosures in 23 states because of possible problems with the necessary documents needed to repossess a home. GMAC Mortgage and JP Morgan Chase have had similar problems recently with documents that prove the bank has the right to foreclose. ADINews.com posted a statement from B of A, "We have been assessing our existing processes. To be certain affidavits have followed the correct procedures, Bank of America will delay the process in order to amend all affidavits in foreclosure cases that have not yet gone to judgment in the 23 states where courts have jurisdiction over foreclosures," BofA spokesman Dan Frahm said in a statement." (Click here for the entire ADINews.com story.) Florida Congressman Alan Grayson says the foreclosure document "problem" is really... |

| The Day Securitized Debt On Mortgages Died Posted: 04 Oct 2010 04:24 PM PDT View the original post at jsmineset.com... October 04, 2010 12:52 PM Dear CIGAs, The following is BREAKING NEWS: Racketeering suits (RICO), now as civil class action suits in two states, have hit the nail on the head. The civil suit says the banks do not have proper title to the homes on which they are foreclosing. This by direct inference questions if securitized debt on mortgages have real collateral behind them. Simply stated a long time ago by Marie McDonnell and myself, THEY DO NOT. That means legacy assets are cooked, dead, and worthless, yet are now marked up in value to cost and above. This is all thanks to FASB’s capitulation that now represents a large amount of capital for the Western world’s financial entities. The you know what hit the fan today for those that understand. October 4th 2010, the essence of securitized debt on mortgages died! That alone gives you gold at $1650.... |

| Posted: 04 Oct 2010 04:24 PM PDT The 5 min. Forecast October 04, 2010 12:41 PM by Addison Wiggin [LIST] [*] A stock rally that’s looking “tired”… Dan Amoss on why this is not March 2009 [*] $100 billion in a day… Uncle Sam’s drastic revision to the national debt [*] TARP is dead, but hardly buried… Rotting near-corpse of AIG dealt another setback [*] U.S. Mint deals silver investors a blow [*] Next shoe drops in the “who owns this title” scandal… Why it won’t crash the system [/LIST] It was the best of times... the best September for the broad indexes since 1939. Alas, “the September rally looks tired,” opines Dan Amoss as we kick off this first full week of October. “The timing and size of the Federal Reserve’s next round of money printing,” suggests Dan, “are driving the stock market right now. My read of both factors tells me that the market is at risk of another sharp move lower. &... |

| Posted: 04 Oct 2010 04:24 PM PDT courtesy of DailyFX.com October 04, 2010 06:23 AM Daily Bars Prepared by Jamie Saettele Daily RSI is now above 81. The rally is clearly extended. An objective going forward is 1405, which is the 100% extension of the 1048-1270 advance. The short term trendline is at 1333 today. A drop below 1300 would shift focus to last week’s low of 1275.... |

| This past week in gold - Oct 04, 2010 Posted: 04 Oct 2010 04:24 PM PDT Jack Chan JACK CHAN's Simply Profits. Precision sector timing for gold, energy, and technology. Oct 4, 2010 GLD – on buy signal. Becoming very overbought... *** SLV – on buy signal. Silver is now clearly overbought and going parabolic…… *** GDX – on buy signal. *** XGD.TO – on buy signal. Summary Long term – on major buy signal. Short term – on buy signals. We continue to hold our core positions, and wait for new opportunities. Gold and silver are going parabolic, with very strong momentum. We are not chasing them at these levels. ### Disclosure We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry point... |

| Gold Market Update - Oct 04, 2010 Posted: 04 Oct 2010 04:24 PM PDT Clive Maund Two of our three requirements for a major uptrend developing across the Precious Metals sector that were set out in the last Gold and Silver Market updates have now been met - first silver has broken out to clear new highs, then gold broke out above the top line of its potential bearish Rising Wedge - the only condition remaining to be fulfilled is a breakout by the stocks indices - and that may be imminent. The important complication is that both gold and silver are now critically overbought as a result of being in unbroken uptrends for many weeks and we will come to the implications of that shortly. On its 4-year chart we can see how gold has broken above the top line of the potential Wedge drawn across the highs from last December. The pale blue trendline shown, drawn from the early 2008 highs, does not mark the top boundary of a true Wedge, but is believed to have some significance and MAY trigger a temporary reaction, which the current criti... |

| How to Make $75,000 a Year Doing Absolutely Nothing Posted: 04 Oct 2010 04:24 PM PDT By Tom Dyson Monday, October 4, 2010 "All I do is push a few buttons, and I earn $75,000 a year…" Most entrepreneurs go into business seeking million-dollar fortunes. The entrepreneur I met last week, Bob, set up a business to generate $75,000 in income each year. Bob's business doesn't employ any staff, make any fancy products, or operate any complex machinery. To open shop in the morning, Bob turns on the lights, sets the air conditioning, and presses the buttons. Then, he spends the rest of the day sitting at a desk, watching the stock market, surfing the Internet, and, of course, collecting money. Bob lives in a town popular with young families. The schools are great. The community is safe. Parents have only one problem. It's extremely hot in the summer and cold in the winter, and the kids had nowhere indoors to run around. Bob noticed this gap in the market. So he leased an abandoned car dealership, outfitted the building with rubber floors and wall... |

| Silver Market Update - Oct 04, 2010 Posted: 04 Oct 2010 04:24 PM PDT Clive Maund Two of our three requirements for a major uptrend developing across the Precious Metals sector that were set out in the last Gold and Silver Market updates have now been met - first silver has broken out to clear new highs, then gold broke out above the top line of its potential bearish Rising Wedge - the only condition remaining to be fulfilled is a breakout by the stocks indices - and that may be imminent. The important complication is that both gold and silver are now critically overbought as a result of being in unbroken uptrends for many weeks and we will come to the implications of that shortly. On its 4-year chart we can see how silver has made a clear breakout to new highs this past week. This is an IMPORTANT BULLISH DEVELOPMENT that is believed to mark the start of a major uptrend in silver. However, the latest gains came at the cost of driving silver deep into critically overbought territory making consolidation/reaction very probable soon. T... |

| Alder Resources and Colombian Gold Posted: 04 Oct 2010 04:24 PM PDT [FONT=Times New Roman]Richard (Rick) Mills Ahead of the Herd [/FONT] As a general rule, the most successful man in life is the man who has the best information Colombia is a constitutional republic bordered to the east by Venezuela and Brazil, to the south by Ecuador and Peru, to the north by the Caribbean Sea (home to 20% of the population and the location of the major port cities of Barranquilla and Cartagena), to the northwest by Panama and to the west by the Pacific Ocean (the principal Pacific port is Buenaventura). World Atlas including Geography Facts, Maps, Flags - worldatlas.com An unprecedented mining and oil boom is taking place in Colombia because of: [LIST] [*]Significant improvement in the security situation [*]The economic stability of the country [*]Recent policy reforms - cutting capital controls, implementing legal stability contracts [*]A highly-qualified Colombian workforce [*]Rising commodity prices [*]Investment incentives [*]Diversificati... |

| LGMR: Gold Slips with Euro as Israel Joins Japan in FX Intervention Posted: 04 Oct 2010 04:24 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:50 ET, Mon 4 Oct. Gold Slips with Euro as Israel Joins Japan in FX Intervention, Monetary Policy "Supports Investment" THE PRICE OF GOLD for everyone but Australian and Eurozone investors slipped early Monday in spot gold market trade, briefly dipping below $1314 an ounce as silver prices dipped below $22.00 the ounce. Western stock markets also fell, while US crude oil contracts edged back from $81.50 per barrel and major-economy government bonds rose.China's financial markets are closed most of this week for national holidays.Tuesday brings interest-rate decisions in Japan and Australia, with the European and UK central banks announcing their latest policies on Thursday.US employment data – often a key driver of Dollar direction – then follows on Friday."Overall, we remain bullish for both gold and silver," says the finance division of Swiss refiners MKS. But "Typically, October isn't a good month for gold a... |

| Crude Oil Unchanged After 2-Week Surge, Gold Holds Record Levels on Long-Term Concern Posted: 04 Oct 2010 04:24 PM PDT courtesy of DailyFX.com October 03, 2010 10:51 PM Crude oil is due for a bit of consolidation after surging notably over the last two weeks. The battle between a brightening economic outlook and ample supplies should keep prices within the established range. Commodities – Energy Crude Oil Unchanged After 2-Week Surge Crude Oil (WTI) - $81.50 // $0.08 // 0.10% Commentary: Crude oil is unchanged in overnight trade after surging 6.7% last week. Over the last two weeks oil has risen an enormous 10.8%. Now that prices are back above $80 and near the top of the 1-year trading range between the high $60’s and low $80’s, gains should be much more gradual. Recall that this latest rally was due to a significant improvement in the global economic outlook, which has supported risk assets across the board, not just crude oil. The evolution of this outlook will be a major driver of oil prices in the coming weeks. The bias is bullish, but as supplies are a... |

| Gold Seeker Closing Report: Gold and Silver End Barely Lower Posted: 04 Oct 2010 04:00 PM PDT Gold rose a few dollars to as high as $1319.70 in Asia before it fell to see a $4.60 loss at $1311.90 in London and then rallied back to see a slight gain shortly before 8AM EST, but it then chopped around near $1315 in New York and ended with a loss of 0.06%. Silver climbed to $22.165 and fell to $21.871 before it rebounded in late trade and ended with a loss of 0.05%. |

| Thoughts on the Greater Depression Posted: 04 Oct 2010 03:56 PM PDT The Gold Report: Doug, at a recent conference you said that the US ought to default on its national debt now. Why that rather than letting it play out? Doug Casey: Several other things almost equally radical should be done besides defaulting on the debt. I recognize that an outright default is most unlikely, but the national debt should be defaulted on for several reasons. To start with, once the US government defaults on its debt, people will think twice before lending it any more money; giving politicians the ability to borrow is like giving a teenager a bottle of whisky and the keys to a Corvette. A second reason is that the debt is an albatross around the necks of the next several generations; it's criminal to make indentured servants out of people who aren't even born yet. A third reason would be to overtly punish those who have been lending money to the government, enabling it to do all the stupid and destructive things that the government does with that money. The debt will be defaulted on one way or another. The trouble is they're almost certainly going to default on it through inflation, by destroying the currency, which is much worse than defaulting on it overtly. That's because inflation will wipe out the relatively few people who are prudent in this country, those who are actually saving money. Because they generally save in the form of dollars, they're going to wipe them out financially. It's just horrible. Runaway inflation will reward the profligates who are in debt - people who've been living above their means. And punish the producers who've been saving and trying to build capital. That's in addition to the fact it will destroy millions of productive enterprises. A runaway inflation is the worst thing that can happen to a society, short of a major war. They just should default on it honestly, as it were. TGR: But your belief is we'll try to inflate our way out of it to pay for it. DC: Don't say "we." Say the US government. I don't consider myself part of the problem. Americans have to learn that the government isn't "us." It's an entity that has its own interests, its own life, its own agenda. It views citizens as milk cows - or perhaps even beef cows - strictly as a means to its ends. TGR: Whether it's overt or by default, doesn't that end up in the same place down the line? DC: There are two ways they can default - one by saying, "We don't have the money and we're not going to pay you," and the other by continuing to print up money and giving people the number of dollars that they're owed, except the dollars are worthless. The first alternative is by far better, for many reasons we can't fully explore now. But it's going to be traumatic either way. TGR: But the assumption that we could actually just print more dollars and pay off the debt implies that somewhere the debt will stabilize. DC: Oh no. It doesn't have to stabilize. To pay interest on the national debt, and to pay for additional spending, all the Federal Reserve has to do is buy bonds from the US government. It doesn't have to stabilize at all. The government is most unlikely to cut back on its spending, most of which has become part of the social fabric - Medicare, Social Security, unemployment benefits, food stamps, corporate bailouts, continuing foreign wars, domestic "security"...These people are crazy enough that it could get like Germany in the '20s or Zimbabwe a few years ago. TGR: At what point do we tip over and turn into a situation such as Zimbabwe or the Weimar Republic? DC: At the moment we're in an economic twilight zone or, if you wish, the eye of a hurricane. There is apparent stability in the economy. The stock market's high. The bond market's high. Only the real estate market is in visible trouble. Retail prices are level; they're not going up and maybe they're even going down in some cases. This is a temporary situation. We will inevitably - and soon - hit the other side of the storm. At some point those trillions of dollars created by the US government - and many other governments around the world have created trillions of currency units - are going to have an effect. When will that be? The timing is uncertain. But I think it's going to be soon. TGR: Will it be rapid? DC: If these things were perfectly predictable, it would be easier to dodge the bullet. This is an almost unique time in world economic history, and I think we're not only going to have economic consequences, but social and political consequences, and very likely military consequences. So hold on to your hat. TGR: To protect what individual wealth we may have, you've recommended selling real estate and renting, holding assets outside the United States, owning gold, etc. When we're out of the eye and in the thick of this economic hurricane, what types of equity investments should people be holding? DC: Now is a very bad time to have most kinds of equities; stocks in general are very overpriced, by almost every parameter. I'm not looking to sell my gold until I can buy solid blue chip stocks for dividend yields in the 8% to 10% area. That's after they cut their current dividends. Although it's certainly not the bargain it was 10 years ago. Nonetheless gold will go higher. Stocks will go lower. I don't know exactly when I'll sell my gold and buy stocks, but it will be when there's a panic into gold and when stocks are bargains. I'm sure I'll be afraid to make the trade when the time comes - but good trades almost always run counter to your emotions. Perhaps the tip-off will be when Newsweek or Time - if either still exists then - run a front cover with a golden bear tearing apart the New York Stock Exchange. I think it will be a generation before American real estate is a solid buy again. And the world at large will likely have quite a different character then. TGR: I take your point about equities in general, but are you also staying away from gold equities? Or do you maybe see an opportunity there? DC: They're a special situation; on the one hand they are a play on gold, but on the other hand they're stocks. There's an excellent chance that with the trillions of currency units being created, the government inevitably will wind up inflating other bubbles. There's a very good chance for a bubble in gold and a very big bubble in gold stocks. So I would say that they are an exception to other equities. We could see these juniors go up by an order of magnitude or more, even while most other stocks are going down. Historically, junior resource stocks are the most volatile class of securities in existence. TGR: Might other sectors also be in that situation? DC: My crystal ball is hazy, but it seems to me that junior resource stocks are the best speculative place in the equities market. There'll probably be others, but I don't see them very clearly at this time. I'm waiting to see what materializes. You have to look at all markets of all types, everywhere in the world, to find things that are overpriced, as well as things that are underpriced. Most of the time the trend in any given market is uncertain. I prefer to act only when, in my subjective opinion, the odds are greatly in my favor, and when the potential return is a multiple of my investment. In other words, most people invest 100% of their capital in hope of a 10% return. I prefer to wait until I can invest 10% of my capital for a 100% return. As to what's going to happen over the next few years, I feel confident that we've entered upon the Greater Depression in earnest. It will be an extended period of time when most people's standard of living drops significantly. But as I said, I think there's an excellent chance of a bubble igniting in resource stocks. That will build on the bubble that's going to come in gold. High levels of inflation make "investing," in the Graham-Dodd sense of the word, very hard. And inflation makes speculation almost necessary. Just don't confuse speculation with gambling - they're very different. Speculation is the art of capitalizing on politically created distortions in the market. TGR: What's your definition of resource stocks? For some, it's very broad and includes metals, agricultural commodities and such. Are you referring specifically to gold? DC: I'm most friendly toward gold; it's the only financial asset that's not simultaneously someone else's liability. I'm friendly toward silver, too, because silver is kind of poor man's gold. I'm very friendly toward oil because I do believe a good, solid argument can be made for what was first defined by M. King Hubbert as "peak oil." Also, oil is likely to be a major player in the next major Mideast conflict. I like uranium; nuclear is certainly the safest, cheapest, and cleanest form of mass power generation. There's an excellent case to be made for agricultural commodities in general, and live cattle in particular. I'm not very friendly toward base metals such as lead, zinc, copper, aluminum, iron and so forth. Usage of industrial metals could drop considerably in the ongoing depression. TGR: You mentioned earlier that you thought it would be a generation before real estate represents a good investment again. Many economic theories, though, tell us that real estate is a good thing to have in an inflationary environment. How do you reconcile those two schools of thought? DC: The problem is that we've just finished a decade-long real estate boom. Actually, there's been a property boom, largely driven by debt, since the end of World War II. There's been immense overbuilding and it's got to be absorbed. A lot of the overbuilding will have to be bulldozed, quite frankly, because it's completely uneconomic. I think the economic contraction we're going into is so serious that in this country you'll be able to buy real estate for back taxes, much like in the last depression. But it's much more serious than what happened in the 1930s when real estate taxes were de minimis. Now many people have to pay $10,000, $20,000, even $30,000 a year in taxes on their houses before they even start paying the mortgage and the utilities and maintenance. And municipalities are likely to try raising the mill rate, because they're largely bankrupt, and assessed values are way down. There's a great deal more I could say about what's yet to come in the real estate sector. But let me just say the real estate bubble has a long way to deflate yet. TGR: Is it both residential and commercial or is it worse in one sector? DC: That's tough. Is emphysema worse than Parkinson's? I suspect, however, that commercial is going to be worse than residential. People's shopping habits are one of the things that the Internet has changed and will continue to change. It makes more sense to buy things online and have them delivered to you, than to take the time and expense of going shopping, and the merchant having to deal with retail space, inventory, a geographically limited clientele and so forth. I wouldn't be surprised to see prices on a lot of commercial property come down 80% or 90%. You'll see a lot of properties permanently shuttered. That's a disaster for owners, who will still have to pay taxes. There will be no money for maintenance. TGR: We spoke earlier about inflation and the likelihood of the US government printing its way out of debt. Do you see a point in time where the United States or even other governments will go back to the gold standard? DC: It's both essential, and inevitable. That's because they have no reason to trust one another. They need a medium of exchange and a store of value that's not faith-based. All the other governments of the world know that the US is bankrupt and the dollar is nothing but a floating abstraction. Why should they hold billions or in some cases trillions of these things on their balance sheets? They're going to go back to gold because it's the only financial asset that's not simultaneously somebody else's liability. It's not because gold is magic in any way. It's just because it has characteristics that among the 92 naturally occurring elements make it uniquely well suited for use as money. It's durable. It's divisible. It's convenient. It's consistent. It has use value in and of itself. And it can't be created out of thin air by some government. It's a better combination of those things than any of the 92 elements. It's infinitely better than paper. So yes, I think they'll go back to gold within this generation. TGR: Thanks Doug! Casey Research and The Gold Report, |

| British Pound Sterling GBP Currency Trend Forecast into Mid 2011 Posted: 04 Oct 2010 03:52 PM PDT

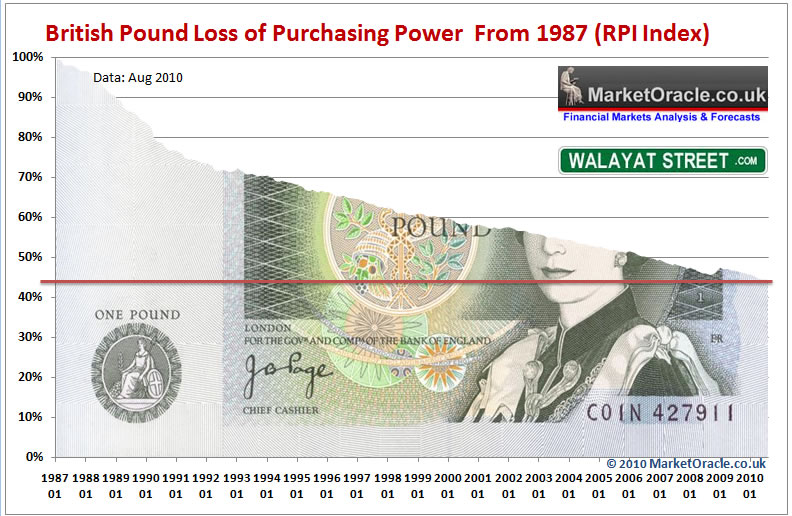

Now some may dispute which if any of the official inflation indices is reliable, after all for the past 10 years successive UK Government's have pushed towards using the Consumer Price Index (CPI) to measure inflation with the new Coalition government accelerating the trend to replace the Retail Price Index (RPI) because the RPI measure tends to trend 1% to 2% above the CPI measure, i.e. current CPI is at 3.1% whilst RPI is at 4.7%, with the RPI itself another 1-2% below the real rate of UK inflation that is nearer to 6% as illustrated by the below annualised inflation graph which maps out the unfolding UK Inflation forecast trend for 2010 (27th December 2009 (UK CPI Inflation Forecast 2010, Imminent and Sustained Spike Above 3%). UK CPI Inflation at 3.1% for August 2010 is precisely inline with the forecast for where CPI inflation would be by August 2010.

The below CPI index graph better illustrates the loss of purchasing power, during the 13 year Labour Government which saw a loss of purchasing power on CPI of 28% and on RPI of 35%, which basically makes a mockery of statements that the Pound is either too strong, or that the Pound is too weak, as in actual fact all governments are debasing their currencies at a continuous rate with forex fluctuations reflecting the relative rate of free fall against one another.

Whilst the mainstream press tends to wholly focus on the relative rates of exchange at particular points in time as a measure of sterling's strength or weakness, which as the below graph implies is suggestive of a trading range for sterling over the past 25 years of between an approximate high of £/$2.00 and low of £/$1.37, with the current rate of £/$ $1.58 being near the middle of its trading range of £/$1.69, which therefore given the weight of press commentary gives people the false assumption that sterling is managing to hold up well against the worlds reserve currency.

However, the real purchasing power of the British Pound is better illustrated by the below graph which shows rather than sterling hovering towards the middle of a 25 year range, it has in fact continued to lose value virtually every year which has seen sterling's real value erode to stand at approximately 45% of the value that it was at in 1987.

The above graph makes a mockery of all of the financial press as they give the various cross rates with commentary that sterling is strong or weak when in actual fact the inflation mega-trend ensures that there exists a stealth trend towards the erosion of the purchasing power of sterling so as to enable the government to run large deficits as well as stealth tax the loss of purchasing power by means of taxes on illusory interest returns and capital gains.

Deflation Delusion The worlds government's require inflation to help finance their ever expanding size and scope which ensures that this Mega-Trend is not going to disappear in some delusional deflationary economic outcome, the reasons for which I have covered at length in the Inflation Mega-trend Ebook (FREE DOWNLOAD) as well as the following recent articles -

The linked analysis basically concludes that there has been NO Deflation despite continuous stream of deflationary commentary form academic economists (paid sales men for the bankster fiat money printing system) that populate the mainstream press with much of their commentary and conclusions then further regurgitated by the BlogosFear. Whilst my analysis is primarily focused on the UK economy, however Puru Saxena recently wrote an article on the US Economy that is pretty close to many aspects of my take on bogus UK deflation expectations (24 Sep 2010 – Deflation Reality or Urban Myth? ). The most notable item in the article is the graph on total commercial bank lending that is expanding (inflating) rather than contracting (deflating), so much for debt deleveraging deflation!

I am sure there are many more such examples of the illusion of debt deleveraging deflation especially where consumers are concerned given the highly artificial government supported U.S. housing market, which follows on from more than a year of debt deleveraging deflation mantra from pseudo economists that contribute towards the primary reason why over 90% of all traders lose which I touched upon recently (10 Sep 2010 – The Real Reason Why 90% of Traders Lose ). The price paid by ordinary citizens for government policies of perpetual inflation and associated taxes is in the loss of purchasing power of earnings and savings, which occurs despite the continuous increase in worker productivity. Currency Manipulation Wars The problem in determining trends between currency pairs is further complicated because it is not only the relative loss of purchasing power through inflationary money printing and debt accumulation policies, but rather all governments to varying degrees (those that are not stuck in the Euro-zone such as the PIGS) seek to competitively devalue their currencies against one another so as to boost exports and reduce imports to improve or maintain their countries balance of trade and global trade induced economic activity which accelerates the rate of decent for all currencies than where they would be as floating currencies, which theoretically should seek to correct trade imbalances that governments instead fight against from occurring. This manifests itself in an artificial managed currency market where instead of countries that run large trade deficits such as the US and UK seeing their currencies fall at a faster pace than countries that run large trade surpluses such as China and Japan, (Germany uses the bankrupting PIGS to its advantage so that they have to intervene LESS to keep the Euro weak). The trade exporters intervene to manage their exchange rates from China's peg to the Dollar, to Japan stepping forward only the other week to spend hundreds of billions of Yen to buy Dollars in an attempt to cap the Yens rise to a 15 year high against the Dollar, which puts its export driven economic recovery at risk. Japan is coming under increasing pressure because China and other asian exporters such as South Korea are eating into Japans export markets, therefore this currency war is just as much Japan vs the rest of Asia than Japan vs USA. In response to Japans intervention other central banks also act to sell their currencies, to buy japanese yen and dollars, not because of a conspiracy of central bankster's, but because Japan sent a ripple through the currency markets as a consequence of weakening the Yen. In fact I would not be surprised if China is behind much of the Yen's recent rally (buying Japanese bonds) so that they can gain more exposure to the U.S. export market share by hurting Japan's exporters. Roughly both China and Japan hold an equal amount of U.S. Treasury bonds at about $830 billion each, so the currency war continues as they both seek to drive their respective currencies lower and the Dollar higher whilst other central banks are also forced to re-act or see their currencies appreciate. However the impact of Japanese buying of dollars proved short lived because as mentioned earlier it is a case of all exporting countries fighting to keep their currencies weak against a FALLING U.S. Dollar and other importing currencies such as the sterling. Some readers may at this point start to feel a little angry as to why the likes of Japan and China don't play fair by manipulating their currencies to keep them artificially weak instead of letting them float to correct unsustainable huge trade imbalances. Don't worry the system is designed so that the last laugh is on the currency pegging countries, for them to keep the pace of decline relative against fundamentally weak currencies such as the US Dollar or the British Pound then they need to BUY Dollars and British Pounds which usually means buying British and U.S. Government Bonds (paper IOU's). This allows countries to live far beyond their means as the people in the west basically live off of the hard work of poorly paid asian workers as the asian trade surpluses are recycled back into western debt. Debt that is constantly losing its value ! Off course there is a price to pay as the likes of the UK and USA find it difficult to compete and export and find it even more difficult to wean their populations off of cheap Chinese junk that fills up their nations garages, which therefore results in higher domestic unemployment and lower level of economic activity, whilst the Chinese enjoy relatively higher levels of employment and economic activity. Some rogue politicians in the west calling for action against currency manipulators have not properly thought out the way the system works as they need to realise that what they are in effect asking for is for China to not only stop buying U.S. Treasury bonds but to sell them, and hence push up U.S. interest rates and at the same time send the U.S. dollar sharply lower and inflation sharply higher, though off course China is not going to stop buying US Dollars which is evident by the size of its $2.5 trillion reserves. The policy of deficit importers such as the US and the UK has been to print money (via smoke and mirrors) to monetize debt with a flood of currency forcing their currencies lower thus prompting asian and other exporters to step into the currency markets in an attempt to soak up this perpetual new supply as well as fight against other exporters in an downward currency pegged death spiral that continuously seeks to inflate the west's debt bubbles by financing consumption and deficits. Since there is no sign of an end to the huge deficits especially for the U.S., therefore there is no sign of an end to quantitative easing to monetize the deficits. All of these competitive devaluations in the face of US money printing to monetize debt IS resulting in higher inflation as evidenced by the surge in commodity prices, and especially gold, which as expected is rising in all currencies that are spiraling downwards with one another as they fight a losing battle to peg themselves to death. So the U.S. Fed is merrily pumping out dollars at 0.25% interest rate which prompts the banks and financial institutions to go across the world and chase higher returns with plenty of cheap dollars thus driving the dollar lower, against which other central banks are fighting hard to maintain their currency pegs and are thus forced to buy dollars which effectively means financing the U.S. budget deficit. It does not exactly match the case that the headline grabbing politicians make of evil foreign currency manipulators, does it ? Also there is the question of U.S. dollar corporate and investment profits, all this flood of dollars invested into say China and other emerging markets would benefit hugely from a dollar devaluation, Chinese Yuan revaluation would mean higher dollar profits for U.S. corporations and financials. Which makes sense as the reason why U.S. politicians are so vocal on this subject as they tend to be on the payroll of Wall Street are thus pushing for a China Yuan revaluation so as to artificially create more dollar profits for Wall Street. Furthermore countries such as the US and to a lesser degree the UK are obsessed with spending large chunks of their GDP on the military, so that they can keep butting in the on the internal affairs of other countries by operating a multitude of foreign military bases right across the globe, all of which means spending dollars for other currencies without any output i.e. one off consumption which explains why the trade deficits will persist no matter what crackpot protectionist trade tariff bill is enacted. However, racking up ever more total debt whether monetized or not is not good, because there is an interest cost to pay on the debt which has an inflationary impact on the economy and results in an even further weakening of the currency that feeds the fires of inflation as the debt interest burden eats into government tax revenues leaving less available for spending which acts as a leverage to the amount of new currency printed which can only have spiraling inflationary consequences towards the ultimate destination of a hyperinflationary bust. The new UK government is attempting to stabilise UK public sector debt as the recent analysis reaffirmed is expected to rise from about 65% of GDP and to stabilise at 72% of GDP as long as the UK government actually implements its severe spending cuts programme (29 Jun 2010 – UK ConLib Government to Use INFLATION Stealth Tax to Erode Value of Public Debt ).

But public debt of approx £850 billion is just the tip of the UK debt iceberg which is reflected by the total liabilities graph which whilst 18 months old is still implies that total PUBLIC liabilities on the UK economy stand at about £3.5 trillion at this time and no matter what the government does will continue to trend higher, and THEN on top of this we have private sector debt of some £5 trillion.

All of which goes towards determining the real downward pressure on sterling, but yet again all of the same pressures are baring down on all of the other currencies, for instance Japan IS bankrupt ! Public Debt is over 200% of GDP with even worse un-funded liabilities due to its exploding demographic time bomb i.e. growing ageing population and a shrinking workforce to support it. Impact on Sterling The impact on sterling of exporters fighting to keep their currencies weak against the dollar, euro and sterling is for sterling to rise because the UK governments priority is not to protect exports to the likes of China and Japan as the UK's key export markets are Europe and then the U.S. which account for more than 70% of UK exports against just 2.5% to China. Dollar Reserve Currency Status Not all currencies are equal which is illustrated by the fact that the U.S. can get away with far more in terms of debt and budget deficits than any other country on the planet by virtue of the fact that the U.S. Dollar is the worlds reserve currency, it is the primary means for exchange in the pricing and transacting of most of the worlds major commodities such as crude oil, which is the life blood of all economies. Therefore, US government's do not care if the dollar falls because they seek to rely on the fools in asia to prop up the dollar, which is why US interest rates could remain at 0.25% as long as the US economy remains weak, regardless of the rate of inflation (Current CPI 1.1%, though shadowstats says it is 8%). The other benefit of a reserve currency is that during panics it is seen as a relative safe haven which results in a rush of investor panic buying. This by its nature can only be temporary as once the panic subsides then so should these funds wash out of the dollar. Over the summer of 2010, the Euro PIGS sovereign debt crisis saw this rush to the dollar safe haven, but given that nothing went pop over in Euro-land so virtually all of that safe haven buying has dissipated over the past 3 months. Therefore this does suggest that the forex markets will continue to be volatile as further shocks emanate out of the banking sector and bankrupting sovereigns, but the dollar safe haven buying 'should' again prove temporary, therefore future crisis will present opportunities to SHORT the dollar. British Pound Currency Trend AnalysisBritish Pound Trend Forecast for 2010 – This analysis seeks to update the existing GBP trend forecast for 2010 (26 Dec 2009 – British Pound GBP Forecast 2010 Targets Drop to Below £/$1.40 ), that expected sterling to weaken against the U.S. Dollar to target a rate below £/$1.40 into the UK General Election on a break below the trigger level of £/$1.57 and thereafter to remain within this trading range for the next 6 months (into June 2010).

1. That sterling is targeting immediate support at £/$1.57 which implies it may temporarily bounce from there back through £/$1.60 before the eventual break. 2. That a break below £/$1.57 would target a trend to below £/$1.40. On a longer term view, the chart is indicative of trading range between £/$1.57 and £/$1.37, on anticipation of the eventual break of £/$1.57. On average this implies a 10% sterling deprecation against the trend of the preceding 6 months or so. Which was further expanded upon in the January 2010 Inflation Mega-Trend Ebook to extend the trading range expectation into the end of 2010 as well as revising the 2010 floor to £/$1.40. The implications of a USD trend towards 84, therefore implies that GBP is expected to break below the £/$ 1.57 trigger level over the next few weeks to enter a new trading range if between to £/$1.57 and £/$1.40 for most of 2010, with the initial expectation of a trend to below £/$1.50 towards the £/$1.40 floor as illustrated by the below graph for 2010 :

The below graph illustrates the actual trend that has subsequently transpired during 2010. The actual low came in at 142.50 shortly after the May General Election as the coalition government started to emerge from the hung parliament, which has resulted in a strong trend all the way back to break the upper end of the range.

The British Pound has shown relative strength against forecast expectations by putting in a slightly higher low at £/$1.4250 and trading above the upper end of the trading range, having put in a high of £/$1.60 during early August and subsequent low at £/$1.53 during early September. This relative strength on face value suggests that going forward GBP is more likely to break above £/$1.60 then below £/$1.53. UK Budget Deficit Reduction - The U.S. has given no sign that it intends on reigning in the large budget deficit that stands at $1.5 trillion or 12% GDP, which is against the UK government that has announced concrete measures aimed at getting a serious grip on the budget deficit that it plans on reducing from £156 billion for 2009-10 to £20 billion by 2015-16. My earlier analysis (29 Jun 2010 – UK ConLib Government to Use INFLATION Stealth Tax to Erode Value of Public Debt ) concluded in the follow trend expectation for the UK budget deficit that expects the coalition government to maintain its deficit reduction target into 2012-13, after which I expect a divergence from the Coalition Government's plan as the government seeks to engineer an election boom going into May 2015.

Thus the UK aims to get a grip on its budget deficit whilst the U.S. is signaling that it could not careless and is prepared to run $1.5 trillion annual deficits all the way into 2020, which implies at least a doubling of the U.S. national debt. The deficits trend expectations is therefore strongly positive for sterling against a weakening dollar as the forex markets act in advance of expanding and contracting deficits which is the relative opposite trend paths for the UK and US. U.S. Dollar Meltdown GBP has traded up towards the top of its 2010 trading range, to judge if this is indicative of sterling strength due to new government deficit reduction measures or dollar weakness, we need to take a look at the USD index which basically comprises 60% Euro against 12% GBP.

The U.S. Dollar bull market trend started to evaporate following the early June peak just shy of USD 90. Quick analysis points to major support in the zone USD 74-77 against the last close of USD78, which suggests that the immediate phase of the dollars downtrend should be coming to an end and suggestive of a bounce back towards USD 80, the implications for sterling are that there should be a pause in its uptrend, th |

| A Market for Long-Term Investors Posted: 04 Oct 2010 03:45 PM PDT What to do now... I really don't know - The Rolling Stones Stocks are up...should you buy? Wait, stocks are up...maybe you should sell! Here's the report from The New York Times: The last time Wall Street saw a stronger September, when the Dow Jones soared 13.49pc, was at the start of the Second World War, when traders anticipated a strong rise in demand for US manufactured goods and war materials. However, on Thursday the S&P 500 fell 3.53 to 1141.20 and the Dow dropped 47.23 to 10788.05 as new data on jobs and economic growth continued to indicate the economy was recovering at a slow pace. Gross domestic product, which measures the output of goods and services in the US, increased at an annual rate of 1.7pc in the second quarter and the number of Americans filing new claims for jobless benefits fell more than expected last week for the third time in four weeks. So you see, everything is looking up. Gold keeps going up too...it rose another $8 on Friday. Experts say it is going to $1,500 next year. Or maybe $2,000. Or $3,000. Maybe you should buy. China is buying. Insurance and pension funds are buying. Even central banks are buying. Wait a minute...maybe you should sell! But it's too early for the final stage of the bull market in gold. The average fellow is not buying gold. There's no frenzy yet. Nobody is worried that his savings will disappear. The final stage seems a long way away. Gold may not be ready for it's great blow-off...but the dollar seems headed for the basement anyway. You should get rid of the dollar. It's trash. It's headed for the dump. But wait. Aren't we in a period of major de-leveraging? Isn't this the Great Correction? Isn't everything going down? Shouldn't the dollar be more valuable? Maybe the dollar doesn't know we're in a major correction? But shouldn't you be holding onto dollars...saving dollars...hoarding dollars? What to do now? The more we think about it, the more we like the solution offered by Rob Marstrand. Rob has just taken the job as chief investment strategist for our family office. That is, he's advising us on what to do with our very long-term oriented family money. This is money that we're not going to spend. It is supposed to go to the next generation...and the one following. So, we're not looking for profits anytime soon. We're more concerned with not losing it. Rob told us about one vegetable producer in China. It's a huge company, but still growing like a teenager. And nobody ever heard of it. You can buy it for barely 4 times earnings - Great Depression levels, in other words. Another one of his discoveries is a company based in Singapore but with huge real estate holdings in the "other" BRIC - Indonesia. He reckons you can buy it for only about 60% of its break-up value. In other words, you can get the business for free. And since these companies are in emerging markets, we can expect that they will do better than stocks in the US. Maybe not this year. Maybe not over 5 years. But over 20 years? Well, who knows, but it seems like a good bet. Which do you think will be worth more, dear reader? Twenty years from now. A $20 bill issued by the US Treasury. Twenty dollars worth of US stocks? Or $20 worth of profit-making companies in high-growth economies? We don't know how much the stocks will be worth. But we have a strong hunch that a $20 bill won't be enough for a cup of coffee. Why? Because dollars don't cost much to produce - especially the electronic variety. And the feds are going to need a lot of them. They're spending $2 for every $1 in tax receipts. You can't do that for too long before your credit is shot. And what's behind the US dollar? Nothing but the full faith and credit of the US government. What to do now? Find solid businesses at bargain prices. Invest in real estate with good cash. Buy collectibles...jewelry...art - things you want to own no matter what the price. And more thoughts... We went to a charity gala dinner on Saturday night. It was to benefit Catholic schools sponsored by the Baltimore Archdiocese. "Why are we going," we had asked Elizabeth earlier in the day. "We're not even Catholic." "Don't be a curmudgeon. Our children went to Catholic schools. They got good educations. So we're helping the schools. They're having a silent auction. I gave a week at our house in Normandy. It will be fun to watch them bid on it... Besides we have two free tickets. There's a band. And there will be dancing. "Remember, we took dancing lessons. We don't want them to go to waste." Americans are good at fundraising. In comparison, the English are amateurs...and the French don't do it at all. We went to an event for the Conservative Party in London a couple years ago. There was a huge crowd, eager to elect David Cameron. The organizers might have made sport of it. They might have made fundraising fun. Instead, they seemed embarrassed to be raising money...and disorganized. The French don't even try. Anything worth doing, they figure, ought to be paid for by the state. They pass the plate at Catholic Mass in France, but the parishioners give little. The typical donation is a 2 euro coin. Then again, the churches are maintained by the government. And everyone thinks the church is rich. But the Catholics in Baltimore did a good job of it. Archbishop O'Brien made a simple and sensible appeal to the 600 or so gala goers. And then a young man gave a speech recalling how a scholarship had enabled him to get an education at the Catholic school. "I can tell you frankly, that it changed my life. I wouldn't be the man you see tonight were it not for that scholarship," he said. There was no need to say any more. Everyone present knew what he meant. The Baltimore public schools were little more than prep schools for prison. But here was a young man who grew up in the Baltimore ghetto (a photo showed his house...it looked very much like where we used to live!) He had no money. No father. And no future. But after he graduated from Catholic high school, he went to college and then to law school. A very impressive fellow; it was easy to imagine him running for Congress in a few years. Naturally, we all gave him a sincere applause. Many were probably thinking - "he's a credit to his race." But no one said it. That quaint sentiment went out of fashion 50 years ago. In fact, he was a credit to any race. And any religion. And with this success story in front of us, who could resist? Pretty soon each table was competing to see who could donate the most. Elizabeth dug deep into her husband's pockets. By the end of the evening, it was the most expensive free dinner we had ever had. Regards, Bill Bonner,

|

| Investors see silver lining in economic gloom Posted: 04 Oct 2010 03:38 PM PDT |

| ‘Gold looks positive, to hit $1405 by year end’ Posted: 04 Oct 2010 03:36 PM PDT Commodity Online: This month the focus is aptly on precious metals with gold and silver prices looks set for further gains. Gold prices have suddenly shot up to near $1300 levels after being range-bound at $1260 levels. Some analysts had already predicted $1500 by year end. Could you explain why gold prices have shot up suddenly and what strategy investors should be looking at- buy or sell? |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Whilst many may perceive currency movements as wide multi-year trading ranges such as between highs of £/$ 2.00 to lows of £/$1.00, however all of the worlds currencies are actually in a continuous state of perpetual free fall where the multi-year high – low trading ranges are fluctuations within the differing rates of decent as all currencies are fiat backed by nothing more than mountains of ever expanding IOU's. The manifestation of the free fall in real values is the loss of purchasing power of currencies as measured by INFLATION that state propaganda has conditioned populations to accept as being a good thing.

Whilst many may perceive currency movements as wide multi-year trading ranges such as between highs of £/$ 2.00 to lows of £/$1.00, however all of the worlds currencies are actually in a continuous state of perpetual free fall where the multi-year high – low trading ranges are fluctuations within the differing rates of decent as all currencies are fiat backed by nothing more than mountains of ever expanding IOU's. The manifestation of the free fall in real values is the loss of purchasing power of currencies as measured by INFLATION that state propaganda has conditioned populations to accept as being a good thing.

The bottom line is that all fiat currencies are in free fall against one another that over the long run ensures that all currencies including the British Pound, U.S. Dollar, Euro, will gradually lose between 95% and 99% of their value over a 100 year time period, regardless of what trading ranges between currency pairs suggest. In other words £1 today will be roughly worth 1p in a 100 years time.

The bottom line is that all fiat currencies are in free fall against one another that over the long run ensures that all currencies including the British Pound, U.S. Dollar, Euro, will gradually lose between 95% and 99% of their value over a 100 year time period, regardless of what trading ranges between currency pairs suggest. In other words £1 today will be roughly worth 1p in a 100 years time.

No comments:

Post a Comment