Gold World News Flash |

- Hourly Action In Gold From Trader Dan

- Would proposed gold-dispensing ATMs be subject to reporting rules?

- Junior Gold Producers

- Resistance Has Cleared for Silver and Gold Prices

- Craig Stanley Bets on Management, Good Assets

- Buying Gold Before the “Blow Off Phase”

- Where Are Oil and Gas Prices Heading Next?

- Welcome to the Mania

- Gold Could Reach 1400 by December

- PHYS: Fizzle not Sizzle So Far

- More Reasons Gold Is Going to $2,000

- Monthly Gold And Silver Charts From Trader Dan

- LGMR: Gold Hits New Highs After Mixed 3rd-Qrtr; Gold/Silver Ratio Falls to 1 Yr Low

- Grandich in Goldline article

- It’s Come To This

- Crude Oil Surges Back Above $80, Gold Hits New Record but Momentum Fading

- How High Will Gold Go This Fall?

- The Price of Gold

- Gold Confiscation: Straws in the Wind

- Learn How Butterflies Can Create Profits When Trading GLD

- SP500 & Gold At Crucial Pivot Points

- GLD – Gold ETF Daily Chart

- Gold “the Most Important Reserve Asset”?

- GLD – Gold ETF Trading Signals

- If Deflation Wins, What Will Gold Stocks Do?

- And The Obligatory “Selloff Day” Gold Plunge Is Here

- Gold Symposium Bail Out

- Data Overload Spurs Markets - But Why?

- Gold Seeker Weekly Wrap-Up: Gold and Silver End the Week at New Highs

- Minings Michael Moore, Phelim McAleer, To Address Silver Summit Banquet

- Have Central Banks lost control of the Gold Market?

- Guest Post: Today's Gold Myth "Its Topped, There Is No Inflation, Get Out Now While You Still Can"

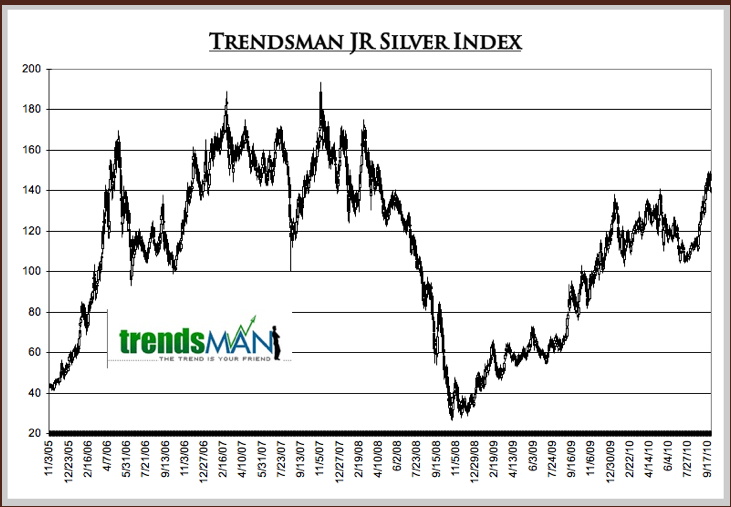

- Premium Sample: Silver Juniors Remain Undervalued

- Bank of America Delays Foreclosures in 23 states

- Rampant Inflation In 2011? The Monetary Base Is Exploding, Commodity Prices Are Skyrocketing And The Fed Wants To Print Lots More Money

- Government Workers: The New Upper Crust?

- Friday ETF Wrap-Up: DBA Sinks, RWX Soars

- Weekly CFTC Report - Kill (Dollar) Bill

- Jim Rickards has it backwards: This is what reallly happens if China monetizes it’s Gold.

- Researching Gold/Silver Mining Companies II

| Hourly Action In Gold From Trader Dan Posted: 01 Oct 2010 06:14 PM PDT View the original post at jsmineset.com... October 01, 2010 10:15 AM Dear CIGAs, Another day – another round of brutal Dollar selling. If it is unclear in anyone's mind that the Fed is in the process of killing the Dollar in order to keep the "animal spirits" of investors from falling into a funk, let the price action of the Dollar convince you to put aside any such reservations. It has now crashed through another support level. First it was critical support near 80. That gave way easily. Then it appeared it might hold 79 for at least a little while after it popped yesterday on the approach towards that level. Today, that gave way like a rotten wooden plank taking it down near 78 before it got a bit of relief. Ominously, there does not appear to be much if anything standing in the way for a fall to 75, where if it takes that out as ignominiously as it has previous "floors", it is heading to 72 and we are heading to a currency crisis. As said the other day, 'overbought' and 'oversold... | ||||||

| Would proposed gold-dispensing ATMs be subject to reporting rules? Posted: 01 Oct 2010 06:07 PM PDT Most of you have probably seen stories like this: http://www.msnbc.msn.com/id/39383743...rsonal_finance Anyone know if machines like this take FRNs, or will they only take credit and debit cards? It'd be sweet if they took FRNs, but the IRS would probably raise an eyebrow or six about the possibility for money laundering. | ||||||

| Posted: 01 Oct 2010 06:00 PM PDT | ||||||

| Resistance Has Cleared for Silver and Gold Prices Posted: 01 Oct 2010 05:59 PM PDT Gold Price Close Today : 1,316.10Gold Price Close 24-Sep : 1,296.00Change : 20.10 or 1.6%Silver Price Close Today : 2203.7 Silver Price Close 24-Sep : 2138.3Change : 65.40 or 3.1%Platinum Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! | ||||||

| Craig Stanley Bets on Management, Good Assets Posted: 01 Oct 2010 05:55 PM PDT Source: Brian Sylvester of The Gold Report 10/01/2010 Pinetree Capital VP of Research Craig Stanley believes that, above all else, junior mining companies need solid management and good assets. And he believes management, in particular, trumps good assets. "We have been known to back management teams even before they have a project, based solely on their history," he says. Pinetree has positions in more than 400 companies and, in this exclusive interview with The Gold Report, Craig offers up some of his favorite gold and base metals plays in the lot. The Gold Report: Craig, in more specific terms, what do you do for Pinetree? Craig Stanley: My job here is to aid in managing the existing portfolio. I am also involved in seeking out and researching new opportunities. TGR: What's the total value of your investments? CS: It fluctuates in and out of positions but, as of June 30, 2010, we had 429 positions worth $318 million. TGR: It's a similar concept to a mutual fund in that... | ||||||

| Buying Gold Before the “Blow Off Phase” Posted: 01 Oct 2010 05:55 PM PDT An interesting graph of "a useful road map to any secular bull market" appeared in Casey's Daily Dispatch. It was a graph showing how investment interest in a developing bubble classically proceeds through four stages. First, there is the Stealth Phase where nobody is paying attention to the undervalued asset except for a few forward-thinkers who are buying, which I figure is probably because they are hip to the Austrian school of economics. Secondly, the market moves into the Awareness Phase as more and more people recognize the value, and the gently rising price, and they start buying, too, leading to higher and higher prices, proceeding to where things are then in the Mania Phase, where suddenly everybody is buying, buying, buying, the price is soaring, soaring, soaring, and fortunes, fortunes, fortunes are being made, the details of which blare from every news source – Gold! Gold! Gold! – causing further buying by the envious latecomers to the investment party, leading to that di... | ||||||

| Where Are Oil and Gas Prices Heading Next? Posted: 01 Oct 2010 05:55 PM PDT By Marin Katusa, Chief Energy Strategist, Casey Research Oil is heading to US$200 per barrel. This isn't speculation but hard fact. But forewarned is forearmed, and with this price expected within the next five years, investors have plenty of time to position themselves. We recently have been talking about tools that investors can use to navigate the economic landscape. The gold-to-oil ratio is one such tool, but another popular compass is the oil-to-natural gas ratio. The oil-to-natural gas ratio relates more to nuances within the energy complex, rather than the gold-to-oil ratio, which relates to monetary values. It's the WTI Cushing price of crude oil per barrel to the Henry Hub Spot Price for natural gas per million thermal units. In theory, based on an energy equivalent basis, crude oil and natural gas prices should have a 6-to-1 ratio. Market characteristics, however, have dictated that since 2006, the price of oil follow a pattern of 8-12 times that of... | ||||||

| Posted: 01 Oct 2010 05:55 PM PDT "James Turk sees silver at $23 and gold at $1,335 within hours! U.S. Mint increases premiums on silver eagles by 33%. Ireland nationalizes itssecond largest bank. Iran's gold traders go on strike... and much more. " Yesterday In Gold And Silver Gold declined a few dollars after it began trading in the Far East on Thursday. But, starting around 10:30 a.m. Hong Kong time, it began a slow rise which ended at gold's high of the day [$1,316.90 spot] at precisely 9:00 a.m. in New York. Then a sell-off began that took gold to its low [$1,295.10 spot] of the day at precisely 11:30 a.m... exactly two and half hour after its high. From its low, gold began a recovery that ended with its price sandwiched between it Tuesday and Wednesday closing prices... almost like it was set their deliberately. There has been a thirty dollar price swing in the last three business days... and all three days close within a dollar of each other? What are the chances that being a random e... | ||||||

| Gold Could Reach 1400 by December Posted: 01 Oct 2010 05:55 PM PDT | ||||||

| PHYS: Fizzle not Sizzle So Far Posted: 01 Oct 2010 05:55 PM PDT Since the launch of the Sprott Physical Gold Fund (PHYS) — marketed as a good alternative for investors to gain exposure to gold prices — an outrageous but shrinking premium to its net asset value (NAV) has prevented investors from participating in the recent run by gold to record levels. As amateurs flocked to PHYS because it was supposedly safer than alternatives like the SPDR Gold ETF (GLD) or even the Central Fund of Canada (CEF), the PHYS share price was bid up to unreasonable levels. Back in May 2010 we made ourselves loud and clear on the subject: [INDENT]…We continue to believe PHYS at a large premium to NAV is a terrible way to own gold unless you are a broker who gets to buy it at the IPO price and then distribute it to the retail (and we suspect a few hedge fund) suckers. What a racket and what a great example of markets behaving irrationally. [/INDENT] Also in May 2010 we discussed a potential trade to take advantage of the significant pr... | ||||||

| More Reasons Gold Is Going to $2,000 Posted: 01 Oct 2010 05:55 PM PDT The biggest holder of U.S. Treasuries isn't happy. And why should they be? They're sitting on the sidelines holding US treasuries worth $797 billion. That's quite a chunk of change. Of course I'm talking about China. The Chinese have been the biggest foreign creditor to the United States and in recent statements they've made it clear that Washington needs to maintain the value of the dollar. "We have made a huge amount of loans to the United States. Of course we are concerned about the safety of our assets. To be honest, I'm a little bit worried," said Chinese Premier Wen Jiabao. It's estimated that around 50% of China's total reserves are held in US treasuries. And they know that the reserve currency they hold is depreciated with each passing day. With so much riding on the price of the dollar you can bet that Beijing has been keep a close tally on America's spending — and the results can't be pleasing. To say the least, Chinese faith in the dollar is feigning. And I'll give y... | ||||||

| Monthly Gold And Silver Charts From Trader Dan Posted: 01 Oct 2010 05:55 PM PDT | ||||||

| LGMR: Gold Hits New Highs After Mixed 3rd-Qrtr; Gold/Silver Ratio Falls to 1 Yr Low Posted: 01 Oct 2010 05:55 PM PDT London Gold Market Report from Adrian Ash BullionVault 10:15 ET, Fri 1 Oct. Gold Hits New USD Highs After Mixed Third-Quarter; Gold/Silver Ratio Falls to 12-Month Low THE PRICE OF GOLD rallied further from yesterday's 1.4% drop in London on Friday, recording another record-high Gold Fix at $1313 – and then rising to $1320 an ounce – as the Euro currency hit 7-month highs to the Dollar and Western stock markets rose. Government bonds edged lower, pushing the yield offered by 10-year US Treasury debt up to 2.54%.Inflation in the US cost of living was today pegged at 1.4% year-on-year by the Personal Expenditure measure.Unemployment in the 16-nation Eurozone meantime rose to 10.1% in August, new data said.Retail sales in Germany and car sales in Japan both showed a fall."We think it would take much better US data and subsequently higher interest-rate expectations or a sharp sell-off in US stock markets to put gold under some substantial pressure," said Swiss refiner MK... | ||||||

| Posted: 01 Oct 2010 05:55 PM PDT | ||||||

| Posted: 01 Oct 2010 05:55 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! October 01, 2010 05:26 AM Call them kooks, goldbugs, tin-foil hats salesmen, etc., but the fact*is people like Adrian Douglas have been incredibly accurate in their forecasts and analysis for nearly a decade.And so what happend when he goes on TV? A stupid host who claims they’ll simply mine more and that will kill gold (He doesn’t even begin to know how stupid his response was), an ex-cop, ex-politican and a couple of other Talking Heads from TV land made a mockery of the discussion. This should come as no surprise since this has been par for the course for almost a decade. Do you and I get frustrated when watching this? Yes! But do what I do – look at the price and what we’ve done versus the fools and perma-bears who have missed the “Mother” of all gold bull markets for nearly a decade! [url]http://w... | ||||||

| Crude Oil Surges Back Above $80, Gold Hits New Record but Momentum Fading Posted: 01 Oct 2010 05:55 PM PDT courtesy of DailyFX.com September 30, 2010 10:51 PM Crude oil pushed past the $80 level for the first time since early August, as traders grow more confident in the global economic recovery. Gold rallied to a new all-time high, but technical studies indicate that momentum may be fading. Commodities – Energy Crude Oil Surges Back Above $80 Crude Oil (WTI) - $80.22 // $0.25 // 0.31% Commentary: Crude oil surged $2.11, or 2.71%, in Thursday’s session, a continuation of the move that began on Wednesday after U.S. petroleum inventories showed a larger-than-expected decline. Prices are now at the highest level since early August, and poised to test the upper end of a range that has contained the commodity for over one year. But with prices now back above $80, upside is limited, though a gradual advance is likely. As long as the global economic recovery remains on track, the bias in crude oil will be higher, but ample supplies should keep oil from breaking out of its ... | ||||||

| How High Will Gold Go This Fall? Posted: 01 Oct 2010 05:11 PM PDT By Jeff Clark, Senior Editor, Casey's Gold & Resource Report The gold price has been hitting ever-new records over the past couple weeks, now closing in on the $1,300 mark. Some gold followers are saying this is extremely bullish for the near-term price since it broke so decisively through its June 28th high of $1,261. If [...] | ||||||

| Posted: 01 Oct 2010 05:11 PM PDT Today we are going to be looking at gold and analyze the recent run-up that has created a great deal of excitement and fear for many investors and traders. We're also going to be looking at some upside measurements that we have for this market. Conversely, we are also looking at an area that should provide [...] | ||||||

| Gold Confiscation: Straws in the Wind Posted: 01 Oct 2010 05:11 PM PDT by David Galland, Managing Director, Casey Research In the emails that our readers at Casey Research send our way, questions and concerns about the possibility of gold confiscation rank high. My somewhat standard response is that, yes, it's possible, but that we should see straws in the wind well before it happened… allowing us to take measures [...] | ||||||

| Learn How Butterflies Can Create Profits When Trading GLD Posted: 01 Oct 2010 05:11 PM PDT In recent articles, we discussed that Theta (Time Decay) has the potential to cause option prices to decline dramatically, particularly in the final weeks leading up to option expiration. As it turns out, we are now in that very period of time and option strategies that utilize Theta (time) decay as their profit engine can [...] | ||||||

| SP500 & Gold At Crucial Pivot Points Posted: 01 Oct 2010 05:11 PM PDT Wednesday was a big session with better than expected manufacturing surging the market 3%. In this article I will do a quick technical take on the current situation for the SP500 and gold as they are both trading at a key resistance level. also its important to know what type of price action we will [...] | ||||||

| Posted: 01 Oct 2010 05:11 PM PDT | ||||||

| Gold “the Most Important Reserve Asset”? Posted: 01 Oct 2010 05:11 PM PDT Tim Iacono Apparently, after what's happened to the global financial system over the last few years, the world's central bankers have had a dramatic change in thinking about gold bullion, formerly known as the "barbarous relic". A metal once considered to be a remnant of a bygone era is now increasingly viewed [...] | ||||||

| GLD – Gold ETF Trading Signals Posted: 01 Oct 2010 05:11 PM PDT This 60 minute chart shows gold getting hit hard on Wednesday morning. Investors and traders around the globe were closing out positions and moving to cash. This high volume dumping of positions pulled virtually all investments lower and was the first tip-off that the market was in panic mode. One the dust [...] | ||||||

| If Deflation Wins, What Will Gold Stocks Do? Posted: 01 Oct 2010 05:11 PM PDT | ||||||

| And The Obligatory “Selloff Day” Gold Plunge Is Here Posted: 01 Oct 2010 05:11 PM PDT by Tyler Durden Just when you thought gold could go through at least one major selloff day without some remarkable fireworks, here comes a perfectly natural $10 selloff in the span of under a minute, because that is precisely how a quantized and "deep" order book looks like. Just how related this [...] | ||||||

| Posted: 01 Oct 2010 04:23 PM PDT I've had to pull out of The Gold Symposium as the Mint's Board meeting (which I have to attend) has been moved to a day of the event. Was looking forward to meeting the speakers and attendees so not too happy. In that case the Board better approve my business case for redeveloping our exhibition area :) or I will have missed the event for no good reason. | ||||||

| Data Overload Spurs Markets - But Why? Posted: 01 Oct 2010 04:01 PM PDT Annaly Salvos submits: Bank of Canada Governor Mark Carney delivered a speech yesterday in Ontario that contained two observations that we think are certainly true:

Uncertainty may abound over the future of the US economy, but that didn’t stop the equity market from having one of the best months on record in September. The SPX rose 8.9%, while the 10-year Treasury ended the month basically where it began. The past few days have featured a slew of data to help investors in their attempts to divine the direction of the economy. Right now, the expectations for third quarter GDP growth are exactly where the second quarter came in: +1.7%. Complete Story » | ||||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver End the Week at New Highs Posted: 01 Oct 2010 04:00 PM PDT Gold rose to a new all-time high of $1320.37 by a little after 10AM EST before it fell back off a bit into the close, but it still ended with a gain of 0.67% at a new all-time closing high. Silver climbed to a new 30-year high of $22.14 before it also fell back off a bit, but it still ended with a gain of 1.19%. | ||||||

| Minings Michael Moore, Phelim McAleer, To Address Silver Summit Banquet Posted: 01 Oct 2010 04:00 PM PDT | ||||||

| Have Central Banks lost control of the Gold Market? Posted: 01 Oct 2010 04:00 PM PDT | ||||||

| Guest Post: Today's Gold Myth "Its Topped, There Is No Inflation, Get Out Now While You Still Can" Posted: 01 Oct 2010 12:09 PM PDT Today's Gold Myth "Its Topped, There Is No Inflation, Get Out Now While You Still Can" By Alex Stanczyk - Oct. 1st, 2010 About the Author: Alex Stanczyk serves as an Executive Vice President for the Anglo Far-East Bullion Co. I am starting to hear this mantra parroted through 'internet rumor' that because there is no inflation, gold has hit its high, and you're better off selling now while you still can, and certainly not buying any. To address why this view is unfounded, let's start off by taking a look at history:

These events preceded the hyperinflation of 1923 in Germany when the German Reichsmark plummeted in value versus gold to the point that an entire city block of commercial real estate in Berlin could be purchased for just 25 ounces of gold. Clearly, a drop of inflation does not mean anything in terms of if it's safe or not safe to buy gold - rather it could actually be a precursor to a hyperinflationary event. In 2008 the Federal Reserve pumped trillions of dollars into the US economy in order to prevent a deflationary depression - just one week ago Federal Reserve Chairman Ben Bernanke went on record indicating he was willing to pump in trillions more. The reason he is willing to do this is because he has no other choice - the fact that there is no inflation is actually far more ominous for the global economy than many realize - it means the first few rounds of paper printing didn't work. It means that if Bernanke pumps another two trillion dollars into the economy to prevent a deflationary collapse that it almost guarantees gold will continue to go up, not down. This argument about "there is no inflation so don't buy gold" also assumes that gold's role is as an "anti-inflation trade" only, and does not take into consideration the primary reason gold is currently rising. Simply put, gold is a currency. It is the ultimate currency against which all other currencies are measured. The reason it is currently rising has nothing to do with gold being in a bubble, and everything to do with the fact that all paper currencies follow the same historic pattern, which is a pattern of debasement - when debasement reaches certain levels gold does not "go up" in price, currencies "go down" versus gold. Gold is not acting in any way like a commodity that is non-correlated to inflation. It is in fact acting like a currency, and the counter-balance to what the world sees as an inevitable devaluation of the dollar as Bernanke once again turns the Quantitative Easing pumps (aka printing more money) on full blast. This massive debasement of the currency will be quickly followed by other nations, not because they want to, but because they have to. According to Brazilian Finance Minister Guido Mantega, we are currently witnessing an "international currency war" - a war where countries continue to devalue their currencies against each other to improve their respective competitiveness in the global export market. I have used this example to illustrate: Imagine a group of ships in the ocean, these ships represent the various currencies of the world. In the middle of this group is a ship, slightly bigger than the rest, that is currently the worlds reserve currency. The funny thing about the saying "rats from a sinking ship" is that the rats instinctively know when a ship is going down, and flee from it. The problem here is, when they arrive at another ship, they realize that the ship they are climbing onto is also sinking...in fact its Captain and crew are sinking it on purpose in order to compete with how fast the big ship in the middle is sinking. Finally, as this pattern continues, the rats start to realize that none of the ships are safe, and instead start swimming over to a small island nearby, that isn't sinking at all. On this island as the rats arrive, they find a few very very smart rats who have been there for a while already, sitting under a nice shady umbrella and drinking iced refreshments. By the way, this island is made up of gold. History shows that towards the end of a fiat currency's life cycle, there is massive volatility in markets and currency values - we are seeing exactly that today. As each country continues to debase its currency, gold will continue to rise against all currencies. In the words of former Federal Reserve Chairman Alan Greenspan speaking before the Council on Foreign Relations in September:

Until some sanity is restored to our monetary system, the fact that gold is acting as a currency will continue in trend. People might be wise to start thinking of gold not in terms of its price rising, but rather that all of the paper monopoly money of the world is actually devaluing against the ultimate currency. Kind regards, Alex Stanczyk | ||||||

| Premium Sample: Silver Juniors Remain Undervalued Posted: 01 Oct 2010 11:44 AM PDT Below is a chart of our junior silver index, which contains 10 stocks. Today, Silver closed above $22, slightly above its 2008 high. The cost of Oil is well below where it was when the silver stocks last peaked. Yet, the junior silver stocks are roughly 25% below their highs. In terms of real value, in a fair world, the junior index would be trading ABOVE its 2007-2008 highs. Despite the recent surge in the silver juniors, there is value to be had. It may not reveal itself instantly but likely will by the time we are six to twelve months in the future. This is only a small sample of our 24-page Silver update sent to subscribers yesterday. If you'd like to learn more about the work we do, then consider a free 14-day trial subscription. | ||||||

| Bank of America Delays Foreclosures in 23 states Posted: 01 Oct 2010 11:43 AM PDT Bank of America is delaying foreclosures in 23 states as it examines whether it rushed the foreclosure process for thousands of homeowners without reading the documents. The move adds the nation's largest bank to a growing list of mortgage companies whose employees signed documents in foreclosure cases without verifying the information in them. Bank of America isn't able to estimate how many homeowners' cases will be affected, Dan Frahm, a spokesman for the Charlotte, N.C.-based bank, said Friday. He said the bank plans to resubmit corrected documents within several weeks. Two other companies, Ally Financial Inc.'s GMAC Mortgage unit and JPMorgan Chase, have halted tens of thousands of foreclosure cases after similar problems became public. The problems could cause thousands of homeowners to contest foreclosures that are in the works or have been completed. If the document problems turn up at other lenders, a foreclosure crisis that's already likely to drag on for several more years could persist even longer. Several states are stepping up pressure to halt foreclosures. On Friday, Connecticut Attorney General Richard Blumenthal asked a state court to freeze all home foreclosures for 60 days. Doing so "should stop a foreclosure steamroller based on defective documents," he said. Buy Silver and Gold Bullion Safely HERE: Scottsdale Silver | ||||||

| Posted: 01 Oct 2010 11:04 AM PDT

Take a few moments and digest the chart below. It shows just how dramatically the U.S. monetary base has been expanded recently.... Up to this point this dramatic expansion of the U.S. monetary base has not caused that much inflation because U.S. government borrowing has soaked most of it up and U.S. banks have been hoarding cash and have been building up their reserves. However, this situation will not last forever. Eventually all this cash will make its way through the food chain and into the hands of U.S. consumers. But what is even more troubling is the dramatic spike in commodity prices that we have seen in 2010. Wheat futures have surged 63 percent since the month of June. Wheat has recently been selling well above 7 dollars a bushel on the Chicago Board of Trade. But wheat is far from alone. In his recent column entitled "An Inflationary Cocktail In The Making", Richard Benson listed many of the other commodities that have seen extraordinary price increases over the past year.... *Agricultural Raw Materials: 24% *Industrial Inputs Index: 25% *Metals Price Index: 26% *Coffee: 45% *Barley: 32% *Oranges: 35% *Beef: 23% *Pork: 68% *Salmon: 30% *Sugar: 24% *Wool: 20% *Cotton: 40% *Palm Oil: 26% *Hides: 25% *Rubber: 62% *Iron Ore: 103% Now, as those price increases enter the chain of production do you think that there is any chance that they will not cause inflation? Do you think there is any chance at all that producers and retailers will not pass those costs on to consumers? It is time to face facts. Those cost increases are going to filter all the way through the system and your paycheck is soon not going to stretch nearly as far. Inflation is coming. Many savvy investors understand what is going on right now. That is one reason why gold and silver are absolutely soaring at the moment. The price of gold set another record high on Friday for the sixth straight day. Silver has also experienced extraordinary gains recently, and the U.S. Mint has officially raised their wholesale pricing above spot on American Silver Eagles from $1.50 to $2.00. Meanwhile, there are even more rumblings that the Fed wants to print lots more money. On Friday, the president of the Federal Reserve Bank of New York, William Dudley, stated that the high unemployment and the low inflation that the United States is experiencing right now are "wholly unacceptable".... "Further action is likely to be warranted unless the economic outlook evolves in such a way that makes me more confident that we will see better outcomes for both employment and inflation before long." During his remarks, Dudley even mentioned what the effect of another $500 billion increase in the Fed's balance sheet would be. Now keep in mind, this is not just another "Joe" who is making these remarks. This is the president of the Federal Reserve Bank of New York - the most important of all the regional Fed banks. In recent weeks it is almost as if you can hear Fed officials salivate as they consider the prospect of flooding the economy with even more money. Up to this point, very little has worked to stimulate the dying U.S. economy. The Federal Reserve and the Obama administration are getting nervous as the American people become increasingly frustrated about the economic situation. So will flooding the economy with even more money and causing even more inflation do the trick? Well, no, but what inflated GDP figures will do is enable Obama and the Fed to say: "Look the economy is growing again!" But if a flood of paper money causes the value of goods and services produced in the U.S. to go up by 5 percent but the real inflation rate is 10 percent, are we better off or are we worse off? It doesn't take a genius to figure that one out. So don't get fooled by "economic growth" numbers. Just because more money is changing hands doesn't mean that the U.S. economy is doing better. In fact, many American families are going to be financially shredded by the coming inflation tsunami. Just think about it. How far will your paycheck go when a half gallon of milk is 10 dollars and a loaf of bread is 5 dollars? Already, it is incredibly difficult for the average American family of four to get by on $50,000 a year. So how much money will we need when rampant inflation starts kicking in? And do you think that your employers will actually give you pay raises to keep up with all of this inflation? Not in these economic conditions. In fact, median household incomes are declining from coast to coast all over the United States. Earlier this year, Ben Bernanke promised Congress that the Federal Reserve would not "print money" to help the U.S. Congress finance the exploding U.S. national debt. Did any of you believe him at the time? Did any of you actually believe that the Federal Reserve would act responsibly and would attempt to keep the money supply and inflation under control? The reality is that the entire Federal Reserve system is predicated on perpetual inflation and a perpetually expanding national debt. Whatever wealth you and your family have been able to scrape together is going to continue to be whittled away month after month after month by the hidden tax of inflation. And unfortunately, as discussed above, inflation is about to get a whole lot worse. So is there any room for optimism? Is there any hope that we will not see horrible inflation in the years ahead? Please feel free to leave a comment with your opinion below.... | ||||||

| Government Workers: The New Upper Crust? Posted: 01 Oct 2010 11:00 AM PDT We're on zombie watch… They're everywhere…but especially here in the Washington metropolitan area. Zombies get their money from the government – directly or indirectly. Or some other perk…some edge…some benefit. Just open The Washington Post. Skip the international news, which is nothing but humbug and claptrap…usually having to do with Iraq, Afghanistan or Israel. Go to the local news. Let's see…how about this: a little item. Martena Clinton made the news after her car was towed by the Secret Service and then lost. She had parked in a handicapped section. But wait…what's this? Ms. Clinton isn't handicapped. She's not a half-wit. She's not lame. In fact, in the photo, she looks pretty good. So what's she doing in the gimpy parking section? Well, her husband is said to be mobility challenged. Special parking spaces seemed like a nice gesture when they were originally introduced. But the zombies quickly took advantage of them. Now, they're used by friends and families of an invalid…often passed down from one generation to the next after the cripple dies. That's how zombies do it. They take advantage of an easily-corruptible system. Government salaries and benefits, for example, are typically about 30% better than those in the private sector. You can see the difference here in Bethesda. The houses are all tarted up. The cars are all new and expensive. The streets and restaurants are full. Everything is modern, rich…. The editor of US News & World Report talks of a "great divide" in the US…those who have government salaries…and the rest of us. People who work for government – or otherwise are supported by the government – have made steady income gains over the last 30 years. Others have not. Government employee labor unions have grown while others have declined. Being a zombie pays. And it's likely to pay even better in the future. Because now zombies control the White House (it was the zombie states…those that owed the most money…and those that get most money from the government) that elected Barack Obama. They control the Congress too. Zombies have the time (what else do they have to do?) and the resources (often, direct contact with the government itself) to get involved in elections. They have a motive too – they can pass legislation putting more money in zombie hands. Military contractors, tax lawyers, "educators" and the handicapped – all have a keen interest in elections. The rest of us have our work, business, families, careers to attend to. Not that every tax lawyer is a chiseler, every military contractor is a cheat, and every person who can't walk is a malingerer – far from it. But they have to be doubly honest and independent to avoid the corrupting gravity of Planet Zombie. Regards, Bill Bonner Government Workers: The New Upper Crust? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||

| Friday ETF Wrap-Up: DBA Sinks, RWX Soars Posted: 01 Oct 2010 10:56 AM PDT ETF Database submits: Equity markets started October in much the same way they began last month; higher thanks to solid data. The Dow and S&P 500 both gained roughly 0.4% while the tech heavy Nasdaq rose by a more modest 0.1%. Precious metals and other commodities also soared as gold continued its march higher, finishing the day at the $1,320/oz. mark; oil soared up past the $81.50/bbl. level. Meanwhile in currency markets, the euro rose once again, as the greenback finished the week 1.1% lower against the common currency in Friday trading. Today’s gains were powered by strong construction spending and robust consumer confidence levels, which both came in ahead of expectations. This news led to quality performances out of the big names in the financial and basic materials sectors including a 4.6% gain for Citigroup (C), a 3.1% gain for Occidental Petroleum (OXY), and a 4.4% surge by major copper producer Freeport McMoRan (FCX). However, technology continued its short term underperformance thanks to weakness out of the semiconductor sector and a 3.3% loss by Hewlett-Packard (HPQ). Complete Story » | ||||||

| Weekly CFTC Report - Kill (Dollar) Bill Posted: 01 Oct 2010 10:25 AM PDT This week's CFTC Commitment of Traders reports validates what everyone knows: that the "short dollar" is now the biggest groupthink trade in the world. Or let us paraphrase - the "Ben Bernanke QE2 Is Imminent" trade is now the biggest groupthink trade in the world. One glimpse at the move in the COT data confirms what we speculated earlier when we discussed Goldman's virtual certainty that QE2 is coming in 31 days: that if there is no QE2 announcement, the shock that would reverberate from this as all the Kill (Dollar) Bill trades are unwound, may just blow up world markets and make the flash crash seems like a dress rehearsal for midgets (of the SEC intellectual variety). Of course, what this means for contrarian traders is more than obvious. First, here is the commodity net spec position summary. Someone missed to tell all these guys that deflation is in the cards. And yes, as the ISM confirmed today, input costs are surging, margins are collapsing, and sooner or later, companies will be forced to raise prices. Next up: treasuries, which for the second week in a row are up to 2010 cumulative net spec positions between the 2, 5 and 10 year. Here, contrary to above, the bet is that prices will continue to rise ever higher. However, this is not due to deflation expectations, as seen above, but due to expectations that the Fed may soon be forced to purchase up to $3 trillion in USTs over the next year, thus becoming the marginal buyer across the curve. Last, and certainly not least, is the FX chart, which speaks for itself: the red arrow highlights what the funding currency of choice is nowaday (and where it is headed). In summarizing the above data: to say that QE is priced in is an understatement. There are currently trillions of dollars on the line that the Fed will launch QE on November 3. The impact of that announcement will be one of a flash of asset price euphoria followed by the realization that monetary intervention will be just as failed that time as it was before, and that even as rates drop to zero, it will do nothing to reduce the excess slack in the economy. As for housing, zero rates will merely keep prices artificially high, and coupled with the recent M3 scandal, it will make transactions even rarer, as few if any will be willing to buy at inflated prices when their economic outlook is not only uncertain but deteriorating. More importantly once the Fed has engorged its balance sheet with $3-5 trillion in assets, all naive hopes that a normal unwind of these economic supports can proceed in a normal manner without triggering full dollar collapse, will be extinguished. One thing is certain: the midterm elections will be a very memorable date. Look for forced leaks of the Fed decision ahead of November, and not just to Bill Gross. Indicatively, we still believe the best tell on what the Fed will do will come in Mid-October when the TRS will disclose its latest holdings, which we will present immediately when available. The traditional CFTC COT reports courtesy of Libanman Futures can be found here: standard and financial.

This posting includes an audio/video/photo media file: Download Now | ||||||

| Jim Rickards has it backwards: This is what reallly happens if China monetizes it’s Gold. Posted: 01 Oct 2010 10:16 AM PDT | ||||||

| Researching Gold/Silver Mining Companies II Posted: 01 Oct 2010 10:03 AM PDT In the first installment of this tutorial on investing in precious metals mining companies, I provided investors with the "ABC's" of researching these companies: simple, basic information which would allow even novice investors to begin to distinguish between these miners. This was followed-up with a piece from our Mining Coordinator, Brian Boutilier – who explained how he used such basic data as part of his "screening process". Before getting into more in-depth research, Brian uses this first level of analysis to separate companies which are potentially worth investing in from those with much less likelihood of success. In this piece, I will introduce readers/investors to a more rigorous level of analysis, which will allow us to get a much clearer picture of exactly what these companies are working towards with their operations. There is much more to analyzing these companies than simply ascertaining whether they are already producing, or still "exploring". Once we categorize these companies in a more precise manner, we can zero-in on what specific pieces of data are of greatest importance. In this respect, analyzing the "producers" is more straightforward, so we will begin with this cross-section of the miners. For purposes of this commentary, I will assume that all producers are small producers (or "juniors"), as there really isn't any "mystery" as to what the larger producers are doing with their own businesses. Regarding the junior producers, the general question to be answered is can any particular miner boost total production, and/or improve efficiencies, and/or increase profits? Concerning the first issue, the first aspect to examine is whether they have the existing capacity to increase production. Can their crushers/ball mills process more ore than what is currently being fed through? Again, this is a question which can and should be easily answered by the investor relations department for these companies. If the answer to this question is "yes", then likely all it will take for the company to increase output is through adding some additional "feeder" equipment to get the ore to the crushers, or perhaps gaining access to additional ore through further drilling and/ore ramp construction. Introducing such changes into operations are relatively low-cost means of boosting production, and very likely would not require additional financing in order to increase production in that manner. For those miners already operating at capacity, the first issue is will this mine ever increase production? This is not strictly an issue of money. Depending on the size of the ore deposit and the nature of the ore deposit, it may never be practical to expand production. For mines with relatively small deposits, there is no point in investing enormous amounts of capital which will ultimately do nothing except cause the mine to close sooner (through using-up the ore at a faster rate). It's unlikely that cramming the production into a shorter time-frame would produce an acceptable rate of return for such a large capital investment. However, even companies with large ore deposits will sometimes find that it makes no sense to attempt to increase the scale of operations. An example of such a mine is the Topia Mine of Great Panther Silver. This mine has been a relatively small producer for over 400 years. Obviously there was plenty of ore to justify a larger operation, so why did none of the mine's owners (over a 400-year history) ever try to make this a much larger producer? The answer to that question is found by examining the nature of the ore deposit more closely. In the case of the Topia Mine, it has always located very high-grade ore, making it a very profitable producer. The "catch" is that this high-grade ore is contained in a multitude of very narrow "veins". It takes much more careful mining to efficiently mine such ore – which reduces the amount of ore which can be fed to the mill. Thus, despite the quantity of ore, increasing production would have never been a cost-effective choice for this mine. As investors, we can gain insight into what sort of mining might be done with any ore-body by referring back to a topic discussed in the first installment: drilling results. As I pointed out previously, there is a wealth of information to be obtained from these samples – starting with the width of the veins of ore which are encountered. |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment