Gold World News Flash |

- Philip Manduca Says There Has Never Been An Empire So Willing To Give Its Wealth And Power Away ...

- All Of This New Regulation Is Going To Make Banks Leave The U.S. And Europe

- 10 Reasons Gold Could Go to $10,000 In the Next 12 Months!

- GATA's Douglas Makes a Case for $56,000 Gold and $936 Silver

- Gold "Absolutely" Still a Buy: Metal Will Double in 5 Years, Frank Holmes Says

- Gold extends record run as Fed policy sinks dollar

- GoldSeek.com Radio Gold Nugget: Gerald Celente & Chris Waltzek

- All-Time High Gold … $22 And Headed North… Just Jacks For Openers!

- Gold at $1,300, where to from here? - James Turk

- 2010-09-29 How Realistic Is $5,000 Gold?

- Economic Collapse Update: Acceleration In Autumn

- The Goldsmiths—Part CLXI

- Hourly Action In Gold From Trader Dan

- No Two Ways About It; Gold Over $2,000

- Taseko Mines: A Growing Copper Producer with Prosperity in the Wings

- Mining News Review: Week of September 20th

- WSJ Finally Notices Gold’s Bull Market

- Daily Dispatch: Is Stock Picking a Dead Art?

- Competing Currency War In View

- Good Article in Midas Letter

- Siddharth Rajeev and Vincent Weber: Uranium's Upside

- World According to Gold: Here comes Tokyo Rose

- Avoiding the Double-Whammy

- Grandich Quoted in Midas Letter

- Gold Former Treads Water at All-Time High

- Jim?s Mailbox

- Savers Told to Stop Moaning and Start Spending

- Grandich Proud to Be a “Tin-Foil Hatter”

- Crude Oil Consolidates Ahead of Inventory Report, Gold Breaks to New Highs Above $130

- Does Silver's ‘Smooth Ride' Lead Past $30?

- Does Silver’s ‘Smooth Ride’ Lead Past $30?

- John Exters liquidity pyramid and Gold

- The Careful Advantages of the Weak Dollar Trade

- Osama’s Dream Congress

- Murray Pollitt: As intervention fails, only gold market has a pulse

- The Stock Market Crash of the '00s

- U.S.-China relationship has messed up the world, Davies tells King World News

- Peak Gold Is Upon Us

- Marc Faber Interview on Chinese Yuan, Gold Prices

- Gold Seeker Closing Report: Gold and Silver Climb To New Highs Yet Again

- Squishy Ball Test for Banks

| Philip Manduca Says There Has Never Been An Empire So Willing To Give Its Wealth And Power Away ... Posted: 30 Sep 2010 02:29 AM PDT You have to go to gold, because of the continued necessary rate of deleveraging. More money is being pushed, and debasement is a problem. Gold is an emerging market driver. Inflation is going higher, interest rates aren't dealing with it because they want those low to deal to preserve exports. There is a real inflation bubble coming out of the emerging markets and these guys are going to buy bubbles. Gold will be through to $2000 in the next 12 months. | ||||

| All Of This New Regulation Is Going To Make Banks Leave The U.S. And Europe Posted: 30 Sep 2010 02:22 AM PDT Where does all this capital go with aggressive regulation? Asia. Asia has been steadfastly quiet during this whole debate. Ironically, Singapore is not a member of the G-20. It doesn't need to abide by any G-20 pronouncements. Singapore has excellent banking regulation that makes it the "Switzerland of Asia". Capital is beginning to flow there. If hedge funds, high frequency traders, and the rest of the marketplace are smart, they will follow that capital over there. There is a 600 trillion dollar a year OTC market at stake. Most of it makes its home in the US and Europe. It might find a new home in Asia. | ||||

| 10 Reasons Gold Could Go to $10,000 In the Next 12 Months! Posted: 29 Sep 2010 08:03 PM PDT We may reach levels for gold previously thought of as crazy - $5,000 an ounce or even $10,000 - with plenty of volatility and pullbacks along the way... and in my opinion there are 10 reasons it could happen within the next 12 months and, if not by then, then soon after. Why? Because, in short, there is way too much fiat currency chasing way too little gold. Words: 894 | ||||

| GATA's Douglas Makes a Case for $56,000 Gold and $936 Silver Posted: 29 Sep 2010 08:03 PM PDT | ||||

| Gold "Absolutely" Still a Buy: Metal Will Double in 5 Years, Frank Holmes Says Posted: 29 Sep 2010 07:41 PM PDT | ||||

| Gold extends record run as Fed policy sinks dollar Posted: 29 Sep 2010 07:27 PM PDT SAN FRANCISCO (MarketWatch) — Gold futures rose Wednesday to their eleventh record close of the month, as the dollar dropped on expectations the Federal Reserve will keep money flowing to revive the economy. Gold's run isn't exhausted, Smith said. Central banks "around the world are printing money to keep (financial markets) afloat," reflecting poorly on the prospects for the dollar. Interest rates are expected to remain low, pushing investors toward gold and other metals, he added. | ||||

| GoldSeek.com Radio Gold Nugget: Gerald Celente & Chris Waltzek Posted: 29 Sep 2010 07:00 PM PDT | ||||

| All-Time High Gold … $22 And Headed North… Just Jacks For Openers! Posted: 29 Sep 2010 06:57 PM PDT | ||||

| Gold at $1,300, where to from here? - James Turk Posted: 29 Sep 2010 06:41 PM PDT GEOFF CANDY: Realistically though, is there enough gold in the world to serve that purpose for an entire global financial system? JAMES TURK: Absolutely - and the reason is that the background stock of gold grows by the same amount as world population and new wealth creation. So as a consequence an ounce of gold today buys basically the same amount of crude oil it did 60 years ago. So you have this steady growth in the supply of gold - the gold money supply and as a consequence gold has this consistent purchasing power over long periods of time. There is in fact enough gold today to continue to handle global commerce. | ||||

| 2010-09-29 How Realistic Is $5,000 Gold? Posted: 29 Sep 2010 06:23 PM PDT | ||||

| Economic Collapse Update: Acceleration In Autumn Posted: 29 Sep 2010 06:14 PM PDT Our current economy is a shell game. A grand fraud designed to siphon more and more tangible wealth (not fiat wealth) from the average person and transport it post-haste into the silk lined pockets of a corporate banking minority. The goal? To reduce the self sufficiency of American citizens to the point of total fiscal and social dependence on the top 1% richest men in the world. Conspiracy theory? Not in the slightest. Just a cold hard fact of history. "Feudalism" is, sadly, rampant in the annals of human culture. Anyone who believes that our modern era is somehow different is simply fooling themselves. Elitists seek power over others, they always have and they always will, and, the most efficient way to gain control over the lives of the masses is through engineered imbalances in economy. Every time you hear the term "bailout", or "quantitative easing", just think "wealth transference". Every dollar that is printed from thin air by the private Federal Reserve and handed to a globalist entity like Goldman Sachs or AIG through our Treasury represents yet another dollar of debt (and another percentage of interest) that you, the U.S. taxpayer, and your children, are expected to eventually pay for without ever seeing any benefits. Right now, at this very moment, you and your descendants for generations to come are being enslaved by forcefully imposed usury. Our country has been "volunteered" for a financial debasement on a scale that dwarfs the Great Depression or even the Weimar catastrophe. We ignore this reality at our peril. This posting includes an audio/video/photo media file: Download Now | ||||

| Posted: 29 Sep 2010 06:03 PM PDT The night of Aug 19-20 was one of those which prompted me to stay up late for four hours to whet my appetite for something different than the normal Rothschild spin and twist on news/events. Coast had a couple of guests on which had some very insightful perception on a couple of major news events which will have a profound impact on the gold, silver and commodity markets in the coming days. | ||||

| Hourly Action In Gold From Trader Dan Posted: 29 Sep 2010 06:01 PM PDT View the original post at jsmineset.com... September 29, 2010 10:39 AM Dear CIGAs, Another day, another leg lower in the US Dollar, another violation of an important technical support level, ho hum! The manner in which the dollar is falling through one support level after another is rather disturbing, and that is putting it mildly. Side note – the Yen is continuing to move back toward the level which forced the BOJ to pull the intervention trigger and yet there is no action from Japan. As I said yesterday, if the Yen breaks through their recent cap, and they do nothing, it is going to be an ENORMOUS defeat for the prestige of the BOJ and a sign that they have lost to the Fed and its QE plan. I would view it as historical and a game changer. Stay tuned for this one. Tonight might possibly be quite interesting in the Forex markets especially if the yen puts on another full point. Gold put in another record high price in late Asian/early European trading last evening with silver also f... | ||||

| No Two Ways About It; Gold Over $2,000 Posted: 29 Sep 2010 06:01 PM PDT Since ancient times, gold has been a safe haven for investors worried about market volatility and political uncertainty. Even the rise of paper currencies hasn't managed to kill the idea of gold in people's minds. That's because gold is no one's liability — currencies come and go, but gold remains the same. For that reason alone, precious metals should always have a permanent place in your portfolio. It is the ultimate hedge. But today holding gold is more important — and can be more profitable — than it's been in years. That's because we're seeing a repeat of the same forces that pushed gold from $35 to over $800 between 1971 and 1980. I'm talking about things like a weakening dollar, easy monetary policies and geopolitical uncertainty. Now, if you've watched the news, you know gold has already breached the $1,000 mark. But there's every reason to suspect this is only the beginning. Even after this tremendous run-up, we expect gold to head higher… much higher. That's because gold's... | ||||

| Taseko Mines: A Growing Copper Producer with Prosperity in the Wings Posted: 29 Sep 2010 06:01 PM PDT On Monday, September 20, 2010, Taseko Mines (TGB) filed a $300 million preliminary base shelf prospectus, communicating to the market that management believes they will receive a positive development decision from Canada’s federal cabinet. And yet the company still trades at levels arguably too low even if we only consider its producing Gibraltar copper mine. Royalty giant Franco-Nevada (TSX: FNV; Pink Sheets: FNNVF.PK) has already agreed to pay over US$350 million for a gold stream on 22% of Prosperity’s gold production subject to full financing of the project and receipt of all material permits to construct and operate the mine. Combined with estimated cash flow from Gibraltar and cash on hand, Taseko estimates that additional financing requirements come in at less than C$200 million. The C$300 million base shelf prospectus could easily fill that gap. Still, investors should bear in mind that there is vehement First ... | ||||

| Mining News Review: Week of September 20th Posted: 29 Sep 2010 06:01 PM PDT Taseko Mines (AMEX: TGB; TSX: TKO) Taseko Files Preliminary Base Shelf Prospectus - September 20, 2010 Previously we have written about an intelligent options strategy to leverage what is likely to be a significant market reaction in the event of the Prosperity project receiving a positive development decision from the federal cabinet. With this latest news, management continues to communicate to the market that they strongly believe the Prosperity project will be developed, and yet the company still trades at levels arguably too low even if we only consider its producing Gibraltar copper mine. Franco-Nevada has already agreed to play over $350 million for a gold stream on 22% of Prosperity's gold production, subject to full financing of the project and receipt of all material permits to construct and operate the mine. Combined with estimated cash flow from Gibraltar and cash on hand, Taseko estimates that additional financing requirements come in at less than $200 million. This $300 m... | ||||

| WSJ Finally Notices Gold’s Bull Market Posted: 29 Sep 2010 06:01 PM PDT Should we be worried now that the Wall Street Journal has "discovered" the bull market in gold? Relax. This bull market has years to go. It's so powerful, in fact, that it will easily be able to shrug off yesterday's front-page headline in the Journal, "Gold Vaults to New High," and continue into the ozone. | ||||

| Daily Dispatch: Is Stock Picking a Dead Art? Posted: 29 Sep 2010 05:56 PM PDT September 29, 2010 | www.CaseyResearch.com Is Stock Picking a Dead Art? (Chris Wood filling in for David Galland) Dear Reader, A declining dollar, not-so-stellar economic reports throughout the globe, and the expectation of another round of quantitative easing by the Federal Reserve all helped keep gold firmly above the $1,300/oz. mark for the past 24 hours. And while we do expect dips, perhaps quite significant ones, going forward, we think the charge of this golden bull still has a long way to go. Fragile global economies, sovereign debt crises, and failing currency regimes will continue to stoke demand, and the higher the price goes, the more buyers will naturally show up. Furthermore, considering that most of the stuff that’s going to hit the fan has yet to do so and that gold still has to climb another $900 (or 70%) to hit its inflation-adjusted high set back in January of 1980, we expect an exciting road ahea... | ||||

| Competing Currency War In View Posted: 29 Sep 2010 05:56 PM PDT by Jim Willie CB September 28, 2010 home: Golden Jackass website subscribe: Hat Trick Letter Jim Willie CB, editor of the “HAT TRICK LETTER” Use the above link to subscribe to the paid research reports, which include coverage of critically important factors at work during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. Some prefatory stories are highly revealing. Bank of America is badly on the ropes. On the same weekend at the end of July, whe... | ||||

| Posted: 29 Sep 2010 05:56 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! September 29, 2010 12:29 PM World According to Gold: Here Comes Tokyo Rose by James West on September 29, 2010 [url]http://www.grandich.com/[/url] grandich.com... | ||||

| Siddharth Rajeev and Vincent Weber: Uranium's Upside Posted: 29 Sep 2010 05:56 PM PDT Source: Brian Sylvester of The Gold Report 09/29/2010 While the prices of gold and silver are reaching death-defying heights, uranium stocks are waiting in the wings. In this exclusive interview with The Gold Report, Sid Rajeev, head of research for Fundamental Research Corp. in Vancouver, exposes the reasons why now-stagnant uranium plays have more upside than gold or silver. He and his research associate Vincent Weber uncover some plays that allow investors to take advantage of all three. The Gold Report: Sid, in your interview with The Gold Report in February you said gold could creep back down to around $750 an ounce by 2012 if there is a strong economic recovery in the U.S. Has anything in the last eight months changed your mind? Sid Rajeev: We have made some revisions to our forecast, but our overall outlook on the market and gold has not changed. We were expecting a gradual recovery in the U.S.; however, the recovery has been much slower than expected. The hou... | ||||

| World According to Gold: Here comes Tokyo Rose Posted: 29 Sep 2010 05:56 PM PDT By James West MidasLetter.com September 29, 2010 Now that gold is muscling its way towards $2,000 an ounce, the forces of ignorance embodied by post-secondary-accredited yet nonetheless clueless commentators are being given voice by government sponsored media outlets such as CNN. Tokyo Rose was the generic handle accorded to any of a dozen women who, during World War 2 broadcast programming designed to undermine the morale of American troops over the radio. Coverage such as stories like today’s "The Case Against Gold" on CNN Money are designed to undermine the determination of gold accumulators who are genuinely frightened about the purchasing power of their dollars as their government ‘quantitatively eases’ the economy back onto its feet. By continuously counterfeiting fiat currencies and flooding the markets with such ersatz lucre, the final rush towards economic collapse is momentarily cushioned. But make no mistake. The acceleration of the rate at wh... | ||||

| Posted: 29 Sep 2010 05:56 PM PDT The 5 min. Forecast September 29, 2010 10:14 AM by Addison Wiggin [LIST] [*] Are stocks up only because the dollar’s down? How to recoup your purchasing power [*] Byron King identifies three catalysts for uranium’s next bull run [*] Chris Mayer on the “workhorse metal” with staggering profit potential [*] Our tech team pinpoints the drivers behind the next innovation wave [*] “Going Galt?”… Rebellion on behalf of gold and freedom in an unlikely place [/LIST] “As pressure mounts on the greenback, U.S. stock futures chart a course modestly lower,” read a headline on MarketWatch before the open this morning. Exhibit One on why the financial media is so confusing. Up till now, a falling dollar has been given as the one constant that has propped UP stocks since coming off their late-April highs. In fact, the upward trend in stocks has become especially pronounced as the doll... | ||||

| Grandich Quoted in Midas Letter Posted: 29 Sep 2010 05:56 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! September 29, 2010 11:49 AM Gold Not Cheap but No Bubble Either • Midas Letter by James West on September 28, 2010 [url]http://www.grandich.com/[/url] grandich.com... | ||||

| Gold Former Treads Water at All-Time High Posted: 29 Sep 2010 05:56 PM PDT courtesy of DailyFX.com September 29, 2010 06:27 AM Daily Bars Prepared by Jamie Saettele Sights remains on round figures such as 1300, 1400, 1500, etc. Watch channel resistance going forward. The line is at 1324 today and increases about $3 a day. Of note are the blue colored bars on the chart. These bars indicates an RSI that is above 75. This happened back in November 2009 and May. In both instances, Gold continued higher (slightly) before reversing.... | ||||

| Posted: 29 Sep 2010 05:56 PM PDT View the original post at jsmineset.com... September 29, 2010 07:46 AM U.S. Dollar Is `One Step Nearer’ to Crisis as Debt Level Climbs, Yu Says CIGA Eric The old idiom of the writing’s is on the wall suggests doom or misfortune. The recent breakdown of yet another head and shoulders pattern provide further support that the writing’s is on the wall for the U.S. dollar. The minimum measured move forecasts a break of the 2009 lows. In time the public will come to recognize the severity of these technical break downs through real world consequences that cannot be ignored. U.S. Dollar Index ETF (UUP): The U.S. dollar is "one step nearer" to a crisis as debt levels in the world's largest economy increase, said Yu Yongding, a former adviser to China's central bank. Any appreciation of the dollar is "really temporary" and a devaluation of the currency is inevitable as U.S. debt rises, Yu said in a speech in Singapore today. Source: bloomberg.com More…... | ||||

| Savers Told to Stop Moaning and Start Spending Posted: 29 Sep 2010 05:56 PM PDT "New record high prices in silver and gold. Plunge Protection Team discussed on CNBC Europe. Bank of England tells savers: "Screw you!" Dollar is one step closer to crisis: China. World currency war has begun. Ambrose Evans-Pritchard apologizes to the world... and much more. " Yesterday In Gold And Silver Well, the attempt to stampede the gold market to the downside early in London Tuesday morning, was not a success... as the price came roaring back shortly after the Comex opened... with most of the big gains occurring after the London p.m. gold fix was in at 10:00 a.m. New York time. Gold closed at a new record high... with the high tick of the day [$1,311.20 spot] coming shortly before 1:00 p.m. Eastern time. Volume was immense. Whether this rally was short covering or new buying is hard to say... and, because [for the umpteenth time] it happened on a Tuesday [the cut-off for Friday's Commitment of Traders report], I would highly suspect that ... | ||||

| Grandich Proud to Be a “Tin-Foil Hatter” Posted: 29 Sep 2010 05:56 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! September 29, 2010 06:37 AM * Proud to stand with the tin-foil hatters in Toronto – Buy Gold … Dear Friend of GATA and Gold: Participants in last weekend's Toronto Resource Investment Conference got a leg up on the gold and silver bull markets. They also enjoyed an appearance by the chairman of the Waterloo, Ontario, chapter of the Order of the Tin-Foil Hat, Gary McMillan. Among those posing proudly with McMillan were Peter Grandich of The Grandich Letter, who solicited donations for the Tokyo Rose Fund and credited GATA's performance at the March 25 hearing of the U.S. Commodity Futures Trading Commission for getting the gold and silver shorts on the run…. Click here to view entire story [url]http://www.grandich.com/[/url] grandich.com... | ||||

| Crude Oil Consolidates Ahead of Inventory Report, Gold Breaks to New Highs Above $130 Posted: 29 Sep 2010 05:56 PM PDT courtesy of DailyFX.com September 28, 2010 10:51 PM If risk appetite continues to rebound as it has been, it is only a matter of time before crude oil breaks above $80 again, but Wednesday’s inventory report could slow the ascent. Gold’s parabolic move continues. Commodities – Energy Crude Oil Consolidates Ahead of Inventory Report Crude Oil (WTI) - $76.54 // $0.36 // 0.47% Commentary: It was another muted day for crude oil price action, as the commodity dipped $0.34, or 0.44%, on the session. Prices continue to consolidate last week’s gains, as elevated inventory levels prevent oil from surging in step with the equity markets. Nevertheless, continued gains in broader financial markets should enable crude oil to break above $80 in the coming weeks, which may open up compelling shorting opportunities. Tomorrow will feature the DOE inventory report. The API survey showed that crude oil inventories declined by 2.4 million barrels, gasoline inventori... | ||||

| Does Silver's ‘Smooth Ride' Lead Past $30? Posted: 29 Sep 2010 05:33 PM PDT Jeff Nielson submits: Regular readers will know that I shun short-term charts and “technical analysis”. Such tools carry a low degree of reliability, since they are built upon numerous false assumptions (beginning with “free and open markets”, and “perfect information”). I submit to readers that markets have never been less “free and open”, and information has never been so far from “perfect”. Worse still, almost none of the people who engage in such analysis have any theoretical training in statistics. Lacking such education, they are simply oblivious to how much accuracy is lost with such tools – when we shorten the time-horizon. Complete Story » | ||||

| Does Silver’s ‘Smooth Ride’ Lead Past $30? Posted: 29 Sep 2010 05:33 PM PDT Jeff Nielson submits: Regular readers will know that I shun short-term charts and “technical analysis”. Such tools carry a low degree of reliability, since they are built upon numerous false assumptions (beginning with “free and open markets”, and “perfect information”). I submit to readers that markets have never been less “free and open”, and information has never been so far from “perfect”. Worse still, almost none of the people who engage in such analysis have any theoretical training in statistics. Lacking such education, they are simply oblivious to how much accuracy is lost with such tools – when we shorten the time-horizon. Complete Story » | ||||

| John Exters liquidity pyramid and Gold Posted: 29 Sep 2010 05:30 PM PDT | ||||

| The Careful Advantages of the Weak Dollar Trade Posted: 29 Sep 2010 04:57 PM PDT Aigail Doolittle submits: In 2009, we witnessed what may go down as the greatest dollar carry trade ever as investors of a more sophisticated stripe borrowed dollars at record low rates and invested those borrowed dollars in higher-yielding asset classes. As a hedge, many of those same investors shorted the dollar simultaneously. And for those who played this high-risk but high-reward game, it was the best of times between March and December of 2009 as the S&P 500 shot up 60%, gold 20%, and oil 25%. All of this came as the dollar index declined more than 15% during that same time period. Now while the dollar carry trade is dependent on the aforementioned low rates, a look back at the reality of the 2009 dollar carry trade shows us it was about more than just those low rates. We know this because the benchmark federal funds rate had been at near-zero since December 2008 and the carry trade didn’t begin in earnest until March of 2009. The carry traders needed another reason to execute such a rewarding but risky and relatively longer-term trade. This elite group needed a spark. Such a spark came on March 18, 2009 when the Fed announced its intention to purchase approximately $1.25 trillion of agency mortgage-backed securities, agency debt, and Treasury securities. Such a monetary response is referred to as quantitative easing and this particular response has become known as QE1. While only a “small” slice of QE1 was devoted to Treasurys, it was large enough to provoke the carry traders into action since it became clear that the Fed had no intention of defending the dollar even though the dollar is under the official “purview” of Treasury. In other words, the Fed’s announcement to expand its balance sheet was the blood in the water that the carry traders had been waiting for in the face of those near-zero rates and once sniffed the traders were on it. The rather unbelievable results listed above speak to the success of that particular trade. That “spark” so to speak has been ignited again on the back of the broken buck which has been on the decline since early 2002 and really since 1985. Specifically, despite a supposed strong dollar policy, the Fed is supporting an “out of sight, out of mind” dollar policy and there are many good reasons for this to be the case. (1) U.S. exports will be cheaper on the global markets under a weak dollar and this could help to improve the U.S. Trade Deficit. (2) Imports will become more expensive under a weak dollar and this could help to stimulate inflation. (3) If the U.S. dollar declines simultaneous to U.S. Treasurys offering ultra-low yields, each becomes unattractive to hold in relation to other investment options. This is true for banks too and perhaps such a dynamic will spur banks to lend thereby helping to increase the velocity of money which has slowed to a level last seen in the early 1980s. (4) A weak dollar may help to inflate some portion of the debt of the last 30 years away. This time around, however, the Fed is not debasing the dollar formally or at least yet. It has simply suggested that it may do so through the potential purchasing of Treasurys to “provide additional accommodation” to support its inflation mandate and the economic recovery if needed. However, based on the strengthening that we’ve see in Treasurys and the weakening that we’ve seen in the dollar, investors have taken this suggestion rather seriously and have brought about some portion of the desired results of a second round of quantitative easing or what has been dubbed QE2. In other words, investors seem to fear that QE2 or large purchases of Treasurys by the Federal Reserve will undermine the dollar and thus are undermining it themselves ahead of any formal undermining. And this is exactly what the Federal Reserve wants to have happen, in my view. Drive investors out of the dollar to stimulate money circulation and support the economic recovery. In other words, make the dollar as unattractive as possible so that banks, corporations and individuals will let go of dollars in exchange for other investment arrangements including lending via credit and/or assets that will yield a higher return. Interestingly, the U.S. government can take this only so far because a truly weak dollar or a collapsed dollar will not be in the best interests of the United States – clearly. This leads one to believe that the Fed will stand by and let the dollar decline long enough to put some of the above goals into motion before stepping in to defend the dollar which may occur naturally too if the U.S. economic data improves to a degree so as to defend it naturally. For the time being, however, and likely for many months, the technical aspects of the dollar index provide good reason to believe the dollar is headed down. Specifically, after the dollar index broke the ultimate level of support of 79.507 found within the support band found around 80, the dollar index’s path is down where there is minor support around 77, better support around 75 while the best support is found around 72. Due to the dollar index’s break of the 79.507 earlier this week, it seems more likely than not that it’s headed toward that 72 level. In turn, a declining dollar provides us with reason to believe that equities, gold, oil, and other commodities are likely to head up as happened in 2009. Interestingly though, the weak dollar trade seems to have begun again. Since the release of the September FOMC statement last week, the S&P 500 is up 1% while gold and oil are both up 2% as the dollar index has declined 2%. Of greater interest, however, is the fact this “seesaw” is more pronounced if we take it back to the end of August. Specifically: - The S&P 500 is up 10% - Gold is up 6% - Oil is up 6% - The dollar index is down 5% It seems to me that that the dollar carry trade restarted after the August FOMC statement was digested by the carry traders. I say this because it was that statement which was viewed by many as the beginning of QE2 with the Fed’s promise to reinvest “principal payments from agency debt and agency mortgage-backed securities in longer-term Treasury securities… [and]continue to roll over the Federal Reserve's holdings of Treasury securities as they mature.” While I think it is debatable as to whether the pledge quoted above amounts to QE2, I think it makes clear the fact that the Fed is open to injecting fresh liquidity into the system if needed. In so doing, the Fed would be pursuing that “out of sight, out of mind” dollar policy. Put more plainly, QE2 would likely deflate the dollar as happened with QE1. And just as QE1 brought the great dollar carry trade of 2009, it seems that the potential alone for QE2 has brought the beginning of a new dollar carry trade. In this potential is the possibility for continued strength in the S&P 500, gold, oil, and other commodities. One difference this time around is what the FT recently called a “hidden currency war” among the world’s various central banks, but the technical aspects of the aforementioned asset classes appear to be quite the opposite of the dollar index’s downtrend. In other words, each appears poised to continue to move up. It seems, then, that the promise of a weak dollar has served as a rally spark once more. Disclosure: Long BGU, SLV, SSO Complete Story » | ||||

| Posted: 29 Sep 2010 04:49 PM PDT MK: As I've been saying on the "Keiser Report," America is finishing the job Osama started by committing suicide on a daily basis. Destroying Net Neutrality on purpose is exactly how to ensure America's competitiveness continues to collapse. | ||||

| Murray Pollitt: As intervention fails, only gold market has a pulse Posted: 29 Sep 2010 04:42 PM PDT 12:38a ET Thursday, September 30, 2010 Dear Friend of GATA and Gold: In his latest market letter, Murray Pollitt of Pollitt & Co. in Toronto remarks that the financial markets lack much of a pulse except in the precious metals, because "we now appear to have come to the end of another 30 years of intervention in the gold market." Gold, Pollitt writes, "will lead other commodities and wealth-creating stocks higher while sending all these overvalued currencies lower." Pollitt's commentary is titled "Pulse" and he generously has allowed GATA to share it with you here: http://www.gata.org/files/MurrayPollitt-09-21-2010.pdf CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth

This posting includes an audio/video/photo media file: Download Now | ||||

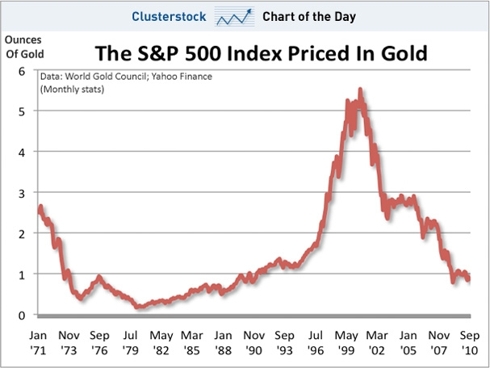

| The Stock Market Crash of the '00s Posted: 29 Sep 2010 04:37 PM PDT John Lounsbury submits: Here is a graph of the stock market crash over the past ten years, from Business Insider Clusterstock: Complete Story » | ||||

| U.S.-China relationship has messed up the world, Davies tells King World News Posted: 29 Sep 2010 04:32 PM PDT 12:30a ET Thursday, September 30, 2010 Dear Friend of GATA and Gold: Hinde Capital CEO Ben Davies tells Eric King of King World News that the U.S.-China trade relationship and the imbalances it has caused are at the root of the international financial turmoil, the recklessness of Wall Street being only a symptom. You can listen to the interview at the King World News Internet site here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/9/29_B... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php | ||||

| Posted: 29 Sep 2010 04:17 PM PDT If you had any doubt about what the driver has been for gold’s meteoric rise to $1,300, take a look at the chart below showing the spike right at the Fed’s announcement that QEII was in the cards. With the speed of a mainframe running the latest algorithm, this bid spread to the other precious metals and commodities as well. Last week, gold ETF’s purchased a staggering 16 tonnes of the yellow metal worth $582 million. The 800 pound gorilla, the (GLD) now owns $38.5 billion of the barbarous relic, making it the sixth largest owner in the world, ahead of Switzerland and China. These are heady inflows into such a small space. All of the gold mined in human history, from King Solomon’s mines to the bars still in Swiss bank vaults bearing Nazi eagles (I’ve seen them) would only fill 2.5 Olympic sized swimming pools. That amounts to 5.3 billion ounces, about $6.3 trillion at today’s prices. For you trivia freaks out there, that is a cube with 65.5 feet on an edge. Peak gold may well be upon us. Production has been falling for a decade, although it popped up to 83 million ounces last year worth $108 billion. That would rank gold 17th as a Fortune 500 company, along with Wells Fargo Bank (WFC), IBM (IBM), and drug store CVS Caremark (CVS). Total above ground reserves amount to only 16% of global public debt markets worth $39 trillion (click here for The Economist magazine’s global public debt clock at http://buttonwood.economist.com/content/gdc ). That is not much when you have the entire world bidding for it, governments and individuals alike. Talk about getting a camel through the eye of a needle! We may well see the bull market end only when those two asset classes, government bonds and gold, see outstanding values reach parity, implying a sixfold increase in gold prices from here to $7,800 an ounce. No wonder buying is spilling out into the other precious metals, silver (SLV), platinum (PPLT), and palladium (PALL), as well as copper (CU) and other hard assets. As much as I love the gold inlays in my teeth, and sometimes leave waitresses quarter ounce gold eagles as tips at restaurants, this is the reason I have been stampeding readers into the yellow metal for the past 18 months. This is not a riskless trade here. Obviously, there is a lot more downside potential at $1,300 than there was at $800, or $34. So if you get involved at this late date, better to play with near money calls spreads. To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on “This Week on Hedge Fund Radio” in the upper right corner of my home page. | ||||

| Marc Faber Interview on Chinese Yuan, Gold Prices Posted: 29 Sep 2010 04:08 PM PDT | ||||

| Gold Seeker Closing Report: Gold and Silver Climb To New Highs Yet Again Posted: 29 Sep 2010 04:00 PM PDT Gold climbed to a new all-time high of $1313.15 in Asia before it fell to see a slight loss at $1305.00 by about 8:35AM EST, but it then rallied back higher for most of the rest of trade and ended near its earlier high with a gain of 0.14%. Silver surged to $21.988 in Asia and fell to $21.667 in London before it also rallied back higher and ended near its New York high of $21.97 with a gain of 1.01%. | ||||

| Posted: 29 Sep 2010 03:57 PM PDT It's an all-out attack on the greenback and everyone else is winning! The Aussie dollar has reached parity with the Canadian dollar (the Loonie) and is fast approaching its previous highs against America's number one export (the U.S. dollar). So is this a turning point in the currency wars? Well, like all wars, a sensible question to ask is, what are we fighting for? Are we fighting for honest money that doesn't lose purchasing power? Are we fighting for low deficits and strong growth? And who are we fighting anyway? The Chinese? The Europeans? Team America? The point we're trying to make is that metaphors are only useful if they reveal some insight into a problem that you can't get in a straight forward way. Are nation's using currencies as a weapon against each other? Well, maybe. But it's more likely that each nation seeks to maximise its trading advantage by managing its currency in a certain way. In the post World War Two era, for example, it's been sensible to keep your currency cheap relative to the U.S. dollar. Americans were big spenders, even when they didn't have money. And from the American perspective, what a great trade! You send paper to people...and they send you real goods and services in exchange. And you get to make as much paper as you want because the rest of the world can't get enough of it! It does seem like kind of a fraud. But then, money is a fraud, when it's not backed by anything tangible. When money is backed by confidence (or a large economy, or the rule of law, or a blue water navy, or a large nuclear arsenal) people don't ask a lot of questions until it's too late and the currency is fatally compromised by massive debts incurred in it. Is it too late for the U.S. dollar? The last time the Aussie neared parity, the whole world fell apart. Correlation is not causation. There's no reason why the Aussie can't smash through parity and go beyond. After all, Australia's terms of trade remain high. And the Treasury expects the roaring commodity trade with Asia to deliver the Federal budget into surplus in just a few years. Frankly, it all seems just a bit too neat. But over the last few years, we've found that our first week from a major overseas trip has been marked by a fuzzy brain. It's probably something chemical. But you look at the markets right now and it just looks too good to be true. We realise that is an utterly superficial and shallow level of analysis. But it's our first intuition, so we're going to keep investigating. One thing to watch for: the end of the quarter. With such a good month for stocks topping off a good quarter, it will be worth watching to see what the smart fund money does next. We use the word "smart" loosely. September surprised everyone with how good it was. You normally see a lot of "window dressing" by fund managers at the end of the month. They buy whatever went up so it looks like the owned it all along. But getting ready for the next quarter may require less following and more leading. For example, yields on four-week T-Bills in the US have fallen by 45% in the last few days. They're down by 60% since late August. This indicates a preference for near-cash, low-yield instruments that are not stocks. It's an indication of risk aversion. Will the risk trade go off the boil now? "The ASX is sinking like a stone this morning," a colleague chimed in from across the room. "But all the gold stocks are up," said another. "And BHP and Rio are down." "So what's falling?" It must be the banks! Not that there's a banking crisis in Australia, at least not yet. There may not even be a problem. Heck, there may not even be any stress. But we'll find out soon if there should be! Wire services are reporting that ratings agency Fitch is ready to stress test Aussie banks for a 40% fall in house prices. Since Australian house prices never fall, Fitch probably won't find anything. But it's going to look anyway. The agency is going to design something that tests, "different scenarios of varying property price decline." What that means is it wants to see if falling house prices or rising mortgage default rates (that could never happen either, even if interest rates went up, which they never do) impact banks and insurers negatively (also probably impossible). What prompted the stress test of an asset class/market that is immune to stress? Fitch says that, "Weighted average established house prices for Australia's eight major cities rose by 18.4 per cent in the year to June 2010 according to the Australian Bureau of Statistics, and are now 41 per cent higher than they were in June 2006." Rising prices don't always indicate a bubble. But sometimes they do. And since we've already established our position on this issue, we're going to shut up about it now. Until tomorrow! Dan Dennning |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment