Gold World News Flash |

- Gold Pushes a New High and Crude a New Low as Volatlity Ends the Week

- Gold/Bonds Ratio Chart From Trader Dan

- Hourly Action In Gold From Trader Dan

- Jim?s Mailbox

- In The News Today

- The Phony Retail Rebound

- Why We Watch The Price Of Gold In All Currencies

- Sprott Physical Gold Trust Buys 6 Tonnes of Gold

- David Morgan: Play Silver, but Don't Get "Stuck"

- Nevada Moonlight and Terraco

- On More Stimulus Spending

- Gold May Correct Back to 1265

- Why Government Is Necessary for Prosperity... Afghanistan Not Vietnam?

- LGMR: Gold's "Z-Score" Defies George Soros' "Bubble", Hits 3rd Dollar Record For Week

- The Boy Who Cried Wolf

- United States Joint Forces Command Warns that Huge U.S. Debt Might Lead to Military Impotence, Default or Revolution

- A beginners guide to investing in Gold

- The Economics of Mass Destruction - Part II (Final)

- Still Having Troubling Understanding Why Cash Is "On The Sidelines"? The Answer Hails... From Nearly A Century Ago

- Greenspan vs. gold's anti-salesman

- Competitive Monetization

- 20 Signs That The Economic Collapse Has Already Begun For One Out Of Every Seven Americans

- Congresswankers Set Gold Hearing

- This Week's Lessons: China and Ireland

- Silver Could Shine for Call Sellers

- Shadow Bank Liabilities Plunge By $700 Billion In Q2, $2.1 Trillion Year To Date

- The Gold Price Closed at 1275.60 a New All Time High Close

- Swiss Institutions Ask: Where's the Gold?

- Substantial down move in Gold today

- Another morsel from our friend, Ed Stein

- Friday Bond Market Recap

- Guest Post: The Long Road to Recovery

- Mine nationalization seen failing at S. African party meeting

- Mine nationalization seen failing at S. African party meeting

- Friday ETF Wrap-Up: RWX Sinks, DBA Surges

- Gold And Silver Charts

- A Silver Bull Recommends Six Silver Stocks

- Gold doesn’t lie

- Gold doesn't lie

- Thailand increases gold holdings by 20%

| Gold Pushes a New High and Crude a New Low as Volatlity Ends the Week Posted: 17 Sep 2010 06:01 PM PDT courtesy of DailyFX.com September 17, 2010 04:08 PM Though the entire week was more or less shot for meaningful developments in risk appetite, the market made a valiant effort to jump start volatility to end the week. For crude this would force support while gold merely weathered the speculative shock. North American Commodity Update Commodities - Energy Fading Risk Appetite and Data Leads Oil to its Worst String of Losses in Three Weeks Crude Oil (LS Nymex) - $73.66 // -$0.91 // -1.22% For a good contrast on price action this week, we should compare the path that the S&P 500 and US-based crude took. The former nudged a four-month high through the morning hours of Friday; but the entire week was otherwise directionless. In comparison, the active Nymex crude futures contract tumbled for the fourth consecutive day (its worst performance since the period through August 24th) and subsequently took out support in the form of a rising trend channel floor along the way. This... | ||||

| Gold/Bonds Ratio Chart From Trader Dan Posted: 17 Sep 2010 06:01 PM PDT | ||||

| Hourly Action In Gold From Trader Dan Posted: 17 Sep 2010 06:01 PM PDT View the original post at jsmineset.com... September 17, 2010 10:08 AM Dear CIGAs, Both gold and silver reached their initial targets in overnight trade with gold missing $1,285 by just $0.60 and silver actually exceeding $21 by $0.025. The Dollar had been dropping rather sharply in overnight trade and late Asian trade and early European trade saw buyers surface in both metals especially as the S&P was also flying higher at the time. The result was that huge flows of more hot money invaded the commodity sector. That has continued this morning especially in the grains that is going to have devastating effects outside of the ag sector, which is basking in new found wealth at the moment. Expect quite vociferous and rightly justifiable anger to soon arise from the livestock and poultry sectors aimed squarely at the idiotic ethanol boondoggle which has helped drive the price of a bushel of corn to a 2 year high with soybeans and wheat riding right alongside of the price spike. Some of t... | ||||

| Posted: 17 Sep 2010 06:01 PM PDT View the original post at jsmineset.com... September 17, 2010 11:48 AM Jim, Greenspan spoke about gold at the Council on Foreign Relations two days ago. Sadly, the world is just now waking up to what you've known all along. Best, CIGA Black Swan Greenspan's Warning on Gold Editorial of The New York Sun | September 15, 2010 Alan Greenspan spoke at the Council on Foreign Relations earlier today, and what was his advice? That central bankers should be doing what these columns, among others, have been rattling on about, namely that they should be paying attention to gold. "Fiat money has no place to go but gold," the former Fed chairman said at the Council, according to economist David Malpass, who quotes Mr. Greenspan in one of Mr. Malpass' emails on the political economy. Mr. Malpass writes that the former chairman of the Federal Reserve's board of governors was responding to a question in respect of why gold was hitting new highs. Mr. Greenspan replied that he'd thought a... | ||||

| Posted: 17 Sep 2010 06:01 PM PDT View the original post at jsmineset.com... September 17, 2010 11:58 AM Exit Harry Schultz, pursued by a bear? Veteran gold bug is now calling sudden hyperinflation Sept. 16, 2010, 8:04 a.m. EDT By Peter Brimelow New York (MarketWatch) — A famous veteran gold bug, who called the Crash of 2008, is now calling for sudden hyperinflation. But he warns he may not be around to comment on it. My headline paraphrases Shakespeare's most famous stage direction (from The Winter's Tale). But I've added a query, because Harry Schultz says that, after closing his International Harry Schultz Letter [IHSL] at the end of the year, he will write regular "Big Picture Editorials" to be included with the Aden Forecast, which will take over his subscription obligations, "for as long as my health allows." He's 87. Schultz's long and colorful career certainly appears to be ending on a high (albeit superbearish) note. Over the year to date through August, IHSL is up 11.7% by Hulbert Financ... | ||||

| Posted: 17 Sep 2010 06:01 PM PDT The 5 min. Forecast September 17, 2010 11:56 AM by Addison Wiggin [LIST] [*] The “Holy Grail of the American School of Economics” bounces back... why it’s too good to be useful… and what you should know about today’s headlines... [*] Sugar at six-month highs, corn at two-year highs... gold sets another new record... three trades to capitalize on the “new bull” in commodities... [*] China plays hardball: Why it should be no surprise, and three ways to play the trend here at home... [*] Quantify your dissent: A new website helps you calculate — to the penny — how badly Washington is hosing you... [*] And... what’s this? One indicator that points to a coming stock rally… it has a flawless 60-year track record... how to prepare... plus reader angst over Alt-As and option ARMs and more! [/LIST] We couldn’t help but chuckle at the following headline: “U.S. Retailers and Suppl... | ||||

| Why We Watch The Price Of Gold In All Currencies Posted: 17 Sep 2010 06:01 PM PDT September 16, 2010 A common flaw that we see the average investor make is to follow their investments measured in foreign currencies and at the same time forget to calculate their local exchange rate on those investments. This is a HUGE mistake as the fluctuation of an investor’s home currency has a massive impact on their returns. Some investors know that the price of gold has been performing well in the past few years but let’s look at the charts to see how well gold has done for investors around the world. The above chart tells us the following: [*]Since roughly 2001 the price of gold appears to be rising relative to most currencies and therefore the value or purchasing power of most currencies has been shrinking. [*]Depending on where an investor is living, the price of gold has appreciated differently against the various currencies. In our opinion it can be very helpful to look at the price of an investment like gold in mul... | ||||

| Sprott Physical Gold Trust Buys 6 Tonnes of Gold Posted: 17 Sep 2010 06:01 PM PDT James Turk says $21 silver should be the trigger price for a price explosion. Sprott buys 6 tonnes of gold. US-China clash over yuan escalates, risking superpower stand-off. One-in-seven Americans living in poverty. Foreclosures Rise; Repossessions Set Record... plus much more. YESTERDAY IN GOLD AND SILVER The gold price in Far East trading meandered around unchanged yesterday. But, about an hour after London opened for business, a tiny rally began that lasted until moments after 8:00 a.m. in New York... and took gold to a new high price of $1,278.30 spot. At that point, someone appeared only too happy to sell the price down a bit... and then gold tracked sideways for the rest of the New York trading session. Silver was a bit of different animal yesterday. It sold off a bit in Far East trading... and its low price of the day [around $20.47 spot] came shortly before 4:00 p.m. Hong Kong time. Then silver spent the next twelve hours working its... | ||||

| David Morgan: Play Silver, but Don't Get "Stuck" Posted: 17 Sep 2010 06:01 PM PDT Source: Brian Sylvester of The Gold Report 09/17/2010 What's up these days with Silver Guru David Morgan? In this exclusive interview with The Gold Report, David talks about his silver obsession and his newsletter, The Morgan Report. He also imparts some investment wisdom: "The simple fact is I'm not a pig. Bulls make money, bears make money—and pigs get stuck. I'm not going to get stuck and neither are you, if you follow what I'm doing." David also discusses some of his "nonstick" silver holdings. The Gold Report: David, not only do you write The Morgan Report, but you've written books about silver, invested in silver as a teenager and you hold a substantial amount of physical silver. What's with your fascination with silver? David Morgan: My fascination really started as a teenager, particularly with the stock market and money. Once I started researching money, I found out that a stable monetary base usually requires the backing of precious metals. But that wa... | ||||

| Posted: 17 Sep 2010 06:01 PM PDT Richard (Rick) Mills Ahead of the Herd As a general rule, the most successful man in life is the man who has the best information Almost 200,000 people heading to the California gold fields crossed through what is now Nevada via the California Trail. Many camped close to the confluence of the Humboldt River and Maggie Creek in northeastern Nevada. None of them had any idea they were just a very short distance away from one of the most prolific gold deposits in the world. The area, known as the Carlin Trend, is a belt of gold deposits roughly 8 km wide and 60 km long extending in a north-northwest direction through the town of Carlin, Nevada. The Carlin Trend has yielded more than 50 million ounces since its discovery - the entire California Gold Rush produced 40 million ounces. In 1961 John Livermore was a Newmont geologist looking for gold in the windows of the Carlin Trend - windows occur where obscuring layers of rock, displaced by an uplift, have eroded to exp... | ||||

| Posted: 17 Sep 2010 06:01 PM PDT Friday, September 17, 2010 Dr. Ron Paul Faced with continuing economic decline and an impending election, the administration, predictably, is entertaining the idea of another stimulus package. To explain why the last one didn't work, adherents to the Keynesian economic philosophy are claiming that they actually did work – it just looks like they didn't because we don't realize how much worse off we would be right now without trillions of dollars of public spending. The last administration bought into Keynesianism just as much as this one does, unfortunately. Until we have leaders who understand that debt is not the way to prosperity, there will be no stopping runaway government spending. While it is nice to hear about business tax breaks, the positive results of these tax cuts will be dwarfed by its negative effects. First of all, $200 billion or so in temporary tax cuts and credits to businesses are nothing compared to the $3.8 trillion in tax h... | ||||

| Posted: 17 Sep 2010 06:01 PM PDT courtesy of DailyFX.com September 17, 2010 07:27 AM Daily Bars Prepared by Jamie Saettele Gold has traded to a new high, which negates the bearish implications and sets sights on round figures such as 1300, 1400, 1500, etc. Last week’s breakdown was of the false variety. Watch channel resistance going forward. The line is at 1298 today and increases about $3 a day. A key reversal today above the top keltner channel would warn of at least a pullback next week. Initial support is 1265.... | ||||

| Why Government Is Necessary for Prosperity... Afghanistan Not Vietnam? Posted: 17 Sep 2010 06:01 PM PDT Why Government Is Necessary for Prosperity Friday, September 17, 2010 – by Staff Report Lawrence Summers Our Best Minds Are Failing Us ... With America in deep trouble, our economists are AWOL, and our scientists are still off 'financial engineering.' The most terrifying moment in modern economic history occurred two years ago this month. For several long days after the fall of Lehman Brothers on Sept. 15, 2008, the financial system was in danger of total collapse, and the United States seemed on the precipice of another Great Depression in that "Black September." Just as bad, our economists and senior policymakers had barely any idea why this was happening. The assumptions of an entire era had been proved wrong. The "Great Moderation"—the period of post-Cold War prosperity in which capitalism was said to have been tamed and risk mastered—was revealed to be an illusion. Alan Greenspan professed his "shocked disbelief" that the Wall Stree... | ||||

| Posted: 17 Sep 2010 06:01 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:45 ET, Fri 17 Sept. Gold's "Z-Score" Defies George Soros' "Bubble", Hits 3rd Dollar Record This Week THE PRICE OF GOLD broke new Dollar records for the third time this week in London trade Friday morning, peaking above $1282 per ounce as world stock markets extended their 2% gains from Monday. Major-economy government bonds also rose, pushing interest rates lower as new German and US data showed inflation stalling on the official measures in August, while crude oil recovered above $75 per barrel.Silver rose once again too, sitting just 7¢ off a three-decade high at the London Fix of $20.85 per ounce, and gaining 5.0% from last week. The Dollar rallied from near 6-week lows to the Euro, which held gold at a 0.7% loss from last Friday's finish at €31,415 per kilo.By the start of New York dealing today, gold priced in Dollars stood 2.4% higher for the week, nearly 29% higher from this time last year. "Unambigu... | ||||

| Posted: 17 Sep 2010 06:01 PM PDT | ||||

| Posted: 17 Sep 2010 05:57 PM PDT As I have repeatedly pointed out, the American military and intelligence leaders say that debt is the main national security threat to the U.S. As I noted in February 2009 and again last December, a number of high-level officials and experts are warning of financial crisis-induced violence ... even in developed countries such as the U.S. And as I pointed out in February of this year, the U.S. runs the risk of going the way of the Habsburg, British or French empires: Leading economic historian Niall Ferguson recently wrote in Newsweek: Call the United States what you like—superpower, hegemon, or empire—but its ability to manage its finances is closely tied to its ability to remain the predominant global military power... This is how empires decline. It begins with a debt explosion. It ends with an inexorable reduction in the resources available for the Army, Navy, and Air Force... If the United States doesn't come up soon with a credible plan to restore the federal budget to balance over the next five to 10 years, the danger is very real that a debt crisis could lead to a major weakening of American power. The precedents are certainly there. Habsburg Spain defaulted on all or part of its debt 14 times between 1557 and 1696 and also succumbed to inflation due to a surfeit of New World silver. Prerevolutionary France was spending 62 percent of royal revenue on debt service by 1788. The Ottoman Empire went the same way: interest payments and amortization rose from 15 percent of the budget in 1860 to 50 percent in 1875. And don't forget the last great English-speaking empire. By the interwar years, interest payments were consuming 44 percent of the British budget, making it intensely difficult to rearm in the face of a new German threat. Call it the fatal arithmetic of imperial decline. Without radical fiscal reform, it could apply to America next. And William R. Hawkins (formerly an economics professor at Appalachian State University, the University of North Carolina-Asheville, and Radford University) fills in some details on the fall of the Hapsburg empire: Spain was the first global Superpower.. | ||||

| A beginners guide to investing in Gold Posted: 17 Sep 2010 05:30 PM PDT | ||||

| The Economics of Mass Destruction - Part II (Final) Posted: 17 Sep 2010 03:36 PM PDT From The Daily CapitalistThis is the final part of two parts of "The Economics of Mass Destruction." For Part I, go here.The Fallout of Economic ConformityThe logical conclusion of these failed policies is economic stagnation. Here is what massive government spending and taxation has done to our economy:

f=federal govt.; s=state govt.; l=local govt. The larger the share of governments’ take of capital out the economy, the less money there is available for businesses and consumers. The less capital available for the private economy, the less it will expand, and the result will be a decline in GDP. While progressive utopians believe that taxation of the “rich” is acceptable to fund social benefits, mathematics, demographics, and the laws of economics prove them wrong. Progressives have yet to understand that government produces nothing. The table, below, shows tax rates of many major economies as a share of their GDP. The welfare states have taxes approaching 50% of their economies, with the median in the high 30th percentile. The U.S.’s tax burden on the economy of 30.4% is less than most of these countries. While we ramp up our welfare state which assures higher taxes, Europe’s welfare state services are crumbling and face drastic shortfalls as their GDP falls, as their populations age, and as their companies find better conditions abroad. The Economics of Mass Destruction The Organisation For Economic Co-Operation And Development (OECD) is an economic think tank put together by 33 countries of which the U.S. is a member (see above chart for members). Most members are economic powers. China and India are not members. It generates a lot of data, but very little useful research. It is located in Paris and has 2,500 international staff members. They take a rather hard Keynesian line. One need only look at their logo to see where they stand: The OECD just came out with their Interim Economic Assessment, “Recovery slowing amid increased uncertainty” said the headline. They, like the Obama Administration are realizing that their Keynesian policies are failing.

It is clear that the OECD does not understand what is happening. Otherwise they wouldn’t need to suggest more fiscal and monetary stimulus if they really believed the “loss of momentum in the recovery” was only “temporary.” Its announcement sounds almost as if the Fed had written it. Here’s what Chairman Bernanke said on August 27, 2010:

The Obama Administration is proposing more government fiscal stimulus spending to boost the economy. The only thing these policies have achieved is the destruction of capital. The Fed and other central banks have been printing money to pump liquidity into their economies. These policies aren’t working. Credit is declining, money supply is declining, and the creation of fiat money is destroying capital by devaluing currencies. Massive government spending on politically favored projects adds nothing to the economy and destroys more capital. One need only look at U.S. stimulus spending at Recovery.gov to see where the billions are going. If it worked the economy would be growing and unemployment would be declining. The opposite is happening. How does repairing a highway in Ohio lead to economic growth? The answer is that it won’t; once the money is spent, the repair jobs go away and the capital is gone. Is it possible that the private economy would find better things to do with that capital? We need to ask what the person whose capital was taxed away by the government was going to do with it. I am sure that the answer would be that it would be preserved or used for new economically viable businesses. Only savings, not spending, creates capital for renewed growth by private enterprise. Eventually governments run out of capital if they dominate their economies long enough. High taxes and a welfare state lead to lower incentives to produce and lower incentives to save. Most of these countries are still spending the capital earned in former, freer market economic times. If they destroy enough capital they will go bankrupt and plunge their economies into serious depressions. The outcomes of policies that destroy capital will vary from country to country, but none of them will be good. In the U.S. we can look forward to stagflation: years of high unemployment, low productivity, and rising inflation. Japan will continue its 20-years of low productivity and deflation. China will experience capital destructive boom-bust cycles. Germany may be the sanest of all by ignoring the conventional Keynesian wisdom by cutting government spending. A sobering thought is that these capital destroying policies are being exported to developing countries as well. As these economies emerge from controlled economies to freer systems, they need time to amass capital to drive their growth. Most advanced economies experienced a century or more of rather hands-off capitalism before they turned into welfare states and regulated economies. China cannot morph into a dynamic capitalistic economy by burning up capital of its entrepreneurs through graft, wasteful spending, and harsh regulations. There is no refuge from the world’s plunge into massive capital destruction. At one time in history you could flee to countries with freedom and free markets, such as America. With the globalization of Neo-Keynesian economics, there is no refuge. Watch out for EMDs: the economics of mass destruction is here. * * * * * For those who wish a printable PDF of the entire article, go here. | ||||

| Posted: 17 Sep 2010 02:53 PM PDT BNY's Nicholas Colas is once again delightfully insightful with an explanation for the "cash on the sidelines" phenomenon so simple, and so elegant, no wonder it has alluded all the neosophists on CNBC for so long. "One of the lingering questions about U.S. equities remains the conundrum of “cheap” price earnings valuations on so many high quality stocks. Perhaps estimates are too high, but after several quarters of generally in-line-or-better earnings reports, that doesn’t seem to be the worry (at least for now). We think the DuPont model, an old (ancient, really) financial analysis model highlights why multiples are as low as they are. Problem #1 – cost cutting only takes you part of the way to maximizing shareholder returns in a cyclical downturn. Problem #2 – investors need to see a resumption of corporate investment growth to allow valuations to return to more normal, long term levels." Perhaps, in a wholesale revulsion to the Frankenstein monsters of modernity, starting with a thoroughly roboticized market, and quadrillions in capital flows each year in the form of electrons, investors have subconsciously reverted to the simple days of yore, in investing analysis as well as in everything else... From BNY ConvergEx' Nicholas Colas: "Old School Business Math Gives Insight on Lackluster Market Valuations" (pdf)

This posting includes an audio/video/photo media file: Download Now | ||||

| Greenspan vs. gold's anti-salesman Posted: 17 Sep 2010 02:51 PM PDT Greenspan vs. gold's anti-salesman Greenspan vs. gold's anti-salesman September 17th, 2010 Dear Friend of GATA and Gold: An editorial in yesterday's New York Sun reports on remarks made about gold that day to the Council on Foreign Relations by former Chairman Alan Greenspan, who is quoted as saying: -- "Fiat money has no place to go but gold." -- And, "If all currencies are moving up or down together, the question is: relative to what? Gold is the canary in the coal mine. It signals problems with respect to currency markets. Central banks should pay attention to it." The phrase "canary in the coal mine" is, coincidentally, the one used about gold for many years by GATA Chairman Bill Murphy. That Greenspan should pick up Murphy's phrasing may puzzle mainstream gold market analysts like Kitco's Jon Nadler, who insists that central banks have "no interest" in interfering with the gold market. But of course over the years Greenspan many times has acknowledged central bank interest in the gold market and even central bank interest in manipulating the gold market, such as his famous testimony to Congress in July 1998 that "central banks stand ready to lease gold in increasing quantities should the price rise" (http://www.federalreserve.gov/boardd...8/19980724.htm) and his musing at the May 1993 meeting of the Federal Open Market Committee about the potential for central bank gold sales to change the psychology of the gold market, remarks disclosed and analyzed by GATA consultant Dimitri Speck here: http://www.gata.org/node/8208 So with Greenspan's remarks this week to the Council on Foreign Relations, Nadler is once again contradicted about the most import factor in the gold market, the interest of central banks in controlling the price of a competitive currency that profoundly influences not only currency values but interest rates and the value of government bonds and equities generally. You can find the New York Sun's editorial quoting Greenspan's latest remarks, headlined "Greenspan's Warning on Gold," here: http://www.nysun.com/editorials/gree...on-gold/87080/ Though Kitco is nominally in the business of retailing precious metal, Nadler has spent years as a sort of anti-salesman there. While he always maintains that investment portfolios should include gold, he never advocates buying it now. With Nadler there's no danger of being misled by the enthusiasm that infects real estate, where "now" is always the time to buy. With gold's anti-salesman, the time to buy has not yet arrived or is so far in the distant past that it might be remembered only by those who helped British Chancellor Gordon Brown empty the Bank of England's vaults to rescue the short-squeezed bullion banks. Having perpetrated most of them, Greenspan knows all the tricks of central banking and is now an adviser to the Paulson & Co. hedge fund, which taken a huge position in gold. Apparently the anti-salesman didn't dissuade them from finding a time to buy. Chris Powell Secretary / Treasurer Gold Anti-Trust Action Committee www.GATA.org * * * Join GATA here: Toronto Resource Investment Conference Saturday-Sunday, September 25-26, 2010 Metro Toronto Convention Center, Toronto, Ontario, Canada http://www.cambridgeconferences.com/...urce-investmen... The Silver Summit Thursday-Friday, October 21-22, 2010 Davenport Hotel, Spokane, Washington http://www.silversummit.com/ New Orleans Investment Conference Wednesday-Saturday, October 27-30, 2010 Hilton New Orleans Riverside Hotel http://www.neworleansconference.com/...x.html&source_... * * * GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at www.GATA.org. GATA is grateful for financial contributions, which are federally tax-deductible in the United States. Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: http://www.gata.org To contribute to GATA, please visit: http://www.gata.org/node/16 | ||||

| Posted: 17 Sep 2010 02:42 PM PDT | ||||

| 20 Signs That The Economic Collapse Has Already Begun For One Out Of Every Seven Americans Posted: 17 Sep 2010 01:50 PM PDT

Unfortunately, most Americans don't really care because it has not affected them yet. But this year, millions more Americans will discover that the music has stopped playing and they are left without a seat at the table. Meanwhile, neither political party has a workable solution. They just like to point fingers and blame each other. The Democrats blame Bush for all the poverty and advocate expanding programs for the poor. Not that there is anything wrong with a safety net. But the "safety net" was never meant to hold 50 million people on Medicaid and 40 million people on food stamps. The number of Americans on food stamps has more than doubled since 2007. So do we just double it again as things get even worse? The truth is that welfare programs are only short-term solutions. Unfortunately, the Democrats do not understand this. What Americans really need are good jobs. The Republicans are so boneheaded that they don't even like to talk about poverty because they think it is a "liberal issue". Some conservative commentators have even been so brutally cold as to mock the "99ers" (those who have been unemployed so long that even their extended federal benefits have run out). Instead of showing some compassion and being the party of the American worker (as they should be), the Republicans are often very uncompassionate and they allow the Democrats to be "the party of the poor" by default. Both political parties need a big wakeup call. There is a tsunami of poverty sweeping the United States, and somebody better wake up and do something about it. More handouts will help people get by in the short-term, but there is no way that the federal government can financially support tens of millions more poor Americans. How long is it going to be before the "safety net" simply collapses under the weight of all this poverty? The path we are on is not sustainable. The economy is falling apart, and somebody better wake up and do something before even more Americans find themselves drowning in poverty. The following are 20 signs that the economic collapse has already begun for one out of every seven Americans..... #1 The Census Bureau says that 43.6 million Americans are now living in poverty and according to them that is the highest number of poor Americans in 51 years of record-keeping. #2 In the year 2000, 11.3 percent of Americans were living in poverty. In 2008, 13.2 percent of Americans were living in poverty. In 2009, 14.3 percent of Americans were living in poverty. Needless to say the trend is moving in the wrong direction. #3 In 2009 alone, approximately 4 million more Americans joined the ranks of the poor. #4 According to the Associated Press, experts believe that 2009 saw the largest single year increase in the U.S. poverty rate since the U.S. government began calculating poverty figures back in 1959. #5 The U.S. poverty rate is now the third worst among the developed nations tracked by the Organization for Economic Cooperation and Development. #6 Today the United States has approximately 4 million fewer wage earners than it did in 2007. #7 Nearly 10 million Americans now receive unemployment insurance, which is almost four times as many as were receiving it in 2007. #8 U.S. banks repossessed 25 percent more homes in August 2010 than they did in August 2009. #9 One out of every seven mortgages in the United States was either delinquent or in foreclosure during the first quarter of 2010. #10 There are now 50.7 million Americans who do not have health insurance. One trip to the emergency room would be all it would take to bankrupt a significant percentage of them. #11 More than 50 million Americans are now on Medicaid, the U.S. government health care program designed principally to help the poor. #12 There are now over 41 million Americans on food stamps. #13 The number of Americans enrolled in the food stamp program increased a whopping 55 percent from December 2007 to June 2010. #14 One out of every six Americans is now being served by at least one government anti-poverty program. #15 California's poverty rate soared to 15.3 percent in 2009, which was the highest in 11 years. #16 According to an analysis by Isabel Sawhill and Emily Monea of the Brookings Institution, 10 million more Americans (including 6 million more children) will slip into poverty over the next decade. #17 According to a recently released Federal Reserve report, Americans experienced a $1.5 trillion loss in combined household net worth in the second quarter of 2010. #18 Manufacturing employment in the U.S. computer industry is actually lower in 2010 than it was in 1975. #19 Median U.S. household income is down 5 percent from its peak of more than $52,000 in 1999. #20 A study recently released by the Center for Retirement Research at Boston College University found that Americans are $6.6 trillion short of what they need for retirement. How anyone can look at those numbers and think that things are about to "get better" absolutely boggles the mind. It is time to wake up. Things are not going to get better. Things are only going to get worse. The United States is rapidly becoming a nation where poverty is absolutely rampant. As poverty continues to spread, crime will not be far behind. Meanwhile, the international community wants to impose a global tax on us so that they can "redistribute" even more of our wealth around the world. The following was just reported by CNSNews.com.... A group of 60 nations will meet next week at the United Nations to push for a tax on foreign currency transactions as a way to generate revenue to meet global poverty-reduction goals, including "climate change" mitigation. Well isn't that great? As American descends into poverty, the rest of the world is pushing for a global tax that will drain us of wealth even more. It is just a tax on foreign currency transactions, but history has taught us that once taxers get their foot in the door they always go for more eventually. Sadly, it is not just the United Nations that is discussing a global tax. In fact, the IMF and the World Health Organization have both been very open about the fact that they want to impose global taxes of their own. Not that we aren't taxed enough already. We already pay dozens of different kinds of taxes each year, and 2011 is already being dubbed as "the year of the tax increase". But most Americans don't have any more to give. Most Americans can barely make it from month to month. More Americans than ever are slipping into poverty. What a mess we have on our hands. Do any of you have any suggestions for how we should go about fixing all of this? | ||||

| Congresswankers Set Gold Hearing Posted: 17 Sep 2010 12:42 PM PDT Congressmen Weiner and Waxman Set Gold Hearing 242 comments | by: Ira Stoll Just as the government is trying to prevent people from investing in anything other than T-Bills by raising taxes on taxable interest and dividends to confiscatory levels, it's also trying to prevent you from parking your wealth in assets, like gold, that compete with the paper dollars issued by the Federal Reserve and the Treasury. A press release from Rep. Anthony Weiner, Democrat of New York, not yet (as of this instant) posted on Mr. Weiner's Web site, announces that a September 23 hearing of the Subcommittee on Commerce, Trade, and Consumer Protection (a subcommittee of Rep. Henry Waxman's Commerce Committee) will focus on "legislation that would regulate gold-selling companies, an industry who's [sic] relentless advertising is now staple of cable television." From the press release: "Under Rep. Weiner's bill, companies like Goldline would be required to disclose the reasonable resale value of items being sold." That's great. Are Mr. Weiner and Chairman Bernanke also going to agree to print on every dollar the reasonable expectation that its value will be eroded by inflation? Gold investors (or speculators) are already punished by the federal government by having their investment, even in a gold exchange-traded-fund, taxed at the higher rates that apply to collectibles rather than long term capital gains. Not to mention the fact that Mr. Weiner's regulatory push seems as much aimed at conservative journalists as at the gold-dealers. The press release says, "Goldline employs several conservative pundits to act as shills for its' [sic] precious metal business, including Glenn Beck, Mike Huckabee, Laura Ingraham, and Fred Thompson. By drumming up public fears during financially uncertain times, conservative pundits are able to drive a false narrative. Glenn Beck for example has dedicated entire segments of his program to explaining why the U.S. money supply is destined for hyperinflation with Barack Obama as president." Imagine the uproar if a Republican-majority Congress started investigating and having a regulatory crackdown on big advertisers in liberal outlets such as the New York Times. The First Amendment freedom-of-the-press crowd would be marching in the streets. The whole situation is amazing. If Mr. Weiner really wants to calm fears about hyperinflation, the last way to do it is to have a government hearing cracking down on the http://seekingalpha.com/article/2255...t-gold-hearing | ||||

| This Week's Lessons: China and Ireland Posted: 17 Sep 2010 12:32 PM PDT Gregory Levine submits: China Complete Story » | ||||

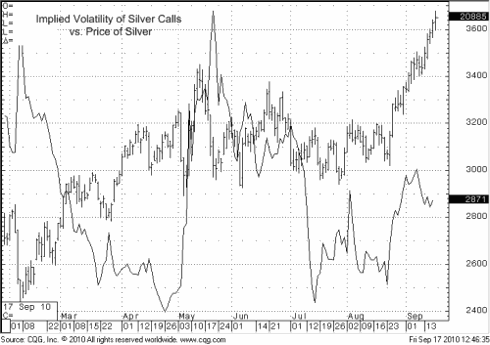

| Silver Could Shine for Call Sellers Posted: 17 Sep 2010 12:18 PM PDT James Cordier submits: Concern over global currency markets and a continued voracious Chinese demand for raw materials has steadily driven silver prices higher over the past month. Volatility in silver call options, however, has not kept pace. And this is primarily because of the orderly nature of the rally, rather than a short, violent burst as seen back in May. The chart below shows the implied volatility of silver call options as opposed to the outright price of silver (the numbers to the right measure the volatility – not the price of silver). Notice that the volatility has shown a lackluster response to the price rally. This indicates that option traders have much less concern about a rapid burst higher in price than they did back in May when wide price swings became the norm for a few weeks.  We would tend to agree. And with an overbought market with strikes still available over 50% out of the money, we continue to like silver calls as a solid premium play in the coming weeks. Options over the $30 strike price continue to offer higher premiums with low deltas (under .10) indicating there is a greater than 90% chance these options will expire worthless. We think the chances of a correction (potentially sharp) are increasing in silver, which could mean early profits for sellers of call options. However, at the existing deltas, one should be able to hold these options for quite awhile, even if silver prices continue to ascend. We will be working closely with clients in the writing of additional silver calls next week. Complete Story » | ||||

| Shadow Bank Liabilities Plunge By $700 Billion In Q2, $2.1 Trillion Year To Date Posted: 17 Sep 2010 12:07 PM PDT Continuing the analysis of today's Z.1 report, we next focus on recent developments in the shadow banking system. And it's a bloodbath: total shadow bank liabilities dropped by $680 billion in Q2, and a massive $2.1 trillion YTD. If one wonders why Ben Bernanke (yes, it's technically TurboTim) continues to print trillions and trillions of debt, and it is still doing nothing (yet) to stimulate the system, here is your answer. As credit will only exist if i) it is needed and ii) there are cash paying assets (or at least the myth thereof) to support its existence, the latest plunge in the shadow banking system is merely the most recent confirmation that the deleveraging in America is only just beginning. In fact, from the peak of the credit bubble in Q2 2008, through Q2, total bank liabilities (shadow and traditional) have plunged by $2.6 trillion, from $32.1 trillion to $29.5 trillion. Yet it is the collapse in shadow banking that was responsible, with shadow liabilities falling by a stunning 20% from $21 trillion to $17 trillion in just over two years even as banks have benefitted from the transfer of cheap government cheap on their traditional lending books (think Fed intervention and QE, leading to record low interest rates). What this means is very clear: the shadow banking system is collapsing, period. Yes, the rate of collapse is slower than in Q1, but the total plunge was still a whopping $4.2 trillion annualized for 2010. And the delta between Shadow Banking and Traditional liabilities has collapsed from $10.7 trillion at the peak in March 2008, down to under $4 trillion. This is a record amount of "money" being removed from the system, and explains why, for now at least, the velocity of money is nothing faster than a crawl. That said, if and when this indicator plateaus and recommences climbing, will be a very "sensitive" moment for all deflationists and inflationists as it will mark the inflection point from credit contraction to renewed credit creation. Alternatively, the Fed can merely force credit into traditional bank liabilities, which banks can then proceed to use and purchase stocks and commodities, at a zero cost of debt. What that will do to select asset prices, we leave to our readers' imagination. Chart 1: Total sub-components of the shadow banking system Chart 2: Comparison of shadow banking and traditional commercial bank liabilities Chart 3: Consolidated shadow and commercial bank liabilities and sequential change | ||||

| The Gold Price Closed at 1275.60 a New All Time High Close Posted: 17 Sep 2010 12:03 PM PDT Gold Price Close Today : 1,275.60Gold Price Close 10-Sep : 1,244.50Change : 31.10 or 2.4%Silver Price Close Today : 20.79Silver Price Close 10-Sep : 19.802Change : 0.99 or 4.8%Platinum Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! | ||||

| Swiss Institutions Ask: Where's the Gold? Posted: 17 Sep 2010 12:00 PM PDT Have you ever wondered what would happen if most of the claimed US gold reserves do not really exist? Can Washington continue to operate under its own questionable and often non-existent accounting rules if it doesn't have the gold reserves as promised? Should we worry about the old idiom, "When the chickens come home to roost" when a person, entity or a government pays dearly for a mistake or something bad they have done in the distant past? | ||||

| Substantial down move in Gold today Posted: 17 Sep 2010 11:25 AM PDT | ||||

| Another morsel from our friend, Ed Stein Posted: 17 Sep 2010 10:47 AM PDT When the financial crisis began to take its toll on the United Kingdom in 2008, Queen Elizabeth at a meeting with financial analysts asked the logical question: "Why didn't anyone see this coming?" … as featured in the latest newsletter, USAGOLD News, Commentary and Analysis, by Michael J. Kosares. Take advantage of our FREE Introductory Information Packet, and while you're there, consider signing up to ensure that you don't miss out on a single issue! | ||||

| Posted: 17 Sep 2010 10:46 AM PDT Bondsquawk submits: By Maulik Mody Stocks were unchanged on a second day and Treasuries gained today on reduced consumer confidence, sparking fears that the economic recovery may slow further in the last quarter of 2010. Stocks across Europe fell on concerns that Ireland’s banks may need more government aid. As a result, the spread between the country’s 10-Yr and German 10-Yr Bunds widened to an all time high and cost of insuring the country’s debt jumped to a record. Complete Story » | ||||

| Guest Post: The Long Road to Recovery Posted: 17 Sep 2010 10:42 AM PDT Submitted by David Galland of Casey Research The Long Road to Recovery Last week the government released the latest unemployment data. Bloomberg, always ready to roll up the sleeves to help its friends in government (get reelected), was running a headline that “Companies in U.S. Added 67,000 Jobs in August.”

| ||||

| Mine nationalization seen failing at S. African party meeting Posted: 17 Sep 2010 10:41 AM PDT By Agnieszka Flak http://af.reuters.com/article/topNews/idAFJOE68G0BP20100917 JOHANNESBURG, South Africa -- Leaders of the ruling African National Congress are unlikely to bow to pressure from unions and within the party by agreeing to nationalise South Africa's mines during a policy review conference next week. Julius Malema, the outspoken leader of the African National Congress' Youth League, has argued that mines in the world's biggest producer of platinum and the fourth-largest producer of gold should belong to the state to benefit the country and its people rather than foreign companies or a selected few. ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php But Minerals Minister Susan Shabangu, keen to calm investors weary of greater state involvement in the sector, has repeatedly said nationalisation was neither ANC nor government's policy, and she is unlikely to change her stance next week. "There is going to be a lot of hot air, but I don't think we are going to see anything material emerge from that meeting," said Gary van Staden, a political analyst at independent economists NKC. The mining sector's influence on the South African economy may have declined, but it is still one of the country's top employers, and accounted for 5.2 percent of the country's gross domestic product in the first quarter. Finance Minister Pravin Gordhan said on Thursday he did not expect any changes in the nationalisation debate, but Stephen Roelofse, an analyst at Metropolitan Asset Managers, said the fact that it was up for discussion was worrying. "Just the fact that it's tabled as a discussion point makes the world jittery. Investors are very much concerned about that," he said. Nationalisation is yet another worry for a sector already battling with power shortages, rising electricity and wage costs, a strong rand, and much stricter safety measures following a series of deaths. A review of the mining charter published this week also showed that whites still dominated the industry and changes were slow despite a decade of affirmative action, fuelling Malema's argument for state ownership in the sector. Only 8.9 percent of mines were owned by blacks in 2009, well below a target of 15 percent, leading the government to threaten that it would revoke mining licences if companies did not comply with a revised plan to speed up the process. Meanwhile President Jacob Zuma's government also imposed a six-month halt on new mining prospecting bids to amend the minerals law after damaging disputes with two firms over rights. "It's a mini disaster zone and could become a major disaster zone if they don't do anything soon," Van Staden said. A state-owned mining company is seen as a step towards nationalisation, with one likely to be formed before the end of this year, although analysts doubt the government has the cash or risk appetite such a venture would involve. The industry believes the government needs to come out with a clear message to reaffirm to investors once again that there is no change in policy on the horizon. "There should be a concise statement coming from Zuma and the ANC about nationalisation ... to alleviate fears and concerns internal and international investors might have," said David Davis, an analyst at Credit Suisse Standard Securities. Yet analysts and industry believe the ANC is unlikely to do that in fear of losing its two major support groups in labour and the Youth League who have threatened not to support Zuma for another term. "They are so scared of alienating any part of their support base, I doubt that they would come down harsh on anyone, " Van Staden said. Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | ||||

| Mine nationalization seen failing at S. African party meeting Posted: 17 Sep 2010 10:41 AM PDT By Agnieszka Flak http://af.reuters.com/article/topNews/idAFJOE68G0BP20100917 JOHANNESBURG, South Africa -- Leaders of the ruling African National Congress are unlikely to bow to pressure from unions and within the party by agreeing to nationalise South Africa's mines during a policy review conference next week. Julius Malema, the outspoken leader of the African National Congress' Youth League, has argued that mines in the world's biggest producer of platinum and the fourth-largest producer of gold should belong to the state to benefit the country and its people rather than foreign companies or a selected few. ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php But Minerals Minister Susan Shabangu, keen to calm investors weary of greater state involvement in the sector, has repeatedly said nationalisation was neither ANC nor government's policy, and she is unlikely to change her stance next week. "There is going to be a lot of hot air, but I don't think we are going to see anything material emerge from that meeting," said Gary van Staden, a political analyst at independent economists NKC. The mining sector's influence on the South African economy may have declined, but it is still one of the country's top employers, and accounted for 5.2 percent of the country's gross domestic product in the first quarter. Finance Minister Pravin Gordhan said on Thursday he did not expect any changes in the nationalisation debate, but Stephen Roelofse, an analyst at Metropolitan Asset Managers, said the fact that it was up for discussion was worrying. "Just the fact that it's tabled as a discussion point makes the world jittery. Investors are very much concerned about that," he said. Nationalisation is yet another worry for a sector already battling with power shortages, rising electricity and wage costs, a strong rand, and much stricter safety measures following a series of deaths. A review of the mining charter published this week also showed that whites still dominated the industry and changes were slow despite a decade of affirmative action, fuelling Malema's argument for state ownership in the sector. Only 8.9 percent of mines were owned by blacks in 2009, well below a target of 15 percent, leading the government to threaten that it would revoke mining licences if companies did not comply with a revised plan to speed up the process. Meanwhile President Jacob Zuma's government also imposed a six-month halt on new mining prospecting bids to amend the minerals law after damaging disputes with two firms over rights. "It's a mini disaster zone and could become a major disaster zone if they don't do anything soon," Van Staden said. A state-owned mining company is seen as a step towards nationalisation, with one likely to be formed before the end of this year, although analysts doubt the government has the cash or risk appetite such a venture would involve. The industry believes the government needs to come out with a clear message to reaffirm to investors once again that there is no change in policy on the horizon. "There should be a concise statement coming from Zuma and the ANC about nationalisation ... to alleviate fears and concerns internal and international investors might have," said David Davis, an analyst at Credit Suisse Standard Securities. Yet analysts and industry believe the ANC is unlikely to do that in fear of losing its two major support groups in labour and the Youth League who have threatened not to support Zuma for another term. "They are so scared of alienating any part of their support base, I doubt that they would come down harsh on anyone, " Van Staden said. Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | ||||

| Friday ETF Wrap-Up: RWX Sinks, DBA Surges Posted: 17 Sep 2010 10:36 AM PDT ETF Database submits: U.S. equity markets had a choppy Friday to close out the week, as all the major equity markets managed to finish in positive territory despite a steep drop to start the day off. Oil again finished the day lower, this time by close to $1/bbl. as the U.S. dollar finished mostly flat against the major currencies of the world. Treasury markets also stayed rangebound, while precious metals continued to remain in focus; gold reached a new intra-day high of $1,284/oz. before slipping back to the $1,276 mark to close out the week. Today’s choppy session saw large gains in some of the tech sector, led by a strong day out of Oracle. The company basked in the glow of its quality earnings report, which helped to propel the stock higher by close to 9%. However, the banking sector was not quite as lucky, as Bank of America lost over 1.1% and JP Morgan sank by 2.1% on continued worries over the state of the economy. “The market’s basically marking time here,” said Tom Samuels, managing director at Palantir Investments. “I don’t think there’s a lot of conviction out there and it makes it hard for the market to make a lot of sharp progress,” he said. “That’s why you’re having a lot of low volatility, low volume days.” Complete Story » | ||||

| Posted: 17 Sep 2010 10:21 AM PDT | ||||

| A Silver Bull Recommends Six Silver Stocks Posted: 17 Sep 2010 10:11 AM PDT Marco G. submits: If you have viewed any of my previous writings, you will know that I am a fan of Silver mining stocks. Firstly, I specialize in mining stocks, and secondly, in searching for the best gains, I believe we have an edge for the Silver metal in the upcoming fall as detailed here in the Silver break of the Gold Silver Ratio. So, let us take a look at some shining Silver possibilities for your portfolio. Silver Wheaton – SLW Complete Story » | ||||

| Posted: 17 Sep 2010 10:08 AM PDT By John Carter Governments around the world are creating literal and figurative piles of fiat currency. Although it is dressed up in lipstick and called a stimulus program, it is really an effort to boost exports, a number not as dependent on quality as affordability. That is, the more affordable the export, the more of that export a country is going to sell. And there is really only one way to control the price of exports — through a cheap currency. In a world where countries are struggling to keep their citizens employed — less they get unruly — cheap currency is a sure way to generate at least some jobs as well as some tax revenue. … The problem with this logic is, if everyone wants to be competitive, then all countries will have to make a deliberate effort to cheapen their currency through the act of creating more and more of it. That is exactly what is happening today. … Gold is watching all of this from its quiet safety haven in its own corner. And as it quietly watches this process, it is also quietly making new all-time highs. … [Governments] do not breath a word of its price action and they certainly downplay its importance. Gold does not mind. It will continue to call them out in its own quiet way, making new highs, as more and more currency is created. [source] | ||||

| Posted: 17 Sep 2010 10:08 AM PDT By John Carter Governments around the world are creating literal and figurative piles of fiat currency. Although it is dressed up in lipstick and called a stimulus program, it is really an effort to boost exports, a number not as dependent on quality as affordability. That is, the more affordable the export, the more of that export a country is going to sell. And there is really only one way to control the price of exports — through a cheap currency. In a world where countries are struggling to keep their citizens employed — less they get unruly — cheap currency is a sure way to generate at least some jobs as well as some tax revenue. … The problem with this logic is, if everyone wants to be competitive, then all countries will have to make a deliberate effort to cheapen their currency through the act of creating more and more of it. That is exactly what is happening today. … Gold is watching all of this from its quiet safety haven in its own corner. And as it quietly watches this process, it is also quietly making new all-time highs. … [Governments] do not breath a word of its price action and they certainly downplay its importance. Gold does not mind. It will continue to call them out in its own quiet way, making new highs, as more and more currency is created. [source] | ||||

| Thailand increases gold holdings by 20% Posted: 17 Sep 2010 09:53 AM PDT Gold Hits New Record on Jitters over Data, Fed By Frank Tang http://www.reuters.com/article/idUSTRE67F05920100917 NEW YORK -- Gold hit a record high on Friday for the third time this week as poor U.S. consumer confidence and market talk of more quantitative easing helped the alternative asset score its biggest weekly gain since May. The metal received a boost from data showing Thailand raised its gold holdings by a fifth in July through open-market purchases, joining a growing list of Asian nations diversifying into gold amid volatility in other markets. Thailand increased its gold holdings to 3.2 million ounces in July from 2.7 million ounces in June, according to financial data published by the International Monetary Fund. ... Dispatch continues below ... ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Silver rose to just below $21 an ounce, approaching levels not seen since 1980 as gold's rally triggered further investor speculation that the white metal would continue a winning streak that began in August. "Gold continues to reflect the overall level of concern. The weak consumer confidence data was certainly supportive to the rally in gold," said Frank McGhee, head of precious metals trading at Integrated Brokerage Services in Chicago. Gold surged to an all-time peak of $1,282.75 an ounce in the European session on expectations that the U.S. Federal Reserve, hoping to stave off double-dip recession, could announce more quantitative easing -- usually a boon for gold. After some profit-taking, the yellow metal turned higher again after data showed consumer sentiment worsened in early September to its weakest in more than a year. Another report indicated little underlying U.S. inflationary pressure. Spot gold fetched $1,275.50 an ounce at 3:11 p.m. EDT, compared with $1,272.20 late in New York on Thursday. It has gained more than $100, nearly 9 percent, since the start of August. U.S. December futures settled up $3.70 at $1,277.50 an ounce. On charts, gold remained well within a long-term rising channel dating to late 2008, and technical buying could propel the metal further above record highs, analysts said. Gold's safe-haven status increased on renewed sovereign debt worries in Ireland, after a report said Irish banks might need a bailout, but Ireland's finance ministry said there was no truth to the claim. Foreign-exchange volatility also boosted gold's appeal as an alternative currency. Japan intervened this week to weaken the yen for the first time in six years and the United States sharpened its tone on China's currency policy. "It's partly a currency move. There's certainly investor nervousness about monetary policy around the world since the yen intervention," precious metals strategist Matthew Turner of Mitsubishi Corp. said. The euro fell as European debt worries and the weak U.S. consumer data enhanced the dollar's safe-haven appeal, while fear of more Japanese intervention kept the yen near a one-month low against the U.S. currency. Dollar sentiment overall has been damaged by speculation that the Fed could announce more quantitative easing when it meets on Tuesday. September and October are typically strong periods for jewelry demand, with a number of major gold-buying festivals near the year-end in top consumer India, while Western manufacturers stock up ahead of Christmas. Eclipsing gold's rally, silver has gained 5 percent this week, double the yellow metal's 2.5 percent increase. Spot silver was up 0.1 percent at $20.74 an ounce from $20.72 in New York on Thursday. "The last few months silver has been benefiting as a monetary metal like gold, when things are looking bad, and as an industrial metal when things are looking good," Mitsubishi's Turner added. However, technical analysis suggests silver is overbought and could be due a correction. "Silver is renowned for overshooting and undershooting. In my opinion that kind of rate of increase can't be sustained. I would not be recommending anyone to get long or longer silver at $21," Credit Suisse analyst Tom Kendall said. Spot platinum hit $1,630 an ounce, its highest since May 19. It rose to $1,611.50 from $1,603.65 on Thursday and palladium fell to $540.50 an ounce from $544.65. Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment