Gold World News Flash |

- Latest Government Scheme for Growth: The Invisible Tax Cut

- GoldSeek.com Radio Gold Nugget: Richard Daughty & Chris Waltzek

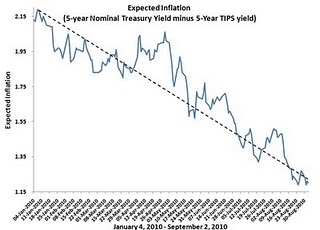

- Four Notes on Expected Inflation's Downward Trend

- Debt Reduction After Crises

- European Debt Worries Resurface

- Mainstream Thinking Is Shifting From Growth to Decline

- Dodging the Rising Cost of Food

- Gold, The Future & The Way Through

- Discovering Opportunity Amidst Investor Fear

- How Much is Too Much for Gold-in-the-Ground?

- Obama Plus Bernanke Equals A Higher Gold Price

- Gold Entering a Virtuous Cycle

- Gold Marks a Record High Close and Crude Retreats as Risk Appetite Retreats

- Grandich Client Update – Farallon Mining

- Client Update – Donner Metals Feasibility Study Says to Me, Show Me The Money!

- Gold Tactics: Chasing Price is Shooting Heroin

- LGMR: Gold "Steals Silver's Limelight" at $20/Oz as Economic Uncertainty Boosts Gold

- Grandich Client Update – Spanish Mountain Gold, Are The Stars Lining Up?

- Hourly Action In Gold From Trader Dan

- Jim?s Mailbox

- 4 Attachment(s) Merv's Weekly Gold and Silver Commentary - Sept 03, 2010

- Stress Test Reality Check

- This past week in gold - Sept 4, 2010

- I Guarantee You'll Lose Money in This "Comfort Trap"

- Gold Closing in on All-Time High

- Grandich Client Update – Formation Metals, One of These Days

- Gold Perma-Bears Bubble Forecast

- Crude Oil Down in Holiday Trade, Gold Attempts to Resume its Rally

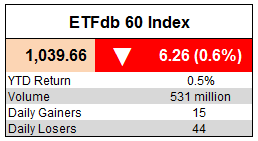

- Tuesday ETF Roundup: XLF Sinks, BLV Continues Rally

- Is U.S. Debt Junk?

- Reckless Fed/Government Policy Could Re-ignite The Housing Bubble Inferno

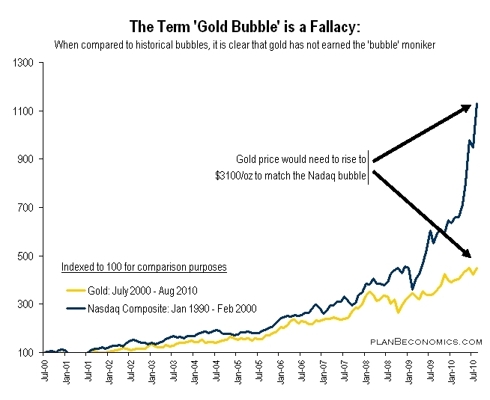

- Chart: There Is No 'Gold Bubble'

- The Cult of Equities Is Alive and Well

- The Insiders and the Speculators

- Gold Seeker Closing Report: Gold Ends at a New Record Closing High

- Jim Sinclair: Strapping in for the big move

- 50 Mind Blowing Facts About America That Our Founding Fathers Never Would Have Believed

- The Muni Bond Crisis Is Officially Here: Harrisburg Drops $3.3 Million in Muni Payments

- Strapping In For The Big Move

- In The News Today

| Latest Government Scheme for Growth: The Invisible Tax Cut Posted: 07 Sep 2010 07:07 PM PDT Bill Zielinski submits: Pulling forward future demand to stimulate economic growth didn’t work with the cash for clunkers program or housing tax credits. Car and home sales collapsed after consumers who were going to buy cars or houses anyway bought today instead of tomorrow. Past stimulus programs have increased government deficits without improving long term economic fundamentals. Undeterred by previous failures the government is again attempting to pull forward demand, this time with accelerated write-offs for new plant and equipment spending. Complete Story » | ||||||||||||||||||||||

| GoldSeek.com Radio Gold Nugget: Richard Daughty & Chris Waltzek Posted: 07 Sep 2010 07:00 PM PDT | ||||||||||||||||||||||

| Four Notes on Expected Inflation's Downward Trend Posted: 07 Sep 2010 06:58 PM PDT David Beckworth submits: It's still happening. Eight months on and counting, expected inflation continues to fall at a steady pace as seen below: (Click on figure to enlarge)

Complete Story » | ||||||||||||||||||||||

| Posted: 07 Sep 2010 06:49 PM PDT Cullen Roche submits: The latest BIS quarterly is excellent as always, but one section is particularly pertinent to the current environment. The authors provide an excellent overview of past financial crises and why they wreak such havoc on an economy. Their findings are similar to the events currently unfolding in the United States – a debt bubble ultimately results in extreme excess, asset collapse, economic collapse and ultimately a long period of private sector de-leveraging. As I’ve been arguing for several years now the true key to quickly overcoming a debt crisis such as the current one is an austro-keynesian approach. Assets must be written down, the debt must be largely extinguished, the losers must lose, the market must be allowed to work and the government should provide aid in cases that does not impede the aforementioned steps. This is obviously not what we have done. Complete Story » | ||||||||||||||||||||||

| European Debt Worries Resurface Posted: 07 Sep 2010 06:40 PM PDT Stocks sold off yesterday as European debt concerns rattled Wall St. Complete Story » | ||||||||||||||||||||||

| Mainstream Thinking Is Shifting From Growth to Decline Posted: 07 Sep 2010 06:25 PM PDT James F. Wood submits: Six months ago, very few mainstream economists or economic commentators were willing to accept the existence of conditions that typically imply recession or even depression. Today, we are seeing a significant number, but still in the minority, of the best and brightest of our economists predicting conditions that typically lead to recession and even depression. I view Bloomberg as the most serious of the national TV commentators on economics and markets. They have shifted from virtually no pessimistic talk six months ago to now about 30% predicting bad things coming. Take the economic papers delivered at Jackson Hole with the Fed last week. There is a marked change in attitude. However, a change in consensus attitude does not mean we have a consensus that a depression is coming. Complete Story » | ||||||||||||||||||||||

| Dodging the Rising Cost of Food Posted: 07 Sep 2010 06:02 PM PDT | ||||||||||||||||||||||

| Gold, The Future & The Way Through Posted: 07 Sep 2010 06:00 PM PDT | ||||||||||||||||||||||

| Discovering Opportunity Amidst Investor Fear Posted: 07 Sep 2010 05:57 PM PDT Pacifica Partners submits: Looking at the current debate about the economy, one cannot help but be reminded of how the discussion can lurch from one extreme to another. A little over a year ago, consensus revolved around the notion that inflation would be a real threat to the economy. Today, the dreaded d-word -“deflation” – has captured investors’ collective attention. As expressed in previous comments before, if inflation is to make its presence felt in the global economy, it would take much longer than many expected. To see just how full circle the economy has come, investors have been confronted with economic growth rates that have come in below expectations in Canada and the US. Complete Story » | ||||||||||||||||||||||

| How Much is Too Much for Gold-in-the-Ground? Posted: 07 Sep 2010 05:33 PM PDT | ||||||||||||||||||||||

| Obama Plus Bernanke Equals A Higher Gold Price Posted: 07 Sep 2010 05:30 PM PDT | ||||||||||||||||||||||

| Gold Entering a Virtuous Cycle Posted: 07 Sep 2010 05:27 PM PDT September 6th, 2010 by Egon von Greyerz Fundamental and technical factors for gold are now in total harmony and gold is entering a virtuous circle that will drive the price up at its fastest pace since this bull market started in 1999. [LIST] [*]It is a fact that gold in US dollars (and many other currencies) has gone up 400% in eleven years or 16% per annum annualised. [*]It is a fact that the US dollar has declined 80% in value against gold since 1999. [*]It is a fact that the dollar and most other currencies have gone down 98-99% against gold since 1913 when the Federal Reserve Bank of New York was created. [*]It is also a fact that the Dow Jones (and many world stock markets) has declined over 80% against gold since 1999. [*]It is a fact that gold has made a new all time monthly closing high in dollars in August 2010. [/LIST] Gold trend We expect gold to start a substantial rise now which will continue for 5-10 months before any major ... | ||||||||||||||||||||||

| Gold Marks a Record High Close and Crude Retreats as Risk Appetite Retreats Posted: 07 Sep 2010 05:27 PM PDT courtesy of DailyFX.com September 07, 2010 12:01 PM After an extended holiday weekend for the US markets, speculators would return to an active market with a very clear vote on investor confidence – uncertainty and fear. For the benchmark risk and safe haven commodities, the impact was met with nuance. North American Commodity Update Commodities - Energy A Correction in Capital Markets Keeps Crude Under Wraps Crude Oil (LS Nymex) - $73.79 // -$0.51 // -0.68% US-based oil fell for the third consecutive active session at the official open to the trading week Tuesday. However, unlike many of its risk-sensitive counterparts, crude was would mark relatively reserved bearish progress through close of the day’s electronic session. In fact, the commodity was ultimately little changed through the close after carving a wide range and tracking equities aggressively lower through the early hours of the New York session open. A comparison between the energy and equities ... | ||||||||||||||||||||||

| Grandich Client Update – Farallon Mining Posted: 07 Sep 2010 05:27 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! September 07, 2010 03:45 PM The Company has been focused on operational improvements and efficiencies in all aspects of the G-9 operation. Management is focused on delivering 2,000 tpd at reserve grades of 10% by Q4 2010. Improvements in metallurgical performance will also be high on the list of priorities for the company. The G-9 Mine has proven to be one of the lowest cash cost zinc producers in the world at $0.05/lb of zinc in Q2 2010 and the company intends to maintain that low-cost advantage that mine enjoys on the global scale. The plan is to add the new G-9 "gold zones" into the mine plan going forward and will be additive to current zinc resource base that the company has established. This should help further improve the economics of the operation at G-9. From an exploration perspective, Farallon has recently completed a Titan 24 IP s... | ||||||||||||||||||||||

| Client Update – Donner Metals Feasibility Study Says to Me, Show Me The Money! Posted: 07 Sep 2010 05:27 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! September 07, 2010 04:17 PM For those of you away from your desks over the long weekend, here is an update on Donner Metals* and their recent news of a Positive Feasibility Study, as well as the confirmation of an additional 2.07 Million Tonnes of Inferred Resources at McLeod Deep. A positive Feasibility Study announcement for the Xstrata Zinc – Donner Metals Bracemac-McLeod zone tells us that the new mine, which has been under construction since July, is economic. By beginning construction back in July, Xstrata made it clear that the results of the Feasibility Study would be positive and in order to meet their own needs for mill feed, construction needed to begin to ensure the Bracemac-McLeod Mine would be ready following the closure of the currently producing Perseverance Mine (wholly owned by Xstrata). A few key take aways from the p... | ||||||||||||||||||||||

| Gold Tactics: Chasing Price is Shooting Heroin Posted: 07 Sep 2010 05:27 PM PDT email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] Sep 7, 20101. How do you spell "party?" I spell it, "ringing the cash register." 2. The greatest danger in markets is believing you have the situation all figured out. For many decades, the "banksters" have controlled the gold market, and many other markets. When the OTC derivatives were marked to market (a small portion of them) in 2007, the losing side of the trade said "we don't have the money, we're bankrupt!." The winning side, the bankster side, said, "If we don't get paid, we shut the system down. We crack the whip and the taxpayers make the trip. Ha ha ha!" The greatest blackmail in the history of the world then immediately took place, as US Gov't borrowed trillions on behalf of the taxpayers (stole it from them), and handed it to the banksters. The bottom line is the banksters became multi-trillionaires in a heartbeat, and b... | ||||||||||||||||||||||

| LGMR: Gold "Steals Silver's Limelight" at $20/Oz as Economic Uncertainty Boosts Gold Posted: 07 Sep 2010 05:27 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:30 ET, Tues 7 Sept Gold "Steals Silver's Limelight" at $20/Oz as Economic Uncertainty Boost Precious Metals Investment THE PRICE OF GOLD in wholesale dealing held in a tight range around last week's close as New York re-opened after the Labor Day holiday on Tuesday, trading at $1247 an ounce while European stock markets fell and government bonds rose. Silver fell almost 2% from Monday's breach of $20 an ounce – a 30-month high previously hit in Nov. 1980. "Each time a rise in gold hits the headlines, it steals the limelight from silver," says Ashraf Laidi at spread-betting firm CMC Markets, quoted today in the Financial Times. "Silver has not only followed rallies in gold, but usually outperformed, as can be seen in a fall in the gold/silver ratio – the amount of gold that can be purchased with one ounce of silver." Yesterday saw the gold/silver ratio fall towards a 12-month low beneath 63 on th... | ||||||||||||||||||||||

| Grandich Client Update – Spanish Mountain Gold, Are The Stars Lining Up? Posted: 07 Sep 2010 05:27 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! September 07, 2010 02:53 PM In the belief of anticipated news flow over the next several weeks, Spanish Mountain Gold appears strategically placed for growth in a strengthening gold market. CEO, Brian Groves' prescient decision to reshape and refocus the company at the start of 2010 could pay significant dividends in the not-too-distant future. With over 4 million ounces of gold in the ground, a land package that has been virtually unexplored, a Preliminary Economic Assessment due out in the fourth quarter and current market conditions favouring gold , Spanish Mountain appears to be at the right place at the right time. In stark rebuttal to the long held misconception about BC mining projects, the recent renaissance of mining in British Columbia has placed it in the forefront as Canada's leader in issued mining permit approvals. The provinci... | ||||||||||||||||||||||

| Hourly Action In Gold From Trader Dan Posted: 07 Sep 2010 05:27 PM PDT | ||||||||||||||||||||||

| Posted: 07 Sep 2010 05:27 PM PDT View the original post at jsmineset.com... September 07, 2010 01:45 PM Dear Eric, This is the seed of market expectations for Currency Induced Cost Push Inflation. When this, a currency event, takes place, many items now viewed bearishly will make new and surprising highs. Regards, Jim The risky allure of copper CIGA Eric As fiat devaluation intensifies (as opposed to being driven by the global recovery), the price of copper and it's on going risky thefts are certain to increase. Predominantly copper coinage, such as 95% copper pennies, is becoming increasingly scarce in circulation. Soon you’ll be lucky to find them as transactional change. Copper theft peaked between 2006 and 2008, before the recession hit and prices plunged to less than a dollar a pound. As the economy recovers and the demand from China grows, the price is going up again, and is now hovering around US$3.40 a pound. Few new copper mines are popping up to boost production. Source: national... | ||||||||||||||||||||||

| 4 Attachment(s) Merv's Weekly Gold and Silver Commentary - Sept 03, 2010 Posted: 07 Sep 2010 05:27 PM PDT For week ending 03 September 2010 Gold continues to climb. It’s not exuberant and it’s not exciting but it keeps on climbing. It’s at a point where one would expect a serious reaction or a new explosion on the up side. Which will it be? Barron’s Gold Mining Index (BGMI) Last week I read an article where this Gold Index was a feature. For those who don’t know Barron’s magazine it is weekly financial journal founded by Clarence W. Barron in 1921 as part of his Dow Jones & Co. empire. He bought the company in 1903 shortly after the death of Charles Dow. Prior to the dawn of the internet THIS was the go-to weekly newspaper for all the information of what went on in the markets. I’m surprised that the paper version is still publishing but I see that they are getting more internet savvy. From the middle of WW2 (1942) to the beginning of 1980 this Index was in a major long term bull market with its inevitable ups and downs. ... | ||||||||||||||||||||||

| Posted: 07 Sep 2010 05:27 PM PDT The 5 min. Forecast September 07, 2010 11:53 AM by Addison Wiggin & Ian Mathias [LIST] [*] Say it ain’t so… Wall Street wakes up to stress test reality six weeks after our warning [*] Commodity consternation: Cotton hits 15-year high, wheat set for another rise [*] Dan Amoss on how Fed policies have reached a point of no return [*] Obama offers sop to small businesses… Why our readers won’t buy it [/LIST] Wall Street is waking up, only this morning, to the fact the “stress tests” on European banks are a joke. Folks who attended the Agora Financial Investment Symposium in Vancouver learned this in real-time six weeks ago when the test results came out. Speaker after speaker said it was ludicrous that only seven of 91 tested banks needed to raise additional capital. Lo and behold, The Wall Street Journal is out this morning with its own analysis of the stress tests. Bottom line: Many banks understated their holdings of shaky sover... | ||||||||||||||||||||||

| This past week in gold - Sept 4, 2010 Posted: 07 Sep 2010 05:27 PM PDT Jack Chan JACK CHAN's Simply Profits. Precision sector timing for gold, energy, and technology. Sep 6, 2010 GLD – on buy signal. *** SLV – on buy signal. *** GDX – on buy signal. *** XGD.TO – on buy signal. Summary Long term – on major buy signal. Short term – on buy signals. We continue to hold our core positions, and add to positions upon new set ups. ### Disclosure We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion. We also provide coverag... | ||||||||||||||||||||||

| I Guarantee You'll Lose Money in This "Comfort Trap" Posted: 07 Sep 2010 05:27 PM PDT By Tom Dyson Tuesday, September 7, 2010 You'll sleep soundly at night. Your neighbors won't laugh at you. Your pulse won't budge. But if you make this trade, I guarantee you'll lose money… One year ago, I opened an essay with the paragraph above. Then I showed you why a certain trade was a foolish proposition, even though it appeared to be a "no brainer." I called this trade a "comfort trap." I was talking about the dangers of betting against the value of United States Treasury bonds. At the time, the government was supplying the market with enormous quantities of bonds. It was the largest bond issuance the world had ever seen. Meanwhile, the economy was recovering and everyone was talking about "green shoots." Finally, the Fed – which had been buying vast quantities of government bonds – had just announced it would no longer support the government bond market. Here's what I wrote: In short, it's a slam-dunk bet that interest rates ... | ||||||||||||||||||||||

| Gold Closing in on All-Time High Posted: 07 Sep 2010 05:27 PM PDT courtesy of DailyFX.com September 07, 2010 06:47 AM Weekly Bars Prepared by Jamie Saettele Gold is closing in on its all-time high. A move to a new high would negate the bearish implications from the impulsive decline and set sights on round figures such as 1300, 1400, 1500, etc. Daily RSI has entered overbought territory for the first time since early May (the top was not until late June). Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Monday evenings), technical analysis of currency crosseson Wednesday and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... | ||||||||||||||||||||||

| Grandich Client Update – Formation Metals, One of These Days Posted: 07 Sep 2010 05:26 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! September 07, 2010 06:41 AM In my last update on FCO (July 19) I prescribed continued patience for ailing FCO shareholders.* The first few days of September seem to be offering some relief as we saw the stock close at $0.96 at last week's end – this up from their three month low over the summer of $0.77.* Although shareholders, including myself, are expecting better performance than $0.96, the stock appears to be moving in the right direction.* This may be in anticipation of some form of positive news or an update regarding management's financing efforts.* For readers interested in an independent valuation research report on Formation Metals from February, 2010, see the following link: [URL]http://www.jenningscapital.com/index.php/research/archive/?company=61&nalyst=all§or=all[/URL] According to FCO management, their hands are tied w... | ||||||||||||||||||||||

| Gold Perma-Bears Bubble Forecast Posted: 07 Sep 2010 05:26 PM PDT | ||||||||||||||||||||||

| Crude Oil Down in Holiday Trade, Gold Attempts to Resume its Rally Posted: 07 Sep 2010 05:26 PM PDT courtesy of DailyFX.com September 06, 2010 10:51 PM Will economic optimism from last week carry over into the coming holiday-shortened week? Regardless, the direction of markets will be extremely telling with regard to whether the latest move was merely an oversold bounce or the start of a new trend. Commodities – Energy Crude Oil Down in Holiday Trade Crude Oil (WTI) - $73.92 // $0.68 // 0.91% Commentary: Crude oil is currently down after falling on Friday despite a better-than-expected U.S. nonfarm payrolls report and rallying equity markets. Surging U.S. inventories continue to put pressure on the commodity, which typically rallies strongly on global growth optimism. It is worth repeating that inventories in the U.S. are at multi-decade highs and that U.S. crude oil production is at 6-year highs. In such an environment, the DOE inventory report becomes much more important, thus that is a key event in the coming week. The report will be released on Thursday at 10:3... | ||||||||||||||||||||||

| Tuesday ETF Roundup: XLF Sinks, BLV Continues Rally Posted: 07 Sep 2010 05:14 PM PDT Michael Johnston submits: Tuesday marked a rough return for investors after an extended holiday weekend, as jitters over the state of Europe’s banking sector weighed on equity markets around the world. That uncertainty helped to propel gold futures to new record highs; contracts for September delivery rose above $1,257 per ounce, while the more actively-traded December contract rallied to more than $1,259. Elsewhere, Barclays named investment banking boss Robert Diamond as its next chief executive while housing inventories increased for the eight consecutive month.

Complete Story » | ||||||||||||||||||||||

| Posted: 07 Sep 2010 05:13 PM PDT Cullen Roche submits: If you missed this segment on CNBC yesterday it’s worth taking a look. Michael Pento, the very vocal gold bug, is debating whether or not the USA is essentially insolvent (we all know my positions here – deflation remains the greater risk and the USA is certainly not bankrupt). He makes all the classic inflationista arguments while always making sure to point out that gold has been rising. What he fails to actually do is exactly what he accuses Erin Burnett of not being able to do – justify his argument. Pento claims that the onus is on Erin Burnett to explain to the guest why she doesn’t believe a particular position. Erin rightly corrects Pento and reminds him that he is the guest and she is merely the moderator. So, of course, the onus is on Pento to prove why the USA is insolvent. Unfortunately, Pento has been beating this drum for ages. He has been fantastically wrong about the macro picture for various reasons. While he’s nailed the gold trade the constant fear mongering over government insolvency, inflation, crashing Treasuries, etc., has all been wrong. He’s been correctly pessimistic, but for all the wrong reasons! Nonetheless, he continues to trot out this inflation argument. The onus is on the inflationistas to explain why they have been so wrong for so long. And simply pointing to one asset's rise is no longer a reasonable explanation. The macro inflation argument has been so far off the mark (in terms of how all other assets have reacted) that gold’s rise is of little significance to the overall debate. If you’re going to continue arguing that hyperinflation and USA default are right around the corner the onus is on you to first explain why you have been so wrong for so long. Only then can we actually have a constructive debate about these issues. Complete Story » | ||||||||||||||||||||||

| Reckless Fed/Government Policy Could Re-ignite The Housing Bubble Inferno Posted: 07 Sep 2010 05:11 PM PDT thereby ulitmately inflicting even more long-term destruction to our economic system. As we have seen with the home-buyer tax credit, Obama succeeded in nothing more than "pulling forward" home buyer demand into the periods covered by the tax credit. He also managed to temporarily prop up housing prices. But if you think about what really occurred there, you will see that propping up housing prices using tax subsidies only resulted in the transfer of wealth from the taxpayers and home buyers to the home sellers, real estate brokers and mortgage banks (Get it? Home buyers paid more than they should have using taxpayer wealth vs. home sellers, who got paid more than they should have; real estate agents reveived more fees on the higher price basis of the transaction; mortgage banks were more likely to get paid fully on the mortgage sitting on their books plus were able to earn higher fees on the higher principal basis of the new loan). Once again Obama screwed the taxpayers for the benefit of those who did nothing to earn that economic largesse. NOW, thru the magic of Fed-induced, artificially low interest rates, Fed money printing and Government guarantees, Freddie Mac (FRE) is rolling out the 95% refinancing mortgage and homebuilders are re-starting previously abandoned housing projects. Check this out from FRE's website: "Reach more borrowers with an easy refinance mortgage" LINK And then there's this story from Bloomberg News detailing how homebuilding companies are reviving old, abandoned projects in the major bubble States: LINK This phenomenon is a by-product of absurdly easy monetary policy and the availability, given that the Government guarantees about 95% of all mortgages now issued, of easy, low down-payment loans. Take a look at this chart from calculatedriskblog.com and tell me if you think the market really needs any more new housing projects: (click on chart to enlarge) This chart shows the number of vacant properties as a percent of total inventory vs. housing starts. Does that chart reflect the need for new housing units to be added to the housing stock? The fact of the matter is that the best way to "fix" the housing market would be for the policy makers to just let prices/supply/demand be determined by the free market. Obviously this would result with much lower housing prices for quite some time. But eventually the excess inventory would clear the market, necessitating a "natural" revival of the homebuilding industry. Of course instead, in a quest to buy votes, the Government is once again in the process of engaging short term greed/long term destructive policy implementation. Can't say I blame Obama, because according to the latest Rasmussen polling, not only is Obama's approval index lower than that of any President who is two years into his term, but it also looks like the voters are going to hand the keys to Congress back to the Republicans, for better or for worse. Good riddance Nancy... This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||

| Chart: There Is No 'Gold Bubble' Posted: 07 Sep 2010 04:36 PM PDT | ||||||||||||||||||||||

| The Cult of Equities Is Alive and Well Posted: 07 Sep 2010 04:28 PM PDT As expected, the passage of the long holiday weekend served to sober up financial markets after the exuberant finish to last week. In the sobering-up process, they were helped by a Wall Street Journal article entitled “Europe’s Bank Stress Tests Minimized Debt Risk.” This article read, in part,

Complete Story » | ||||||||||||||||||||||

| The Insiders and the Speculators Posted: 07 Sep 2010 04:24 PM PDT How about another big hand for gold ladies and gentleman? What a great performance by the yellow metal. The near-month futures contract for element number 79 on the periodic table traded at an all-time high in New York. Gold's new benchmark, for now, $1,257.30. Of course that's the picture in U.S. dollar terms. In Aussie dollar terms, gold is up 9.8%. In the last six months, it's up 19.58%. Over the last year-taking into account the slump from its all-time highs in May-it's up just 2.18%. And over five years, it's up 147%.  You can see that Aussie gold has some work to do before it makes new highs like the USD counterpart. A weaker Aussie dollar would do the trick. And who knows? Maybe another twelve months of political uncertainty and a renewed debate about a mining tax will weaken the local unit. Of course it's also possible that the prospect of a weak government with a small majority is bullish for the dollar inasmuch as that government won't be able to do much. We'll see. In the meantime, all the real double- and triple-digit action in the gold market is in the equities. This is where you get the most leverage to the gold price. But we have to admit, we're a bit ambivalent about it. This moves you into the realm of speculating more than buying an undervalued asset that's due for a mean reversion. Below, you'll find a note from our old desk mate in London, Adrian Ash. He does a good job of looking at the merger and acquisition activity in the gold market. Ade points out that for big gold producers to gain more exposure to the rising gold price, the quickest way is through acquisition. New discoveries of major gold deposits aren't keeping up with demand, and, in fact, have fallen steadily since 1980. You could argue, of course, that even if the supply side for gold looks pretty bullish, the demand side could quickly change. What would make that happen? We're tackling the scenarios in more depth in an early edition of the next issue of our newsletter Australian Wealth Gameplan. But without elaborating, the things that could lead to lower gold demand are: liquidation by major investors in the gold exchange traded funds, a resolution to the mortgage rot in America's financial system that investors actually believe and allows houses to reach a clearing price without major social fallout, or the banning of gold ownership by the public and the fixing of its price (although this would, in fact, mean higher gold prices). But it's really the first issue - the investment demand for gold - that probably holds the key to its run from here. Our fundamental argument is that owing the collapse of the Welfare State funding model (perpetual debt serviced by higher taxes) gold is being remonetised into the global financial system. It's not just a commodity. As a practical matter, though, that's probably not what most investors think when they buy gold shares or a gold ETF. That's okay, too, though. What it means, we reckon, is that gold is finding a place (albeit very small) in the asset allocation/diversification strategies of investors. This hasn't really happened before, except on the lunatic fringe where we hang out. A minor shift in preferences away from equities and bonds and toward precious metals (real money) is enough to support considerable gold demand. That's probably a claim we should quantify and prove. And we will. But we'll do it on our full research report for paid subscribers first and report back to you later. What makes us nervous about gold stocks - especially Australian ones, but in a good way - is that you can never quite tell what's going on in the trading action. It's true that an inherently irresponsible monetary and fiscal policy globally makes gold stocks very attractive because of the leverage to the gold price. But it also - maybe - true that if you want to tell when the insiders know something is about to happen in a stock (any stock) it gaps up on unexplained volume and begins making new 52-week highs. Our friend Phil Anderson was careful to point out at last night (during one of his charting seminars) that new 52-week highs and gap ups are not a sure-fire indication of insider trading. We couldn't help but think of connecting the dots ourself. Check out the chart of Andean Resources below. You'll see it does the things Phil spoke about - gaps up and makes new highs. You'll also see the last gap up (break) we've circled was days before Andean informed the ASX that the company had been approached by no-less than two other potential acquirers.  This would seem to confirm the chartists and traders like Dawes who maintain that nearly everything you need to know about when to buy or sell a stock can be found in an analysis of the chart. Dawes buys and sells the breaks as well, and uses a careful combination of moving averages to study momentum. We admit it's not our style. But it's more and more intriguing in a market like this. Of course the fundamentals matter. But if the price action can correctly tell you what "the market" knows about a stock before a company reveals that knowledge to the ASX, maybe it is the sort of thing you can use to your advantage. Stay tuned. Dan Denning | ||||||||||||||||||||||

| Gold Seeker Closing Report: Gold Ends at a New Record Closing High Posted: 07 Sep 2010 04:00 PM PDT Gold fell as much as $4.45 to $1244.65 in London before it jumped up to as high as $1259.35 in early New York trade and then fell back off a bit into the close, but it still ended with a gain of 0.66% and made a new record closing high. Its record intraday high of $1265.07 was made this past June 21st. Silver fell to $19.53 and climbed to $19.987 before it fell back off in late trade and ended with a loss of 0.15%. | ||||||||||||||||||||||

| Jim Sinclair: Strapping in for the big move Posted: 07 Sep 2010 03:52 PM PDT 11:57p ET Tuesday, September 7, 2010 Dear Friend of GATA and Gold: For fearlessness, straightforwardness, and commitment, nobody in the gold world tops Jim Sinclair, the veteran trader and mining executive who runs JSMineSet.com as an financial education forum and, sometimes, as a handholding service for gold bugs at risk of losing their nerve. Six years ago, as gold had been hovering around $400 for a year, Sinclair offered a great gift to his readers. He made an arrangement with Monex Deposit Co. (http://www.monex.com/) in Newport Beach, Calif., by which his readers could purchase and take delivery of 1-ounce Austrian Philharmonic gold coins with his guarantee that he would buy the coins from them at $400 a year hence if gold fell below that price. It might have been called the Sinclair put on gold. Emboldened by the Sinclair put, a fair number of his readers, including your secretary/treasurer, took a bunch of real metal off the market and socked it away. They have tripled their money in six years, an average of 33 percent per year. Tonight Sinclair again has put his money where his mouth is. In commentary headlined "Strapping in for the Big Move," Sinclair writes that, as in 1979, it is now time to go "throttle to floor" in gold -- and that he has done so himself, "committing 100 percent of all the cash I can accumulate to what I believe in." He expects gold to reach $1,650 by January 14, 2011 -- barely three months away. He adds that if he's wrong with that prediction, he'll make another one -- that gold will be "much higher than $1,650 five months later." GATA often has noted that those pursuing free markets in the precious metals are up against all the money and power in the world. But we do have Sinclair. To find his proclamation that the big move in gold begins now, visit JSMineSet.com here: http://jsmineset.com/2010/09/07/strapping-in-for-the-big-move/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | ||||||||||||||||||||||

| 50 Mind Blowing Facts About America That Our Founding Fathers Never Would Have Believed Posted: 07 Sep 2010 03:18 PM PDT

Needless to say, our founders would certainly not understand many of our institutions or many of the advanced technologies that we have today. But without a doubt they would be able to grasp how far we have fallen as a nation and how far we have strayed from the fundamental principles that they enshrined in our founding documents. The United States is a much different place today than it was in 1776, and unfortunately many of the changes have been for the worse. The following are 50 mind blowing facts about modern America that our Founding Fathers never would have believed.... #1 In 2010, not only does the United States have a central bank, but it also runs our economy and issues all of our currency. The Federal Reserve has devalued the U.S. dollar by over 95 percent since 1913 and it has been used to create the biggest mountain of government debt in the history of the world. #2 The U.S. Court of Appeals for the Ninth Circuit has ruled that U.S. government agents can legally sneak onto your property in the middle of the night, place a secret GPS device on the bottom of your car and keep track of you everywhere that you go. #3 The 50 wealthiest members of Congress saw their collective fortunes increase by 85.1 million dollars to $1.4 billion in 2009. #4 The U.S. government has accumulated a national debt that is rapidly approaching the 14 trillion dollar mark. #5 All over the United States, asphalt roads are being ground up and are being replaced with gravel because it is cheaper to maintain. The state of South Dakota has transformed over 100 miles of asphalt road into gravel over the past year, and 38 out of the 83 counties in the state of Michigan have now turned some of their asphalt roads into gravel roads. #6 Americans now owe more than $849 billion on student loans, which is more than the total amount that Americans owe on their credit cards. #7 In 2010, Americans waste an astounding amount of food. According to a study by the California Integrated Waste Management board, 63 percent of the average supermarket's waste stream is food. When you break that down, it means that each supermarket wastes approximately 3,000 pounds of food each year. #8 The city of Cleveland plans to sort through curbside trash to ensure that people are actually recycling properly. If it is discovered that some citizens are not recycling they will be hit with very large fines. #9 Once upon a time, U.S. industry was the envy of the world. But since 1979, manufacturing employment in the United States has fallen by 40 percent. #10 Even though the U.S. population has exploded in size, the number of Americans with manufacturing jobs today is smaller than the number of Americans who were employed in manufacturing in 1950. #11 Having one out of every eight Americans enrolled in the food stamp program is now considered "the new normal" and Americans continue to drop into poverty in astounding numbers. #12 One out of every six Americans is now being served by at least one government anti-poverty program. #13 A family of four actually has difficulty surviving on an income of $50,000 a year in America in 2010. #14 Barack Obama is backing a proposal to create a national database that will store the DNA of all individuals who have been arrested, even if they end up not being convicted of a crime. #15 In 2010, it takes the average unemployed American worker over 8 months to find a job. #16 The U.S. government has made some parts of Arizona off limits to U.S. citizens because of the threat of violence from Mexican drug smugglers. The federal government has actually posted signs more than 100 miles north of the Mexican border warning travelers that certain areas are unsafe because of drug and alien smugglers. #17 One recent survey of last year's college graduates discovered that 80 percent moved right back home with their parents after graduation. #18 In one of the very first military commissions held under the Obama administration, a U.S. military judge ruled that confessions obtained by threatening the subject with rape are admissible in court. #19 The average American worker now pays literally dozens of different kinds of taxes each year. #20 In recent years the U.S. government has spent $2.6 million tax dollars to study the drinking habits of Chinese prostitutes and $400,000 tax dollars to pay researchers to cruise six bars in Buenos Aires, Argentina to find out why gay men engage in risky sexual behavior when drunk. #21 Christians are being arrested and thrown in jail in some areas of the United States for quietly passing out Christian literature on public sidewalks. #22 The Florida State Department of Juvenile Justice has announced that it will begin using cutting edge analysis software to predict crime by young delinquents and will place "potential offenders" in prevention and education programs. #23 Organic milk is now considered such a national crisis that the FDA has been conducting military style raids on Amish farmers in the state of Pennsylvania. #24 The U.S. Environmental Protection Agency recently announced that they are considering a crackdown on farm dust. #25 According to a new CDC report, nearly half of all Americans now use prescription drugs on a regular basis. #26 Oakland, California Police Chief Anthony Batts says that due to severe budget cuts there are a number of crimes that his department will simply not be able to respond to any longer. The crimes that the Oakland police will no longer be responding to include grand theft, burglary, car wrecks, identity theft and vandalism. #27 Today, Americans are losing their homes in staggering numbers. One out of every seven mortgages was delinquent or in foreclosure during the first quarter of 2010. #28 Many of our leading scientists are now calling themselves "transhumanists" and are openly proclaiming that a future where men have fully merged with machines is inevitable. #29 Americans who spend large amounts of cash are viewed as "potential criminals" by the U.S. government in 2010. #30 New full body security scanners going into airports all across the United States can actually see through our clothing and produce very clear and very detailed images of our exposed bodies as we walk through them. #31 The U.S. financial system has become a massive gambling parlor in 2010. As a result, a horrific derivatives bubble has developed that threatens to destroy our entire economy at any moment. Nobody knows exactly how big the derivatives bubble is, but low estimates place it at around 600 trillion dollars and high estimates put it at around 1.5 quadrillion dollars. Once that bubble pops there simply will not be enough money in the entire world to fix it. #32 The U.S. government is spending an amount of money equivalent to approximately 25.4 percent of GDP this year. #33 Today, 10,000 people make 30% of the total income in the United States. #34 A 2006 Immigration and Customs Enforcement investigation discovered that 250 employees of the Defense Department used credit cards or PayPal to purchase images of children in sexual situations. However, the investigation also found that the Pentagon investigated only a handful of those cases. #35 According to a recent poll of Americans between the ages of 44 and 75, 61% said that running out money was their biggest fear. The remaining 39% thought death was scarier. #36 Approximately 57 percent of Barack Obama's 3.8 trillion dollar budget for 2011 consists of direct payments to individual Americans or is money that is spent on their behalf. #37 A recent Department of Justice guide for investigators of criminal and extremist groups lists "constitutionalists" and "survivalists" alongside organizations like Al-Qaeda and the Aryan Brotherhood. #38 The U.S. trade deficit has exploded to nightmarish proportions over the past two decades. Every single month tens of billions more dollars goes out of the United States than comes into it. Essentially, the United States is becoming far poorer as a nation each and every month. #39 Factories are closing in droves across the United States because the American people would rather buy things made in China. #40 Millions upon millions of good paying middle class jobs are being shipped off to China and they are never coming back. Meanwhile, U.S. politicians stand by idly and do nothing. #41 Some analysts now believe that China could become the largest economy in the world by the year 2020. #42 If the U.S. government was forced to use GAAP accounting principles (like all publicly-traded corporations must), the annual U.S. government budget deficit would be somewhere in the neighborhood of four to five trillion dollars. #43 According to one recent survey, 28% of all U.S. households have at least one person that is currently searching for a full-time job. #44 The U.S. dollar continues to rapidly decline in value. An item that cost $20.00 in 1970 will cost you $112.35 today. An item that cost $20.00 in 1913 will cost you $440.33 today. #45 Major international organizations are actually proposing that the United States start considering the adoption of a truly global currency. #46 Students at a high school in Missouri have built a car that they claim can get up to 450 miles per gallon. On another note, some of the top energy experts in the world believe that thorium could solve our energy problems and supply very cheap energy for society for hundreds of thousands of years. But in today's world technologies such as these are endlessly suppressed by the rich and powerful. #47 One Colorado high school student is seeking an explanation from officials at his school after he was ordered by security guards to remove American flags from his truck because they might make other students at the high school "uncomfortable". #48 Three California high school students were recently forced to remove their American flag T-shirts on Cinco de Mayo. #49 Memorial crosses erected along Utah public roads to honor fallen state troopers have been found unconstitutional by a federal appeals court and now must be removed permanently. #50 One group of high school students made national headlines recently when they revealed that a security guard ordered them to stop singing the national anthem during a visit to the Lincoln Memorial. | ||||||||||||||||||||||

| The Muni Bond Crisis Is Officially Here: Harrisburg Drops $3.3 Million in Muni Payments Posted: 07 Sep 2010 02:40 PM PDT

Back in January, I outlined a general 2010 forecast for the financial markets to subscribers of my paid newsletter Private Wealth Advisory. All in all, I outlined ten specific items I thought would come true.

They were:

1) MASSIVE increases in volatility in the markets (CHECK) 2) The Fed to continue its bailout efforts but in a more subtle “behind the scenes” manner (less public bailouts, more non-public lending windows/ purchases of Mortgage Backed Securities/ etc.) (CHECK 3) The market potentially struggle to a new high (potentially 1,200 on the S&P 500) sometime before March 2010 (this is negated by any major negative catalyst e.g. a sovereign debt default, major bank going under, etc.) (CHECK though I was off by a month+ on the top, which occurred in April). 4) Once the market peaks, a serious, VIOLENT reversal followed by a volatile roller coaster ride downward for the first half of 2010 culminating in a Crash (CHECK on the first part and we’re getting there on the Second: the Crash). 5) Several sovereign defaults and credit rating downgrades (Sort of CHECK on the first part, DEFINITE CHECK on the second) 6) Multiple states to beg for bailouts or default on their debt. (Getting there but not yet) 7) A municipal bond Crisis (Check: Harrisburg last week) 8) Interest rates to rise or inflation to break loose (Half CHECK: Negative on interest rates, but food inflation and cost of living is breaking loose) 9) China’s credit bubble to pop (Getting there but not yet) 10) Civil unrest in the US (Getting there but not yet: see Atlanta riots at section 8 housing)

All in all, every single one of these predictions has either come true or is in the process of coming true as I write this. I take great pride in my work, so I’m pleased to have provided such an accurate forecast to my subscribers. However, I get no pleasure from the fact the financial world is heading to “you know where” in a hand-basket.

Indeed, just last week my prediction #7, a municipal bond Crisis began in earnest when the capital of Pennsylvania, Harrisburg, dropped $3.3 million worth of municipal bond payments for the month of September.

This is just the beginning. Collectively US states continue to face massive budget short-falls in spite of massive Federal Aid. According to the Center on Budget and Policy Priorities, US states are expected to run deficits of $144 billion and $119 billion in FYs 2011 and 2012 respectively, unless they can cut spending further or raise taxes dramatically to close these gaps.

States can cut spending and raise taxes all they like, but the stark reality is that most of them have debt problems. And a growing number will be forced to choose between social programs and debt payments to make ends meet. Social programs buy votes, debt payments buy credit ratings.

Which do you think politicians are going to sacrifice?

I believe we that Harrisburg, Pennsylvania’s actions represent the very tip of the iceberg municipal bond missed payments and/or defaults. Remember, the muni bond market is $2-3 trillion in size, so we’re not talking about a minor issue here.

Worst of all, individual investors are the ones most likely to end up getting creamed. Indeed, ever since the 2008 Crash, investors have been generally pulling money from stocks and putting them into bond funds. All in all they’ve put $480 billion into bond funds since June 2008. Of this, some $88 billion or 18% has gone into municipal bond funds according to the Investment Company Institute.

These folks are in for a very rude surprise when they find out that munis, which historically have maintained extremely low default rates, are not nearly as risky as once thought.

I strongly urge you to review any muni bond holdings you might have in your portfolio. Below is a list of the states with the largest projected fiscal deficits for FY 12.

Subscribe to:

Post Comments (Atom)

| ||||||||||||||||||||||

The

The

No comments:

Post a Comment