Gold World News Flash |

- Kocherlakota on Loose Money and Deflation: Color Me Clueless

- Daily Charts Show Oversold or Overbought Conditions

- Top Stocks Based on PEG and Momentum

- British Gilts vs Gold, - Vying for "Safe Haven" Money

- Chinas Gold Demand: Saving, Not Spending

- I Know, I Know - Everytime I Make Bullish Call On Silver...

- 20 Bullish Charts

- Adapt or Perish

- Why the JGB Market May Be Ready to Collapse

- Gold Seeker Closing Report: Gold Gains Almost 1% While Silver Rises Over 3%

- New Fed Proposal To Bankrupt America: Government Guarantee Of Entire ABS Market

- David Morgan on this week's surprising action in silver

- David Morgan on this week's surprising action in silver

- I Took The Road More Travelled By... And It Was Swarming With Vicious High Frequency Traffic Jams

- Daily Dispatch: Uncle Scam

- Guest Post: Jim Altucher Proves Yet Again The Truth And Koolaid Don't Mix

- A Tolerance for Event Risk Leads Oil to a Correction, Gold to New Highs

- Regulators seek public comment in race to regulate Wall Street

- Pension Ponzi Scheme $16 Trillion Short?

- 10 Practical Steps That You Can Take To Insulate Yourself (At Least Somewhat) From The Coming Economic Collapse

- Time for a bounce in risk?

- Housing May Drop Another 25%?

- Dvae Morgan vidoe: Silver Market up before options expiration

- The Nonsense Recovery

- Credibility Inflation

- The Idiots Guide to Repairing an Economy

- Guest Post: International Sanctions Inflicting Pain At Gas Pump, Stalling Energy Projects

- Most Likely Track is for the Gold Price Uptrend to Keep On Rising

- Why Are The Irish Not Rioting And Insulting The Germans Yet?

- New Home Sales Forecast

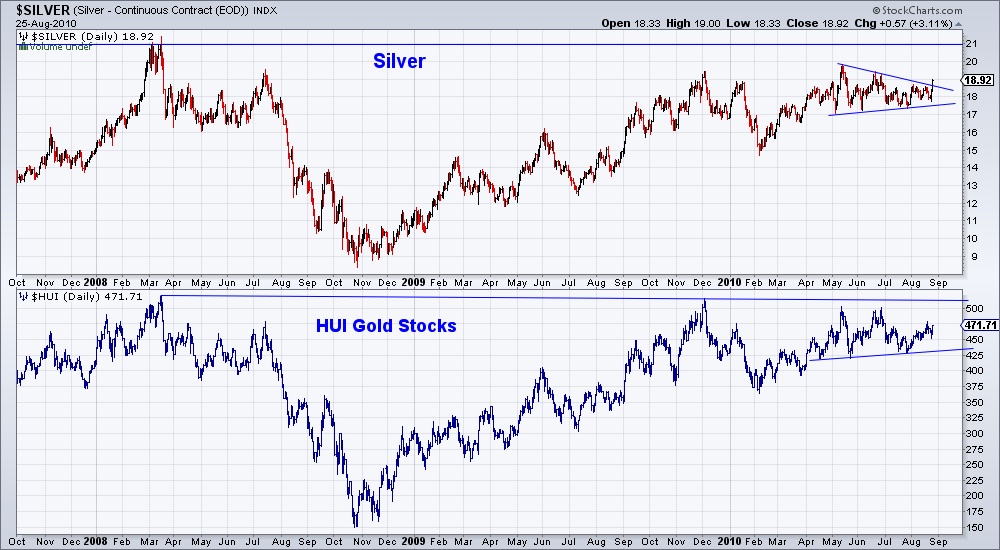

- Gold Stocks and Silver Nearing Huge Breakout

- China's Gold Demand: Saving, Not Spending

- WEDNESDAY Market Excerpts

- ALPS Launches First MLP ETF

- You'll Buy Gold Now and Like It!

- Must-read article refutes the myths of the Great Depression

- China to eliminate death penalty for smuggling gold and silver

- A Never-ending Recession, The Contained Depression and More Strategic Defaults

- Guest Post: In A Nutshell Our Economy Is Really An Insane Asylum Run By Lunatics

- If you own bonds, you could be getting ripped off

| Kocherlakota on Loose Money and Deflation: Color Me Clueless Posted: 25 Aug 2010 07:24 PM PDT The Angry Bear submits: By Robert Waldmann Minneapolis Fed President and famous economist Narayan Kocherlakota made my jaw drop with this argument: Complete Story » | ||||||||||||||||||||||||

| Daily Charts Show Oversold or Overbought Conditions Posted: 25 Aug 2010 07:20 PM PDT Richard Suttmeier submits: The yield on the 10-Year US Treasury tested 2.419 on Wednesday with overdone momentum. Gold remains overbought with a test of $1243.7 overnight. Crude oil is oversold with a daily pivot at $72.06. The Euro is oversold with a daily pivot at 1.2741. The Dow is oversold with weekly and daily pivots at 10,035 and 10,129. New and existing home sales take a plunge. What to do with Fannie and Freddie. Mortgage applications rise for refinancings. Savings & Loans report a second quarter profit.

Complete Story » | ||||||||||||||||||||||||

| Top Stocks Based on PEG and Momentum Posted: 25 Aug 2010 06:45 PM PDT Scott's Investments submits: I conduct the following screen on a monthly basis. Early out-of-sample results have been mixed, performing well during bullish environments and poorly during bearish/choppy markets. Last month's list here, June's list is here, May's list is here, April's list is here, March's list is here, February's list is here and January's here. The screen looks for the following:

January's list returned 1.39% vs .57% for SPY. February's list returned a solid 11.78% vs. 6.77% for SPY. March returned 7.91% vs. 4.23% for SPY, April was a down month, nearly matching SPY in returning -11.57% vs -11.52% for SPY, May's list returned -6.55% vs -.56% for SPY, June's list returned -1.74% vs. 3.27% for SPY and last month's list returned a sour -10.36% vs -5.55% for SPY. One note on May's list is that due to the pullback in the market there were very few stocks that qualified for the list, four in total. When the screen results in more than 5-10 stocks I have also started tracking returns of the top 5 or 10 stocks at the beginning of each list. The top stocks are selected based on fundamental factors. For the full list of stocks and results, please see the right hand side of Scott's Investments. The screen has tested well historically in bullish periods so strategies an investor could use to avoid drawdowns would be to either a) abandon this type of strategy entirely when the S&P 500 or another major index is below a long term moving average, or b) hedge positions with a position in SH or write a short option strategy on an equity index or ETF like SPY. This month's list contains only three stocks, which tells us the overall market is showing very few stocks trading near their 52 week highs. Two possible tools an investor could use to conduct this screen on his/her own are stockscreen123 or Finviz. This screen was conducted using stockscreen123.

Disclosure: No positions in stocks mentioned Complete Story » | ||||||||||||||||||||||||

| British Gilts vs Gold, - Vying for "Safe Haven" Money Posted: 25 Aug 2010 05:37 PM PDT | ||||||||||||||||||||||||

| Chinas Gold Demand: Saving, Not Spending Posted: 25 Aug 2010 05:30 PM PDT | ||||||||||||||||||||||||

| I Know, I Know - Everytime I Make Bullish Call On Silver... Posted: 25 Aug 2010 05:22 PM PDT it gets hit hard by the illegal manipulative activities of JP Morgan and HSBC. BUT, here I go again. I will preface this by saying that silver has an extraordinary reversal off of its 200 dma over the past 2 trading sessions - $17.75 to $19, or nearly 10% - so a consolidating pullback here would not surprise me. Having said that, if you look at the chart below, silver appears poised to make a big move, with seasonal factors now blowing some wind into the sails of the poor man's gold. I slightly modified this chart, which was posted in tonight's Midas at http://www.lemetropolecafe.com/ courtesy of "Richard from the Scarborough Bullion Desk:" (click on chart to enlarge) This is a weekly chart of silver, and the relative positioning of the standard momentum indicators are tremendously bullish. Also, as Richard pointed out, the bollinger bands have become quite narrow, indicative of a tightly "coiled" trading behavior which often makes a big break up or down. As you can see, the last two "coils" made huge moves to the upside. And finally, there's that massive inverse head n shoulders formation, with the "right shoulder" oscillating just below a potential breakout to the upside. I know several long-time participants in the silver market think we could see the low $20's before the end of the year. I also know one chart technician who believes this silver chart is pointing toward $30 sometime in the next 6-9 months. Personally, I'm not putting any price objectives on silver here. I think if silver can get over the $19.60 area and hold, the sky is the limit. Certainly new highs in the low-mid $20's would be my expectation. And then there's the physical problem. I know that Sprott is going to float its silver trust sometime in mid-late October. I mentioned to a colleague that they may find it difficult to find $200 million worth of silver (the proposed offering size, roughly). He said that they are aware of that issue... This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||

| Posted: 25 Aug 2010 05:12 PM PDT Calafia Beach Pundit submits: Pessimism is rampant, and most of the articles and commentaries I see have some doom-and-gloom flavor to them; indeed, many pundits are already claiming to see a double-dip recession either in progress or as imminent. I think the "conservative" bull case—that the economy is growing at a sub-par trend rate of 3-4%, which will leave the unemployment rate uncomfortably high for some time to come—is not getting its fair share of the news. So here is my attempt to balance the scales: a collection of charts (click on each to enlarge) that to me point to ongoing economic growth, however mild that might be, with not a hint of a double-dip recession. All charts contain the latest data available, and they are shown in no particular order. I've discussed all of these in recent posts, so for long-time readers this just is a recap of how I see things today. Capital spending has grown at an impressive rate since the end of the recession, with no signs yet (assuming the July numbers contained a faulty seasonal adjustment, as I detailed in an earlier post yesterday) of any slowdown. Strong capex reflects at least some positive degree of confidence on the part of businesses, and that is a leading indicator of future growth in the economy. Complete Story » | ||||||||||||||||||||||||

| Posted: 25 Aug 2010 04:57 PM PDT "Do not overbid for assets - especially at the top of a real estate cycle." You can't really argue with that, can you? The big question is, where are we in the cycle? The opening line above came from our friend Phillip J. Anderson. Phil was speaking to a packed room in a building on Flinders Lane Tuesday night. He first came to our attention a few years ago when one of his readers hand-delivered us a copy of his book, "The Secret Life of Real Estate: How it Moves and Why." His talk Tuesday night was fascinating. It was good to get out of our lair on Fitzroy Street and hear a different perspective on the market and the world. We won't give away all of Phil's observations since the event was for paid up readers. But if you're interested in his book or his study of historical cycles, you can check out his website. Unlike your editor, Phil's research tells him the U.S. and U.K. property markets have already made a low. If you use the past as a guide, he says, "When bad real estate news is coupled with higher stock market lows, it's generally a bullish sign. As the stock market goes up, the productive capacity of the economy is increasing." Phil reckons that if the Aussie stock market doesn't take out the July lows by the end of the first week of September, "it's an exceedingly bullish sign." That kind of price action in the midst of an increasingly bearish turn in sentiment would be remarkable. Phil says it would also tell you that the Global Financial Crisis is effectively over. These are certainly not the sort of arguments were used to hearing (or making) at the DR Australia headquarters. But Phil doesn't make them lightly. And he makes a good point - students of the market's price action don't rely on opinions. The price action, he says, is "unambiguous" and the weight of money argument dictates the direction of markets. We were impressed and even a bit sympathetic with the contrarian nature of the call. Phil even picked a day - September 7th. If new lows aren't in by then, he reckons, look out above! And though we can't go into a lot of detail here, there is an enormous amount of study of previous economic and real estate cycles that goes into Phil's forecasts. We even detected a bit of Dawes in the way Phil applies the "big picture" understanding of asset markets to trading. His trading philosophy is to buy stocks when they "break out" of a trading range. This is somewhat counterintuitive. It requires you to buy stocks making new highs. How can something be cheap or good value if it's making new highs? Well, the price action is what it is. And Phil is right that understanding where you are in a cycle is crucial to figuring out whether you should be a buyer or a seller of a particular asset. What made his talk so interesting is that the 18.6 year cycle that figures so much in his work derives, ultimately, from the value of land - the ultimate tangible asset the basis of much bank collateral. If you're into cycles, you won't be surprised to learn that Kondratieff cycles figure in Phil's work. A Kondratieff cycle is a 50-60 year cycle (or about three 18.6 year cycles) of expansion, stagnation, and recession in an economy. The theory was based on a study done by the Russian Nickolai Kondratieff. Kondratieff was asked by the communist Russian dictator Josef Stalin to study the economy and figure out when the internal contradictions of the capitalist system would cause its destruction and pave the way for the linear march of the Marxist system to worker's world paradise. When Kondratieff's work didn't show any kind of inevitable decline and fall of the West - but instead showed a cyclical process of growth and contraction - Stalin had him banished to the Gulag where he died. So much for science and dissent. This, by the way, shows you the insidious nature of outcome-based policy making. Policy can't guarantee outcomes, which are usually driven by idealistic or naive political goals. Good policy can only guarantee that the conditions in which everyone operates are fair and equal, leaving the outcome up to your own effort, or luck, or fate, or God's will, if you prefer. Many people study Kondratieff. Fewer still understand him. And using his work as a forecasting tool is pretty tough. After all, Kondratieff's study of commodity prices was based on analysis of 19th and early 20th century commodity prices, and mostly grains at that, from what we understand. A model is only as good as the data that goes into it. So you wonder how good the data was. Further, it's one thing for real scientists conducting experiments to use a model. But it's quite another thing for social scientists to do the same and then claim it predicts what should or must happen. This is probably our main beef with the cyclical view of history or markets. Though it makes sense and conforms to your personal experience of the world - birth, adolescence, adulthood, parenting, old age, death - it may not be true economically. Why? Every story and every life is a kind of closed system. They each have a beginning, a middle, and an end. Some are long. Some are short. Some are memorable. Most are forgotten. But they all look like a line or a distinctive arc through time that is unique to your life. But neither the economy nor the natural world itself are closed systems. They are not finite lines. They are infinite. This is important because it means you can never predict how an open system will ultimately behave or evolve. There's always one variable beyond your control, like the crazy Uncle at the Christmas dinner who is capable of unleashing drunken chaos at any moment or the asteroid that could crash into the Earth tomorrow. Yet life remains constant, whether it's a cockroach or a member of the Federal Parliament (with one being a sophisticated and evolved piece of natural engineering and the other managing to be predator, parasite, and scavenger). It's odd that life endures when even geography does not. In the natural world, mountain ranges come and go. What's more, the Earth is not a closed system. For one, energy in form of solar radiation rains down on the Earth every minute of the day, creating opportunities for all kinds of life and work. More importantly, through the genius of its un-designed design, DNA manages to replicate itself time after time and survive in many different forms. Life persists as the physical world changes. And life doesn't just persist in the same state. It changes constantly. Nature produces an immense variety of life. The forms best adapted for the conditions which exist survive and reproduce. The rest don't. Entropy - the tendency of things to fall from order into disorder - is only defeated by life's relentless effort, through DNA, to replicate itself in as many different survivable forms as possible. What does any of this have to do with Kondratieff and the share market? An economy is not a closed system, either. It does not behave in a linear way. That means you can't really predict how it's going to turn out. And importing a linear or cyclical theory into a complex adaptive system like the economy means you are going to be confounded in your understanding and your forecast. You will not predict what you can't know. The unknown unknowns will get you every time. The key variables that we do know about in any economy - land, labour, energy, and innovation - are always changing and changing the way they interact and producing new possibilities (not always good, of course). For example the role of technology in the Kondratieff cycles is, as far as we know, unexplored. When Kondratieff wrote, the industrial revolution was increasing crop yields. Human population was on the verge on productivity explosion - both physically and economically. As people moved out of the country and into the city, labour and capital were freed up to harness the power of coal and oil to make entirely new systems of transportation and. It really was a new frontier in terms of productive possibilities. You went from cows and washing boards to refrigerated milk and milkshakes. By the way, these new frontiers (space, the final) always make some people nervous. These nervous people are the ones who could have the most to lose from a change in the status quo. Or, they could be genuinely and quite negatively affected by the change - the proverbial buggy whip maker watching a Model T roll down the street. Or they could be type of conservative person, psychologically and emotionally speaking, who reacts to a changing world by pining for the "old days" when things were more certain and didn't change. This is why far right conservatives and the Greens will find they have more and more in common in coming years - both pine for a world that doesn't change much. The traditional Right defines that world in moral and religious terms. The new Left defines it in environmental and resource terms. But both are essentially backward looking and want the State to interfere in private life to keep things as they were, or as they should be again. What the Kondratieff cycle may not accommodate is what you can never predict: the future. But at the risk of making a major ass of ourselves we'll make a prediction: the current system has been fatally compromised by the world improvers and the backward lookers. Three hundred years of improvement in the general living conditions of man are at risk. The first major improvement in standards of living came with an increase in calories. When hunter gatherers became settled farmers, excess calories became a kind of credit humanity could spend on other things, like developing technology. With the development of industrial technology, powered by coal-fired steam engines, the next great leap came in the amount of time people had to spend growing food and the number of people required to grow it. Industrialisation meant fewer people had to be employed growing food. More could be employed making things. The variety of technology and durable and finished goods exploded in the 19th and 20th centuries. The further concentration of labour in cities made more and subtler variety possible, this time in the form of leisure and entertainment. You got the Jazz Age, Sinclair Lewis, George Bernard Shaw, the Charleston, and the Blitzkrieg. But then - and we think it started to happen in about 1914 but really picked up pace in the 1970s - we hit the limits of the frontier of this previously stable system. With the advantage of creating money from nothing - fiat money and fractional reserve lending - a huge global credit boom accelerated the use and abuse of scarce real resources (land, labour, and capital). It also accelerated the use of energy. More importantly, an already-complex system produced by a few simples rules - private property, sound money, low taxes, and free trade, the rule of law - became even more complex and fragile and stagnant as those rules were tinkered with to produce designed outcomes cherished by the political class. Here we are today. Our prediction is that that great complexity and prosperity produced by the 19th and early 20th century is being destroyed by the tinkering and the tinkerers. They have created something that cannot sustain itself - a model of asset-based private and corporate wealth creation that is not based on sound money or honest work or the rule of law (the corporations and the financiers and the politicians make the law to protect their interests now). Nature punishes the inefficient and destroys the wasteful. And so do markets, when we let them. We take the amount of surplus in the world - calories, time, leisure - for granted. In fact, we even begin to call it a right. What we forget is that all those calories and all that time and all that leisure were the by-products of a system based on simple rules. With those rules being broken, twisted, and disfigured to meet other ends, we shouldn't expect the system to produce the same kind of surplus we are used to. And now we see, it's not. Of course without all the theory most people know intuitively that things aren't working anymore. That's because most people have already begun to adapt to a world where big institutions have trouble delivering on promises they've made and where the rules constantly change. Some people prefer not to think about this and would rather eat Cheesy Puffs instead. Woe unto them! What we think the Kondratieff cycle doesn't show is that the history of the natural world is punctuated by extinction events - events which so radically changed the landscape or the habitat that most species didn't survive. And in the financial world? We have seen a series of minor extinction events in the finacial world beginning with the Mexican devaluation in 1995. The Asian Tigers, Russia, LTCM, the tech bubble, and then Bear Stearns, Lehman, Greece and beyond. And beyond? All of these financial events are steadily concentrating risk in a smaller and smaller number of assets into which a greater and greater number of people are congregating: namely bonds and especially U.S. bonds. This concentration is made of refugees from other bubbles that have faith that central bankers can keep a few bubbles going. But oh ye of little faith, ye reckoners, what do you reckon? Will the counterfeiters running the world's central banks pull of the greatest confidence trick of all time that you can create wealth by printing money and solve a debt problem with more debt? Or will they fail? They'll probably fail. Will it be before September 7th? Will it be in a few years? Stay tuned. And in the meantime, adapt or perish! Dan Denning | ||||||||||||||||||||||||

| Why the JGB Market May Be Ready to Collapse Posted: 25 Aug 2010 04:33 PM PDT When I first arrived in Japan in 1974, international investors widely expected the country to collapse, a casualty of the overnight quadrupling of oil prices to $12 and the global recession that followed. Japanese borrowers were only able to tap foreign debt markets by paying a 200 basis point premium to the market, a condition that came to be known as “Japan Rates.” Hedge fund manager, Kyle Bass, says that the despised Japan rates are about to return. There is nothing less than one quadrillion yen of public debt in Japan today. A perennial trade surplus powered high corporate and personal savings rates during the eighties and nineties, allowing these agencies to sell their debt entirely to domestic, mostly captive investors Those days are coming to a close. The problem is that the working age population peaked in Japan last year, and the country is entering a long demographic nightmare (see population pyramids below). This year, the Ministry of Finance will see ¥40 trillion in receivables, the same figure seen in 1985, against ¥97 trillion in spending. Interest expense, debt service, and social security spending alone exceed receivables. The tipping point is close, and when it hits, Japan will have to borrow from abroad in size. Foreign investors all too aware of this distressed income statement will almost certainly demand big risk premiums, possibly several hundred basis points. That’s when the sushi hits the fan. To top it all, no one in living memory in Japan has ever lost money in the JGB market, so expectations are unsustainably high. Need I mention that Japan’s Q2 GDP growth came in at an arthritic 0.1 %, not exactly a performance to run up the flagpole? Both the JGB market and the yen can only collapse in the face of these developments. I know that the short JGB trade has killed off more hedge fund managers than all the irate former investors and divorce lawyers in the world combined. Read about my own recent, futile attempt to sell these markets by clicking here at http://www.madhedgefundtrader.com/august-6-2010.html . But what Kyle says makes too much sense, and the day of reckoning for this long despised financial instrument may be upon us. How much downside risk can there be in shorting a ten year coupon of under 1%. I have included a breakdown of Kyle’s portfolio below, which you should note, has absolutely no equities anywhere in the world. Is Kyle trying to show us the writing on the wall? To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on “This Week on Hedge Fund Radio” in the upper right corner of my home page. | ||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold Gains Almost 1% While Silver Rises Over 3% Posted: 25 Aug 2010 04:00 PM PDT | ||||||||||||||||||||||||

| New Fed Proposal To Bankrupt America: Government Guarantee Of Entire ABS Market Posted: 25 Aug 2010 03:58 PM PDT From The Daily Capitalist Let us assume for the purpose of argument that our corporate bond market is and always has been backed by federal government insurance. In its many years of operations companies would float bonds at relatively low interest rates because of the government's guarantee. Industry would be financed for their various projects, and, perhaps because of the lower cost, maybe this would be the preferred financing option for seasoned companies rather than common stock. If anyone were to suggest that this market should shed its guarantee and rely on the private securities market to finance corporations, I am sure they would be laughed down by most economists and politicians. They would use the standard arguments against free markets. Everyone knows that without the guarantee corporate bonds would not get financed, or, there is not sufficient evidence that the private market would finance bonds without the guarantee, or, if they did, the lending covenants would be too harsh or the interest rate would be too high for corporations to afford. And, of course, the government has a "strong social interest" in maintaining a stable source of capital for corporations. We all know, of course, that such thinking is wrong, and that the securities markets can well provide bond financing for business without the government's guarantee. Yet I just read an article about a forthcoming paper coming from two Fed economists recommending that the federal government guarantee all asset backed securities.

Just the other day Pimco's Bill Gross said:

It is dismaying to see famous financiers and respected economists have so little faith in, or so little knowledge of, how free markets work. The bond market works well precisely because there are no government guarantees. Investors seem to be able to assess and accept risk. Perhaps I should wait until the paper is published before I comment, but it is already making the rounds at conferences. According to the above article, the paper will be published just at the "critical juncture of the debate over the future of the government-sponsored enterprises." It appears to be an idea that Chairman Bernanke favors. I did read an earlier paper by Passmore and Hancock ("Three Initiatives Enhancing the Mortgage Market") that argued in favor of this idea for the mortgage market. But now they are expanding it to include all ABS (asset-backed securities, such as auto loans, consumer loans, credit card debt, and the like). I also saw Dr. Passmore's presentation material of the idea at a May conference sponsored by the Chicago Fed. It appears from their writings that they believe the major reason for the bust of 2008 was because the ABS market lacked uniform explicit federal guarantees. They completely ignore the role of the Fed in creating the boom-bust cycle and the role of the government in creating the guarantees that encouraged and funneled vast sums of money into mortgage-backed securities and other securitized assets. Their solution looks to control the effects of the problem rather than cure the causes. It is much like the doctor breaking the thermometer of a fevered patient. It was just this same kind of well meaning thinking that created the mess that is Fannie Mae, Freddie Mac, and Ginnie Mae (GSEs). As always, this well-meaning legislation was used by politicians for political ends rather than for market-driven goals. That is, they substituted their personal wishes for the choices of millions of individuals who vote in the marketplace every day with their own dollars. The rules were eventually corrupted to permit loose lending standards resulting in risky loans guaranteed by these agencies. Who can forget Barney Frank's comments about the GSEs:

As of Q1 2010, Fannie had lost double its profits made for the previous 35 years. It has already cost taxpayers about $85 billion. Estimates of bailout costs range as high as $1 trillion if home values decline another 20% and foreclosure rates continue to climb. Passmore and Hancock take a little different approach to the ABS guarantee markets than presently exists. In their version they envision a federal entity like the FDIC to insure ABS like the FDIC insures banks. Thus, securitizers would pay for the insurance as do banks for the FDIC guarantees. This new entity would probably replace the GSEs. There are several things to consider about this proposal. First is the huge size of the market they propose to backstop. The U.S. mortgage market is about $10.5 trillion in size. If you add in all the other types of ABS securities, you could probably double that amount. It is likely that government guarantees would quickly become the standard insisted by the buyers of ABS, so we could expect the government's role in this market to be dominant. In essence these economists are saying that bureaucrats are capable of managing the insurance of markets that may exceed $20 trillion. I suggest that is fanciful and naive thinking, but not atypical, of central planners who think they have the ability to better manage the decisions of millions of people than those millions themselves. The history of most such central planning schemes have ended badly. In fact the ABS market that fared the worse in the crash were residential mortgage-backed securities, the underlying loans of which were often guaranteed by the GSEs; as guarantors of one-half of this mortgage market, those infamous toxic assets were created because of the implicit federal guarantees. Second, the idea presupposes increased government regulation of the ABS markets that few bureaucrats understand. To guarantee the enormous ABS market, new rules and regulations need to be devised to define the conditions of the guaranty. In order to protect taxpayers they will establish rigid standards that would be more conservative than are currently required by the market. It is likely that the rules will initially tend to stifle the ABS market and inhibit innovation. At least until the special interests work their magic to allow special rules for their needy industry. Sound familiar? The recently passed Dodd-Frank Wall Street Reform and Consumer Protection Act gives a vast new federal bureaucracy almost diktat powers over the financial industry. There is almost nothing these new czars cannot do if they find that a company "threatens financial stability." Passmore and Hancock's idea is just another extension of the Dodd-Frank Act. Sadly, neither the Act nor the ABS guarantee idea do anything to prevent another boom-bust cycle from occurring. While I understand the nature of Passmore and Hancock's job, their idea is an excellent, yet unfortunate, example of short-term thinking coming from government economists and politicians. Perhaps they should have considered the real causes of the last crisis before they made recommendations to cure the next one. To propose a vastly expanded system of government guarantees of financial markets in light of the failed history of Fannie and Freddie is irresponsible. | ||||||||||||||||||||||||

| David Morgan on this week's surprising action in silver Posted: 25 Aug 2010 03:53 PM PDT 11:50p ET Wednesday, August 25, 2010 Dear Friend of GATA and Gold (and Silver): David Morgan of The Morgan Report (www.silver-investor.com/) today posted 100 seconds of video commentary about this week's surprising action in silver, which has defied the usual pounding down of options expiration week and seems to him to be massive new buying rather than short-covering. You can watch it at YouTube here: http://www.youtube.com/watch?v=jDkokNj7-Mk CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | ||||||||||||||||||||||||

| David Morgan on this week's surprising action in silver Posted: 25 Aug 2010 03:53 PM PDT 11:50p ET Wednesday, August 25, 2010 Dear Friend of GATA and Gold (and Silver): David Morgan of The Morgan Report (www.silver-investor.com/) today posted 100 seconds of video commentary about this week's surprising action in silver, which has defied the usual pounding down of options expiration week and seems to him to be massive new buying rather than short-covering. You can watch it at YouTube here: http://www.youtube.com/watch?v=jDkokNj7-Mk CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | ||||||||||||||||||||||||

| I Took The Road More Travelled By... And It Was Swarming With Vicious High Frequency Traffic Jams Posted: 25 Aug 2010 03:23 PM PDT Courtesy of Tom Cochrane, we know that life is a highway. But did you know that so is the stock market? BNY's Nicholas Colas explains...

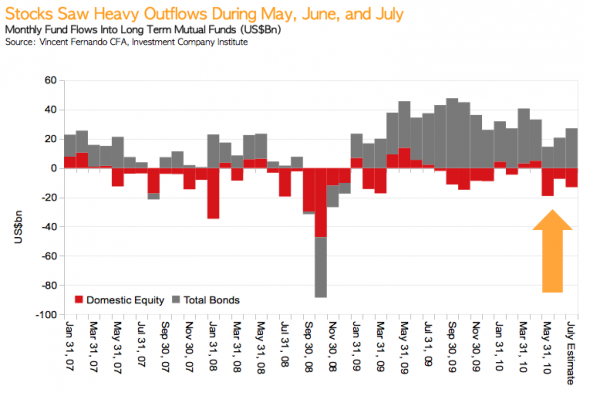

The Low Spark of High Heeled Boys Summary: Sitting in traffic on busy summer weekends feels a lot like trading the capital markets at the moment. The HOV lane (bonds) seems to be moving, but there are quite a few folks in Ferraris and Bentleys (the smart money?) crawling along, not sure which lane to pick. There is a growing library of academic work on traffic jams and these studies seem oddly applicable to the life of an investor at the moment. As it turns out, traffic jams pop up for reasons other than crashes. Sometimes it is just one or two vehicles that stop short, setting off a cadence of slowdowns behind them. Other times it is a group of tailgating cars that can set off a serious slowdown by stopping short and setting off a chain reaction behind them. And even after a crash is cleared, traffic can stay snarled for a while, as drivers struggle with the stop-start aftermath of a temporary tie up. Any way you cut it, equity markets – and the domestic economy - feel a lot like a clogged freeway. Only time will get the traffic moving again. If you need any more proof that capital markets are not efficient, visit NY State Route 27 in the Hamptons between now and Labor Day weekend. You will see a slow moving parade of the some of the finest cars in the world, crawling their way to restaurants and nightclubs. The occupants of these Ferraris, Porsches and Lamborghinis will wait for tables, service, food, and drinks before saddling up and slowly driving back to their rental houses along the same clogged one lane highway that connects all the towns of the East End from the Shinnecock Canal to Montauk. The ironic thing about all this is that these “Masters of the Universe” (if that term still applies) don’t need to be stuck in traffic – there are free flowing back roads that cut through some of the most beautiful landscapes in the Hamptons. There are horse farms, apple and peach orchards, roadside stands with fresh-off-thestalk corn roasted over coals for sale, and the last wide open vistas the area has to offer. But no, Rte 27 is the most straightforward way, and the back roads need a bit of learning before you can avoid getting lost at night on their unlit blacktop. And since most folks just go out for 10- - 15 weeks during the summer they don’t bother to learn them. So they sit still in Watermill or Bridgehampton, letting the hours pass by, occasionally chirping the otherwise dull rumble of their Italian V-12 or turbocharged German flat-6. Those are the folks you are competing with for incremental information – the people who don’t seem to want to go off the beaten track, even though the alternative path is faster and more pleasant. So despair not – there is still information advantage to be had over the V-12 set. Learn the back roads. That little rant aside, the topic of traffic generally and traffic jams specifically have been getting more attention in academic circles in recent years. That makes sense – road congestion got progressively worse in the last decade as commute times rose for workers who moved further and further away from their jobs because escalating property values pushed them away from population centers. And, as it turns out, the study of traffic has some striking similarities to how capital markets behave. Not such a stretch, when you think about it. Humans try to make time maximizing choices while driving – what lane to pick, how fast to drive, how close to get to the car in front, how many times to change lanes. Those choices can affect others driving alongside and either advance or retard the overall flow of traffic. Of course, the precondition for a traffic tie-up is, well, lots of vehicles on the road, all wanting to go in the same direction. We have that in spades in the capital markets at the moment. Correlations are at record highs across industry sectors as well as asset classes. It is such an overarching problem that it does not have one fixed reason. Low interest rates and easy money are one – these push capital out on the risk spectrum in a very uniform manner, heightening the linkage between previously less correlated assets. Then of course there are macro concerns like taxation, government policy, and a still moribund economy that impact asset classes like bonds (for the good) and stocks (for the not-so-good). So the stage is set for traffic jams. We’ll use that as a euphemism for a market drop, not the stasis that accompanies an actual wall-to-wall collection of cars on the highway. The catalyst for a traffic jam isn’t always a rubbernecking delay from an accident; it can, and often is, just a spot where everything inexplicably slows down. There is even a name – a “jamiton” – for this kind of disruption. They are caused when one, or a handful, of drivers slows down unexpectedly. This forces everyone behind this cluster to slow down, and before you know it things are flat-out stopped. As it turns out the effect is similar to the shock waves of an explosive detonation. A more full description of the effect is included here, with some color from the MIT scientists that coined the term “jamiton”: http://www.sciencedaily.com/releases/2009/06/090608151550.htm. Just like in the markets, amateurs have their points of view about what causes traffic jams/market declines. In this non-scientific description, a traffic science “layman” outlines how jams take time to resolve themselves even when the cause – an accident – has been cleared. It is a version of the same crowded lane/sudden slowdown effect outlined above: http://amasci.com/amateur/traffic/traffic1.html. The author calls the jam a “pressure wave,” created by the temporary slowdown of cars in front and the subsequent delay as the whole system just stops as a result. So what do you do to help avoid jams? Keep your distance from the car or truck in front of you. That gives you time to slow down deliberately, rather than mashing the brakes and causing the cars behind you to stop short and create that “pressure wave/jamiton.” An impassioned appeal from another amateur follows: http://www.skaggmo.com/newsletter3a.htm. We’ll finish off this note with a few observations about what this stocks-are-like-traffic-jams comparison means to investors and traders. The most important point is that jams – or market drops – seem to happen when everyone wants to go in the same direction (high correlations between asset classes). Jams occur once that stage is set because a relatively small number of participants do something unexpected. They can, in short, have a disproportionately large effect on the entire system. And – worse still - if a lot of people slow down at once, the system grinds to a halt. That feels a lot like what we have right now. Mutual fund outflows from domestic stock funds are effectively the retail investor putting their foot on the brakes – something they have been doing for 15 weeks straight. Combine that with plenty of distracting scenery in the form of lousy economic data and the jam gets worse. One thing all traffic jam experts seem to agree on: when the chain reaction that starts a jam really kicks in, only time will unwind it. And that seems like the most accurate comparison point to stocks.

| ||||||||||||||||||||||||

| Posted: 25 Aug 2010 02:59 PM PDT August 25, 2010 | www.CaseyResearch.com Uncle Scam Dear Reader, The latest data on global gold trends, Q2 2010, just popped into my email box from the World Gold Council. The bad news is that the higher nominal price of gold has caused a 5% decrease in jewelry sales over the prior year. If you’re thinking “Hey, that’s not that bad!”, you’d be right. On this date last year, gold closed at $950… which is $286 below where it trades as I write. In other words, a 30% rise in price has resulted in a decrease of just 5% in jewelry sales. And even that number is skewed, because the currency value of the gold purchased is up – way up. For example, India – the 800-pound gorilla in the global gold jewelry market – saw total gold jewelry sales fall only by 2%, but in local currency terms, there was a 20% increase in the nominal value of the gold trading hands. China, which only... | ||||||||||||||||||||||||

| Guest Post: Jim Altucher Proves Yet Again The Truth And Koolaid Don't Mix Posted: 25 Aug 2010 02:51 PM PDT By Geoffrey Batt, founding partner and managing director of Euphrates Advisors LLC, a frontier market fund management company

Altucher penned an article in yesterday’s WSJ called “What 4 Bullish Billionaires are Buying.” In it he makes the following claim: “Very interesting new changes for Warren Buffett. The richest man in the world (or #2 or #3, it varies day by day) bought 17 million more shares of Johnson & Johnson (JNJ). JNJ has everything going for it: It has a 3% dividend, has raised its dividend for 48 consecutive years and trades for just 11 times forward earnings, its lowest P/E ratio ever.” I suggest both the WSJ and Mr. Altucher take better care in fact checking, as J&J’s P/E ratio was lower on at least three occasions: 1947, 1950, and 1980.

Altucher fancies himself a market historian of sorts, often using data from the distant past to underpin his arguments about the present and future. I, too, see Altucher as a market historian- a revisionist one.

This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||

| A Tolerance for Event Risk Leads Oil to a Correction, Gold to New Highs Posted: 25 Aug 2010 02:33 PM PDT courtesy of DailyFX.com August 25, 2010 10:00 AM Speculative panic has diminished since yesterday’s shocked response to an economy-stalling US existing home sales report. And, while the data scheduled for release today is just as disconcerting, we have seen most risk-based assets claw back lost ground. North American Commodity Update Commodities - Energy An Overdue Correction for Crude Would Take Advantage of Tempered Risk Aversion Trends Crude Oil (LS Nymex) - $72.65 // $1.02 // 1.42% After five consecutive daily declines – a series that would break a stable rising trend channel and extend a very deep retracement – US-based crude was overdue for a correction (at least on a speculative basis). With the gnawing probability of short-covering and early adopters on a reversal building, the market simply needed an opening to put in an advance. Wednesday’s fundamentals were far from supportive of the outlook for economic activity and en... | ||||||||||||||||||||||||

| Regulators seek public comment in race to regulate Wall Street Posted: 25 Aug 2010 02:30 PM PDT By Roberta Rampton http://www.reuters.com/article/idUSN2515836220100825 WASHINGTON -- U.S. regulators are soliciting comments before attempting to write new rules ahead of fast approaching deadlines to implement the extensive swaps portion of the Wall Street reform law. The Commodity Futures Trading Commission, which will bear the brunt of the swaps rule-making frenzy, said on Wednesday it will publish a Federal Register notice seeking comments, its latest plea for information from players in the $615 trillion over-the-counter derivatives industry. "Regulators are charged with putting some meat on the bones of the new law, but we want comments from folks to get it right," said CFTC Commissioner Bart Chilton in a statement. "We know Washington doesn't have all the answers and we can't write these important rules in a vacuum," he said. ... Dispatch continues below ... ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth The CFTC has organized its to-do list into 30 topic areas, and has invited submissions on its web site to each. See: http://www.cftc.gov/LawRegulation/OTCDerivatives/otc_rules.html Most of the areas have a 360-day deadline, meaning the CFTC will need to propose draft rules by late November to mid-December so they can be finalized by mid-July, the agency's general counsel told a Futures Industry Association meeting this month. "It's a very fast-moving process," Dan Berkovitz said, describing the challenge of trying to grapple with the intense industry interest on the plethora of rules. Some rules with tighter deadlines will be drafted sooner, such as the much-anticipated revised rule for position limits for energy and metals markets. The final version of the rule is due by January. Normally, interested parties often hold a series of meetings with CFTC staff members and commissioners to press their views on proposed rules, Berkovitz said. "Unfortunately, we don't have that luxury under the current process," he said. Agency staff are holding some meetings and public roundtables to gather input on issues, he said. The Securities and Exchange Commission, which also must draft regulations to implement parts of the derivatives rules, is following a similar course and will aim to have drafts published by mid-December, said Brian Bussey, associate director of the SEC's Division of Trading and Markets. "Even though it's somewhat unorthodox to be seeking comment before proposed rules are actually out the door, I cannot stress enough the importance of commenting early and often," Bussey told the FIA meeting. To listen to or watch the meeting: http://www.futuresindustry.org/fia-financial-reform-forum-program.asp?t=... Both the CFTC and SEC are posting comments they receive on their websites. For the SEC's site, see: http://www.sec.gov/spotlight/regreformcomments.shtml Bank regulators are also putting an emphasis on transparency as they develop rules for other sections of the new law. Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php | ||||||||||||||||||||||||

| Pension Ponzi Scheme $16 Trillion Short? Posted: 25 Aug 2010 01:45 PM PDT Laurence J. Kotlikoff, professor of economics at Boston University and author of “Jimmy Stewart Is Dead: Ending the World’s Ongoing Financial Plague with Limited Purpose Banking”, wrote an op-ed piece for Bloomberg, Retiree Ponzi Scheme Is $16 Trillion Short:

Wall Street plays no role and makes no money? Who are we kidding here? Wall Street wolves are hungry and they want a piece of the Social Security (SS) pie. In fact, conspiracy theorists will tell you that this whole financial crisis was manufactured with the ultimate goal of privatizing SS to allow the fat cats on Wall Street to make even more money as they find new sources of revenues to fund prop desks, hedge funds, private equity funds and real estate funds. But there is a legitimate argument to be made for properly diversifying SS. Back in 2002, Mark Sarney and Amy M. Preneta of the Social Security Administration’s Office Retirement Policy wrote a discussion paper on The Canada Pension Plan’s Experience with Investing Its Portfolio in Equities. The paper is outdated but very relevant and well written. In particular, there is an excellent discussion on governance and oversight on the Canada Pension Plan Investment Board, including measures to ensure accountability to the public:

Canadians are lucky that they have the Office of the Chief Actuary of Canada (OCA) playing a key role overseeing the activities of the Canada Pension Plan Investment Board (CPPIB). In my opinion, the OCA sets the bar in terms of professionalism and accountability when it comes to how Canadian federal government entities run their operations. And while CPPIB has its critics, the reality is that they are very well managed and take governance issues very seriously. My biggest beef with CPPIB and other large public pension funds is that they're too big. I prefer splitting up CPPIB, the Caisse, CalPERS, and other large public pension funds because at one point, size is a concern and it becomes harder to deliver the required actuarial returns without taking undue risk. But that's a discussion for another time. Getting back on topic, is the Pension Ponzi $16 trillion dollars short? No, it's worse if you factor the trillion dollar gap of underfunded state retirement systems. Most state retirement funds lack the governance standards of their Canadian counterparts. [Note: Read on how trustees of the Kentucky state retirement system will re-open an investigation into payments to investment middlemen.] One thing is for sure, the US and other developed nations face a huge retirement problem and if they don't take measures and introduce proper reforms, which includes the highest governance standards and proper funding of these systems, then they're heading for a major collision somewhere down the road. Finally, as long as they reform retirement systems, maybe authorities can finally introduce meaningful reforms to the financial markets. On Wednesday, the Council of Institutional Investors applauded the Securities and Exchange Commission’s (SEC) adoption of a rule that gives shareowners a bigger voice in electing corporate directors. Great but this is the tip of the iceberg. Much remains to be done to clean up financial markets from the crooks and banksters who routinely and legally steal money from individual and institutional investors. Before you privatize SS, make sure you restore confidence and faith by cleaning up the markets once and for all. On this last point, listen to Jim Puplava's recent interview with Laurence Kotlikoff below. | ||||||||||||||||||||||||

| Posted: 25 Aug 2010 01:00 PM PDT

But before I get into what people need to do, let's take a minute to understand just how bad things are getting out there. The economic numbers in the headlines go up and down and it can all be very confusing to most Americans. However, there are two long-term trends that are very clear and that anyone can understand.... #1) The United States is getting poorer and is bleeding jobs every single month. #2) The United States is getting into more debt every single month. When you mention the trade deficit, most Americans roll their eyes and stop listening. But that is a huge mistake, because the trade deficit is absolutely central to our problems. Every single month, Americans buy far, far more from the rest of the world than they buy from us. Every single month tens of billions of dollars more goes out of the country than comes into it. That means that every single month the United States is getting poorer. The excess goods and services that we buy from the rest of the world get "consumed" and the rest of the world ends up with more money than when they started. Each year, hundreds of billions of dollars leave the United States and don't return. The transfer of wealth that this represents is astounding. But not only are we bleeding wealth, we are also bleeding jobs every single month. The millions of jobs that the U.S. economy is losing to China, India and dozens of third world nations are not going to come back. Middle class Americans have been placed in direct competition for jobs with workers on the other side of the world who are more than happy to work for little more than slave labor wages. Until this changes the U.S. economy is going to continue to hemorrhage jobs. The U.S. government has helped to mask much of this economic bleeding by unprecedented amounts of government spending and debt, but now the U.S. national debt exceeds 13 trillion dollars and is getting worse every single month. Not only that, but state and local governments all over America are getting into ridiculous amounts of debt. So, what we have got is a country that gets poorer every single month and loses jobs to other countries every single month and that has accumulated the biggest mountain of debt in the history of the world which also gets worse every single month. Needless to say, this cannot last indefinitely. Eventually the whole thing is just going to collapse like a house of cards. So what can we each individually do to somewhat insulate ourselves from the economic problems that are coming?.... 1 - Get Out Of Debt: The old saying, "the borrower is the servant of the lender", is so incredibly true. The key to insulating yourself from an economic meltdown is to become as independent as possible, and as long as you are in debt, you simply are not independent. You don't want a horde of creditors chasing after you when things really start to get bad out there. 2 - Find New Sources Of Income: In 2010, there simply is not such a thing as job security. If you are dependent on a job ("just over broke") for 100% of your income, you are in a very bad position. There are thousands of different ways to make extra money. What you don't want to do is to have all of your eggs in one basket. One day when the economy melts down and you are out of a job are you going to be destitute or are you going to be okay? 3 - Reduce Your Expenses: Many Americans have left the rat race and have found ways to live on half or even on a quarter of what they were making previously. It is possible - if you are willing to reduce your expenses. In the future times are going to be tougher, so learn to start living with less today. 4 - Learn To Grow Your Own Food: Today the vast majority of Americans are completely dependent on being able to run down to the supermarket or to the local Wal-Mart to buy food. But what happens when the U.S. dollar declines dramatically in value and it costs ten bucks to buy a loaf of bread? If you learn to grow your own food (even if is just a small garden) you will be insulating yourself against rising food prices. 5 - Make Sure You Have A Reliable Water Supply: Water shortages are popping up all over the globe. Water is quickly becoming one of the "hottest" commodities out there. Even in the United States, water shortages have been making headline news recently. As we move into the future, it will be imperative for you and your family to have a reliable source of water. Some Americans have learned to collect rainwater and many others are using advanced technology such as atmospheric water generators to provide water for their families. But whatever you do, make sure that you are not caught without a decent source of water in the years ahead. 6 - Buy Land: This is a tough one, because prices are still quite high. However, as we have written previously, home prices are going to be declining over the coming months, and eventually there are going to be some really great deals out there. The truth is that you don't want to wait too long either, because once Helicopter Ben Bernanke's inflationary policies totally tank the value of the U.S. dollar, the price of everything (including land) is going to go sky high. If you are able to buy land when prices are low, that is going to insulate you a great deal from the rising housing costs that will occur when the U.S dollar does totally go into the tank. 7 - Get Off The Grid: An increasing number of Americans are going "off the grid". Essentially what that means is that they are attempting to operate independently of the utility companies. In particular, going "off the grid" will enable you to insulate yourself from the rapidly rising energy prices that we are going to see in the future. If you are able to produce energy for your own home, you won't be freaking out like your neighbors are when electricity prices triple someday. 8 - Store Non-Perishable Supplies: Non-perishable supplies are one investment that is sure to go up in value. Not that you would resell them. You store up non-perishable supplies because you are going to need them someday. So why not stock up on the things that you are going to need now before they double or triple in price in the future? Your money is not ever going to stretch any farther than it does right now. 9 - Develop Stronger Relationships: Americans have become very insular creatures. We act like we don't need anyone or anything. But the truth is that as the economy melts down we are going to need each other. It is those that are developing strong relationships with family and friends right now that will be able to depend on them when times get hard. 10 - Get Educated And Stay Flexible: When times are stable, it is not that important to be informed because things pretty much stay the same. However, when things are rapidly changing it is imperative to get educated and to stay informed so that you will know what to do. The times ahead are going to require us all to be very flexible, and it is those who are willing to adapt that will do the best when things get tough. Do you have any additional tips that you would like to share with us? If so, please feel free to share them in the comments below.... | ||||||||||||||||||||||||

| Posted: 25 Aug 2010 12:51 PM PDT More bearish US data came out today, as July durable goods came in at -3.8% MoM vs 0.5% expected vs a revised 0.2% in May and new home sales drop a record 12.1% in July to 276k vs 300k (0% MoM) vs a revised 315k (12.1% MoM) in May. Home prices also fell 0.3% in July vs an 0.1% expected increase.

Because of the pervasive negative sentiment (AAII survey for the week ending 8/14 showed a 42.5% bearish print, 12.4 points above the week prior) and technical support levels coming back into play in a number of assets, I have been mentioning my expectation of a small bounce in risk soon. Today, we hit the significant 1040 level in the S&P, which marked February and early June lows, and I was looking for a bid around there. 1039.83 ended up being the LOD and the market rallied from there, with the SPY ending up only 0.39%, but with some volume expansion to boot. Lower highs and lower lows are still intact, as is my bearish outlook, but I think today could be day one of a short term bounce in risk that could take SPY to retest the underside of the channel it broke down from on the 20th. The bounce in risk definitely got some help from today’s rally in yields, with the 10yr posting a bullish engulfing candlestick with a nice bullish hammer signifying an intraday reversal to the upside. I went long 10yr yields yesterday at 2.5% but got stopped out as my unnecessarily-tight 2.45% stoploss was taken out. But I went long yields again (shorting /ZN), as today showed the highest volume in three months in /ZN. Zero Hedge had a nice chart today showing how S&P futures are tracking the 2s10s30s butterfly, which I have mentioned in previous pieces as an important correlation to watch. Another product trading off of yields is the USDJPY cross, which traded up about 50 pips today and is challenging that 84.75 S/R zone it broke down through yesterday. A rally back above this level could send USDJPY shooting up to 86-87, but it is too early to tell if yesterday’s move was a false breakdown or today’s move is just a countertrend bounce to retest the breached support line. If USDJPY continues ticking higher, expect all risk to follow. The Dollar Index indeed found some selling at its 55d today, as I predicted in last night’s piece, and if it pulls back a little bit more, it should take out the 38.2% Fibo level I’ve been pointing out, which would suggest a near-term correction in USD. When the 55d is taken out however, I expect a strong rally in the dollar. CADJPY found a bid around the S/R represented by July 2009 lows and bounced more than 50 pips today. Technically, this cross is a helpful proxy for risk because of the overhead 81 S/R level it broke down from yesterday. If this level cannot be breached, any rallies in risk can be considered oversold bounces. A breakout through CADJPY 81 implies a more sustained countertrend rally could be in play, however. Because of the widespread support levels I’m seeing, as well as the very short bias of my current positions, I went long a couple high-beta go-to equities as tactical bullish bets and strategic hedges for my core positions. BIDU is bouncing off its 55d and if risk continues to be bid, some volume could come in and help it rally back into the mid-80s. CMG posted a nice intraday reversal to the upside today, as it too bounces off its 55d and has a nice three-month base it is working on that could propel it higher if risk is bid, especially after its bullish earnings release late last month. Again, these are short-term trades to buy hedges at technically low levels. Crude also had a nice bounce today, as it found support near its July lows around $71/bbl, reversing higher after an intraday selloff from higher-than-expected inventories in distillates, crude, and gasoline. A retest of the support trendline of the triangle it broke down from this month could be next if markets extend today’s bounce. I am holding my crude short position but still see a small bounce in oil developing. The USO ETF, which is a poor proxy for crude prices but is a heavily-traded product whose technicals sometimes can be very relevant to oil price fluctuations, also bounced off of a support level today, with strong volume coming in as well. If I were a more short-term trader I’d probably close my crude short today and/or buy some USO or /CL as a hedge, but my market outlooks are for longer-term positions. Precious metals had a bullish day today and my silver long from yesterday turned out to be a timely purchase as silver rallied over 3% today. A test of its long-term resistance level around $19.65 seems to be up next, and a breakout through there could send the metal flying. Ireland’s credit rating was downgraded one notch to AA- by S&P overnight last night. Though European sovereign CDS rallied today, they ticked down from their highs later in the day and their recent rally in the last few weeks may have been pricing in the downgrade. It is too early to tell if debt concerns get a bit of a rest, as everyone seems to be watching US data, but if risk is bid in the near-term then EURUSD and EURCHF could rally a bit. I still contend that any rallies in EURUSD and EURCHF should be sold but the technicals are aligned for a possible bounce from current levels. If CHF does sell off a bit, it could also provide an attractive entry point for the CHFHUF long I presented a short thesis for in last night’s piece. Reclaiming the 1.31 handle in EURCHF would signal a short-term bid is in play. VXX reversed yesterday’s rally today, and could not break out through the $24 level I mentioned last night. If the small ascending triangle VXX has developed in the last 3-4 weeks sees a breakdown, markets could see a continuation of today’s bounce. A breakout through $24 would indicate risk-off, however, and as I’ve said, a breach of VXX’s 55d should lead to more bearish price action in risk assets. And a quick note on the JCJ—implied corrs sold off today and yesterday’s surge could have marked a short-term peak as today offered no follow-through. To conclude tonight’s piece, I’d like to respond to reader comments and questions regarding a possible bond bubble in the making. Hawks and vigilantes point to the US’s ballooning debt levels and ratios and the analogues of sovereign debt issues abroad to suggest Tsy yields are way too low and that the recent bond rally is little more than a bubble. It is my opinion that the United States does not suffer from any near-term funding issues and though the bailouts and deficit spending and QE have increased US sovereign credit risk, deflationary risks are much greater and justify a decreasing-yield environment, at least presently. However, a number of technical dynamics are also behind the recent bond surge, including duration-hedging from MBS books ahead of/as a result of the massive refi boom in the spring and QE 1.5 earlier this month, record retail inflows into bond funds as equity funds see consecutive monthly outflows, and positive net convexity still existing in curve flatteners. These factors alone are enough to explain and justify the current rate environment. But beyond internal dynamics, there is the fact that the Fed/Treasury/Congress account for the entire marginal supply and demand of Tsys, as the Treasury issues record supply that Congress is requiring financials to hold increasingly greater ratios of (as a consequence of financial reform’s capital ratio requirements) and that the Fed is buying more amounts of. While the macro and financial environment remains risk-averse, Tsys and other core sov bonds should continue to outperform, allowing countries like USA & Germany to issue debt at very low rates. The increasing government spending also finds justification as a “necessary evil” that will be unwound and reversed as crisis abates. However, when global growth does finally pick up, the structural deficits and debt burdens will be exposed and will be the relevant theme to be watched, and when yields start rising, they could really take off. I see this as a scenario in Japan in 2011-2012 and in the US as early as 2012-2013. However, that is far in the future and right now, the UST is about as safe of a security as one can buy to shelter away from global growth declines, and there’s no use delving into whether UST’s are a bubble until there are some near-term catalysts for Tsy outflows and until growth picks back up. OPEN TRADES

NEW TRADES If you would like to subscribe to Shadow Capitalism Daily Market Commentary (which include charts with technical studies drawn on them that were not included in this online version), please email me at naufalsanaullah@gmail.com to be added to the mailing list. | ||||||||||||||||||||||||

| Posted: 25 Aug 2010 12:40 PM PDT With all the talk of the awful sales numbers for both existing and new homes in July, there was one small kernel of seeming good news: existing home prices rose slightly. The national median home price actually increased by 0.7% last month compared to a year earlier, according to the National Association of Realtors. But don't expect this trend to continue -- prices still have a ways to fall before they settle at their natural level. Several weeks ago, Barry Ritholtz posted the following chart. It was originally featured by the New York Times, and updated by a commenter to Ritholtz's blog named Steve Barry. This is a pretty fascinating picture. First, it shows just how incredibly absurd the housing boom was. Beginning in the 1940s, inflation-adjusted homes prices have settled around the 110 value according to the Case-Shiller index. Yet, the index value exceeded 200 in 2006. Prices began a descent when housing collapsed, but as of May the index remained well above the natural value of 110. More Here.. | ||||||||||||||||||||||||

| Dvae Morgan vidoe: Silver Market up before options expiration Posted: 25 Aug 2010 12:08 PM PDT | ||||||||||||||||||||||||