Gold World News Flash |

- Ruined by Government Dependents

- LGMR: Gold Nears 1% Week-on-Week Gain, Fed Likely to Extend Money-Creation

- A Dip in Capital Markets Pushes Oil Towards Reversal, Tempers Gold's Rally

- Take Your Pick: Sinking US or Soaring BRIC

- Daily Dispatch: Welcome to the Dis-Service Economy

- Are Banks Selling WORTHLESS Loans to Fannie?

- Big Autumn Silver Rally 2

- HUI Bull Seasonals 3

- Silver Velocity -- the Coming Bullet

- Joe Foster: Catalysts Pushing Gold

- In The News Today

- Lefty Hackery Exposed: Phil's Stock World

- Gold May Have Put in a Top

- Crude Attempts to Confirm Reversal, Gold Extends a Remarkable Trend

- Crude Oil Tumbles on Dismal Data, Gold Uptrend Back in Full Force

- Billions for the Bankers, Debt for the People

- The Road To Stagflation

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week

- 15 Signs The U.S. Housing Market Is Headed For Complete And Total Collapse

- Topping Gold and Bottoming USD Index or Vice-Versa?

- Let's Change the Debate

- Even Tony Robbins Is Warning That An Economic Collapse Is Coming

- The Gold Price Did Nothing Worse Than Undergo An Expected Correction Today

- CNBC Squawkbox Europe

- The Daily Gold Podcast #4

- Economic outlook – look out (take 2)

- Will an M&A Boom Lift Sagging Markets?

- Hedge Fund Corners the Cocoa Market

- Ex-Moore Trader Chris Pia Identified As "Close Banger" Of Platinum And Palladium, And Other Things

- FRIDAY Market Excerpts

- Gold Up on Flagging Global Recovery

- ** Special Offer **

- Guest Post: Seeking Solutions In An Uncertain World

- Use of Dispersants in the Gulf Proves to Have Little Benefit

- The Split Personalities of Platinum and Palladium ETFs

- The Bull/Bear Weekly Recap - August 20

- Gold Daily Chart

- Top Five Performing Single Country Emerging Market ETFs

| Ruined by Government Dependents Posted: 20 Aug 2010 05:51 PM PDT Frederick Sheehan has a blog titled aucontrarian, which, I am sure, is a play on the classy French phrase "au contraire," meaning, as I understand it, "to the contrary," but for a gold bug like me, all I see is the "au" prefix, which is the symbol for gold! Gold! Fabulous gold! Anyway, he has the news that David Rosenberg, economist at Gluskin, Shef, "calculates that 'private incomes' (non-government jobs and transfers) in the United States have fallen from $8.7 trillion in the third quarter of 2008 to $8.2 trillion in April 2010." Now, most people would probably look at that and say, "Hmm! Incomes have only fallen from $8.7 trillion to $8.3 in two years? A 7% loss! Not too bad!" Obviously, they are wrong, or else I would not be writing about this or have this stupid look on my face, and you can probably tell from my expression that I am upset about it. So, how bad is it? Well, there are only are only 100 million non-government/non-taxpayer paid jobs in the whole country, so $8.7 t... |

| LGMR: Gold Nears 1% Week-on-Week Gain, Fed Likely to Extend Money-Creation Posted: 20 Aug 2010 05:51 PM PDT London Gold Market Report from Adrian Ash BullionVault 09:25 ET, Fri 20 August Gold Nears 1% Week-on-Week Gain as Stocks Fall, US Fed "Likely" to Extend Money-Creation THE PRICE GOLD fell $10 an ounce from Thursday's new 7-week high in light wholesale dealing today, nearing the weekend 1% up from last Friday as world stock markets extended their drop. Government debt prices rose, pushing two-year US yields down to new all-time lows as the Japanese Yen flirted again with a 15-year high to the Dollar. Crude oil struggled below $75 per barrel. Silver prices gave back the last of the week's gains, trading down to $18.12 per ounce. "After years of being long, [we now] see gold as vulnerable to central bank inactivity in the face of rising deflation risk," Goldman Sachs' Market Pulse team advised a select group of institutional clients this week. Last week, Goldman Sachs' commodities analysts publicly raised their 2010 price-target to $1300 an ounce. The i... |

| A Dip in Capital Markets Pushes Oil Towards Reversal, Tempers Gold's Rally Posted: 20 Aug 2010 05:51 PM PDT courtesy of DailyFX.com August 20, 2010 11:51 AM Commodities slip across the board to the end the week despite a lack of tangible fundamental interest and otherwise light speculative backdrop. Perhaps next week’s heavy docket can inspire meaningful trends. North American Commodity Update Commodities - Energy Another Six-Week Low for Oil Sets a Bear Trend in Motion Ahead of a Wave of Growth Data Crude Oil (LS Nymex) - $73.46 // -$0.97 // -1.30% Despite a tangible lack of major event risk (scheduled and exogenous) this past week, crude has endeavored to extend the impressive trend that followed the reversal at the beginning of the month. Friday’s decline would set a new six-week low for the US-based futures contract. At the same time, the day’s performance would fit into a tumble that has spanned eight of the past nine active trading sessions and it would further threaten to overrun a very blatant rising trend channel that has developed... |

| Take Your Pick: Sinking US or Soaring BRIC Posted: 20 Aug 2010 05:51 PM PDT [FONT=Arial,Helvetica,sans-serif][COLOR=#000000][FONT=Arial]John Browne, Senior Market Strategist at Euro Pacific Capital. [/COLOR][/FONT] Since March 2009, the S&P 500 has surged by nearly 60% and US Treasuries have continued to surge, pushing yields close to all-time lows. This has elicited sighs of relief from professional investors, who see the strength as sure signs of recovery. Yet, these investors are ignoring - willfully or otherwise -- the very thin trading volume upon which this rally is built. Retail investors remain scarred by the '08 collapse and have steered clear of the stock market altogether. Instead, they have parked cash in the Treasury market (hence the low yields). Still, financial gurus are flush with tales of deep value that await investors who have the fortitude to wade into the market. This past week, with significant fanfare, Warren Buffett reduced his position in Proctor & Gamble while increasing his holdings of Johnson & Johnson. Pe... |

| Daily Dispatch: Welcome to the Dis-Service Economy Posted: 20 Aug 2010 05:51 PM PDT August 20, 2010 | www.CaseyResearch.com Welcome to the Dis-Service Economy Dear Reader, I was going to discuss cyber-crime and data security (which is becoming a booming business) with you today, but I received a few surprise entries from other members of the team that I’d like to run instead. So we’ll save the data security stuff for another day. Now, without further ado I’ll turn it over to Jeff Clark, Kevin Brekke, and Vedran Vuk. You'll Buy Gold Now and Like It! By Jeff Clark, Casey's Gold & Resource Report I get this question a lot: "Should I buy gold now, or wait for a pullback?" It’s a valid question. For nearly two years, gold hasn't had a serious decline. There have been pullbacks, of course, but nothing assumption-challenging. In fact, since October 2008, gold’s largest price drop is 10.6% (based on London PM fix prices), and yet the average of all declines since 2001 is 13% (o... |

| Are Banks Selling WORTHLESS Loans to Fannie? Posted: 20 Aug 2010 05:51 PM PDT Market Ticker - Karl Denninger View original article August 20, 2010 01:20 PM If this is true, it's deadly-serious. I have here a record of a note that was open (and unpaid) during a bankruptcy. It was held by one of the big mortgage joints that was swallowed The debt was not reconfirmed, and it was a second. The first is underwater. That makes the second uncollectable. Oh sure, they can sue to foreclose, but that just throws more money after what's already been lost: Foreclosure throws the person out of the house but you not only get nothing, you have to spend the legal funds to prosecute the foreclosure! The reasonable expectation would be that this loan is a zero - that is, it has no actual value, as the home is worth less than the first (which was reconfirmed) and thus there is no collateral behind it. Now this note shows that it is owned by Fannie. So when was it sold and more importantly, for how much? This leads to the following... |

| Posted: 20 Aug 2010 05:51 PM PDT Adam Hamilton August 20, 2010 2687 Words Silver has been drifting in a rather lackluster summer. Ever since surging to $19.50 in mid-May, this often-popular white metal has been grinding sideways to lower. By late July it had fallen over 10% to about $17.50. But despite silver’s recent excitement-bereft sojourn, it actually has excellent potential for a big autumn rally in the coming months. The primary reason is gold. Since the early 1970s, silver has closely followed and sometimes amplified the price moves of the granddaddy of precious metals. Over the vast majority of this decades-long span, silver has been nearly perfectly statistically correlated with gold. When gold is strong, traders flock to silver. And when gold... |

| Posted: 20 Aug 2010 05:51 PM PDT Adam Hamilton August 13, 2010 2604 Words Precious-metals stocks really haven’t had a great summer by any means. After rallying initially in June, they started relentlessly drifting lower in July. The net result of this lackluster summer trading is a lethargic drift sideways. Naturally this listlessness has weighed on sentiment among this sector’s traders. At the end of May just before the dawn of the financial-market summer, the flagship HUI gold-stock index closed at 454. Since then, it has generally been flat averaging just 458 on close. At best so far this summer, the HUI was up 8.8% in mid-June. At worst, it was down 4.7% in late July. For a sector accustomed to wild volatility and exciting action, 10 weeks of ... |

| Silver Velocity -- the Coming Bullet Posted: 20 Aug 2010 05:51 PM PDT As you can see from the chart below, gold didn't do anything in Far East trading... with the low of the day [around $1,127 spot] coming at 11:00 a.m. in London yesterday morning. From there, gold rallied a couple of bucks going into the Comex open. At that point, the rally developed more legs... and hit its high of the day [$1,238.70 spot] a few minutes before 10:30 a.m. in New York. That was it for the day as gold began to sell off... and then a not-for-profit seller dropped the price $7 in minutes starting around 11:30 a.m. Eastern... and ending a few minutes before noon. The gold price recovered a few bucks... and then basically traded sideways for the rest of the day. As you know, dear reader, this is a very common daily chart pattern. Starting from it's London low, the silver chart looks almost identical to the gold chart. The only really difference being that when the not-for-profit seller showed up at 11:00 a.m. in the New York session, t... |

| Joe Foster: Catalysts Pushing Gold Posted: 20 Aug 2010 05:51 PM PDT Source: Brian Sylvester of The Gold Report 08/20/2010 Portfolio Manager Joe Foster calls himself a "stock picker." And he's pretty good at it. Class A shareholders in Van Eck Global's International Investors Gold Fund have seen an average return of almost 25% for 10 straight years under his care. "I'm looking for the gold companies that are going to outperform the indexes, my peers and gold," Joe says. And he shares some of those companies with you, in this exclusive interview with The Gold Report. The Gold Report: Joe, in your view, what are the catalysts that will push gold to the next level? Joe Foster: Well, there could be a range of catalysts, any one of which could rear its ugly head. TGR: Which ones are most likely? JF: The financial system has not yet recovered from the shock of the credit crisis. We're in the midst of a historic credit contraction that could turn into a deflationary credit contraction. As the Fed and the economy deal with this, there is ... |

| Posted: 20 Aug 2010 05:51 PM PDT View the original post at jsmineset.com... August 20, 2010 07:17 AM Jim Sinclair's Commentary Let not get deflected by MOPE. It is not the selling of US Treasuries by China that is the problem. It is the momentum collapse of that buying that harbors an ill motive to the bond safety bubble. Gold is your only insurance and that message is very near to the delivery point via the long bond market. You run the near and intermediate bond rates of return to negative interest rates, and you put the pin in the Bond Bubble. That is the final Pillar of Gold at $1650 and beyond. It Looks Like U.S. Government Bonds Aren’t Supported By China Anymore Vincent Fernando, CFA | Aug. 20, 2010, 3:45 AM Earlier this week we highlighted how cut its holdings of U.S. government bonds by the largest ever monthly amount in June. Expanding this thread, it should be noted that China’s U.S. debt ownership has fallen to $843.7 billion in June from $938.3 billion in September 200,9 according... |

| Lefty Hackery Exposed: Phil's Stock World Posted: 20 Aug 2010 05:51 PM PDT Market Ticker - Karl Denninger View original article August 20, 2010 07:34 AM How do you know someone is a left-wing whackjob? All you have to do is catch them lying about the "full faith and credit" of Social Security and Medicare, which they (of course) use as an excuse to avoid fiscal reality. [INDENT]Well, almost solved because, according to the 14th Amendment to the Constitution (oh that thing), right there in section 4, is the statement that: "The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned." So we're stuck with those damned Social Security obligations (the ones people put money into their whole lives on the good faith that the US Government would take care of it for them and pay them back when they retire) unless we can figure out a way to get that 14th Amendment repealed so we can d... |

| Posted: 20 Aug 2010 05:51 PM PDT courtesy of DailyFX.com August 20, 2010 05:53 AM 240 Minute Bars Prepared by Jamie Saettele Gold has topped. Please see the latest special report for details. Gold is making its way lower in an impulsive fashion. It seems as though the first 5 wave decline ended following a terminal thrust from a triangle. I do expect this rally from the low to prove corrective. Price has reached the 61.8% retracement – additional resistance would be the parallel channel, which intersects with a 100% extension.... |

| Crude Attempts to Confirm Reversal, Gold Extends a Remarkable Trend Posted: 20 Aug 2010 05:51 PM PDT courtesy of DailyFX.com August 19, 2010 04:00 PM They are two distinctly contrasting markets. On the one hand, gold has put in for a tame but surprisingly consistent trend. On the other, oil has finally broke free of a three-month channel. Will these developments last? North American Commodity Update Commodities - Energy Has Crude Established a Critical Trend Break on a Light Fundamental Day? Crude Oil (LS Nymex) - $74.43 // -$0.99 // -1.31% Technical traders will note that Thursday’s close for US-based crude officially pushed the lower boundary of a three-month rising trend channel. If this were to occur when the general activity level of the market were higher, earlier in the week or amid a thicket of scheduled event risk; there would almost certainly be a speculative reaction to this development that catalyzed meaningful follow through. As it happens, the newswires were relatively quiet through the day – at least when it comes to those indicators that ... |

| Crude Oil Tumbles on Dismal Data, Gold Uptrend Back in Full Force Posted: 20 Aug 2010 05:51 PM PDT courtesy of DailyFX.com August 19, 2010 10:51 PM Unexpectedly bad economic data sent crude oil to a new recent low and gold to a new recent high. Of note has been silver, which fell for the second day despite strong gold prices. Commodities – Energy Crude Oil Tumbles on Dismal Data Crude Oil (WTI) - $74.45 // $0.02 // 0.03% Commentary: A significant drop in equity markets sent crude oil tumbling on Thursday. The commodity fell $0.99, or 1.31%. Markets are now intensely focused on the U.S. economy and the likelihood of a double dip recession. Economic readings only bolstered the bears’ case, as jobless claims surpassed 500,000 for the first time since November 2009 and the Philadelphia Fed survey actually indicated contraction in the manufacturing sector in the Philly area for the first time since July. Look for the economic outlook to continue to drive prices for equities and crude oil in the near-term. Technical Outlook: Prices have taken out the bottom o... |

| Billions for the Bankers, Debt for the People Posted: 20 Aug 2010 05:45 PM PDT |

| Posted: 20 Aug 2010 04:42 PM PDT From The Daily Capitalist

This is an article I wrote for a newspaper that is a reprise of my reasoning why I think we are headed for stagflation. The article will appear next week, but it will be familiar stuff for Daily Capitalist readers. ***** The Fed voted two weeks ago to print money as much money as they think is necessary to fight deflation, economic decline, and rising unemployment. It is a major policy change little noticed by the media. There has been a lot of noise in the media lately about deflation. While a few of us have been forecasting deflation and a decline in the economy for some time (your truly since December, 2009), it is as if most economists had just discovered it. The reason for all this concern is the weak economic data coming in:

There are two more data points that really have the Fed concerned. One is that the Consumer Price Index is very low. While you would think that low rates of inflation are good, the Fed wants inflation. The other thing that bothers the Fed is that money supply is declining and has been doing so since last December. They think that we may be heading for deflation. What does all this mean? It means that everything the Fed and the federal government have done to revive the economy has failed. From massive fiscal stimulus (spending $787 trillion on mostly wasteful projects), to the TARP bailouts of Big Money, to zero interest rate policy (“ZIRP”), to gimmicks such as Cash for [your industry here], they have failed to stimulate the economy. With all the bad data coming in, it is no wonder that the Fed, as reported in the minutes of its June, 2010 meeting, was so pessimistic: Participants generally anticipated that, in light of the severity of the economic downturn, it would take some time for the economy to converge fully to its longer-run path as characterized by sustainable rates of output growth, unemployment, and inflation consistent with participants’ interpretation of the Federal Reserve’s dual objectives; most expected the convergence process to take no more than five to six years. They are saying that they think it could take 5 or 6 years from 2008 for things to turn around. What they overlook is that it is the Fed’s manipulation of the money supply that is the cause of our boom-bust cycles: they are the problem, not the solution. And that is why their policies are failing. Which gets us back to the inflation-deflation issue. It is an axiom of faith with the economists who control Fed and government policy that the economy needs a little bit of inflation to grow. They think that all the Fed has to do is step on the money pedal and the new money stimulates the economy, money supply grows evidencing healthy business lending, prices rise modestly, employment rises, and the economy grows. The only problem with that idea is that it isn’t working. Why have they failed? It all has to do with the banks, mostly the regional and local banks that finance about one-half of our economy. These banks have two problems. First, as a result of the crash, their balance sheets are clogged up with (mostly) bad commercial real estate loans. Bad loans tie up a lot of capital that banks would otherwise lend out. Second, because of the economic decline, business customers aren’t borrowing. And it’s not just because banks have tightened lending standards; businesses see weak demand plus, with all the new laws passed, they are very uncertain about the future. The Fed saw the plight of banks and they lowered the interest rate (the Fed Funds rate) to zero on money banks borrow from the Fed to make loans. They have also massively increased the pool of money available to banks to tap into (money base). But, if banks aren’t lending and borrowers are reluctant to borrow, the new money never gets lent out, and the giant pool of new money just sits at the Fed as banks’ reserves. Since the money is not being lent out, which is their main tool to increase money supply, money supply is now declining, and that is deflation. This is why the Fed is very concerned with a potential “deflationary spiral,” a phenomenon that occurred during the Great Depression. What can the Fed do? They can’t lower the Federal Funds rate because it is already as low as it can go. And this hasn’t worked anyway. This is what the big change in Fed policy was all about. There was a huge internal fight at the Fed between the anti-deflationists and the anti-inflationists, and the anti-deflationists won. The Fed decided they would fight deflation through “quantitative easing” or “QE.” With QE, another tool the Fed has to increase money supply, the Fed buys Treasury debt (bills, notes, and bonds) from its primary dealers and prints money to pay for it. This puts money directly into the economy. It’s not as if this is something new. From last year through April of this year, the Fed bought $1.25 trillion of debt issued by Fannie Mae and Freddie Mac. They also bought about $700 million of Treasury debt. This put $2 trillion of new money into the economy. This apparently wasn’t enough. The second important thing they announced is that they will replace their Fannie/Freddie paper with Treasury debt. This seems harmless at first because the Fed is not increasing its total debt holdings—yet. They announced this with a seemingly innocuous statement: that they would keep their current level of debt at about $2 trillion. In Fed-speak this means they are clearly worried about the sinking economy, and that they will print as much fiat money as they think is necessary to increase the money supply to induce inflation. In economic terms, buying Treasury debt is called “monetizing” debt. In plain English it means that the government prints money to pay for its debts. This policy has been the downfall of many governments who destroy their currency through hyperinflation. |

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week Posted: 20 Aug 2010 04:00 PM PDT |

| 15 Signs The U.S. Housing Market Is Headed For Complete And Total Collapse Posted: 20 Aug 2010 03:18 PM PDT  Sales of new and existing homes in the U.S. are at depressingly low levels. For example, during the month of May sales of new homes in the U.S. declined to the lowest level ever recorded. Yes, you read that correctly. The U.S. Department of Commerce began tracking sales of new homes back in 1963, and since that time the number of new homes sold has never been as low as it was in May. Sales of new and existing homes in the U.S. are at depressingly low levels. For example, during the month of May sales of new homes in the U.S. declined to the lowest level ever recorded. Yes, you read that correctly. The U.S. Department of Commerce began tracking sales of new homes back in 1963, and since that time the number of new homes sold has never been as low as it was in May. Not only that, but existing home sales (which had been faring a bit better) are also showing signs of serious decline. In the month of July, sales of existing homes in southern California fell nearly 22% from a year earlier. In Austin, Texas sales of homes declined 25% from a year ago in the month of July. The truth is that home prices are still way too high. As prices begin to decline that should help home sales a bit, but the truth is that the days of the real estate boom are gone and they not coming back. This posting includes an audio/video/photo media file: Download Now |

| Topping Gold and Bottoming USD Index or Vice-Versa? Posted: 20 Aug 2010 02:58 PM PDT This essay is based on the Premium Update posted on August 20th, 2010 This week we have sent out several messages to our Subscribers regarding the current market situation. Now, the markets have calmed down for the weekend, and we are able to provide you with a report summarizing precious metals performance over the whole week, and – to some extent – provide you with our thoughts regarding gold's next move. Specifically, we will comment on the link between gold and the U.S. Dollar, and in the following part of the essay, we will also comment on the price of gold directly. We will start with the long-term USD Index chart (charts courtesy by http://stockcharts.com.) In this week's long-term USD Index chart, we see some consolidation after last week's small rally (reflection of the current consolidation in the Euro Index). Since these consolidations often take place in the middle of the move, we might expect the recent rally to take the dollar higher to 84.5 or so. Similar examples can be seen – in a bigger way – in the recent December to June prolonged rally. The rally itself lasted for nearly seven months and it included one big consolidation – from Feb to April 2010, which was right in the middle of the move. Again, it is likely that the USD Index will move higher very soon. The probable downtrend for the euro, which we discussed previously, is an important contributing factor to the dollar's likely near-term direction. By comparing the current rally with that seen earlier in 2010, a target for the top of this USD Index rally seems to fall in the 84-85 range. The main determining factor here is the assumption that this current consolidation period is somewhat near the mid-point of the rally. It is important to note that the term mid-point refers to index levels which may or may not correspond to mid-points in time. Precious metals have, for the most part, been moving on their own lately. It is possible, however, that their turning points could coincide with those of the USD Index. In this week's short-term chart, there are two developments worthy of note. First, the break above the declining trend channel has been verified this week. We have seen several consecutives closings above this level, which was surpassed last week. It is likely that the dollar will rally from here. The second observation clearly seen in this chart is the vertical red line which indicates a likely turning point to the upside for the USD Index. A close inspection of recent turning points reveals that in seven out of the last eight, gold and silver declined either immediately thereafter or in the next few days. Since we are in this position today, it is something which cannot be overlooked in our precious metals analysis and a decline in gold, silver and mining stocks therefore appears quite likely for the near-term. The likely short-term trend for the Euro Index appears to be down. As is normally the case, this is bullish news for the USD Index and a rally may very well be seen here soon. Gold, silver, and mining stocks will likely see lower prices in the close future. Speaking of gold, let's check how did the yellow metal perform in the previous weeks. The long-term chart for gold this week provides some evidence in support of a soon-to-be-seen local top. The RSI has risen to levels which often marked previous local tops. The GLD SPDR level is presently only slightly above the 61.8% Fibonacci retracement level, and the long-term resistance line (rising thick black line) is being touched right now. The situation is quite similar from the non-USD point of view. From a non-USD perspective (valuable for instance to Investors/Traders watching gold priced in the euro, sterling, or rupee), it also seems that gold is approaching a local top as is gold in USD. The 50-day moving average seems to be a resistance level. This average has provided strong support or resistance on many past occasions, so we shouldn't ignore it here. Keep in mind that gold in non-USD currencies will likely trend similar to USD gold markets, that is local tops may very well coincide. Before summarizing, we would like to comment on one of the questions that we've received this week (thank you for your feedback, we really appreciate it). The question came from an Investor, who purchased shares of a silver producing company in order to profit from a speculative trade that was supposed to take only a few days (this was a bet on good earnings report). The company didn't do well, and this Investor finally end up with about 1/3 portfolio allocated in this company's shares. The question is what to do given the current market environment. Our reply is that if it was our money on the table, we would close the position right away, not only because of the possibility of a correction from here. We would do that mainly because the factor that made us open this position in the first place is no longer valid and because we would not open such a position if we didn't own any shares – at least it would not be this big. If – at any point – you are not sure if you should hold on to a position that you currently have (and there are low transaction costs), all you need to do is ask yourself a different question – would you open this position at current market price in the amount that it currently equals to in your portfolio. If the answer is no, then you have just told yourself to close the position. Summing up, it is likely that the local top for gold is in or very close to being in. Bearish indicators are in place for the near-term and if the expected downturn does not begin immediately, we expect it will be seen very soon. Much of the doubt present today will be erased once the downturn is confirmed. Additional information, detailed price/time targets and explanations are available to our Subscribers along with the in-depth description of a new way to analyze the gold market. To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time. Thank you for reading. Have a great and profitable week! P. Radomski * * * * * Interested in increasing your profits in the PM sector? Want to know which stocks to buy? Would you like to improve your risk/reward ratio? Sunshine Profits provides professional support for precious metals Investors and Traders. Apart from weekly Premium Updates and quick Market Alerts, members of the Sunshine Profits' Premium Service gain access to Charts, Tools and Key Principles sections. Click the following link to find out how many benefits this means to you. Naturally, you may browse the sample version and easily sing-up for a free weekly trial to see if the Premium Service meets your expectations. All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. |

| Posted: 20 Aug 2010 02:32 PM PDT |

| Even Tony Robbins Is Warning That An Economic Collapse Is Coming Posted: 20 Aug 2010 01:16 PM PDT

The video that Tony Robbins published where he gives his economic warning is posted in two parts below. This is unlike any Tony Robbins video that you have ever seen before and it is absolutely jaw dropping.... Part 1: Part 2: So is Tony Robbins right about what is coming? Yup. An economic collapse is coming. You need to get prepared. For those not familiar with my previous articles, let's review just some of the reasons why America is headed towards an economic nightmare of unprecedented proportions.... The National Debt - The U.S. government has accumulated a national debt that is rapidly approaching the 14 trillion dollar mark. According to Democrat Erskine Bowles, one of the heads of Barack Obama's national debt commission, if we continue on the path we are on the U.S. government will be spending $2 trillion just for interest on the national debt by 2020. State And Local Debt - Many of America's state and local governments may be in even worse financial shape than the federal government is. In fact, some state and local governments are in such a financial mess that they have starting cutting off even the most essential services. Consumer Debt - The total amount of consumer debt that Americans have accumulated now stands at approximately 11.7 trillion dollars. The Trade Deficit - The U.S. trade deficit has exploded to nightmarish proportions over the past two decades. Every single month tens of billions more dollars flows out of the country than flows into it. The rest of the world is literally bleeding us dry in slow motion. No Jobs - Today it takes the average unemployed American over 8 months to find a job. The number of Americans receiving long-term unemployment benefits has risen over 60 percent in just the past year. The Credit Crunch - The U.S. is experiencing a credit crunch unlike anything it has seen since the Great Depression. Lending has really, really dried up, but without loans our economic system cannot function properly. The Housing Crisis - Even with mortgage rates at historic lows, a shockingly low number of Americans are buying houses. There has been a total collapse in home sales since the home buyer tax credit expired. At the same time, mortgage defaults, foreclosures and home repossessions by banks continue to set new all-time records. Rising Bankruptcies - Nationwide, bankruptcy filings rose 20 percent in the 12-month period ending June 30th. Rising Poverty - One out of every eight Americans and one out of every four American children are now on food stamps. Approximately 50 million Americans couldn't even afford to buy enough food to stay healthy at some point last year. The Coming Pension Crisis - America is facing a pension crisis that is so nightmarish that it is almost impossible to adequately describe it. State and local government pension plans are woefully underfunded, dozens of large corporate pension plans either have collapsed or are on the verge of collapsing, Social Security is a complete and total financial disaster and about half of all Americans essentially have nothing saved up for retirement. The Derivatives Bubble - Our financial system has become a gigantic gambling parlor and we have allowed a horrific derivatives bubble to develop that could destroy the entire world economy if it ever bursts. Nobody knows exactly how big the derivatives bubble is, but low estimates place it at around 600 trillion dollars and high estimates put it at around 1.5 quadrillion dollars. Once that bubble pops there simply will not be enough money in the entire world to fix it. The Federal Reserve - The Federal Reserve has devalued the U.S. dollar by over 95 percent since 1913 and it has been used to create the biggest mountain of government debt in the history of the world. There are many economists who would argue that the Federal Reserve is at the very core of our economic problems. As we get even closer to the economic abyss that we are racing towards, even more big names such as Tony Robbins will come forward with warnings. The truth is that these problems did not develop overnight, and they are not going to be solved overnight either. Perhaps our economic future is best summed up by this one statement that economist Paul Krugman recently made.... "America is now on the unlit, unpaved road to nowhere." It would be great if I could write about America's bright economic future and the unlimited prosperity that is ahead for all of us, but that would be a lie. We are headed for an economic collapse. It is going to be painful. It is time to get prepared. |

| The Gold Price Did Nothing Worse Than Undergo An Expected Correction Today Posted: 20 Aug 2010 01:04 PM PDT Gold Price Close Today : 1,227.70Gold Price Close 13-Aug : 1,213.50Change : 14.20 or 1.2%Silver Price Close Today : 1812Silver Price Close 13-Aug : 1810Change : 2.00 or 0.1%Platinum Price Close Today... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Posted: 20 Aug 2010 12:15 PM PDT |

| Posted: 20 Aug 2010 12:02 PM PDT |

| Economic outlook – look out (take 2) Posted: 20 Aug 2010 11:46 AM PDT Double dippers are on the rise. Nouriel Roubini: "Risk of a double dip recession in advanced economies (US, Japan, Eurozone) has now risen to 40%." Robert Schiller: "... also said last week that there's a greater than a 50 percent chance of falling into another downturn." San Francisco Fed: "put the odds of a second recession in the next 10 months at "no greater than a coin toss." Mohamed El-Erian (PIMCO): "... said earlier this month that the U.S. faces a 25 percent chance of a double dip and deflation." David Rosenberg: "higher than 50-50," and "If You Don't Believe In A Double Dip, It's Because The First Recession Never Ended". Thursday and Friday began with the markets' reaction to data concurring with the double dippers. It's the mainstream, stupid Poor Mr. Hoenig is the lone dissenter at the Fed. The New York Times tugs at the rug under his feet, not realising he stands on a bedrock of logic:

While Mr. Hoenig's view is far from the mainstream ... Poor guy. Opposing the Chairman of the Federal Reserve means anything you say is no longer mainstream. Even if it is blatantly obvious and true, it's not mainstream, so it's wrong. Hoenig continues with more comments, which are not only self evident, but vindicated by the recent financial crisis:

Remember though, he's not mainstream, so ignore him. (Why are you reading this?) It's pretty rare for a central banker to forecast boom, doom and gloom. It's also rare for central bankers to accurately and concisely point out the causes of financial crises. But whether the phrase "too low for too long" will ever make it into mainstream economics textbooks is unlikely. If you want to find out just how competent the mainstream is, this is one of the best articles around. Our favourite central banker Perhaps the rarest of all central banking achievements is to forecast, pinpoint the causes of and make provisions for an incoming financial disaster, all in a timely manner. Who you ask? Glenn Stevens? Nope. Ben Bernanke? Nope. Maestro Greenspan? Certainly not. Not even the mentor of all of the above, Zimbabwe's Gideon Gono, saw the crisis coming. But one central banker did. Governor Riad Salameh, of Lebanon!

Never again shall it be said that nobody saw the crisis coming. Even a central banker saw it coming. We won't go into the IMF's track record again. Instead, check out this link, which features more than 20 articles by Austrian economists predicting the crisis, or various elements of it. Riad doesn't belong to the Austrian school. No central banker does. And we don't endorse Riad. He is simply the only competent forecaster when it comes to central bankers. That is of concern considering their responsibilities. (Dan points out that financial crisis guru Nassim Taleb is also from Lebanon.) Keynes needs a bailout The most delightfully ironic news comes, as always, from the bailout and stimulus arena. Now remember that the idea of stimulus is to stimulate demand, which then has a multiplier effect. The idea of a bailout is to avoid a similar implosion from a reversed multiplier effect. At least that was the Keynesian idea. But once again Keynesians have come up short. That's not a surprise for those possessing some logic. David Stockman, President Regan's Budget Director, points out how well stimulus has performed in the land of stimulus itself:

What is surprising is that even the stimulus applied directly by the state doesn't stimulate, let alone have a multiplier effect. US state governments, despite their pathetic budget management of the past years, have had a financial epiphany on the matter. They have decided to use much of the $26 billion handed to them by the federal government by not using it... yet. Why? "We're a little wary about hiring people if we only have money for a year," Clark County Las Vegas CFO Jeff Weiler said in The New York Times. So it takes a government CFO to figure out the flaws of stimulus. A once off injection will withdraw any stimulus effect it had as soon as it ends. Which is why they tend not to end, or, when administered by people who have figured this out, there is no initial stimulus in the first place. Agora's 5 Minute Forecast elaborates:

So not only is the intention of stimulus flawed, but its execution doesn't work either. The terminator has taken all this rather badly. 150,000 Californian workers have been furloughed by the other kind of Austrian. That means taking a compulsory holiday without pay. So working for the government no longer means job security. Another lesson learned the hard way. The cost of costing The costing debate rages on. The only conclusion drawable is that both sides are chronic hypocrites. And it's not like costing estimates are remotely accurate: Public Transport Minister Martin "Pakula has admitted in a statement to Parliament that the average expected cost of stations the government promised in 2006 at Lynbrook, Williams Landing and Cardinia Road in Pakenham had almost tripled." On the national level, one comment does stand out. The much publicised efforts of the parties to pay off the debt have lead to some concerning guarantees for Keynesians. Gillard says she will not budge on returning to surplus by 2013. She won't even answer hypotheticals on the issue. So, we take it that the onset of another economic crisis will leave the Australian stimulus story dead in the water. If Julia could be trusted to stand fast, we might even vote Labor. The Australian tells us to do a donkey vote after doing its questionnaire. Strangely enough, the Greens and the Liberals tied in terms of matching you editor's preferences. That would suggest your editor is an Ass more than a Donkey. Abbott bonding with the taxpayer

In Australian academic speak, "bonds" are government borrowing. (Private bonds are referred to as debentures.) Could someone explain this whole thing please? Here are 1, 2, 3 articles on the topic. None seem to say anywhere how those bonds will be repaid. It just mentions a tax benefit on holding the bonds. Will the completed infrastructure projects charge people, or will the government pay off the bonds through tax revenue? Either way, it seems Tony may have pulled off quite a hoax. Regardless, long term Daily Reckoning and Money Morning readers will recall Dan and Kris' warnings about the government's upcoming efforts to tap the super industry's funds. Well, this bonds thing is another development:

One step closer to having super funds funding government projects. Is long term investing dead?

Apparently, fund managers seeking "alpha" (returns above the broader market's performance) are now in fashion. Here at Port Phillip Publishing, we wouldn't know if there is anything to this new idea. It's not like it has been our business model from the beginning... (being fashionable). Even the super funds are catching on. But the amusing thing is that managed funds will of course incur higher fees (all else equal). And they can't all beat the market. So will greed defeat Aussie egalitarianism? Only one of the two is common sense when it comes to making money. At least based on the past few years of range bound markets. But if the bottom falls out of this basic concept of investing, what will financial advisers tell their clients? After years of claiming stock pickers are jerks, there seems little else to fill the void. One thing they won't mention is something Michael Evans at The Age has pointed out:

"Extraordinary wealth transfer". If you are a blind buy and hold investor, someone is laughing at your expense. Deutschland ueber alles The Germans are making themselves unpopular with their stellar economic growth:

A reader sent us an article about debt levels, which pointed out that Germany isn't exactly debt free. But what people tend to forget is that debt can be a very good thing, if it is invested in assets that provide a return. Germany's export success requires this kind of debt. American consumption levels required a different kind. Guess where Aussies sit... Burn and churn baby The outrage over banking profits has exposed another hypocrisy in the Aussie property mania psyche.

Who makes money on all this? Banks and lawyers do. And plenty of it. (We can vouch that many of both do so in dangerously incompetent fashion). The editor of our sister publication Money Morning wrote a fantastic article on the state of the property industry on Wednesday. We can't remember where we read or heard it, but the following point struck a chord: Rising house prices don't benefit Australia. They are merely a transfer of wealth from the property buyers to the property sellers. And yet, rising prices are one of Australia's most celebrated news items. Until next week, Nickolai Hubble. |

| Will an M&A Boom Lift Sagging Markets? Posted: 20 Aug 2010 11:26 AM PDT Anupreeta Das and Gina Chon of the WSJ report, Deals Stage a Comeback:

Interestingly, BHP tendered a $40 billion all cash offer to acquire Potash Corporation at $130-a-share, a 20% premium, and Intel unveiled a $7.68 billion purchase of antivirus software maker McAfee at $48-a-share offer, a hefty 60% premium. Earlier this week, Stéfane Marion, Chief Economist & Strategist at the National Bank of Canada wrote a comment, Word: M&A activity levels remain depressed:

But not everyone is convinced that an M&A boom is on the horizon or that mergers benefit acquirers. Earlier this week, Zachary Mider of Bloomberg reported, M&A Losers in $10 Trillion Deal Binge Led by McClatchy, Sprint:

Despite these missteps, I see an M&A boom on the horizon. Cash rich companies will look to grow through acquisition. What does this mean for large pension funds? They should already be invested with Merger Arbitrage hedge funds (beware of betas in merger arb funds), and more importantly, they should be overweight the top companies that are being acquired and underweight the top acquirers. As for the overall market, an M&A boom couldn't come at a better time. Sagging markets need a lift, and big acquisitions will help bolster confidence. Will it be enough to propel markets higher? If you couple this with the Fed sponsored liquidity tsunami, it might spark things up again, but if the economy keeps weakening, a lot of merger plans might be placed on hold or permanently shelved. |

| Hedge Fund Corners the Cocoa Market Posted: 20 Aug 2010 10:53 AM PDT That Hershey bar you’ve been sneaking out to buy on breaks is about to cost you a lot more. London based Anthony Ward’s Amajaro hedge fund built up a billion dollar long position in the cocoa futures market which traders expected him to unwind going into expiration. To the absolute shock of investors and industry insiders alike, he took physical delivery instead of 240,000 metric tonnes of the delectable soft commodity, about 7% of the world supply. |

| Ex-Moore Trader Chris Pia Identified As "Close Banger" Of Platinum And Palladium, And Other Things Posted: 20 Aug 2010 10:42 AM PDT As frequent readers will recall, in late April we pointed out that a Moore Capital ploy to "bang the close", which is merely a trading artifice in which the closing price is manipulated by repeated barrages of buy or sell orders to get a closing print that causes a derivative instrument to be in (or out of) the money, resulted in a then near-record fine charged by the SEC to go alongside a settlement of manipulation allegations. We then observed: "As the saying goes, if you look around the table, and you can't figure out who is using illegal manipulative mechanisms to push the market higher or lower, you are an idiot: the answer is all of them." Well, we know the manipulator is Moore, but not who the specific trader was. Today, via the WSJ, we learn that the guilty person is none other than former Moore trader, and recent sole hedge fund manager, Chris Pia, who also happens to be Louis Bacon's right hand man for 18 years running. We also learn that platinum are palladium were merely two of the numerous products that Chris was banging (into the close). And the coolest thing: Mr. Pia is now running his own hedge fund Pia Capital Management, as if nothing happened (although the anchor Swiss gold-refining investors in Pia Capital may soon have to reevaluate their relationship with the PM (no pun intended) at this point). One also wonders if these were the accepted illegal trading practices at Moore (for which they got caught) just what else is the $10 billion hedge fund guilty of doing on a daily basis to attain that ever more elusive alpha (the 7x return that Pia generated in 8 years at Moore sure wasn't from holding T-Bills). From the WSJ, we learn that Pia is a perfectly normal, calm, collected, orthodox person, just like most other happily married, responsible, hedge fund managers:

Yet it is not his character we are interested in, but his precious metals manipulation scheme, which while applicable to platinum and palladium, is perfectly relevant to the daily gyrations, especially prior to Comex close, in gold and silver.

And guess, what the CFTC is likely buying this. We are confident in this because they are actually confused by Pia's apparetn motives:

In other words, in addition to manipulating thin volume closes, was also allegedly frontrunning internal (presumably prop although Moore is so big it may well have been flow) trades. One would almost think Pia took a master class in market manipulation at Goldman. Oh wait:

Yes indeed, to Goldman such practices were not only not worth pursuing legal action against (who needs capital when you have discount window access and are, after all, the squid), but in fact, were laudable and worthy of commendation. Oh yes, and it appears that in addition to platinum and palladium, Pia was guite a close banger of the NZD, and who knows what other currencies. Perhaps the CFTC will tells us that the FX market is as thin as the palladium one, and just 10 people give or take trade carry pairs? (Actually that may be quite true right now that nobody trades any more, but it surely wasn't the case in 2008). We don't have any bad blood with Mr. Pia: "The new fund, headquartered in Greenwich, Conn., has about $500 million under management, and is down 0.6% for the year." Since it is relatively difficult to be down (or just barely up), if performing alleged illegal market manipulative scams, we are confident he has learned his lesson. Yet for every Pia, there are 1,000 LBMAs, who perform precisely the same act on the Comex all day every day, in an attempt to constantly push down the key Central Banker nemesis: "gold." We are confident that the CFTC and the DOJ will get right on with their investigation of comparable manipulation in the gold and silver markets. Because after all, nobody has anything to hide there... And gold would still be where it was if it weren't for consistently shady PM activity in the market. We hope Mr Pia will come forth to the media out of his own volution and discuss what else the broader public should be aware about manipulative practices, be they in the FX market, or in commodities. Alas, we are not holding our breath. Nor are we holding our breath that the DOJ, which has now be ruminating for about about 4 months as to whether or not to launch an investigation into silver market manipulation by JPM, will ever come to an affirmative conclusion. After all, they have said on so many occasions there is absolutely nothing wrong with the PM market, how can one possibly not believe them?...

|

| Posted: 20 Aug 2010 10:18 AM PDT Gold futures soften, trim weekly gain to 1% The COMEX December gold futures contract closed down $6.60 Friday at $1228.80, trading between $1223.60 and $1235.60 August 20, p.m. excerpts: see full news, 24-hr newswire… August 20th's audio MarketMinute |

| Gold Up on Flagging Global Recovery Posted: 20 Aug 2010 10:07 AM PDT |

| Posted: 20 Aug 2010 09:43 AM PDT Napoleon Bonaparte — French 20 franc gold coins

Only 1,000 coins available. |

| Guest Post: Seeking Solutions In An Uncertain World Posted: 20 Aug 2010 09:20 AM PDT Submitted by Todd Harrison of Minyanville Seeking Solutions in an Uncertain World “We used to play for silver, now we play for life; ones for sport and one’s for blood at the point of a knife.” --Grateful Dead We live in interesting times. During the last two years, a financial virus spawned and infected the economic and social spheres as a matter of course. What does that mean? They’re selling businesses, unwinding trading operations or otherwise distancing themselves from the capital markets. The thematic reasoning is straight out of an Ayn Rand novel: “I can’t compete and when I do, the rules of engagement change in the middle of the game. I’ll let the powers that be vanquish themselves and return in three to five years to sift through the remains.” (See: The Last Gasp Bubble)

Now, I’m not suggesting we cower in a corner, buy guns and butter and get all Mel Gibson on each other. Further, I understand most folks aren’t in a position to seize the day and walk away. I’ve written in the past that if we’re not part of the solution, we’re part of the problem and that remains true, now more than ever; society, at the end of the day, is simply a sum of the parts. |

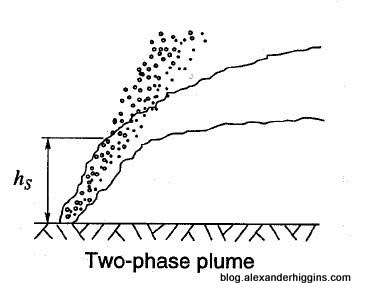

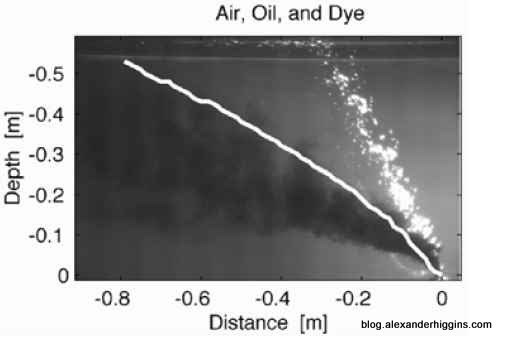

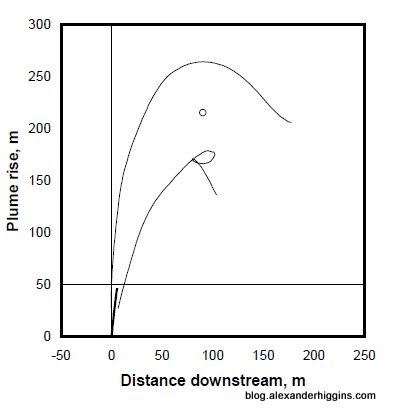

| Use of Dispersants in the Gulf Proves to Have Little Benefit Posted: 20 Aug 2010 09:18 AM PDT Dr. David Valentine - one of the world's leading experts on oil-eating bacteria - told me today:

That may not seem like a very interesting or controversial sentence. But it is actually a jaw-dropping statement, showing that the use of Corexit in the Gulf has failed by any measure. To understand why, let's quickly run through the science of the oil spill. Why Was Corexit Used in the Gulf? While many - including me - have accused BP of dumping millions of barrels of Corexit in the Gulf in order to hide the oil, some scientists argued that Corexit would make it easier for oil-eating microbes to break down the oil. As Scientific American pointed out in May:

In fact, there is no clear science showing that dispersants help microbes break down oil. As Chemical and Engineering News noted in June:

Nevertheless, tremendous quantities of Corexit have been sprayed some 5,000 feet underwater at the wellhead. Does Corexit Interfere with the Microbes? Dr. Valentine - a biogeochemist at the University of California, Santa Barbara - received funding from the National Science Foundation to characterize the microbial response to the Gulf oil spill. The National Science Foundation has funded Dr. Valentine's research into how the oil-eating microbes are dealing with the spill, and whether or not Corexit is interfering with the microbes' ability to break down the oil. As I wrote last month:

Alcanivorax borkumensis is the main microbe breaking down oil in the Gulf. For the real science nerds, here are two illustrations of how breaks down oil (click either image for full graphic): No Microbes in Deepwater Plumes He replied that he doesn't yet have any findings on that issue. However, he said, "We have found no Alcanivorax borkumensis in the deepwater plumes". I asked him whether that was because of the cold temperatures deep under the surface of the ocean, and he replied "we don't know". I had been worried that the microbes would break down the crude in the underwater oil plumes more slowly than normal ... but Valentine said there are no microbes at all down in the plumes. Mongeese, Rats and Deepwater Oil Spills

As the University of California Santa Barbara notes, microbes like the lighter portions of the oil:

Corexit: A Failed Science Experiment So let's recap. The overwhelming majority of oil from deepwater spills stays beneath the surface in plumes. See this and this. Corexit helps oil to sink beneath the surface, so even more of the oil stays underwater. Oil-eating microbes like the lighter portions of oil - the ones which tend to rise to the surface. They tend not to like the heavier portions, which tend to stay underwater (especially after Corexit is applied). Dr. Valentine found none of the main oil-eating microbes in the deepwater plumes he tested. Scientists have already said that Corexit is dangerous to sealife and humans (see this and this), and called the application of Corexit the largest science experiment ever conducted. For example, Rob Kendall, director of Texas Tech’s Institute of Environmental & Human Health, says:

And Kim Withers, a coastal ecologist at Texas A&M University in Corpus Christi notes:

They were talking about the toxic effects of Corexit on sealife. But Dr. Valentine's findings lead me to conclude that the experiment on the potential of Corexit to help the microbes break down the oil has failed as well.

|

| The Split Personalities of Platinum and Palladium ETFs Posted: 20 Aug 2010 09:15 AM PDT Morningstar submits: By Abraham Bailin Among commodities, precious metals like gold have been widely adopted as inflationary hedges and "safe-haven" assets because of their traditional store of value. To the layperson, platinum and palladium are merely pricier alternatives to white-gold engagement rings. Fittingly, those interested in commodities exposure may associate the metals with their "precious metals" group cousins. While both platinum and palladium can be used for beautiful and durable jewelry, well- informed investors should be aware that these metals are primarily used in industrial applications and are thus likely to fluctuate with economic ups and downs. Complete Story » |

| The Bull/Bear Weekly Recap - August 20 Posted: 20 Aug 2010 09:14 AM PDT The Bull/Bear Weekly Recap Bullish +More signs surface that banks are beginning to loosen lending standards and is a critical element in sustaining and further boosting the economic recovery. The demand-side is stabilizing as well after quarters of contraction. + Industrial Production shows a healthy rise led by auto production and was larger than expected. The manufacturing recovery continues and has not fallen off a cliff by any stretch. Coupled with last weeks report of the UCLA-Ceridian Pulse of Commerce (a leading indicator), we can be sure that this sector will continue to contribute to Q3 growth. +Confidence in Europe continues to show as Irish and Spanish auctions go on without a hitch, while the German ZEW current conditions rose the most in its history in August. Economic performance in the country continues to defy skeptics. + The Mortgage Bankers Association reports that their Refi-Index has reached the highest level since May 2009. Increased refinancings will help in freeing up disposable income for increased consumption. + Abroad, the Shanghai and Sensex stock markets show improving prospects for economic growth in those regions. Lower inflation gauges will support more stimulus measures in China, while India’s Sensex is near 30 month highs. + In Europe, Greece is surpassing expectations in controlling its budget deficit and has helped ease sovereign debt concerns, while the German Bundesbank raised its 2010 growth forecast. The global recovery continues with China and Germany leading the way.

Bearish - Empire and Philly Manufacturing Indexes show a slowly fading recovery in this sector as both readings come in less than expected. For the both indexes, New Orders move into negative territory for the first time in over a year. End demand better come soon! - Jobless Claims are strongly pointing to a double-dip on the horizon as job losses are increasing. The job market is not improving as the bulls state. Looking at the details of the Philly Manufacturing index, the “Average Employee Workweek" sub-index fell from +1.7 to -17.1. Demand for labor from this sector is decreasing as the inventory restocking phase is complete. - NAHB Index fell to the lowest reading since the March of 2009, when the stock market was plunging to its lows. Given that every recovery has been presaged by a rebound in this sector, can we be confident that this whole "recovery" is sustainable and that a double dip can be averted? While housing accounts for a smaller portion of GDP, home prices are still extremely important to consumer confidence. A struggling sector, along with the huge glut of homes, will ensure that housing prices will take another leg down and with it, consumption and the banks. Need proof? Check the latest Mortgage Applications report from the MBA as it seems that demand is showing stabilization after some increased readings in the past few weeks. If this is where new demand is, prepare for the housing “ice age” this winter. (Link Courtesy of CalculatedRiskBlog) - Consumer confidence remains in the doldrums as per the ABC and Gallup Polls. No recovery is being seen on Main Street. This is translating to weakening consumption trends as the second most important shopping period for retailers, back-to-school, is thus far turning out to be a dud. Weekly consumption metrics, Goldman and Redbook, are showing renewed weakening in YoY consumption growth rates as well. Earnings growth penciled in by analysts is too high given this metric. - Leading indicators point to a slowing economy. However, one must note that most of the positive impetus in the past months has been due to the “Interest Rate Spread”, which has been artificially maintained by the Fed’s ZIRP policy. Subtracting this from the metric and you get an economy that is facing a higher probability of entering a double-dip recession with every passing month. - The ECRI leading indicator growth rate just declined back into double digit territory @ -10.0, while the prior week was revised from -9.8 to -10.2, so in reality we have no been in double digit negative growth for 3 weeks. The signs of a double-dip continue to grow despite the consensus clearly not expecting one. Observations/Thoughts Looks like their will be little to no help coming from the fiscal side for a while. That one last stimulus based on fear that I was expecting in my Q2 Outlook has come and gone (though I thought it would be bigger), meanwhile, … …the warning flags are waving more aggressively: housing, treasury yields, jobless claims, manufacturing, and consumer confidence. Is the other side of this hurricane upon us?

As an investor, these are the types of articles you do NOT want to see on Bloomberg. It shows that consumers are still struggling and that the second most important period for retailers is turning out to be a dud. An excellent synopsis of the impending protectionism that investors are failing to discount (only beginning to get slightly mentioned in the media). (Link Courtesy of Mish' Global Economic Trend Analysis) What you see here are countries that are dependent on exports. China has the same problem as they have kept the Yuan from strengthening. Speculation is that England may do another round of QE. Obama is promising to double exports. Not everyone can be an exporter ladies and gents. The world economy will remain set back until emerging markets can formulate sustainable recoveries in their underdeveloped domestic economies. That development would be a step in the right direction. …our Fed continues to believe that QE is the best solution to our problems. For a good analogy regarding stimulus and the economy, check this out. I wrote it a while back. Note: QE qualifies as monetary “stimulus”. Here we go again. It’s been a great run for Treasuries for quite a while. My Bullish call on this asset class was spot on. But the gains are unlikely to continue now that we are seeing “capitulation” from the most ardent Treasury bears and high levels of bullishness in general. Everyone is now on the same side of the boat, which means that there’s little impetus for further considerable bullish moves for the time being. I’m considering moving to a neutral stance…stay tuned. |

| Posted: 20 Aug 2010 09:13 AM PDT |

| Top Five Performing Single Country Emerging Market ETFs Posted: 20 Aug 2010 09:03 AM PDT Tom Lydon submits: It is no surprise that the fastest growing economies are in the emerging markets. For the last six months, some of the best performing ETFs were also those that covered the developing world. Thailand. The Thailand Development Research Institute projects that the Thai economy could grow 6.4% to 7.2% this year, according to MCOT. The economy is estimated to expand by 3.5% to 7.1% for 2011. Inflation is expected to stay within 3% to 3.5% for 2010. The only risk to the country’s growth may come in the third or fourth quarter if political violence escalates. Complete Story » |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

With economic uncertainty continuing to loom–and a wave of economic reports coming next week that could further damp investors' moods–market observers think gold is ready to test its all-time high. Peter Grant, senior metals analyst with USAGOLD-Centennial Precious Metals Inc., said a vast majority of his clients are getting into gold as a strategy for preserving their wealth, and that trend accelerated after Thursday's disappointing economic news…

With economic uncertainty continuing to loom–and a wave of economic reports coming next week that could further damp investors' moods–market observers think gold is ready to test its all-time high. Peter Grant, senior metals analyst with USAGOLD-Centennial Precious Metals Inc., said a vast majority of his clients are getting into gold as a strategy for preserving their wealth, and that trend accelerated after Thursday's disappointing economic news…

No comments:

Post a Comment