Gold World News Flash |

- Crude Oil to Move on Growth Outlook, Gold a Safe Haven for Now

- The Worst of Intentions

- Bear Market Race Week 148: Blowing a Bubble in the Bond Market

- Gold and Financial Crisis

- Gold in a Bull Market, Stocks in a Bear Market

- Inflation Over the Past Century

- Willem Buiter's Game Theoretical Explanation Of The Interaction Between Central Banks And Treasuries

- Upcoming Weekly Calendar

- August, and Everything After

- GLD – Gold ETF Trading Signals

- Tons of fake gold imported into the UAE

- Tons of gold imports in UAE turn out to be fake

- Honest Money Gold and Silver Report: Market Wrap Week Ending 8/13/10

- A Couple Of Pointers For TheStreet.com On Blogging Etiquette

- The Rise, Fall, and Rise of Disaster

- No Doubt About the Road Ahead

- Let BABs Die

- The Recent History of the Future of Gold

- South Korea's Pensions to Boost Equity Stake

- August 15, 1971 Speech : Nixon Announces the end of Gold to Dollar Convertibility

- Gold, Oil, SP500 & Dollar At Key Pivot Points

- Wall Street’s Asset-Grab

- Geithner’s Delusional Recovery

- Henry Smyth: The recent history of the future of gold

- Adrian Douglas: Gold market isn’t ‘fixed’; it’s rigged

- Gold Providing Safety During Market Downturn

- Is Vanguard Blogger John Ameriks Right That ‘It’s Too Late for Gold’?

- Inflation Scorecard: Gold Widens Its Edge Over European Currencies

- Stocks Decline on Economic Data; Inflation Accelerated

| Crude Oil to Move on Growth Outlook, Gold a Safe Haven for Now Posted: 15 Aug 2010 05:39 PM PDT courtesy of DailyFX.com August 15, 2010 10:51 PM Crude oil will look to U.S. economic data, including key housing figures, to determine price direction in the coming week. Gold may move on the same data, only in the opposite direction. Commodities – Energy Crude Oil to Move on Growth Outlook Crude Oil (WTI) $75.59 // +$0.20// +0.27% Commentary: Crude oil is little changed in overnight trade after falling dramatically last week. Crude shed over $6/barrel, or 7.5% over four sessions, as global growth concerns reemerged following cautious comments from the U.S. Federal Reserve. This week is likely to feature more of the same consternation surrounding the state of growth around the world, but with prices notably lower than they were a week ago, there is always the possibility of an oversold bounce. Whether prices can muster such a bounce will be determinant on whether the economic data that is released in the coming week allows for a bit of optimism. Data th... | ||||

| Posted: 15 Aug 2010 05:39 PM PDT Via Stoppani 220 Milan, Italy E-mail: [EMAIL="info@stockmarketbarometer.net"]info@stockmarketbarometer.net[/EMAIL] Web site: www.stockmarket barometer.net WEEKLY REPORT Aug 15, 2010 Ancient Rome declined because it had a Senate, now what's going to happen to us with both a House and a Senate? -by Will Rogers, humorist Housing foreclosures hit new highs last month as the hangover from the housing bubble continues. It is estimated that 32% of all mortgages now have negative equity, meaning the debt on the house exceeds the value of the house. So here's a question: if you bought a house for US $400,000, you have a mortgage on it for $350,000, and it's worth US$ 225,000, what is the proper business decision to make? I'm not talking about the moral dilemma here; I am simply looking at it as a business decision. Assuming you have a ten year mortgage, you'll probably pay close to US $600,000 in capital and interest for a prop... | ||||

| Bear Market Race Week 148: Blowing a Bubble in the Bond Market Posted: 15 Aug 2010 05:39 PM PDT The 1929 & 2007 Bear Market Race to The Bottom Week 148 of 149 Blowing a Bubble in the Bond Market Commodity Baseline Shifts Update Mark J. Lundeen [EMAIL="mlundeen2@Comcast.net"]mlundeen2@Comcast.net[/EMAIL] 13 Aug 2010 Color Key to text below Boiler Plate in Blue Grey New Weekly Commentary in Black Below is my BEV chart for the Bear Race. One week to go before the 2007-2010 Bear Market has lasted as long as the Great Depression Bear. Beginning in Wk 150, this report will be Wk 150 of 149, because the world’s Financial Markets are managed by Malignant Narcissists who don’t give a Damn about anyone or anything other than their parochial and selfish interests. Paul Volcker, when he was Chairman of the Fed, never made the world safe from paper money, but he did raise the Fed Funds Rate to over 14%, and the Prime Rate to 21%. This stopped the Inflationary “Malaise” that consumed the Carter Presidency, and created the Econom... | ||||

| Posted: 15 Aug 2010 05:35 PM PDT | ||||

| Gold in a Bull Market, Stocks in a Bear Market Posted: 15 Aug 2010 05:30 PM PDT | ||||

| Inflation Over the Past Century Posted: 15 Aug 2010 05:16 PM PDT Calafia Beach Pundit submits:

Complete Story » | ||||

| Willem Buiter's Game Theoretical Explanation Of The Interaction Between Central Banks And Treasuries Posted: 15 Aug 2010 04:12 PM PDT Despite missing this most recent paper by Buiter at its first publication three weeks ago, it represents the bedtime reading for this evening as it is just as relevant now as it was then. In it, the Citi strategist asks "who will control the deep pockets of the central bank?" and does so from the perspective of a game of "chicken" in a prisoner dilemma context. Buiter summarizes the problem as follows: "As long as neither the monetary authority nor the fiscal authority gives in, the deficit is financed by public debt issuance. With the public-debt to GDP ratio rising without bound, an eventual catastrophe occurs: the sovereign defaults and banks holding large amounts of sovereign debt may collapse, triggering a financial crisis and a deep slump. Following default, the fiscal authority loses access to the government debt markets, at least for a while. The resulting need to instantaneously balance the government’s primary budget means sharp public spending cuts and tax increases. This would be the "collision" outcome. The outcome where the monetary authority gives in and monetises public debt and deficits is called Fiscal Dominance. Monetary dominance is the outcome where the fiscal authority gives in and cuts public spending and/or raises taxes to stabilise or reduce the public debt to GDP ratio to prevent a sovereign default." Buiter does a dramatic deconstruction of this theoretical principal to the practicality of Europe, in a truly fascinating and must read analysis. His conclusion is that the "analysis emphasises that the Eurosystem can absorb much larger losses without risking its solvency or undermining the effective pursuit of its price stability target. We don’t, however, argue that the resources of the Eurosystem should be used in this quasi-fiscal manner. Openness, transparency and accountability suffer when the central bank is used/abused for quasi-fiscal purposes, and the legitimacy of the institution can be undermined." Alas, this only means that fiscal stimulus fundamentalists like Krugman will now start pushing for monetary replacements to traditional policy. And with that QE2 (and its myriad of imminent associated alphabet soup programs) is even more of a certainty.

This posting includes an audio/video/photo media file: Download Now | ||||

| Posted: 15 Aug 2010 03:46 PM PDT A look at the key economic events in the relatively quiet week ahead from the perspective (and benchmarks) of Goldman Sachs.

| ||||

| Posted: 15 Aug 2010 03:38 PM PDT --Before we get into this week's first episode of "As the U.S. Dollar disintegrates" we should point out that some people are go about the business of making money in almost any conditions. Last week we read a draft version of Dr. Alex Cowie's latest investment recommendation in Diggers and Drillers. --He was writing about the "micro-cap" of base metals. Huh? --Tin! Tin is a small market, in terms of annual sales and volume, compared to say, that big shot Dr. Copper. But Alex pointed out that the supply chain for tin was tight. Even in generally bleak economic conditions, you could still see the metal rise. --And so it has. Today's wires report that, "LME cash tin moved to a premium over the three-month price, going into backwardation for the first time in more than eight months. The backwardation suggests looming tightness in supply, although tin is a relatively illiquid market and is the smallest on the LME." There is also this report from Mineweb that Indonesian tin output may fall by 20% due to heavy rains. Indonesia is the world's largest exporter of tin. --Backwardation, by the way, means that near-term futures prices are a lot higher than longer-term futures prices. If you had a supply bottleneck, near-term prices would spike. That's not the reason Alex recommended an Aussie tin producer. The best reason, in our opinion, is that it's a low cost producer thanks to great management and a great resource. --You can read Alex's whole Diggers and Drillers story in the August issue. Mind you, your editor is not entirely convinced that buying base metals in the current environment is a great idea. But Alex has been knocking them out of the park. And with respect to what we think is the biggest threat to Australia's continued resource propserity - China - Alex had this to say in his Friday update to Diggers and Drillers readers:

This is still fast growth by anyone's standards. China is fraught with inequalities, dodgy deals, and questionably efficient markets, agreed. Yet there are still 1.3 billion people hell bent on industrialising, and that will generate economic growth (as well as demand for resources) for years. China's economic growth certainly won't take a straight line in coming decades, but it will be a line that goes up. The communist core of the economic model does mean that it can respond aggressively to changing market conditions. It is now diverting its reliance on the debt-straddled US-consumer, and focusing its future growth plans on the Chinese consumer. This is a radical change that will take years, but is already taking place. In the meantime this week's figures also pointed out that China is currently making plenty of money sending most of its exports to other emerging economies. China is doing just fine. --Well, according to today's Wall Street Journal, China, at least in terms of output, has eclipsed Japan to become the world's second-largest economy:

--Hmm. Does this mean Alex is right and we are wrong about China? We'll see. One of the virtues of having an office full of independent thinkers is that you don't get groupthink. People often disagree. Ultimately, we have no idea of what the future holds. We try to get a bunch of hard working people producing their best investment ideas and they let you decide how to fit them into your own financial plan. --Speaking modestly, though, we're sure we're right about China. Its massive industrialisation was accelerated by the great credit bubble. As the bubble bursts and deflates, surplus and inefficient Chinese production will be idled or shuttered, as began to happen last week. Of course China has a real advantage in certain manufacturing industries, like those requiring rare earth elements. --But the daily speculation about the economy and stock prices can lull you into a false sense of security that things are normal. They continue to be abnormal, and very dangerous. August - probably because it's when many folks in the Northern hemisphere get back from summer vacation - tends to be the month where big bear moves begin. And we're in a big bear that's enjoyed a minor bullish up-trend. --For the rest of this week we'll look at whey deflation may give way to default and why honest money never lies. Until then... Dan Denning | ||||

| GLD – Gold ETF Trading Signals Posted: 15 Aug 2010 03:28 PM PDT This 60 minute chart shows gold getting hit hard on Wednesday morning. Investors and traders around the globe were closing out positions and moving to cash. This high volume dumping of positions pulled virtually all investments lower and was the first tip-off that the market was in panic mode. One the dust [...] | ||||

| Tons of fake gold imported into the UAE Posted: 15 Aug 2010 01:59 PM PDT Tons of gold imports turn to dust on arrival Gold imported into the UAE by traders and investors turned out to be fake on closer inspection 15 August 2010  Several tons of gold imported into the UAE by traders and investors turned out to be fake on closer inspection, resulting in millions of dirhams in losses and high levels of stress to the victims. Speaking to Emirates 24|7, Mohamad Shakarchi,, Managing Director of Emirates Gold, said: "A lot of people in the UAE who tried to import gold at lower prices or through dubious overseas companies have been cheated. We have inspected many consignments from African countries, especially Ghana, and found that there is not an ounce of gold in them. For importing pure dust or other metals with yellow colour, these traders have paid several million dirhams." Dubai Customs sources confirmed the incidence of fake gold imports, but did not reply to a questionnaire sent by Emirates 24|7 ten days ago. "The concerned official is on leave," said a spokesman. Emirates Gold has stopped examining gold imported from Africa. "We send specialists to examine a gold consignment only if it is routed through a local company. We don't have time to waste because most of these so called gold imports are fake. The traders got greedy. They thought they were getting gold at a discounted rate." Mohammed said that at least five tonnes of fake yellow metal is lying with Dubai Customs. A tonne of gold will cost approximately $40 million. Merchants estimated that the minimum loss of fake gold imported by local traders is nothing less than $200 million. He said many clients and Dubai Customs have requested the use of company's expertise to verify the purity of gold. "The fake gold issue has affected many people. Some of the traders got heart attack, after our inspectors said there is no gold in the tonnes of imports brought from Africa," Mohammed said. Recent media reports suggested that several million dollars worth of gold with the Ethiopian Central Bank turned out to be fake. These bars of gold turned out to be gold plated steel bars African gold merchants claim to be in possession of large quantities of gold dust or gold bars, which they offer to sell at below market prices. The would-be buyer is made to send money for travel of the seller, for insurance, for shipping and for refinery assays before they would receive anything of any value. Investors are shown samples, which may be original gold. But when the consignment reaches the port, it will be only mud or sand. Once Dubai Customs tightened controls, fake gold imports started reaching the UAE through other ports. The seller can walk away at any point with virtually no risk of being caught as all contacts are via anonymous free webmail accounts accessed from Internet cafes and via prepaid mobile phones. After the real estate and stock market investments became dull, many local investors have turned to commodity, especially gold investment, said the Chief Executive Officer of JRG Commodities, Sajith Kumar PK. http://www.emirates247.com/markets/g...08-15-1.279082 | ||||

| Tons of gold imports in UAE turn out to be fake Posted: 15 Aug 2010 01:22 PM PDT From Emirates 24/7, Dubai http://www.emirates247.com/markets/gold/tons-of-gold-imports-turn-to-dus... Several tons of gold imported into the UAE by traders and investors turned out to be fake on closer inspection, resulting in millions of dirhams in losses and high levels of stress to the victims. Speaking to Emirates 24|7, Mohamad Shakarchi, managing director of Emirates Gold, said: "A lot of people in the UAE who tried to import gold at lower prices or through dubious overseas companies have been cheated. We have inspected many consignments from African countries, especially Ghana, and found that there is not an ounce of gold in them. For importing pure dust or other metals with yellow colour, these traders have paid several million dirhams." Dubai Customs sources confirmed the incidence of fake gold imports but did not reply to a questionnaire sent by Emirates 24|7 10 days ago. "The concerned official is on leave," a spokesman said. ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Emirates Gold has stopped examining gold imported from Africa. "We send specialists to examine a gold consignment only if it is routed through a local company," Mohamad said. "We don't have time to waste because most of these so-called gold imports are fake. The traders got greedy. They thought they were getting gold at a discounted rate." Mohammed said that at least five tonnes of fake yellow metal are lying with Dubai Customs. A tonne of gold will cost approximately $40 million. Merchants estimated that the minimum loss of fake gold imported by local traders is nothing less than $200 million. He said many clients and Dubai Customs have requested the use of the company's expertise to verify the purity of gold. "The fake gold issue has affected many people. Some of the traders got heart attacks after our inspectors said there is no gold in the tonnes of imports brought from Africa," Mohammed said. Recent media reports suggested that several million dollars worth of gold with the Ethiopian Central Bank turned out to be fake. These bars of gold turned out to be gold-plated steel bars. African gold merchants claim to be in possession of large quantities of gold dust or gold bars, which they offer to sell at below-market prices. The would-be buyer is made to send money for the travel of the seller, for insurance, for shipping, and for refinery assays before receiving anything of any value. Investors are shown samples, which may be original gold. But when the consignment reaches the port, it will be only mud or sand. Once Dubai Customs tightened controls, fake gold imports started reaching the UAE through other ports. The seller can walk away at any point with virtually no risk of being caught as all contacts are via anonymous free Webmail accounts accessed from Internet cafes and via prepaid mobile phones. After the real estate and stock market investments became dull, many local investors have turned to commodity investment, especially gold, said the chief Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | ||||

| Honest Money Gold and Silver Report: Market Wrap Week Ending 8/13/10 Posted: 15 Aug 2010 01:21 PM PDT | ||||

| A Couple Of Pointers For TheStreet.com On Blogging Etiquette Posted: 15 Aug 2010 01:04 PM PDT Our religulous readers at theStreet.com decided to take a stab at Zero Hedge over the weekend due to our discovery, first among all media, that the Hindenburg Omen had struck this past Thursday. We take this opportunity to teach theStreet a few of the key rules of blogging etiquette. 1. A website run by Jim Cramer describes Zero Hedge narrative as if "writing in a vein that seems made for professional boxing or WWE pay-per-view event hype, describes the Hindenburg Omen as "Easily the most feared technical pattern in all of chartism (for the bullishly inclined). Those who know what it is, tend to have an atavistic reaction to its mere mention." Seriously? Jim Cramer's website accusing someone of hype? That's some serious "crossing the streams" voodoo. We have nothing to say here - South Park's Eric Cartman did the best job of capturing the essence of thestreet.com's CEO style previously.

2. Oddly enough, The Street had no such qualms about the description of the Hindenburg Omen by David Buik at BGC Partners. As the Telegraph highlighted out, Buik "drew attention to the Hindenburg Omen, which he described somewhat theatrically as "easily the most feared technical pattern in all of chartism"." Hmm - this seems oddly identical to our own language, which the Street decided to ridicule. While we may or may not seek copyright arbitration vis-a-vis the nice folks at BGC, it seems somewhat obtuse of theStreet's staff to take offense by our characterization of the H.O., but not an idential one presented by one "of the world's leading interdealer brokers." Why the bias? 3. It is accepted etiquette to link up to the source, especially when that source breaks the news. Benzinga and most other sources did so. Does theStreet.com think traditional web rules do not apply to it? Or perhaps, theStreet believes that no rules apply to it? To wit, and as a case study of hyperlinking for the sole benefit of theStreet, we present this example of how that whole process works, from a previous Zero Hedge post. Note the hyperlink to thestreet's form 12B-25:

4. Last, and probably least, if theStreet has an issue with our writing style, perhaps they can tell Google's adsense to no longer advertise Jim Cramer's theStreet premium service contextually and based on cookies, on Zero Hedge (a process we have no control over). We assume had theStreet's revenue numbers (and thus traffic) been sufficiently attractive, they would not need to reach out and attempt to steal the eyeballs of Zero Hedge's nearly 200k a day readers. And that concludes our web etiquette lesson for today.

| ||||

| The Rise, Fall, and Rise of Disaster Posted: 15 Aug 2010 12:52 PM PDT The US Department of Agriculture may have some usefulness. Projecting future prices isn't one of them. In 2005, it looked five years ahead and saw a bushel of wheat selling for $3.50. Last week, the price rose to more than twice that much. Why? God himself is to blame. Not since 1880 has Russia been so dry. And not since Napoleon's invasion has Moscow suffered so much soot. The government banned wheat exports and prices shot up to their highest point in 51 years. In the curious way that one thing lead to another, Napoleon's Russian Campaign grew out of the French Revolution like a forest fire out of a careless barbecue. The revolution stirred up enemies on all France's frontiers. When Napoleon had finished with them all, he had to reach farther - all the way to the banks of the Moskva River - to get his fingers burnt. But the Revolution may never have happened without the summer of 1789. That was God's work too. That summer was the opposite of the Russian summer of 2010. Europe was cold and rain-soaked, believed to be the result of the explosion of the volcano Laki in Iceland. The price of bread in Paris rose 67% in 1789. The average laborer only made about 20 sous a day, barely enough to buy a loaf of bread. The intellectuals may have been stirred by the Enlightenment. But it was high bread prices that gave the mob an appetite for revolution. One of the awake observers of this period was a young Anglican clergyman named Thomas Malthus. While the rest of the intelligentsia imagined a world of industrial and social progress, Mr. Malthus peered down to the bottom of a dark well. Ten years after the French Revolution, he published his Essay on the Principle of Population. His point was simple, obvious and modest: populations can grow faster than food production. This led to the idea of a "surplus" of humanity, which was practically a Christian heresy. It presumes that God is a jackass, something that occurs to the average man about once a day, but which is a rare thought for a member of the clergy. Everything in nature is bounded by limits and hounded by failure. Trees don't grow to the sky. Bull markets don't last forever. And every step people take in life brings them closer to the grave. God told man to be fruitful and multiply. Was he just setting him up for catastrophe? But the Malthusian limits keep getting pushed back. Even after nearly two centuries and 6 billion more people added to the human population, most people can still multiply without worrying about mass starvation. Paul Ehrlich published his Population Bomb, in 1968. But his prediction was as big a bomb as Malthus's. Populations didn't outrun food supplies. Instead, output per acre doubled in the 'green revolution' that followed - rising faster than the number of people. If people starved, it wasn't God's fault. And now, Le Monde reports that obesity may be a bigger health threat to the poor than starvation. Forty years ago, experts said the world was running out of oil, too, with only 40 years' worth of reserves. They predicted disaster. But huge new discoveries of deep reserves have been made since then. Four decades later and the world still has 40 years' of reserves. The only a disaster was for those who were counting on buying it at $10 a barrel. And now, the alarmists are on to other worries. Water, for example. Not that there isn't plenty. The seas and rivers are full of it. But getting the right kind of water to the right place is going to be expensive. Peak water...peak oil...peak food...peak this, peak that. After so many alarms with so few fires, many people think they can put away the fire extinguishers. Higher prices draw forth more supply...and substitutes. The limits seem to recede forever. But the threat of disaster hasn't disappeared; it is just retreating in good order like the Tsar's troops...waiting for the worst possible moment to strike. There is only so much arable land. There is only so much water. There is only so much energy to move food and water. Man has been growing food for 12,000 years. Surely, he's reached capacity, no? Experts see disaster coming again. The undeveloped world is still multiplying - and with much larger numbers. The population of the earth is expected to add nearly 3 billion people by the middle of this century. On that basis alone we'd need another "green revolution" to keep up with it. But since the mid-90s there's been little improvement in farm output. In fact, people have eaten more than they've produced for most of the last decade. And as people get richer, thy change their eating habits. Grain is fed to the cows and pigs; people want meat. China's consumption of pork, for example, increased 45% between '93 and 2005. The need for grain multiplies 5 times faster than the people they are meant to support; a calorie from grains takes only about 20% of the inputs needed to produce a calorie from meat. Is the world running out of wheat? No. There will be plenty of wheat available. But probably not at $3.50 a bushel. But every half-empty glass is also half-full. The summer of 1789 was a disaster for plants in Europe. But with so much volcanic ash in the air, the sunsets were uncommonly pretty. Bill Bonner, | ||||

| Posted: 15 Aug 2010 12:28 PM PDT Why the US Economic Outlook is Only Facing One Direction Another week gone by. Nothing has been learned. Nothing has been proven. Nothing has been decided. In the markets, we mean. It looks like the stock market is finally rolling over. After a big drop on Wednesday, the Dow followed up with a modest drop yesterday - down another 58 points. Is the market really headed down? We've been wrong about it before. About the timing, that is. But we still have little doubt that this market is headed down. Why? That's just the way it works. After hitting extraordinary highs, we must have extraordinary lows in the forecast. Winter follows summer, no? You can imagine as many reasons why stocks might want to go down as we can. Households are de-leveraging. People are getting older and shopping less. Savings rates are going up. Housing is underwater and sinking. Unemployment is nearly 10% officially...much higher than that in reality. The US is broke. The empire is probably rolling over too. Emerging markets are leaner, faster, more solvent and more competitive. We now have to compete on both ends - sales and raw materials - with 3 billion people who do not have to carry the burdens of success on their backs. Do we have to go on? Of course, Mr. Market can do what he wants. He won't get any argument from us. But we're pretty sure he's ready to take a long walk down a long, lonely road. Want to see the roadside attractions? Just look out the window. The New York Times: The delinquency rate on home equity loans is higher than all other types of consumer loans, including auto loans, boat loans, personal loans and even bank cards like Visa and MasterCard, according to the American Bankers Association. Lenders say they are trying to recover some of that money but their success has been limited, in part because so many borrowers threaten bankruptcy and because the value of the homes, the collateral backing the loans, has often disappeared. The result is one of the paradoxes of the recession: the more money you borrowed, the less likely you will have to pay up. For two years, we've been talking about US household de-leveraging. Some of the debt is paid off. But much of it just disappears. Here's how; the TIMES continues: Lenders wrote off as uncollectible $11.1 billion in home equity loans and $19.9 billion in home equity lines of credit in 2009, more than they wrote off on primary mortgages , government data shows. So far this year, the trend is the same, with combined write-offs of $7.88 billion in the first quarter. Even when a lender forces a borrower to settle through legal action, it can rarely extract more than 10 cents on the dollar. "People got 90 cents for free," Mr. Combs said. "It rewards immorality, to some extent." The amount of bad home equity loan business during the boom is incalculable and in retrospect inexplicable, housing experts say. Most of the debt is still on the books of the lenders, which include Bank of America, Citigroup and JPMorgan Chase. Yes, dear reader, we are on a long, lonely road. Want to know where that road leads? More on that, after today's column... And where does that long and winding road lead, dear reader? To Japan! Here's Bloomberg: Ten-year Treasury yields slid to a 16-month low after the Federal Reserve said yesterday the US economic recovery will be "more modest" than previously anticipated. The spread between yields on US and Japanese 10-year debt is at the narrowest since May 2009. "The aftereffects of the credit bubble along with the aging population mean it's possible that the US will slip into deflation" in the next three years, said Tsukatani, whose company manages about $211 billion in assets globally. "If real interest rates fall in the US, it's likely to drag down those in Japan." Tsukatani said he derives real interest rates by subtracting inflation rates from 10-year bond yields. Deflation increases the value of the fixed payment from bonds. Scott Mather, head of global portfolio management at Pacific Investment Management Co., wrote in an article this week that "the risk is rising" that the US will follow a similar path to Japan's. St. Louis Fed President James Bullard wrote in a report released last month that the US is "closer to a Japanese-style outcome than any time in recent history." "The US hasn't been an engine for the world's economy since around 2005 but it's being driven by countries like China and India whose economies grow 8, 9 percent," Tsukatani said. "With slowing population growth and more emphasis on debt reduction, the US economy probably won't grow that much." A total of 12.8 percent of the US population was 65 years or older at the end of 2009, up from 11.3 percent in 1980, Bloomberg show. That compared with 22.2 percent in Japan. Meanwhile, the price of gold took off yesterday. Up $17 to $1,216. It didn't make much sense. The rest of the news is recessionary, deflationary and dreary. Why does gold still glitter? We don't know. Maybe investors are thinking what we're thinking: that the feds will get desperate, sooner or later. They won't be able to resist the allure of free money. Then, even in the midst of a de- leveraging cycle, the price of gold will soar. Regards, Bill Bonner, | ||||

| Posted: 15 Aug 2010 12:15 PM PDT The Sunday talk show economic topic was what to do with the Bush tax cuts that expire at the end of this year. I thought I heard a unanimous voice from the likes of Zandi, Corzine, Tyson and (surprisingly /importantly) Senator Corker (R.Tenn.) that Congress should act quickly to agree to do nothing on those tax increases for at least another year. Look for that terrible choice to be made sometime in the next month.

According to congressional lobbying records and interviews with market participants, 78 organizations have either hired lobbyists or lobbied on their own for BABs, and as many as 202 lobbyists have taken on the issue since the taxable stimulus bonds were created in February 2009. But activity spiked most noticeably this year, as muni market participants began pushing for a BAB extension

Bank of America NA, Citigroup Management Corp. and Goldman have all reported BABs in lobbying records since last fall.

| ||||

| The Recent History of the Future of Gold Posted: 15 Aug 2010 11:30 AM PDT | ||||

| South Korea's Pensions to Boost Equity Stake Posted: 15 Aug 2010 11:28 AM PDT Jung Jae-yoon reports in the JoongAng Daily, Pension funds seen increasing equity stake:

You'll remember South Korea's National pension Service recorded an overall return of minus 0.75% in 2008, its first loss ever, with its investment in stocks yielding minus 41.20% that year.

What remains to be seen is whether South Korea's pensions will also boost their equity stake in foreign stocks and bonds. As I stated in my previous post, shifts in asset allocation from these sovereign funds are important and need to be carefully monitored. | ||||

| August 15, 1971 Speech : Nixon Announces the end of Gold to Dollar Convertibility Posted: 15 Aug 2010 10:40 AM PDT | ||||

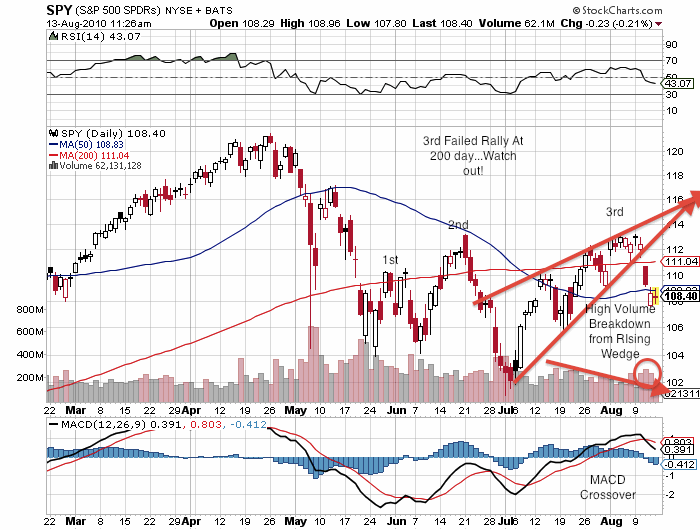

| Gold, Oil, SP500 & Dollar At Key Pivot Points Posted: 15 Aug 2010 10:21 AM PDT By Chris Vermeulen, TheGoldAndOilGuy Sunday Aug 15 Just to recap, Wednesday the market went into free-fall mode sending traders and investors running for the door. This was obvious from looking at the large percent drop coupled with heavy selling. That day the NYSE showed panic selling with 37 shares sold for every 1 share purchased meaning pure panic. In my Wednesday night report "How to Take Advantage of Panic Selling for SP500 and Gold " I explained how to read these extreme market conditions and what to expect the following sessions. Currently the price of gold, oil, spx are trading somewhat at the opposite extremes seen last week. Below are a few charts explaining the situations: GLD – Gold ETF Trading SignalsThis 60 minute chart shows gold getting hit hard on Wednesday morning. Investors and traders around the globe were closing out positions and moving to cash. This high volume dumping of positions pulled virtually all investments lower and was the first tip-off that the market was in panic mode. One the dust settled and investor's regrouped we saw money surge back into gold creating a nice pop the following day. Problem I see is that gold is now trading at a key resistance level when reviewing the daily chart. And if you take a look at the 60 minute chart below you can see the price of gold sold down in the morning on August 13th and drifted up into the close on Friday forming a bearish wedge. Also there was some very strong selling just before the market closed which is also a concern. USO – Oil Traded FundBoth times oil has fallen we have seen the price pierce key support levels where the bulls would have the majority of their stops placed. The intraday pierce causes the stops to be triggered washing the market of long positions while the smart money loads up accumulating everyone's sell orders . This is something which happens with virtually every type of investment and the main reason traders get shaken out just before the market goes in their direction. Anyways, running of the stops is something I will cover in a future report. Looking at the chart below you can see oil trading at trendline support. Each time the key support levels (blue arrows) have been pierced the market has rocketed higher. Just from looking at the chart from August 9th forward you can see that this move down is overextended and visually looks ready for a pause or bounce in the coming days. *Trading Tidbit - When trading trendlines it is important to try and play the third test. Reason being is that the first two pullbacks create the trendline and the third test is when active traders generally jump on board causing a sizable bounce. Each test of a trendline it becomes weaker and the probability of a breakdown is more likely.* SPY – SP500 ETF Trading FundThe SP500 chart shows last week's breakdown on the 5th test of the trendline. The market is oversold here and ready for a bounce which I hope we get this week. My concern is that the downward momentum is to strong and a bounce will be negated. US Dollar IndexUS dollar put in a huge bounce last week after testing is 61.8% Fib retracement level from the 2009 December low. The strong bounce has pushed the dollar up to a key resistance level which happens to be 38.2% Fib retracement level from both the December up trend and the recent sell off. I figure this will hold the dollar down for a few days easing the pressure on oil and equities. Weekend Gold, Oil, SPX and Dollar Trading Conclusion:In short, I feel there will be a relief bounce in oil and equities while the dollar and gold will have some profit taking and trade sideways or down at the beginning of the week. After that it looks as though stocks and oil will head lower while the dollar and gold rally. If you would like to receive my Trading Analysis and Signals Complete with Entry, Targets and Protective Stops please visit my website at: www.TheGoldAndOilGuy.com Chris Vermeulen JOIN MY FREE NEWSLETTER AND STAY AHEAD OF THE MARKET | ||||

| Posted: 15 Aug 2010 10:21 AM PDT By Jeff Nielson, Bullion Bulls Canada A recent Bloomberg article should have filled every American with rage. "Morgan Stanley's $11 Billion Makes Chicago Taxpayers Cry", proclaimed Bloomberg. As is often the case when these media outlets (partially) "shine a light" on the activities of the Wall Street Oligarchs, this was a case of gross understatement. The article discusses how a "Morgan Stanley led partnership" will haul in more than $11 billion in parking revenues – thanks to a long-term lease agreement with the City of Chicago. As is to be expected, Bloomberg attempted to cover-up this taxpayer outrage through its intentional use of deceitful euphemisms. The deal illustrates how Wall Street banks, recipients of more than $300 billion in taxpayer bail-outs in the worst credit collapse since the Great Depression, are profiting from helping states and cities close record recession-induced deficits [emphasis mine] by selling bonds and leasing public properties [emphasis mine]. Lets examine this collection of half-truths, one by one. Were Wall Street banks recipients of "more than $300 billion" in taxpayer hand-outs? Yes – more than ten times that amount. A precise measurement of the size of the hand-outs is impossible, until (in hindsight) we can measure the precise value of trillions of dollars in tax-breaks, asset-guarantees, and zero-interest "loans". Was this the "worst credit collapse since the Great Depression"? Yes, actually it was far worse – and what Bloomberg somehow forgot to include was any mention of how this "collapse" was caused 100% by these same, Wall Street Oligarchs. Regular readers will be familiar with how Wall Street planned and executed its massive Ponzi-schemes, built atop the U.S. housing bubble (which the Oligarchs also created). Are these Oligarchs "helping cities and states" through "leasing public properties"? Absolutely not, and it is nothing less than a vile deceit to even suggest such a thing. Let's review the chronology. As a consequence of the most-extreme greed ever witnessed by our species, Wall Street turned the world's largest economy into a giant, Ponzi-scheme – with absolutely no concern or consideration as to how this would destroy the U.S. economy, and (individually) destroy the lives of tens of millions of Americans. After causing all this damage, the Oligarchs then commanded their servants in the U.S. government to provide them with more than 90% of all stimulus and bail-outs being created through Ben Bernanke's "magic" printing-press. By the government's own admissions, the total value of all hand-outs/loans/guarantees is well over $10 trillion – not counting the literally "infinite" guarantees on all Fannie Mae/Freddie Mac losses (since you can't put a price-tag on "infinity"). Let me repeat this: 9 out of every 10 dollars went to the handful of Oligarchs (who caused all these problems). The other dollar was split-up amongst over 300 million American people, 50 states, and tens of thousands of local governments. Most of the Wall Street hand-outs were undertaken with the explicit understanding that Wall Street would use much/most of this money to lend to American businesses and families. In fact, the Oligarchs reduced their lending, violating the implicit (explicit?) terms of this contract (with the only legally just result being that they should return every penny, with interest). In the process, they have destroyed millions more American families (through denying both they and their employers credit). Yet instead of returning what they fraudulently misappropriated from the U.S. government, they are allowed to keep their ill-gotten hand-outs – and use that money to betray the American people again. First the federal government blind-sided every state and local government in the U.S. This was done through incessant market-pumping (during the U.S. housing bubble) by an endless procession of Treasury Department and Federal Reserve shills. Can anyone forget the "Goldilocks economy" promised over and over again by Ben Bernanke? Apparently, every member of the U.S. government, and every member of the U.S. mainstream media could "forget it" – since they never mentioned the phrase again after the bubble burst. Caught woefully unprepared for any economic downturn, state and local governments were immediately betrayed a second time by Fed/Treasury shills – who then proclaimed the U.S. would experience a "soft landing". That lie was also instantly forgotten by every member of the mainstream media and every member of the U.S. government – as the U.S. economy suffered its "hardest" landing in at least 80 years. Thus, it wasn't until the collapse of the U.S. economy had already reached epic proportions that state and local governments finally began some modest fiscal restraint. More articles from Bullion Bulls Canada…. | ||||

| Geithner’s Delusional Recovery Posted: 15 Aug 2010 10:20 AM PDT Bill Bonner here at The Daily Reckoning writes that Tim Geithner, Secretary of the Treasury of the United States of America, is the author of the now-infamous "Welcome to the Recovery" piece he wrote for The New York Times, which I meant to read, and tried to read, but I could only get part way through it before getting visibly upset with such self-serving, lying, sophomoric qualitative excuse-mongering. I also think I remember quickly scanning the article, but it was just, "Bah! More of the Same Old Crap (SOC)" about how the brave, handsome and beautiful brilliant Obama people (like Mr. Geithner himself) and the brave, handsome and beautiful geniuses in Congress courageously worked together in a glorious heroic effort to "save us" from the terrible fate of booms caused by inflationary increases in the money supply and the cancer of deficit-spending governments grown to grotesque proportions, by (oddly enough) providing more government grotesqueries by dint of outrageously more deficit-spending and even outrageously more money created by the outrageous Federal Reserve! Outrageous! How could I continue reading such crap? Anyway, Mr. Bonner thankfully does not mention how I seem to be working myself into a Raging Mogambo Snit (RMS) about this stuff right in front of his eyes, like some kind of weird Jekyll and Hyde monster, or how I am so angry that little specks of spittle are flying out of my mouth at high rates of speed as I speak, which I do, loudly, so that even the furthermost disinterested passerby will hear me and think to him or herself, "Gee! The Federal Reserve is a monster that has destroyed us with their stupid neo-Keynesian econometric inanities, which apparently translates as 'Mathematical reasons why the money supply should be increased all the time, only varying between more and a lot more, depending upon, you know, the current whim as to arrangements of formulae and computer models!'" Instead, he apparently intuits that it would calm me down to note that Geithner mentions "that households were paying down their debts," which he somehow sees as "a sign of recovery." And you know what? He was right! Whereas I was angry, now I am laughing! Hahaha! I am laughing the Bitter Laugh Of Scorn (BLOS) at Tim Geithner and that anyone else would see good news in massive leveraging of a depreciating fiat currency to amass suffocating, bankrupting, un-payable debt levels in every part of the economy, leading to less consumption, leading to losses, declining sales revenues to retailers, credit card companies, and taxing authorities. Hahaha! Bitter Laugh Of Scorn (BLOS)! BLOS! Hahaha! Apparently, I was too detailed in my explanation of how Tim Geithner is an idiot, and I was immediately bombarded with questions like "Did you say something that was not stupid?" and, "Could you explain that, please, or are you too stupid?" and, "What is wrong with you that you sound so stupid?" So I was soon busy with explaining to the media nerds how a consumer-driven society, especially one where total government spending is half of GDP, is the Shining Path To Doom (SPTD), and Mr. Bonner shows not only real insight into the problem, but with the brevity that is, so they say, the soul of wit, which explains with crystal clarity that debt repayment is not, as Mr. Geithner believes, a sign of recovery, as, in a consumerist, debt-driven currency and economy, "it is actually the source of the slump." Paradoxically, it is also the sign of a boom in gold, silver and oil which, because they are so cheap right now, makes you gloat, "Whee! This investing stuff is easy!" The Mogambo Guru Geithner's Delusional Recovery originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day."

| ||||

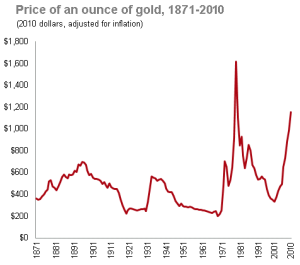

| Henry Smyth: The recent history of the future of gold Posted: 15 Aug 2010 10:20 AM PDT 2:05p ET Sunday, August 15, 2010 Dear Friend of GATA and Gold: Demand for gold has been building markedly for five years, causing the rise of gold's price chart to steepen as the markets restore gold to its traditional role as money, Granville Cooper gold fund manager Henry Smyth writes in a report published last week. Gold buying pressure, Smyth remarks, "is global and now includes every investment player, from central banks to individuals. This buying pressure spans the paper gold markets as well as the physical markets, from the forward, futures, and derivatives markets in New York and London to the gold loops, chains, and bars sold in the bazaars of Dubai, Mumbai and Shanghai." Smyth concludes: "Some have called for an official revaluation of gold by central banks to alleviate the strain in the global credit markets. I say gold's revaluation has been under way for 10 years through the collective decisions of millions of individuals across every time zone. This will produce profound changes in the geofinancial landscape in ways very few can imagine." Smyth's report has a couple of interesting charts, is headlined "The Recent History of the Future of Gold," and can be found at the Granville Cooper Internet site here: http://www.granvillecooper.com/manrep_history.htm Smyth was interviewed about his report last week by TheStreet.com's Alix Steel for Kitco News and you can watch it at the Granville Cooper Internet site here: http://www.granvillecooper.com/press.htm CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Adrian Douglas: Gold market isn’t ‘fixed’; it’s rigged Posted: 15 Aug 2010 10:20 AM PDT 10:11a Saturday, August 14, 2010 Dear Friend of GATA and Gold: Following research done by GATA consultant Dmitri Speck, GATA board member Adrian Douglas has studied the morning and afternoon "fixing" of the gold price by the major London trading houses and concludes that it is just as much a price-suppression mechanism as the London Gold Pool of the 1960s admittedly was. "The more gold rises overnight in essentially Asian markets," Douglas writes, "the more it is sold down into the PM fix. This was exactly the modus operandum of the London Gold Pool but now it is being done covertly." Douglas, publisher of the Market Force Analysis letter, continues: "Such a consistent manipulative effort would necessarily involve entities with access to large amounts of gold; this implicates central banks, as they are the only entities with large hoards of gold, and furthermore they have a motive for suppressing the price of gold, which is to hide their mismanagement and debasement of their national currencies. Further, the five bullion banks that conduct the fix would have to be complicit because by definition they are responsible for determining the clearing price on the fix, so they must be aware of the impact on price of the selling activities of the entity or entities offering gold in such large quantities that it causes such price aberrations. As the central banks do not trade themselves, it is more than likely that some or all of the banks involved in the fix also act on behalf of central banks. What is irrefutable from this analysis is that the gold market is not 'fixed'; it is rigged." Douglas' analysis is titled "Gold Market Is Not 'Fixed,' It's Rigged" and you can find it at GATA's Internet site here: http://www.gata.org/files/AdrianDouglasGoldMarketRigged-08-14-2010.doc And at the Market Force Analysis Internet site here: https://marketforceanalysis.com/articles/latest_article_081310.html CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Gold Providing Safety During Market Downturn Posted: 15 Aug 2010 10:20 AM PDT Jeb Handwerger submits: Several weeks ago I wrote about the death cross phenomenon. The death cross occurs when the 50 day moving average crosses the 200 day moving average on the downside. These patterns, when combined with other technical indicators can predict major market downturns. You may have read articles from the bullish camp and from many technicians contending that the death cross is not a proven or a contrary indicator. I, however, assert that this warning indicator prevented many wise investors who heeded its signal from losing their life savings in 2008. The recent post-Fed free fall is confirming the death cross as this will be the third major failure of the 200 day moving average. When a technician starts seeing bearish signs, it is important to look for subtle clues in chart patterns. In this case the clue was the bearish rising wedge: It is a rally that trades up on decreasing volume. This bearish rising wedge took place concurrently with the right shoulder formation of a head and shoulders pattern. This breakdown coupled with bearish price volume action confirms that selling pressure far exceeds buying. When all these signals happen at the same time, you can expect a rapid downturn to follow. This correction is putting pressure on the 200 day moving average slope. If that moving average begins to slope down, it becomes a heavy area of resistance and will confirm the death cross from early July. The odds of a long term downtrend are becoming highly probable. These signals could possibly indicate the start of a twelve to eighteen month down cycle. | ||||

| Is Vanguard Blogger John Ameriks Right That ‘It’s Too Late for Gold’? Posted: 15 Aug 2010 10:20 AM PDT Writing for the Vanguard Blog, John Ameriks offers these thoughts about how the world’s smartest investors are foolishly piling into gold and how some of the richest people in the world are deluding themselves if they think the metal will help preserve their wealth. We’ve been hearing a lot about gold over the last few months, related to concerns about inflation, the creditworthiness of various governments, and fallout from the financial crisis—all against the backdrop of what is the most significant increase in inflation-adjusted gold prices since the early 1980s. | ||||

| Inflation Scorecard: Gold Widens Its Edge Over European Currencies Posted: 15 Aug 2010 10:20 AM PDT Hard Assets Investor submits: By Brad Zigler Real-time Monetary Inflation (last 12 months): -1.3% Gold continued to rally against Continental currencies this week but lost 0.3% against the Japanese yen. Bullion rose 2.0% in euros, 1.7% in sterling and 1.3% in Swiss francs. | ||||

| Stocks Decline on Economic Data; Inflation Accelerated Posted: 15 Aug 2010 10:19 AM PDT By Stephanie Borise and Stephen Kirkland Aug. 13 (Bloomberg) — U.S. stocks fell for a fourth day, The S&P 500 retreated 0.4 percent to 1,079.25 at 4 p.m. New The decline in the sales data was tempered by a consumer "We in the market are coming to the realization, and we're Economic Reports Almost $2 trillion has been wiped from the value of global The U.S. consumer-price index increased 0.3 percent, the Ten-year note yields dropped 5 basis points, or 0.05 Retailers Decline Retailers fell the most among 24 industries in the S&P 500, The Dollar Index headed for a five-day gain that would The Markit CDX North America Investment Grade Index, which European Bonds The yield on the 10-year German bund fell three basis The premium investors demand to hold Greek 10-year bonds Spanish banks borrowed a record 130.2 billion euros ($167.2 The Thomson Reuters/Jefferies CRB Index of commodities has |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment