Gold World News Flash |

- Owning Gold When an Ounce Will Buy the Dow

- Daily Dispatch: If Deflation Wins, What Will Gold Stocks Do?

- Peak Gold? Maybe So

- China Crash “Looming” While India Jewelry Zooming

- Gold

- Gold's Gravy Train Technicals

- Hourly Action In Gold From Trader Dan

- In The News Today

- Why Gold Stocks are Certain to Go Higher

- How To Read The REAL GDP Chart

- Grandich Client Update – Timmins Gold

- A New Trend in 2010 is the Movement Toward Fully Allocated Physical Gold: UBS

- Excellent Article on Gold and Silver

- Idiots On Parade In DC

- Things

- Will the Gold Market Shift To the East?

- Commercial Collapse To Take Hundreds Of Banks Down

- What Will the World Look Like in 100 Years?

- De-risking Australia

- Gold Seeker Closing Report: Gold and Silver End Slightly Higher

- The Ideological Subversion of the Retail Investor Towards Monetary Enslavement

- Great Sentiment Analysis from Steve Saville…

- Another Lower High in Gold?

- Tuesday ETF Roundup: XLY Flops, BWX Jumps

- Seven Faces of “The Peril”?

- Most Overbought ETFs

- The Lowdown On The Euro's Relation To The Dollar

- Gold Daily Chart; Silver Daily Chart; US Dollar Daily Chart;

- Son of Subprime

- Peak Gold? Maybe So

- When Good Falling Prices Go Bad

- Hiccups? Not Bubbles? How About Now?

- The Gold Price Needs to Break Through $1,190 and Silver Through 1860c Before it Will Run

- Mexicana Airlines Files For Bankruptcy

- Obama Threatens Forex; Says Goodbye to OTC Gold Trading

- GMI Describes "The Future Recession In An Ongoing Depression" In This Must Read Report

- TUESDAY Market Excerpts

- US Treasury yields fall to record low on Fed's 'QE lite' plan

- Guest Post: Candy From Strangers, Or Who Is Buyng All Those Treasuries?

- All 96 Cent Currencies go to a Dollar

- How China is really buying gold

| Owning Gold When an Ounce Will Buy the Dow Posted: 03 Aug 2010 06:02 PM PDT |

| Daily Dispatch: If Deflation Wins, What Will Gold Stocks Do? Posted: 03 Aug 2010 05:50 PM PDT August 03, 2010 | www.CaseyResearch.com If Deflation Wins, What Will Gold Stocks Do? Dear Reader, I have three excellent articles from my esteemed colleagues to share with you today, so I’ll be taking a back seat in today’s missive after a brief anecdote. On the way home from the office last night, I stopped at a little convenience store that I frequent to buy some milk, a sandwich, and a bottle of a local craft beer I’m quite fond of. After tallying up my three items, the clerk said to me, “That will be $8,000, sir.” With hardly a breath in between, he then said, only half-joking, “Sorry, I’m just practicing for a few years down the road when those items will be $8,000,” adding, “probably much sooner than anybody thinks.” I was shocked, to say the least. And while the inflation vs. deflation debate rages on among academics and professionals alike, it is certa... |

| Posted: 03 Aug 2010 05:50 PM PDT It was just a few years ago that the world was realizing that Hubbert's Peak, a forecast set some decades prior, was proving to be incredibly true with oil. While no one expects that oil will ever disappear in its entirety, we know that at the rate it is used, cheap oil may be gone forever. Will gold have a similar fate? Well, one industry insider believes that may be the case. Peak Gold In a recent interview with Reuters, Peter Munk, chairman of Barrick Gold, said that he believed the new wave of growth for mining firms isn't in single metal mines. Gone are the days that a mining company could buy acreages of land to find just one valuable metal. Instead, companies are shifting to mixed metal operations due to the fact that the purest lands are now used up, and companies are forced to dig deeper and extract lessened amounts of metals to sustain profits. In An Ideal World Mining companies would greatly prefer to dig for a single metal at a time. One met... |

| China Crash “Looming” While India Jewelry Zooming Posted: 03 Aug 2010 05:50 PM PDT China's extreme economic growth rates were met by both cheerleaders and detractors, many of whom were afraid that the real estate expansion was just another repeat of the US growth from 2002-2007. One of the key elements of the Chinese economic situation is its impact on precious metals, with many analysts stretching the news to say that a Chinese slowdown is bad for metals. But how? The greater impact on metals comes from India. Indian Jewelry Demand India remains as one of the leading buyers of foreign gold and silver for use in its jewelry operations. The key ingredient to the demand, however, is largely dependent on natural factors, not on economic factors. The annual monsoons are important piece of the Indian economy. Weak rains mean poor farm business, while strong rains from the wild winds bring economic prosperity. This year, India hit the jackpot, and silver demand in the second half and later looks to be better than ever. Traders now ex... |

| Posted: 03 Aug 2010 05:50 PM PDT courtesy of DailyFX.com August 03, 2010 08:06 AM 240 Minute Bars Prepared by Jamie Saettele Gold has topped. Please see the latest special report for details. Gold is making its way lower in an impulsive fashion. The short term count has changed slightly. It seems as though the first 5 wave decline ended following a terminal thrust from a triangle. Expectations are for strength towards 1208/1220 before gold rolls over and plunges in a larger 3rd wave. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Monday evenings), technical analysis of currency crosseson Wednesday and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Posted: 03 Aug 2010 05:49 PM PDT Stewart Thomson email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] Aug 3, 2010 1. An open invitation. There's a number of reasons I work from a La-Z-Boy recliner chair, with my laptop going to a 6 ft wide projection screen. Here's one of them: Jobs Report 2. Notice that I've highlighted the date of August 6th in yellow. That date is 3 days away, and together with the comex gold options expiry/rollover it forms the double feature gold movie, starring the banksters working to separate the world's hedge funds and retail investors from their gold, with a terror plot that rivals any of the best Hollywood horror movie scripts. 3. Not every Options Period or Jobs Report plays out perfectly according to script, but most do. Gold is sold by investors who don't understand the show, investors who are not prepared, investors who are taken by surprise, and sell out believing even greater horrors are coming to their holdings valued in paper money. 4. In actual... |

| Hourly Action In Gold From Trader Dan Posted: 03 Aug 2010 05:49 PM PDT |

| Posted: 03 Aug 2010 05:49 PM PDT View the original post at jsmineset.com... August 03, 2010 11:30 AM Thought For The Day Now what do you think of the recent reaction in gold? It was a play to get yours, and to bring home the gold option at zero value. You can switch options and not let them expire with the same ease as switching metals contracts, but few do it. They simply sail into option expiration day with whatever they have. Half way to option expiration consider switching to more forward option expiration dates at the same or greater price. Bernanke: Long way to go for recovery. "We have a considerable way to go to achieve full recovery in our economy," Bernanke said yesterday, "and many Americans are still grappling with unemployment, foreclosure, and lost savings." Constraints faced by budget-strained state and municipal governments are also hindering the recovery. Jim Sinclair’s Commentary All things end. Treasuries Lack Safety, Liquidity for China, Yu Yongding Says By Bloomberg ... |

| Why Gold Stocks are Certain to Go Higher Posted: 03 Aug 2010 05:49 PM PDT by Jordan Roy-Byrne, CMT Certain may not be the best word to use in a post-bubble world. Is anything truly certain? Ok maybe not. If you don't like certain then lets replace it with “highly probable.” So why is it highly probable that gold stocks will go higher? Let me digress for a moment. Making big money isn't all that difficult. It doesn't involve making numerous profitable trades or correct investment decisions. Simply put, one needs to find the long-term trends and ride them from their infancy to their apex. Currently, there are three long-term secular trends that still have a ways to go. In future commentaries we will discss the other two trends. So why are precious metals shares bound to go much higher? Firstly, the trend is firmly in place and no one can argue that we are not in a secular bull market. Now take a look at just a few charts. These charts illustrate that the vast majority remains uninvested in precious metals stocks. This mea... |

| How To Read The REAL GDP Chart Posted: 03 Aug 2010 05:49 PM PDT Market Ticker - Karl Denninger View original article August 03, 2010 10:44 AM Since I keep getting asked, I have put the revisions to the GDP report and the original on one graph. Note that the "non-revised" numbers will stop updating after this particular series, obviously. Also note that the 2nd Quarter numbers will be revised. Here's the chart: Ok, let's go through the math. First, note that the Treasury Data (blue line) is not revised. That's because it never really is. It is what it is, so to speak. This, incidentally, is the total outstanding Federal Borrowings, and thus "captures" the theft from the Social Security and Medicare accounts - something the government's "deficit" pronouncements do not. The source of this data is the Treasury's own web site - "Debt to the Penny", which they conveniently provide on a daily basis. The green lines are the nominal reported GDP. The annualized change is computed - the raw numbers are nominal ... |

| Grandich Client Update – Timmins Gold Posted: 03 Aug 2010 05:49 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 03, 2010 10:28 AM I spoke about a long base-building process for Timmins Gold and a technical belief it was about to break out. Barring a significant retreat in the gold price or unforeseen bad news on the corporate side of things, TMM should see former resistance now become support. A re-rating of the stock has been underway and higher valuations are possible as more people pay up for an emerging producer with strong exploration potential. Some consolidation after a break out would be healthy. [url]http://www.grandich.com/[/url] grandich.com... |

| A New Trend in 2010 is the Movement Toward Fully Allocated Physical Gold: UBS Posted: 03 Aug 2010 05:49 PM PDT The gold price spent most of Far East and early London trading basically unchanged from Friday's closing price in New York. But, at 10:00 a.m. sharp in London, a seller showed up... and three hours later... at 8:00 a.m. in New York, the gold price hit its low of the day around $1,174 spot. Once Comex trading began, the gold price rose quickly... and within an hour it was up to $1,190 spot, with it's apparent high of the day [$1,191.60 spot] coming at 10:20 a.m. Eastern... which may have been a later-than-normal London p.m. gold fix. Once that high was in, the gold price got sold right back down to unchanged on the day... and from there, the gold price flat-lined into the close of electronic trading in New York. Volume was pretty light. Silver's price pattern was very similar... with the European high [around $18.20 spot] coming around 8:30 a.m. in early London trading... which was up about 23 cents from its Friday close. From there, silver got ... |

| Excellent Article on Gold and Silver Posted: 03 Aug 2010 05:49 PM PDT |

| Posted: 03 Aug 2010 05:49 PM PDT Market Ticker - Karl Denninger View original article August 03, 2010 05:29 AM And here I thought I'd get to ignore this.... [INDENT]Aug. 3 (Bloomberg) -- Economists Alan Blinder and Mark Zandi say fiscal and monetary stimulus measures taken by the U.S. government staved off a depression. Stanford University economist John B. Taylor disagrees. "The totality of the response was impressive and ultimately successful," Zandi, chief economist at New York- based Moody's Analytics Inc., said yesterday in a radio interview on "Bloomberg Surveillance" with Tom Keene. "It brought an end to the recession much more quickly than otherwise would have been the case." [/INDENT]Like hell. I had this report last week, as it was being circulated in Congressional Offices. My read of it produced guffaws of laughter, as the central premise - that one can drink oneself sober - is just continuation of the general Keynes BS that underlies general fraudulent bubble economics. As such I was... |

| Posted: 03 Aug 2010 05:49 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 03, 2010 07:28 AM [LIST] [*]Yeah Tokyo Rose, no demand-lol [*]America’s future? [*]Job creation myth [*]Ho Yo Silver [*]Til debt due us part [/LIST] [url]http://www.grandich.com/[/url] grandich.com... |

| Will the Gold Market Shift To the East? Posted: 03 Aug 2010 05:44 PM PDT |

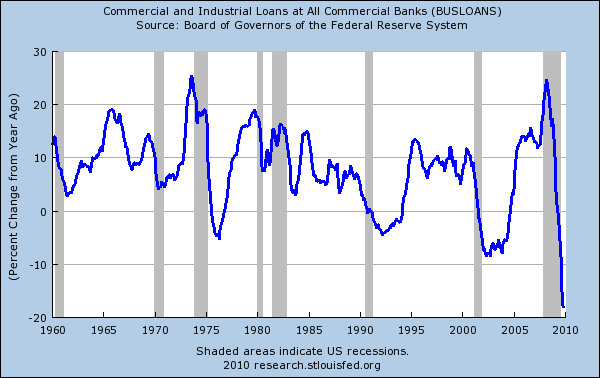

| Commercial Collapse To Take Hundreds Of Banks Down Posted: 03 Aug 2010 05:26 PM PDT The commercial real estate disaster is sinking banks on a weekly basis. Talk of a V-shape recovery is now largely a moot point since we are past the point of a quick and strong recovery. The question now revolves around what we are going to face for the next few years. Commercial real estate really is a harbinger of what went wrong in the last decade. Banks and builders hungry for massive profits overestimated the demand for Starbucks and Macys locations around the country. After all, you actually need money to spend and many average Americans are struggling just to pay their monthly bills. The only way commercial real estate (CRE) was going to do well is if we had a booming population of young and wealthier professionals with more disposable income. Yet that did not happen. Even though the claim of building and bottom talk is now out there in the open, banks that actually lend the money for these projects have different ideas: Lending for commercial loans has collapsed. Even though banks would like you to believe that all is healthy and strong they have a front row seat to the carnage in the CRE market. And with CRE locations you get an actual real feel of the economic problems we are facing. Many Americans have pulled back on their spending and without spending many places simply cannot move forward. Banks are also taking scissors to American credit cards and access to other people's money is slowly going away. The CRE market at one point was valued at $6.5 trillion. Today it is closer to $3 to $3.5 trillion. The loan amount at the peak was roughly $3.5 trillion so you had a nice equity cushion. Today, the balance is nearly the same but the value of the collateral has collapsed: |

| What Will the World Look Like in 100 Years? Posted: 03 Aug 2010 05:09 PM PDT China is in serious trouble. That is the conclusion of Dr. George Friedman, president of STRATFOR, a geopolitical strategy consulting firm. While it has had a great 30 year run, that performance will not extrapolate 30 years into the future, as many China (FXI) bulls believe. Of the Middle Kingdom’s 1.3 billion citizens, only 60 million earn a $20,000 middle class annual income, while 440 million make $3-$6/day and 600 million take in under $3/day. The people’s liberation army, which is manned predominantly by the under classes from the hinterlands, could move the country away from its modernizing trend at anytime, especially if a recession leads to starvation in the countryside. The problem is that the Chinese are investing their massive reserves anywhere but in China, which they fear may lead to an overheating of the economy. Are they aware if risks invisible to foreign investors? The future direction of the country may be decided by its next election, the first open one in history. Dr. Friedman much prefers investing in Japan (EWJ), which has the benefit of a stable society, immense industrial plant, advanced technology, and the largest military force in Asia. Demographic challenges can be met by offshoring labor intensive industries in China, which they have been doing aggressively for three decades. Japan is a classic case of a nation with strong fundamentals, but lousy management which can be solved with a simple change of government. The largest threat to the nascent global economic recovery is a breakdown of back channel negotiations between the US and Iran, which could lead to a blocking of the Straits of Hormuz. This would cause oil to spike to $500 a barrel, trigger a global depression, lead to widespread sovereign debt defaults, and send Western governments toppling. That’s why neither the US or Israel will not bomb the rogue nation’s nuclear program, which in any case can only produce impractical, unusable weapons. The greatest threat to US power would be the coalescing of a pan Middle Eastern super power. US policies that triggered a Sunni/Shiite civil war can be viewed as a success in that they prevent this from happening. The war’s trillion dollar price tag is a bargain as long as we can still buy gas at home for $3/gallon. George likes Poland (EPOL), which he describes as the South Korea of Europe. It will greatly benefit from closer relations between Russia and Germany (click here for my own recent Poland piece at http://www.madhedgefundtrader.com/june-10-2010.html ). Turkey (TUR) is another buy, with a rising middle class, an economy that is not dependent on exports, and a robust banking system (click here for “Turkey is on the Menu” at http://www.madhedgefundtrader.com/july-23-2010.html ). Russia (RSX) is moving towards a stable economic platform built around its resource riches, moving on from the kleptocracy of the nineties. It is creating integrated energy majors which are establishing a global footprint and present a potent oil weapon. Monopolies in wood, grain, and diamonds are moving in the same direction. Dr. Friedman started out life as a refugee from Hungary, his parents rowing him across the Danube in 1949 under glaring searchlights. He obtained his BA from the City College of New York and his PhD in government from Cornell. He then spent two decades teaching political science at Dickinson College in Pennsylvania. Dr. Friedman has recently published a New York Times best seller entitled The Next 100 Years: A Forecast for the 21st Century. In the book Friedman claims the current Islamic assault on the West is failing, and will cease to be a factor on the international scene within the decade. Russia will take another run at becoming a superpower, which will fail by 2020, and leave the country even more diminished than it is today. When standards of living in China level off or reverse in the 2020’s, chronic resource shortages could cause the Middle Kingdom to implode and break up. China is far more fragile than we realize. Japan may deal with stagnant economic and population growth the same way it did during the 1930’s by invading China as early as 2030. Japan may also take a bite out of indefensible Siberia when it remilitarizes. Poland, a unified Korea (click here for “The Economic Miracle that is South Korea” at http://www.madhedgefundtrader.com/april_29__2010.html ) , and Turkey will develop into regional military and economic powers in their own right. Friedman then describes a theoretical war by a coalition of Turkey and Japan against the US in 2050, resulting in an American victory, which leads to a new US golden age in the second half of the century. Scramjet engines make possible the development of unmanned hypersonic aircraft which can launch a precision attack any place on the planet in 30 minutes. Warfare will move into space and be fought from “battle stars,” which will also become major energy sources for earth. Friedman kind of lost me when he predicted that the next Pearl Harbor could come from Japan, but not from the sea going aircraft carriers of old, but from caves on the moon. The big challenge towards the end of the 21st century will be the emergence of a Hispanic nation in the Southwest, which is culturally isolating itself by not integrating with the rest of the country. This could lead to the secession of several states, or a new war with Mexico, which by then, will develop into a major power in its own right. I think to avoid a second Civil War and offload some huge state deficits, Washington just might say “¡Adios!” You can argue that someone making many of these predictions is looney. But if you had anticipated in 1970 that China would become America’s largest trading partner, the Soviet Union would collapse, Eastern Europe would join NATO, the US would enter a second Vietnam War in Afghanistan, and oil would hit $150 a barrel, you would have been considered equally nutty. I know because I was one of those people. It does seem that long term forecasters have terrible track records. All in all, the book is a great armchair exercise in global realpolitics, and an entertaining contemplation of the impossible. More than once, I heard myself thinking “He’s got to be kidding.” To listen to my interview with George Friedman on Hedge Fund Radio in full, please go to my radio archives by clicking here at http://www.madhedgefundtrader.com/hedge-fund-radio-archives , and click on the “PLAY” arrow. Or you can download it to your IPod or your pc for free. Where would Dr. Friedman focus his investments now? In the US, which with a 25% share of world GDP and the most powerful military in history is in an ideal position to dominate the global economy for another century.

|

| Posted: 03 Aug 2010 04:36 PM PDT In today's Daily Reckoning take up the question of whether Australian stocks are undervalued and whether price-to-earnings ratios are useful at all when you're analysing cyclical stocks. There is also the little issue of whether Aussie stocks could be "de-risked" by the result of the Federal election and whether that is a tradeable event. A note on gold first, though. "China has moved to liberalise its gold market further, increasing the number of banks allowed to trade bullion internationally and announcing measures that will encourage development of gold-linked investment products," reports the FT's Leslie Hook in Beijing. Chinese investors bought 73 tonnes of gold last year, according to the FT. That was up from 18 the year before. According to our maths, that's a 315% increase in demand from retail Chinese investors. Maybe this is the domestic demand being unleashed that everyone's been waiting for! More seirously, the gradual liberalisation of capital rules in China has unpredictable consequences. China is the world's largest producer of gold and the second-largest consumer behind India. But keep in mind that as recently as 2008, China's savings-rate-to-GDP ratio was nearly 52%, according to People's Bank Monetary Policy Committee Member Fan Gang. It is believed/hoped for that this "glut" of Chinese savings is both responsible for economic imbalances in the world and also the future salvation of global growth. But would it surprise you if middle class investors in China choose to store some of their wealth in bullion instead of plasma televisions? That is, they might, if given the choice, turn paper into bullion instead of turning paper into plasma. It just depends on the cultural attitude toward risk, toward affluence, and, of course, toward gold. Meanwhile, gold futures got up off the matt in trading at the New York Mercantile Exchange and traded at $1,185.20. Cop that gold bears. And even while the bullion price is consolidating, it would not surprise us to see a rally soon in major gold producers. But that is a topic we're saving for a weekly update to Australian Wealth Gameplan subscribers. Here in this free space we would draw your attention to the crashing bond yields in the United States and Japan and the corollary to those events; the resumption of hot money risk trades that could drive up commodity currencies, commodity futures, and resource equities. It is madness. But it's worth a look. First up is the fact that two-year Treasury yields in the U.S. again fell to record lows in New York trading. Yields fell to just 51 basis points during trading before settling at 54 basis points - or just about half a percent in interest for loaning money to the American government for two years. In Japan, the yield on the 10-year government bond fell below 1% for the first time since 2003, or about the same time the huge liquidity driven rally in all asset classes kicked off last time. What gives? Well, traders may be anticipating more Quantitative Easing from the Fed and are now simply getting ahead of the game by buying Treasuries before the Fed does. The idea for more QE was floated in a paper in late July by St. Louis Fed President James Bullard. The Wall Street Journal is also reporting that the Fed may invest profits from its portfolio of maturing mortgage securities right back into the Treasury bonds. What do we have here then? On the one hand you seem to have investors and the Fed conceding that growth in the developed Western industrial economies (including Japan) is sub-par. They're ditching equities and favouring short-term sovereign debt as the way to beat deflation in other asset markets. On the other hand, we know that short-term rates in Japan and the United States are just the sort of thing to set off speculators looking to borrow cheap and seek risk and high yield. If you can't make anything on bank interest, you go off in search of junk. And oh by the way, did you know that wheat futures are up 62% in the last month? Hmm. This led us to ask Slipstream Trader Murray Dawes if his charts were showing him evidence that hot money flows were boosting commodity futures. He said it sure looked like it. And from there the conversation progressed to whether this evidence, along with the Federal election here in Australia, made a case for being a very short-term bull on Australian resource shares. Usually elections are not tradeable events, unless there is a clear policy proposal that will hurt or help a specific industry. In Australia, for example, you could argue that a Liberal victory at the polls will hurt renewable energy stocks (presuming the carbon tax dies a richly deserved death). That policy change might hurt renewable energy stocks that suck off the government development teat. According to the ALTEXGreen Renewable Energy Index, renewable energy shares were up 33.3% last year but are down 14.5% this year. This is probably a case of "buy the rumour, sell the news." That is, the markets may have already discounted a Liberal win at the polls. Then again, the scrapping of the Mineral Resource Rent Tax (MRRT) altogether could "de-risk" Australia enough in the eyes of foreign speculators that the big resource shares (and some of the little ones) get a boost. But a trading strategy based on the outcome of a political contest is probably a losing trading strategy. Your best bet is to look at each business on a case-by-case basis and evaluate it (or value it) on its merits. Dr. Alex Cowie is busy doing so out at the Diggers and Dealers show in Kalgoorlie and this morning we saw the most recent issue of the Australian Small Cap Investigator as it gets ready to go out the door this afternoon after the market closes. Besides, it doesn't make much sense to use metrics on the overall market to time your entry and exit positions in individual shares, by our reckoning. Take price to earnings ratios. According to an article by Stephen Shore in yesterday's Australian Financial Review, the forward P/E ratio for the Aussie market is around 11.5 right now. That's well below its average of about 15 times forward earnings from 1990-2010. In an era of low inflation and high GDP growth, investors are prepared to pay more for stocks because earnings grow much faster than inflation. And expectations during credit-fuelled growth are generally for more growth. But in a credit depression, growth expectations shift. So does the current lower-than-average P/E tell you it's time to buy or sell Aussie stocks? Not so fast! "A lower than average P/E," writes Shore, "is usually a sign investors are worried that companies' earnings will fall short of forecasts. Another possibility is that the relative economic stability enjoyed in recent decades has come to an end, and the market has undergone a structural shift to a new normal of a lower P/E ratio." This "new normal" sounds a lot like the "new normal" PIMCO bond manager Bill Gross has written about. In that "new normal," investors prepare for lower economic growth and take fewer risks. But if fortune favours the bold, should you think about buying the market, or at least the best stocks in the market, anyway? "Some investors are concerned Australia could be entering a situation similar to that of the 1970s, where shorter, sharper cycles for earnings caused the market to trade at a lower P/E. Australia trades at a discount to Canada and the US, despite no obvious signs that the risk to future earnings in Australia are any higher," Shore writes. There is, of course, an obvious risk to future earnings in Australia in the form of the MRRT. Thus, the scrapping of the MRRT might "de-risk" the market enough to lead to a snap back in forward P/E ratios and a nifty and nimble little trade. But that is not our game. That is, forward earnings estimates are mostly rubbish in a market dominated by resource stocks. There is too much cyclicality and volatility for companies in capital intensive extractive industries to give you realistic "visibility" about what commodity prices are going to be five years out, and thus what earnings will be. Costs routinely explode to the high side at the peak of the commodity cycle. Thus, the overall P/E on the Aussie market is pretty useless in guiding your individual decisions on resource shares. Where you go from there is a matter of preference. Of course you have to construct valuations for prospective investments, otherwise you're just gambling. Our guys establish valuations for their recommendations all the time here. But they are general guides with giant concessions to a huge array of variables (known and unknown). The only upside to investing with so much uncertainty about a particular company or a commodity is that you can make a lot of money if you get it right. That leads us, finally to a point we made earlier in the week that we need to clarify. The issue is whether any of the editors at Port Phillip Publishing directly own or trade the shares they recommend to readers. On Monday we wrote, "For the record, ASI editor Kris Sayce sold out of the Linc position in February of this year. When he sold, the stock was up 122% from the original share price. Kris managed to bank gains on the stock, even though the business itself has yet to generate cash-flow in the way your editor described in the original story. That's the world of speculation, where you take your gains when you have them" Kris didn't sell out of the Linc position himself because he doesn't own any Linc shares. In fact, no one employed by Port Phillip Publishing can trade in the shares recommended by the editors. We've voluntarily adopted this policy so that we can avoid the appearance that we're profiting by recommending shares we also own. When we wrote that "Kris managed to bank gains" we meant that readers of the Australian Small Cap Investigator could have banked gains had they bought and sold the shares following Kris' recommendations. To be honest, it's not the most popular policy among staff, nor is it legally required. We could own the shares we write about as long as we disclosed it. And there's an understandable argument that a share recommendation has more credibility if the editor puts his money where his mouth is. So why not allow it? It keeps things simple and direct. For one, the buy and sell recommendations made by editors are not compromised by any personal emotional or financial interest in the share. It keeps them objective. More importantly, it keeps the business relationship clear: our editors are paid full time (and well) to research and write the kind of stories that they probably wouldn't be allowed to write anywhere else. Their compensation, and really the whole firm's viability, hinges on whether you find the work we do useful and profitable. We don't make management fees because we don't manage money. And we don't profit by trading the shares we recommend. We only make money if readers find our ideas intriguing enough to subscribe to a service and useful enough to continue subscribing. Clean, transparent, and without any hidden incentives. And if that is not good enough for you, it's hard to imagine what is! Dan Denning |

| Gold Seeker Closing Report: Gold and Silver End Slightly Higher Posted: 03 Aug 2010 04:00 PM PDT Gold fell slightly to as low as $1179.30 in Asia, but it then rose throughout most of trade in London and New York and ended near its late morning high of $1190.40 with a gain of 0.27%. Silver fell to $18.26 in Asia and rose to as high as $18.583 in New York before it fell back off in the last couple of hours of trade, but it still ended with a gain of 0.33%. |

| The Ideological Subversion of the Retail Investor Towards Monetary Enslavement Posted: 03 Aug 2010 03:07 PM PDT Below is a 3-part video series in which I discuss how bankers have used the concept of ideological subversion to brainwash hundreds of millions of retail investors into accepting harmful propaganda that allows them to build their bottom line at the expense of the investors while simultaneously convincing investors to ignore alternate behavior that would be beneficial to their financial welfare. Ex-KGB agent Yuri Bezmenov explained the process of ideological subversion as a four stage process utilized by the Soviet Union to brainwash its citizens during the cold war: (1) Demoralization; (2) Destabilization; (3) Crisis; and (4) Normalization.

The below 3 videos may not find me in my most eloquent state as they are unscripted, free flow productions that involve nothing more than the scribbling of few notes in pre-production. However, I hope to simply convey the processes by which bankers have used psychological warfare against the masses to bludgeon billions of people into a state of learned helplessness. I have slightly modified the time frames of the four above stages explained by Bezmenov to fit the model that bankers have cleverly executed against the people over the past several decades. The process of ideological subversion ensures that billions of people are unable to process facts, change their behavior and take sensible tactics to defend the welfare of their families despite being presented with an abundance of evidence that challenges and refutes their current harmful belief system about money and financial markets.

The inability of the masses today to reach sensible conclusions even in the face of abundant evidence is the reason why we still have ludicrous debates in the media today about signs of economic recovery in the US and Europe despite an abundance of evidence that contradicts such a conclusion. The inability of the masses to reach sensible conclusions when struck over the head with cold hard facts is the reason why today we still have ludicrous debates regarding the purchasing power stability of gold versus fiat currencies. The inability of the masses to reach sensible conclusions today is why commercial investment firms can still sell the masses the kool-aid of strong fundamentals as the number one reason behind rising stock markets when creative accounting 101 is the primary driver behind improved earnings statements for most global banks worldwide. The inability of the masses to formulate logical opinions is the reason why hundreds of millions of investors today still subscribe to one of the worst investment strategies ever – diversification. And a deliberate process called ideological subversion executed by bankers in the open for all to see can explain all of the aforementioned aberrant behavior.

Perhaps a brief explanation of how ideological subversion is achieved, as simple as these videos are, can awaken the sleeping zombies from their century-long, banker-induced slumber and help the masses in taking their first step towards awakening to the truth of our global monetary system and the inherent fraud in financial markets.

"The Ideological Subversion of the Retail Investor, Part I"

"The Ideological Subversion of the Retail Investor, Part II"

"The Ideological Subversion of the Retail Investor, Part III"

|

| Great Sentiment Analysis from Steve Saville… Posted: 03 Aug 2010 02:47 PM PDT These days it is popular and conventional to be a contrarian. It seems that almost everyone tries to figure out what everyone else is thinking/doing so that they can then do the opposite. Right now, for example, it seems that almost everyone thinks that almost everyone else is bullish on gold, and, therefore, that it's a good idea to lean the other way. Of course, if the majority is either bearish or anticipating a major bull-market correction on the basis that too many people are bullish, then most market participants are actually NOT bullish. Despite the fact that gold is the only high-profile market to make a new all-time high over the past few months, objective indicators of sentiment suggest that the general level of gold-related optimism is relatively low. For example, the results of the latest Market Vane survey show that only about 60% of traders are bullish on gold. This bullish percentage is in the bottom quartile of the three-year range. For another example, the premiums to net asset value for Central Gold Trust (GTU) and Central Fund of Canada (CEF) dropped to 2.9% and 4.8%, respectively, on Tuesday 27th July, which is near their lows of the past two years. Now, sentiment is just one piece of a large puzzle, so just because sentiment is not particularly bullish — contrary to the beliefs of many pseudo-contrarians — doesn't guarantee that the gold price won't drop to much lower levels over the months ahead. It simply means that sentiment is not a headwind for gold at this time. |

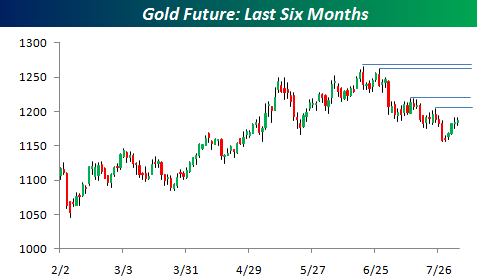

| Posted: 03 Aug 2010 02:42 PM PDT  Hickey and Walters (Bespoke) submit: Hickey and Walters (Bespoke) submit: Ever since stocks made a short-term low back in late June/early July, gold hasn't been able to get out of its own way. After several months of higher highs and higher lows, the commodity has now been making a series of lower highs and lower lows.

Complete Story » |

| Tuesday ETF Roundup: XLY Flops, BWX Jumps Posted: 03 Aug 2010 02:33 PM PDT Michael Johnston submits: By Jared Cummans Stock markets pulled back from their strong gains yesterday to finish the day in the red. Although investors were hopeful that a strong start to August would push equities forward, their expectations were halted today with the Dow losing 38 points, the Nasdaq dropping 11.8 points, and the S&P 500 falling 5.4 points. Though equity markets felt the pinch, oil gained 1.3% and gold was 0.2% higher on the day as investors sought the relative safety of the precious metals market. The fall in equities was attributed to disappointing earnings from Procter & Gamble and Dow Chemical which both reports weak profits which fell short of earnings estimates. Meanwhile, consumer spending for July showed little change from June signaling to many that the recovery was continuing to slow down. As markets slid, many investors piled into fixed income securities which helped to send interest rates sharply lower and bond prices surging yet again. Complete Story » |

| Posted: 03 Aug 2010 02:29 PM PDT Chris Ciovacco of Ciovacco Capital Management sent me this interesting comment:

You can download an executive summary of The Seven Faces of "The Peril" by clicking here. I will add on the Chris Ciovacco's comments, focusing on what more QE will mean for pensions. The country's top 100 companies made a record 17.5 billion pounds in pension contributions last year, some paying more into their schemes than to shareholders to tackle deficits, consultant Lane Clark & Peacock (LCP) said. FTSE 100 firms increased contributions to defined benefit (DB) schemes by 50 percent to help plug shortfalls due to the market turmoil that hit pension assets, LCP said in a study published on Wednesday. "By some distance, (this is) the highest contribution amount that we have seen in the past six years," said Bob Scott, partner at LCP and the report's main author. Higher contributions as well as rallying markets helped cut the corporate pension deficit to 51 billion pounds ($78.88 billion) at the end of June 2010 from 96 billion last year. Payments last year to defined contribution (DC) schemes, the cheaper option used as an alternative to DB, nearly doubled compared to the last five years to more than 21 billion pounds. The largest reported contribution was by Royal Dutch Shell at 3.3 billion pounds. BAE Systems, British Airways, Invensys, Lloyds Banking Group , Morrisons, Rolls-Royce, Serco and Wolseley paid more into their schemes than they did to their shareholders in 2009. LCP said that one-third of the sample, or 32 companies, failed to make reference to pension risk or did not report taking any steps to reduce it in their 2009 accounts. In 2009 pension schemes continued to budget for increasing life expectancy by increasing their members' longevity estimates, which LCP said added 9 billion pounds to FTSE 100 balance sheet liabilities. "These adjustments reflect as well pressure from the pensions regulator and auditors for assumptions to be more prudent," Scott said. The extra cost of longer-living pensioners could be partly offset following the government's announcement that inflation increases to pensions will be switched in future to the consumer price index from the current retail price index. If the switch had already taken place the pension deficit would have been cut by 30 billion pounds, LCP said. And public sector pensions are faring worse. The Telegraph reports that Public sector workers need to pay more towards pensions, experts warn:

In the US, the WSJ reports that lawmakers in at least 10 states have voted this year to require many new government employees to work longer before retiring with a full pension, or have increased penalties for early retirement. A similar proposal is pending in California. Mississippi, already among the states requiring more years of service for a pension, is weighing the additional step of increasing its retirement age. In Canada, there is a big fight between public sector unions that want to keep the momentum on pension reform and the private sector which wants changes to the Canada Pension Plan to take a back seat. I am not convinced the Fed will engage in more QE. Just the perceived threat that they can come in at any moment and buy more bonds should scare the daylights out of speculators who are massively shorting Treasuries. Importantly, the Fed may be jawboning the market down to cap any potentially significant backup in yields. They will continue flooding the banking system with cash to reflate risk assets, in an attempt to introduce mild inflation in the economic system. |

| Posted: 03 Aug 2010 02:20 PM PDT  Hickey and Walters (Bespoke) submit: Hickey and Walters (Bespoke) submit: Of the 200 or so key ETFs that we track across all asset classes, the Spain ETF (EWP) is currently trading the farthest above its 50-day moving average. How quickly things have changed since June when Spain and the rest of Europe was plagued with sovereign debt worries. In fact, the nine ETFs trading the farthest above their 50-days are all related to European equities. And of the 30 most overbought ETFs shown, only one is related to US equities -- the Steel ETF (SLX). While things here have been hot, they've been even hotter elsewhere. click to enlarge Complete Story » |

| The Lowdown On The Euro's Relation To The Dollar Posted: 03 Aug 2010 01:53 PM PDT Dear Friends, I have received a fair number of emails asking me what is going on with the Euro in relation to the Dollar, especially considering the fact that a mere few weeks ago it was pronounced dead and the European monetary union with it. What appears to have happened is two-fold: First, those Euro zone areas that were causing the most trouble, Greece, Spain, Portugal, etc. seem to have been able to sell their bonds, alleviating fears of a sovereign debt meltdown (for now). We all know that a tremendous amount of behind-the-scenes machinations were occurring by the Central Banks and the monetary authorities to insure that the bond sales were not a dismal flop. The repercussions of such would have indeed been earth shattering to say the least. Secondly, and most importantly, were the comments coming from several US Federal Reserve officials, including Chairman Bernanke, who laid to rest any fears among the hedge fund, hot-money crowd, that the Fed would be tightening monetary policy in any form, fashion or shape anytime soon. Voila! That was the signal for hot money to pour back into the commodity sector as well as the equity markets. Basically, the Fed has given investors the green light to goose commodities and equities higher and to take the bonds higher as well. Please note the following chart of the CCI and observe how close it is to making an upside breach of a critical technical resistance level. In regular speak, this translates to a shift by market participants in favor of inflation and away from deflation. We could very well be on the cusp of a Federal Reserve-induced commodity buying binge once again as the Fed works feverishly to avoid deflation. They should be careful what they wish for. Lastly, the language coming from the Fed has essentially guaranteed low interest rates for the foreseeable future which totally takes the props out from underneath the US Dollar. That is why it is getting sold off. What investors are looking at is a global economy which is basically two-tiered. One tier is the West, particularly the US which remains mired in a sluggish growth environment saddled with an extreme level of government debt (Japan for all practical purposes should be included in this category). The other tier is the emerging markets of Asia and to a certain extent, portions of South America. Capital flows will move towards the latter and away from the former which removes an important floor of support beneath the Dollar. The Euro is gaining on the Dollar in more of an aversion to the low interest rate environment guaranteed by the Fed. The Dollar is extremely oversold and could pop higher almost any time but barring any further dire news out of the Eurozone, it is most likely that its rallies will be short-lived. Click chart to enlarge in PDF format |

| Gold Daily Chart; Silver Daily Chart; US Dollar Daily Chart; Posted: 03 Aug 2010 01:16 PM PDT |

| Posted: 03 Aug 2010 12:04 PM PDT In 2007, the writing was on the wall. The famous "perfect storm" had gathered above the US housing market, its eye hovering over subprime loans. As you know, the storm came...and it rained, and rained, and rained... Ultimately, it washed away trillions of dollars in investor wealth. Now in an entirely different sector - probably the last place you'd look - the clouds are turning black once again. Strip out the finer details, and you'll find the very same mechanics that brought the subprime market from boom to bust:

This crisis-yet-to-be is...municipal bonds Munis have been a long-standing pillar of stable return. Only bonds from sovereign governments and blue chip corporations have a better reputation for credit-worthiness than munis. So when a city or state sells bonds to build a new school, sewer or stadium, investors form a line around the block. In the history of the union, only one US state has ever defaulted on its debt (Arkansas 1934). A few cities here and there have also done so. In other words, munis have performed admirably over the years. But reputations, as this credit crisis has taught the world, no longer mean jack. Ask debt holders of "blue chip companies" like GM, or "sovereign" states like Greece. Investors are learning an old lesson the hard way: No asset class - not one in the history of the world - is a sure thing. Though vast and complicated, the root of American municipalities is like any business or household: Money goes in, money goes out. Done right, a municipality takes in more money than it pays out. Money comes in mostly from taxes and revenue streams such as utilities and tolls. Money goes out to finance municipal government payrolls and public works programs. Cities and states sell bonds when they either can't pay upfront for such needs. No big deal...at least, it wasn't a big deal until recently. In this era of high unemployment and shrinking economies, municipal revenues are hurting. Tax revenue tends to be lower with 15 million Americans out of work. Just the same, they use less power, drive through fewer tolls. Pay that parking ticket? I don't think so...not this year. Not surprisingly, municipalities are struggling to cut spending in line with lost revenue. But their biggest expense of all is untouchable - pension plans. California offers a telling example. A recent Stanford study concluded that the state pension fund program is underfunded by roughly $500 billion. The researchers urged Gov. Schwarzenegger to inject $360 billion into its public benefit systems - right now - to have an 80% chance of meeting 80% of obligations over the next 16 years. Facing a $20 billion state budget gap, what can he possibly do? It's precisely this pickle that undid Vallejo. The San Francisco suburb declared bankruptcy in 2008. Tax revenue had collapsed, a major shipyard closed and all of a sudden the city found itself paying 90% of its annual budget to retired public employee pensions. 90%! The problem, just like with subprime, is an irrational form of leverage. In essence, municipalities borrow current earnings of public employees in exchange for some of the most favorable retirement plans in the world. That borrowed money is invested aggressively, just like a private-sector employee would in his 401(k). Except if the fund loses money, which they all have over the last 10 years, pension funds don't adjust payouts. The social and political pressure to maintain the status quo - keeping our public employees comfortably retired - is just too strong. So municipalities kick the can down the road. New employees buy into the funds. Fund managers maintain their projections of endless 8% annual returns. Retirees keep taking out the funds they were promised...and no one pays the tab. And it's not just California. Orin Cramer, chairman of New Jersey's pension program, estimates a national funding gap around $2 trillion. The municipal bond market is roughly $2.7 trillion. If Cramer is on target, that's a total liability about the size of France and Britain's annual GDP - combined. Therefore, in yet another subprime redux, Wall Street has found a way to make the muni bond problem even worse. Like the mortgage market, the municipal bond market has morphed into its own new era of highflying finance, adjustable-rate loans and complex securities. For proof, read "Looting Main Street," a recent Matt Taibbi expose in Rolling Stone. How could a $250 million sewer project leave taxpayers on the hook for $5 billion? Easy - if you're a Wall Street bank and you engineer a "synthetic rate swap" deal. It brought Jefferson County, Alabama, to its knees: The county got the stability of a fixed rate, while paying Wall Street to assume the risk of the variable rates on its bonds. That's the synthetic part. The trouble lies in the rate swap. The deal only works if the two variable rates - the one you get from the bank, and the one you owe to bondholders - actually match. It's like gambling on the weather. If your bondholders are expecting you to pay an interest rate based on the average temperature in Alabama, you don't do a rate swap with a bank that gives you back a rate pegged to the temperature in Nome, Alaska. That's the "beauty" of modern lending. This deal, struck by JP Morgan, allows a cash-strapped county to upgrade to a world-class sewage system it could otherwise never afford. The extra costs - the fees, adjustable rates and superfluous debts... That's a problem for the next generation. Just like the state pension fund. And as Taibbi also observed, banks pull in millions upon millions in fees for structuring these loans and swaps. Bonuses live and die by such deals. Just like the 2005 mortgage market, there is both intense demand for new age municipal financing - and remarkable incentive for Wall Street to "help out." Of course, what modern catastrophe is complete without a credit ratings debacle? According to the National Conference of State Legislatures, 34 states are projecting budget gaps for 2010. The total shortfall will likely exceed $84 billion. Yet only two US states, California and Illinois, are currently rated lower than AA by Standard & Poor's. Only four states have fully funded pension programs. Yet 11 have S&P's coveted AAA credit rating. Given all that we've explored above, and the ratings agencies' track record over the last 10 years, those AA and AAA ratings seem woefully optimistic. Insolvent is insolvent, not matter what the rating agency's say. For the conservative investor, therefore, our advice is straightforward: Avoid municipal bonds. For the speculating investor, check back in tomorrow to learn about a risky way to bet against the municipal bond market. Here's a myth we'd like to smash. It's the one about how America stopped being a manufacturing economy and became a "service" economy. The truth is found in figures like these:

Call it the "financialization" of the economy. The root of the problem is the nature of investing itself - at least, the public form of investing, as practiced by most investors and as tempted by Wall Street. The idea of it is that a man can get rich without actually working or coming up with an insight or an invention by careful study or dumb luck. All he has to do is put his money "in the market" by handing it over to Wall Street, and poof! - by some magic never fully described it comes back to him tenfold. Too often in the last couple of years, it's felt as if Wall Street's hocus-pocus has had the opposite result - collapsing wealth tenfold. We see it happening all over - in sovereign debt, municipal debt, even the gold market. In yesterday's edition of The Daily Reckoning, I explained why municipal bonds, in general are a bad bet. The numbers just don't add up. Municipal finances have become as ugly - and as unsustainable - as the federal government's. Municipal obligations are simply too large, relative to current and (likely) future revenues. It is a classic "train wreck." All this being said, betting against municipal bonds, or funds of muni bonds, is a bad idea for most investors. Most of the closed-end funds and ETFs that hold municipal bonds pay monthly or quarterly dividends. Which means that a short seller of those securities would have to cover them while they wait for their bet to pan out. And the muni breakdown could be months away, if not years. Also, when muni funds do suffer, the fallout may not be as dramatic as the housing bust. Even if you manage to pick the right municipal bond to short, it's tough to make money. Take an ETF of Californian muni bonds (CMF). You'd think it would have suffered terribly over the last few years. But it never fell more than 20% during the worst of the credit crisis. Furthermore, financially stressed municipalities pull all kinds of strings to avoid actually defaulting. It's an all-too-common practice for cities and states to rescue failing projects (with taxpayer money) to prevent the repercussions of a bond default. Those wishing to bet against muni bonds - the fates of local and state balance sheets - are better served shorting companies that hold a large portfolio of municipal bonds or those that are in the business of insuring munis. The latter category means the monolines like MBIA, AMBAC and Financial Guaranty. As for the former, organizations with large portfolios of municipal bonds, one in particular comes to mind. It has a notoriously opaque business and balance sheet. It's a bailed out, flailing company that also holds the world's second largest portfolio of American municipal bonds... AIG. "AIG holds approximately $48.6 billion of tax-exempt and taxable securities issued by a wide number of municipal authorities across the US and its territories," its latest 10-K boasts. "The average credit quality of these issuers is A+." It continues... Currently, several states, local governments and other issuers are facing pressures on their budget revenues from the effects of the recession and have had to cut spending and draw on reserve funds. Consequently, several municipal issuers in AIG's portfolios have been downgraded one or more notches by the rating agencies. The most notable of these issuers is the State of California, of which AIG holds approximately $1.1 billion of general obligation bonds and which at Dec. 31, 2009, was also the largest single issuer in AIG's municipal finance portfolio. Nevertheless, despite the budget pressures facing the sector, AIG does not expect any significant defaults in portfolio holdings of municipal issuers. In our opinion, these two paragraphs alone warrant intense suspicion. AIG holds tens of billions in munis, and with an average rating of A+, a lot of them aren't very good. The company's stake is so big that the fate of muni bonds and AIG is intertwined. In a company presentation to the Treasury Department, AIG warned, "A forced sale of AIGCI's investment portfolio would significantly stress the US municipal bond market." In short, if munis fall, so does AIG... and vice versa. Gravity, it seems, is tugging at both. "AIG has no common shareholder equity remaining on its balance sheet," famous short seller Steve Eisman proclaimed at Grant's 2010 spring investment conference. "It would likely be insolvent if not for government support." Eisman, subject of Michael Lewis' book The Big Short, publicly announced his shorting campaign against AIG in early April. He's famous for nailing the subprime bust, netting his hedge fund clients ungodly amounts of money. Eisman is also often cited as mentor to Meredith Whitney, the analyst who so spectacularly called out bank stocks in 2008. Eisman has built an argument against AIG almost as complicated and difficult to comprehend as AIG itself. We'd boil it down to this:

Factor in a $48 billion portfolio of muni bonds we think are suspect (at best) and you've got a fine case for shorting AIG. Of course, betting against AIG is not a sure thing. The principal risk is the government. It has saved AIG from bankruptcy once. There's no guarantee it won't do it again. The Treasury could lend more money or forgive AIG's debt. The Fed could give greater access to lending facilities. We feel, however, that the public ire toward both AIG and taxpayer bailouts is so strong the government will offer AIG more support only under extreme circumstances. So with the caveat that this is only for the adventurous, you might consider short-selling AIG, say, above $40 a share. Fair warning: It's a "crowded short." Your broker may have trouble locating shares to borrow. But Dan Amoss of Strategic Short Report agrees with Steve Eisman's scenario: The government will convert its preferred shares to common stock - massively diluting existing shareholders and driving down the share price. Still, don't expect this to occur until after the midterm elections in November. Even if you don't short, AIG, beware munis! Addison Wiggin |

| Posted: 03 Aug 2010 11:56 AM PDT It was just a few years ago that the world was realizing that Hubbert's Peak, a forecast set some decades prior, was proving to be incredibly true with oil. While no one expects that oil will ever disappear in its entirety, we know that at the rate it is used, cheap oil may be gone forever. Will gold have a similar fate? Well, one industry insider believes that may be the case. Peak Gold In a recent interview with Reuters, Peter Munk, chairman of Barrick Gold, said that he believed the new wave of growth for mining firms isn't in single metal mines. Gone are the days that a mining company could buy acreages of land to find just one valuable metal. Instead, companies are shifting to mixed metal operations due to the fact that the purest lands are now used up, and companies are forced to dig deeper and extract lessened amounts of metals to sustain profits. In An Ideal World Mining companies would greatly prefer to dig for a single metal at a time. One met... |

| When Good Falling Prices Go Bad Posted: 03 Aug 2010 11:52 AM PDT Keeping it short and sweet today... Well, at least short...well, maybe sweet... The Dow stood up on its hind legs yesterday - up 208 points. Gold rose $1. The dollar continues to fall. What to make of it? Well, it could be we're wrong about this market. There seems to be a lot of money eager to get into stocks. It's mostly fund managers and institutions. They can't risk missing out on a stock market rally - even a small one. If they fail to get in, what will they tell investors at the end of the quarter? And what kind of bonuses will they take home? Wall Street does not encourage people to take the long view. Instead, it focuses on quarterly results. Over the last ten years, even solid, blue chip companies have gone nowhere. Investors have waited...and waited... If there's an important rally now, they won't want to miss it! But what if it's a trap? Ah, there's the rub. After many years of trial and error, we now accept the fact that God may have other plans for the world than those He's disclosed to us. Still, when we look out at the US economy and the world in which it sits, we wonder how a rally at this point could be real and enduring. Are not consumers shedding debt? Are not 40 million on food stamps? Are not there more people out of work than at any time in history? And does not the US economy face the greatest competition ever...at a time when it is hobbled by its greatest burden of debt? Maybe, as we said, the stock market rally is just another trap. We'll find out...in the fullness of time. Meanwhile, we mentioned St. Louis Fed governor James Bullard yesterday. He seems to understand better than the others what is going on. The US economy, he says, risks being "enmeshed in a Japanese-style deflationary outcome within the next several years." We're not sure what being 'enmeshed in...a deflationary outcome' means exactly. Outcome sounds like something you get after being enmeshed. But we think we get the sense of it. "Japanese-style" and "deflationary" sound like what we've been expecting too. Mr. Bullard is viewed as an inflation hawk, which means he usually is worried about rising prices. But now is not the time to worry about inflation and Mr. Bullard knows it. The problem with inflation now, at least from the Fed's point of view, is that there isn't any. So Mr. Bullard is going to worry about something else. And he's not the only one. Another Fed governor - Mr. Rosengren of the Boston branch office - said, "While I am not anticipating we will be in a deflationary period, it's a risk that I do take seriously, and we should continue to monitor what's happening with prices." What's happening with prices is hard to tell. The official tally puts consumer price inflation at less than one-third the level it was at when Ben Bernanke told us he had it under control. Targeting 2%...the CPI now measures 0.5%...which means either Mr. Bernanke missed the target by 300% or he can't really control inflation after all. We're told that there are two kinds of falling prices. There are the good kind and the bad kind. The good kind are the kind you find at Wal- Mart and Best Buy. They're the kind you find at the gas station when you see the price of gasoline is less than it was the day before. And they're the kind you read about in the paper when someone else's house is now much more affordable than it was a year ago. The bad kind of falling prices, on the other hand, are the kind that keep economists up at night worrying. They're the kind of falling prices that put Japan into a 20-year on-again, off-again slump. They're the kind of falling prices that lower the value of your own house below what you paid for it and that cut your retirement portfolio in half. But here at The Daily Reckoning, we see it differently. No prices are bad prices - unless they are crooked and dishonest. An honest price is just information. It tells producers what to produce, consumers what to consume, and investors where to put their money. In a healthy economy, prices often fall...because businesses get better at making things. At least, this was true in the 19th century. Industrialization improved output rapidly and incomes and consumption increased. Prices held steady...or fell. But this was before the Fed got control of the nation's money. The dollar was worth about the same thing in 1910 as it had been in 1810. But here we are in 2010, after nearly 100 years of Fed control. What's the dollar worth today? About 5% of a 1910 dollar. Maybe less. Maybe that is what stock market investors are really thinking: stocks may not go up...but at least they won't lose 95% of their value as Bullard, Bernanke et al desperately try to fight deflation... Stay tuned... And more thoughts... "When I retired, I didn't know what to expect. I didn't know what I was going to do with myself. And my wife didn't know what to do with me either. It was pretty rough at first." We were talking to a slightly older man. He retired two years ago. "There seem to be two possibilities. Either the wife is happy to have the man back after so many years of work, when they might not have seen much of each other...or, she is annoyed to have this fellow butting in to her life. Some guys try to re-organize the kitchen...or try to bring some more efficiency to the management of the household. They're trying to 'help,' of course, but it's a very bad idea. "In either case, though, the man needs to find another occupation pretty fast...or things are going to go bad. If the wife is glad to see him, he should enjoy the attention. She'll probably get tired of having him around the house after a while. If she is not happy to have him in the house at all, he'd better make himself scarce right away. Otherwise, the marriage might not work at all. People establish a pattern after many years of living together. If you change the pattern all of a sudden, it may not work. "I found a couple of non-profit organizations I like to help. I'm busier now than I was when I was working full time. "And there are the children too. Once they hear you're retired they think of things that you can do for them. We have the kids on the weekends sometimes. Or, they need help moving. Or this. Or that. Honestly, I thought I'd have a lot of time to do nothing. I don't have any free time at all." Regards, Bill Bonner |

| Hiccups? Not Bubbles? How About Now? Posted: 03 Aug 2010 11:29 AM PDT Following yesterday's theme of economists, bubbles, and the like here and here, in Eric Janszen's latest musing over at iTulip can be found this clip from early-2008 where Chicago University economist Steven Davis speaks with disdain about the idea that bubbles are bad (remember, this was two-and-a-half years ago). The fun begins at about the 2:40 mark. You can feel the hubris oozing out of Davis' pores as he begins, "What Mr. Janszen calls bubbles might also be called financial development or the hiccups associated with financial development." He then proceeds to dig himself a humongous hole that has aged well over the years and should give any non-economist a good chuckle. |

| The Gold Price Needs to Break Through $1,190 and Silver Through 1860c Before it Will Run Posted: 03 Aug 2010 11:28 AM PDT Gold Price Close Today : 1185.20Change : 1.80 or 0.2%Silver Price Close Today : 18.407Change : 0.004 cents or 0.0%Platinum Price Close Today : 1580.10Change : -21.30 or -1.3%Palladium... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Mexicana Airlines Files For Bankruptcy Posted: 03 Aug 2010 11:17 AM PDT Mexicana Airlines, the busiest foreign carrier at Los Angeles International Airport, announced Tuesday that it had filed for bankruptcy protection in the U.S. and Mexico, blaming much of its financial trouble on high labor costs. The debt-ridden airline made the announcement one day after suspending a total of 31 flights in Mexico and across the U.S., including some of its departures from Los Angeles, New York, Chicago, San Jose, Sacramento, San Francisco and Oakland. At LAX, the airline put a hold on four of 15 daily flights to Puerto Vallarta, Guadalajara and Mexico City. The Mexico City-based airline promised to contact passengers with tickets on canceled flights for a refund or to rebook them on another Mexicana flight or with another carrier. |

| Obama Threatens Forex; Says Goodbye to OTC Gold Trading Posted: 03 Aug 2010 11:12 AM PDT |

| GMI Describes "The Future Recession In An Ongoing Depression" In This Must Read Report Posted: 03 Aug 2010 10:31 AM PDT Raoul Pal, who retired from managing money at the ripe age of 36, after co-managing GLG's Global Macro Fund, and the hedge fund sales business in equities and equity derivatives at Goldman among others, and has been publishing the attached Global Macro Report since, has just come out with the most condensed version of truth about our economic reality we have read in a long time. The attached report provides the most in depth observation on the "future recession in an ongoing depression" which is arguably the best way the describe the current economic predicament. Raoul goes all out in describing he worst recovery in history, touches on he complete disconnect between the bond world and the imaginary equity surreality, provides countless evidence the economy has not only not left the recession but is getting progressively deeper into it, shares several trade recommendations, and on occasion swear like a drunken sailor. A must read report for everyone who is sick of the CNBC/sellside daily onesided propaganda.

h/t Mike |

| Posted: 03 Aug 2010 10:24 AM PDT China news, softening dollar lift gold The COMEX December gold futures contract closed up $2.10 Tuesday at $1187.50, trading between $1181.60 and $1193.00 August 3, p.m. excerpts: see full news, 24-hr newswire… August 3rd's audio MarketMinute |

| US Treasury yields fall to record low on Fed's 'QE lite' plan Posted: 03 Aug 2010 10:15 AM PDT |

| Guest Post: Candy From Strangers, Or Who Is Buyng All Those Treasuries? Posted: 03 Aug 2010 10:14 AM PDT Submitted by Marc McHugh from Across the Street Candy from Strangers When TrimTabs Charles Biderman questioned the source of the money that propelled stocks 65% from the March 2009 lows, he got beaten with the idiot stick so badly that he actually turned bullish in April 2010. Lost in the ensuing choke-out was the fact that no one ever actually answered his question, unless scoffing and muttering “dark pools and stuff,” under your breath counts (and he’s the one who should be wearing the tin-foil hat?). Here we go again. The first thing you should notice when looking at The Treasury’s 2010 Q1 Bulletin is that it’s incomplete, as I’m sure most of Secretary Tim Geithner’s homework assignments were. Of the 12 columns on Table OFS-2 (Estimated Ownership of U.S. Treasury Securities), Turbo managed to fill in only 5 (FYI: it takes Treasury more than two months to prepare the bulletin). From the data actually present, we can determine that Treasury issued 461.7 Billion in new debt Q1. That’s not surprising, we’ve been running at the $500 per person per month clip for almost two years now. What is surprising is that the Fed & Intragovernment holdings went down $17B. Foreigners, God bless ‘em, scooped up an additional $192.5 B, while US saving bond holdings were basically flat (-$1.1 B). Um, we’re out of data now, but not debt. 287.4 Billion (62%) of Q1&rime;s public debt is not accounted for on the report. Fortunately when discussing who could digest that much debt in three months, we can quickly eliminate 6 of the 7 “not available” data points (depository institutions, pension funds, mutual funds, insurance companies, and State & local governments). The only logical conclusion is at least a quarter trillion in debt was purchased by “Other Investors” in Q1. Aren’t you glad we cleared that up? What’s that? “Who the hell are Other Investors,” you say? Good question. It does seem rather nebulous, especially considering that they are now clearly our best customer(s). Not very bright though. They stepped in and bought like crazy as interest rates went to record lows. Still I think we should send a basket of fruit and a nice thank you note, because without them we would surely have had a failed auction (read Keynesian apocalypse). The Treasury defines Other Investors as:

Thanks Turbo, for narrowing it down to just about everyone under the sun. Let’s go ask Ben!Geithner’s a slacker, this is known, but Fed Chair Ben Bernanke’s SAT score (1590!) suggests analality (?) (mine was considerably lower). Besides, Treasury’s footnotes on tables OFS-2 tell us that the source for 6 of the 7 empty columns is the Federal Reserve Board of Governors, Flow of Funds Table L.209 (and which was actually released before the Treasury Bulletin – don’t get me started…). The Fed’s flow of funds data is an exercise in convolution, but it wasn’t too difficult to extract the data missing from the Treasury bulletin. Here’s the breakdown:

Depository institutions and Private pensions purchased record amounts of Treasuries in Q1. Which means that “Other Investors” accounted for $215 B of the Treasuries issued in Q1. Yes, I realize that this is somewhat lower than my original estimate, but in my defense that was a logical conclusion. Who knew banks and private pensions are expecting another stock market collapse? Nobody at CNBC anyway. They’re too busy laughing at Main Street for not seeing the awesomeness of the recovery. Before putting away the Fed’s flow of funds, it is worth noting that brokers and dealers (who are included as other investors) do not share the pessimism of banks and private pensions. They dumped $19 B during the quarter. This brings us to the turd in the punchbowl. The Household sector, who the Fed says purchased a whopping $68 B. Now before you start thinking your neighbors are taking their unemployment checks and sneaking off to Treasury auctions, listen to what Sprott Asset Management’s Eric Sprott and David Franklin said of the household sector in their December 2009 report entitled, Is it all just a Ponzi Scheme?:

I guess that means your neighbor isn’t our superhero, and besides, if he was he’d have a cooler car. So who are these strangers with candy hell-bent on making sure this sugar high doesn’t end? I don’t know. There I said it. Maybe Charles Biderman gets rattled when everyone calls him a moron, but I’m used to it. S0 fire away, but answer the question. By the end of 2010, Other Investors will own more than 10% of the US public debt (1.5 Trillion or so). They bought more than 45% of the new debt in Q1. At what point does this kind of opacity become unacceptable? Why can’t the Treasury fill out its own bulletin with information already available? Why do we have to wait five months for information that is so vague, you can’t even call it information with a straight face? And last but not least, where do we send the fruit basket? Other Reading: Is it all just a Ponzi Scheme? (Sprott & Franklin) Smoking Guns of US Treasury Monetization (Jim Willie) Treasury table OFS-2 (updated by author). |

| All 96 Cent Currencies go to a Dollar Posted: 03 Aug 2010 09:49 AM PDT Looking at the FX screen today you have to conclude: The dollar is weak. Oh the pain. How many big names have stuck their heads out and said that the strong dollar bet was the trade of the year.

|