Gold World News Flash |

- Gold Basis Screwed

- How to Buy Your Kids a House

- What's the Best ETF for Hedging Against a Market Decline?

- US Money Supply Prompts a Hard Goodbye

- Gold Basis Screwed: Who needs a thermometer to know that the heat-wave is on?

- Vikas Ranjan: Good Potential in Junior Golds

- Gold Technicals for July 26th

- Jim?s Mailbox

- In The News Today

- Betting on a Bubble, Bracing for a Fall

- How To Be Positioned for SP500, Gold & Oil

- ECU Silver Edges Closer to Senior Production in Mexico

- LGMR: Physical Buying "Supporting Gold" Amid Slow Summer Dealing

- Green Sharts! Chicago Fed Index -0.63

- Crude Oil Risks Tilted To the Upside, Gold Investor Liquidation Continues

- Americans Are Getting A Lot Less But It's Costing Them More

- The US Mint Fraud

- Momenta Pharma Closes In on Sanofi Aventis With Biogeneric Approval

- What is George Soros up to in the gold market? “It is the ultimate asset bubble.”

- Why Do U.S. Asset Managers Fear Government Confiscation of Gold? Part 1

- SP-500, GLD and GDX - Sentiment Trumps Everything

- Physical Buying "Supporting Gold" Amid Slow Summer Dealing

- When Will We Have Inflation?

- 2 Stocks for a Stock Picker's Market

- Jim Rickards: Fundamental analysis, fair value nullified by government intervention

- Jeff Saut: The 'Businessman's Risk' Portfolio

- The Scariest Unemployment Graph I've Seen Yet

- Let the Good Times Roll

- The American People Don't Need More Handouts – What They Need Are Good Jobs

- Gold Seeker Closing Report: Gold and Silver End Mixed

- Too Much Debt, Not Enough Oil

- Major German business magazine publicizes gold price suppression scheme

- Forecast Leaves 232 Dow Points to Go

- Ron Paul: We Cannot Even Maintain the Zinc Standard

- Soft-Core Deflationism

- Bullion, coin dealers call for investigation of U.S. coin blanks supply

- Coin Monday: The Quantum Pedigree

- Landmark Sixpence Leads Heritage ANA Boston World Coin Auction

- Legend Acquired and Sold Rare 1804 Eagle Coins to Appear at Boston ANA

- The Story of the Two Greatest Gold Shipments In The History of the United States Mints

- The U.S. Mint's lame excuse for rationing gold and silver coins

- The U.S. Mint's lame excuse for rationing gold and silver coins

- FOFOA: Lease rates falsified to hide gold backwardation

- Two Reports from CBO

- The Troubling Truth About Future Oil Prices

- A More Dismal Economic Forecast

- Marc Faber: Relax, This Will Hurt A Lot

- The Bombshells Bernanke Did NOT Tell Congress About Last Week

- MONDAY Market Excerpts

| Posted: 26 Jul 2010 06:15 PM PDT Fofoa has just published another thoughtful paper with the title: Red Alert: Gold Backwardation!!! http://fofoa.blogspot.com. It raises the question nobody has apparently raised before: "Is the dollar bidding for gold, or maybe gold is bidding for dollars?" And it gives an amazing answer: the gold basis has been screwed and it has been giving bogus signals for more than a year. |

| Posted: 26 Jul 2010 06:13 PM PDT So, if gold peaks and real estate bottoms in about five years, then a house will cost you about 100 ounces of gold in 2015. Maybe it will take ten years, but the point is, I think we can count on the ratio moving lower this decade, and probably significantly so. Even for the modest budget, 100 ounces almost sounds manageable. |

| What's the Best ETF for Hedging Against a Market Decline? Posted: 26 Jul 2010 06:12 PM PDT Joseph L. Shaefer submits: Before we can answer that question intelligently, we need to ask three others: “The best for what?”, “The best for whom?”, and “Over what time frame?” Depending upon your intent and your situation, I would answer differently, as I have in accommodating the different goals and temperaments of our own client base. There are single, double and triple inverse ETFs we might go long and there are single, double and triple long-side ETFs we might go short. Depending on whether you are located in the US or elsewhere, or believe strongly that the US or some other market will be most affected by a market decline, there are US long and short index and sector ETFs, foreign developed market long and short ETFs, and foreign emerging market long and short ETFs. Then there are sector ETFs for some segment of a particular market as well as individual country ETFs. Quite the panoply – and I haven’t even mentioned the various allegedly contra-cyclical long precious metals, bond, Treasury-only bond, energy or food commodity ETFs! Complete Story » |

| US Money Supply Prompts a Hard Goodbye Posted: 26 Jul 2010 06:12 PM PDT The way that federal taxes are going up next year by huge percentages is Very Interesting News (VIN) for gold-bugs like me, and probably the Founding Fathers who wrote the Constitution, too, if they were still alive, as we all think that gold-as-money is the only "way to go" because it absolutely precludes rapid increases in the supply of money, which is important because increases in the money supply cause increases in prices, which is important if you think that paying $1,000 for a loaf of bread is important or if milk costs $2,000 per gallon, and pretty soon the rest of the world is going to wake up to that fact, too. Note the way the soundtrack has gotten all gloomy and discordant in an ugly, dissonant way, and the dark, dreadful tone to my voice when I dramatically say, "But only after it is too (pause) late." But with a soundtrack changing to sounds of happy birds chirping and children laughing, it also means soaring demand for gold, silver and oil, with their prices and all pr... |

| Gold Basis Screwed: Who needs a thermometer to know that the heat-wave is on? Posted: 26 Jul 2010 06:12 PM PDT position papers of professorfekete #6, July 28, 2010. Antal E. Fekete Fofoa has just published another thoughtful paper with the title: Red Alert: Gold Backwardation!!! http://fofoa.blogspot.com. It raises the question nobody has apparently raised before: “Is the dollar bidding for gold, or maybe gold is bidding for dollars?” And it gives an amazing answer: the gold basis has been screwed and it has been giving bogus signals for more than a year. We have likely had backwardation all this time but it has been stonewalled. There is no real gold market any more. Goldman Sucks is playing with itself. Most trades are bogus, sales as well as purchases. Leases ditto. What Goldman Sucks couldn’t get away in a falling market, it can in a rising one. There are other metrics beside the gold basis that the market has developed in the meantime. One such is GOFO = $ LIBOR – GLR (the gold lease rate). On the face of it, GOFO cannot ever go ... |

| Vikas Ranjan: Good Potential in Junior Golds Posted: 26 Jul 2010 06:12 PM PDT Source: Brian Sylvester of The Gold Report 07/26/2010 Could gold hit $1,500 by year-end? Ubika Research Cofounder and Analyst Vikas Ranjan thinks so. In this exclusive with The Gold Report, Vikas tells us he's pretty bullish on the yellow metal and lists a handful of gold plays he believes have strong potential for serious gains. The Gold Report: Vikas, in a July market overview you said: "The world economy is certainly at an interesting juncture. On one side, markets are fretting about the end to government stimulus measures and the likely impact on economic growth, while at the same time remaining concerned about rising government debt and deficits." Where does that leave us? Vikas Ranjan: We really have a situation that is mixed. It seems to us that the world is divided into two camps. First are the Western countries that have debt fatigue. They are keen to get the deficit and debt down and are facing weak domestic demand. Second are the emerging countries like B... |

| Posted: 26 Jul 2010 06:12 PM PDT courtesy of DailyFX.com July 26, 2010 07:28 AM Gold has topped. Please see the latest special report for details. Gold is making its way lower and in an impulsive fashion. I wrote last week to “look for gold to form a low next week as wave 5 comes to an end. Expectations will then be for a move back to 1220.” After bouncing to 1204, gold is testing its low so a secondary top may be in place at 1204. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Posted: 26 Jul 2010 06:12 PM PDT View the original post at jsmineset.com... July 26, 2010 07:57 AM Chicago Fed National Activity Index CIGA Eric [INDENT]Index shows economic activity declined in June Led by deterioration in production- and employment-related indicators, the Chicago Fed National Activity Index declined to –0.63 in June, down from +0.31 in May. Three of the four broad categories of indicators that make up the index made negative contributions in June, while the sales, orders, and inventories category made the lone positive contribution. [/INDENT]Chicago Fed National Activity Index (CFNAI) is a lesser known economic series that suggest economic weakness in June. Trend inflections and divergences in the CFNAI often foreshadow trend changes in U.S. stocks. While the CFNAI trend line has yet to break, any weakness from June will met with further liquidity blasts from the Fed and public sector wishing to maintain the trend in stocks. Chicago Fed National Activity Index (CNFAI... |

| Posted: 26 Jul 2010 06:12 PM PDT View the original post at jsmineset.com... July 26, 2010 08:01 AM Jim Sinclair’s Commentary This financial world is loaded with time bombs. One major device is surfacing over the balance of the year. The financial problems of the euro are always expressed as total debt outstanding. This is nothing compared to the financial problems of the MOPEd US that are always presented as the potential State Budget Deficit for fiscal year 2010. The Death of Paper Money As they prepare for holiday reading in Tuscany, City bankers are buying up rare copies of an obscure book on the mechanics of Weimar inflation published in 1974. By Ambrose Evans-Pritchard Published: 7:05PM BST 25 Jul 2010 Ebay is offering a well-thumbed volume of "Dying of Money: Lessons of the Great German and American Inflations" at a starting bid of $699 (shipping free.. thanks a lot). The crucial passage comes in Chapter 17 entitled "Velocity". Each big inflation — whether the early 1920s in Ge... |

| Betting on a Bubble, Bracing for a Fall Posted: 26 Jul 2010 06:12 PM PDT Excerpt from the Hussman Funds' Weekly Market Comment (7/26/10):[INDENT]Over the short-term, my impression is that the technicals may hold sway for a bit. The economic data points simply do not come out every day, and to the extent that economic news is not perfectly uniform in its implications, the eagerness of investors to speculate can easily dominate briefly. We established enough contingent call options at lower levels that we've now got about 1% of assets in roughly at-the-money index calls - a modest "anti-hedge" that removes any concern we might have about a frantic short-squeeze if the S&P 500 moves materially above 1100. At the same time, the historical evidence suggests that fundamentals have ultimately trumped technicals when we've observed similar warnings from economic indicators in the past. My impression is that the economic cold water could hit investors very abruptly, so that gains achieved over several weeks may be suddenly ... |

| How To Be Positioned for SP500, Gold & Oil Posted: 26 Jul 2010 06:12 PM PDT The second half of last week we saw some strong price action in the equities market. The SP500 broke through the 5 and 50 day moving averages closing the week just under key resistance levels. The SP500 futures will find resistance at the June high $1099.25, $1100 which is whole number then at $1103 which is the 200 day moving average. Each of these are clumped together making it really just one solid area which sellers will be waiting to short the market. The market momentum and internals are looking strong for the equities market overall. With last weeks strong close we have seeing the percentage of stocks closing above their 50 and 200 day moving averages surge from 40% to 68% from the previous week. Stocks closing above their 20 day moving average jumped from 40% to 82% from the previous week. Seeing this type of shift in the market Momentum is generally a bullish indicator. From a quick glance at the internals it looks as though Monday will trade flat/negative for... |

| ECU Silver Edges Closer to Senior Production in Mexico Posted: 26 Jul 2010 06:12 PM PDT By Claire O'Connor James West MidasLetter.com Monday, July 26, 2010 For over a decade now, ECU Silver (TSX.V: ECU) has been exploring and developing the company's mineral rich Velardeña Properties in the State of Durango, Mexico. Major gold and silver discoveries on the properties have seen the Velardeña resource jump from 1.6 million tonnes to a staggering 30 million tonnes in just over 3 years. Already the reigning kings among their peer group of junior silver producers, ECU Silver is well on its way to realizing its dreams of senior silver and gold production within the next few years. Located in the Velardeña Mining District, a known but under-exploited mineral bearing region in Mexico's silver belt, the Velardeña Properties consist of three projects – the Velardeña Property, the Chicago Property and the San Diego Property. ECU hol... |

| LGMR: Physical Buying "Supporting Gold" Amid Slow Summer Dealing Posted: 26 Jul 2010 06:12 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:45 ET, Mon 26 July Physical Buying "Supporting Gold" Amid Slow Summer Dealing THE PRICE OF GOLD gave back an early rally on Monday morning to trade just below Friday's close of $1190 an ounce amid what one Hong Kong dealer called "a typically slow summer day." "There is physical gold buying coming in as prices are below $1200," said a Seoul-based trader. "Physical gold demand is supporting the market towards the $1185 level," said Afshin Nabavi of MKS Finance in Geneva, also speaking to Bloomberg. "A lot of the interest we are seeing at the moment is from long-term investors, and we don't see that abating," the Wall Street Journal quotes Barclays Capital analyst Suki Cooper in London. Dealing in Asian and European equities was also quiet early Monday, leaving London's FTSE100 index unchanged from last week's two-month closing high. Crude oil slipped from an 11-week high near $79 per barrel. ... |

| Green Sharts! Chicago Fed Index -0.63 Posted: 26 Jul 2010 06:12 PM PDT Market Ticker - Karl Denninger View original article July 26, 2010 05:50 AM Oops.... [INDENT]Led by deterioration in production- and employment-related indicators, the Chicago Fed National Activity Index declined to –0.63 in June, down from +0.31 in May. Three of the four broad categories of indicators that make up the index made negative contributions in June, while the sales, orders, and inventories category made the lone positive contribution. [/INDENT]Well now let's see... we add this to the ECRI leading index (which is now recording a -10% number) and you have yet more indications of the dreaded "double dip." Or is it? Naw. We simply never left recession, and now the Federal Government's attempts to prop up the economy with a full 11% of GDP in debt-based-spending (just like you might with your credit card if you lost your job!) are failing too. The government should have left well-enough alone and forced the insolvent to take their lumps in 2007. We'd be done wit... |

| Crude Oil Risks Tilted To the Upside, Gold Investor Liquidation Continues Posted: 26 Jul 2010 06:11 PM PDT courtesy of DailyFX.com July 25, 2010 08:18 PM Crude oil is making its way toward the psychological $80 barrier, as price action indicates that risks are tilted modestly to the upside. Gold tries to hold up despite continued investor liquidation. Commodities - Energy Crude Oil Risks Tilted To the Upside Crude Oil (WTI) $79.12 +$0.14 +0.18% Commentary: Crude oil is up very slightly after rising 3.9% last week. The primary catalyst for crude’s latest advance is not what has happened, but rather what has not happened. The 26.3% decline in oil prices during May was due in large part to fear. As those worst-case economic fears have so far failed to materialize, the commodity has snapped back to more normalized levels. In the bigger picture, crude oil has been largely rangebound, fluctuating between the upper-$60’s and the lower-$80’s since September of 2009. The latest economic scare was enough for crude oil to test the bottom of the range,... |

| Americans Are Getting A Lot Less But It's Costing Them More Posted: 26 Jul 2010 06:11 PM PDT |

| Posted: 26 Jul 2010 06:04 PM PDT |

| Momenta Pharma Closes In on Sanofi Aventis With Biogeneric Approval Posted: 26 Jul 2010 05:52 PM PDT  Derek Lowe submits: Derek Lowe submits: So we actually had two converging stories on Friday afternoon - the news that Sanofi-Aventis (SNY) is going after Genzyme (GENZ), and the news that tiny Momenta Pharmaceuticals (MNTA) finally got FDA approval for a biogeneric of Lovenox (enoxaparin). . .a big seller for Sanofi-Aventis. I knew something was going on with those folks - I'm close enough in Cambridge that I could hear them whooping and popping champagne corks. They've got backing from Novartis (NVS), who will actually be making the stuff using Momenta's techniques, but this was make-or-break news for them, and they've been waiting for quite a while to hear it. Meanwhile, Sanofi-Aventis has been hoping just as long that this day wouldn't come. Complete Story » |

| What is George Soros up to in the gold market? “It is the ultimate asset bubble.” Posted: 26 Jul 2010 05:52 PM PDT |

| Why Do U.S. Asset Managers Fear Government Confiscation of Gold? Part 1 Posted: 26 Jul 2010 05:49 PM PDT |

| SP-500, GLD and GDX - Sentiment Trumps Everything Posted: 26 Jul 2010 05:46 PM PDT |

| Physical Buying "Supporting Gold" Amid Slow Summer Dealing Posted: 26 Jul 2010 05:25 PM PDT |

| Posted: 26 Jul 2010 05:23 PM PDT  Larry MacDonald submits: Larry MacDonald submits: Many analysts expect inflation to take off because governments around the world are monetarizing their huge debt loads/deficits in the aftermath of their gigantic bailouts of the financial sector and stimulus packages. So far, inflation is no where to be seen in the U.S. and elsewhere, despite huge jumps in the money supply. Complete Story » |

| 2 Stocks for a Stock Picker's Market Posted: 26 Jul 2010 05:11 PM PDT David I. Templeton submits: One issue confronting investors at this point in the market cycle is the fact the growth rate of earnings on the S&P 500 Index are anticipated to slow going into 2011. Although operating earnings for the S&P 500 Index are projected to reach $92.19 per share, this level of earnings represents a lower rate of increase (the second derivative) than the earnings growth achieved in 2010. Click to enlarge: Complete Story » |

| Jim Rickards: Fundamental analysis, fair value nullified by government intervention Posted: 26 Jul 2010 05:08 PM PDT 1a ET Tuesday, July 27, 2010 Dear Friend of GATA and Gold: Market analyst, historian, philosopher, and lawyer Jim Rickards of Omnis Inc. has given another great interview to Eric King of King World News, if an awfully depressing one, finding parallels between the fall of Rome and recent developments in the United States. But in one big respect Rickards has begun to sound like GATA, which doesn't depress us at all. Rickards tells King that the recent gold swaps undertaken surreptitiously by the Bank for International Settlements were probably meant to manipulate the gold market, and he wonders whether fundamental analysis of markets and fair value has any use amid pervasive government intervention in markets, which can always change valuations abruptly and thereby trump investors. This market intervention, Rickards says, invites investors to withdraw from productive enterprise and reserve their wealth in cash or gold. This is much like what people heard at GATA's Washington conference two years ago: "The main purpose of central banking now is to prevent ordinary markets from happening at all." That is, "there are no markets anymore, just interventions": Rickards' interview can be heard at the King World News Internet site here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/7/26_J... In addition, he has written an entertaining short essay for King World News, "The Myth of August," which you can find here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2010/7/26_Ji... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Jeff Saut: The 'Businessman's Risk' Portfolio Posted: 26 Jul 2010 04:57 PM PDT Market Folly submits: Earlier today we highlighted market strategist Jeff Saut's thinking that it may be time to rebalance portfolios. Within his commentary, he laid out a theoretical asset allocation as to how he would structure a "businessman's risk" portfolio. When Saut first entered the industry 40 years ago, his mentor told him to allocate 20% of money to Treasuries, 20% to stocks, 20% to bonds, 20% into precious metals, and 20% into real estate. Saut did not heed this advice though admits that over the long haul it has performed decently. Instead, Saut has constructed the aptly named "businessman's risk" portfolio which is more to his liking. Here's the breakdown: Complete Story » |

| The Scariest Unemployment Graph I've Seen Yet Posted: 26 Jul 2010 04:56 PM PDT  The median duration of unemployment is higher today than any time in the last 50 years. That's an understatement. It is more than twice as high today than any time in the last 50 years. The median duration of unemployment is higher today than any time in the last 50 years. That's an understatement. It is more than twice as high today than any time in the last 50 years.OK, you're saying, but what does this mean? Does it mean we must increase the duration of unemployment benefits to protect this new class of unemployed, or does it mean we need to stop subsidizing joblessness? Does it mean we need to expand federal retraining programs, or does it mean federal retraining programs aren't working? Does it mean we need more stimulus, more state aid, more infrastructure projects, more public works ... or does it mean it's time to stop everything, stand back and let business be business? You're going to find smart people make a case for all six of the above public policy directions. (I tend to side with the first of each coupling.) It's hard to know for sure how to design public policy for historically unique crises precisely because they are historical orphans, without precedent to show us the right way from the wrong. One of my first reactions to this graph was: Surely this is why we don't have to worry about inflation for a very, very long time. However, here's evidence that despite the historically inverse relationship between inflation and joblessness, "the long-term unemployed put less downward pressure on inflation." Ultimately, this is a graph that should humble policy makers more than it should scare them into confidently arguing they know exactly how to fix it. This posting includes an audio/video/photo media file: Download Now |

| Posted: 26 Jul 2010 04:02 PM PDT Can you be a world dominating company when there's inherently cyclicality and volatility in the underlying price of the commodity you produce? Or even more simply can commodity stocks be world dominators? We take up the same question we tackled in yesterday's Daily Reckoning. If you accept the premise that you're investing in a great transitional period in history where, generally speaking, standards of living are falling in the West and rising in the East, what Australian companies (if any) are in the best spot to dominate (or at least profit) from this trend? It might not be as easy to profit as it sounds. Take volatility. According to Emma Connors in today's Australian Financial Review, "A sharp increase in volatility in the always fast-moving commodities markets has underlined the difficulty inherent in forecasting prices." Despite this difficulty, the government is basing its budget forecasts on record high commodity prices and a record high terms of trade. It's the huge gains in coal and iron ore prices that will contribute to a nominal 9.25% rise in GDP next year according to the Treasury forecasts. Remember, though, that you can subtract 6% from that rate, the undeclared rate of inflation. In recent weekly updates to Australian Wealth Gameplan we've reported that Chinese steel prices and iron ore imports (along with ore prices in the spot market) have both been trending down. But in Bloomberg today we read that Chinese steel prices were up 4.7% last week, the most in eleven months. What gives? We reckon this volatility is introduced by the $1.4 trillion in Chinese stimulus measures from last year. That spending coincided with a boom in fixed asset investment. Now, the question is how much of the demand and spending was driven by stimulus, and how much is sustainable? "Chinese banks may struggle to recoup about 23 per cent of the $1.3 trillion they've lent to finance local government infrastructure projects, according to a person with knowledge of data collected by the nation's regulator," reports Andrea Papuc, also in Bloomberg. "About half of all loans needed to be serviced by secondary sources including guarantors because the ventures couldn't generate revenues, the source said, declining to be identified because the information is confidential." Hmm. You mean Chinese banks went on a lending boom to finance projects that are not generating a return and the loans might damage bank capital? Sounds familiar, doesn't it? "The government has been grappling with how to rein in the credit fuelled stimulus before it leads to overheating, according to a July 14 report by Fitch Ratings analyst Charlene Chu. Lending hasn't slowed as much as official data suggests because Chinese banks are shifting loans off balance sheets by repackaging them into investment products sold to investors, the report show." Hey, that doesn't sound anything like the securitisation of subprime mortgages AT ALL, does it? But rather than make allusions to the last credit bubble in which cheap money was fuelled into an asset class that was sold to investors but failed to generate a big return, we should just say that if the earnings growth of Aussie resource stocks depends on regular, predictable, steady Chinese demand, earnings growth is going to be really volatile. That's not to say that the iron ore and coal companies taking advantage of record export prices can't be world dominators. They can be, if only based on their ownership of easily accessible, high quality ore bodies. But the underlying assumptions about the prices for those commodities may be overly stable, given the violent nature of bursting bubbles. But hey, laissez le bon temps rouler, as they say in New Orleans. Let the good times roll. Tomorrow, how not to get rolled over. Dan Denning |

| The American People Don't Need More Handouts – What They Need Are Good Jobs Posted: 26 Jul 2010 04:00 PM PDT

The truth is that the American people were never told that "free trade" and a "global economy" would mean that they would soon be lumped into a giant global labor pool and would be forced to compete for jobs with people on the other side of the globe. No, we were just told that we should enjoy all of the cheap plastic crap made overseas that all of the "big box" retail stores were pushing us to buy. Well, the party was fun while it lasted. Americans ran up unprecedented amounts of debt on their credit cards buying all this stuff, while our once great manufacturing cities degenerated into rotted-out war zones. But isn't it a good thing to get all these products at such a cheap price? After all, who wants to pay substantially more for things? Well, running an economy this way is kind of like tearing off pieces of your house in order to keep your fire going. Sure the fire will burn brightly for a while, but eventually you will have torn down your entire house. One way or another, we end up paying dearly for the jobs we have shipped overseas. You see, the millions of Americans who are now chronically unemployed because of "free trade" have to be supported by the U.S. government. That means that it is the U.S. taxpayers who end up footing the bill. You didn't think that we were going to let all of those unemployed workers starve in the streets, did you? Without good jobs, an increasing number of Americans are becoming completely dependent on government handouts. Already, state governments across the United States are going broke trying to pay out unemployment benefits to the hordes of Americans who don't have a job and can't find a job. In addition, for the first time in U.S. history, more than 40 million Americans are on food stamps, and the U.S. Department of Agriculture projects that number will go up to 43 million Americans in 2011. Also, according to one new study, somewhere around 21 percent of all children in the United States are living below the poverty line in 2010, which is the highest rate in 20 years. The truth is that more Americans are dependent on direct payments from the federal government than ever before. But how long can we afford to support the millions upon millions of Americans who have been impoverished by this new "global economy"? The U.S. government budget deficit was a record $1.4 trillion in 2009. Now the White House says that we will exceed that figure in 2010 and again in 2011. So just how long can we afford to run deficits equivalent to 10 percent of GDP? Anyone with half a brain knows that these kind of debts are not anywhere close to sustainable. So where is the money going to come from to pay for these exploding government programs? Well, from you of course. Recently I dubbed 2011 "the year of the tax increase". A whole slew of new taxes is scheduled to go into effect starting next year that will impact every single American taxpayer. It is almost enough to make you want to stop working and start collecting government handouts instead. But the American people don't need even more handouts. Handouts are only a temporary solution to a long-term problem. What the American people need are good jobs. But where in the world are these jobs going to come from? The reality is that in the new "global economy", the United States is a very unattractive place to do business. If you were a global corporation, would you rather open a new facility in the third world where there are very few rules and regulations and where people will work for less than a dollar an hour, or would you rather open a new facility in the United States where there are literally thousands of laws and regulations to comply with and where you are going to have to pay workers at least ten times as much? It doesn't take a genius to see where all of this is headed. For decades, an increasing number of Americans have been forced into lower paying service jobs, but now there aren't even nearly enough of those to go around. But it isn't just the jobs that have been shipped overseas that are depressing wages and causing unemployment to skyrocket. The millions of illegal immigrants that have flooded unchecked across the border have depressed wages and fundamentally changed the employment picture in industries such as construction and food service. Not only that, but in this environment not even high tech workers are safe. In fact, there are some corporations in the high tech industry that have been openly abusing worker visas to ship in large numbers of foreign workers to replace more expensive American employees. What all this means is that it is becoming much more difficult to live a middle class lifestyle in the United States. Perhaps that is why one of my articles struck such a nerve recently. An article that I originally wrote for The American Dream blog and adapted by Business Insider has gone mega-viral and has ended up on Yahoo Finance. The article was entitled "The Middle Class In America Is Radically Shrinking - Here Are The Stats To Prove it" and it has received over 9000 comments on Yahoo. So why did it provoke such an extraordinary response? Well, because it hits people where they live. Today, millions of American families are really struggling. Record numbers of middle class Americans are receiving foreclosure notices and record numbers of middle class Americans are going bankrupt. In fact, more Americans than ever find themselves just trying to survive. According to a poll taken in 2009, 61 percent of Americans "always or usually" live paycheck to paycheck, which was up from 49 percent in 2008 and 43 percent in 2007. You see, the truth is that most American families are not concerned with saving for retirement or even with planning for next year. In this economic environment, most American families are worried about how they are going to survive until next month. So who has been doing well in the new global economy? The very, very wealthy of course. According to Harvard Magazine, 66% of the income growth between 2001 and 2007 went to the top 1% of all Americans. Now, the truth is that there is absolutely nothing wrong with making money, but by any reasonable standard an economic system that produces such skewed results is horribly broken. So will "redistributing the wealth" solve things? No, it won't. At best, "redistributing the wealth" is only a temporary solution and it always ends up creating a lot of long-term problems. What the American people really need are millions more good jobs. But as we have seen, the current imbalances in the new "global economy" make it more likely that the American people will continue to lose millions more good jobs rather than gaining them. Unless something is done, the standard of living for middle class Americans will continue to be forced down as labor increasingly becomes a global commodity. So are you just going to accept that, or are you going to start demanding that your representatives change things? The choice is up to you. |

| Gold Seeker Closing Report: Gold and Silver End Mixed Posted: 26 Jul 2010 04:00 PM PDT Gold rose $6.10 to as high as $1194.50 in Asia before it fell back off in London and New York to as low as $1179.80 by around 11AM EST and then climbed back higher in the last couple of hours of trade, but it still ended with a loss of 0.29%. Silver dropped to as low as $17.98 in London before it spiked up to $18.24 in early new York trade and end then dropped back to see a slight loss by late morning, but it then rallied back higher in late trade and ended with a gain of 0.44%. |

| Posted: 26 Jul 2010 02:27 PM PDT I just returned from the 2010 Agora Financial Investment Symposium in Vancouver, B.C. This year's theme, "Assault on Enterprise," provided a fascinating context for a wide range of investment insights and recommendations. According to many of this year's presenters, the assault on American enterprise is intensifying. Because the government has been overpromising, overcommitting and overspending for decades, it is hurtling toward a fiscal train wreck. The numbers have stopped adding up. Looking out, there's NO WAY that most Western governments can ever pay their ongoing obligations or pay off past debt. But that doesn't mean that governments won't try to maintain their expensive and intrusive invasion of the private sector. In fact, the odds point to rising taxation and tightening strictures on all aspects of capital formation. The effects will be to make you poorer, either by taking your money or by blocking you from pursuing your dreams. On the first day of the Vancouver conference, for example, former US comptroller of the currency David Walker summed things up, saying, "Government has grown far too big, promised far too much and delivered far too little for far too long." Mr. Walker backed up his claim with slides showing how, over just the past nine years, unfunded liabilities on the government's balance sheet - Social Security, Medicare, Medicaid, etc. - have tripled. For example, Medicare alone has a $38 trillion ("trillion," no typo) hole in its future. Meanwhile, according to Mr. Walker, Social Security is now cash-flow negative. That is, Uncle Sam is paying out more out than he receives in revenues. Uh-oh. So where does the "extra" money come from? Out of general revenues. Which means that the federal deficit makes up the difference. Which means that the government just borrows the money and papers over the hole in the budget. On this track, the nation's key social safety net - a "retirement fund" (ahem) for elderly people - is moving further and further into the red, forever. What's the answer? Well, you could ask the always understated Doug Casey. In Doug's view, it's all good - for the moment. That is, he believes we're in the midst of a "Greater Depression" and right now we're basking in the calm eye of the hurricane. The problem, according to Doug, will come when we go through the eye and get hit by the other side of that storm. But Doug is not one simply to identify a problem and fail to offer solutions. Indeed, he shared five ways reduce the inevitable damage:

Sad to say, according to Doug, none of this will happen. These proposals are mere "pipe dreams," he admits. "The government is doing the exact opposite," says Doug, despite the clear evidence that "the very idea of the nation-state - which has been around only since the 17th century - has failed." Thus, instead of a somewhat orderly, controlled financial collapse as governance across the world restructures, we'll experience the chaos of decline and collapse. Doug's recommendation? For the individual, buy gold and silver. Doug is also big on productive agricultural land - in remote parts of the world, far from the looming unpleasantness. Otherwise? Well, you just have to do the best you can. Gloomy, right? In my mind, "provocative" is more like it. That is, if there's one thing that Doug Casey can do, it's push the edge of the intellectual envelope. There's no failure of imagination with Doug and his views of where the economy is headed. In my talk to the 1,000 or so Vancouver attendees, I discussed the failure of imagination that brought about the explosion and sinking of the Deepwater Horizon (DWH) and the subsequent well blowout in the Gulf of Mexico (GOM). I noted that when I was in Houston in May for the Offshore Technology Conference, I had a discussion with some people from the maritime insurance industry. One guy told me that before the DWH exploded and sank, the insurance industry rated the risk of such an event as zero. Zero? As in no large deep-water drilling vessel would ever sink. "We thought it could never occur," he said. "Never." In my talk here in Vancouver, I analogized how that sort of failure of imagination was right up there with the idea that the Titanic was unsinkable. Thus did the British Board of Trade not mandate enough lifeboats on the vessel. I looked back at two other disasters, both in January 1969. I reviewed the terrible fire aboard the nuclear-powered Navy aircraft carrier USS Enterprise on Jan. 14 of that year. The flight deck was an inferno, with 500-pound bombs cooking off. Dozens of sailors were killed, with hundreds more injured. The ship suffered severe damage, and for a time, there was a distinct possibility of the vessel - and its eight nuclear reactors - sinking in the middle of the Pacific Ocean. Yes, heroic actions by the crew saved the ship. But it was a close call. Then I discussed the Santa Barbara, Calif., oil blowout about two weeks later, on Jan. 29, 1969. No lives were lost, but the environmental impact was severe. Political pressures all but closed off the West Coast of the US to future energy exploration. Out of these two disasters, the Navy, of course, kept on going with nuclear power, but with much-changed procedures to improve safety and harden against damage. The oil blowout was a key factor in the rise of the modern environmental movement. The offshore industry redoubled its efforts to drill safely, in deeper and deeper waters. For the past 41 years, since Santa Barbara, there was all that oil coming from offshore, and from deeper and deeper waters, and with equipment that seemed to work safely. It was, to go back to Doug Casey's notion, like being in the eye of a hurricane. Things seemed OK, for the moment. In a sense, looking back over the decades, it was almost easy to imagine big, expensive, well-built drilling rigs would never blow up and sink. It sure fooled the normally flinty insurance industry. Also, considering the track record of operations, it was easy to believe that deep-water wells would never blow out. It apparently fooled the engineering and regulatory community. Surely, no one was ready to deal with the current Gulf of Mexico blowout. As I've noted many times, in the past couple of months, we've witnessed decades of R&D all compressed into an emergency-level time frame. The hastily imposed GOM drilling "moratorium" is just one more energy problem for the US. It compounds an already dysfunctional national energy policy. It's as if we would shut down the entire airline industry just because one airliner crashed - due almost certainly to pilot error, by the way. The GOM drilling moratorium is terrible policy for medium- and long- term US energy production. We're already seeing rigs leave the GOM destined for other continents. We won't see those rigs back here for many years, most likely. And GOM oil output is now destined to fall, meaning that US oil imports will rise - if we can find the oil in a competitive world. Meanwhile, I discussed how some other energy sources might help the US, but with a hard cautionary note: These other energy supplies might not offer as much as many people believe. The short version is that there's not as much shale gas as people believe, although there are some great shale gas investments. And then I highlighted the promise of Canadian oil sands. Much of that was similar to what I said in the most recent Outstanding Investments issue, in which I introduced readers to Cenovus (NYSE:CVE), an up-and- coming oil sands producer. I'll amplify the Vancouver message of resource scarcity in future emails and Outstanding Investments issues. The times may be rough for debt-strapped governments, but there has never been a better time for identifying investment opportunities in the natural resources sector. Regards, Byron King |

| Major German business magazine publicizes gold price suppression scheme Posted: 26 Jul 2010 02:05 PM PDT 10:07p ET Monday, July 26, 2010 Dear Friend of GATA and Gold: The July 21 edition of a major German business magazine, Focus Money (http://www.focus.de/finanzen/) carries a huge and profusely illustrated article written by its editor, Johannes Heinritzi, about gold market manipulation by central banks and governments. The article begins with reference to the mysterious and surrpetitious gold swaps recently undertaken by the Bank for International Settlements. It cites speculation that central banks do not really have the gold they claim to have. It notes that there has been no audit of the U.S. gold reserve for half a century. It repeats former Federal Reserve Chairman Alan Greenspan's famous testimony to Congress that "central banks stand ready to lease gold in increasing quantities should be price rise." It reports that Asian central banks have become gold buyers. And it quotes gold analyst Ronald Stoferle of First Group Bank in Vienna as saying that the motives of central banks and governments to suppress the gold price "are clear and plausible" and that it would be "naive" to think that they're not doing it. Imagines of the magazine's cover and the pages with the gold price manipulation article can be found here: http://bullioncafe.blogspot.com/ A hamhanded and occasionally comic but still generally helpful computer translation of the article from German to English can be found here: This cat is out of the bag and prowling Europe. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

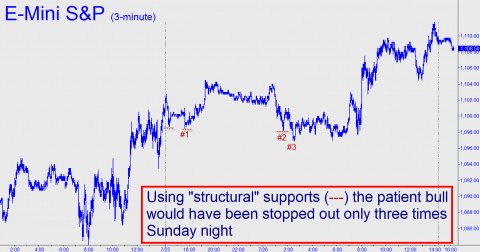

| Forecast Leaves 232 Dow Points to Go Posted: 26 Jul 2010 01:40 PM PDT By Rick Ackerman, Rick's Picks Stocks on Monday achieved a bit less than a third of the gains we had unenthusiastically projected for the week, with the Dow Industrials settling exactly 100 points above Friday's close. We say we were unenthusiastic in forecasting a 350-point rally because share buyers themselves have shown little enthusiasm for the task. Even so, they've continued to lift offers more or less steadily, producing a rising trendline with a pitch of about 12 degrees. We've seen steeper grades driving through Nebraska, but that's not the point. In fact, the lukewarm, steady buying that has persisted in July is exactly the kind of buying that typically accounts for most of the stock market's gains most of the time. This summer's rally has been punctuated by short squeezes and gap-up openings whenever conditions have been favorable, which has been about once or twice per week. The actual close on the Dow yesterday was 10525, exactly 232 points shy of the 10757 target sent out to Rick's Picks subscribers Sunday night. (Get free forecasts and access to the 24/7 chat room for a week by clicking here.) If you're a market timer, we'd suggest paying close heed to that number, since, according to the Hidden Pivot method we use to predict swing points both minor and major, it is not exactly chopped liver. We'll likely use Diamond puts to get short if and when the opportunity arises, although we would be doing so without any preconceived notions about catching the Mother of All Tops. Simply catching "a top" is usually good enough to chase summer boredom and perhaps make a few bucks in the process, but we would be the first to acknowledge that few have gotten rich over the years by buying put options. (As much could be said of those who have bought call options over the years. Truth be told, it is a tough game, and beating it even a little bit takes every bit of knowledge that we have acquired in 35 years of option trading). Not as Devious We also hope to leverage the implied 232-point rally to the target, although it is usually much more difficult to get onboard a well-developed trend than to get short at the trend's predicted destination. We acknowledged this Sunday night in trading advice proffered for the E-Mini S&Ps. That the futures would head higher in the wee hours Sunday night seemed pretty obvious, at least to us, but we saw no easy way to catch a ride without risking getting stopped out at the obvious "structural" supports that other traders would be using. As it happens, the rally was less devious than we might have expected. The chart above shows that it aborted just thee times overnight by taking out lower lows. This hinted that Monday's action would be bullish but not powerfully so. Strong rallies often traverse the distance between the day's lows and highs without stopping out any prior lows on the intraday charts. The trick to catching such rallies requires only that one be a true believer the whole day. In practical terms, that means assuming that each new rally leg will unfold without much of a pause. (If you'd like to have Rick's Picks commentary delivered free each day to your e-mail box, click here.) Rick's Picks is a trading newsletter for stock, gold, silver and mini-indexes. All trades are based on the proprietary Hidden Pivot technical analysis method. © Rick Ackerman and www.rickackerman.com, 2010. |

| Ron Paul: We Cannot Even Maintain the Zinc Standard Posted: 26 Jul 2010 01:36 PM PDT The US Mint has had trouble keeping up with precious metal coin demand for most of this year, and it now appears the investigation into why that's the case may also consider the economics of penny and nickel production. The US House Subcommittee on Domestic Monetary Policy has been looking into why there are backlogs at the Mint, especially with proof and uncirculated coins, and what can be done to improve the production process. For quite some time it's been easy to find disclaimers such as this on the US Mint website: "Due to the continued, sustained demand for American Eagle Gold Bullion Coins, 2009-dated American Eagle Gold Proof Coins were not produced." The bullion coins are made available through authorized dealers and not directly through the Mint. Mineweb has more details: "[Director of the U.S. Mint Edmond] Moy told the subcommittee uncertainty surrounding traditional investments and inflation concerns 'drove investor demand for bullion precious metals in all forms to exceptional highs in 2009.' "As a result, the agency did not mint and issue what Moy called 'the very popular' American Eagle One-Ounce Proof Gold and One-Ounce Proof Silver Coins in 2009. "Although bullion coin demand seemed to be subsiding earlier this year, in May, the Mint experienced an increase in orders for silver bullion coins to over 3.6 million coins. In fiscal year 2009, bullion coins sales reached an all-time high of $1.7 billion, nearly 80% above the sales of fiscal year 2008." The Chairman of the Subcommittee, Congressman Melvin Watt (D-NC), is interested in diverting some of the precious metal coin blanks allocated for bullion coin production to supplement needs for numismatic coin production. Separately, Director Moy also griped that, "with regard to the one-cent and five-cent coins, never before has the nation spent more to mint and issue a circulating coin than its legal value. This problem is needlessly wasting hundreds of millions of dollars." Dr. Ron Paul (R-TX) disagrees with the Watt and Moy perspectives because the Mint should not be gaining any additional power to decide the metal makeup of coins in circulation. Here is his language verbatim, again from the Mineweb article: "We could not maintain the gold standard nor the silver standard. We could not maintain the copper standard, and now we cannot even maintain the zinc standard," Paul noted. "Paper money inevitably breeds inflation and destroys the value of currency." Moy brings up a valid point. The US is spending more to produce pennies and nickels than they are worth. However, Dr. Paul recognizes the greater problem is the eroding value of US legal tender, one that isn't showing any signs of abating. You can read more details in Mineweb coverage of bullion and coin dealers calling for an investigation into the US coin blanks supply. Best, Rocky Vega, Ron Paul: We Cannot Even Maintain the Zinc Standard originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| Posted: 26 Jul 2010 01:36 PM PDT There are two major schools of thought on what is coming next…and two renegade, home-schools too. There are those who believe we have a recovery…though weak…that will continue and eventually bring the economy back to health. This is the line of the Obama Administration and most mainstream economists. Then, there are those who think the recovery will not come as planned…and that the feds' efforts to spur a recovery – along with strong demand from Asia and the emerging markets – will lead to higher levels of inflation, destroying the dollar and bonds. This is what Marc Faber expects. He urges listeners to avoid going too heavily into cash, since it might be the number one victim of inflation. Instead, you'll do better in stocks and real estate, he says. A third line of thinking is what Faber calls "hard core deflationism" – typified by Robert Prechter and Gary Shilling. They think the de-leveraging trend will be catastrophic – leading to outright deflation, taking the Dow down below 1,000, for example. Then, there's The Daily Reckoning line. You can call it "soft-core deflationism": 1) There is no recovery; there won't ever be a recovery What does that mean for gold? Well, it means gold won't do spectacularly well. It might decline…say, down to $850 or so. Eventually, the bull market in gold will resume, however. You can't keep a good metal down. Just don't expect it to go up dramatically while the private sector is reducing its debts in an orderly fashion. Does that mean you should sell your gold? We wouldn't if we were you. Because something could go very wrong. Another big bank failure. A blow-up in China. It wouldn't take much to cause a panic. Investors could turn to gold for security. Or, maybe the feds will panic…and dump dollars from helicopters as Ben Bernanke threatened. Besides, we could be wrong. Predictions are always difficult to get right. Especially when they're about the future. Regards, Bill Bonner Soft-Core Deflationism originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| Bullion, coin dealers call for investigation of U.S. coin blanks supply Posted: 26 Jul 2010 01:34 PM PDT Bullion, coin dealers call for investigation of U.S. coin blanks supply A congressional subcommittee has been asked to investigate the growing backlog in and foreign procurement of U.S. bullion and collectors' precious metals coin blanks manufactured by the U.S. Mint. Author: Dorothy Kosich Posted: Monday , 26 Jul 2010 RENO, NV - Witnesses before and members of the U.S. House Subcommittee on Domestic Monetary Policy have urged Congress to direct the U.S. Mint to buy U.S. manufactured blanks for gold and silver bullion coins and discontinue the practice of using Australian-made blanks. Meanwhile, the Director of the U.S. Mint Edmond Moy told the subcommittee that, if the Mint can begin production by September, "we will be able to produce about 830,000 one-ounce silver American Eagle coins to meet collector demand for this product in the remaining months of 2010." Moy told the subcommittee uncertainty surrounding traditional investments and inflation concerns "drove investor demand for bullion precious metals in all forms to exceptional highs in 2009." As a result, the agency did not mint and issue what Moy called "the very popular" American Eagle One-Ounce Proof Gold and One-Ounce Proof Silver Coins in 2009. Although bullion coin demand seemed to be subsiding earlier this year, in May, the Mint experienced an increase in orders for silver bullion coins to over 3.6 million coins. In fiscal year 2009, bullion coins sales reached an all-time high of $1.7 billion, nearly 80% above the sales of fiscal year 2008. While Moy said the Mint had no difficulty in obtaining gold, silver and platinum in raw materials form, "We experienced considerable difficulty in getting this raw material fabricated into planchets by our vendors in sufficient quantities to meet public demand." As a result, sales of discretionary gold and silver proof and uncirculated coins where hurt because they use the same planchets as their mandatory bullion coin counterparts. Moy told the committee that all incoming planchets were diverted "to fulfill our statutory obligation to meet public demand for bullion coins." Moy said he was encouraged that the House Subcommittee on Domestic Monetary Policy "is exploring the possibility of an amendment that would afford the Secretary [of the Treasury] the authority to approve the minting and insurance of American Eagle Silver Proof and Uncirculated Coins even when we are unable to meet the public's demand for the bullion versions of these coins." "Indeed, such a change would be one of the most positive customer satisfaction measures that could be taken to benefit your coin collecting constituents without having an effect on Americans' ability to acquire investment-grade silver bullion.' However, he added, "such a change needs to be enacted soon." Meanwhile, Moy told the subcommittee, "Compared to their face values, never before in our nation's history has the government spent as much money to mint and issue coins and, with regard to the one-cent and five-cent coins, never before has the nation spent more to mint and issue a circulating coin than its legal value." "This problem is needlessly wasting hundreds of millions of dollars, he declared. The Department of Treasury is seeking the authority to determine the materials for all coin dominations. Moy said "we are proposing to save millions of dollars per year-over one billion dollars in the next 10 years-by determining the materials for the other coin dominations." Subcommittee Chairman Rep. Melvin Watt, D-North Carolina, said, 'We need to evaluated whether it would be a good idea to divert refined gold and silver from the bullion program to meet demand for numismatic products and what impact this would likely have on the supply of metals for bullion products." Ranking Subcommittee Member Rep. Ron Paul, R-Texas, said he opposes the Mint's current efforts to gain greater power in determining the composition of circulating coinage. "We could not maintain the gold standard nor the silver standard. We could not maintain the copper standard, and now we cannot even maintain the zinc standard," Paul noted. "Paper money inevitably breeds inflation and destroys the value of currency." Michael B. Clark, president of the Diamond State Depository, a subsidiary of the Dillon Gage group, one of 12 authorized purchasers of American Eagle Silver Bullion Coins, told the subcommittee, "The Mint's inability to keep pace with demand has had a negative and unnecessary impact on the investment and hobby community." He added that the Mint's reliance on just three suppliers for planchets or blanks "is flawed. Moreover, there is some irony in the fact that while Congress requires the Mint to procure the gold for its Eagle bullion coins from newly mined U.S. deposits, the Mint then ships that gold to Australia to be made into blanks. Then, the fabricated blanks are later shipped back to the United States for the production of coins." "The efficiency of this system is obvious, and it seems that we should be able to create jobs at home by sourcing these blanks in the United States and eliminate the costs of inter-continental shipping," Clark noted. Clark, who is a past chairman and currently a director of the Industry Council for Tangible Assets, asked Congress to take the following actions: 1. Authorize the Mint to produce both proof and uncirculated versions of the Gold and Silver Eagle Coins, regardless of the bullion coin demand requirements; 2. Direct the General Accountability Office to undertake a review of the Mint's blanks procurement process and seek GAO's recommendations on what can be done to improve it; and 3. Require the Mint procure the blanks for its bullion program from sources within the United States by no later than 2014. The Industry Council also is asking Congress to produce a palladium bullion investment coin through the American Eagle Bullion Coin Program. "Further, the introduction of a palladium coin may absorb some of the demand for the Silver Eagle, and reduce some of the Mint's production burden for that coin," Clark advised. He also suggests a palladium bullion coin would create or maintain U.S. mining and refining jobs in Montana, New Jersey, California and South Carolina. Finally, Clark urged Congress "to take swift action to protect consumers" from the increasing counterfeiting and subsequent marketing of counterfeit numismatic, rare and investment-grade level tender U.S. Coins. http://www.mineweb.co.za/mineweb/vie...ail&id=102055 |

| Coin Monday: The Quantum Pedigree Posted: 26 Jul 2010 01:34 PM PDT Heritage Auction Galleries Written by John Dale Schrödinger's cat is dead. Schrödinger's cat is not dead. Schrödinger's cat is replaced by Schrödinger himself whenever I consider his thought experiment, because I could never do that to a kitty. (I skipped the AP Biology course in high school because I would have had to dissect a cat. To do that and then go home to Bootsie, Callie, and Tribble… it wasn't happening.) Quantum states, probability and uncertainty, the idea that the top card of a shuffled deck is 1/52 an ace of spades and just as much a deuce of clubs until the moment you turn it over… it's rare that such concepts can be applied to numismatics. Most coin information is either treated as established fact or considered unknowable, lost in myriad possibilities. We know whether Schrödinger is dead or not dead… or we will never be able to open the box. Yet I came across an instance recently with two well-defined and discrete possibilities, served up with a large side of uncertainty. There were two Plain Edge, Wire Rim Saint-Gaudens ten dollar pattern coins made in 1907. Heritage has one of them, the only one known to have survived, in its upcoming Official ANA U.S. Coin auction in Boston.

The known history of this particular coin goes back only a few years. Yet recent numismatic research has revealed what happened to the two Plain Edge, Wire Rim tens immediately after they were struck:

In mid-July 1907, one was sent to then-Secretary of the Treasury George B. Cortelyou, who forwarded the coin to President Theodore Roosevelt. The other was sent to the coins' designer, the sculptor Augustus Saint-Gaudens.

One coin, two possible destinations… Roosevelt or Saint-Gaudens, president or artist… a quantum pedigree. If the coin went to President Roosevelt, then it was seen by the man who made coin design reform his "pet crime," whose drive and determination had brought the project this far and would see it through after the death of Saint-Gaudens. Impressive history, and yet this coin could be even more important. Augustus Saint-Gaudens died on August 3, 1907. He did not live to see his designs on circulating coinage. In fact, he only ever saw his work in coin form once, just weeks before his death, when he was sent the Plain Edge, Wire Rim ten in mid-July. If this is the Saint-Gaudens coin, then it is the only Saint-Gaudens gold coin that the artist himself ever saw. The possibility is historically important and emotionally resonant. Little is known about either coin in the time after distribution. The Saint-Gaudens coin fell completely off the radar, while archived Mint materials indicate that the Roosevelt specimen was sent back to the Mint. Just as there is no record of the Saint-Gaudens piece in the artist's estate, there is no record of the Roosevelt piece in the National Numismatic Collection, successor to the Mint cabinet. Assuming only one of the Plain Edge, Wire Rim tens survived, which environment would be more likely to produce a single coin in private hands: the Mint, where many patterns were saved for the Mint cabinet but many more were melted; or the estate of Saint-Gaudens, where family members and relations-in-art were grieving over his death? The latter environment, with its reverence for all things Saint-Gaudens, seems far more likely to have preserved its Plain Edge, Wire Rim ten; thus, it gets the nod from Heritage's perspective as the pattern's more likely origin. For now, uncertainty reigns… though not only uncertainty, but also probability and hope. Beyond the known lies the possible, and someday, a future researcher poring through Mint correspondence or the Saint-Gaudens archives may find the answer, the one key clue that opens the box and reveals the truth, attaching a single story to this singular pattern. Until then, we can savor the possibilities.

To leave a comment, click on the title of the post.

-John Dale Beety |

| Landmark Sixpence Leads Heritage ANA Boston World Coin Auction Posted: 26 Jul 2010 01:33 PM PDT Highlights include rarities from Brazil, China, Great Britain and Russia, plus Spanish Colonial and U.S. regulated World gold, Aug. 12-16 DALLAS, TX — The global reach of numismatics is on full display with Heritage Auction Galleries' Official American Numismatic Association World Coin Auction, to be held Aug. 12-16, at the ANA in Boston, MA.  The first known George V 1928 South Africa Sixpence, struck in sterling silver and graded SP63 by NGC is the Heritage ANA Boston World Coin Auction highlight. It is estimated at $200,000 to $300,000 (USD). "We've put together a very strong sale for our first official ANA World Coin auction," said Cristiano Bierrenbach, Vice President of International Numismatics for Heritage…. Read the rest of Landmark Sixpence Leads Heritage ANA Boston World Coin Auction (977 words) © 2010 CoinNews Media Group LLC |

| Legend Acquired and Sold Rare 1804 Eagle Coins to Appear at Boston ANA Posted: 26 Jul 2010 01:33 PM PDT "It's beyond incredible to see these two coins side-by-side. A silver proof 1804 $10 redefines 'coolness' in my book, and I've handled an awful lot of world-class rarities. The gold 1804 $10 is so sharply struck it looks like a medal, and it's one of the most beautiful coins I have ever seen," said Laura Sperber of Legend Numismatics. One of the three known proof 1804 Eagles made on behalf of President Andrew Jackson and a rare 1804 Eagle silver pattern have been acquired by Legend Numismatics of Lincroft, New Jersey and sold to a Texas collector.  Graded NGC PF65 Ultra Cameo, this 1804 proof Eagle (Judd-33) was recently acquired and sold by Legend Numismatics, and now will be displayed at the ANA World's Fair of Money in Boston, August 10 – 14, 2010. (Photo credit: Numismatic Guaranty Corporation) Both coins will be publicly displayed together for the first time at the upcoming American Numismatic Association World's Fair of Money convention in Boston, August 10 – 14, 2010…. Read the rest of Legend Acquired and Sold Rare 1804 Eagle Coins to Appear at Boston ANA (527 words) © 2010 CoinNews Media Group LLC |

| The Story of the Two Greatest Gold Shipments In The History of the United States Mints Posted: 26 Jul 2010 01:32 PM PDT by Dr. Thomas F. Fitzgerald from the California Numismatist Twice within a span of almost twenty-five years, all of the gold from the vaults of the 2nd San Francisco Mint, sometimes called the "Granite Lady," was sent to the United States Mint in Denver, Colorado. Yet the story of these two operations could not have been more different. The first transfer was accomplished with so much secrecy that even the newspapers knew nothing of what was going on. But the second transfer was so well publicized that it included parades and search-lights calling attention to the shipments. This is the story of these two great shipments of gold. The Very Secret Gold Transfer of 1908In May 1897 newspaper editor and publisher Frank A. Leach accepted a political appointment by President McKinley to become the superintendent of the San Francisco Mint. He had wanted to divest himself of the newspaper business and this seemed like an ideal new career. Leach assumed his duties on August 1, 1897. The Great San Francisco Earthquake and Fires

Just two years after the famous 1906 earthquake left the San Francisco mint's surroundings in shambles, concerns about the mint's storage capacity and security prompted the move of 331 million dollars worth of bullion to the mint in Denver. Frank Leach made his way from his home in Oakland to the mint and, together with 50 mint employees and a squad of 10 soldiers, prepared to fight the inferno and save the mint. However, at the beginning of the struggle, the outcome was very much in doubt. The battle lasted for hours but shortly before 5:00 p.m. the fires were out and the building was saved. The men were able to leave the mint, return to their homes and reunite with their families. More importantly for our story, the mint's basement vaults that contained millions of dollars of gold and silver coins were saved. The First Great Shipment of Gold to DenverPresident Theodore Roosevelt had succeeded the assassinated President McKinley in 1900. Ten years later in 1908, the president named Frank Leach as "director of all the mints" requiring him to move to Washington DC. In the summer of 1908 it was decided to move all of the 270 million dollars in gold coin and another 61 million in silver coin from the Granite Lady to the Denver Mint because of the lack of storage space in San Francisco. Another factor was the location of San Francisco on the Pacific Ocean and thus, subject to an attack from some foreign power. Who could have predicted in 1908 what was to occur at Pearl Harbor in 1941, some 33 years later? The First Great Transfer of Gold to the Denver MintThere were several concerns regarding the transfer of the gold coins from the San Francisco Mint to the Denver Mint. There was a concern that this transfer of coins would not result in any loss because of a petty theft and of course, there was always the possibility of a robbery by a well organized gang of train robbers.

Early in 1908 Frank Leach traveled to San Francisco to make the arrangements for the transfer that would contain the largest amount of coinage ever moved! A contract was signed with Wells Fargo & Company, and the U.S. Marshal in San Francisco employed 30 guards. No one involved, from those who would transfer the coins to those mint employees who would inventory and pack the shipment in both San Francisco and Denver, could divulge any information. The money in the vaults of the mint in San Francisco was stored in canvas bags that each contained $5,000 in gold coins. Eight of these bags were packed in strong pine-boxes that were bound with iron bands. The lids were screwed on and then sealed with the seal of the United States by a specially designated official. The first shipment of gold coins to Denver took place on August 15, 1908. This was followed with two shipments of $5 million each per week. The coins were placed in horse-cars that were a part of the regular express trains in 1908. To any observer, the horse-cars could have been transferring thoroughbred horses. Each shipment was accompanied by 15 deputy United States Marshals dressed as ordinary citizens. The last shipment was on December 19, 1908. There was never any sign of trouble and not a word appeared in the newspapers of San Francisco or Denver. Not one dollar was lost! The Second Great Transfer of GoldIn July of 1933, following the election of Franklin Delano Roosevelt as the 32nd president of the United States, Peter J. Haggerty replaced Michael Kelly as Superintendent of the mint in San Francisco. In fact, he became responsible for two mints in that city because the new facility, located on Market and Buchanan streets, was now ready to replace the "Granite Lady." He assumed responsibilities for both facilities. Hagerty served as superintendent of the San Francisco Mint until 1945. The Second Great Transfer of Gold to the Denver Mint The 3rd San Francisco Mint was built to strike coinage and did not have space in well-protected vaults to store large numbers of coins. As plans were made to vacate the 2nd mint, the circumstances were similar to the conditions resulting in the very secretive transfer of gold coin in 1908. However this time, Haggerty made significant changes in his plans for the shipments of gold to the Denver Mint in 1933. This transfer of gold, greatly surpassed the amount of gold transferred in 1908. It was called "The greatest movement of gold bullion in all history." Unlike the secrecy of 1908, these shipments were accomplished with great fanfare including spotlights and a "parade of trucks loaded with gold bars." The parade, to the Southern Pacific railroad depot, was repeated three times per week until all of the bullion had arrived safely at the Denver Mint. The San Francisco Police and the United States Army provided the security for these shipments. After all of the counting was done at the mint in Denver, it was discovered there was a shortage of only one gold bar that was valued at $37,000. Eventually the missing bar was found under the seat of one of the delivery trucks. The driver testified that it had fallen under the seat without his knowledge. Now that all of the gold was accounted for, no charges were filed against him.

According to the US Mint website, Fort Knox holds 147.3 million ounces of gold which is held as an asset of the United States at a book value of $42.22 per ounce. In 1941 the holdings peaked at 649.6 million ounces. The weight of a standard gold bar is 27.5 pounds. Related posts:

|