Gold World News Flash |

- The Bear Is Back

- Gold Prices Slide as Dollar & Stocks Sink on Weak US Inflation

- A Small 'I-Told-You-So' On Bank Stocks

- General Silver’s Last Stand

- Why You Should Begin Buying the World's Safest Stocks

- Update

- Last bull standing 2011

- More Chinese economists urge easing out of Treasuries, adding gold

- If you want to know WHY Scotiabank abused that cancer-stricken silver depositor. ...

- If you want to know WHY Scotiabank abused that cancer-stricken silver depositor. ...

- Biased Lenders

- Credit Crunch 2010

- Gold, Oil and SP500 Trading Patterns

- Ferdi Lips warned about gold market's 100-1 leverage nine years ago

- Ferdi Lips warned about gold market's 100-1 leverage nine years ago

- CARPE AURUM

- Scotiabank gives long abuse to cancer victim trying to reclaim her silver

- Don't get fleeced - get rich: CRASH UPDATE

- Is the Gold Trade ‘Crowded’?

- Gene Arensberg: Metals in backwardation but a little more slippage likely

- James Turk: Waiting for silver's upside breakout

- James Turk: Waiting for silver's upside breakout

- Sinking Prices; Sinking Ships

- More On Scotiabank's Fraudulent Bullion Safekeeping Services

- Gold Prices Holding Up Well

- In The News Today

- A Look Back at the Future of America

- Got Gold Report – Gold “Rumored” Lower, Euro Pops

- Huge Flurry Of Gold/Silver Sales Coming?

- How Will Nations Deal With the End of Their Debt Supercycle?

- GOLD – How Low? $1,181 or $1,165, Maybe?

- Intermediate Term Thesis Renewed

- Buying Gold When Ambivalence Prevails

- Hinde Capital’s Ben Davies On The Gold Market

- Is Gold a Crowded Trade?

- Charting

- Imminent Waterfall Decline in Commerical Real Estate

- Economic Recovery Is Unsustainable in Its Current Form

- Sunday Quickie On Silver

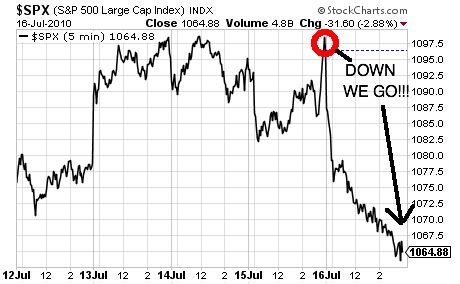

| Posted: 18 Jul 2010 05:42 PM PDT Graham Summers submits: No less than three times last week did I warn that options expiration week would end with a market collapse. Heck, I even published the exact day it would fall to pieces (Friday).  Sure enough, Friday was a disaster, just as I forecast. The S&P 500 kissed its 50-DMA before rolling over and wiping out the entire week's gain in one day. Complete Story » |

| Gold Prices Slide as Dollar & Stocks Sink on Weak US Inflation Posted: 18 Jul 2010 05:29 PM PDT |

| A Small 'I-Told-You-So' On Bank Stocks Posted: 18 Jul 2010 05:27 PM PDT David Goldman submits: On July 13, when I posted my last note urging investors to avoid bank stocks, the BKX bank stock index closed just over 51; on Friday it fell to just over 46, a decline of almost 8%. Bank of America’s (BAC) results showed just what the aggregate data should have made clear in advance: the collapsing loan books of banks makes them dependent on the thin gruel of the Treasury carry trade. With the collapse in yields during the past few weeks, the carry trade is harder and harder to bring off (58 basis points on 2-year Treasuries just doesn’t do very much). Complete Story » |

| Posted: 18 Jul 2010 05:17 PM PDT www.preciousmetalstockreview.com July 17, 2010 I’m referring to the 1876 battle near the Little Bighorn River in Montana where General Custer made his last stand against the Lakota and Northern Cheyenne Native Tribes. In that battle 268 people from the US Seventh Cavalry were killed, including General Custer himself. It was a shocking annihilation that was not expected. Silver is nearing such a battle with the lines drawn and converging on the $18.50 level once again. This level has been a thorn in my side since early 2008, and General Silver has been defeated every single time to date, even after breaching that line temporarily. Will this be the time General Silver prevails, or will he be pushed back once again? That’s the question I cannot answer, and the charts are very mixed as to the outcome at the moment. In terms of the general equity markets I am sending out updates to subscribers on a weekly basis or m... |

| Why You Should Begin Buying the World's Safest Stocks Posted: 18 Jul 2010 05:17 PM PDT By Porter Stansberry Saturday, July 17, 2010 This month, I faced one of the most difficult choices of my career as an investment analyst. If you've been reading my Investment Advisory or DailyWealth for more than a month, you probably know I'm concerned with exploding levels of government debt in Europe and the United States. Western governments have taken on obligations they cannot possibly hope to repay. The outcome will be a severe devaluation of their paper currencies. You can read some of my thoughts on this subject here and here. Now, this is where it gets difficult… Despite all of the world's credit and currency problems, many of the market's highest-quality companies are once again trading for extremely attractive prices, thanks to the fall in stock prices during the second quarter. The question that's keeping me up at night isn't whether or not the currency crisis we're experiencing will worsen. I know it will. What keeps me up at night now i... |

| Posted: 18 Jul 2010 05:17 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 18, 2010 12:43 PM U.S. Stock Market – The Obama aura has disappeared and the majority of Americans now realize the magic carpet some thought he came into power on was just an illusion. In fairness to him, many of the staggering economic, social, political and spiritual problems facing America began long before he took office. Unfortunately, those who thought he could chip away at some of them are now concluding he's only piling on. This in turn has IMHO limited any upside in the stock market. While we can still managed to trade in the upper end of the trading range we've been in for a few months, I do think as* fall approaches the upcoming elections will grip the market's attention and the pressure will be to the downside. U.S. Bonds – There's going to come a day when despite a very weak economy and no real signs of inflation, bonds are... |

| Posted: 18 Jul 2010 05:17 PM PDT One of the most important contributions made in the science of market analysis is the series of equity market rhythms known as the Kress Cycles. The one who discovered these cycles, Samuel J. “Bud” Kress, has done for cycle theory what virtually no one else been able to accomplish, namely discovering a series of inter-related “hard” cycles that are all harmonically related and which provide an accurate context from which to view the past, present and future financial and economic climate. Kress accurately predicted the top of the secular bull market in 2000 with his cycles as well as the credit crisis of 2007-2008. He also called the bottom in March 2009 and, more recently, forecast an interim top for April 2010. For the last 10 years, Bud has published a series of interim reports – roughly once per year – called “Special Editions” (available through his SineScope advisory service, 15 Phoenix Ave., Morristown,... |

| More Chinese economists urge easing out of Treasuries, adding gold Posted: 18 Jul 2010 04:58 PM PDT China Should Cut U.S. Treasury Holdings: Economist By Langi Chiang and Alan Wheatley http://www.reuters.com/article/businessNews/idUSTRE66I05U20100719 BEIJING -- China should cut its holdings of U.S. Treasury securities when market demand is strong, a prominent economist said in remarks published on Monday. Beijing reduced its Treasury holdings in May by $32.5 billion to $867.7 billion, but it actually bought a net $3 billion in long-term Treasuries and remained the largest single holder of U.S. government debt, the Treasury reported on Friday. Yu Yongding, a former academic adviser to the central bank and now a professor with the Chinese Academy of Social Sciences, said Beijing should invest in assets denominated in other currencies as well as other financial instruments and real goods. ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php "Although assets in other currencies and forms are not an ideal replacement for U.S. Treasury bonds, diversification should be a basic principle," Yu wrote in the China Securities Journal. "When demand for U.S. Treasury securities is strong, it's a rare opportunity for us to gradually pull back. That way, it will not have a big impact on prices and China will not suffer too much," he said. Zhang Monan, a researcher with the State Information Center, a think tank under the powerful National Development and Reform Commission, told the paper that China should invest more of its $2.5 trillion of foreign exchange reserves, the world's largest stockpile, in hard assets such as gold. Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| If you want to know WHY Scotiabank abused that cancer-stricken silver depositor. ... Posted: 18 Jul 2010 04:24 PM PDT 12:29a ET Monday, July 19, 2010 Dear Friend of GATA and Gold (and Silver): Thanks to our great friend A.D. in Vancouver for writing, hours before your secretary/treasurer could attempt something similar, an e-mail letter to Toronto Globe and Mail columnist Christie Blatchford, whose compelling account of Scotiabank's abuse of a cancer-suffering silver depositor was dispatched to you Sunday. (See http://www.gata.org/node/8837.) The letter from A.D. is appended. CHRIS POWELL, Secretary/Treasurer * * * Sunday, July 18, 2010 Dear Christie: You wrote a great human-interest story on Scotiabank's treatment of a very ill old lady but missed the background that accounts for the lengths Scotiabank went to in an effort not to have to part with a precious ounce of real physical silver bullion. If, after extensive study and research, you were to form an opinion and disclose the facts from the background to which I refer, your editors would not publish it. In a nutshell, world prices of silver and gold are largely controlled by bullion banks that sell paper futures contracts on the New York Commodities Exchange -- JPMorganChase and HSBC being the big two, with Scotiabank also involved. The paper tail wags the physical dog. (Your dog Obie would like that!) ... Dispatch continues below ... ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth A handful of banks are naked short massive quantities of futures contracts in gold and silver and there is smoke coming out of the market, in particular the silver market. Of the Canadian banks, Scotiabank is the leading player in precious metals trading. Before you dismiss me as a conspiracy nut wearing a tinfoil hat, take a look at a few sentences just written by Ed Steer of Edmonton in his daily commentary for Casey Research. Ed has a worldwide readership, and wrote the following: "Well, I guess you've already figured out that there was nothing free-market about what happened in both the gold and silver pits yesterday. This was all collusively orchestrated by the big bullion banks. Platinum and palladium weren't spared either ... with the bids on both pulled at the New York open as well. It took Ted Butler quite a number of years to pound into my brain that what happens anywhere else in the world is irrelevant as far as the precious metals are concerned. The price is always set by the big bullion banks, led by JPMorgan in New York. I hope, Dear Reader, that you've got that figured out now too." If you want to read all of Ed's commentary it's here: Christie, if your appetite is whetted sufficiently to want to learn more, try the free two-week trial subscription at Bill Murphy's LeMetropoleCafe.com, and once you are into that site, click on: http://www.lemetropolecafe.com/man_ray_table.cfm?pid=8642 Also Google the Gold Anti-Trust Action Committee, which has spent more than 10 years accumulating firm evidence of the manipulation of prices of gold and silver and which also has a large, worldwide subscriber base. I hope that you may now appreciate that the treatment afforded by Scotiabank to the ailing elderly cancer patient who just wanted her silver bullion back was motivated by forces running deeper than you may have anticipated when you wrote your article. Regards, A.D. Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| If you want to know WHY Scotiabank abused that cancer-stricken silver depositor. ... Posted: 18 Jul 2010 04:24 PM PDT 12:29a ET Monday, July 19, 2010 Dear Friend of GATA and Gold (and Silver): Thanks to our great friend A.D. in Vancouver for writing, hours before your secretary/treasurer could attempt something similar, an e-mail letter to Toronto Globe and Mail columnist Christie Blatchford, whose compelling account of Scotiabank's abuse of a cancer-suffering silver depositor was dispatched to you Sunday. (See http://www.gata.org/node/8837.) The letter from A.D. is appended. CHRIS POWELL, Secretary/Treasurer * * * Sunday, July 18, 2010 Dear Christie: You wrote a great human-interest story on Scotiabank's treatment of a very ill old lady but missed the background that accounts for the lengths Scotiabank went to in an effort not to have to part with a precious ounce of real physical silver bullion. If, after extensive study and research, you were to form an opinion and disclose the facts from the background to which I refer, your editors would not publish it. In a nutshell, world prices of silver and gold are largely controlled by bullion banks that sell paper futures contracts on the New York Commodities Exchange -- JPMorganChase and HSBC being the big two, with Scotiabank also involved. The paper tail wags the physical dog. (Your dog Obie would like that!) ... Dispatch continues below ... ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth A handful of banks are naked short massive quantities of futures contracts in gold and silver and there is smoke coming out of the market, in particular the silver market. Of the Canadian banks, Scotiabank is the leading player in precious metals trading. Before you dismiss me as a conspiracy nut wearing a tinfoil hat, take a look at a few sentences just written by Ed Steer of Edmonton in his daily commentary for Casey Research. Ed has a worldwide readership, and wrote the following: "Well, I guess you've already figured out that there was nothing free-market about what happened in both the gold and silver pits yesterday. This was all collusively orchestrated by the big bullion banks. Platinum and palladium weren't spared either ... with the bids on both pulled at the New York open as well. It took Ted Butler quite a number of years to pound into my brain that what happens anywhere else in the world is irrelevant as far as the precious metals are concerned. The price is always set by the big bullion banks, led by JPMorgan in New York. I hope, Dear Reader, that you've got that figured out now too." If you want to read all of Ed's commentary it's here: Christie, if your appetite is whetted sufficiently to want to learn more, try the free two-week trial subscription at Bill Murphy's LeMetropoleCafe.com, and once you are into that site, click on: http://www.lemetropolecafe.com/man_ray_table.cfm?pid=8642 Also Google the Gold Anti-Trust Action Committee, which has spent more than 10 years accumulating firm evidence of the manipulation of prices of gold and silver and which also has a large, worldwide subscriber base. I hope that you may now appreciate that the treatment afforded by Scotiabank to the ailing elderly cancer patient who just wanted her silver bullion back was motivated by forces running deeper than you may have anticipated when you wrote your article. Regards, A.D. Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Posted: 18 Jul 2010 04:22 PM PDT Oh great. There's a federal election in Australia and it's scheduled for the 21st of August. If it were possible to avoid all the media coverage of the upcoming election by holding our breath while immersed in a bucket of molasses, we would. But the truth is that you cannot separate politics from share markets these days. Like regular prostate checkups, discussing politics is something we have to do for our own financial health, whether we like it or not. The main reason you have to figure politics and policy into your investment calculations is that governments around the world are in dire financial straits. They need money. So they're taxing everything in sight to get it. And you are in their sights. This, among other things, is what U.S. healthcare legislation was about (taxing or fining Americans for not having health insurance). Here in Australia, there are two preferred methods for squeezing the household wallet in the name of the public good. The first is the Mineral Resource Rent Tax. It exists today like a soufflé just taken out of the oven: all puffy and full of promise, but ready to fall flat. It's hard to say if this is still keeping a lid on the upside in Aussie commodity shares. The other big tax con game is the assertion that carbon needs a price. We have yet to see a compelling argument about why this is so. The only argument we have seen is that carbon dioxide emissions from man-made activities are causing the Earth's temperatures to rise. Thus, carbon needs a price so businesses can be discouraged from carbon dioxide emissions and households can foot the bill to halt the oceans from rising and save the Planet (from us, presumably). There is surely someone in the DR readership who can educate us as to why the free market has yet to establish a price for carbon. Feel free to edify us with your thoughts by sending an email to dr@dailyreckoning.com In the meantime - since it' what we try to do - we'll offer you the alternative for why the global political class is eager to shove a carbon price down your compliant throat: money. If you put a price on something you can sell it. Or, you tax transactions between buyers and sellers. Either way, a price on carbon produces billions in new government revenues at a convenient time, when many governments are staring bankruptcy in the structural face. Government wants a price on carbon because it is the ultimate cash cow; a way to clip every single ticket in the economy. It can't tax it right now, though, because there is no market for it. So it must create a market in order to charge a tax to raise the money for the bills it can't pay because of its previous intervention in the economy and its general overweening pride about how people should live. Discuss. Or, judging my previous reactions to our view on the carbon con, disgust. From a business perspective, if you viewed a carbon tax or a price on carbon as some kind of political inevitability, you'd just want some certainty over the matter. The, at least you could figure it in to your models so you'd be able to determine how much higher to raise prices on your customers to cover the new artificially created, government-mandated price. The lack of certainty for a price on carbon doesn't justify just making one up. For instance, if you were confronted by a clown with a chainsaw in one hand and a gun in the other and he asked you which way you wanted to be killed and to decide in ten seconds, you might consider rejecting the question altogether and punching him in his big bulbous red nose instead. Honk. But whether there is a carbon price - especially in an economy like Australia's with lots of mining and coal - fired power plants - is another issue (contrived we'd argue, or self-inflicted) that creates uncertainty for business costs and profits. And the more uncertainty, the worse it is for business and share prices. Come to think of it, the more uncertainty, the harder it is for anyone at all to make plans. Carbon dioxide does have a price already, by the way. It's zero. No one wants to buy it. No one wants to sell it. The only way to give it a price is to make it a cost. And the only way to make it a cost is to claim that it's damaging the public good (air quality, the climate). And speaking of Australia's public good, what is NAB head of business banking Joseph Healy up to? Last week, according to news accounts, he made the claim, we think, that the Big Four banks have over-invested in residential housing at the expense of small business lending. Hmm. That sounds right. Healy said the Basel II capital rules we wrote so much about last week have produced a bias toward home lending. He said, "A bias toward allocating capital to home lending may mean there is less credit to allocate to business, the most productive areas of the economy...The is ultimately bad for growth, bad for competition, bad for jobs, bad for business and in the end bad for Australia." If it's so bad, then, why is it so? Because it's good, at least in the short term, for the banks, real estate agents, the government collecting stamp duty, and the whole property spruiking industry in general. You promote housing as a national investment priority if your health and welfare depends on it. The nation's health and welfare, as Mr. Healy points out, cannot be provided for by people buying and selling houses from each other. And finally, to close the loop on this climate change an emissions trading scheme subject, do you really care about it? Answer honestly. We're asking because the media keep claiming that the Australian public turned on Kevin Rudd when he backed down on his ETS (the 'great moral challenge of our time'). This, we've read, is what doomed him. But is that so? Maybe. But we think it's not that people really care about climate change. They like to be seen and heard caring about it because it is both fashionable and morally satisfying. But understanding this about themselves, we think they realised that the Prime Minister cared more about getting re-elected than anything else. This is generally unappealing in a politician when displayed so ostentatiously and without shame. Kevin Rudd reaped what he sowed, just as we all will by our choices, financial and otherwise. But is it true that the electorate turned on the Prime Minister because he did not share their urgency about climate change? We doubt it. Belief in climate change has become an orthodox position within mainstream media and politics. It is natural then, in the echo chamber of the establishment, for everyone to agree with everyone else and assume the rest of us must agree. As a non-Australian, though, we wonder if it's true. Feel free to let us know your thoughts at dr@dailyreckoning.com. But keep your comments clean, or at least civil. We're trying to save the financial planet here. Dan Denning |

| Posted: 18 Jul 2010 03:46 PM PDT

The truth is that once a deflationary cycle starts, it tends to feed on itself. People quit spending money, banks quit making loans and everyone starts hoarding cash. And right now there is a lot of fear out there. According to one major indicator, consumer sentiment declined in early July to its lowest in 11 months. U.S. consumers are starting to pay down debt and are holding on to their money. Others can't spend more money because they are out of work or are completely tapped out. But without more spending, the U.S. economy won't get revved up again. And if the U.S. economy does not get going soon, there are going to be more foreclosures, more bankruptcies and even more jobs lost. In a recent article for The Telegraph, Ambrose Evans-Pritchard set out some of the statistics that show that the U.S. economy is in really, really bad shape right now.... The US workforce has shrunk by a 1m over the past two months as discouraged jobless give up the hunt. Retail sales have fallen for the past two months. New homes sales crashed to 300,000 in May after tax credits ran out, the lowest since records began in 1963. Mortgage applications have fallen by 42pc to 13-year low since April. Paul Dales at Capital Economics said the "shadow inventory" of unsold properties has risen to 7.8m. "The double dip in housing has begun," he said. It seems like almost everyone is using the words "double dip" these days. It is almost as if it was already a foregone conclusion. But the truth is that this would have just been one long economic decline if the U.S. government (and many of the other governments around the globe) had not pumped so much "stimulus" into their economies over the past several years. Now that governments around the world are pulling back and are beginning to implement austerity measures, the "sugar rush" of the stimulus money is wearing off and the original economic decline is resuming. All that the trillions in "stimulus" did was to give the world economy a temporary boost and get us into a whole lot more debt. In his recent article entitled "The U.S. Is On The Edge Of A Growing Deflationary Sinkhole", Lorimer Wilson did a really good job of detailing how all of this debt has gotten us into a complete and total mess.... Capitalism cannot function unless its constantly compounding debt is serviced and/or paid down. Today, the U.S., the world's largest debtor, can no longer pay what it owes except by rolling its debt forward and borrowing more [in] what the late economist Hyman Minsky called ponzi-financing, financing common in the final stages of mature capital systems. The amount of outstanding U.S. debt, according to Martin D. Weiss, www.moneyandmarkets.com, has now reached levels that can never be paid off. The United States government and its agencies have, by far, The truth is that the United States is in the early stages of a truly historic financial implosion. Earlier this year, all of the focus was on the European sovereign debt crisis, but now all eyes are turning back to the U.S. once again. David Bloom, currency chief at HSBC, recently remarked that world financial markets are extremely concerned about the state of the U.S. economy right now.... "We're in a world of rotating sovereign crises. The market seems to become obsessed with one idea at a time, then violently swings towards another. People thought the euro would break-up. Now we're moving into a new phase because we're hearing alarm bells of a US double dip." Without direct intervention from the U.S. government, the U.S. financial system is headed for a world of hurt. The truth is that the credit markets are freezing up, and without efficiently operating credit markets, the economic system we have constructed simply will not work. The following information comes courtesy of the Consumer Metrics Institute. If you have never visited their site, you should, because it is packed full of excellent data. In their most recent report, they do a good job of detailing the astounding credit contraction that we have been witnessing.... During the past week there has been a flurry of Federal Reserve reports and commentary concerning the levels of credit in the current economy. The two most notable were: ► On July 8th they reported that the level of seasonally adjusted outstanding U.S. Consumer Credit (their G.19 report) decreased during May by $9.1 billion, representing an annualized rate of credit contraction of 4.5%. Although even this change is above the average for the preceding twelve months, it is much smaller than a quiet revision to the previously published April U.S. Consumer Credit figure -- which is now reported to have decreased by $14.9 billion (a 7.3% annualized contraction rate). The Federal Reserve fails to put these numbers into perspective: 1) Consumer credit has contracted during 15 of the past 16 reported months, and it is down a record total $148 billion over that time span. 2) The $14.9 billion in credit 'lost' during just April is the second highest monthly amount in history, second only to the $23.4 billion 'lost' during November, 2009. 3) And the nearly 6% cumulative reduction in consumer credit over the past 16 months is the largest (on a percentage basis) for any 16 month span since September 1944 -- when FDR was still in the White House and people were buying War Bonds instead of tightly rationed consumer goods. ► On July 12th Federal Reserve Chairman Ben Bernanke noted that small businesses were not getting the loans that they need to create new jobs. The Federal Reserve's own data reports that lending to small businesses dropped to below $670 billion in Q1 2010, down about $40 billion (5.6%) from two years ago. The New York Times reported Mr. Bernanke wondered: "How much of this reduction has been driven by weaker demand for loans from small businesses, how much by a deterioration in the financial condition of small businesses during the economic downturn, and how much by restricted credit availability? No doubt all three factors have played a role." Small businesses, which account for over 60% of gross job creation, are not - for whatever reason - tapping into the credit necessary to create those jobs. If you know anything about economics, the excerpt that you just read should be chilling you to your bones right about now. Without loans, businesses can't start or expand, consumers cannot buy homes or vehicles and retail spending will be in the toilet. But, as a recent USA Today article pointed out, part of the problem is that so many Americans now have very, very low credit scores.... Figures provided by FICO show that 25.5% of consumers — nearly 43.4 million people — now have a credit score of 599 or below, marking them as poor risks for lenders. It's unlikely they will be able to get credit cards, auto loans or mortgages under the tighter lending standards banks now use. As I recently pointed out on The American Dream blog, historically only about 15 percent of Americans have had credit scores that low. So can the U.S. economy fully recover if the number of Americans that are a bad credit risk has nearly doubled? That is a very good question. As I noted in a previous article, the truth is that the retail sector is already a huge mess, and if we don't get the American people pulling out their credit cards soon this holiday season may not be very jolly at all.... Vacancies and lease rates at U.S. shopping centers continued to get even worse during the second quarter of 2010. In fact, in some of the most depressed areas of the United States, many malls and shopping centers could end up looking like ghost towns by the time Christmas rolls around. So this is the point where Barack Obama comes riding in on his white horse and rescues the U.S. economy, right? Well, at this point Obama has joined with the other G20 leaders in pledging to get government spending under control. So right now there are not any plans for new stimulus packages. But as the U.S. economy starts sinking into a deflationary depression, the temptation to pump up the economy with even more government spending will become too great. This will especially be true the closer to the election of 2012 that we get. By the time election season rolls around, Obama will likely be much more willing to pile up even more debt for a short-term economic boost. So yes, we are headed for a complete and total economic nightmare, but exactly how it all plays out is going to depend a lot on what Barack Obama, the Federal Reserve, other world leaders and other central banks decide to do. For the moment, we are heading for an absolutely brutal credit crunch, and if something is not done quickly, it is going to dramatically slow down the world economy. |

| Gold, Oil and SP500 Trading Patterns Posted: 18 Jul 2010 02:13 PM PDT |

| Ferdi Lips warned about gold market's 100-1 leverage nine years ago Posted: 18 Jul 2010 01:33 PM PDT 9:30p ET Sunday, July 18, 2010 Dear Friend of GATA and Gold: Our friend Ben Davies, CEO of Hinde Capital in London, among the few gold advocates lately given time on CNBC, points out that the late, great Swiss gold banker Ferdinand Lips made in his 2001 study "Gold Wars" the same observation made at the March 25 hearing of the U.S. Commodity Futures Trading Commission by CPM Group executive Jeffrey M. Christian -- that the leverage in the gold market is around 100 to 1, that each ounce of gold is supporting as much as 100 ounces of gold trading. Lips, whose work is preserved by the Lips Institute (http://lips-institute.ch/) and whose books are available at a page at the institute's Internet site (http://lips-institute.ch/en/books/), wrote in the book's "Part IV: Gold Rush and the Gold War": "It is estimated that the 'paper gold' market in 1999 is many times larger than the actual physical market. Estimates range from a minimum of 90 to an excess of 100 paper-ounce contracts being written for every ounce of physical gold that changes hands. This is not only mind-boggling, or a Frankenstein monster, as James Dines calls it, but a king-size horror trip." Last week Davies gave MiningMaven.com an interview about the gold and silver markets whose first part is 17 minutes long and mentions GATA's work. You can listen to it here: http://www.miningmaven.com/blog/51-blog/169-gold-focus-part-1-ben-davies... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Ferdi Lips warned about gold market's 100-1 leverage nine years ago Posted: 18 Jul 2010 01:33 PM PDT 9:30p ET Sunday, July 18, 2010 Dear Friend of GATA and Gold: Our friend Ben Davies, CEO of Hinde Capital in London, among the few gold advocates lately given time on CNBC, points out that the late, great Swiss gold banker Ferdinand Lips made in his 2001 study "Gold Wars" the same observation made at the March 25 hearing of the U.S. Commodity Futures Trading Commission by CPM Group executive Jeffrey M. Christian -- that the leverage in the gold market is around 100 to 1, that each ounce of gold is supporting as much as 100 ounces of gold trading. Lips, whose work is preserved by the Lips Institute (http://lips-institute.ch/) and whose books are available at a page at the institute's Internet site (http://lips-institute.ch/en/books/), wrote in the book's "Part IV: Gold Rush and the Gold War": "It is estimated that the 'paper gold' market in 1999 is many times larger than the actual physical market. Estimates range from a minimum of 90 to an excess of 100 paper-ounce contracts being written for every ounce of physical gold that changes hands. This is not only mind-boggling, or a Frankenstein monster, as James Dines calls it, but a king-size horror trip." Last week Davies gave MiningMaven.com an interview about the gold and silver markets whose first part is 17 minutes long and mentions GATA's work. You can listen to it here: http://www.miningmaven.com/blog/51-blog/169-gold-focus-part-1-ben-davies... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

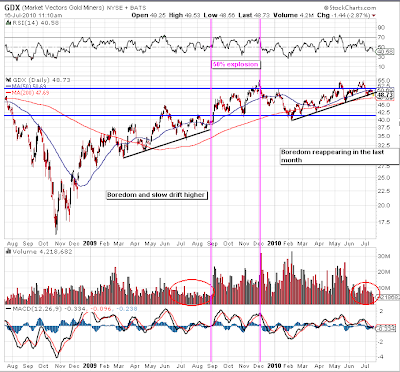

| Posted: 18 Jul 2010 01:06 PM PDT By Toby Connor, Gold Scents For the purposes of this discussion we will concentrate on the intermediate and daily cycle, after a quick explanation of the two larger degree cycles. At this point all one needs to know is that gold's 8 year cycle bottomed in `08 and isn't due to bottom again until 2016. The yearly cycle bottomed in February, and no yearly cycle except the one at the 8 year cycle low has ever moved below a prior yearly cycle low since the secular bull started in 2001. That means in order for gold to move below $1044 we would have to entertain the fact that the current 8 year cycle has already topped in only two years. That would also mean the secular bull has likely topped. I just don't buy that, as no secular bull in history has ever topped before reaching the bubble stage and gold is clearly a long way from that. So all this nonsense about gold falling back below $1000 is just that – nonsense. The odds of a move back to $1000 anytime during the remainder of this bull market are probably less than 1%. I don't know about you, but I make it a rule to never bet on something with odds of success at only 1%. Now let's move in and take a look at the next larger cycle, the intermediate cycle. This cycle has averaged 18 weeks since the secular bull began in 2001, but has lengthened to 23 weeks after the global debt problems began in `07.

My guess is that the Fed's extreme monetary policy is acting to stretch golds intermediate cycle slightly. As you can see from the chart, gold is now about to enter the 24th week of the current intermediate cycle. This of course means it's becoming extremely dangerous to sell gold. On the contrary, this is the time where savvy investors want to be looking to add to positions. Remember, this is a secular bull market after all, and you only get this kind of opportunity about every 5 to 6 months. You certainly don't want to blow it now as you will have to wait another half year before it comes again, and since this is a bull market the next opportunity is going to come at higher prices. For all you traders who claim that you are going to back up the truck when gold experiences a pullback, well you are getting your pullback right now. The question is, will you follow your own advice? Now let's look at the smaller daily cycle and see if we can pinpoint a closer time frame for when we should be looking for the final bottom of this intermediate cycle. On average the daily cycle tends to run about 20 days. However, it's not completely out of the question to see a cycle run as long as 30 days occasionally. I will also note that we usually see a failed daily cycle as gold moves into a final intermediate cycle low. With that in mind here is where I think we are in the current daily cycle which, by the way, does appear to be a failed and left translated cycle as it was unable to break to new highs. It appears we are now on day 16 of this cycle. Since we know that the average duration trough to trough for a daily cycle is 20-30 days, we can extrapolate a reasonable timing band for a final bottom somewhere in the next one to two weeks. Here's what to look for. First off, I think gold will need to retrace at least 50% of the intermediate rally. That would come in around $1155. Next, I would like to see sentiment turn extremely bearish. We are already well on our way to that happening as public sentiment is now nearing the same levels we saw at the February intermediate cycle bottom. Another big clue will be to watch the comments on the blog. At intermediate cycle bottoms troll infestation will become intense with comments reaching upwards of 200-300 per post. That is always a fool proof sign that gold is about to slam down on the shorts. Hey, this is a secular bull market after all, what could you possibly be thinking trying to short gold? About this time we will see the conspiracy theorists start blaming a mysterious gold cartel for what in reality is just a normal correction within an ongoing bull market, and one that happens like clockwork about every 20 weeks. So the bottom line is we are on the verge of getting one of the best buying opportunities we ever get in a bull market sometime in the next week or two. The question you have to ask yourself is, will you take it or will you let the "technicals" talk you into missing another fleeting chance to accumulate at bargain prices in the only secular bull market left? Let's face it, at intermediate cycle bottoms the technicals are not going to look like a bottom. Instead, they are going to look like the bull is broken. Only those people who can think like a value investor and keep the big picture firmly in mind are able to buy into an intermediate cycle bottom. You have to make a decision. Are you going to seize the opportunity or are you going to let the bull trick you into losing your position?

Carpe Aurum (Seize the gold) Toby Connor A financial blog primarily focused on the analysis of the secular gold bull market. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions, email Toby. |

| Scotiabank gives long abuse to cancer victim trying to reclaim her silver Posted: 18 Jul 2010 01:00 PM PDT 11:15a ET Sunday, July 18, 2010 Dear Friend of GATA and Gold (and Silver): The difficult attempt of a cancer-stricken Toronto woman to exchange her Scotiabank silver certificates for real metal, witnessed last week by a writer for the Globe and Mail, whose account of the matter is appended, recalls the difficult attempt of Harvey and Lenny Organ to do the same thing with the same bank. (See http://www.gata.org/node/8513.) The bank's mistreatment of the Toronto woman is so outrageous that perhaps some of those who were skeptics of the Organs' story will begin to wonder if there isn't after all really a bullion banking policy to discourage buyers from taking possession of their metal precisely because the banks are selling far more claims to metal than they have actual metal. CHRIS POWELL, Secretary/Treasurer * * * An Unkind Complicatedness By Christine Blatchford http://www.theglobeandmail.com/news/national/christie-blatchford/an-unki… In the end, nothing else would do for Scotiabank but that Amar Patel — 73 years old, bald from chemotherapy, in the throes of metastatic breast cancer — should drag her aching bones down to the bank's head office in downtown Toronto. The trip from her airy apartment above the Indian Rice Factory, the landmark restaurant she founded in 1970 and has run ever since, was an agony of no fewer than five transfers — from the hospital bed in her living room to a commode, from commode to the chair lift for the first set of stairs, from that chair to the next chair lift for the second set, from that chair to a walker, from walker to the car. This exercise took 59 minutes and the best efforts of her son Aman, daughter-in-law Deepa, and restaurant employee Chandan Sindhwal. I should note that despite her illness and pain, Mrs. Patel, who hadn't been out of the apartment for almost two months, was gracious, beautiful in a red-striped caftan, and, but for occasional moans when the car hit a rough patch of road, remarkably uncomplaining. All she wanted was to do was take delivery of the silver the bank was holding for her in the form of the certificates she'd bought decades earlier. It was, or ought to have been, an uncomplicated transaction. Another major financial institution, TD Bank, managed to handle the same transaction within a couple of days, and delivered the bullion to Mrs. Patel's local branch for pickup. By this Thursday, Mrs. Patel had done the following to obtain Scotiabank's agreement to give her what is rightfully hers: In early March, Aman, a Toronto criminal lawyer, had attended the downtown headquarters to explain his mom's situation. He suggested that either a bank official go to her apartment to witness her signature (he even offered to pick up and drive back the official) or consider meeting his mother in the car outside the bank to save her a bit of the journey: Both requests were rejected. On March 17, Aman faxed the silver certificates to his mom's local Scotiabank branch and then drove his mother there; they were advised she would have to attend the King/Bay office downtown. For a time, Mrs. Patel gave up; she was hoping she could tackle it in a few weeks or months, when she was better and had her strength back. When that didn't happen, she hired a Bay Street lawyer and, through him, signed a power of attorney appointing Aman as her attorney. In early July, Scotiabank asked first to "pre-inspect" the power of attorney, then demanded the original; then pronounced it unacceptable because it wasn't sealed; then insisted that a notarized copy, with covering letter from the lawyer, be produced; finally, the notarized POA had to be submitted to the home branch, then the bank's legal department. Even with these various approvals finally in place, Aman was told (being a lawyer, he has notes of all these conversations and e-mails) that the bank could still deny the transaction if it was deemed not to be in Mrs. Patel's "best interest." So she hired another lawyer, this time to help her get what was hers. Then the bank said it had to decide if the transaction was to be for the benefit of the attorney, from a business point of view. In other words, Scotiabank would decide if the transaction made business sense — not Mrs. Patel, or her lawyer, or Aman, who had her power of attorney. This Thursday, having heard nothing from the bank about whether it would honour the now-approved and vetted POA, Aman called and got Judy McBride, the head of customer service at King and Bay Streets. She told him the bank would not honour the POA and that Mrs. Patel had to come down in person. Aman again explained how weak his mother was, to no avail. That afternoon, Aman, his wife and Chandan managed to carry out the five transfers and get Mrs. Patel in the car. Once they arrived downtown, Aman went in to ask, one last time, if Scotiabank would at least dispatch people outside to do the signing in the car. Absolutely not, came the answer. They got Mrs. Patel into the commode chair and into the lovely, high-ceilinged headquarters with its polished marble floors they went. Ms. McBride asked a number of questions, in my presence. Among them: "Do you understand what this transaction is that is taking place? We're taking your certificates and giving you the actual bullion? Why would you want to do that? It's more difficult for you to cart around." At this point, Aman's seemingly endless store of patience was exhausted and he said — mildly, I thought, in the circumstances — "That's none of your business." Ms. McBride said that it was, that "simply putting a POA in place doesn't give carte blanche," that the bank had a responsibility too, and asked Mrs. Patel, "Why would you need the physical metal?" Ms. McBride said the bank "reserves a right to ask questions," because, she said, "We need a comfort level." Bank spokesman Joe Konecny denied the bank ever insisted Mrs. Patel had to come in person, said they were "willing to act" on the POA, but that "a heightened level of due diligence was required for a number of reasons," among them, bizarrely, that the transaction wasn't initiated at her home branch, although that branch had directed her downtown. In any case, after about an hour, Mrs. Patel finally got her silver. But it must have been a mortifying experience for this very dignified woman to make such a trip in her bedclothes, and the whole thing struck me as a profoundly condescending and arbitrary intrusion of bank functionaries into Mrs. Patel's and her family's business. And what if her son wasn't a lawyer who knew how to fight back? What if she'd had a stroke and wasn't able to sign the documents? If she wanted to buy crack cocaine with that silver, or sleep with it at her side, that's her call, because it belongs to her, not the bank. The bully-boy functionaries might want to find a comfort level around that notion. * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Don't get fleeced - get rich: CRASH UPDATE Posted: 18 Jul 2010 01:00 PM PDT So let's make this as clear as possible - if there is another market crash soon as expected, investors are going to do what they always do, which is go into blind panic and toss almost everything overboard, and that can be expected to include gold, silver and PM stocks. Yes, we fully understand that the fiat money system is rapidly approaching its nemesis and that gold is the ultimate safe haven and is set to soar as currencies become worthless, but that won't help it much short-term during the crash phase, which is likely to result in a heavy reaction in gold back probably to its long-term uptrend support line. |

| Posted: 18 Jul 2010 12:59 PM PDT It’s true that GLD’s assets just passed the $50 billion mark, and that it’s the second largest U.S. ETF. Yes, mints had difficulty filling orders when the Greek crisis broke. And yes, the gold price is up nine years in a row. But those who look at statistics like these are missing the other side of the equation. I think it’s less about how much money is already invested in gold and more about what’s available to invest. After all, one could be impressed that China, for example, invested $14.6 billion in gold over the past few years – until you realize they have $2.45 trillion sitting in reserves. |

| Gene Arensberg: Metals in backwardation but a little more slippage likely Posted: 18 Jul 2010 12:58 PM PDT 9p ET Sunday, July 18, 2010 Dear Friend of GATA and Gold (and Silver): Gene Arensberg's latest "Got Gold Report" finds gold and silver in backwardation and the large commercial shorts covering their positions but expects a little more decline in each metal before their upward trend resumes. Arensberg's commentary is headlined "Gold 'Rumored' Lower, Euro Pops" and you can find it here: http://www.gotgoldreportsubscription.com/2010_7_18GGR.pdf CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| James Turk: Waiting for silver's upside breakout Posted: 18 Jul 2010 12:46 PM PDT 8:45p ET Sunday, July 18, 2010 Dear Friend of GATA and Gold (and Silver): GoldMoney founder and Freemarket Gold & Money Report editor James Turk has gotten out his silver chart and writes that silver's accumulation pattern is nearly complete and the metal should soar once it breaks $20 per ounce. Turk's commentary is headlined "Waiting for Silver's Upside Breakout" and you can find it at the FGMR Internet site here: http://www.fgmr.com/waiting-for-silvers-upside-breakout.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| James Turk: Waiting for silver's upside breakout Posted: 18 Jul 2010 12:46 PM PDT 8:45p ET Sunday, July 18, 2010 Dear Friend of GATA and Gold (and Silver): GoldMoney founder and Freemarket Gold & Money Report editor James Turk has gotten out his silver chart and writes that silver's accumulation pattern is nearly complete and the metal should soar once it breaks $20 per ounce. Turk's commentary is headlined "Waiting for Silver's Upside Breakout" and you can find it at the FGMR Internet site here: http://www.fgmr.com/waiting-for-silvers-upside-breakout.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Posted: 18 Jul 2010 12:16 PM PDT Imagine the face of Lt. George Morris. On March 8, 1862, his ship, the USS Cumberland, found itself a victim of what the economist Joseph Schumpeter called 'creative destruction.' The creativity came in the form of a revolutionary new technology, iron-clad ships. The destruction came in the form of cannonballs, which were smashing the poor Cumberland to bits. The Cumberland fired its cannons too. But its volleys merely ricocheted off its adversary, the CSS Virginia, like pebbles off a turtle's back. Our subject today is not naval warfare. Nor is it history or metallurgy. Instead, it is a worry fit only for an economist. No sensible man would waste a minute on it. It is the problem of 'too much.' The normal ups and downs of a healthy economy frighten capitalists terribly. As soon as their businesses get into trouble they howl for subsidies. When their investments go down, they whine for bailouts and central planning. It is not brains they lack; it is courage. They are not dumb, in other words; they are wimps. But their philosophers and policymakers are the most pusillanimous of all. Their desperate reaction to the mini-recession of '01 led to the bubble of '05-'07. In a panic, they turned the fiscal balance of the US government upside down, from surplus to deficit; the country added $2 trillion to its national debt in the following 48 months. Meanwhile, interest rates dropped below the rate of consumer price inflation - where they've been ever since. Then, when their bubble popped in '07- '09, they showed no interest in discovering what was really going on or why. Instead, blinded by fear, they rushed in like a waiter dousing the flames on a bananas foster. And now we sit in front of a soggy mess. Having learned nothing, our leading economists are all for action. In his advice to the Fed, for example, Paul Krugman urges a variety of experiments. "Nobody knows how well any one of these actions would work," he admits. But the Fed should be "doing all it can..." Why? His English counterpart, Martin Wolf, answers. Because "...advanced countries remain highly short of demand...a threat to the survival of the Eurozone and even the open world economy." This terror du jour is the most remarkable yet. Wolf and Krugman believe there is an imbalance between the supply and demand. No kidding. They fear capitalism is not up to its most basic and simplest challenge. Krugman: "The fact remains that our current problem is, in effect, a problem of excess worldwide savings, looking for someplace to go." With five people looking for every US job, there is also presumably an excess of labor. Even the normally level-headed Nouriel Roubini says we have a "world of excess supply." Can you believe it? Their knees give way, fretting that markets no longer match up buyers and sellers. They might as well worry that maggots won't find dead meat. Karl Marx warned about the same thing. Driven by the profit motive, entrepreneurs will always overdo it, he said. Then comes a correction, as overcapacity is eliminated. The correction will cause people to lose jobs, he continued. The unemployed workers will have to stop shopping, causing a depression. Oh ye of little faith! There's always a buyer for every seller - at some price. For thousands of years, supplies have always come together with demand. What is the cure for 'excess' capacity? Falling prices. Everybody who is not a swindler or a fool knows it. The real problem, from the activists' point of view, is not excess or shortage. It is fear. They are afraid of the prices it will take to clear the market. Shares may have to lose half their value. Property could be knocked down by another 20%. Banks and nations may go broke. Falling prices are painful. But it could be worse. Capacity could be reduced in another way. Iron ships were pioneered by the French in 1859. Their first effort was named La Gloire. The British quickly made their own ship, Warrior, a year later. But it was in America, at the mouth of the Chesapeake Bay, that the world first saw what iron hulls and steam engines had wrought. The iron-clad CSS Virginia shot up the USS Cumberland, and the USS Congress. It retired for the night, having destroyed an entire industry too - timber-based shipbuilding. The next day, the confederate ship came back to finish off the USS Minnesota, which had run aground the previous day. In its path was an even newer and more modern ship, the USS Monitor, with only two big guns and a revolving turret. The two of them blasted away at each other for three hours. Neither could land a decisive blow. In 48 hours, shipbuilding capacity was destroyed twice. Until then, there were shipyards all over the world that could turn out state-of the art vessels. But on March 10, 1862, there was hardly a single one. First, the heavy iron-clad Virginia had made wooden warships obsolete. And then, the technologically more advanced Monitor brought forth a whole new era. It was not enough to cover a ship in iron. The ship had to be radically redesigned and constructed using new skills and new materials. Suddenly, the iron mongers were working night and day...and the great oaks could relax. Bill Bonner |

| More On Scotiabank's Fraudulent Bullion Safekeeping Services Posted: 18 Jul 2010 12:14 PM PDT If you read this story and decide to keep your bullion at Bank Nova Scotia - OR utilize investment products that are supposedly backed by gold/silver which are safekept at BNS - may your god have mercy on your net worth. For all others, please read this story, go back and review Harvy Organ's experience with Scotia and then go retrieve every ounce of bullion from Scotia that is rightfully your's. You should move it a private depository, like First State Depository in Delaware. Here's the story link: Pulp Non-Fiction Hat tip to the reader who posted the link in the comment section, which was originally posted HERE by GATA. If you have exposure to Scotia, I can only lead you to water... |

| Posted: 18 Jul 2010 12:11 PM PDT |

| Posted: 18 Jul 2010 11:56 AM PDT Jim Sinclair's Commentary Now this is really bad news for the dollar. Regulators list 40 North Carolina banks as 'troubled' Nearly half of North Carolina's 86 state-chartered banks are on N.C. regulators' list of troubled institutions, up 74 percent in less than a year and a grim record that underscores the strain of the multiyear downturn. The tally of 40 troubled banks compares with 23 in October 2009. Typically, there are only two or three on the list. Regulators are legally barred from disclosing individual bank names or ratings. Doing so could risk a "run" on deposits, which could prevent banks from working through problems. However, banks where conditions have deteriorated significantly are made public. In North Carolina, there are seven of those, according to state and federal regulators' records. "We work hard every day to try to resolve those situations without failure," said N.C. banking commissioner Joseph Smith. "I can't promise you they're all going to work out."

Jim Sinclair's Commentary Whether or not this is the right "why," it now broadcasts to the sheeple that the dollar will fall hard if I am correct that the recent recovery takes the form of a Ski Jump. I am and it will. Fed's volte face sends the dollar tumbling The euro rocketed to a two-month high of $1.29 and sterling jumped two cents to almost $1.54 after the Fed confessed that the US economy may not recover for five or six years. Far from winding down emergency stimulus, the bank may need a fresh blast of bond purchases or quantitative easing. Usually the dollar serves as a safe haven whenever the world takes fright, and there was plenty of sobering news from China and other quarters on Thursday. Not this time. The US itself has become the problem. "The worm is turning," said David Bloom, currency chief at HSBC. "We're in a world of rotating sovereign crises. The market seems to become obsessed with one idea at a time, then violently swings towards another. People thought the euro would break-up. Now we're moving into a new phase because we're hearing alarm bells of a US double dip." Mr Bloom said a deep change is under way in investor psychology as funds and central banks respond to the blizzard of shocking US data and again focus on the fragility of an economy where public debt is surging towards 100pc of GDP, not helped by the malaise enveloping the Obama White House. "The Europeans have aired their dirty debt in public and taken some measures to address it, whilst the US has not," he said. The Fed minutes warned of "significant downside risks" and a possible slide into deflation, an admission that zero interest rates, $1.75 trillion of QE, and a fiscal deficit above 10pc of GDP have so far failed to lift the economy out of a structural slump. |