Gold World News Flash |

- RUST DISCOVERED ON BANK OF RUSSIA-ISSUED 'GOLD' COINS

- Last bull standing 2011

- Daily Dispatch: Bring Out Your Dead

- Chinese Economic Growth: Commodities to Go Up Middle Class

- Gold Technicals for July 16th

- The Real Trade of the Decade Redux

- Jim?s Mailbox

- In The News Today

- Hourly Action In Gold From Trader Dan

- Mickey Fulp: Summer Slump Good for Gold

- Government Mules

- Just Another Day Off the Calendar

- LGMR: Gold & Silver Slide Together with Dollar as Stocks Fall on Weak US Inflation

- Good Gold Interview

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Over 1% on the Week

- Should You Sell Your Pension?

- Disaster Plan

- The Dollar's Predicament

- Compendium 3 Now Available!

- Ending The Comex Gold Charade

- Guest Post: Lloyd Blankfein's Days Are Numbered As Chairman Of Goldman Sachs

- John Lee: Blame Volatility on Summer Doldrums, Not Deflation

- Rust Discovered On Bank Of Russia Issued 999 Gold Coins

- Weekly Credit Summary

- The Gold Silver Ratio Presents Us with a Cliffhanger. Over 69.5 It Breaks Out Upside, Under 64.5 to the Downside.

- Money for Nothing and Cheques from Centre Link

- FRIDAY Market Excerpts

- Is the Gold Trade “Crowded”?

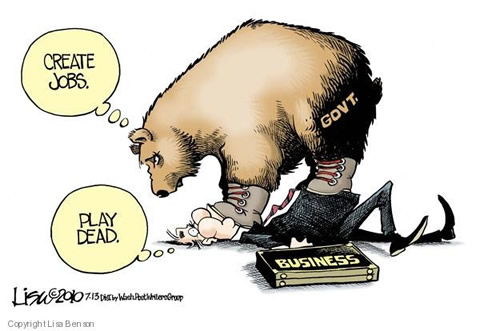

- When a Bear Won’t be its Usual Cautious Self

- The Micro View - Q2 Earnings Season: Past, Present And Future

- Austrians, Keynesians and Price Target for Mining Stocks

- This perfect indicator says a new recession could be here soon

- SP 500 September Futures Daily Chart and Gold Chart at the Close: Option Expiry Bear Raid

- Guest Post: Is The Gold Trade “Crowded”?

- Top speculator Paulson is betting big on casinos

- Gold remains great for the long haul

- Is the Gold Trade 'Crowded'?

- ShadowStats: CPI - Alt Running 4.3%, Gold $2,382 Silver $139

- Chinese Treasury Dump Brings Holdings to 1 Year Low

- The Real Trade of the Decade… Redux

- Zookeepers Unite Against Behavioral Economics

- EUR Shorts Plunge, As CHF Goes Net Long For Only Fourth Time In 2010, JPY At Most Bullish

- Risk Rally Stalls, More Downside Likely

- BIS footnote unlocks major development in gold use

- Why Ricardian Equivalence Is Nonsense

- Reuters actually puts gold questions to BIS, which clams up

- Market Loses Nearly Half Of Short Covering Relief Rally In A Few Hours On High Volume, And A LHLL Deja Vu

- Hamptons Weekend Ruined, Hedge Fund Managers Enraged

| RUST DISCOVERED ON BANK OF RUSSIA-ISSUED 'GOLD' COINS Posted: 16 Jul 2010 05:48 PM PDT RUST DISCOVERED ON BANK OF RUSSIA-ISSUED 'GOLD' COINS Zero Hedge reports tonight about Bank of Russia-issued gold coins that have been found rusting, which gold doesn't do. Zero Hedge concludes: "The Central Bank of Russia has been one of the biggest purchasers of gold in 2010, having bought gold every single month. It would be embarrassing if it were discovered that not only is the bank diluting the gold content with oxidizable materials, but subsequently passing it off for .999-proof precious metal. And if this is happening in Russia, one wonder what trickery other central banks, with a far lower amount of gold in their vaults, resort to." Now that it seems to be in a journalistic mode again, maybe Reuters should ask the Bank for International Settlements if its recent gold swaps have anything to do with those Bank of Russia coins. Another refusal to comment from the BIS would be especially delightful right now. |

| Posted: 16 Jul 2010 05:32 PM PDT One of the most important contributions made in the science of market analysis is the series of equity market rhythms known as the Kress Cycles. The one who discovered these cycles, Samuel J. “Bud” Kress, has done for cycle theory what virtually no one else been able to accomplish, namely discovering a series of inter-related “hard” cycles that are all harmonically related and which provide an accurate context from which to view the past, present and future financial and economic climate. Kress accurately predicted the top of the secular bull market in 2000 with his cycles as well as the credit crisis of 2007-2008. He also called the bottom in March 2009 and, more recently, forecast an interim top for April 2010. For the last 10 years, Bud has published a series of interim reports – roughly once per year – called “Special Editions” (available through his SineScope advisory service, 15 Phoenix Ave., Morristown,... |

| Daily Dispatch: Bring Out Your Dead Posted: 16 Jul 2010 05:32 PM PDT July 16, 2010 | www.CaseyResearch.com Bring Out Your Dead Dear Reader, As I write, the price of gold has again broken below its new base at $1,200, and the U.S. stock market is again under strong pressure, due to a confluence of fears, most of which point to a deflationary double-dip. The fears are fanned by disappointment in the early quarterly results now being released, by the latest CPI reports that show inflation continuing to moderate, and by yet another poll revealing faltering consumer confidence. The market is also spooked, no doubt, by just-released notes from the latest Fed Beige Book that make it clear that the Fed is (finally) beginning to understand the entrenched and endemic nature of this crisis. While the notes are written in shamanic double-speak, the point is unambiguous – members of the Fed don’t expect the economy to get back on track until 2015 or 2016. [LIST] [*]“Participants ... |

| Chinese Economic Growth: Commodities to Go Up Middle Class Posted: 16 Jul 2010 05:32 PM PDT Lately, I have been hinting to my boss that I need a raise to do my job, and she has been hinting that she needs an employee to competently do my job, so you can see how we are temporarily at an impasse in negotiations. Not so in China, however! The Economist magazine notes that in China, "Wages have been rising at 10-15% annually, but recently workers have begun to demand even heftier increases." Well, I am already astonished at this increase in incomes, and to impress you with my facility with the Rule of 72, I calculate with simple division that a 10% increase in wages will double wages in 7.2 years, which you gotta agree is a lot of extra spending power, unless inflation in prices eats it all away, which, unfortunately, it probably will. And this is compounded by the Chinese economy itself growing by at least 10% a year, too, meaning that the Chinese economy will double in size in that selfsame 7.2 years! Wow! An economy that is twice as big, and wages that doubled? My Inne... |

| Posted: 16 Jul 2010 05:32 PM PDT courtesy of DailyFX.com July 16, 2010 07:38 AM Gold has topped. Please see the latest special report for details. Near term, gold is making its way lower and in an impulsive fashion. Look for gold to form a low next week as wave 5 comes to an end. Expectations will then be for a move back to 1220. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| The Real Trade of the Decade Redux Posted: 16 Jul 2010 05:32 PM PDT The 5 min. Forecast July 16, 2010 10:53 AM by Addison Wiggin & Ian Mathias [LIST] [*] A follow-up to the “real” Trade of the Decade: 140,000% in April, another 1,900% now [*] The “Goldilocks economy” redefined by Fed economists… who say this economics stuff is hard [*] Checking real-world economic stats -- rail traffic, state tax receipts [*] As we prepare for Vancouver conference, media mogul advises we don’t come back [*] The ghost of George Steinbrenner looks down upon 5 readers debating estate tax [/LIST] “Goldman, those bastards.” That’s how we began these 5 Minutes on April 19, in the wake of the SEC’s civil complaint against Goldman Sachs. As we put it then, “The SEC is either stupid or corrupt for announcing their suit on options expiration Friday, the most volatile day of the month.” That’s because if you’d been lucky enough to hold April 170 Goldman put options that day, ... |

| Posted: 16 Jul 2010 05:32 PM PDT View the original post at jsmineset.com... July 16, 2010 07:37 AM Michigan Consumer Sentiment Index Fell in July CIGA Eric Consumer expectations, a "feel good or bad" consumption survey, serves as a good proxy of confidence for a consumption driven economy. Confidence is an important, often dificult to measure, component of currency valuation. The big drop in confidence, obviously ignoring today’s coordinated hit, will be reflected in higher future gold prices. The correlations between consumer expectations and gold during periods of deteriorationg confidence in fiat of 1968-1980 and 2000-2015 have been -0.67 and -0.73, respectively. Perfect inverse correlation is -1. Correlations of -0.67 and -0.73, therefore, are strong inverse correlations. That is, as consumer expectations declines, the price of gold tends to rise. University of Michigan Consumer Expectations (CE) and Gold: A Correlation Study: Confidence among U.S. consumers slumped in July to the lowest leve... |

| Posted: 16 Jul 2010 05:32 PM PDT View the original post at jsmineset.com... July 16, 2010 07:39 AM Dear CIGAs, Gold is off this Friday AM. Please note the degree of concern in the office today. * Jim Sinclair's Commentary Major bonus granting in the financial industry is taking place as the last chance to take a dip from the well, maybe for a decade, is here. Citigroup Profit Falls 37% By NATHAN BECKER JULY 16, 2010, 8:56 A.M. ET Citigroup Inc.’s second-quarter profit fell 37%, which was better than analyst estimates, as year-earlier results were heavily boosted by a $6.7 billion gain related to the combination of its Smith Barney brokerage operations with those of Morgan Stanley. Citi reported profit of $2.7 billion, or nine cents a share, down from $4.28 billion, or 49 cents, a year earlier. Revenue dropped 33% to $22.07 billion. “While the market environment lowered revenues in securities and banking, credit improved for the fourth consecutive quarter,” Chairman and... |

| Hourly Action In Gold From Trader Dan Posted: 16 Jul 2010 05:32 PM PDT |

| Mickey Fulp: Summer Slump Good for Gold Posted: 16 Jul 2010 05:32 PM PDT Source: Barbara Templeton and Karen Roche of The Gold Report 07/16/2010 A professional investor with Boy Scout genes in his DNA, Mercenary Geologist Mickey Fulp picks winners in the junior resource sector based on three criteria: share structure, people and projects. In this exclusive Gold Report interview, Mickey touches on how he studies up on such key factors as insider holdings that indicate management's skin in the game and the public float necessary for liquidity. He also suggests that the summer slump—with low volumes and low prices—is a good time for some homework on equities that could double within 12 months. The Gold Report: So far in 2010, there's been both positive and negative economic news. We now have health reform, about to have financial reform and stimulus money is still working its way through the system. The markets are bumpy. What's your view for the second half of 2010? Mickey Fulp: We always see volumes take a nosedive in the su... |

| Posted: 16 Jul 2010 05:32 PM PDT By David Galland, Managing Director, Casey Research Watching my children grow older, now heading into the treacherous shoals of the teenage years, has been a visceral reminder of how the human mind develops. As young children, we see the world with fresh eyes and wonderment, and then quickly begin testing the physical and societal bounds as part of morphing into our more mature selves. As we age into our teens and beyond, the testing of boundaries evolves into a series of calculations. If I do “A,” we wonder, will it lead to “B” or maybe “Z”? From a young age, most of us are told to advance our education and otherwise better ourselves so that we will be able to find a good job, or a succession of good jobs, that will provide sustenance and security lasting most of a lifetime before retiring to dawdle about in our golden years. At least that is the modern view of life pursued by the vast majority of the citizenry in th... |

| Just Another Day Off the Calendar Posted: 16 Jul 2010 05:32 PM PDT Without going into a lot of detail, Thursday's action was almost a carbon copy of Wednesday's trading activity. Nothing happened in Far East and London... and gold's third attempt in a row to break through its 50-day moving average in New York trading, ran into the usual not-for-profit sellers. Nothing to see here, folks. Silver's action on Thursday was no different than gold's... and the result was exactly the same. From 3:00 a.m. yesterday morning until 5:00 p.m. yesterday afternoon, the world's reserve currency dropped a bit over 110 basis points... and nowhere in yesterday's price action in gold was there any sign of that. While I'm on the subject of the U.S. dollar... here's the 6-month dollar graph. You'll note that from its high in early June, the dollar has fallen about 6.1 cents... which is a hair under 7%. Here's the 6-month gold chart... and it certainly hasn't been tracking the dollar... as gold is down around 2.5% dur... |

| LGMR: Gold & Silver Slide Together with Dollar as Stocks Fall on Weak US Inflation Posted: 16 Jul 2010 05:32 PM PDT London Gold Market Report from Adrian Ash BullionVault 10:00 ET, Fri 16 July Gold & Silver Slide Together with Dollar as Stocks Fall on Weak US Inflation & Investment-Flow Data THE PRICE OF GOLD fell hard at the start of New York trading on Friday, dropping back to this week's early lows for Dollar buyers – and hitting the lowest price since early May for Euro, Sterling and Aussie buyers – while stock markets sank on weak US data. Commodity prices slipped, with silver also falling toward Tuesday's low of $17.80 an ounce. The Dow Jones index dropped 1.0% at the opening. "With [Thurs] afternoon's US Dollar weakness," say bullion bank Scotia Mocatta's analysts in a note, "gold bulls would have expected a decent move up to the $1225 technical pivot. "On the bright side for gold, this [was] the third consecutive close above $1200." Gold prices today slid to $1190 an ounce, while the US Dollar rallied against the British Pound but slipped to a near 10-w... |

| Posted: 16 Jul 2010 05:32 PM PDT |

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Over 1% on the Week Posted: 16 Jul 2010 04:00 PM PDT Gold saw a slight gain at $1209.25 in Asia before it fell off in London and early New York trade to as low as $1185.80 by a little after 10AM EST and then rebounded to $1193.08 shortly afterwards, but it ultimately fell back near its earlier low in the last few hours of trade and ended with a loss of 1.61%. Silver followed a similar pattern and ended near its midmorning low of $17.72 with a loss of 2.9%. |

| Posted: 16 Jul 2010 03:08 PM PDT Emma Simon of the Telegraph asks, Should you sell your pension?:

I caution pensioners and plan members to be very careful with these "enhanced transfers". Such deals are typically conjured up to cut costs and save the company from future pension liabilities. Of course, if there is a high likelihood the the company will go bankrupt, you might want to accept such a deal or risk seeing your pension payments get slashed. It's quite disconcerting seeing how the pension war is being fought. Instead of bolstering pension plans to make sure members will enjoy a worry-free retirement, companies are looking at ways to cut costs, passing the responsibility onto individual members. Unfortunately, this isn't in members' best interests, and the social cost of all these cost-cutting measures will borne by taxpayers down the road. |

| Posted: 16 Jul 2010 03:05 PM PDT

Not that an economic collapse is the only reason to have a family disaster plan. We live at a time when it seems like the whole world is going crazy. You never know when or where the next oil spill, hurricane, earthquake, volcano, pandemic or terror event is going to strike. So the reality is that it is imperative that we all have a disaster plan that sets out exactly how we are going to provide food, water, shelter and security for our families in the event of a major disaster or emergency. So exactly what should such a disaster plan entail? If you have not done so already, please read the following two articles that we previously published on this theme.... 1) 20 Things You Will Need To Survive When The Economy Collapses And The Next Great Depression Begins 2) What To Do Both of those articles lay out some of the basic principles of emergency preparedness. But there is so much to know about emergency preparation beyond just the basics. Over the last couple of months, the readers of this column have shared some amazing information on this topic, and we have compiled some of the very best of those tips below.... Smuggler: As a long time hiker and back country lover I have had a bit of experience in rustic living. From Tents in the Rockies and Sierras to the bottom of the Grand Canyon and an old trapper's cabin in Alaska I have pretty much lived in that way most of my life. Survival depends on a lot of things, not just how much grub you got or how many bottles of water are stashed away. If all roads are blocked your stocked RV is suddenly going to be a liability not an asset.With roads blocked by earthquake or check points the ability to travel cross country will be reduced to foot transportation, unless you plan to tote your pick-up over the mountains think lighter…. If it all goes up the first thing you must do is realize that this is not a camping trip, you come home from a camping trip, you won't have a home to come to if it all goes up. You are going to have to find food and water as you go and in the case of food you will most likely have to kill it and clean it. Man bites dog will have a whole new meaning. That is where the best survival tool will be most welcome. The nice thing about this tool is it takes up no room and it doesn't weigh an oz. Become knowledgeable.learn about water and how to test it, find it and save it. learn how to preserve foods by drying or smoking. learn what plants in your area can be eaten or used for medicine. You get the idea here, the more ya know the longer you will live. One of the places I have spent some time hiking is the Idaho and Utah boarder area and parts of the old Boozeman Trail. one of the remarkable things you see on the Trail is tons of cast Iron cook stoves, nickel trimmed Parlor stoves, furniture, house hold goods, sinks etc. that litter the ground. All tossed off overloaded wagons, from about the middle part of the Trail tapering off to just a few items the farther west they got. Take to much you have to throw it away. A good make pro back pack, a good sleeping bag/ground pad, light tent, fire making items, [ I recommend a mag and steel striker. ]a good hand axe, a good hunting knife, a pro grade compass, [Learn how to use it.} Food, freeze dried is best very lite and can carry many days of food. Limit clothes as appropriate for the weather and how much you can carry. Water, what you can carry and treatment tablets for new sources if in doubt. Other wise boil it for ten mins. Things like sewing kits are nice but won't kill ya if you don't have one. Judge your wants balanced against your needs, in the case of candles and radios and such, they are heavy hard to secure and take up lots of room. In the case of candles I've had them melt all over the inside of my back pack not a fun thing. Keep it light and essential,you may have to relocate in a big hurry. Now, do you see why community is a good idea? You can survive one man alone, but in a group is easier, safer and more productive and more fun. Here's hoping all your trips are camping trips and may you always come home. RLTW: Food: If you are about to go on a long "hike" like for a couple of weeks… seriously fatten up. Talk to anyone who has done ranger school. They lose 20-45lbs in only 63 days. Most fatten up just before going. If you only have one meal/ day, then eat in the morning and eat small amounts throughout the day (like a candy or cracker) and keep drinking water. Surprise salt is important, dont go low sodium in food especially if you are consuming a lot of water. On the move, Eat the most perishable first, eat based solely off the energy you are expending. If you open it consume it, or you will have unwanted pests/animals. In bear country, hang it from a high limb away from where you sleep. If you cant brush your teeth, chew gum, or chew soft twigs. Gerber or Leatherman is better than a Swiss knife, and BTW Butch I pack heat, so good luck and don't let the laser sight on your forehead deter you. Gasoline doesnt store for very long, and know the difference between diesel and gas (I know this is basic, but some people cant tell except for what it says at the pump). And also know that Syphoning gas from new autos is impossible, so don't try, remove it from the fuel line/filter under the car. Have a small tool kit/box, with basic tools. If you are on the move, the right Clothing is extremely important…. Get loose fitting clothing that you can easily layer, have about 3 layers or more (depending on your local climate). One layered set should be enough, but you NEED extra socks, 2-3 pair (or more) of heavy cushioned socks are ESSENTIAL if you are on the move. Change your socks every day, even if you cannot wash them. A week could turn into a month. Dont pack underwear, b/c after a week it will be gone anyway (Most infantry soldiers go without in the field) and is just extra weight. Think of going for a long hunting trip when packing this up, and remember its always colder than you think even in the summer especially when you cannot go indoors anywhere. Pack gloves and ski type hats. At a minimum, keep your feet and shoes dry. If they get wet, walk it out, & change socks more frequently. In the cold, Keep your shoes/boots next to you when you sleep to keep them warm and be ready if you need to move out quickly. Dont be unpacked, take out what you need and leave the rest packed. You may have to take off quickly. (Pack everything you want to keep dry in gallon-sized ziplocks) Don't rely on a store first aid kits, buy a medium sized tool bag and get a good first aid "trauma" list(most stuff you can get at walmart). But also consider learning how to start an IV and get a few. Also, address all knicks and cuts, even the small ones. Infections can put you under, ESPECIALLY ON YOUR FEET/LEGS. Water: If you have bleach, you can use that to purify water. One drop per Quart. Be careful, if you use too much then you will have a bad case of buttmud. Fire: can be started with 2 D-cell batteries and steel wool, but invest in a magnesium stick that you can use with a knife. If Money is worthless, have things to bargin with & you will be better off. Consider gold coins, you can always cut off chucks to use as payment. CAUTION: To much of something valuable will make you a target, so consider things that are valuable other than Gold. A NON-digital watch is helpful, and can be used for navigation… plz dont ask, google it or get a survival book (which is also good) – I use the SAS survival book MAPS!!!!! Hello, a good map of your area where you intend on going is very helpful, especially of your immediate area (topographic) and will help you locate water. It is impossible to hand carry your water needs, know your sources along your route. Keep a good small atlas with your kit, may have to leave a contaminated area and may have to travel on the roads or beside the roads. You can easily use a good atlas to terrain navigate in lieu of a good topo map. Know the state evacuation routes, then plan an alternative b/c they will be packed. Set up "rally" points that everyone knows and will link up or leave messages if safe and no communications exist. Flashlight: invest in an efficient LED headlamp, that way you have both hands free. The AXE is not required: You need only a good Knife, like a K-bar…dont buy a cheap hollow survival knife (they will break), buy a regular good 5-8in blade that is heavy and durable. You can use the knife with a piece of wood or log to hammer the knife like an axe for firewood….but your call. Remember, you may have to carry it. If you have a friend in Spec ops or is a Ranger, Seal, etc… ask them for tips or advice… we train in this type of thing. Elocutionist: There are other things people can do; must do: Build up a network of support. Get to know your neighbors and be certain all of you support one another. I live in a small development of about 90 homes. We are closed off from the main highway and, even in these relatively 'good' times, we always rely on one another for various things (i.e. snow ploughing, lawn mowing, etc.). Make a plan with your family, if they're not nearby, so that in tough times you're not alone. Develop a skill. Learn how to make bread, for instance, from flour on a wood stove. Become an expert 'handyman,' the ability to repair things will be an important skill. Plan for the worst, hope for the best. In either case, you'll be prepared. Jim: You'd be surprised at how little work it takes to have a seed turn into dinner. It's almost as if that was what the seed was designed to do. Even people in apartments can cut their food down quite a bit with herbs, tomatoes, and the like in the windows. 1/4 acre can feed a family of more than four, and that's worth spending a few minutes a day if you ask me. Paul: A couple of useful items: Clorox. Very cheap. Can purify water and also handy for sterilizing anything. Saving a pile of old newspapers is another good cheap item — useful for starting a fire and, hey— better than nothing, using as toilet paper. More expensive — a couple of handfuls of silver coins in case no one wants US paper dollars. John: Also, look at yard sales and thrift shops. If you really need a couple of cheap shirts, instead of buying cheap ones made in India, recycle what is already in your community, putting some money into your neighbors' pockets. Try to buy food locally. It's more expensive, but if you are careful, you can find a few affordable items. If you live in the city, talk to your local council and try to get projects going that allow community vegetable patches on vacant land. In some areas this is already happening. Grow herbs in your kitchen. When you are down to beans and rice, it is amazing how a little bit of fresh herbs can spice up your life. YOu have a sunny window in your house? Start growing something easy like zucchini. Learn how to repair – anything. You won't get rich, but you might eventually make a decent living. Most of us are getting poorer and are going to want what we have to last longer. I remember as a kid in a small town there was a shoe repair shop, an electrical repair shop, a furniture repair shop, etc. Now they have all disappeared because most of us have gotten use to throwing things out and buying new. My guess is that the market for repairs is only going to grow. Have you got a sewing machine? Buy up cheap clothing/fabrics from a thrift shop and turn them into quilts, stuffed animals, bags, interesting clothes for kids. This Xmas lots of people are going to be looking for cheap gifts for their children. You won't be making much per hour, but at least you might be making something Go dumpster diving. Especially if you live in a private college town, you will be amazed at how much perfectly good clothing and furniture gets dumped every year. In a small town that I visit every summer, one thrift shop fills a complete dumpster with clothes every week – almost all of it in near perfect condition. The dumpsters near dorms are overflowing at the end of terms. Boycott. Don't buy from/do business with companies that send all their jobs overseas. If you live in a place with a community college and if you have a bit of money, learn a trade. Community colleges tend to be relatively cheap and they give you good skills. And if you have a kid of college age, ask them if they really want that degree in 18th century literature badly enough to starve. Finally – get involved and become political. A lot of people know that they are not happy, but they are not sure what to do and are waiting around for other people to come up with the solutions. Start thinking about something that is important to you locally, regionally or nationally and figure out a way to be part of the solution. One reason we are in such a mess is because we all tuned out a bit and let the bigshots call all the shots – and they created a world that works great for them, but at our expense. Michael: Every once in a while, I see these "survivalist" cans of Costa Rican canned green coffee beans. Ok, so I pay about $80 bucks (not to mention some paying for some hefty shipping charges). I thought to myself-why can't I do it (in the spirit of DIY). Ok, it can be easily done. First, purchase GREEN coffee beans. Second, seal them in a good container. I use a half gallon Ball canning jar WITH an oxygen absorber. A half gallon jar will hold about 2.5 pounds of beans and I use one or two 500CC oxygen absorbers-just to make sure no oxygen exists afterwards. Thrid, Seal the jar with a new canning jar lid. Keep out of light. No moisture (dry beans and glass sealed jar), no oxygen (absorber does that), no light, and keep in cool storage (room temp or cooler); and the coffee is good to go for years! J.E. Chapman: I will tell you that a swiss army knife wont cut it, you need a good beefy knife like a K-Bar fighting knife something you can use to pound, dig, chop, and even kill with if nessesary, a SOG is another good choice, remember you get what you pay for. Also read and study up time I believe is short a good manual is Emergency Preparedness and Survival Guide from Backwoods Home magazine is a very good book to have along with all the military survival manuals you can get your hands on, arm up with a Good rifle a good sidearm and plenty of ammo, enough food for a year and good luck. Praying Helps moreso than most would believe, God Bless. Uncle Sam: Knowledge is the store of value that "neither moth nor flame can corrupt or destoy" They can't take that from you. Store enough food to make it through a year from ANY point in the agricultural cycle. Start growing food now, so you can learn how it works. A farmer doesn't become a farmer after one or two seasons, you must get everything wrong before you know how to do it right, and that takes time and experience. Start now, its July…plant greens in August and have salads through November just to get some experience. Basically, you will find that it breaks down like this…If you can't grow it, mine it, trade for it, or kill for it; you are not going to have it, and if you are not prepared to do all four of those, you are in danger. There exists a critical tipping point, a point of mass despair and anger that will capitulate our way of life. This is NOT like the 30's. In that era, we were set up to live autonomously, so long as we could keep the mortgator at bay (with a shotgun) we are not like that anymore. Americans especially are not prepared for what is coming. We are too integrated. Most have neither the means or opportunity to live autonomously, they only have fear as the motive when they run out of food or are kicked out of their homes. Very dangerous, they are forced to crime. In the 30's, people were bummed that they had to return to the agrarian lifestyle of their ancestors on the family farm instead of "making it" in the city, we don't have that option today. People will riot hard and more and more police are laid off every day. One day, the power will go out and not return. The day that happens, the poles will be felled for the wood, and the copper stripped for trade. Then, the infrastructure is gone. Remember that sight, as the defining momonet of the descent. Francis: The two of us have a tiller, a grubbing hoe and some smaller hoes. Each spring we hire a tractor to prepare the garden. Get soil tested through gov't. or ag school for knowledge of correct soil amendments (lime, fertilizer etc.) Bugs will take care of themselves for the most part, though some hand work may be necessary. Diseases will need to be worked around (different varieties of plants) We don't use poisons. We work about an hour a day in the spring, 4-5 days a week on about 1/2 acre, less as the year goes along. We grow two crops, the fall garden is usually small. Our biggest chore is weeds. The two of us could live off of this if we had to. We have about 20 fig trees and lots of other fruit trees. Yes, we are blessed. But there is something we can all do to supplement the bounty nature gives. City folk, think small. You will be amazed at what some diligence and patience will do when joined to a willing hand and some knowledge. By the way, the sweetest meal you will ever eat is the one you grow yourself. Lots of you talk about slavery. The best way out is to get rich. The best way to get rich is slowly. If you are profligate forget it. But if you save some of everything you get and through nothing away that has any possible worth, you will start finding ways to save a penny here and there. And community is the long term key to subsistence. Even the hard-headedest persons I know take notice when the fruits of frugality are exposed. I can't fix a motor and my mechanic neighbor can't grow corn. I have gone out of my way to make him a friend. We Americans are resourceful when not anesthetized by superfluity. Despise nothing. Make every object the subject of evaluation. A lot of something adds up to a little of anything. Wake up. Bearmaster: Those of us who are preparing for what now seems to be at our door will be ready. Not only preparing with water, food, fuel, matches, seasonal clothing and whatever else is needed, we will be the few who do survive and will remember the rest of you who did not 'believe'. There is no shame in getting ready for any event, especially when it comes on suddenly. Those caught by surprise are the ones who will suffer the most. If you think because you have guns and ammo that you will come and take away what you feel you need and deserve, how? Without water after two days you will be delirious to the point you can't think straight. After five days of beans and bacon bits you'll wish you had stocked up on toilet paper. When you come staggering up with gun in hand, do you really think you'll be able to pull off this 'robbery' and take what you can, how? Will you have a shopping cart or a little red wagon? Maybe the back of your pickup would work but where will you get the gas? How can you carry anything with guns in hand, don't you think there will be others waiting who will then take advantage of you? Those who think the 'community' idea won't work are those who can't get along with or won't trust other people. How can you stay awake and alert for 24/7, you, the wife and kids against what odds? Think about it, trusting family, neighbors and friends in a small group will be the only way to get through this unless they bomb us into eternity. A small group can provide many things, sharing in the expense of preparing and putting things away in the best, safest location you can find. Those living in a city, large town or even in a development, you need to have a plan of escape to quickly get to a safer location. ***** So what do you think of the tips shared by the readers? Do you have any additional disaster plan tips to share? Please feel free to leave a comment with your thoughts below.... |

| Posted: 16 Jul 2010 02:37 PM PDT |

| Posted: 16 Jul 2010 02:30 PM PDT Dear CIGAs, At long last we are now offering Compendium Version 3 for sale. There will also be a very limited printing of Compendium Version 1 and 2 for sale as well. If you want a copy I suggest you order it while you have the chance. We release Compendiums every couple years to help cover the operating costs of running a site like JSMineset. Over the years we have gotten quite large and these costs have grown substantially. If you like what we do here please purchase a copy – you will be supporting a good cause and allow us to continue providing this service free of charge. **PLEASE NOTE YOU DO NOT NEED A PAYPAL ACCOUNT TO PURCHASE ANY OF THE COMPENDIUM SETS. COMPENDIUMS SHOULD ARRIVE WITHIN 2-4 WEEKS DEPENDING ON YOUR LOCATION** What you will receive with each set: **NEW** Compendium Version 3 ($80 USD): Included in this two DVD set is a DVD Rom (accessible by computer DVD drive only) that is a searchable database of nearly two thousand articles over the last two years from Jim Sinclair, Trader Dan, Monty Guild and a collection of other JSMineset contributors. This is one of the largest collections of articles related to the Gold market available today on DVD and includes all charts we have posted over the last year and a half. The second DVD is the much anticipated CIGA Meeting in Toronto from February 2010. This DVD includes over 3 hours of discussions with Jim Sinclair himself and is playable in any DVD player. **NEW** Compendium Version 1-3 Package ($210 USD): This package includes Compendium 1 & 2 listed below and the new Compendium 3 above. Compendium Version 2 ($80 USD): Compendium Version 2 includes all articles posted from December 2005 to the end of October 2008. All articles are categorized and presented in HTML format and are PC and Mac compatible. Several thousand articles are again included in this archive disc which makes up literally thousands of pages of market commentary from Jim himself. Compendium Version 2 also includes an hour long DVD video commentary on financial markets by Jim Sinclair. This disc is playable in any DVD player and any computer that supports DVD playback. Compendium Version 1 ($50 USD): Compendium Version 1 includes all articles posted from the inception of JSMineset in 2002 to December 2005. It comes packaged as a searchable PDF database and includes several thousand articles on Gold and financial markets. As a bonus, a separate Technical Analysis video disc by Jim Sinclair is included in the package. This video is viewable on a computer only and is both PC and Mac compatible. Compendium Version 1 & 2 Package ($130 USD): This package includes both compendium 1 & 2 which are shown above. As you have noticed by this point, JSMineset does not subsidize costs with garbage advertising nor do we ever promote products through our free eblast system. If you feel JSMineset has helped you over the years, purchase Compendiums 1, 2 and/or 3 and help keep us alive! For the price you pay the information you receive is unbeatable and you know it is going to a good cause. All prices are in US dollars and include shipping and handling. Thank you all for your continued support! Dan Duval |

| Posted: 16 Jul 2010 02:29 PM PDT Jim Sinclair's Commentary Here are words of absolute wisdom from Trader Dan. Dear CIGAs, The only way to end the charade that takes place at the Comex in the gold pit is to do what I have been saying now endlessly for years – STAND FOR DELIVERY OF THE METAL. Until the longs get it into their heads to take the actual metal out of the warehouses and force the bullion banks to come up with the gold that they are selling in unlimited quantities, the farce will continue. It remains a source of continued astonishment to me that the longs, which have it completely in their power to end the price suppression scheme, refuse to do the ONE THING that can end it all almost overnight. That is the Achilles' heel of the bullion banks and until exploited the Comex bears will sell with impunity. Any entity attempting to do in wheat or cattle for example, what the bullion banks are doing in gold, would end up having their heads handed to them on a platter. Egypt would step in and buy all the wheat they wanted to sell or a large packer would end up getting a huge discount on cattle and looking forward to hearing all those Moo-moos bellowing in the rail cars that would be coming their way knowing that it is the sound of huge profits based on someone else's brazen stupidity. The large traders in the gold pit (hedge funds) are run by mindless dolts who could not trade their way out of a wet paper bag if their life depended upon it. What else explains their inability to break the hold of the bullion banks in the gold market except a failure to think apart from their computerized black boxes. DJ UPDATE: Liffe July Cocoa Delivery Second-Highest On Record LONDON (Dow Jones)–Liffe cocoa has seen its second-largest delivery on record, raising concerns of a squeeze on European cocoa supplies, NYSE Euronext Liffe (NYX) data showed Friday. A total of 240,100 metric tons of cocoa were delivered against the July contract, the highest figure for 14 years and one of only six on record over 200,000 tons, according to data from the exchange. The delivery raised concerns that Europe may face a shortage of cocoa after data show that a total of 246,810 tons of certified cocoa stocks are currently being held in Liffe warehouses in Europe. BNP Paribas Commodities Futures Ltd. was the biggest buyer of cocoa delivered against the July contract, accounting for 43% of cocoa bought, or 102,450 tons. The biggest seller was Newedge Group SA, which accounted for 78% of the sales, or 188,020 tons of cocoa. Concern over the level of cocoa stocks in Europe has been growing since the July contract expired Thursday with 24,866 options open, equivalent to 248,660 tons of cocoa. A further 16,070 tons of expired stock waiting to be regraded are also held in Liffe's warehouse, as well as a further 17,372 tons of non-tenderable or Binfested stock, but these aren't deliverable against the current contract. Cocoa futures on NYSE Liffe are traded as instore contracts, meaning that the warrants for the stocks will be exchanged, but no physical cocoa will be delivered at this point. -By Caroline Henshaw, Dow Jones Newswires |

| Guest Post: Lloyd Blankfein's Days Are Numbered As Chairman Of Goldman Sachs Posted: 16 Jul 2010 01:47 PM PDT Submitted by Charlie Gasparino Lloyd Blankfein's Days Are Numbered as Chairman of Goldman Sachs It's a testament to the odd world in which we live that when a Wall Street firm pays a $550 million fine by conceding negligence in how it dealt with clients, its stock surges, adding billions of dollars in market value for the firm's shareholders. But that's what's happening to Goldman Sachs, as it reached its long awaited settlement with the Securities and Exchange Commission over how it sold a basket of mortgage related debt to investors in 2007. Back when the SEC brought the case, the conventional wisdom on Wall Street and the financial media was that Goldman didn't have to settle -- the case was weak and Goldman is, after all, Goldman. As I wrote on these pages back then, Goldman would have to settle because: (a) the SEC dug up some real questionable activity; and (b) no Wall Street firm, not even one with the ties to government that Goldman possesses can go to war with its primary regulator. Now that Goldman has indeed settled, the news is being spun, again mostly by the financial media, that the deal with the SEC was a victory for Goldman's CEO Lloyd Blankfein, who survived the investigation largely unscathed, paying a measly $550 million to the government (equivalent to a few days trading gains at Goldman) and without having to give up any power, such as relinquishing his role as chairman of the board, as senior executives both inside Goldman and at competing firms believed would be part of any settlement. Well, if history is any guide, Blankfein may not go tomorrow, or even next month, but sometime in 2011, Blankfein will at the very least no longer be chairman of Goldman, and may also be forced out of the firm altogether. If you don't believe me ask former Citigroup CEO Sandy Weill. Like Blankfein, Weill (at least on paper) was a good CEO from an operational standpoint. Following the creation of Citigroup in 1998, shares of the big bank soared. The bank was what's known as a Wall Street darling for its strong earnings and a surging stock price, and Weill was regarded as the King of Wall Street, having engineered the largest financial deal ever when he merged his company, the Travelers Group brokerage, insurance and investment banking empire, with commercial banking powerhouse Citicorp. At the height of his power, Weill suddenly popped up on the radar screen of New York Attorney General Eliot Spitzer. Before Spitzer got involved with hookers and became a TV host, he was the sheriff of Wall Street, looking to right wrongs from the last great scandal, the internet bubble where firms sold worthless dotcom and tech stocks to unsuspecting investors. Emails he uncovered showed that Weill at least did something stupid, if not fraudulent: He pressured an analyst, Jack Grubman, to inflate his stock rating on telecom giant AT&T, which was an investment banking client (Weill also sat on AT&T's board, while AT&T CEO Michael Armstrong sat on Citi's board) Grubman wrote in an email that as a favor for upgrading the stock, Weill got his kids in an exclusive pre-school. The scandal, was described by the Wall Street Journal, as a "kid pro quo." Weill continued to deny wrongdoing and was never charged. Citigroup, however, was charged with fraud and ended up paying a $400 fine to settle the matter, but Weill appeared to have retained his control of the bank. The initial reaction in the press and among his peers in the financial business was that Weill had won, by having the bank pay a relatively small fine, and his status as CEO and the King of Wall Street secure. Not quite. A few months later, Citigroup announced that Weill was stepping down as CEO, handing that job to Chuck Prince, who basically negotiated the settlement package. Citigroup maintained that the two moves were unrelated. But people in Spitzer's office told me they really weren't: While negotiating the settlement, Citigroup's board made it clear to investigators that Weill's days were numbered at the top of the firm that he founded. Spitzer was merely affording Weill a graceful exit in an effort to end the case. Full disclosure: I have no knowledge that Goldman's board has tacitly agreed to pull a Weill on Blankfein and has plans for him to step aside, but the circumstances involving the two men are so remarkably similar. While Blankfein wasn't directly involved in the questionable trade that landed Goldman in trouble, he is responsible for remaking Goldman into predatory trading culture that has caught the attention of regulators, Congressional committees (recall Sen. Carl Levin badgering Goldman traders for selling "shitty" investments to their clients) and hurt Goldman's once stellar reputation, as Weill's actions hurt Citigroup's. Some would say that's where the comparisons end; Citigroup deals with the general public that buys stocks through its brokerage unit (Smith Barney) and makes deposits in its branch banking offices. Goldman deals with large sophisticated investors who couldn't care less how Darwinian the company behaves. That used to be true, but no more. Goldman's image has been battered, not as bad as say a company like BP, but not far behind. And image does count these days given the scrutiny and oversight placed on Wall Street and the banks following the financial collapse-induced bailouts. Now that financial reform has been passed, Goldman will have to cut back on some of that aggressive trading that powered its earnings and was Blankfein's forte. That means it will have to devote more and more resources to developing its client business and relationships, convincing blue chip companies that it is the right firm to handle delicate negotiations involving mergers, acquisitions, and other corporate financing assignments. More and more, these clients do care about image (ask yourself why has so many top companies embraced the useless but politically correct "green agenda"). In fact some have already jettisoned Goldman as scrutiny of the firm grew over the past year. Who is the right guy to change Goldman's image to fit the new paradigm it faces? It's not Lloyd Blankfein and that's why he won't survive. |

| John Lee: Blame Volatility on Summer Doldrums, Not Deflation Posted: 16 Jul 2010 01:35 PM PDT

The Gold Report: Everyone is concerned with the volatility in the markets. What's going on out there? John Lee: Well, there's the proverbial "sell in May and walk away" going on, even though commodity prices have stayed fairly buoyant. In the junior market, there's a lot of paper that came out and began trading from the financings conducted in November and December. I think we're experiencing a little bit of a weak season where equity markets are vulnerable. TGR: I was reading some of your presentations and one thing that you talk about is paper currencies being at the mercy of government and you consider gold a hedge against paper. On July 1st, one of the more popular gold futures contracts lost $40, its biggest drop since February. Investors seem to be gravitating toward T-bills because they fear deflation. Should we fear gold's prospects in a deflationary economic environment or should we expect gold ultimately to continue its record bull run? JL: Well, you touched on a number of issues there. July 1 was Canada Day and Canadian markets were closed and you had the futures markets trading. There is actually some evidence to suggest that the markets, on a given Friday or the day before a holiday, will see a heavy correction—a one-day correction. However, gold is trading at $1,211 right now (July 2). It's only $50 from its all-time high. And so, the market is really healthy. In terms of the discussion of inflation and deflation, I am firmly in the inflationary camp. In the history of fiat currency, there has never been a scenario where deflation has occurred. You have to adhere to the real definition of deflation, which is a decrease in money supply. The money supply is, in the history of fiat currencies, always on the way up, not on the way down. There may be brief periods when the increase in money supply slows, but rest assured that the money supply is still increasing. With deflation we're talking about an actual decrease in the money supply. I think it's almost nonsense to become concerned about deflation. Going back to the Great Depression of the 1930s, the reason we had a deflationary scare was because gold was tied to the dollar. But this time it is not tied to the dollar. So in a true deflationary scenario, gold's purchasing power will go down because the paper currencies' purchasing power is going up. But this is not what we have today. TGR: Right, but people like T-Bills because if you buy a $100 T-bill and you cash it out a year later or even three months later, it is still going to be worth at least the original $100. They're safe. Should people be buying T-bills, gold bullion or shares in gold companies as a hedge against what's happening right now in financial markets? JL: You should have bonds and equities and in cash. Then you can break it down further: the equities into international equities and domestic equities; the cash, into precious metals and currencies. Also, you should really allocate a basket of commodities, and get some real estate as well. Depending on your risk tolerance, you may structure your portfolio differently. There is a place obviously for T-bills in the cash category. I think in terms of gold and precious metals, it's money so it belongs to the same category as T-bills. And it's not necessarily a good idea to put all your T-bills in U.S. dollars. I think in a reasonable portfolio you should have about 30% cash, which is a prudent way to go. I would say 10% in foreign currencies, 10% in U.S. dollars, and 10% in precious metals. It depends on which country you live in, because I think a number of currencies trend together. TGR: Is there anything that you put faith in when it comes to monitoring global economic conditions? Charts? LIBOR rates? JL: Usually commodity prices are a good indicator or forecast of what is to come, and so are equity markets, particularly the emerging equity markets such as Brazil, Shanghai and Hong Kong. What they're telling me is it's a pretty mixed picture, but I would say growth in commodity prices such as copper and oil, and growth in emerging equity markets are good signs. You talked about the bond prices; usually, if bonds and equities both go down together, that is a signal of something severe that could be coming into place. But right now the bond markets are still staying fairly stable, even though the equity markets have corrected somewhat from earlier this year. It looks to me now like there is some profit-taking, given that all the major indices, including the Canadian TSX and S&P and the Asian markets, have racked up over a 50% gain since their low in March 2009. Another gauge is the Baltic Shipping Index. It tells you the global shipping activities from everywhere else are pretty much gravitating toward Asia and China. Since the financial crisis (in 2008) it has recouped a lot of its losses; however, it's gone down the other way quite severely; 30%–40% in the last 30 days. I think it's a mixed picture. Nobody really knows what's going on. Even within Asia there are mixed pictures between, say, Korea, Taiwan, Thailand and China. Only in China are things going on all cylinders. TGR: Really? I think Hong Kong's Hang Seng Index is down about 20% so far this year. JL: Yes, and the Shanghai is down more than that. TGR: So if China is going on all cylinders, shouldn't those markets be performing better? JL: In the short run, there is obviously a disconnect between the equity markets and the economy. Although a lot of times the equity markets are forecasting what's going to happen, you can't read so much into the markets as they go up 10% and down 10% on a monthly basis. Keep in mind, China is very centralized; it's not a free economy. The government has $2.2–$2.5 trillion in their coffers so they can easily weather any sort of a storm and dictate the pace of progress. For example, they're spending around $1 trillion building high-speed railways; in three years time they're going to have more high-speed rails than the rest of the world combined. Any short-term corrections are not going to dissuade them from their plans. And they're building buildings, a lot of them. Their low occupancy rate is not going to stop them from trying to deploy as much of their $2 trillion as they can before the dollars go bad. It's the first time since the 1960s that the dividend yields are lower than the interest rates. So, basically you have this giant casino going on; you have money coming in, going out; and you have the Greek situation and the Spanish situation. Every time the U.S. market rebounds, they're crediting that to Chinese growth, and every time you have an equity correction it's going back to China again. China has already surpassed the United States in both automobile purchases and auto production. Their rate of auto consumption is growing somewhere around 50% annually. TGR: What did you think of today's job numbers out of the U.S.? 83,000 jobs added. JL: Some people will tell you they're suspicious of the numbers and the way the numbers are calculated. If you look at the foreclosure rate, it's in the range of 15%–25%, depending on the region of the country. I think that's probably a better indicator of the employment rate than the government's stated numbers. Even though the official unemployment rate is 9.5%, the real numbers could be twice as much, depending on how you define that. The U.S. economy is no longer the world's largest consumer of commodities; they're no longer the world's largest auto purchaser; they constitute 6% of the world's population. At the same time, they're not even the main influence on the U.S. equity market, given that S&P 500 companies derive somewhere around 50% of their revenues and profits from outside the U.S. TGR: But you're still a big believer in junior mining companies, correct? JL: Yes, I am. That's my specialty. TGR: Can you talk about some of your favorite names among the junior miners? JL: Yes, but first I would like to talk about the junior market scene. For example, on the TSX Venture Exchange, about 70%–80% of the companies listed are mining related in one way or another. It went from c$600–C$700 in 2001 to a high of C$3,300 in 2008, so that's about a 500% increase. In December 2008, it was down to C$700, and now it's back to about C$1,400. It's still less than half of what the peak was, and I think there's a lot of people who say, "You know what? If gold prices are $50 down from an all-time high, and copper is not that far from its all-time peak either—copper went from $0.70 in 2001 to $4 in early 2008, and now is trading around $2.80—then surely the juniors will have to follow, if not exceed its previous high of C$3,300." It would make sense because commodity prices have resumed their bull run. TGR: What do you look for in a junior? JL: I would not be so much focusing on value because a lot of management has lost a lot of their traditional means of financing. I mean it used to be that you could just walk down a Vancouver street and get broker financing at a 20% discount (to market price). It doesn't work that way anymore; the model has broken down. So, you have a lot of companies that are sitting on very good assets, but the management doesn't have the energy to go to unconventional financing sources such as the Chinese, the Middle East or the Europeans. Therefore, I tend to focus on companies with a higher market cap and—I can't believe what's coming out of my mouth right now—the companies that are trading at a slight premium. Those companies are on the path of becoming a producer. What I am trying to say is that the gap between a producer and an explorer is widening, and I don't see that trend changing anytime soon. More than ever you've got to be really selective on the junior market. There is not a lot of stupid money around chasing promotional stories, and when there is, instead of driving it much higher, it's barely a blip on the radar screen. I would say that with the junior market today you've got really to be cautious and look for stories that will be in production in the near term. Or gold exploration companies that have legitimate ounces in the ground. I am not so much into drill plays because these near-term producers are still selling at extreme discounts. You don't really have to go down that far in the food chain to gain leverage. TGR: But what do you define as a good asset? JL: A good asset is one that has a reasonable time line and road map into production. I would not be so much into a gold deposit way out there in, say Nunavut, that has tens of millions of ounces or tens of billions of pounds. I am more into where you have a modest size, say 1–2 million ounces, in a good jurisdiction, and also you have to look for management that has a history—proven history—of an ability to raise money. Ideally, the company is aligned with one of the big backers, whether it's Lukas Lundin or Ross Beaty or Hunter Dickinson; you really have to identify a company with a good management group that can raise money. And with a deposit that doesn't require billions of dollars for infrastructure because, like I said, money is very hard to come by now. TGR: Could you give us some of the names that you like within those parameters? JL: Sure. Like I said, I tend to be focusing on market caps of $50 million or more. In fact, more like a $100 million market cap or more, but that has crashed back down to less than $50 million. I would stay away from micro caps because of their inability to raise money because of their lack of liquidity. In the gold space, among my favorite holdings is Minera Andes Inc. (TSX:MAI ; OTCBB:MNEAF). That's a company chaired by Rob McEwen; it has a great history, proven management, a good cash position and it's a gold-silver producer in Argentina, even though there is somewhat of a dispute with Hochschild Mining (LSE:HOC), the joint venture partner. I like Klondex Mines Ltd. (TSX:KDX, OTCBB:KLNDF); it's a gold story out of Nevada, and again, I am a shareholder on all of these issues. I have some smaller companies like Apogee Minerals Ltd. (TSX.V:APE)—it's a silver explorer in Bolivia, but because it is in Bolivia it has been extremely heavily discounted. TGR: What's the issue with Bolivia? JL: For investors that follow Bolivia they will know that Evo Morales came on the scene about four or five years ago now, and it's a lot of the same talk as Hugo Chavez (president of Venezuela) in wanting to nationalize a lot of the mining industry. However, there's walking the walk and talking the talk. Morales has been talking about possibly nationalizing foreign mining companies, but it hasn't happened. A lot of the conversations are taken out of context by the Western press and because of his words, a lot of Bolivian explorers are being somewhat unjustifiably punished in terms of lower valuations than similar mining companies. TGR: But does Apogee have a good project there? JL: Yes, their Pulacayo Deposit silver project, which I visited. I am a shareholder of Apogee and it's a good project. It's one of the few advanced silver projects, and, in fact, I would say this is probably the only silver junior that I will hold. But then because of its geographical political risk, I would just place a small holding there. You would not mortgage your house and put all that money into a lottery ticket; you would not do the same with Apogee. However, at these prices, trading around $0.07, with over 100 million silver-equivalent ounces, which includes some very high-grade pockets, it's a very low-risk stock, very low risk for silver. And they're backed by Stan Bharti, who is well-known in Toronto. This is one company I would consider buying besides the couple of other companies I talked about earlier. TGR: One of the companies you mentioned earlier was Minera Andes. A company that's similar to Minera is Minefinders Corporation (TSX:MFL; NYSE:MFN). Its Dolores gold-silver project in Mexico is in production. The company has a solid market cap, its mine is in a safe jurisdiction. Would that company fit your parameters for investment? JL: Yes, it's a good gold and silver deposit, modest in size, and it does have a fairly hefty market cap, around half a billion dollars, as I recall. Its production is still in its infancy. It's a good jurisdiction, in my view. I would like to see more stabilized production and some cash flow coming out of production, because so far it is still sort of cash flow neutral. When you're in the early stage of production, there tends to be a lot of times where things might go wrong, so it's not an optimal choice for me. TGR: It's ramping up, so that could easily change. JL: I would wait for a quarter or two and wait to see what the situation is. I think, again, Minefinders has good management; it's a good story; it's been around for a long time. It has proven its ability to raise money; so, I think it's a story that one should follow. TGR: Earlier you talked about China and how it is running on all cylinders. What about some junior mining companies operating there? Maybe a junior like Jinshan Gold Mines Inc. (TSX:JIN)? It's in a safe jurisdiction, it's producing gold too. It would seem to fit your guidelines. JL: Jinshan used to be run by Canadian companies, but now it's run almost like a quasi-state enterprise because the management has been taken over by the Chinese. I think one good thing about being run by China National Gold Group, which is one of the largest gold producers in China, is that they will always save face and not let companies go down, because these are icons of how the international investors perceive the prowess of the Chinese companies. So, you're not going to lose your pants on Jinshan as a producer in China. At the same time, investors should take note of the possible transparency issue with a Chinese management running a Canadian company. TGR: What are your top five holdings? JL: My top five holdings right now? I like the idea of evenly spreading your bets through different commodity sectors. I tend to have the top-down approach. Currently, I favor gold and silver. But even then, that's only about 50% of my portfolio. My top holding is Prophecy Resource Corp. (TSX.V:PCY), because recently I was appointed chairman. Besides Prophecy, my second largest holding is silver. As I said earlier, I like gold and silver, even though gold equities are trading at a bit of a discount to metal prices, but we're entering into a traditionally slow period, the summer. TGR: And the others? JL: The second is Minera Andes; then we have a lot of other bets across the other commodities. I like Candente Copper Corp. (TSX:DNT) for copper; I like some natural gas producers. I think natural gas is a good contrarian play. So in natural gas, I like Anderson Energy Ltd. (TSX:AXL); I also have some uranium issues, and some platinum producers—it's just all over the map. I have some zinc companies. One thing that comes to mind that I like quite a bit at current prices ($0.18) is Donner Metals Ltd. (TSX.V:DON). Donner has a joint venture with Xstrata PLC (LSE:XTA), so Xstrata is footing all the exploration bills at the Matagami copper-zinc-silver project and looking to advance Donner into production within the next 12–18 months. John Lee, CFA, founded Mau Capital Management in 2004. John has been investing in equities for over 10 years and is a keen student of market history and psychology. Since 2001, Mr. Lee has researched hundreds of mining companies and personally met with dozens of management teams. John has degrees in economics and engineering from Rice University. He previously studied under James Turk, a renowned authority on the gold market. John is a speaker at all major resource conferences, including the Cambridge House resource conference series among others. John has gained invaluable insights by living in three continents and making frequent globe-spanning site visits. Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page. DISCLOSURE: |

| Rust Discovered On Bank Of Russia Issued 999 Gold Coins Posted: 16 Jul 2010 01:32 PM PDT Here's a head scratcher: as everyone knows from elementary chemistry courses, gold is the most inert metal in the world - it does not rust, nor corrode. Yet this is precisely what Russian commercial precious metal trading company, International Reserve Payment System, discovered on thousands of (allegedly) 999 gold coins "St George" (pictured insert) issued by the Central Russian Bank. The serendipitous discovery occurred after various clients of the company had requested that their gold be stored not in a safe, but in a far more secure place: "buried under an oak tree." As the website of IRPS president German Sterligoff notes: once buried, "the coins began to oxidize under the influence of moisture." And hence the headscratcher: nowhere in history (that we know of) does 999, and even 925 gold, oxidize, rust, stain, spot or form patinas, under any conditions. Furthermore, as IRPS discovered, Sberbank of Russia released an internal memorandum ordering the purchase of the defective coins with the spotted appearance. Sterligoff concludes: "It should be noted that the weight and density of the rusty coins coincide with the characteristics of gold that would be expected after after conventional testing methods would reveal. We think that the experts will be interesting to determine the nature of this phenomenon." So just how "real" is 999 gold after all, either in Russia or anywhere else?

As Zero Hedge has pointed out previously, the Central Bank of Russia has been one of the biggest purchasers of gold in 2010, having bought gold every single month. It would be embarrassing if it were discovered that not only is the bank diluting the gold content once received with oxidizable materials, but subsequently passing it off for 999 proof precious metal. And if this is happening in Russia, one wonder what trickery other Central Banks, with a far lower amount of gold in their vaults, resort to... h/t Janis |

| Posted: 16 Jul 2010 12:02 PM PDT Commentary courtesy of www.creditresearch.com Spreads closed considerably wider today, with the biggest close-to-close widening since 6/22, as HY dramatically underperformed (pushing back above 600bps for the first time since 7/7) with the macro fears that we have been discussing crystallized and micro issues seem to be turning the same way. Spreads were wider on the week in all the major credit indices with Friday's rapid derisking the main culprit and running well ahead of underlying single-names. The rush for a liquid macro cover as anxiety re-appeared sets the stage for another round of single-name CDS and bond derisking and with decent fund flows in the rear-view mirror we suspect the best is behind us for the next leg. HY underperformed IG on the week as did IG ratings cohorts relative to HY cohorts which again supports a more deflationist view of modest reach-for-yield and fixed income safety over HY's levered asset devaluation. It is perhaps notable once again the relative non-existence of HY issuance this week - even as spreads screamed tighter for over a week. http://www.scribd.com/doc/34439498/CDR-CSA-20100716 Spreads were mixed in the US this week with IG worse, HVOL improving, ExHVOL weaker, and HY selling off. Indices typically underperformed single-names with skews widening in general as IG underperformed but narrowed the skew, HVOL outperformed but narrowed the skew, ExHVOL's skew widened as it underperformed, HY's skew widened as it underperformed. |

| Posted: 16 Jul 2010 11:03 AM PDT Gold Price Close Today : 1,188.00Gold Price Close 9-Jul : 1,209.60Change : -21.60 or -1.8%Silver Price Close Today : 17.773Silver Price Close 9-Jul : 18.053Change : 28c or -1.6%Platinum Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Money for Nothing and Cheques from Centre Link Posted: 16 Jul 2010 11:00 AM PDT Governments around the world are in trouble. They face unhappy voters at every turn. It's when voters are unhappy that they tend to care. That is supposed to be good for democracy. But who knows what sort of hair brained schemes the voting public might come up with once empowered? Telling people what clothes they can wear seems quite popular at the moment. So then you wonder whether politicians will stand up and do the right thing in the face of adverse political pressure. Will the mob rule? That's what constitutions are for, by the way. When popular opinion goes haywire, there are certain things the majority can't do. But politicians and the judiciary have watered down their constitutions in the name of practicality, necessity and their careers. There were poor to be supported, refugees to be saved, gunmen to be kept at bay, criminals to be cared for, consumers to be protected, rich to be made more equal and houses to be made affordable. Constitutional barriers are mere inconveniences to these lofty goals. Now we face the consequences. High taxes are the main one. Low employment rates are another. Who works when you get your money for nothing and your cheques for free from Centre Link? Wait a minute. Low employment in Australia? Yup, "Australia's employment rate - the percentage of the population with a job - ranks only 20th of the 27 rich OECD countries for prime-age workers" reports Tim Colebatch at The Age. The details are very much worth a read. Never again do we wish to receive an email from subscribers about Australia's lofty employment numbers. They aren't fair dinkum. Back to the global sphere. It's going to take an impressive set of politicians to educate the masses on the consequences of many years of free lunches. One woman who people can look to for guidance is Maggie. Janet Albrechtsen at the Australian is a fan:

Strangely enough, Margaret Thatcher probably wouldn't object to Janet's description. And she would probably measure her success by her death threats. But Australia isn't exactly stuck in the middle of an economic crisis, so why worry? GDP stats indicate the private sector is doing just fine. And house prices barely sneezed as the US was deciding on flower arrangements for its funeral in 2008. It hardly seems necessary to point out that the Aussie stock market did in fact plunge. And the battles raging around the world are ideological ones. It isn't likely that Australia will remain a lone bastion of Keynesianism if the world figures out how stupid that is. So change is in the air. Where do we turn? If a rather annoyed public opinion does control politics, where will it take its political leaders? That's where Janet Albrechtsen's second and recent article comes into play: Hey, big spenders, hands off our money. The sub-heading a slightly confused "Julia Gillard can learn much from the principles of Hayek and Friedman." We won't get into the Hayek vs Friedman story. Aside from that, Janet probably didn't read the "Why I am not a Conservative" chapter in Hayek's The Constitution of Liberty, nor Friedman's Free To Choose. But the remaining article itself is excellent.

One example was the Green Loans Program.

(Perhaps the longest sentence ever written?) Ahh, stimulus. The Working (to be) Poor The Age's article titled "Sea of Debt" sounded good from the beginning. It got worse. Geoff Strong went on a bit of a tangent with a so called Stacey:

We go on to read about how "the registration on her 1995 Toyota Camry has sometimes gone unpaid and she has only allowed herself a one-week holiday in Hobart in two years. Her weekly outing is ten-pin bowling with friends." And she doesn't even celebrate Christmas. This is a sad story indeed. Then Geoff Strong drops the bombshell: Stacey has a "full-time permanent job with the state government pays $55,000 a year". So if life is that difficult for an Aussie on that income, this country really is in trouble. But perhaps there is more to the story. Find out yourself here. (Hint: Her house was refinanced several times in a suburb with "the third-highest price rise for houses in Melbourne" in 2008.) But if "unremarkable expectations should allow [a person] at least a small slice of the Australian dream," then communism would work. Sadly it's not about expectations. It's about reality. And changing your expectations to conform with reality is a rather basic skill, one would have thought. To console Stacy and Australians in the same position, the Greeks are having trouble with it too. Hedgies in High Places When your editor was young, he got stuck in a hedge maze in London while experiencing some severe hay-fever. Wherever we turned, there was another hedge. It wasn't pretty. Now, it's the same thing all over again. Last week, we discovered a former hedge fund manager at the helm of Europe's bailout fund. This week Obama nominated a hedge fund managed from Citigroup to be his budget director. Apparently the favoured candidates were too busy fighting among themselves to see this coming. Surprisingly enough, the new guy's connections (read employment) to a bailed out firm are up for discussion at his confirmation hearings. But it will take someone as bright as a Hedgie to do the jobs these two have been tasked with. Dan Denning pointed out the inherent flaw in the European bailout plan in his latest edition of the Australian Wealth Gameplan: "The absurdity is that a bankrupt government cannot be expected to bail out a bankrupt bank when the bank was bankrupted by the bad government debt in the first place." And as for the American budget outlook, it seems Obama's Debt Commission is talking the talk. If the issue is left unchecked, it "will destroy the country from within". But America has already check mated itself:

The 'flations The 'flations are back in the news. Like some sort of dysfunctional family in a reality TV series, the central bankers are all over the place. Australia's Glen 'flation is expected to continue his rate rises. Jean-Claude 'flation has been busy doubling Spanish bank's debt to the ECB. Minutes from the Federal Reserve, home of 'flation family Chief Ben 'flation, indicated the "Committee would need to consider whether further policy stimulus might become appropriate". One thing that has been confusing is the central banker's definition of inflation. Supposedly it's rising prices. But, based on Stacey's anecdotal evidence of rising energy prices, it seems much of inflation comes from increased costs to the businesses providing goods and services. (Climate change policy perhaps?) A central bank's interest rate raising won't affect the cost of energy favourably. Nor the price of un-poisoned tomatoes if they become rarer. Yet the CPI's (or similar price indexes') moves supposedly dictate monetary policy. What if the central bank is merely interfering in supply and demand changes when it makes policy decisions on perfectly appropriate price changes? That might cause something like a global financial crisis or something, mightn't it? Despite their differing behaviour, all the 'flations have one thing in common. A dislike of the US dollar. Most central banks are either questioning, berating or dumping dollars. But only Ben 'flation is capable of showing true disdain for the Greenbacks. In an ultimate display of his apathy for them, he simply creates more. And when the great inflation begins, the 'flations will blame the free market again. But, to paraphrase investigators into South Korea's missing ship, it was either the Dear Leader, Ben 'flation, or it was the Martians. Perhaps we are being too harsh on Ben Bernanke. Let's go to former White House Budget Director David Stockman for a fair and balanced view:

Bankers Get a Reprieve in Switzerland - Surprise! Naming bank capital requirements after a Swiss city turned out to be an indication of what was to come. And it wasn't "works like clockwork" nor was it efficiency. It was secrecy and snobbery. And the banks came out on top. Closely followed by the ratings agencies. Now the circus continues:

This bit got Dan Denning all fired up on Wednesday.

Dan's reply:

Degraded Downgraders Downgrading the Degenerating Debts for Deutschland Another week, another downgrade from our steadfast bastions of financial wisdom - ratings agencies. Portugal falls victim this time. As the German's see it, countries can't change their Kuhflecken, let alone leopard spots. That's why Infowars reports ze Germans are preparing a European bankruptcy framework. Supposedly with a provision for giving up state sovereignty! They are at it again... The United Shambles of America In order of absurdity (not sure if rising or falling though):