Gold World News Flash |

- The Dow Chart is Ugly

- Jim?s Mailbox

- Daily Dispatch: Weekend Edition - July 03, 2010

- July and Emerging Markets

- Hourly Action In Gold From Trader Dan

- Gold Buyer's Checklist

- Why you can’t day trade Gold

- BP plc And The Administration Replace First Amendment With $40,000 Fine And Class D Felony

- Currency Wars and Fugitives from Justice

- Gold Wars : Military Conflicts, Gold and Currency Crises

- Bond Market Worried About 1930s Echo?

- 20 Questions with Robert Prechter: Long Decline Ahead

- Gold ETF: Time To Buy?

- Unaware of $60 Trillion in National Obligations

- Rick Santelli Uncut (And GE Turbofan Commercial Free)

- This Past Week in Gold

- Jim's Mailbox

- How to Play “The Land of Rising Stocks”

- Charts Showing The Commercial Real Estate Collapse

- The Risk and Reward Ratio on The Precious Metals Market

- Goldman Sachs: "The Second Half Slowdown Has Begun"

- Metals smash down was just another paper affair, Butler tells King World News

- One Last Observation On Thursday's Price Ambush

- If it quacks like a welfare duck, then it probably is a welfare duck

- Jim Rickards: Gold is money and probably manipulated for its deadly power

- Video: Gold Losing its Luster?

- Unavailability of Spending Crisis

| Posted: 03 Jul 2010 06:31 PM PDT From its Thursday low of $1,195 spot shortly after 4:00 p.m. in New York... gold rose quietly until about 1:00 p.m. in Hong Kong trading on Friday. From there it only added a few more dollars to its London high of around $1,213 spot shortly before lunch their time. From that high, the gold price slowly rolled over... and by the time the Comex opened in New York... had given back about $10 of those gains. This decline ended abruptly at $1,202 spot at precisely 8:30 a.m. Eastern time. Then, about a half hour after the London p.m. gold fix was in at 10:00 a.m. Eastern time, gold rose in fits and starts to close almost back at its London high. Gold's New York high of was $1,213.20 spot... with its low of the day occurring at the opening of Far East trading twenty-two hours prior. It wasn't very exciting trading... but volume was pretty decent... although it really fell off as the day progressed, as traders headed for the exits early, in order to get sta... | ||||||||

| Posted: 03 Jul 2010 06:31 PM PDT | ||||||||

| Daily Dispatch: Weekend Edition - July 03, 2010 Posted: 03 Jul 2010 06:31 PM PDT Weekend Edition Dear Reader, Welcome to the weekend edition of Casey's Daily Dispatch, a compilation of our favorite stories from the week for the time-stressed readers. Of course, if you want to read all of the Daily Dispatches from the week, you may do so in the archives at CaseyResearch.com. [B] Deficit Hawks at the G-20?[/B] By Chris Wood You may have read that "leaders" of the world's biggest economies agreed on Sunday to a timetable for cutting deficits and halting the growth of their debt. But that's not really true. Rather than a firm deadline, the timetable to cut government deficits in half by 2013 and stabilizing the ratio of public debt to GDP by 2016 is really just a loose expectation. Furthermore, even if it had been a hard deadline, at least in the case of the U.S., the idea is laughable. Not that I don't hope the U.S. government gets its deficits and debt under control. I do. I just think at this point it's become ... | ||||||||

| Posted: 03 Jul 2010 06:31 PM PDT July and Emerging Markets By Frank Holmes CEO and Chief Investment Officer There's no shortage of bleak news out there that's weighing heavily on the markets, but we could be coming into a positive period for emerging markets investors. The chart below, from Jim Lowell at Dow Jones MarketWatch, shows that July tends to be a good month for emerging market equities. The sector's beta-weighted performance in July tops 2 percent on average, far greater than any other asset class on the chart. Of course, emerging markets can be highly volatile and there's no assurance that this month will follow the pattern. But Lowell's observation is certainly timely and may be of value to investors looking for opportunities in the current market. Our experience is that seasonality is one of many important variables to monitor to keep a finger on the pulse of the market. We have found it useful over the years to watch the seasonality of gold, oil, copper and other commodities a... | ||||||||

| Hourly Action In Gold From Trader Dan Posted: 03 Jul 2010 06:31 PM PDT View the original post at jsmineset.com... July 02, 2010 02:25 PM Dear CIGAs, Gold held fairly well today considering the fact that there was further unwinding of those Gold/Euro and Gold/Sterling spread trades. That trade continues to be tied to the shift away from the problems of sovereign debt in Euroland and an increasing focus on the abysmal state of the US economy which we were reminded of with today's payroll numbers. You can see the unwind by looking at the performance of Dollar-priced gold versus Euro-priced gold at the London PM Fix over the past week. Euro gold lost 6.4% of its value against a fall of only 4.2% in Dollar gold. If you recall, gold priced in Euro terms had been outperforming gold priced in Dollar terms during the height of the European sovereign debt crisis. Now that those fears are fading somewhat, Euro gold is dropping at a faster clip. We will be able to see where the investment community focus is shifting from day to day or week to week by monitoring ... | ||||||||

| Posted: 03 Jul 2010 06:31 PM PDT by Paul Tustain BullionVault Friday, 27 November 2009 A nine-point checklist for secure gold investment... LOOKING TO buy gold today? Here's a nine-point check-list for secure gold investment presented to this week's Investor's Chronicle Gold Conference, hosted at the London Stock Exchange... #1. Don't take it home, except maybe a few coins History is littered with sad stories of people who bought gold (rightly) because they feared severe economic contraction in their home country, and then made the mistake of holding their gold at home. When they needed it they could not release its value because it had become contraband. Think of Zimbabwe (now), Argentina (2001), Yugoslavia (1990s), Vietnam & Cambodia (1970s), Nazi Germany (1930s), the USA (1933), Russia (1917). Gold secures your wealth when it is held in a reliable country. This is unlikely to be your own country if you are wise to be buying gold. 2. Buy 'Good Delivery' fine bullion to save 6-10% over coins & small bars Th... | ||||||||

| Posted: 03 Jul 2010 06:00 PM PDT | ||||||||

| BP plc And The Administration Replace First Amendment With $40,000 Fine And Class D Felony Posted: 03 Jul 2010 11:54 AM PDT CNN's Anderson Cooper, one of the few people who apparently hasn't or isn't leaving the troubled news network (surely Ted Turner has learned by now from CNBC that his female anchors should wear transparent body suits, show belly button deep cleavage, and install a stripper pole or seventeen for those ever more elusive Nielsen points), reports some troubling developments out of New Orleans. "The coast guard today announced new rules keeping photographers, reporters and anyone else from coming within 65 feet of any response vessel or booms, out on the water or on beaches. In order to get closer you need to get direct permission from the coast guard captain of the Port of New Orleans. Shots of oil on beaches with booms - stay 65 feet away. Pictures of oil soaked booms useless laying in the water because they haven't been collected like they should. You can't get close enough to see that. And believe me, that is out there. But you only know that if you get close to it, and now you can't without permission. Violators could face a fine of $40,000 and class D felony charges. The coast guard tried to make the exclusion zone 300 feet before scaling it down to 65 feet." While Cooper's conclusion is spot on, "we are not the enemy here, those of us down here trying to accurately show what is happening down here, we are not the enemy. If we can't show what is happening, warts and all, no one will see what is happening, and that makes it very easy to hide failure and hide incompetence", it doesn't matter, and little by little, nothing else matters, except for what the administration, the Fed, and the megacorps think it is in America's best interest to be able to see, hear, read, do, and what assets they have, where they can invest... especially if all this is done in conjunction with maxing out yet another credit card to buy the latest and greatest weekly edition of the iPhone.

h/t Arnoldsimage | ||||||||

| Currency Wars and Fugitives from Justice Posted: 03 Jul 2010 11:31 AM PDT Stacy Summary: Excellent piece from Jesse's Cafe Americain. We're already seeing this . . .

| ||||||||

| Gold Wars : Military Conflicts, Gold and Currency Crises Posted: 03 Jul 2010 11:10 AM PDT | ||||||||

| Bond Market Worried About 1930s Echo? Posted: 03 Jul 2010 10:31 AM PDT David Leonhardt of the NYT wrote an excellent article this week, Governments Move to Cut Spending, in 1930s Echo:

Not everyone agrees that government spending shouldn't be reigned in. An editorial in the Calgary Herald comments, A new long depression?: World should follow Canada's lead:

Of course, Paul Krugman isn't one to back down from debates on the economy. He was interviewed on Charlie Rose on Friday night (click here to watch) and he has taken on his critics in his blog, even openly threatening to punch them in the kisser. On Saturday, Mr. Krugman wrote an op-ed, The Hawks Who Cried Wolf:

And rates can rise from these levels, especially if economic data comes in stronger than expected. Consider this, Bloomberg reports that Treasury Two-Year Yield Drops to Record Low on Slowdown Concern:

My feeling is that the curve flattener trade is getting overcrowded, and yields can easily snap back from these levels, especially if economic data come sin stronger than expected. But maybe the bond market is worried that austerity measures will effectively kill the fragile economic recovery, pitching the world into a protracted period of deflation. With 10- and 30-year yields plummeting to their lowest level since April 2009, there sure seems to be an ominous 1930s echo in the air. | ||||||||

| 20 Questions with Robert Prechter: Long Decline Ahead Posted: 03 Jul 2010 07:39 AM PDT The 7¼-year cycle has been quite regular since the first bottom in 1980. The next bottom was at the crash in October 1987. The next one was November 1994, which is when the economy went through four years with lots of layoffs ... | ||||||||

| Posted: 03 Jul 2010 07:28 AM PDT On Thursday, the SPDR Gold Trust (symbol: GLD), which is the ETF that tracks the performance of gold, saw its worst one day performance since February, 2010. No one would deny that gold is in a bull market ... | ||||||||

| Unaware of $60 Trillion in National Obligations Posted: 03 Jul 2010 07:00 AM PDT The mellow stock market decline through mid-2008 (measured by historical yardsticks) and the bull market in U.S. Treasuries of all maturities belied not a crisis but some dreadful disease that had been effectively quarantined. Perhaps as in history's great epidemics, the doctors in this case had not seen this sort of sickness before and had yet to understand completely what strain of bug was at work. Although having DNA similar to pathogens seen in wartime debt buildups, this season's strain encoded itself with the pattern of socialism: entitlements, bloated and intrusive government, and punitive taxation exclusively directed at the top brackets. Its vector of transmission is fiat currency. Our culture leaves the body politic and the investment community with no antibodies to recognize this threat. In earlier eras such as the 1980s, the bond vigilantes watched the money supply and government outlays closely. At the turn of the century, leading bankers looked over their shoulder for signs of the next wave of panic from others who might have lent speculatively, and they kept their balance sheets in good shape for that rainy day. Today, those who took defensive action through short selling or exchanging their money for commodities were instead pilloried in public hearings and damned for being speculators. Even before the stock market panic that began in 2008, lenders were willing to accept historically low returns on short- and long-dated treasuries even if these nominal returns were being eroded by a CPI-U that pierced through 5 percent from June through August, or worse, by that and taxation, too. The low interest rates then may have anticipated the risks revealed once the stock market collapsed. More joined this wary camp to push nominal returns below zero once deflation became evident. It may be this contagion is a virus capable of fooling the body's defenses, sort of an HIV look-alike, since with long-term Treasury rates in the low single digits and a public that is not alarmed (or even aware) of the dangers of $60 trillion of national obligations, a message is being sent to the government that it might have unlimited supplies of free money that it might spend. Private debt of $40 trillion plus $60 trillion of public debt and entitlements might have been enough moisture to feed a hurricane. But it might just as well require more, due to the behavioral aspects of the system and its complexity, so no economist might know what the breaking point may be. Unfortunately, sometimes markets, like ocean skies, can be clear before bed but stormy in the morning. The storm that could break hardest would be the downgrading of the credit rating of the United States. For if we expect to pay off the obligations of the government through concentrating tax increases on the top brackets, foisting debts of somewhere between $500,000 and $2 million upon each rich household (depending on where the cut-point is drawn), no longer would the Treasury have the resources to honor its obligations. Yes, complete dismantling of the socialist entitlement state would fix the problem. But the political will to do something this drastic could never come out of thin air; it would only come once we as a society as a whole hit rock bottom. Regards, Bill Baker, [Editor's note: This passage is reprinted from William W. Baker's book, Endless Money: The Moral Hazards of Socialism, with the permission of John Wiley & Sons, Inc (©2010). You can get your own copy of his book here.] Unaware of $60 Trillion in National Obligations originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||

| Rick Santelli Uncut (And GE Turbofan Commercial Free) Posted: 03 Jul 2010 06:54 AM PDT Having rapidly become the only person worth listening to on CNBC, Rick Santelli's insights on the economy are now far more valuable than any other guest's on the Jeff Immelt propaganda station. Which is why we were very happy to find that Eric King's latest interview was with none other than Mr. Santelli. The topics discussed are numerous, varied and and very critical to our economy, covering such concepts as deflation, deficit spending, bailouts, government spending multipliers, Fed transparency, spending cuts, austerity, the folly of Keynesianism, strategic defaults, direct bidders and treasury auctions, and lastly, tea party dynamics, making this a must hear interview for anyone still on either side of the economic fence, and who enjoys listening to Rick for longer than the 45 second segments the CNBC producers will allow.

Full must hear interview can be listened to here, courtesy of King World News. | ||||||||

| Posted: 03 Jul 2010 06:31 AM PDT By Jack Chan at www.simplyprofits.org Summary Disclosure | ||||||||

| Posted: 03 Jul 2010 06:06 AM PDT Gold Stocks Cup and Handle Once the highs have been cleared, the trend will accelerate. | ||||||||

| How to Play “The Land of Rising Stocks” Posted: 03 Jul 2010 04:00 AM PDT The Wall Street Journal reported last week that, for the first time in three years, foreign investors are increasing their holdings in the Japanese stock market. Data released by the Tokyo Stock Exchange shows that foreign ownership of Japanese shares rose to 26% for the year that ended in March, up from 23.5% a year earlier. The Journal suggests that a recovery in Japanese corporate earnings is tempting foreign investors back to the country's equity markets. But I think there's more going on here. Perhaps hedge fund managers and other savvy global investors have paged back through their old, dog-eared copies of Dr. Jeremy Siegel's Stocks for the Long Run. If so, they may have recognized something significant… Crunching the Numbers on Japan Siegel notes that it's rare for stocks to go 10 years without giving a positive return. Yet we've experienced just such a rarity over the last decade. For stocks to go 20 years without giving a positive return is almost unheard of. And 30 years? That's rarer than Big Foot, Nessie and the Abominable Snowman combined. Which brings me back to Japan… In 1989, the Nikkei 225 – Japan's equivalent of the S&P 500 – hit a new all-time high near 40,000. Today, more than 20 years later, it languishes near 10,000 – almost 75% lower. In other words, the Nikkei 225 would have to rise 300% just to get back where it was in 1989. And it wouldn't surprise me if it did just that by the end of the decade. After all, it's happened before. In the 1970s, the US market returned just 0.34% a year – a 3.4% total return for the decade. Yet the Japanese market compounded at 16%, generating a 10-year return of 344%. What other asset class offers that kind of potential return over the next decade? (Gold bugs, keep your seats.) Don't Chase the Bullet Train… Get on Board Now The groundwork has been laid. Last August, after more than 50 years, Japan's opposition party trounced the Liberal Democratic Party in a landslide election. The new government has promised to shrink the country's massive bureaucracy and cut wasteful public spending. It also intends to end more than 20 years of economic stagnation by cutting taxes and focusing on small and mid-sized businesses. Of course, we're all skeptical of politicians' promises, but there is evidence that they mean business this time. Twenty years is a long time to leave your economy in a funk. It's resulted in Japanese stocks being among the cheapest and most unloved in the world. Virtually no one is enthusiastic about the Tokyo market. However, great opportunities are born when dirt-cheap valuations marry investor apathy. Plus, Japanese investors are flush with cash. They've largely ignored domestic stocks after two decades of sub-par returns. And as that money begins to find its way out of mattresses and back into Japanese equities, the Tokyo market should lift off. This is doubly true when institutional money managers return to Japan in a serious way. For years, global fund managers have outperformed the world benchmark by simply underweighting Japan. But let the Shinkansen take off without them and they will be forced to dash after it. So how do you play this? Two Ways to Ride the Japanese Stock Market There are dozens of worthwhile Japanese ADRs trading on Nasdaq and the Big Board. But you can gain exposure to Japanese stocks through two ETFs… – iShares MSCI Japan Index (NYSE:EWJ), which invests in large-cap Japanese stocks. Or you can spread your bets and own both. Incidentally, if you remain skeptical about Japanese stocks digging their way out of this 21-year hole, consider again how unlikely it is that Japanese stocks will earn a negative 30-year return. As Dr. Siegel writes in Stocks For the Long Run: In the 12 years from 1948 to 1960, German stocks rose by over 30% per year in real terms. Indeed, from 1939, when the Germans began the war in Poland, through 1960, the real return on German stocks matched those in the United States and exceeded those in the U.K. Despite the total devastation that the war visited on Germany, the long-run investor made out as well in defeated Germany as in victorious Britain or the United States. The data powerfully attest to the resilience of stocks in the face of seemingly destructive political, social, and economic change. The story in Japan was similar. By the end of 1945, stock prices stood at approximately one-third of their level just prior to the Empire's surrender. Over the next 40 years, the Japanese market returned more than 20 times its American counterpart. If 200 years of world stock market history is any guide, the current decade should be another barnburner for Japan. Good investing, Alexander Green How to Play "The Land of Rising Stocks" originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||

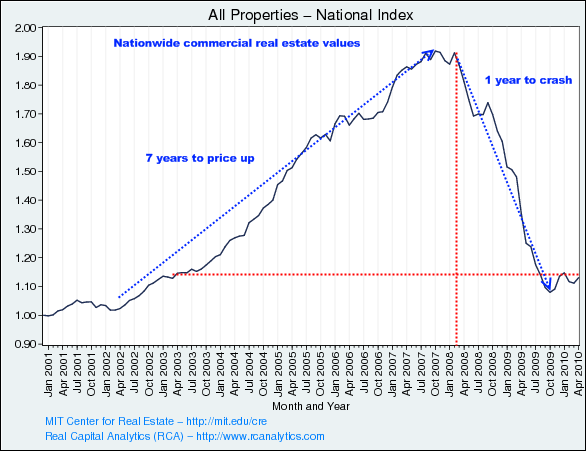

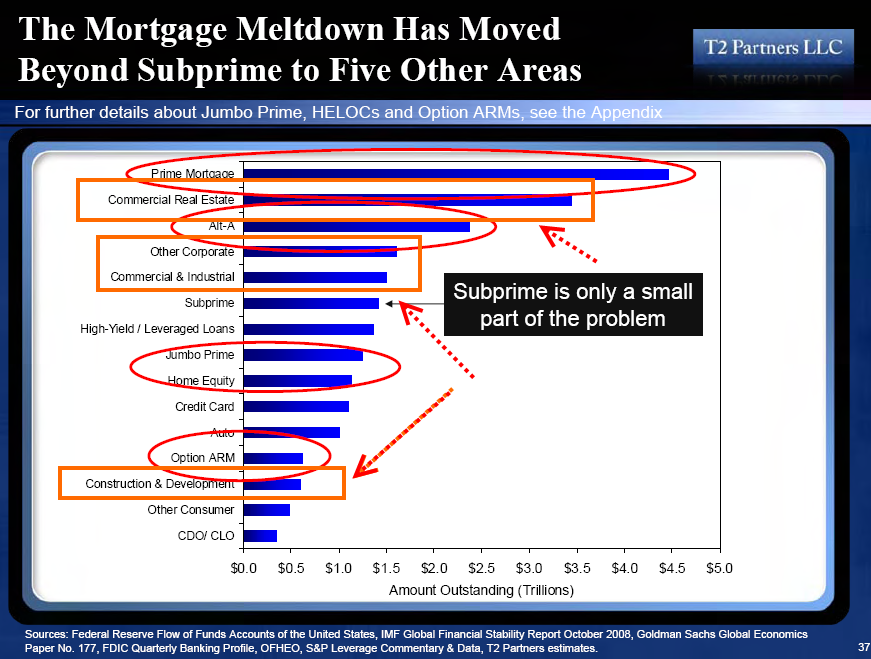

| Charts Showing The Commercial Real Estate Collapse Posted: 03 Jul 2010 03:59 AM PDT Source: MIT The above chart is extremely helpful in showing how quickly bubbles can grow but also, how fast they can deflate. It took 7 years for prices to peak and only one year for prices to collapse. We have seen similar trends in the residential real estate market. The crash is rather obvious but why did it happen? The reason prices collapsed so fast was that it was a speculative boom. Lending became much too easy with the Federal Reserve flooding the system with easy capital trying to find a home. In more sober times, CRE deals were scrutinized with a due diligence and it was inspected to produce cash flow from day one with sizeable down payments and strong financial reports. But this is not the case and many of these giant deals ended up going the way of the little to nothing down world of residential real estate. The market in CRE is enormous. This market is over $3.5 trillion and is likely to damage the regional banks much more deeply than larger banks that have a taxpayer safety net: Source: T2 Partners | ||||||||

| The Risk and Reward Ratio on The Precious Metals Market Posted: 03 Jul 2010 03:26 AM PDT At times daily volatility can cause one to lose the big picture from sight - focusing on trees is ok as far as one doesn't forget about the whole forest. This universal approach can be applied today since we have just seen a massive decline ... | ||||||||

| Goldman Sachs: "The Second Half Slowdown Has Begun" Posted: 03 Jul 2010 03:12 AM PDT The economic mood at 200 West has officially downshifted. In a report by Jan Hatzius, the Goldman chief economist warns that "the second half slowdown has begun." Hatzius says: "This is consistent with our long-standing forecast of materially slower growth of just 1½% (annualized) in the second half of 2010." And while the contraction has been obvious to all those without a metric ton of wool in front of their eyes, the two indicators that have broken Goldman's will were this week's NFP and ISM reports. And not only that, but Hatzius is now firmly in the Krugman camp, blaring an even louder warning that should the government cut off the fiscal subsidy spigot "there is some downside risk to our forecast of a gradual reacceleration in 2011 (to about 3% on a Q4/Q4 basis)." In other words, not only will H2 GDP officially suck, but since Goldman has now officially jumped on the Keynesian gravy train, and as Goldman has rapidly become the best contrarian indicator in the world (we can't wait for David Kostin to realize that endless economic stimulus, GDP and corporate profits are, gasp, related), it likely means that Obama will not allow for even $1 dollar of extra unemployment subsidies or state bailouts just to spite Goldman. From Hatzius:

And here is the part that comes straight out of the fundamentalist Keynesian textbook:

For all those who are keeping their fingers crossed for a few extra trillion in fiscal stimulus to kick the can down the street with no actual changes ever occurring (which is exactly what happened the last time there was a massive fiscal stimulus, and the time before, etc), we would like to quote Lieutenant Ripley: "happy to disappoint you." Of course, monetary stimuli are a different matter altogether, and we are confident that in the absence of the fiscal piggybank, the Fed will have no choice but to further destabilize trust in the currency via QE 2-X. And remember - hyperinflation is ultimately not a pricing phenomenon, it is one driven by faith in the currency. Or lack thereof.

| ||||||||

| Metals smash down was just another paper affair, Butler tells King World News Posted: 03 Jul 2010 02:53 AM PDT 10:50a ET Saturday, July 3, 2010 Dear Friend of GATA and Gold (and Silver): In his weekly interview with Eric King of King World News, silver market analyst Ted Butler remarks that last week's smash down in the precious metals was another typical manipulation by the big commercial traders, a paper affair on the Comex without any real metal selling. The big commercials, Butler adds, began buying again on Friday. Butler says he has lost patience with the U.S. Commodity Futures Trading Commission, calls the silver market a criminal operation, identifies its perpetrators, as he has done before, and notes that none of them have ever challenged his accusation. The interview is about 10 minutes long and you can find it at the King World News Internet site here: http://www.kingworldnews.com/kingworldnews/Broadcast_Gold+/Entries/2010/... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | ||||||||

| One Last Observation On Thursday's Price Ambush Posted: 03 Jul 2010 01:34 AM PDT Gold is in a long term bull market. As such, all sell-offs, price pullbacks, secular price corrections and overt, illegal manipulative price attacks, like Thursday's, are to be bought - aggressively. Feel free to take profits on part of your positions on big price rallies only if you have mining shares or paper surrogates (GLD, CEF, GTU, PHYS, etc). Never, I mean NEVER, sell your physical gold/silver holdings until this long term bull has run its course. On average, bull market cycles last 18-20 years. We are only 9 years into the precious metals bull market cycle. Historically, the most spectacular price gains occur in the latter stages of a bull cycle (think stocks, 1981 - 2001; housing 1991 - 2007). Those of you/us who are willing to spend the time learning about, researching, investing in and trading the precious metals market will know what to look for when it is time to sell. Until then, as per Jim Sinclair's perfect advice: "never trade your core 2/3's position, always buy 'fishing line' sell-offs (like Thursday's) and take profits on 'rhino horn' price rallies." Have a great holiday weekend. | ||||||||

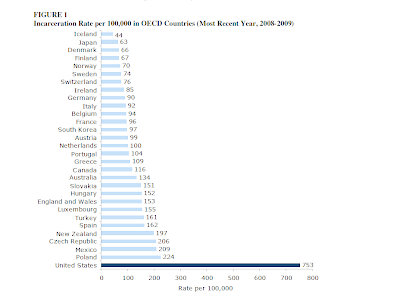

| If it quacks like a welfare duck, then it probably is a welfare duck Posted: 02 Jul 2010 10:54 PM PDT Stacy Summary: The US Congress refused to pass an extension of unemployment benefits to over a million Americans because they were "opposed to adding another $33 billion to our $13 trillion mountain of national debt." A few days later, they agree to spend $30 billion on an escalation of killing and occupation. American politicians, usually of the Republican persuasion, speak often of the evil that is 'socialism' in Europe is for its welfare state. But if it quacks like government spending, it is government spending. And the US government spends, as we all know, more than the rest of the world combined on war. Domestically, it keeps with this same theme of violence against others and depriving them of their liberty as a favored means of welfare spending. In Europe, the government attempts to provide more rights than it can afford; but in the U.S. the government attempts to take more rights than it can afford to. Check this report out on the high cost of US incarceration of its population, the highest in the world on a per capita basis. Bizarrely, the above-mentioned welfare war machine is sold to the population as a means of liberating others around the world who we are told are unfree. And yet, here is the US incarceration rate compared to other OECD nations:

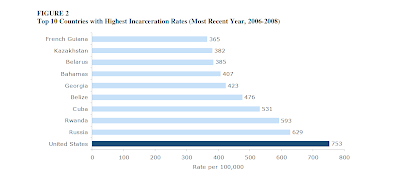

And here is the US compared to the other top ten incarceration nations:

And here is just the US incarceration rate going back to 1880:

What happened from early 1970′s? Did the American population suddenly go wildly violent? Was it something in the water? Here is the incarceration rate since 1960 against the rate of crime:

Nope, I don't think it was something in the water. I think it was something in the currency. There is no way the U.S. could have afforded so much fear, war and incarceration if it were not for the abandonment of the gold standard. Here is Alan Greenspan in 1966, before the US dropped the gold standard and before he became an apologist for units of fraud as currency:

It doesn't matter whether that deficit spending is in the name of providing benefits to certain people in society or depriving certain people of benefits. It is still confiscation whether done in the name of aggression or in the name of benevolence. This brings me back to the European social welfare state that provides more health, pension, childcare, etc than it can afford. The financial crisis is, according to some analysts, forcing Europeans to rethink their way of life:

Is there any discussion on changing the "American way" of welfare: war and incarceration? I think not. | ||||||||

| Jim Rickards: Gold is money and probably manipulated for its deadly power Posted: 02 Jul 2010 07:00 PM PDT | ||||||||

| Video: Gold Losing its Luster? Posted: 02 Jul 2010 06:49 PM PDT | ||||||||

| Unavailability of Spending Crisis Posted: 02 Jul 2010 02:18 PM PDT My thesis holds that the market's structural debt fears are shifting from the Eurozone to here in the U.S. The Euro gained 1.5% this week against the dollar. The Swiss franc jumped 2.7%. European debt markets showed hopeful indications of ... |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment