Gold World News Flash |

- After this Particular Dog-Fight, Both Metals Will Turn Up Again

- THURSDAY Market Excerpts

- Central Banks Push Up the Gold Price

- Market Meltdown & Metal Missiles – SPX, Gold, Silver & Oil

- What Hurricanes, BP and the FDIC Have in Common

- JPM Lowers Q2 GDP Forecast From 4.0% to 3.2%

- Jeff Nielson: Inventory fraud increases in silver market

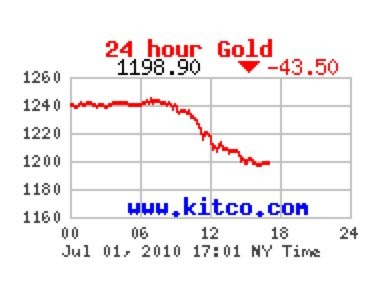

- Gold got killed!

- The End of the Nominal Recovery

- Market's swoon prompts fears of the dreaded ‘death cross'

- Jim?s Mailbox

- In The News Today

- Why We Do What We Do

- Hourly Action In Gold From Trader Dan

- More Bernanke (And Geither) Perjury?

- AIG's Cassano: Poster Child for Compensation Problems

- U.S. Mint Sells Another Three Million Silver Eagles in June

- LGMR: Gold Falls with Dollar But "Way Under-Owned" as Euro LIBOR Rates Rise

- Blame Central Banking Not Obama... The Flaw in Western Justice

- Gold 07-01

- Mr. Magoo: Isn't Beelzebub Calling You Yet?

- Crude Oil Falls Under First Level of Support, Gold Facing Crosscurrents

- Peter Grandich Hunts for Treasures Beyond Gold's Glare

- Fear, Fear, Fear: Time to Buy?

- What The Hell Was That?

- Zerohedge Shows Its Ignorance Twice Today

- Gold Mining Stocks Trendpower

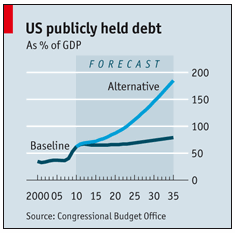

- CBO Sees a Gloomy Outlook for U.S. Debt, Or Does It?

- Gold Resource Corp Announces Commercial Production, President Promotion

- The Bullish News From Yesterday's Market

- Mortgage Rates at Record Lows and Still Buyers Are Balking

- Best Performing ETFs in Q2: Gold, Long-Term Treasury Bonds

- Double-Dip Recession a Fashionable Discussion Piece

- Global Recovery on Track Despite Sovereign Debt Hiccup

- The Double-Dip recession Lies Ahead - What of Gold and Silver?

- The global recovery is faltering

- This chart shows stocks have fallen much more than you realize

- Gold Below $1,200 As Asset Liquidations Spread Like Wildfire

- Gold Daily Chart: Shock and Awe; Cup and Handle Formation; US Bonds on Deck

- As Curve Flattening Accelerates, Morgan Stanley Goes All In, Tells Clients To Bet Against Fat Tails

- Gold vs. Treasuries: What’s Your Pick?

- Gold vs. Treasuries: What's Your Pick?

- The big deal about debt

- Mortgage Rates at New Record Lows

| After this Particular Dog-Fight, Both Metals Will Turn Up Again Posted: 01 Jul 2010 11:54 AM PDT Gold Price Close Today : 1206.30Change: -39.20 or -3.1%Silver Price Close Today : 17.760Change -91.1 cents or -4.9%Platinum Price Close Today: 1501.50Change: -35.80 or -2.3%Palladium Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! | ||

| Posted: 01 Jul 2010 10:13 AM PDT Gold follows other markets lower amid continuing sell-off The COMEX August gold futures contract closed down $39.20 Thursday at $1206.70, trading between $1205.60 and $1244.80 July 1, p.m. excerpts: see full news, 24-hr newswire… July 1st's audio MarketMinute | ||

| Central Banks Push Up the Gold Price Posted: 01 Jul 2010 09:59 AM PDT By David Galland, Managing Director, Casey Research For some years now, Doug Casey has gone on record with his view that we'll know the gold bull market is really picking up steam when central banks stop selling their reserves of gold and begin buying the stuff. The following excerpt from a Wall Street Journal article titled "As Gold Hits Record, Central Banks in Focus"indicates that this is now happening… [LIST] The metal has surged over worries about Europe's debt woes and the slumping value of the euro. Investors in metals and currency markets have been on alert for any sign that the world's central banks, and China in particular, are shifting reserves out of the euro and into gold. Though central banks typically are coy about investment decisions, there have been signs lately that they might be shifting out of euros and into gold. [/LIST] A key point in this discussion has to do with the Central Bank Gold Agreement under which signatories were... | ||

| Market Meltdown & Metal Missiles – SPX, Gold, Silver & Oil Posted: 01 Jul 2010 09:57 AM PDT What a nutty week for the equities market! The bleeding has not led up with almost 2 weeks of straight selling. Also we are seeing oil break down with a rather large bear flag and if that happens, which it looks like it will… then hold on tight or cash out of the market! There has been nothing but negative news for the past month and its not looking like there is much light at the end of the tunnel for a long time still… The only places which people feel some safety is in gold and silver. That being said the market is way over sold here and we could get a bounce lasting a couple days soon. But that bounce will be sold and pulled back down as it looks like a new bear market is starting. Here are few charts of how I am seeing things in general. Gold ETF GLD – Daily Chart Gold has formed a large cup & handle pattern. It has held up well during the recent weakness. But zooming into the intraday charts I do have some concerns about a sharp sell of... | ||

| What Hurricanes, BP and the FDIC Have in Common Posted: 01 Jul 2010 09:31 AM PDT Luckless Hero submits: I’ll give away the game right up front and let you know that all three are terrible for the Gulf Coast and spell out quite clearly a near future of gloom. But, as with many of my posts, the things that I am concerned about are banks and the banking system. Banks reflect how strong the economy can be and indicate how strong the economy actually is based on deposit inflows and lending outflow. I’ll give away the game one more time and share what sparked me wanting to write this article. Looking at Hurricanes, BP (BP) and the FDIC together paints a grim picture and here is why. Complete Story » | ||

| JPM Lowers Q2 GDP Forecast From 4.0% to 3.2% Posted: 01 Jul 2010 09:28 AM PDT JPM economist, Michael Feroli, who recently made oily waves by claiming the BP spill effort would actually end up being a boost to US GDP courtesy of all the unemployed people who would be picking off tarballs off the Louisiana, Mississippi, Florida (and soon many more) coasts, has just capitulated and lowered his Q2 GDP from the stratospheric 4.0% to 3.2%. Of course, Feroli now is only massively, as opposed to infinitely, disconnected from reality, as his Q3 and Q4 GDP predictions are at 3.0% and 3.5%, respectively. Compare these numbers to even permabullish Goldman, which is at 1.5% for both. As JPM is forced to face the music of a now-defunct stimulus, and lower future estimates repeatedly, the follow through into lowered corporate earnings will inevitably follow, and the result will be a drop in EPS for corporates. Couple this with a multiple contraction courtesy of the now-pervasive double dip, and all calls for an undervalued market at a 11x multiple become irrelevant (although, admittedly, if the Obama administrartion does nuke the GoM, the tens of millions hired to collect radioactive rain and fallout will certainly result in an immediate GDP doubling). | ||

| Jeff Nielson: Inventory fraud increases in silver market Posted: 01 Jul 2010 09:10 AM PDT 5p ET Thursday, July 1, 2010 Dear Friend of GATA and Gold (and Silver): Jeff Nielson of Bullion Bulls Canada reports that the silver purportedly being held by silver exchange-traded funds is being counted as part of silver inventories, not as silver removed from the market by investment demand. Since any silver held by EFTs can be sold quickly by investors and returned to the market by the ETFs, this may not be quite the fraud that Nielson calls it. But it would seem that ETF silver is easily available for shorting and that silver investors who purchase ETF shares instead of taking possession of their metal or otherwise removing it from the control of ETF custodians like J.P. MorganChase & Co., the big silver short, are handicapping themselves and contributing to the silver price suppression scheme. Nielson's commentary is headlined "Inventory Fraud Increases in Silver Market" and you can find it at Bullion Bulls Canada here: http://www.bullionbullscanada.com/index.php?option=com_content&view=arti... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php | ||

| Posted: 01 Jul 2010 09:07 AM PDT Stacy Summary: Mike/Liverpool . . . I blame you. Ha ha, will post links below the gold chart as I find them.

| ||

| The End of the Nominal Recovery Posted: 01 Jul 2010 09:00 AM PDT Monetary and fiscal stimulus can halt a deflation spiral, but central banks and governments can't print purchasing power. In other words, one year after the official end of the recession, the economy shows no signs of booming. Emergency Keynesian policy measures taken to keep the debt crisis from devolving into a 1930s deflationary spiral show signs of losing effectiveness, and the self reinforcing economic growth story is giving way to talk of a "double dip" recession, as trouble in Europe is expected to slow the US economy by the end of the year. Confidence in the resilience of the recovery is waning. CEO Confidence Survey noted the bottom of the recession and the beginning of recovery. CEO confidence dipped slightly in Q1 2010 for the first time since Q1 2009, to 62 from 64 in Q4 2009 (a reading of more than 50 points reflects more positive than negative responses). The Q2 2010 data are due out the week of July 5. A decline in CEO confidence below 50 points will strongly support leading economic indicators that are pointing to a second recession. The last time the economy struggled under the weight of public debt taken on to stimulate demand after a private-sector credit collapse was during the Great Depression. Is the nation's debt-heavy balance sheet able to finance ongoing stimulus spending without triggering a US debt and currency crisis? The question is once again divided along ideological lines. It's 1937 all over again as Democrats and Republicans battled in the Senate last week over how to pay the $141 billion cost of new legislation that extends unemployment benefits to more than two million who remain unemployed a year after the recession ended. What if a second recession arrives while we're still arguing about what to do about the after-effects of the last one? Even if we dodge a double-dip recession, conditions of the economy and debt markets are the opposite today of 1983, the last time new home and car sales were this slow. Without a tail wind of falling interest rates and low debt levels, for the next 20 years inflation and interest rates will rise as policy seeks to deflate debt against wages and the dollar; real housing prices and wages decline. A year after touring the aftermath of the Housing Bust Recession, many retailers remain closed, windows once whitewashed are now broken, boarded up, and festooned with graffiti. The same condition is true for the financial system that got a whitewash but has yet to receive even a partial renovation. An optimist might conclude that home and car sales are thus only as bad as in 1983, except that the economy was only one quarter the size of today's; this post-recession housing market contraction is proportionally four times worse than the housing downturn that occurred at the end of the early 1980s recessions. The May 2010 collapse in new home sales to 1983 levels occurred despite 30-year mortgage rates at levels not seen since 1971. Today's 4.69% rate on a 30-year mortgage is less than half the 13% rate paid by borrowers the last time new home sales were this weak. In 1983, mortgage rates had only one way to go – down – as disinflation proceeded for decades, although they took a detour to 15% in the two years that followed. The ultra low rates result from the Fed's continued purchases of mortgage-backed securities from banks. With $1.1 trillion of MBS on its balance sheet as of early June, starting from zero in January 2009, the Fed can't find private hands to offload the securities onto and instead uses them as collateral at full market value for new loans, despite the fact that the market value is virtually nothing, as evidenced by the unwillingness of private institutions to buy them. Business Week reported recently: Borrowing costs have tumbled in the past two months as concern that a debt crisis in Europe may spread boosted demand for the safety of bonds including mortgage-backed securities. The lower rates have failed to lift housing demand, which has tumbled since a tax credit for first-time and certain other buyers expired at the end of April. The average price of $5.2 trillion of bonds guaranteed by government-supported Fannie Mae and Freddie Mac or federal agency Ginnie Mae climbed to 106.3 cents on the dollar yesterday, according to Bank of America Merrill Lynch's Mortgage Master Index. That's up from 104.2 cents on March 31, when the Federal Reserve ended its program purchasing $1.25 trillion of the debt.

But did the Fed really stop buying MBS? The Fed planned to stop buying MBS at the end of this March, yet Fed MBS balances have increased by $45 billion since March 31. What will happen to the housing market when the Fed finally does begin to lower its MBS balances? Regards, Eric Janszen The End of the Nominal Recovery originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| Market's swoon prompts fears of the dreaded ‘death cross' Posted: 01 Jul 2010 08:58 AM PDT Thursday July 1, 2010 (CNBC) — Investors may feel like looking to the heavens for help in this volatile stock market, but what they will see now shining ever-brighter is the dreaded Death Cross. The stock market constellation, which happens when the Standard & Poor's 500 50-day moving average crosses beneath the 200-day moving average, has not yet made a complete appearance but is, by some estimates, just days away. That's a decidedly bearish sign for a market that already has surrendered 16 percent from its most recent high. While the Death Cross isn't always a bearish sign, a market falling at such an accelerated pace as the current one frequently signals a further drop ahead for stocks. That's because it reinforces the notion that stocks are decling much faster in the short term and indicative of swooning investor sentiment. It is the opposite of a Golden Cross, which is where the 50-day average crosses above the 200-day. The current clip of the market's downward trend has inspired some analysts to begin shaving their S&P projections: Goldman Sachs strategist John Noyce recently told high-end investors that if the 1040 support level didn't hold on the S&P (it hasn't), the next support area would be 865. "People are focusing on fundamentals because the market has been so volatile and extreme," says Abigail Doolittle, founder of Peak Theories Research in Albany, N.Y.. "The technical levels have become that much more obvious." Doolittle says that if current patterns hold, and the S&P continues to make what she calls a "twin peaks" formation, the index could fall to the 425 range, an extremely pessimistic projection not widely held. S&P is telling clients to cut US equity exposure and increase Treasury holdings; Doolittle is recommending a move to cash or to the sidelines altogether; Gluskin Sheff economist and strategist David Rosenberg believes safety to be the best bet. [source] RS View: The Administration, and especially its beleaguered Treasury Department, is probably ecstatic that rank and file investors are being so deftly herded into the avenue of Treasury holdings. Imagine how much worse the government's plight might be if it had no such clamor to absorb its shrill generation of debt. | ||

| Posted: 01 Jul 2010 08:48 AM PDT View the original post at jsmineset.com... July 01, 2010 09:05 AM Jim, It is during times like these when I find a review of the monthly Gold Currency Index chart to be constructive: This remains a very strong, healthy secular bull market, so the buy-on-the-dips strategy will continue to benefit the long-term investor. Best, CIGA Erik Fear and Leverage CIGA Eric Nothing has changed but fear and leverage will make appear that it has. When the black boxes, chasing strength and selling weakness, all try to squeeze through a tiny exit door, the chart (short-term technical analysis) quickly crumbles. Click to Animate: There’s very good support at the 12/04/09 gap, but I doubt the black boxes are programmed to notice it. Paper Gold: More… Dear Jim, Once again the rise in unemployment is "unexpected". Month after month, and now year after year it’s always "unexpected". This MOPE has veritable shades of the Soviet Union now. The result... | ||

| Posted: 01 Jul 2010 08:48 AM PDT View the original post at jsmineset.com... July 01, 2010 09:11 AM Thoughts For The Morning Who bought the Spanish sovereign bond offering? 1. Enron? 2. New York State retirement fund? 3. The rescue the euro funds via beards? US States will have a $62 billion budget deficit this July fiscal year end. Can you imagine what next July is going to look like as the Formula grinds on? Intervention was not aimed at the cause, OTC derivatives. Spain sells bonds a day after downgrade warning By HAROLD HECKLE (AP) MADRID, Spain — Spain successfully raised euro3.5 billion ($4.3 billion) Thursday in an oversubscribed bond sale, a reassuring sign for markets a day after ratings agency Moody’s warned it may join others in downgrading the country’s debt. The average interest rate for the five-year bonds was 3.65 percent, up from 3.53 percent at the last such auction in May, and the sale was 1.7 times oversubscribed, the Treasury Department said. The government had ho... | ||

| Posted: 01 Jul 2010 08:48 AM PDT View the original post at jsmineset.com... July 01, 2010 09:26 AM Dear Extended Family, There are times when you must ignore the hedgie madness in the marketplace and revert to why we are doing what we are doing. The deflation being spoken of today is the catalyst for the coming hyperinflation. The fact is it has been so in all historic examples. The flooding of markets with debt has been brought on for different reasons, but the ways and means of hyperinflation has always been the same. Therefore it is today’s financial market deflation talk that is the reason why you should own gold. This continued downturn in business will find government in a panic, not in austerity when their constituency does the Greek dance of panic as the pain on Main Street becomes intolerable. It will. Contemplate what each of the following means to you one at a time. Do not try to do them all at once. You do not want to do this as a routine memory exercise as much as a meditation on why you have ... | ||

| Hourly Action In Gold From Trader Dan Posted: 01 Jul 2010 08:48 AM PDT View the original post at jsmineset.com... July 01, 2010 10:07 AM Dear CIGAs, It is not a pretty day for Easy Company in the Gold war today (nothing is ever easy in Easy Company). There appears to have been another one of those mass exodus days in which leveraged trades were being unwound en masse and money was rushing into Treasuries. Apparently deflationary fears led to wholesale dumping of commodities with only a few commodity markets moving higher and defying the selling trend such as the grains and natural gas, and oddly enough, lumber, of all markets. Interestingly enough, the European based currencies, Euro, Sterling and Swissie, were all strongly higher, particularly the Euro, based on the assumption that things were not quite as bad in Euro land as initially feared. The Yen was sharply higher as well. Gold/Yen, Gold/Euro, Gold/Sterling, trades were all crushed in the process. It appears that there was a type of currency trade unwind occurring in which gold, which has been t... | ||

| More Bernanke (And Geither) Perjury? Posted: 01 Jul 2010 08:48 AM PDT Market Ticker - Karl Denninger View original article July 01, 2010 09:21 AM Gee, where are the handcuffs? [INDENT]July 1 (Bloomberg) -- Federal Reserve Chairman Ben S. Bernanke and then-New York Fed President Timothy Geithner told senators on April 3, 2008, that the tens of billions of dollars in "assets" the government agreed to purchase in the rescue of Bear Stearns Cos. were "investment-grade." They didn't share everything the Fed knew about the money lied like a bear-skin rug. [/INDENT]Indeed, they just plain didn't tell the truth: [INDENT]The so-called assets included collateralized debt obligations and mortgage-backed bonds with names like HG-Coll Ltd. 2007-1A that were so distressed, more than $40 million already had been reduced to less than investment-grade by the time the central bankers testified. [/INDENT]There's a further problem: This was arguably illegal. See, The Fed is not permitted to lend unsecured. At all. To anyone. The Fed also can't ... | ||

| AIG's Cassano: Poster Child for Compensation Problems Posted: 01 Jul 2010 08:48 AM PDT Joseph J. Cassano, head of what was formerly an obscure 400 employee division of American International Group (AIG) with main offices in London, called AIG Financial Products (AIG-FP), testified today before the FCIC (Financial Crisis Inquiry Commission). The inability of AIG-FP to meet collateral calls by CDS (Credit Default Swaps) partners was a major trigger to the collapse of the company and the purchase of majority ownership of AIG by the U.S. government to prevent bankruptcy. An oversimplified summary of Cassano's testimony is as follows: 1. AIG-FP had a diverse portfolio, including CDSs on CDOs (collateralized debt obligations). 2. The underlying loans in the CDOs were diversified, and we insured only the super-senior tranche, which always had a AAA layer of loans below it. 3. In late 2005 we (AIG-FP) came to a decision to stop writing CDSs on CDOs backed by sub-prime mortgages and announced this decision in February, 2006. 4. We had a firm view ... | ||

| U.S. Mint Sells Another Three Million Silver Eagles in June Posted: 01 Jul 2010 08:48 AM PDT Gold didn't do a lot in Far East and London trading yesterday... but the moment that the Comex opened, gold got sold off to its low of the day around $1,236 spot... which was shortly after 9:00 a.m. Eastern time. Then gold rallied to it's high of the day of around $1,249 spot at 10:15 a.m. Then it got sold off, and any subsequent rally got firmly and quietly sold off as well. Once the Comex closed, all was quiet into the close of electronic trading. Silver didn't do much in the Far East... and had its high of the day [around $18.80 spot] occurred shortly after 11:00 a.m. in London. From there, silver 'fell' to its low of the day [$18.48 spot] around 9:30 a.m. in New York... and from there the silver price bounced around a little more before closing up 11 cents on the day. All in all, it was just another day off the calendar in both markets... but there was obviously a seller lurking about making sure that no rally in either metal got out of ha... | ||

| LGMR: Gold Falls with Dollar But "Way Under-Owned" as Euro LIBOR Rates Rise Posted: 01 Jul 2010 08:48 AM PDT London Gold Market Report from Adrian Ash BullionVault 08:45 ET, Thurs 1 July Gold Falls with Dollar But "Way Under-Owned" as Euro LIBOR Rates Rise THE PRICE OF GOLD fell hard alongside the Dollar early Thursday in London, dropping to $1235 for US investors but losing more than 2% vs. the Euro as the single currency jumped on the forex market. "Gold was [already] weakened by sporadic selling from Chinese dealers," says one Hong Kong trader in a note. "Risk-aversion is still evident, but...I think people are just waiting for some clear direction," says Andrey Kryuchenkov, analyst at VTB Capital analyst in London. As a percentage of global financial assets, investible gold has gone from 17% in 1982 to 4% today, notes J.P.Morgan Private Bank's chief investment officer Michael Cembalest. Put another way, "Gold is way under-owned compared to other times when the world sucked," says Paul Kedrosky at Infectious Greed. On the currency market today the Euro ro... | ||

| Blame Central Banking Not Obama... The Flaw in Western Justice Posted: 01 Jul 2010 08:48 AM PDT Blame Central Banking Not Obama Thursday, July 01, 2010 – by Staff Report Why Obamanomics Has Failed ... Uncertainty about future taxes and regulations is enemy No. 1 of economic growth. The administration's stimulus program has failed. Growth is slow and unemployment remains high. The president, his friends and advisers talk endlessly about the circumstances they inherited as a way of avoiding responsibility for the 18 months for which they are responsible. But they want new stimulus measures – which is convincing evidence that they too recognize that the earlier measures failed. And so the U.S. was odd-man out at the G-20 meeting over the weekend, continuing to call for more government spending in the face of European resistance. The contrast with President Reagan's antirecession and pro-growth measures in 1981 is striking. Reagan reduced marginal and corporate tax rates and slowed the growth of nondefense spending. Recovery began about a yea... | ||

| Posted: 01 Jul 2010 08:48 AM PDT courtesy of DailyFX.com July 01, 2010 06:54 AM Gold may be carving out a top. Objectives remain at 1276 and 1300. 1276 is where wave v would equal wave i (1050-1147). 1300 is where wave c of v would equal wave a of v (the rally from 1050 is a diagonal, consisting of 3 wave movements) and where wave v equals 61.8% of waves i through iii. Trading below 1216 would signal that a top is probably in place. Jamie Saettele publishes Daily Technicals every weekday morning, [COLOR=#0070C0]COT analysis[/COLOR] (published Monday evenings), technical analysis of currency crosses on Wednesday and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of [COLOR=#0070C0]Sentiment in the Forex Market[/COLOR]. Follow his intraday market commentary and trades at [COLOR=#0070C0]DailyFX Forex Stream[/COLOR]. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"][COLOR=#0070C0]jsaettele@dailyfx.c... | ||

| Mr. Magoo: Isn't Beelzebub Calling You Yet? Posted: 01 Jul 2010 08:48 AM PDT Market Ticker - Karl Denninger View original article July 01, 2010 06:25 AM Greed, er, Greenspan, of course... Two of four pieces, interspersed with my commentary (I'd have done the other two but I started projective-vomiting after the first two.... and couldn't continue) We start with the stock market. Magoo's view? "The stock market is not merely an indicator it is a cause of economic activity." Oh, so how does one "pump" stock market valuations? Why you blow a huge credit bubble! But is this actual prosperity? No, it's not. Stock valuations can only come "(We've run into) an invisible wall." Oh really? An invisible wall? You mean spending 12% of GDP by borrowing and blowing the funds as a means of refusing to recognize and excise the fundamental economic rot you caused didn't hit a very visible wall that I called when these policy actions started? Greenspan correctly identifies that "financial intermediation" is ... | ||

| Crude Oil Falls Under First Level of Support, Gold Facing Crosscurrents Posted: 01 Jul 2010 08:48 AM PDT courtesy of DailyFX.com June 30, 2010 07:58 PM Though Wednesday's oil inventory report was neutral for prices, crude oil is at no loss for potential catalysts. Key technical levels are being tested and significant fundamental uncertainty persists. Gold is caught between two powerful forces. Commodities - Energy Crude Oil Falls Below First Level of Support Crude Oil (WTI) $74.78 -$0.85 -1.12% Crude oil once again held above key $75.50 support despite U.S. stock markets that continued to careen to new multi-month lows. At one point in Wednesday’s session, oil prices got as low as $74.39, but the commodity clawed its way back above support by the end of the New York session. Granted, stocks were holding near neutral territory when crude oil settled at $75.63, but regardless, the $75.50 level has put up a good fight thus far. Currently, prices are back below support, and if stocks continue to sink, it is likely that crude will probe even lower levels ne... | ||

| Peter Grandich Hunts for Treasures Beyond Gold's Glare Posted: 01 Jul 2010 08:48 AM PDT Source: Brian Sylvester of The Gold Report 06/30/2010 Financial Commentator and Market Analyst Peter Grandich, who sees no end in sight to the "mother of all gold bull markets," expects the price of the yellow metal to climb past $2,000+ before the ride eventually comes to an end. But while gold has been riding high, its glitter isn't blinding Peter to the opportunities others may be overlooking. In this exclusive Gold Report interview, he shares some of his favorite gold juniors, as well as a mix of players in the cobalt, lithium, uranium and iron ore niches. The Gold Report: Peter, you accurately forecast the market crash of 1987, the peaks of 2000 and 2007 and the bottom in 2009. Where is this volatile market headed now? Peter Grandich: I've been looking for over a year for a countertrend bear market rally to end in the June–July period around 11,000. I think we are getting very close to that. There's still an argument to make that the market could rally a... | ||

| Fear, Fear, Fear: Time to Buy? Posted: 01 Jul 2010 08:18 AM PDT Quick update, since this is obviously going to be a crazy day. The last month or so has been quite volatile for the stock market We are currently very oversold and nearing all-out capitulation. I don't think we're quite there yet, but I expect a pretty significant snap-back rally when all is said and done. Contain your emotions because buying opportunities are starting to open up. Take note that the dollar is cratering, the Euro is flying, yet equities are down. I'm probably in the minority in the gold bug camp in my opinion that we're in a longer term bull market for stocks. This doesn't take 800-900 on the S&P off the table, but it does suggest that those levels will be supreme buying opportunities. It will be hard to pull the trigger now, but the big value is in the gold space. I am starting to nibble on some of the more battered shares. Please bring on the capitulation! | ||

| Posted: 01 Jul 2010 08:16 AM PDT Forget stocks, gold, and oil. The story of the day was the EURUSD, and the various trading desks that blew up are a result of the 2.4% move in the pair... What the hell happened there? The confluence of the LTRO termination, today's MRO, end of quarter, the official descent into a double dip for the US, and who knows what else, apparently ended up blowing up one or more players. That, or someone gave Jerome Kerviel direct access to the RBS FX trading desk... well, unlikely, but someone in SocGen is very unhappy with the bank's short EURUSD positions. Note how every pair had a mind of its own today. The last time this happened was September 16, 2008. Also, as much as we love him, we can't help but feel for F/X Concepts John Taylor (if only for the ultra short-term; he will most certainly be proven right as all fiat hits parity with each other at +/- 0). EURCHF: note the anomaly early in the day And the only normal pair of the day, AUDJPY. | ||

| Zerohedge Shows Its Ignorance Twice Today Posted: 01 Jul 2010 08:03 AM PDT Earlier today Zerohedge announced in marquee lights that AIG manipulated the metals markets. They acted like they unveiled the splitting of the atom. Those of us who have been involved in this market for this past decade and who support GATA, have been aware since at least 2002 that AIG has been, was, one of the main manipulators in the silver market. All of the evidence has been there for those who cared to understand the facts. Second, Zerohedge is blaming today's action in gold on "asset liquidations." Today was not about asset liquidations. Today was about Gary Gensler and the CFTC letting the bullion banks who have manipulated the markets unfettered for the past 20 years. Today was a classic drop in gold that was triggered by an avalanche of selling exactly at the open of Comex trading. This trading action has occurred almost every day over the past two weeks and 100's of times over the last 9 years that I've been trading this market. It is criminal and enabled by a Government that enables widespread fraud and corruption. Here's the chart: (click on chart to enlarge) I guess the pundits would say that today's action was coincidental to the fact that Comex is edging closer to a condition of defaulting on its physical gold/silver deliveries... This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 01 Jul 2010 08:00 AM PDT | ||

| CBO Sees a Gloomy Outlook for U.S. Debt, Or Does It? Posted: 01 Jul 2010 07:59 AM PDT Research Recap submits: Here’s a worrisome-looking chart from The Economist, based on the Congressional Budget Office’s gloomy long-term outlook for the US budget.

Complete Story » | ||

| Gold Resource Corp Announces Commercial Production, President Promotion Posted: 01 Jul 2010 07:55 AM PDT Gold Resource Corporation announces Commercial Production as of July 1, 2010 from its 100% owned El Aguila high-grade gold and silver project. The El Aguila Project is located in the southern state of Oaxaca, Mexico. The Company also announces effective July 1, 2010, the promotion of Mr. Jason Reid to Gold Resource Corporation's President. | ||

| The Bullish News From Yesterday's Market Posted: 01 Jul 2010 07:32 AM PDT Hard Assets Investor submits: By Brad Zigler Real-time Monetary Inflation: -3.6% Amid all the tumult that sent stocks tumbling yesterday, some investors missed a big story. Corn prices gapped up more than 29 cents a bushel, or 9%, Wednesday. Chicago wheat was taken along for the ride, climbing 25 cents, or nearly 6%, but not soybeans. Beans rallied along with the grains, but gave up at the end of the day to settle down more than 2 cents. Complete Story » | ||

| Mortgage Rates at Record Lows and Still Buyers Are Balking Posted: 01 Jul 2010 07:32 AM PDT  Tim Iacono submits: Tim Iacono submits: It’s fair to say that mortgage rates have now fallen to levels that, most students of history would characterize as simply ridiculous. And, what’s even more ridiculous is that, even at these low rates, buyers aren’t taking the bait and loading up on new debt to go out and get that home of their dreams.

Complete Story » | ||

| Best Performing ETFs in Q2: Gold, Long-Term Treasury Bonds Posted: 01 Jul 2010 07:28 AM PDT Tom Lydon submits: Economic uncertainty, lingering debt problems in Europe, tepid employment numbers and high volatility are just some of the reasons why the markets and ETFs have see-sawed in the part quarter. Still, investors found some safe havens and heavily traded in two particular asset classes. Gold. The current economic uncertainty will continue to make gold a hot investment, according to some. Concerns over the eurozone sovereign debt crisis, fears of a double-dip recession, possible inflation worries and a need for a general safe haven for assets are just some of the reasons why investors are parking their wealth into gold. Additionally, Central Banks have been showing signs lately that they might be shifting out of currency holdings and into gold. Complete Story » | ||

| Double-Dip Recession a Fashionable Discussion Piece Posted: 01 Jul 2010 07:28 AM PDT To make money investing, you have to be ahead of the crowd…or at least looking for the story no one is telling. That was a tough task this morning. Suddenly, discussing the unthinkable – a double-dip recession and a retest of the March 2009 lows – is in vogue. Even readers are bored with the end of the world as we have known it… With good reason, we suppose. Stocks registered their worst quarter since everything hit the fan in Q4 2008. After hesitant trading most of yesterday, the major indexes went over a small cliff in the final half-hour as soon as the S&P hit 1,040… closing the day down 1%. As we suggested yesterday, technical analysts believe this 1,040 figure is an important line in the sand. "If the S&P falls below 1,040," writes Dan Amoss, editor of Strategic Short Report, "then we're likely to revisit the lows below 700. Who knows if this widely cited 'if, then' conditional probability is valid? We may find out soon enough. When universally accepted technical support levels are breached, we tend to see heavy bouts of 'self-fulfilling prophecy'-based selling. "Regardless of how the technical conditions play out, there's still a big difference between current stock prices and the prices that most value investors are willing to pay to assume the risks of owning stocks. The word 'risk' is key. In periods of heightened economic and political risk, investors demand higher risk premiums to hold stocks. "A simpler way of stating 'higher risk premiums' is 'lower stock prices.'" Ah, those pesky fundamentals. Addison Wiggin Double-Dip Recession a Fashionable Discussion Piece originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

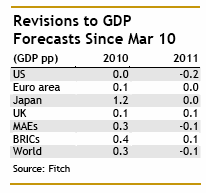

| Global Recovery on Track Despite Sovereign Debt Hiccup Posted: 01 Jul 2010 07:21 AM PDT Research Recap submits: Despite the increase in volatility within sovereign debt markets, the global economic recovery remains on track, albeit at an uneven pace across countries and regions, Fitch Ratings says in its quarterly Global Economic Outlook.

Complete Story » | ||

| The Double-Dip recession Lies Ahead - What of Gold and Silver? Posted: 01 Jul 2010 07:20 AM PDT | ||

| The global recovery is faltering Posted: 01 Jul 2010 07:16 AM PDT From Bloomberg: Manufacturing growth from China to the euro region and the U.S. slowed in June, suggesting the global export-led recovery is losing strength. In China, manufacturing growth slowed more than economists forecast, and a gauge of factory output in the 16-member euro region weakened for a second month, two surveys showed. The U.S. Institute for Supply Management’s manufacturing index fell more than economists forecast to 56.2 from 59.7 in May. Asian, U.S. and European stocks fell on concern that a Chinese economic slowdown combined with deepening budget cuts from Spain to the U.K. may undermine the global recovery. While the Organization for Economic Cooperation and Development on May 26 raised its global growth forecast for this year, it said that a “boom-bust scenario cannot be ruled out” in some countries. “We expect data to soften from here,” said Jacques Cailloux, chief European economist at Royal Bank of Scotland Group Plc in London. “It’s going to raise some question marks about the outlook, about a double dip. It’s an environment with significant downside risks.” The MSCI Asia Pacific Index dropped 1 percent today. The Euro STOXX 50 Index was down 1.4 percent at 3:01 p.m. in London. The Standard & Poor’s 500 Index has shed 4.2 percent over the past month, bringing its year-to-date decline to 8.1 percent. The economy of the OECD’s 30 members will grow 2.7 percent this year instead of a previously projected 1.9 percent, the Paris-based group said on May 26. China may expand more than 11 percent this year compared with growth of 3.2 percent in the U.S. and 3 percent in Japan, according to the OECD. The euro- region economy may expand 1.2 percent, it said. G-20 Statement Limited demand in advanced economies has left the world reliant on emerging markets, led by China, to drive a recovery that Group of 20 leaders this week described as “uneven and fragile.” Signs of a slowdown as the Chinese government clamps down on property speculation and the effects of its stimulus package fade have unsettled investors. Baosteel Group Corp., China’s second-biggest steelmaker, this week scaled back its growth plans, cutting its target for capacity in 2012 by 38 percent and forecasting a “bumpy, unpredictable and long” global recovery. China’s economic growth will slow over the second half of this year, which is welcome news “given the slight uptick in inflation recently,” Stephen Roach, Morgan Stanley’s Asia chairman, said in Beijing yesterday. A pace of 8 percent or 9 percent would be “much more sustainable than the overheated growth rate in the first quarter,” he said. ISM Index In the U.S., the Tempe, Arizona-based ISM’s gauge dropped beyond the median forecast of 59 in a Bloomberg News survey of 81 economists. More Americans unexpectedly applied for jobless benefits last week, Labor Department figures showed today in Washington. An index of U.K. manufacturing also declined last month. The gauge by Markit Economics dropped to 57.5 from a 15-year high of 58, signaling slower expansion. Japan’s Tankan index of manufacturing sentiment climbed more than economists forecast. Bank of Japan board member Yoshihisa Morimoto said in Tokyo today that the economy has yet to achieve a “full-fledged” recovery and there are still “many risk factors” at home and abroad. German Investors In the euro region, a recovery is also showing signs of weakening. German investor confidence plunged in June and euro- region unemployment rose to 10.1 percent in April, the highest in almost 12 years. In France, consumer confidence weakened for a fifth straight month in June. “Europe has shown signs of life,” Carl-Peter Forster, chief executive officer at Tata Motors Ltd., India’s largest truckmaker and owner of Jaguar, told Bloomberg Television in an interview yesterday. “The recovery is somewhat brittle.” With households holding back spending and governments cutting budget deficits, European companies have been reliant on exports to boost earnings. The euro has shed 14 percent against the dollar this year, making goods more competitive abroad. Siemens AG, Europe’s largest engineering company, on June 29 predicted “continued strong profitability” in its third quarter on reviving demand. Pirelli & C. SpA CEO Francesco Gori said on June 24 that the euro’s weakness against the dollar had a “moderately positive” impact on the Italian tiremaker’s second-quarter revenue. An index of euro-area services, which will be released on July 5, probably declined to 55.4 in June from 56.2 in the previous month. A composite index of manufacturing and services probably fell to 56 from 56.4. To contact the reporter on this story: Simone Meier in Zurich at smeier@bloomberg.net. More on the economy: This key "economic barometer" is plummeting Budget crisis: 46 U.S. states face "Greek-style" deficits This important indicator is warning a new recession could be coming | ||

| This chart shows stocks have fallen much more than you realize Posted: 01 Jul 2010 07:14 AM PDT From Zero Hedge: It may come as a surprise to some that when the market's performance is expressed in the opposite of infinitely dilutable paper, we are currently just barely 15% higher than the generational S&P low of 666. As the chart below demonstrates, the S&P expressed in gold is plunging, and has dropped... Read full article (with chart)... More on gold: This chart says gold could pass $1,300 soon What you need to know about gold and your taxes Rick Rule: Gold stock investors could make a fortune in the next 5 years | ||

| Gold Below $1,200 As Asset Liquidations Spread Like Wildfire Posted: 01 Jul 2010 07:04 AM PDT The European liquidations we discussed earlier courtesy of the ECB MRO and the repo rate spike, which resulted in a massive EURUSD covering squeeze, have followed through into industrial commodities such as oil and lastly into gold. And as liquidations are merely emblematic of a broken liquidity system (as the name implies), the unwind behind the scenes must be fierce. On the other hand, as the only recourse to prevent an all out systemic collapse should the deflationary trend continue, from Ben Bernanke's perspective, is just to print more money and thus solidify the position of the precious metal as undilutable and a currency which can not be backed with toxic MBS and Greek Sov Bonds, today's sell off is a much welcomed respite for the commodity which traded at record highs as recently as this week. Also, our recent disclosure of PM market manipulation via disclosed COMEX-OTC arbing by such former behemoths as AIG then (and presumably JPM now), should only add to your comfort that once the finger on the scales is removed, the natural reaction will be that of a coiled spring.

In the meantime, here is a one year gold price chart. | ||

| Gold Daily Chart: Shock and Awe; Cup and Handle Formation; US Bonds on Deck Posted: 01 Jul 2010 07:02 AM PDT | ||

| As Curve Flattening Accelerates, Morgan Stanley Goes All In, Tells Clients To Bet Against Fat Tails Posted: 01 Jul 2010 06:41 AM PDT The2s10s has plumbed fresh new lows: - the most levered trade in the history of the world (the curve steepener for the uninitiated) is now the most abhorred. The amount of neg P&L incurred here over the past 2 months is just staggering. After hitting an all time of 290bps in March, the 2s10s has collapsed by over 20% in the last three months. And as the leverage associated with this trade is second to none, the impact of this collapse is magnified hundreds of times, not to mention that the money banks charge for mortgages (if anyone wanted these to begin with) and credit cards is marginally so much lower that Q2 and certainly Q3 bank profitability will be very badly impaired. Which is why we were eagerly anticipating the one firm which has been the biggest defendant of the steepener trade to come out with its "double or nothing" all-in on the economic rebound which is critical for this bearish flattening to terminate. Today, we got our wish. As expected, Morgan Stanley's Jim Caron throws the kitchen sink into the bull case, and this time also pitches the "no fat tails" trade - the same trade that worked miracles for Boaz Weinstein and Merrill Lynch. Alas, with MS clients sick and tired of losing money, almost as much as Goldman's FX clients, this could be too little too late. Furthermore, with trite claims such as "no ‘double-dip’, We expect growth in China to slow but expect a soft landing, No deflation in 2H10, Policy rates to remain lower for longer, Europe to muddle along, and solvency risks in 2H10 overstated" it may be difficult for MS to find the last standing greatest fool out there. As for pitching the "Iron Butterfly" to said fool, good luck. But it sure sounds cool. Here is Caron telling the burning theater not to panic:

And the obligatory mea culpa: after all, who could have possibly imagined that the entire "recovery" was built on a rickety house of cards held together by promises, change and $5 trillion in fiscal and monetary stimuli.

So even though Morgan Stanley has been dead wrong so far, it is about time, literally, it was correct. After all, teh mean reversion must happen... eventually.

So just because you got anihilated once following MS' advice, here is why you should do so all over again. Only this time, MS believes that collecting pennies in front of an out of control rollercoaster is a surefire way to recoup all those steepener losses.

So in conclusion: once again, from the beginning, this time with feeling and even more other people's money.

Sigh. | ||

| Gold vs. Treasuries: What’s Your Pick? Posted: 01 Jul 2010 06:22 AM PDT By Shanthi Venkataraman Gold prices have soared about 21% to $1,245.90 an ounce in 2010 and feverish investors are betting prices could rise to as high as $1,300 an ounce by the end of the year. Meanwhile, 10-year bonds have also rallied significantly, with the yield falling below 3% on Tuesday for the first time since April 2009. Here's the bad news: the rally in one of these assets will eventually trip. For months now, the simultaneous rally in gold and treasury notes has confounded investing gurus who have long held that gold and treasury yields are usually inversely related. Gold is normally taken as a hedge against inflation, which means it goes up when the market expects inflation to rise. Investors in gold expect that the U.S will keep printing money to service its mounting debt, which would in turn spark inflation. On the other hand, no investors in their right mind invest in treasury notes if they expect inflation, because rising interest rates hurt bond prices. … If inflation rises, Treasury bond holders stand to lose big time. [source] RS View: The answer is simple. Fill your coffers with gold — because, in the end, bonds are merely debt, and DEBT is never a winning hand. | ||

| Gold vs. Treasuries: What's Your Pick? Posted: 01 Jul 2010 06:22 AM PDT By Shanthi Venkataraman Gold prices have soared about 21% to $1,245.90 an ounce in 2010 and feverish investors are betting prices could rise to as high as $1,300 an ounce by the end of the year. Meanwhile, 10-year bonds have also rallied significantly, with the yield falling below 3% on Tuesday for the first time since April 2009. Here's the bad news: the rally in one of these assets will eventually trip. For months now, the simultaneous rally in gold and treasury notes has confounded investing gurus who have long held that gold and treasury yields are usually inversely related. Gold is normally taken as a hedge against inflation, which means it goes up when the market expects inflation to rise. Investors in gold expect that the U.S will keep printing money to service its mounting debt, which would in turn spark inflation. On the other hand, no investors in their right mind invest in treasury notes if they expect inflation, because rising interest rates hurt bond prices. … If inflation rises, Treasury bond holders stand to lose big time. [source] RS View: The answer is simple. Fill your coffers with gold — because, in the end, bonds are merely debt, and DEBT is never a winning hand. | ||

| Posted: 01 Jul 2010 06:17 AM PDT | ||

| Mortgage Rates at New Record Lows Posted: 01 Jul 2010 06:10 AM PDT It's fair to say that mortgage rates have now fallen to levels that, most students of history would characterize as simply ridiculous. And, what's even more ridiculous is that, even at these low rates, buyers aren't taking the bait and loading up on new debt to go out and get that home of their dreams.

Extrapolating from the current trend, aspiring homeowners will be able to borrow from the big banks at zero percent by the end of the summer. Freddie Mac's weekly report on the cost of financing a home purchase added to this week's bizarre set of financial market numbers, 30-year fixed-rate mortgages dropping from 4.69 percent to 4.58 percent, a new record in a data series that goes back almost 40 years. Fifteen-year mortgage rates have been setting records for more than a month now, last week dropping from 4.13 percent to 4.04 percent. With the benchmark ten-year note sitting comfortably below three percent, we'll probably soon see 15-year mortgages going for under four percent, part of this brave new financial world of 2010 that, lately, looks like it wants to do an encore of its 2008 performance. |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Gold held up firm the last two days in the face of heavy losses in the stock markets, but its eventual decline Thursday was similar to a pattern back in May. "Gold has been caught up in commodity liquidation after poor data and as equities (fall)," said Simon Weeks, head of precious metals at the Bank of Nova Scotia. "Usual story — selling first as people need cash… and then further down the road, the gold as a currency demand will kick in." Gold's usual inverse correlation with the dollar remained erratic, as the greenback also tumbled on fears that the U.S. economic recovery is stalling…

Gold held up firm the last two days in the face of heavy losses in the stock markets, but its eventual decline Thursday was similar to a pattern back in May. "Gold has been caught up in commodity liquidation after poor data and as equities (fall)," said Simon Weeks, head of precious metals at the Bank of Nova Scotia. "Usual story — selling first as people need cash… and then further down the road, the gold as a currency demand will kick in." Gold's usual inverse correlation with the dollar remained erratic, as the greenback also tumbled on fears that the U.S. economic recovery is stalling…

It’s not clear who’s balking more – lenders or borrowers, as it doesn’t seem that anyone trusts anyone else anymore when it comes to credit and debt - but “freakishly” low rates are no longer the exclusive domain of big banks borrowing from the Fed at zero percent.

It’s not clear who’s balking more – lenders or borrowers, as it doesn’t seem that anyone trusts anyone else anymore when it comes to credit and debt - but “freakishly” low rates are no longer the exclusive domain of big banks borrowing from the Fed at zero percent.

It's not clear who's balking more – lenders or borrowers, as it doesn't seem that anyone trusts anyone else anymore when it comes to credit and debt - but "freakishly" low rates are no longer the exclusive domain of big banks borrowing from the Fed at zero percent.

It's not clear who's balking more – lenders or borrowers, as it doesn't seem that anyone trusts anyone else anymore when it comes to credit and debt - but "freakishly" low rates are no longer the exclusive domain of big banks borrowing from the Fed at zero percent.

No comments:

Post a Comment