Gold World News Flash |

- In The News Today

- Hourly Action In Gold From Trader Dan

- The Move To $1650 And What It Means For Producers

- A Note From CIGA Eric

- The gold standard: generator and protector of jobs

- Brien Lundin: Gold's (Almost) Free at Last

- Daily Dispatch: $1,260.90

- Time To Focus On Silver

- Gold & Silver Power Update

- Are Buffett and Gates Losing It?

- Client Update – Evolving Gold

- Gold Article

- GLD, GDX and GDXJ True Strength Index Momentum

- Tickerforum's Turning Three: Teaser #2

- I Buy Gold. I Don't Know What Else to Buy: Marc Faber

- PM Summer Doldrums 2

- Banks are lending again

- Hoenig Sees Inflation Ahead... Disturbing Questions Around BP Leak

- LGMR: Gold Jumps to New Dollar High as T-Bonds "Pose Risk" to Asian Central Banks

- European Debt Crisis Coming to a City or Town Near You

- Bottom in Junior Resource Sector?

- Financial Terrorist and ‘Paper Bug’ Morgan Stanley Tries to Talk Down Gold

- Machine Gunning Civilians On Wall St. and Iraq Using Derivatives and Lead

- Gold Climbs Through $1260

- Gold and Economic Freedom (1966)

- Gold Seeker Weekly Wrap-Up: Gold and Silver Gain Over 2% and 4% on the Week

- Will Genetic Modification Usher In A New Age Of Prosperity Or Will It Unleash Health, Environmental And Economic Nightmares Of Unprecedented Magnitude?

- The Wild Gold Price Bull Ride Has Begun

- Europe Has Data Retention, Australia Next

- Will Gold Shares Catch Up to the Gold Price?

- Guest Post: Return Moves to the Quarterly Average in the Bear Market of 2007-2009: Gann Time and Price and Cycle Analysis Overlay

- Gold and Silver Option Expiration Dates Remaining in 2010

- SNB Loses 8b on Euro Intervention. Folds.

- Guest Post: Behind and Beyond The Sinking of The Cheonan

- Brien Lundin: Gold's (almost) free at last

- Brien Lundin: Gold’s (Almost) Free at Last

- Gold, Silver, and SP 500 Futures Daily Charts

- FRIDAY Market Excerpts

- Gold RUSH: Gold shatters all-time record

- What you need to know about gold and the U.S. dollar

- Yankees Seek Tax Refuge in the Deep South

- Friday ETF Roundup: UNG Reverses, GDX Gains

- Quantitative Easing Does Not Guarantee Higher Stock Prices

- China could be lying about gold

- Jim Rogers: All paper money is doomed

- Leading Indicators Don't Spell Recession ... Yet

- Quadruple Witching Tops Off Weekly Trading

- A Flock of Fed Funds Forecasts

- COT Weekly Data Discloses Biggest Euro Short Covering Episode In History

| Posted: 18 Jun 2010 08:03 PM PDT View the original post at jsmineset.com... June 18, 2010 09:02 AM My Dear Friends, You are all my extended family in Tanzanian tradition. To all the Fathers out there, Happy Fathers Day. To the Mothers, a nation stands on the integrity of its Mothers. If Mothers are degraded the nation will certainly fall. Respectfully, Jim Jim Sinclair’s Commentary Greece is nothing compared to the 33 states of the USA charging at 200mph towards a stone wall of bankruptcy. Nearly Bankrupt Illinois Forced To Pay Through The Nose To Borrow Money Joe Weisenthal | Jun. 18, 2010, 9:02 AM The market has lost confidence in Illinois, a state which has now adopted its own IOU system. Illinois sold $300 million of Build America Bonds at a yield premium over Treasuries about 40 percent higher than two months ago after lawmakers failed to close a $13 billion budget deficit for the year starting July 1. The fifth most-populous U.S. state sold the taxable debt maturing in 20... |

| Hourly Action In Gold From Trader Dan Posted: 18 Jun 2010 08:03 PM PDT View the original post at jsmineset.com... June 18, 2010 09:52 AM Dear CIGAs, Gold shot up to a brand new record high in US Dollar terms in today's session as it continues moving higher on its own merits. It did not especially matter what the Euro or the Dollar seemed to be doing today as both were rather quiet compared to recent volatility that has marked those pits; nevertheless, gold powered through the capping efforts of the banks at $1,250 on good volume forcing some of the fresh shorts encouraged by some CTA's and other advisory newsletters out of the market. It would seem that gold is becoming a star in its own right as crude oil was tame today as was the bond market and the equity markets. In other words, the typical "outside influences" were missing that tend to impact gold leaving the larger macroeconomic forces the main factor in gold's performance. Clearly investors who have deep misgivings about the current state of the global economy, particularly the West and its incre... |

| The Move To $1650 And What It Means For Producers Posted: 18 Jun 2010 08:03 PM PDT View the original post at jsmineset.com... June 18, 2010 10:27 AM Dear CIGAs, It is my feeling that gold is headed on this move to $1650 with its normal drama. Let’s think about what this means to gold producers. With gold valued at $1650 per ounce: - 500,000 ounces = $825,000,000 less the cost of mining. - 1,000,000 ounces = 1,650,000,000 less the cost of mining. - 2,000,000 ounces = 3,300,000,000 less the cost of mining. Costs: - Underground average costs are approximately $500-$600 (assuming no derivatives or derivatives covered as international and Canadian GAAP requires derivative losses be expensed to the specific property). - Open cut average costs are approximately $300 (again, assuming no derivatives or derivatives covered). - On surface average costs are approximately $22-$75 (again, assuming no derivatives or derivatives covered). Economist tips gold price to keep rising By resourceINTEL · June 18, 2010 · 9:58 am THE price of gold could reac... |

| Posted: 18 Jun 2010 08:03 PM PDT View the original post at jsmineset.com... June 18, 2010 11:17 AM Dear CIGAs, My view, and I never trade the wiggles, remains the same. The setup in the gold stocks looks solid. When the time is right, and the window has begun to open, they will take out their 30-year consolidation pattern with conviction. We might have to wait until the start of the C-wave, but that remains to be seen. The Fed is a mouthpiece of standardized quips that provide zero information in terms of anticipating market direction. Their actions/policies, contrary to popular opinion, follow rather than lead the market. In other words, I could care less about the Fed meetings or pronouncements. Capital will continue to follow confidence. As long as devaluation and confidence continue to erode within the periphery zones of Europe, capital will first seek safety, then increasing risk in areas deemed comparatively safe or safer. The comparatively safe areas, such as the US, however, are anything... |

| The gold standard: generator and protector of jobs Posted: 18 Jun 2010 08:03 PM PDT Hugo Salinas Price The abandonment of the gold standard in 1971 is closely tied to the massive unemployment the industrialized world has suffered in recent years; Mexico, even with a lower level of industrialization than the developed countries, has also lost jobs due to the closing of industries; in recent years, the creation of new jobs in productive activities has been anemic at best. The world’s financial press, in which leading economists and analysts publish their work, never examines the relationship between the abandonment of the gold standard and unemployment, de-industrialization, and the huge chronic export deficits of the Western world powers. Might it be due to ignorance? We are reluctant to think so, given that the articles appearing in the world’s leading financial publications are written by quite intelligent analysts. Rather, in our opinion, it is an act of self-censorship to avoid incurring the displeasure of t... |

| Brien Lundin: Gold's (Almost) Free at Last Posted: 18 Jun 2010 08:03 PM PDT Source: Brian Sylvester of The Gold Report 06/18/2010 The U.S. dollar may only look good because its fiat currency brethren look bad, but declining confidence in paper money has thrust gold toward a position it hasn't enjoyed for a century or so— freedom from its seesaw relationship with the U.S. dollar. In this exclusive Gold Report interview, Gold Newsletter Editor and Publisher Brien Lundin—who also hosts the New Orleans Investment Conference—says that mounting troubles in Euroland threaten to end the traditional inverse correlation between the price of gold and the value of the U.S. dollar. Of course the dollar decoupling can only go so far. "Gold stands as the one currency that governments cannot debase or debauch," Brien says, but "the dollar is the only currency accepted by margin clerks." The Gold Report: You've said that it would be "foolish to think officials aren't manipulating the gold market." Could you tell our readers why you say tha... |

| Posted: 18 Jun 2010 08:03 PM PDT June 18, 2010 | www.CaseyResearch.com $1,260.90 Dear Reader, Chris here. David is busy with other things so I’ll be with you for this Daily Dispatch. Try not to cry, but my time with you must be particularly short today because I have two excellent but rather longish articles from my esteemed colleagues I’d like to share with you. And I don’t want today’s missive to turn into a book. Before vacating the stage I would like to show you this: Gold rose to a new record as it reached $1,260.90 per oz. earlier today. The previous all-time high for the yellow metal was $1,252.11 set June 8. The new record is significant because it shows that despite what governments around the world are reporting, that all is hunky-dory, people are starting to catch on that it just ain’t so. Don’t worry if you haven’t yet had the chance to purchase the only financial asset that isn’t someo... |

| Posted: 18 Jun 2010 08:03 PM PDT It is not exactly groundbreaking analysis to say that whats good for Gold is generally good for Silver. As observers of the precious metals know, Silver tends to lag Gold but eventually catch up quickly. In the long-term sense, Silver is still a year or two behind Gold as Gold has broken above all resistance levels. Technically speaking, we do favor Gold over the next few months, but ultimately, Silver is poised to catch up with vengeance. Here is a great 40-year Silver chart from Nick Laird at sharelynx.com, with my annotations. This long-term chart shows $15/oz as a critical level. Silver rebounded strongly from $15 earlier this year and is soon to attempt to break $20. A clean breakout and Silver should reach $25, which is its final long-term resistance. This brings up the question, when will Silver break $20/oz? The above chart provides some helpful hints. First, the 40-week bollinger bands are nearly tight enough (as in previous breakouts). Second, Silver ha... |

| Gold & Silver Power Update Posted: 18 Jun 2010 08:03 PM PDT Graceland Updates 4am-7am www.gracelandupdates.com Email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] June 18, 2010 - Gold blasted out of the ascending triangle I highlighted this morning right before the breakout. - GOLD ASCENDING TRIANGLE - Gold blasted off leaving a crowd of top callers and gold worriers behind. The target of the triangle is 1320. The worst traders I know are pretty much out of gold. - The reality is that some big name gold stocks are making new 52 week highs, and this is the beginning of what I call, “the great gold confirmation”. [*]The gold community has focused on what is generally perceived as a non-confirmation of the GDX. - (see chart here: GDX Daily Chart ) The view is that because GOLD has made a new high, but gold stocks have not, something is “wrong”, or at least it is disappointing. The bears thought it meant gold itself would crash, and the gold stocks th... |

| Are Buffett and Gates Losing It? Posted: 18 Jun 2010 08:03 PM PDT The 5 min. Forecast June 18, 2010 10:04 AM by Addison Wiggin & Ian Mathias [LIST] [*] Gold touches another record… The 5 discovers several answers to the question “Why now?” [*] The return of the commercial mortgage monster… and how to play it conservatively for a double-digit gain [*] California lawmaker devises new kind of dividend… Jim Nelson on how it could easily backfire [*] Gates and Buffett as “morons”… Readers overwhelm The 5 with their take on the billionaires’ charitable impulses [/LIST] Gold has reached record territory on this Friday in June. The spot price briefly broke through $1,260 this morning. Gold for August delivery rose $8.70, to $1,257.40 on the Comex. Now… some of this is simply because it’s, well, a Friday in June. Volume is generally thinner in the summer, thinner still as traders take a three-day weekend. But some powerful longer-term t... |

| Posted: 18 Jun 2010 08:03 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 18, 2010 09:23 AM You can revisit past posts of mine regarding Evolving Gold to get the full gist but the bottomline (in my highly biased position) is two critical factors: [LIST] [*]This company has not one, but two world class deposits 99% of their peers would be glad to have just either one [*]The company stumbled and fumble in the past on the corporate communication side of things [/LIST] Because of point #2, the fact of #1 has been either lost or severely (the degree of how deserving this is varies from person to person) discounted to a point where in my biased but candid view, has made the recent share price not representative of what the company has “project-wise”. But because of this, I believe it’s going to take very good results to remove most of point #2 from the equation. The share price has been so compressed. Reasons for today’s big... |

| Posted: 18 Jun 2010 08:03 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 18, 2010 10:45 AM Maybe it’s because “Tokyo Rose”, Bagdad Bob and the rest of the gold perma-bears continue to yell to the people to get off the wall before it comes crumbling down. To “Tokyo Rose” from us tin-foil foolish gold owners. [url]http://www.grandich.com/[/url] grandich.com... |

| GLD, GDX and GDXJ True Strength Index Momentum Posted: 18 Jun 2010 08:03 PM PDT The True Strength Index is a low lag-time momentum indicator that can be used at www.FreeStockCharts.com. Generally, it is bullish when the indicator is above ZERO and bearish when it is below ZERO. As the indicator is very sensitive and responsive to movements of price, it can be effectively interpreted for buy and sell decisions. GLD is making new all-time highs today. So let’s see what the momentum indicator is telling us. Below is a chart of the hourly price action of GLD. A couple of things are obvious. First, the price performance of GLD has been steadily accelerating for the past 6 trading sessions. This is significant because it means that as the acceleration begins to slow, price could still continue higher – but climbing at a slower rate. As the current reading is .45, which is relatively high, I think it likely that gold will continue to rise while the TSI momentum indicator will begin to diverge (trend lower). There are a couple... |

| Tickerforum's Turning Three: Teaser #2 Posted: 18 Jun 2010 08:03 PM PDT Market Ticker - Karl Denninger View original article June 18, 2010 09:08 AM In reminder, Tickerforum turns three on the 26th. I continue to be impressed with both the forum and, of course, the readership of The Market Ticker. In order to take advantage of the promotional specials you will need to have a Tickerforum login account. There will be both "no obligation" freebies available over the weekend and a promotional special for those who donate between the 10th (my first posting on this) and the 26th. The "full monte" will be posted on Friday, the 25th, right here and on Tickerforum itself in the "Administrative" section. Watch for it and, if you're a trader, consider a Gold donorship (see the FAQ on the forum for details and requirements.)... |

| I Buy Gold. I Don't Know What Else to Buy: Marc Faber Posted: 18 Jun 2010 08:03 PM PDT Gold didn't do a whole heck of a lot all through Far East trading, but around the London a.m. gold fix at 10:30 a.m. local time... 5:30 a.m. Eastern time... gold finally caught a bit of a bid. Then, about 15 minutes before the Comex opened, gold accelerated to the upside... hitting $1,245 spot. And, except for a spike to its high of the day [$1,252.50 spot] at half past lunchtime in New York, that's where gold closed at 5:15 p.m. Eastern time. It was obvious, at least to me, that there was a not-for-profit seller lurking about to make sure that gold didn't close about $1,250 spot. Silver, once again, hoed its own row yesterday. Between the Far East open on Thursday morning and precisely 9:00 a.m. in London [4:00 a.m. in New York], silver fell about 15 cents. That proved to be its absolute low of the day. Then, for the next four hours, silver gained all that back. Then, like gold, silver really took off to the upside just minutes after 8:00 a.m. in... |

| Posted: 18 Jun 2010 08:03 PM PDT Adam Hamilton June 18, 2010 2625 Words Over the past month or so, precious-metals stocks’ performance has been frustrating. Even though gold looks great, lazily meandering over $1200 without a care in the world, the PM stocks have drifted sideways to lower. Unfortunately such behavior is typical in the dreaded PM summer doldrums. These doldrums exist because strong seasonal forces affect gold demand. While gold’s newly-mined supply flows to the markets at an essentially constant rate throughout the year, this metal experiences wild fluctuations in demand. And unfortunately none of the usual demand spurts coincide with summer. Asian gold buying ramps up in autumn as ... |

| Posted: 18 Jun 2010 08:03 PM PDT June 17, 2010 – Banks are lending again. After many months of sitting on their hands while trying to repair their over-leveraged balance sheets, banks are making new loans. They also continue to buy US government paper, though those purchases tapered off over the past month. Earlier this year I noted how banks were using their depositors’ money to buy US government paper instead of making loans. Those circumstances are changing, as is illustrated in the following chart. From the above chart we can see that bank loans have grown so that they are now essentially unchanged from where they were two years ago. But the important question for now remains unanswered. Were these new loans made over the past few months used for productive purposes that could help spur economic growth, or were they simply extensions of credit to help troubled borrowers cope with their existing debt? It remains to be seen which alternative caused this growth in bank loans &#... |

| Hoenig Sees Inflation Ahead... Disturbing Questions Around BP Leak Posted: 18 Jun 2010 08:03 PM PDT Hoenig Sees Inflation Ahead Friday, June 18, 2010 – by Staff Report Hoenig continues to advocate for raising federal funds rate ... Tom Hoenig, president of the Federal Reserve Bank of Kansas City, again made a case for raising the federal funds rate as he spoke to members of The Kansas City Club on Thursday afternoon. The federal funds rate, the overnight interest rate banks can charge to lend money to other banks through the Federal Reserve, is the main tool the Fed uses to control the economy. The rate is about 0.2 percent, its lowest in 65 years. Earlier this month, Hoenig argued that he wants to move the federal funds target rate to 1 percent by the end of summer. He further explained that position on Thursday. The United States is on track this year for 3 percent to 3.5 percent growth in gross domestic product, he said, and though that may not be thrilling, it's still a systematic improvement. "If that trend continues — although the job m... |

| LGMR: Gold Jumps to New Dollar High as T-Bonds "Pose Risk" to Asian Central Banks Posted: 18 Jun 2010 08:03 PM PDT London Gold Market Report from Adrian Ash BullionVault 09:35 ET, Fri 18 June Gold Jumps to New Dollar High as T-Bonds "Pose Risk" to Asian Central Banks THE PRICE OF GOLD jumped to new record highs for Dollar investors on Friday morning, peeping through the "resistance" identified by several bank analysts at last week's peak of $1254 an ounce. European stock markets held flat but emerging Asia ended the week 3.6% higher – the best showing of 2010 so far. Commodity prices fell, with US crude oil contracts losing 1% to $75 per barrel. G7 government bonds slipped in early trade, nudging interest rates higher. "The direction of official [government] policy looks inflationary, but the economic fundamentals look deflationary," says Phillip Coggan's Buttonwood column in today's Economist magazine. "Faced with this dichotomy, investors who buy both Treasury bonds and gold are not displaying cognitive dissonance. They are just hedging their bets." "Given ... |

| European Debt Crisis Coming to a City or Town Near You Posted: 18 Jun 2010 08:03 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 18, 2010 05:31 AM While Europe is the main focus at the moment, it’s only a question of when (not if) America becomes the ultimate focus of a debtor gone bad. Sadly, I must say “stay tuned.” [url]http://www.grandich.com/[/url] grandich.com... |

| Bottom in Junior Resource Sector? Posted: 18 Jun 2010 08:03 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 18, 2010 05:37 AM June, July and August are many times the most seasonally-weak period for the junior resource sector. This year it’s been especially tough given the fact that the new highs in gold have not been remotely reflected in the juniors. The chart below suggests the market is attempting to make a significant bottom. Fingers and toes crossed as it’s been ugly! [url]http://www.grandich.com/[/url] grandich.com... |

| Financial Terrorist and ‘Paper Bug’ Morgan Stanley Tries to Talk Down Gold Posted: 18 Jun 2010 07:21 PM PDT |

| Machine Gunning Civilians On Wall St. and Iraq Using Derivatives and Lead Posted: 18 Jun 2010 07:10 PM PDT Indescriminate murder of civilians to satisfy twitching soldiers suffering from Xbox withdrawal mirrors the indescriminate murder of civilian wealth by twitching High Frequency Traders high on Meth. Human life is trading at new, all-time lows on the Pentagon's Terror Exchange and Goldman's NYSE. The world has no way to adequately express their hatred of American foreign and economic policies; so they buy gold instead. |

| Posted: 18 Jun 2010 06:23 PM PDT |

| Gold and Economic Freedom (1966) Posted: 18 Jun 2010 05:30 PM PDT |

| Gold Seeker Weekly Wrap-Up: Gold and Silver Gain Over 2% and 4% on the Week Posted: 18 Jun 2010 04:00 PM PDT |

| Posted: 18 Jun 2010 03:36 PM PDT

Most Americans spend very little time thinking about genetic modification, but the truth is that this debate if of the utmost importance. Some believe that improving upon nature is the number one key to a bright economic future, while others warn that messing with nature could not only destroy our economy but also literally destroy the earth. But right now there are very, very few limits on what scientists can do when it comes to genetic modification, and many of them are running around like "kids is a candy store" modifying anything and everything that they can get their hands on. The goal for many of these scientists is to produce plants and animals that are bigger, stronger, grow faster, produce more food and generally make life "better" for humanity. Most people don't realize it, but genetic engineering technology is everywhere now. In fact, you have probably eaten some genetically modified food recently without even knowing it. Today approximately 93 percent of all soybeans and approximately 80 percent of all corn in the United States grow from seeds genetically altered according to Monsanto company patents. The population of the world is projected to hit 9 billion around the middle of this century, and scientists are hoping that further advances in genetic engineering will enable us to feed all those people. So many researchers are "pushing the envelope" in an effort to create new creatures that can feed as many people as possible. For example, one team of scientists recently created a genetically modified "monster salmon" which grows three times as fast as normal salmon. Three times as fast? That is impressive by any standard. But are there dangers? Well, yes. For example, a stunning new study that was recently published in the International Journal of Biological Sciences has conclusively demonstrated the extreme toxicity of three genetically modified corn varieties produced by Monsanto. According to the study, each of the three strains of corn tested cause serious problems in the kidneys and the liver. Perhaps that could help to explain the absolute explosion of kidney disease in the United States. Not only that, but prison inmates in Illinois are becoming seriously ill from all of the genetically modified soy that they are constantly being fed. In fact, there are entire websites devoted to documenting the dangers that genetically modified foods pose. Despite the potential dangers, the U.S. government continues to promote genetically modified crops as the solution to the global food shortage problem. For example, the U.S. Department of Agriculture is attempting to downplay the risks of genetically modified alfalfa, a crop previously banned by numerous federal courts. The truth is that the U.S. government is being completely reckless in promoting these genetically modified crops before sufficient research can be performed on them. You see, once these genetically modified crops get out into the environment they can never be contained. You can't put the genie back into the bottle. A perfect example of this occurred in Europe recently. A genetically modified variety of maize banned in the EU was accidentally sown all across Germany. But now that it has gotten out there and started spreading there is no way that it can ever be fully eliminated. The reality is that we are monkeying around with life itself, and that is a power that we simply do not fully understand. But as frightening as the genetic modification of our food supply is, what scientists are now doing with animals is even more alarming. How so? Well, the Canadian government recently approved the introduction of extremely bizarre genetically modified pigs into the Canadian food supply. These new mouse/pig cross-species hybrids have been nicknamed "enviropigs" and are being touted as being much better for the environment. This new "breed" of Yorkshire pigs was created by scientists in Ontario at the University of Guelph, who spliced in genes from mice to decrease the amount of phosphorus produced in their poop. It all sounds very noble. After all, who wouldn't want to do something good for the environment? But will eating mouse/pig hybrids be good for us? Millions of Canadians will soon be eating them, and it is anticipated that approval for these "enviropigs" will be sought in the United States as well. Are you starting to get the picture? And sometimes scientists genetically modify animals for no particular good reason at all. For example, scientists have now created a cat that actually glows in the dark. Yes, seriously. A genetically modified cat created by scientists named Mr. Green Genes was the very first fluorescent cat in the United States. So does such a "creation" have any legitimate purpose? Well, perhaps it could serve as a "night light", but other than that there is no good reason for abusing cats like that. What in the world are our scientists thinking? They are pretty much running around doing whatever they want these days. In fact, creatures that are a lot more frightening than fluorescent cats have already been created. Have you heard of "spider goats"? A Canadian company named Nexia is actually producing goats that are genetically modified to be part spider. The genetic modification causes these "spider goats" to produce spider silk protein in their milk that is collected, purified and spun into incredibly strong fibers. These fibers are reportedly more durable than Kevlar, more flexible than nylon, and much stronger than steel. Apparently these fibers have some very valuable industrial and military applications. Perhaps you have never heard of these spider goats. Perhaps you are skeptical. The YouTube video posted below contains a television news report that discusses these "spider goats" and features scientists describing exactly how they create these spider goats and what they are doing with them.... Okay, so they are recklessly genetically modifying plants and animals, but they would never do that to humans, right? Wrong. Scientists have begun breeding genetically modified pigs with a goal of providing organs for transplant to humans. These genetically modified pigs actually have human genes in them. So these pigs are actually part human. Does the idea of a pig/human hybrid bother you? Well, perhaps they are being grown in your backyard. These pig/human hybrids are actually being produced in the state of Missouri. So could these pig/human cross-species hybrids ever end up in our food supply? No? You don't think that they would ever do that to us? Don't be so certain. The truth is that the FDA has already announced that the offspring of cloned animals could be in our food supply right now and that there is nothing that they can do about it. Isn't that comforting? Science is not just crossing new barriers - they are obliterating them. Our world is rapidly changing, and new species, new lifeforms and even new diseases are being created at a staggering pace. Once upon a time, only the most highly advanced scientists in the field of genetic engineering would dare do this type of work, but now even college students are transplanting genes and creating new lifeforms. In fact, a lot of "synthetic biology" startup companies are "developing" new plants, new animals and even new microorganisms in garages and basements. So what will the result of all this genetic chaos be? Will devastating new diseases be unleashed upon the world? Will creatures that are incredibly dangerous to humanity be created? Will we destroy entire ecosystems? Could all of this genetic engineering actually cause massive crop failures and bring about a major worldwide food crisis? Will we soon have creatures that are part human/part animal running around all over the place? The truth is that we have entered into unknown territory, and the consequences of our actions could end up being much more severe than we ever thought possible. So what do you think? Do you think that genetic engineering will enable us to feed the starving masses, cure cancer and bring in an unprecedented era of economic prosperity? Or do you think that genetic engineering will devastate our economy, our health and our environment? Feel free to leave a comment with your opinion.... |

| The Wild Gold Price Bull Ride Has Begun Posted: 18 Jun 2010 02:49 PM PDT Gold Price Close Today : 1,257.20Gold Price Close June 11: 1,228.90Change: 28.30 or 2.3%Silver Price Close Today : 1917.5 Silver Price Close June 11 : 1822.2 Change 95.30 cents or 5.2%Platinum Price... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Europe Has Data Retention, Australia Next Posted: 18 Jun 2010 02:17 PM PDT ZDNet Australia broke the news on Friday that the Federal Government Attorney-General's Department was considering how it could best implement a data retention regime in Australia. "The Attorney-General's Department has been looking at the European directive on data retention, to consider whether such a regime is appropriate within Australia's law enforcement and security context," the Attorney-General's Department had said. "It has consulted broadly with the telecommunications industry." Data retention requires telecommunications providers, including internet service providers (ISPs), to log and retain certain information on subscribers for local enforcement agencies to access when they require it. The regime sees certain data logged before any suspect is identified, meaning that every internet users' online activities are logged by default. Europe has oneSuch a system currently exists in Europe, and has been adopted by select states. The call for the European directive on data retention came after the 2004 Madrid train bombings in Spain.According to the EU directive, where internet access is concerned, ISPs must retain the user ID of users, email addresses of senders and recipients, the date and time that users logged on and off from a service, and the IP address (whether dynamic or static) applied to their user ID. Importantly, the EU directive requires ISPs to retain data necessary to trace and identify the source, destination, date, type, time and duration of communications — and even what communication equipment is being used by customers and the location of mobile transmissions. For telephone conversations, this means the number from which calls are placed and the number that received the call, the owner of the telephone service and similar data such as the time and date of a call's commencement and completion. For mobile phone numbers, geographic location data is also included. The data is retained for periods of not less than six months and not more than two years from the date of the communication. More Here Romania's Health Service on Brink of Collapse More Here.. |

| Will Gold Shares Catch Up to the Gold Price? Posted: 18 Jun 2010 01:23 PM PDT |

| Posted: 18 Jun 2010 01:08 PM PDT Return Moves to the quarterly average in the bear market of 2007-2009: Gann Time and Price and Cycle Analysis Overlay: Potentially a Very Bearish Configuration, Submitted by John Bougearel of Structural Logic

|

| Gold and Silver Option Expiration Dates Remaining in 2010 Posted: 18 Jun 2010 01:06 PM PDT |

| SNB Loses 8b on Euro Intervention. Folds. Posted: 18 Jun 2010 01:00 PM PDT The Euro/CHF cross closed in NY at 1.3732 Friday. I believe that is an all time low close. I am still scratching my head how this could happen during a week where the Euro did a five big figure move to the upside.

HILDEBRAND, MAY 11

|

| Guest Post: Behind and Beyond The Sinking of The Cheonan Posted: 18 Jun 2010 12:39 PM PDT Submitted by www.OilPrice.com on behalf of the OSINT Group Behind and Beyond The Sinking of The Cheonan |

| Brien Lundin: Gold's (almost) free at last Posted: 18 Jun 2010 12:07 PM PDT 8p ET Friday, June 18, 2010 Dear Friend of GATA and Gold: In an interview today with Brian Sylvester for The Gold Report, Gold Newsletter editor and New Orleans Investment Conference organizer Brien Lundin explains why and how governments manipulate the gold market, quotes GATA consultant Frank Veneroso on the likely depletion of central bank gold reserves via gold leasing, predicts that gold is breaking out now anyway, offers some stock recommendations, and generally earns another tinfoil hat. The interview with Lundin is headlined "Brien Lundin: Gold's (Almost) Free at Last" and you can find it at The Gold Report here: http://www.theaureport.com/pub/na/6573 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Brien Lundin: Gold’s (Almost) Free at Last Posted: 18 Jun 2010 11:55 AM PDT

http://www.theaureport.com/cs/user/print/na/6573 The U.S. dollar may only look good because its fiat currency brethren look bad, but declining confidence in paper money has thrust gold toward a position it hasn't enjoyed for a century or so— freedom from its seesaw relationship with the U.S. dollar. In this exclusive Gold Report interview, Gold Newsletter Editor and Publisher Brien Lundin—who also hosts the New Orleans Investment Conference—says that mounting troubles in Euroland threaten to end the traditional inverse correlation between the price of gold and the value of the U.S. dollar. Of course the dollar decoupling can only go so far. "Gold stands as the one currency that governments cannot debase or debauch," Brien says, but "the dollar is the only currency accepted by margin clerks." The Gold Report: You've said that it would be "foolish to think officials aren't manipulating the gold market." Could you tell our readers why you say that? Brien Lundin: I've never been a big believer that the government manipulates the gold price on a day-to-day basis. By and large you can't blame everyday fluctuations on the secret hand of some government bureaucrat. My feelings that they don't do this every day has nothing to do with motivation, but rather government inefficiencies. I don't think they could do it. However, they're certainly motivated to manipulate gold prices in a broader sense. That's something they have done, and I think they are doing it now. The reasons I think it's foolish to believe that governments aren't manipulating the gold market in some broader sense are: 1) it suits their purposes; and 2) they've done it in the past. Gold serves as the barometer not only of government mismanagement of the currency but of investor and saver confidence in the currency. As such, the gold price has been marching higher relentlessly, which certainly can be interpreted as a decline in confidence in the dollar and in government management of finances. Both overtly and covertly, government manipulation of the gold price dates back to 1933, when Roosevelt confiscated private gold that U.S. citizens owned and proceeded to revalue it, raising the official gold price from $20.67 an ounce to $35. That, in effect, devalued the dollar; but, because they did it after confiscating the gold, it's an example of overt manipulation. After Bretton Woods, following World War II, in concert with foreign governments the U.S. government routinely manipulated the gold price, primarily with the establishment of the London Gold Pool in the 1960s. They tried in vain to suppress the price, to keep the exchange rate closer to the official rate of $35 an ounce. As with all such manipulations of the market, that eventually failed and the London Gold Pool collapsed. After legalizing gold ownership again in 1974, the U.S. government immediately cratered the price through Treasury sales of gold, which resulted in tremendous gains for the U.S. Treasury and tremendous losses for private investors. Throughout the 1970s, those efforts continued through public Treasury auctions of gold, which obviously were designed to suppress the gold price. Of course, ultimately these efforts failed as well, because the gold price broke free in 1979 and hit record levels. After that, gold leasing through bullion banks was used to depress the gold price for some time. That was the primary tool throughout the 1990s. TGR: Did that work? BL: As detailed in research by Frank Veneroso, which we first published in the late 1990s, gold from central government vaults was loaned to the market either through fabricators or miners using gold hedges to protect the price they received for gold and thus their profit margins. That's still being done to some extent for project financing, although not nearly as much as in the 1990s and the early 2000s. But bullion banks essentially hedged their positions with gold miners and gold fabricators, borrowing gold from central banks at very low interest rates and selling it into the market, which would depress the price. Then they reinvested the proceeds into more leveraged investments—at least T-bills, but often using T-bills as collateral for even riskier investments. In that manner, the official central bank gold holdings dropped from about 30,000 tons to less than 15,000 tons. TGR: Wow! BL: In effect, that's a large, accumulated gold short position. Citizens of a lot of nations don't realize that much of the gold they think sits in the vaults of their central banks is really a pile of IOUs that can't be settled with gold. These IOUs would have to be settled with cash at some level. That's a lit fuse, and it's been out there for some time. It's a potential X-factor in the gold market that could send prices higher much more quickly. TGR: Any other examples of how government manipulation is manifesting itself now? BL: One of the ways is simply through manipulation of the futures and options markets and gold derivatives. TGR: Europe's problems also seem to be influencing the gold price. This week, just after Moody's downgraded Greece's credit rating to junk bond status there was a late—though small—rally in gold. BL: Right. As you know, gold and the U.S. dollar were on opposite sides of a seesaw for some time; when one rose, the other one fell and vice versa. I've been arguing that gold's real breakout would come when gold could rise regardless of what happened to the U.S. dollar. That actually happened with the early troubles with the euro. Early this spring, when we saw the first signs of this, we reported on them in Gold Newsletter. For brief periods, gold began to rise even when the dollar was strong. It wasn't a very pronounced trend, but it was the first sign that the inverse correlation between gold with the U.S. dollar was weakening. As troubles began to mount in Euroland, especially Greece's sovereign debt troubles, gold began to trade completely independently of the direction the dollar—in fact, both were acting as safe havens. The real impact of these problems, particularly among the PIIG nations, is that gold has regained its status as a reserve currency, not only in the minds of central banks, but also with individual investors and savers around the world. Gold's been a currency for some 5,000 years of human experience, but in the last century or so it lost much of its allure as a reserve currency. Now, as the rest of the world's currencies lose favor, gold is rising as a more favorable alternative. We still have the dollar as a reserve currency, and probably right behind the dollar we have gold. However, while gold may be the "ultimate currency," the dollar is the only currency accepted by margin clerks. TGR: Is that what you meant in your June newsletter when you said the fact that gold that cannot be created at will—as dollars and euros are—is the most important factor in any secular bull market? BL: Exactly. And it is the factor that has come to the fore. TGR: What range are you forecasting for the gold price through the rest of this year and into next? BL: The rest of this year looks very interesting. Once gold passed $1,000 again last fall, the breakout was so powerful and so similar to two previous breakouts during this bull market that Gold Newsletter began tracking the rally against them. Those breakouts occurred in 2005 and 2007, with a year of consolidation in between. Our tracking made it appear that this rally would carry gold up somewhere between previous rallies' gains—which were around 75% and 57%—taking it to between $1,350 and $1,500. When the rally faltered in December and January, we thought the analogy might not hold, but then gold really got back on track this spring. Projecting this rally to the average length of those two previous rallies, we could get up to $1,400 by the end of this year. Even by the early fall. TGR: Wow! And then do you see it going even higher than that in 2011? BL: Another period of consolidation is very likely, but that's just looking at it from a technical standpoint, not in terms of fundamentals. It's very possible that we could see gold around $1,600 in 2011. But that's in current dollars. Based on the official CPI, gold would have to reach around $2,300 in today's dollars to equal its record price in 1980. However, the government has changed the CPI. People don't realize that in the 1980s and then again during the Clinton administration, the government jiggered the CPI to minimize reported inflation. Economists can argue whether these changes were justified, but the point is that they changed the unit of measurement. If you look at the gold price measured in previous versions of the CPI, you're talking about far higher gold prices in current dollars. John Williams of Shadow Stats has gone back and recalculated what he calls the "Alternate CPI," which takes out the government's changes to the index. As it turns out, when you use the historical CPI that was actually in effect during the 1980s, that $850 gold price record in 1980 is equal to $7,576 in 2010 dollars. TGR: Yikes! That's if we measured inflation by exactly the same methodology the U.S. Department of Commerce used in 1980. But that $850 level didn't hold for very long, did it? BL: Oh, no. It gained a few hundred dollars in the span of a month to get to $850, and $850 actually just was a hyperbolic blow-off price. Even so, the current gold price has a long way to go before it even approaches such a blow-off stage. TGR: One way you're taking advantage of this gold bull market is through gold equities. Could you update us on some of the companies you talked about when we interviewed you in March? BL: I know we talked about Linear Gold Corp. (TSX:LRR) last time around. TGR: Oh, right. In your Gold Newsletter in April edition, shortly after news of the upcoming merger with Apollo Gold Corporation (NYSE.A:AGT; TSX:APG) broke, you wrote that you weren't very excited about the deal at first. You'd been very bullish on growth potential for Linear's Goldfields project and feared that the deal with Apollo would dilute that potential. When should investors expect to see the market recognize the value from this merger? BL: Actually, they're starting to get some of that value recognized in the restructuring of Apollo's debts, through the preliminary transactions with Linear, and improved production at the Black Fox Mine. Some input from Linear's management probably is helping there, but I think Linear moved for the merger because they also recognized some improvements coming along the way. Both stocks are in limbo until the merger gets approved, which I am confident will happen by the end of this month. Once it does, we may see a bit of a relief rally in the stock, and then improvements in gold production primarily over the next couple of quarters. Having Wade Dawe at the tiller as president and CEO of the combined entity should be of great comfort to shareholders. Wade has done an outstanding job of managing Linear since its inception. For all of those reasons, I'd say it's in a very good buying range now, headed toward some appreciable gains in as we get into the fall. BL: I think we talked about Treasury Metals Incorporated (TSX:TML). The Goliath gold project, which it's developing, is a great project and the company is drilling deeper to delineate richer resources. It's in a wonderful area in northwestern Ontario with great exploration potential. I expect the preliminary economic assessment they're working on, which should come out shortly, to be very revealing as to Goliath's development prospects. Beyond that, Treasury Metals is looking to consolidate the region around that mine and bring a number of resources together for the first time in a gold district that has been both underappreciated and underdeveloped compared to other gold districts in Canada. I am very positive about Treasury Metals as a longer-term play. In other words, I don't think it's a drill-hole play, where you're looking for the next drill result to launch a stock higher. TGR: What will launch the stock higher? BL: It's going to be a slow but sure process. Barring any surprisingly positive results from the preliminary economic assessment, I expect this to be a longer-term building of a resource and a business as they develop the Goliath Mine and consolidate the district. TGR: The fabled Rick Rule—who we see on your speaker faculty for your New Orleans Investment Conference again this fall—says that he likes the prospect generators better than those drill-hole plays you mentioned a moment ago, because he favors "process over product." Do you keep any prospect generators on your radar? BL: Lara Exploration Ltd. (TSX.V:LRA) follows that model of finding projects and joint venturing out the risky exploration phase of discovery. That doesn't always provide the speculative excitement that some investors like in drill-hole plays, but it's a way to build a business, and Lara has done a wonderful job at that—good management and a very diversified project portfolio, most of it in South America. In Brazil, for instance, Lara has Curionópolis (iron oxide copper gold), Canabrava (volcanogenic massive sulphide), Araguaia (nickel), São Lourenço (tin) and Sergipe (potash). The company's range of projects in Peru includes at least a half dozen that are at near the drill stage. They also have a few projects elsewhere, in Columbia and China. TGR: Speaking of China, the Ministry of Industry and Information Technology reported that China—not only the world's second-largest gold consumer but for the past three years the world's top gold producer as well—produced nearly 100 tons of gold during the first four months of 2010. Are you looking at any companies in particular there? BL: Well, Inter-Citic Minerals Inc. (TSX:ICI) keeps putting out positive news releases. They just keep finding more gold. Their Dachang project is enormous. They've explored only a fraction of it so far and I believe their drilling hit ratio approaches 95%. One of the important things they've done on the corporate front recently is bringing in major financing from a local Chinese gold company. Combining this with their large shareholding by another local—and powerful—Chinese group, it seems that this project is very likely to make its way into production. While working toward production, I think they're also looking at ways to maintain the exploration upside for shareholders. Dachang has evolved into a development project and they're getting all those ducks in a row to bring that project forward to mine it. But huge swaths of their property position, where they are finding very similar mineralization, are underexplored. The company wants to preserve that upside potential for investors as well as the steady development potential of Dachang as a gold project. So while Inter-Citic's had a good run in the share price, tremendous upside potential remains. I couldn't be more positive about it. TGR: Any other companies we've talked about before that you can give us updates on? BL: The management group makes me very positive about Animas Resources (TSX.V:ANI). The geologists and the people in the front office consistently work on behalf of the shareholder, and they're developing exciting exploration models at Santa Gertrudis, their flagship project in Mexico. That project is essentially a district in itself, where they still have a very good chance of delineating a world-class resource. They haven't done that as yet, but this management group's relentless concern for shareholders will make Animas work one way or another. They've recently acquired some other very interesting projects in Nevada to diversify their portfolio, too. As I see it, anyone who buys Animas at its current levels is very likely to reap great rewards. TGR: Any other players in the gold space you want to talk about? BL: Pediment Gold Corp. (TSX:PEZ; OTCBB:PEZGF) has embarked on a very aggressive drill program at its San Antonio gold project in Baja Sur, Mexico. They'd originally contemplated 11,000 meters this year, but then nearly quadrupled that figure—to 40,000 meters. They're going to simplify their story by just going out and finding gold and building their resources. The company also has a scoping study underway. The results should be available by the end of September, giving us a first look at the economics of mining San Antonio's 1.5 Moz. measured and indicated gold resource. TGR: Mentioning Mexico brings silver to mind. Do you like silver? BL: Silver is obviously much more volatile than gold, and as such tends to act as a lever on both gold price gains and declines. As a number of others, I like silver for that reason. I don't play the silver/gold ratio as much as some people do. I just recognize that gold is in a long-term secular uptrend. Along the way, to the extent that it moves somewhat in synch with gold, silver will have price swings with wiggles in the line that are much more pronounced than gold's. Whenever those wiggles take silver down to a significantly undervalued level, that's the time to buy. In fact, silver's a great way to trade that secular bull market in gold. TGR: Who do you like in the silver space? BL: Great Panther Silver Limited (TSX:GPR) may be my very top overall silver recommendation. The key to that company is its great management and its primary proje |

| Gold, Silver, and SP 500 Futures Daily Charts Posted: 18 Jun 2010 11:12 AM PDT |

| Posted: 18 Jun 2010 10:09 AM PDT Safe haven demand lifts gold to new highs The COMEX August gold futures contract closed up $9.60 Friday at $1258.30, trading between $1243.10 and $1263.70 June 18, p.m. excerpts: see full news, 24-hr newswire… June 18th's audio MarketMinute |

| Gold RUSH: Gold shatters all-time record Posted: 18 Jun 2010 10:09 AM PDT From Bloomberg: Gold futures rose to a record $1,263.70 an ounce in New York as Europe’s fiscal woes and dimming prospects for the U.S. economy prompted investors to step up purchases of bullion as an alternative asset. The metal has climbed 15 percent this year, outperforming equities and bonds, while the euro slumped 14 percent. A majority of Greeks believe the country may go bankrupt, an opinion poll showed. Spain has 24.7 billion euros of maturing debt in July and may need to use a financial lifeline from the European Union. “The problems over in Europe are just as pernicious over here in the U.S.,” said Michael Pento, the chief economist at Delta Global Advisors Inc. “You can’t trust sovereign debt and sovereign currency. Gold is the only real honest money that we have.” Gold futures for August delivery rose $9.60, or 0.8 percent, to $1,258.30 on the Comex in New York, the highest settlement for a most-active contract ever. The metal has gained 2.3 percent this week and risen four weeks in a row. Before today, the record was $1,254.40 on June 8. This month, the metal reached all-time highs in euros, U.K. pounds and Swiss francs. Gold for immediate delivery reached a record $1,262.50. Yesterday, reports showed U.S. jobless claims rose unexpectedly and manufacturing in the Philadelphia region missed forecasts by analysts. “People are looking at the euro as a wake-up call and they’re skeptical of a U.S. recovery,” said Adam Klopfenstein, a senior market strategist at Lind-Waldock, a broker in Chicago. “The big fear is that there are going to be other governments who are going to have sovereign-debt risks. People are clamoring to get into gold.” $1,600 Forecast Gold may reach $1,400 this year and rise as high as $1,600 in 2011 should the Federal Reserve be forced to keep interest rates at a record low to stimulate the economy, said Pento of Delta Global. U.S. lawmakers, debating a $50 billion jobs bill in Congress this week, are struggling to meet demands to spend more to boost the economy while cutting the government’s $1.5 trillion deficit. “Smart money like hedge funds and big insurance companies have been accumulating gold,” James Dailey, the chief investment officer at TEAM Financial Asset Management LLC in Harrisburg, Pennsylvania, said in an interview in New York. “Gold has taken the monetary asset role.” Gold may rally to $1,500 this year, he said. Assets in the SPDR Gold Trust, the biggest exchange-traded fund backed by bullion, increased 1.83 metric tons to a record 1,307.96 tons yesterday. Holdings are up 15 percent this year. ETF Demand Gold may climb to $1,400 in 2010 should the current pace of investment in ETFs continue, Goldman Sachs Group Inc. said in a report dated yesterday. China should increase its holdings of precious metals and oil, Yin Zhongqing, the vice chairman of the finance committee of the National People’s Congress, said today at a conference in Shanghai. Gold accounts for 1.6 percent of China’s reserves, according to the World Gold Council. Russia and the Philippines have increased gold holdings this year, the council said today. “If we come to understand that gold is now a truly reservable asset, we can understand how it can be that bonds can rally on deflation news and gold can do the same,” said Dennis Gartman, an economist and the editor of the Suffolk, Virginia- based Gartman Letter. “Precious metals are no longer driven by fears of inflation, but by the notion that precious metals are currencies.” Silver, Platinum Silver futures for July delivery rose 40.8 cents, or 2.2 percent, to $19.184 an ounce on the Comex, capping a 5.2 percent gain this week. Silver may outperform gold as a “cheap” alternative, Deutsche Bank AG said in a report. Silver will average $20 an ounce in the third quarter and $22 in the fourth quarter, the bank said. Platinum futures for July delivery climbed $15, or 1 percent, to $1,587 an ounce on the New York Mercantile Exchange. The metal climbed 3.4 percent this week. Palladium futures for September delivery gained $10.15, or 2.1 percent, to $491.40 an ounce. The metal gained 9.6 percent this week, the most since early March. To contact the reporter on this story: Pham-Duy Nguyen in Seattle at pnguyen@bloomberg.net. More on gold: Top SocGen analyst: This is the time to sell gold Why you're wrong to buy gold as an inflation hedge Marc Faber: "I buy gold... I don't know what else to buy" |

| What you need to know about gold and the U.S. dollar Posted: 18 Jun 2010 10:03 AM PDT From Bespoke Investment Group: With gold trading at a record high, we wanted to highlight the shifting correlation between it and the US Dollar. Normally, when gold rallies, the dollar declines and vice versa. However, as the chart below illustrates... Read full article (with chart)... More on the U.S. dollar: It's official: China now dumping the dollar Why the dollar is as dangerous as the euro Porter Stansberry: This key gov't statistic is signaling crisis |

| Yankees Seek Tax Refuge in the Deep South Posted: 18 Jun 2010 10:00 AM PDT Florida seems to have been invaded by zombies. "Injured in a workplace accident? Treated unfairly? Call 1-800-A-LAWYER." The signs are along the highway…on the radio…and in magazines. Chasing ambulances must be good business in Florida. The advertising must pay. We got back from Florida on Wednesday and immediately got stuck in a traffic jam. The Washington, DC beltway must be one of the worst traffic areas in the US. Later, we went to dinner in Bethesda. The downtown area has been spiffed up – like a mall. Restaurants have been replaced with noisy, crowded eateries where you stand in line to get a table…and then wait to get an entree scarcely more refined than a McDonald's Happy Meal. Meanwhile, Forbes Magazine tells us that people with money are on the move – from the North to the South. Why? Taxes. Cost of living. Lifestyle. Judging from what we've seen in the Maryland suburbs, it's not surprising that people are moving out. It's surprising that anyone is left: Where America's Money Is Moving Topping the list: Collier County, Fla., which includes the city of Naples. Tax returns accounting for 15,150 people showed moves to Collier County from other parts of the country in 2008, the latest year for which IRS data is available. Their average reported income: $76,161 per person – equivalent to $304,644 for a family of four. Although slightly more taxpayers moved out of Collier County than into it, the departing residents' average income came out to just $26,128 per person. Households that moved to Collier County principally came from other parts of Florida, with Lee, Miami Dade, Broward, Palm Beach and Orange counties leading the list. Big northern cities also sent lots of migrants: Cook County, Ill. (home to Chicago); Oakland County, Mich. (near Detroit); and Suffolk County, N.Y. (on Long Island) each sent more than 100 people to Collier County during 2008. In second place is Greene County, Ga., with a population of just 15,743 at the Census Bureau's last estimate. The IRS data show that in 2008, 788 people moved to the county, about 75 miles east of Atlanta. Rounding out the top five: Nassau County, Fla., near Jacksonville; Llano County, Texas, 70 miles northwest of Austin; and Walton County, Fla., 80 miles east of Pensacola. The dominance of the list by Florida and Texas – the former has eight of the top 20 counties, the latter four – makes sense to Robert Shrum, manager of state affairs at the Tax Foundation in Washington, D.C., since neither state has an income tax. "If you're a high-income earner, then that, from a tax perspective, is going to be a driving decider if you're going to move to one of those two states," Shrum says. After accounting for property taxes, Shrum's analysis shows that Texas has the fourth-lowest personal tax burden in the country, and Florida has the eighth lowest. Shrum also points to eight states that have targeted wealthy households with extra-high tax brackets: California, New Jersey, New York, Maryland, Hawaii, Oregon, Connecticut and Wisconsin. Six of the top 10 counties the rich are fleeing are located in those states. Regards, Bill Bonner Yankees Seek Tax Refuge in the Deep South originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Friday ETF Roundup: UNG Reverses, GDX Gains Posted: 18 Jun 2010 09:58 AM PDT Michael Johnston submits: After weeks of big price swings and frantic activity in equity markets, a relatively quiet week on Wall Street came to a close with most major indexes posting small losses on the day. A week that saw BP’s chief dragged before Congress, multiple indications of tame inflation, and further seesawing over the outlook for Europe ended with gold touching a record high as investors continued to flock towards safe havens.

Complete Story » |

| Quantitative Easing Does Not Guarantee Higher Stock Prices Posted: 18 Jun 2010 09:57 AM PDT |

| China could be lying about gold Posted: 18 Jun 2010 09:54 AM PDT From The Reformed Broker: You just know that these guys are and have been stockpiling gold. They're not going to tell you. They don't have to. They also don't want to be front-ran (or is it front-runned?). I have no knowledge of their activities outside of what's been said in the press so take my speculation with a grain of rice. But I have my Street Smarts and they're telling me that... Read full article... More on China: Why China wants gold to plunge to $800 Meet the junior mining stocks China is targeting now Frank Curzio: This tiny stock could solve China's biggest problem |

| Jim Rogers: All paper money is doomed Posted: 18 Jun 2010 09:49 AM PDT From Zero Hedge: On one hand you have BNP revising their mid-term EURUSD forecast to 0.98, on the other you have such pessimists as Jim Rogers saying to buy the Euro. Who to trust anymore? ...in the long-term, Jim is just as bearish as always: "The European governments are not getting their act together, not at all. All paper money is flawed, nearly every currency in the world." Rogers on European credibility... Read full article... More on Jim Rogers: Jim Rogers: Inflation data is a lie Jim Rogers: The U.S. should be worried about this Jim Rogers: Now is the time to buy silver and natural gas |

| Leading Indicators Don't Spell Recession ... Yet Posted: 18 Jun 2010 09:30 AM PDT James Picerno submits: The risk of recession is rising, warned Lakshman Achuthan, managing director Economic Cycle Research Institute, in an interview today. But it's not yet clear if the risk is the real deal or an idle threat. What's clear is that the rate of growth in the economy is slowing, according to ECRI's weekly leading index, which slumped 5.7% last week and 3.7% the previous week. The downturn is pronounced and pervasive, Achuthan explained today on Yahoo Finance's Tech Ticker. What's missing to seal the deal in terms of making a clear forecast of recession is persistence in the trend, added the co-author of Beating the Business Cycle Complete Story » |

| Quadruple Witching Tops Off Weekly Trading Posted: 18 Jun 2010 09:16 AM PDT Daryl Montgomery submits: Friday was a quarterly quadruple witching day with stock options, options on futures, single stock futures and index futures all expiring. While volatility frequently takes place on expiration days, this one was uneventful. Expirations can move markets starting days before however, with prices tending to move in the opposite direction of their recent trends during the week of expiration. The week of June 14th was bullish for U.S. stocks, the euro, oil and gold. The euro gained 2.7% on an oversold rebound. Gold hit a record high, with GLD closing up 2.5% on the week. There was little difference though between gold's performance and that of the major U.S. stock indices. The Dow rose 2.3% on the week, the S&P 500 2.4%, the tech heavy Nasdaq 3.0% and the small cap Russell 2000 3.2%. Oil was a much bigger winner than gold, gaining 5.2% from last Friday's close. The one notable loser was economically sensitive copper, which dropped 1.5% in the last five days. Complete Story » |

| A Flock of Fed Funds Forecasts Posted: 18 Jun 2010 08:51 AM PDT Annaly Salvos submits: There has been some chatter recently on the direction of traditional monetary policy (i.e., the Federal Reserve changing the Fed Funds target rate to influence the availability and cost of money and credit to help promote national economic goals), with most of it involving a pushing out of the first date of a Fed tightening. Just yesterday, the US economic research team of JP Morgan edged their expectations for the first rate increase from the second quarter of 2011 to the fourth quarter. “The prime motivation for the change is the behavior of inflation,” they write. Credit Suisse had earlier delayed their call for the first hike from late 2010 into next year, and Deutsche Bank pushed theirs out from third quarter 2010 to fourth quarter 2010 (with a year-end call of 75 basis points). Blaming the European debt crisis, UBS now thinks the first tightening will happen in January 2011 and not September 2010. The monthly Bloomberg survey of street economists shows the consensus has moved its call to the first quarter of 2011; in December 2009 the consensus was for third quarter of 2010. As we type, the Fed Funds futures market is also changing its thinking. This market is projecting that there will be no hike until after the first quarter of 2011, with a 66% chance of a 25 basis point hike to 0.50% at the April 27, 2011 meeting. Back in March, the market thought that there was a better than 50% chance of a hike at the November 3, 2010 meeting. Complete Story » |

| COT Weekly Data Discloses Biggest Euro Short Covering Episode In History Posted: 18 Jun 2010 08:30 AM PDT The CFTC Commitment of Traders is out and, it's a doozy: the amount of short covering in net spec EUR short positions hits what is certainly an all time record, as just under 50 thousand (49,585) short contracts are covered. This represents a huge 44% of all outstanding EUR net shorts (-111,945) as of the prior week. No wonder the EUR surged, and no wonder Goldman downgraded the EURUSD - in tried and true fashion we wonder how many banks tightened up margin requirements only to force the biggest short squeeze in history. It is only logical that every sellside desk would try to sucker as many clients as they could in advance of this rampage. The current net spec short position takes total shorts back to levels from mid-April, when the euro was trading in the 1.30 range. This is very bad news for existing EUR longs as it is now guaranteed that all weak hands have certainly been shaken out. Any additional move higher will actually have to occur for truly fundamental reasons. Alas, those will not be coming any time soon. |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Importantly, the EU directive requires ISPs to retain data necessary to trace and identify the source, destination, date, type, time and duration of communications — and even what communication equipment is being used by customers and the location of mobile transmissions.

Importantly, the EU directive requires ISPs to retain data necessary to trace and identify the source, destination, date, type, time and duration of communications — and even what communication equipment is being used by customers and the location of mobile transmissions.

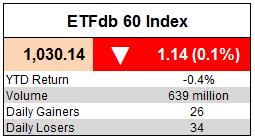

The ETFdb 60 Index, a benchmark measuring the performance of asset classes available through ETFs, slid 1.14 points, or 0.1%, in relatively light trading. Only seven index components swung by at least 1% on the day, with most finishing Friday little changed.

The ETFdb 60 Index, a benchmark measuring the performance of asset classes available through ETFs, slid 1.14 points, or 0.1%, in relatively light trading. Only seven index components swung by at least 1% on the day, with most finishing Friday little changed.

No comments:

Post a Comment