Gold World News Flash |

- Rob McEwen: Looking Ahead of the Curve

- S&P-500, Gold & Oil Trend Trading Charts

- Chinese Navy Faces a Critical Watershed as the East Asian Strategic Balance Changes

- US Best for Growth - Say What?.. False Meme of Anarchy?

- Why You Need to Short Stocks Right Now

- Government Spending Cuts Necessary for Long-Term Prosperity

- Why Governments Hate Gold

- Jim?s Mailbox

- In The News Today

- Ladies Love Bondholders!

- The GLD ETF Adds Another 391,312 Ounces of Gold

- Gold Is Bernanke’s Conundrum

- Microsoft Debt Issuance Makes Zero Economic Sense

- Turning Gold Into Straw: Steel Production Cuts Coming

- Dissecting 'Headline Risk'

- SPX, GLD and USO Indicate Markets About to Shake Everyone Out

- Strengths and Weaknesses of Yamana Gold

- Pressure Mounts for Financial Terrorist Goldman Sachs. Will The Wolf Pack Attack?

- Microsoft's Dumb Debt Plan

- 5 Reasons the U.S. Will Likely Emerge From the Great Recession Stronger Than Ever

- 3 European Oil Companies for Contrarians

- Is BP About to Fail?

- Two Months Later, The Market Finally Fears an Ambac Bankruptcy

- What's Ben Selling?

- Canada's Housing Bubble Showing Cracks

- Gold Prices Nudge $1250/oz, Are You Prepared?

- Gold Prices Nudge $1250/oz, Are You Prepared?

- Empty Words for an Empty Set of Policy Choices

- The Coming Apple iOS – Android Wars

- Bernanke says "Gold Acting Differently than Rest of Commodities Group"…

- Bernanke says "Gold Acting Differently than Rest of Commodities Group"…

- Oil Gusher and Global Financial Meltdown: Each Mirrors The Other

- With Market Tanking Why Are These Three Stocks Up?

- SP-500, Gold and Oil Trend Trading Charts

- The Correction Won

- How to Profit from a High Risk Market

- RealtyTrac Reports Foreclosure Activity Over 300,000 For 15th Straight Month As REOs Set New Monthly Record

- All Currencies Will Collapse Gold To $7000

- New Gold (NGD) Showing Great Relative Strength To Gold

- Gold Seeker Closing Report: Gold and Silver Fall Over 1%

- Third World America?

- A Gold Trade for This Week

- John Taylor On A Schizophrenic Europe - A Must Read

- Mutual Fund Bloodbath: Fifth Consecutive Week Of Domestic Stock Outflows Leads To $25 Billion In Cumulative Redemptions

- Cramer Goes From Buy To Bye Bye On BP, Loses Fans 33% In Two Weeks

- The Housing Non-Recovery

- Transatlantic Financial Risk Inverts: European Bank Default Risk Greater Than American For First Time

- More Than 1 In 5 American Children Are Now Living Below The Poverty Line

- HFT Takes Over Vegas? April Vegas Performance Disappoints As Luck Runs Out

- Gold Daily Chart: Update of the Cup, and the Long Term Golden Bowl

| Rob McEwen: Looking Ahead of the Curve Posted: 09 Jun 2010 08:53 PM PDT Source: Karen Roche of The Gold Report 06/09/2010 Rob McEwen, whose Midas touch in mining has been as transformational as anyone's, sat down recently for this exclusive, wide-ranging interview with The Gold Report. Hoping we manage to avoid the "darkest hour" he envisions, he describes fearsome parallels between the Weimar Republic of the late '20s and early '30s to the United States of today. Fast-forwarding to the future, he also explores a few of the things the mining industry might do to start making itself invisible in terms of environmental impact. The Gold Report: We see a lot of troubling scenes on the global economic landscape—from the bailouts in Europe to ever-increasing deficit spending in the U.S. to talk about a housing bubble about to burst in China. What's your view of all of this turmoil? Rob McEwen: I think the economic news will continue to get worse. We've had a lot of monetary stimulation by the governments of the West. In Europe, we're ... | ||

| S&P-500, Gold & Oil Trend Trading Charts Posted: 09 Jun 2010 08:53 PM PDT Market volatility continues to shake things up making it profitable for traders who are quick to spotting key reversal points, manage risk and taking profits before it evaporates. On Tuesday we saw the market go up and down more than I have seen in a long time… It moved over 5% as it trended up then down in 1% increments as shown in the chart below. Members of FuturesTradingSignals were able to capture a 1-2% gain which may not sound like much but when trading the leveraged ETFs, Futures or CFD’s we are making 4-200% profit within a few hours. That being said this type of price action is proof that the market just does not know which way to go and why trades must be very quick to enter and exit positions. The SP500 daily etf chart shows my simple volume analysis during market corrections. During the early stages of a trend, pullbacks are quick and simple. But as a trend matures we start to see corrections become much more complex. We first saw the ... | ||

| Chinese Navy Faces a Critical Watershed as the East Asian Strategic Balance Changes Posted: 09 Jun 2010 08:53 PM PDT New strategic brinkmanship by the Democratic People's Republic of Korea (DPRK); a now-clear determination by the People's Republic of China (PRC) to "more aggressively assert its territorial claims in regional waters"; the near-collapse of Japanese strategic cohesion during 2010; and the increasing signs of US political caution in North-East Asia, all point to a period of strategic concern for the Republic of China, particularly in its maritime responsibilities. What is of particular concern is that the casus belli — the legitimate cause and act of war — thrown down by the DPRK with the March 26, 2010, sinking of the South Korean Po Hang-class corvette, ROKS Cheonan, highlighted the lack of readiness of the ROK, the US, and Japan to be able to handle any major regional crisis. This in turn highlights the extreme vulnerability of the Republic of China, given that the US is showing great reluctance to support the Republic of Korea, and would be even more reluctant to take ... | ||

| US Best for Growth - Say What?.. False Meme of Anarchy? Posted: 09 Jun 2010 08:53 PM PDT US Best for Growth - Say What? Wednesday, June 09, 2010 – by Staff Report Lawrence Summers The U.S. has supplanted China and Brazil as the most attractive market for investors as confidence in the global economic recovery wanes in the wake of the Greek debt crisis. Investors are putting their money on President Barack Obama's stewardship of the U.S. economy even as his job-approval rating has declined, according to a global quarterly poll of investors and analysts. Almost four of 10 respondents picked the U.S. as the market presenting the best opportunities in the year ahead. That's more than double the portion who said so last October, when the U.S. was rated the market posing the greatest downside risk by a plurality of respondents. Lawrence Summers (left), director of the White House National Economic Council, aid this attests to Obama's efforts at "restoring the United States to strong economic fundamentals." He added that "while there remains much t... | ||

| Why You Need to Short Stocks Right Now Posted: 09 Jun 2010 08:53 PM PDT [URL="http://whiskeyandgunpowder.com/author/garygibson-2/"]Gary Gibson:[/URL] Dan, you said the summer should be the best environment for short selling since 2008. That implies a lot of declining stocks. How bad is the outlook for stocks really and why? [URL="http://whiskeyandgunpowder.com/author/danamoss/"]Dan Amoss:[/URL] Okay, well I start from the assumption that most economists and analysts are ignoring the importance of balance sheets. There's way too much bad debt in the global economy, and governments and central banks are trying to paper over these bad debts. And the consequence of this is that governments will eventually reach the limits of what the market will allow in terms of debt to GDP ratios. At that point, it will be hard for the economy to both grow and service the incredible burden of debt that it has. Overindebted balance sheets at all levels of society tells me that this is not a typical economic cycle. Yet the stock market is priced for a typical economic cy... | ||

| Government Spending Cuts Necessary for Long-Term Prosperity Posted: 09 Jun 2010 08:53 PM PDT Sustainable Wealth - Axel Merk June 09, 2010 10:06 AM Watch the video below where I tell FoxBusiness government spending cuts are necessary for long-term prosperity – not just in Europe, but in the U.S. as well. Axel Merk Author of Sustainable Wealth – order now. President and Chief Investment Officer, Merk Investments In my book, SustainableWealth: Achieve Financial Security in a Volatile World of Debt and Consumption, I dive into the dynamics that drive this world before discussing how you can invest in a boom, in a bust, in a personal or economic crisis. Make sure you follow the blog. This report was prepared by SustainableWealth.org, and reflects the current opinion of the contributor. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any investment security, nor provide investm... | ||

| Posted: 09 Jun 2010 08:53 PM PDT This past week several emerging and ongoing crises took attention away from the ongoing sovereign debt problems in Greece. The bailouts are merely kicking the can down the road and making things worse for taxpaying citizens, here and abroad. Greece is unfortunately not unique in its irresponsible spending habits. Greek-style debt explosions are quickly spreading to other nations one by one, and yes, the United States is one of the dominoes on down the line. Time and again it has been proven that the Keynesian system of big government and fiat paper money are abject failures in the long run. However, the nature of government is to ignore reality when there is an avenue that allows growth in power and control. Thus, most politicians and economists will ignore the long-term damage of Keynesianism in the early stage of a bubble when there is the illusion of prosperity, suggesting that the basic laws of economics had been repealed. In fac... | ||

| Posted: 09 Jun 2010 08:53 PM PDT View the original post at jsmineset.com... June 09, 2010 08:37 AM Gold Stocks – Follow the leverage CIGA Eric While the recent attempt to break the previous swing high lacked the necessary energy for a clean break yesterday, see for once relax, money flow indicators such as the junior to major ratio (JMR) suggest that it is only a matter of time before it will be tested again. The power down trend (PUT) of the JMR has been broken. This suggests that gold money flows are seeking leverage to the rising price of gold. I expect this ratio, like the price of gold, to back and fill before technical confirmation (a green stick) is generated. It’s only a matter of time before the 5/12 swing high around $1250 is decisively broken to the upside. Junior to Major Gold Stock Ratio: More…... | ||

| Posted: 09 Jun 2010 08:53 PM PDT View the original post at jsmineset.com... June 09, 2010 08:41 AM Morning Thought: France and Great Britain are trying to talk their way out of being further and critically attacked by CDS, the IMF and the media by claiming austerity. Jim Sinclair's Commentary Gold at $1650 and beyond. Bernanke Says Fed to Take Necessary Steps on Growth (Update2) By Scott Lanman and Joshua Zumbrun June 9 (Bloomberg) — Federal Reserve Chairman Ben S. Bernanke said the U.S. central bank will act as needed to aid financial stability and economic growth after restarting emergency currency-swaps to help contain Europe's debt crisis. "Our ongoing international cooperation sends an important signal to global financial markets that we will take the actions necessary to ensure stability and continued economic recovery," Bernanke said today in testimony to a House Budget Committee hearing. The impact of the crisis on U.S. growth is "likely to be modest" if financial markets "co... | ||

| Posted: 09 Jun 2010 08:53 PM PDT The 5 min. Forecast June 09, 2010 10:20 AM by Addison Wiggin & Ian Mathias [LIST] [*] Bernanke finally admits the obvious: U.S. debt is out of control [*] Visit from the ghost of American future: Japan resorts to sexual propaganda to sell government bonds [*] Dan Amoss presents a compelling new short selling idea, courtesy of the Obama administration [*] Byron King offers one investment theme that every industry craves -- from miners to drillers, farmers to homemakers [*] Plus, a new bull market on the streets of Baltimore: Wires [/LIST] At long last: “The federal budget appears to be on an unsustainable path,” the maestro of money printing, Ben Bernanke, admitted this morning in a congressional hearing. Mr. Bernanke might as well have been reading from the script of I.O.U.S.A., a documentary about national debts and deficits we made years ago. “Unless we as a nation make a strong commitment to fiscal responsibility, in the longer run, we will have n... | ||

| The GLD ETF Adds Another 391,312 Ounces of Gold Posted: 09 Jun 2010 08:53 PM PDT All the excitement in the precious metals came during early London trading yesterday... which I wrote about in my closing commentary on Tuesday... and not much happened after gold peaked around $1,255 spot shortly before 11:00 a.m. in London yesterday morning, as it was basically all down hill from there, right into the close of electronic trading at 5:15 p.m. Eastern time in New York. There was about a ten dollar rise the moment that the London p.m. gold fix was in at 10:00 a.m. New York time... but that was all the New York excitement there was. Gold closed at $1,234.80 spot... down a bit over $20 from the London high. The absolute low of the day was in late trading in New York... $1,232.70 spot. Silver's path was very similar to gold's... the main differences being that silver finished up 14 cents on the day... and silver's high was in New York rather than London... and that was shortly before 1:30 p.m. Eastern time at $18.51 spot. Silver's low price [around ... | ||

| Posted: 09 Jun 2010 08:53 PM PDT Dr. Duru submits: In December, 2009, Federal Reserve Chairman Ben Bernanke insisted that gold’s surge was not signaling increased inflation expectations because it was simply following along with the general rise in commodities. Now that gold stands head and shoulders above the commodity pack, Bernanke is expressing his bewilderment at gold’s strength. Gold is still not a signal of rising inflation expectations because the data show no current inflationary pressures. Let’s call this Bernanke’s conundrum in honor of former Chair Alan Greenspan’s professed bewilderment with the persistence of low long-term rates even as the Fed dished out short-term rate hikes in bite-size morsels. Bernanke claimed the following during Q&A following his Wednesday testimony to Congress (2:09 on NightlyBusiness Report video for June 9, 2010): Complete Story » | ||

| Microsoft Debt Issuance Makes Zero Economic Sense Posted: 09 Jun 2010 07:51 PM PDT  Vitaliy N. Katsenelson, CFA submits: Vitaliy N. Katsenelson, CFA submits: Tuesday’s headline from the WSJ reads: “Microsoft Corp. (MSFT) to offer up to $1.25 billion in 3-year convertible notes.” The software company will use the sales proceeds to repay short-term debt. If it was any other company I’d ignore this headline as simple daily noise as this kind of thing happens all the time. But Microsoft has $39 billion of cash and generates $16-$17 billion of free cash flow a year. Issuing short-term debt, for which Microsoft will surely pay higher interest than it receives on its pile of cash makes absolutely no economic sense – zero. Complete Story » | ||

| Turning Gold Into Straw: Steel Production Cuts Coming Posted: 09 Jun 2010 07:44 PM PDT Michelle Galanter Applebaum submits: Volatility Bites Back. What China giveth, China taketh away. Steel prices are down some 5-10% globally due not so much to a slowing of economic growth in China, but due to worries of slowing. The next big question the global steel industry will be addressing will clearly be production cuts; in the first six months of the post crisis world in 2008 the global steel industry cut production by 30%, an unprecedented response. The argument for cuts in China in particular is compelling given China’s higher cash cost position and the coming cost increases locked in for 3Q. In the past week there have been dozens of reports from Chinese “establishment press” calling for production cuts, culminating in a high profile Bloomberg interview with the Chairman of Baosteel earlier this week calling for production cuts by “smaller mills” . We view this as a clear challenge to Beijing and CISA to allow market forces to drive production cuts by the higher cost provincial mills and avoid the past export subsidies that become the industry’s lifeline during prior periods of economic slowing. Production Cuts in the West. The profound production cuts early in this recession were, in our view, not so much a result of so-called “discipline” but reflected the new economics where cash costs dominate steel production, as compared to the high fixed cost environment of a decade ago where producers maximized profits by running flat-out. With steel prices peaking only weeks ago, there are already numerous press reports of idlings; in the US we’ve already seen Severstal’s giant Sparrows Point facility – at 3mtpy about 6% of the domestic sheet market – scheduled for market-related closure; ArcelorMittal (MT) has already talked about idling 3 blast furnaces in Europe. Outlook – Chinese Production Cuts Will Accelerate Quickly. We expect to see meaningful production cuts coming out of China in the coming weeks. In the prior decline, Chinese production had declined in the months ahead of the crisis due to the Olympics; so China actually did very little cutting in late 2008 and, in fact, was raising production from December 2008 onwards. This time the slowing is coming from China, so there will be no choice but to cut production or ramp up exports into the West – and there are very few places in the world today that will be tolerant of a temporary surge in high cost steel from China. So we expect to see China bring the globe back to equilibrium in the next quarter through a combination of production cuts and continued strong economic growth.

Complete Story » | ||

| Posted: 09 Jun 2010 07:32 PM PDT Symmetry Capital Mgmt submits: Financial pundits have been recycling a favorite meme from 2007-2008 -- that despondent markets are responding to negative "headline risk" rather than positive fundamentals. As in 2008, that's an assertion that investors accept at their peril. Here's why: First and foremost, with the sovereign debt crisis in Europe, we are not dealing with routine difficulties that can be worked out with minimal fallout to the global economy. As with the failure of Lehman and AIG, these events will eventually, if unchecked, threaten to cause another sudden stop in the global payments system. Trade and commerce will grind to a halt, however momentarily, as they did in late 2008. Complete Story » | ||

| SPX, GLD and USO Indicate Markets About to Shake Everyone Out Posted: 09 Jun 2010 07:19 PM PDT Chris Vermeulen submits: Market volatility continues to shake things up making it profitable for traders who are quick to spotting key reversal points, manage risk and taking profits before it evaporates. On Tuesday we saw the market go up and down more than I have seen in a long time. It moved over 5% as it trended up then down in 1% increments as shown in the chart below. Members of FuturesTradingSignals were able to capture a 1-2% gain. That may not sound like much but when trading the leveraged ETFs, Futures or CFD’s we are making 4-200% profit within a few hours. That being said, this type of price action is proof that the market just does not know which way to go and why trades must be very quick to enter and exit positions. Complete Story » | ||

| Strengths and Weaknesses of Yamana Gold Posted: 09 Jun 2010 07:13 PM PDT Michael Moretto submits: Yamana (AUY) is Canadian gold mining company focused in South America (Argentina, Brazil, Chile, Mexico). It is listed on the TSX, NYSE, LSE and has a 52 week average of $8.22-$14.37 on the NYSE. It has a NAV (on $1200 Gold assumptions) of approximately $10. Gold production makes up slightly over 66% of its revenues, with Copper and Silver making up 23% and 10% respectively. When compared to some of its larger rivals it has a much lower output, and sits right in the middle of its peer group with approximately 930,000 oz of Gold produced in 2009. How is Yamana as an investment? I will compare and contrast some of the strengths and weaknesses of the company. Yamana has a strong Potential for natural growth (without further acquisition) of reserves through exploration including a conservative doubling of Pilar’s reserves from 1.5 million to 3 million with up to 5 million of total reserves) This will also serve to increase production in some of Yamana’s smaller mines, thus moving from small to medium sized mines. This may help to improve the market’s perception on the quality of Yamana’s assets, and help increase its NAV multiple close to one of the big Cap players in the industry. Another strength for the stock is the reduction of reliance on Copper as a revenue stream since more Gold based resources are coming online between 2010 and 2013. This should serve to help the market to see Yamana as more of a pure play on Gold rather than as a diversified precious/base metal producer. This will ultimately give investors a higher leverage play on gold. Complete Story » | ||

| Pressure Mounts for Financial Terrorist Goldman Sachs. Will The Wolf Pack Attack? Posted: 09 Jun 2010 07:09 PM PDT Max says: Who will declare bankruptcy first; Eco(logic) Terrorist British Petroleum or Eco(nomic) Terrorist Goldman Sachs? "Goldman Sachs Group Inc.'s $2 billion Hudson Mezzanine collateralized debt obligation, sold in 2006, is the target of a probe by the Securities and Exchange Commission, according to a person with knowledge of the matter." "In a separate case, Goldman Sachs was sued by Australian hedge fund Basis Capital for $1 billion. In the suit, filed yesterday in Manhattan federal court, Basis claims it was forced into insolvency after buying mortgage-linked securities that the firm created and one of its executives termed "one shi**y deal."

| ||

| Posted: 09 Jun 2010 07:08 PM PDT Jeff Moore submits: Here is a link to a good write up on Microsoft's (MSFT) seemingly dumb debt issuance. I would argue that it is a good example of an MBA making an irrational decision, or, of some banker bribing someone in the company. Complete Story » | ||

| 5 Reasons the U.S. Will Likely Emerge From the Great Recession Stronger Than Ever Posted: 09 Jun 2010 06:56 PM PDT Kevin Grewal submits: Despite massive debt and an extremely slow economic recovery, the United States could potentially emerge from its worst economic downturn since the Great Depression stronger than ever. Despite China’s extraordinary economic growth, the U.S. is still the largest and most productive in the world. America’s economy is three times the size of China’s and the per capita income of China is only about 10% of that of the U.S. Additionally, the U.S. generates more output in one year than Japan, China and Germany (the next three largest economies) combined, while only constituting a little under 5% of the world’s population. Complete Story » | ||

| 3 European Oil Companies for Contrarians Posted: 09 Jun 2010 06:49 PM PDT  Kurt Wulff (McDep Associates) submits: Kurt Wulff (McDep Associates) submits: We classify buy recommendations Royal Dutch Shell, plc (RDS.A), Statoil ASA (STO), and Total S.A. (TOT) as Contrarian Buys to acknowledge that the current stock price trend is down in comparison to the 200-day average. By a similar measure, oil price may have begun a downtrend measured by six-year futures at $83 a barrel settling below the 40-week average of $86. The Contrarian Buys are attractive on a value basis with McDep Ratios at 0.75, 0.71 and 0.60 respectively. Income is strong with dividend yields indicated at 6.2%, 4.3% and 5.9%. The abrupt change in price trend in currency markets may have contributed to the greater stock price decline for TOT, the only large cap in our coverage headquartered in a country that uses the euro. The currency effect may be temporary as oil price tends to adjust to a global level in real terms. The oil price decline does not cause us much concern as our long-term assumption for calculating McDep Ratios is $75 a barrel adjusted for inflation. At the same time, we are optimistic that natural gas price may be near an upturn before next winter. Complete Story » | ||

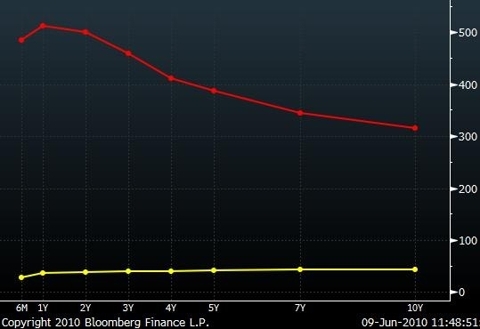

| Posted: 09 Jun 2010 06:27 PM PDT The Pragmatic Capitalist submits: Credit markets are giving an ominous sign for what was once a blue chip among blue chips. Credit spreads are forecasting increasing near-term solvency risks in shares of BP (BP) as the oil catastrophe in the Gulf continues to worsen. The term structure in CDS has severely inverted implying a very high risk of near-term default: Complete Story » | ||

| Two Months Later, The Market Finally Fears an Ambac Bankruptcy Posted: 09 Jun 2010 06:25 PM PDT Dr. Duru submits: At the heights of the stock market’s low-volume spring rally, Ambac Financial (ABK) soared 72% and the 105% on two consecutive days. ABK was up another 50% the next day before closing with a 28% loss. The upward surge was quite startling given ABK was pretty clear in its earnings report at the time about the risks of bankruptcy. The first of its 33 risk factors stated:

Complete Story » | ||

| Posted: 09 Jun 2010 06:08 PM PDT Bruce Krasting submits: Fed Chairman: Recovery on Track (CNBC) That was the take of the MSM of Ben Bernanke’s words over the past few days. To some extent Ben’s soft talk has had a beneficial impact. “Soothing” was how Paul McCully of PIMCO described it. But the market overall does not seem to be listening. The NY close stank. Currencies, bonds and stocks moved to risk off mode again. Complete Story » | ||

| Canada's Housing Bubble Showing Cracks Posted: 09 Jun 2010 06:05 PM PDT Edward Harrison submits: Canada has had quite a run in its property market. But, the most recent data are a bit soft. David Rosenberg writes:

Complete Story » | ||

| Gold Prices Nudge $1250/oz, Are You Prepared? Posted: 09 Jun 2010 06:03 PM PDT We will kick off with a quick at the chart for gold prices and what a great chart it is. Despite the bears constantly jostling to be the first bear to call a major correction for gold prices to drop back to the depths of the last decade, gold is just not listening and continues to strengthen as the demand for real value grows. | ||

| Gold Prices Nudge $1250/oz, Are You Prepared? Posted: 09 Jun 2010 06:03 PM PDT We will kick off with a quick at the chart for gold prices and what a great chart it is. Despite the bears constantly jostling to be the first bear to call a major correction for gold prices to drop back to the depths of the last decade, gold is just not listening and continues to strengthen as the demand for real value grows. | ||

| Empty Words for an Empty Set of Policy Choices Posted: 09 Jun 2010 05:55 PM PDT Recently, I have noted several times that the failure of the massive federal fiscal stimulus to provide a lasting spark to growth should not be particularly surprising, since when the government spends it also takes the money away from alternative spenders currently (through taxes) or in the future (by borrowing). For example, see this comment here. Moreover, while small deficits might provide a spark, since the government’s ability to service debt – and therefore to postpone indefinitely the repayment of that redirected spending – grows with the economy over time, large deficits should have less current impact than a mere multiplication of small-deficit effects would suggest. This happens because with mammoth deficit spending, as we have seen, the rational response of the folks who know they will one day have to pay taxes to service this debt is to start saving now. I was delighted to find out that recent research has actually established a pretty clear link between increased government spending and decreased private spending. A friend pointed me to research done by Harvard Business School professors that examined what happens to private spending in states when pork-barrel money starts to roll in. Advocates of deficit spending would say that this should have a salutatory effect on private production, or at worst is neutral. In fact, the authors of this paper (“Do Powerful Politicians Cause Corporate Downsizing?”, available here) find that once a powerful congressman ascends to a committee chairmanship and begins dispensing pork, the average firm in his/her home state cuts capital expenditures by 15%. Complete Story » | ||

| The Coming Apple iOS – Android Wars Posted: 09 Jun 2010 05:50 PM PDT Edward Harrison submits: In my last technology post, I wrote that we are moving to an Internet-centric world where your computing device or operating system are less important because your data will live and breathe in the Internet cloud. Google (GOOG), in particular, is preparing for this world because it has a dominant role in the Internet through search. But everyone is moving to an Internet-centric service and content delivery strategy. The telecom providers understand that their networks make them gatekeepers who can extract rents from content providers. Having paid handsomely to build these networks, they are fighting to not become dumb pipes and resisting net neutrality in order to keep that gatekeeper role. This is one reason Google is trying to build its own network and circumvent the telcos. Eventually, I think the land-based telcos will lose and the battle will move to one between mobile operating systems like Apple’s (AAPL) iOS and Android. Although mobile phone operators may still be able to extract rents for a while longer than the fixed-line telcos. Complete Story » | ||

| Bernanke says "Gold Acting Differently than Rest of Commodities Group"… Posted: 09 Jun 2010 05:48 PM PDT | ||

| Bernanke says "Gold Acting Differently than Rest of Commodities Group"… Posted: 09 Jun 2010 05:48 PM PDT | ||

| Oil Gusher and Global Financial Meltdown: Each Mirrors The Other Posted: 09 Jun 2010 05:40 PM PDT The explosion of Deepwater Horizon and the collapse of Lehman Brothers share similar characteristics of risk, denial and coverup. My good friend G.F.B. recently observed that the Deepwater Horizon catastrophe uncannily mirrors the global financial meltdown that was triggered by the September, 2008 collapse of Lehman Brothers. G.F.B. suggested that the Deepwater Horizon fiasco mirrored the global financial meltdown, almost as if it were a physical manifestation of the same hubris, denial of risk, manipulation and misinformation which collapsed the global financial house of cards.  How? Consider: 1. The extreme levels of inherent risk in each system were downplayed/misunderstood by those responsible for their management. 2. The unprecedented risk intrinsic to each system was masked by facsimiles of regulation and specialized expertise. 3. The initial warning signs were dismissed, downplayed or ignored. 4. Each system was on the outer edge of human engineering (mechanical and financial) but was treated by regulators and managers as entirely standard. 5. Once the system collapsed, nobody knew how to fix it. 6. As the full extent of the damage became apparent, those responsible sought to mask the true extent pf the damage. 7. The mainstream media and elected officials unskeptically accepted prevarications, mis-statements, misinformation and manufactured facades as representations of the truth. 8. As the true extent of the damage, distortion/manipulation and failure of responsible authorities became undeniable, public confidence in government, regulatory agencies and the market irrevocably eroded. Here is a chart of the market with my notes. This basic pattern applies to Deepwater Horizon as well, only on a much shorter timescale.  Didn't anyone notice that it is the height of insanity to be drilling down 18,000 feet down into a seabed which is 5,000 below the surface of the sea? More Here.. | ||

| With Market Tanking Why Are These Three Stocks Up? Posted: 09 Jun 2010 05:38 PM PDT Stockerblog submits: Since the beginning of the year, the S&P 500 dropped 6.8%. Just the last couple months, and even the last several days, the stock market has been performing miserably. But amazingly, there are over 60 stocks that have outperformed the S&P 500 by over 50%. How do these companies do it? Three of those stocks have either no debt or very low debt, have price to earnings ratios below 15, and have market caps over $1 billion. SanDisk Corp. (SNDK) has performed admirably, up 40.7% year to date. The manufacturer of NAND-based flash storage memory card products has a PE ratio of 11.7, and a price earnings growth ratio of a very favorable 0.69. (Remember, below 1 means that the stock is underpriced, over 2 means the stock is over-priced.) Revenues for the latest reported quarter were up about 65%. Although the stock was down 28 cents yesterday, it jumped 1.81 in the aftermarket. Complete Story » | ||

| SP-500, Gold and Oil Trend Trading Charts Posted: 09 Jun 2010 05:36 PM PDT | ||

| Posted: 09 Jun 2010 05:32 PM PDT They fought the correction; the correction won. We refer to Bernanke, Summers, Obama, Geithner, Krugman - the whole lot of them. They added three trillion dollars to US debt in the last two years. In two more years the debt will be at 100% of GDP. Add in the debts they've guaranteed - from Fannie Mae, for example, and state and local debt implicitly backed by the feds - and you're already at 150% of GDP. Worse than Greece, in other words. And what do we get for it? A recovery? A healthy economy? A gold medal? We'll take the gold medal, thank you. It's the only one that's real. The stock market was ready for a little bounce yesterday. So that's what it did...a little bounce - the Dow up 123. Gold kept climbing - to a new record high of $1,245. If you had asked us 10 years ago which we'd rather have - stocks or gold - we would have said gold. Ask us now. Same answer. Gold. There aren't many times when it makes sense to favor gold over productive investments. But this is one of those times. Why? Because the world's monetary system is heading for a crackup. And because the people running it have no idea what they are doing. Bloomberg:

You can fight a correction. You can delay it. You can distort it. You can make it bigger and nastier. But you can't beat it. Eventually, mistakes have to be corrected...one way or another. Usually, the mistakes take the shape of bad investments or bad loans. You can pretend that they're still worth what you have in them. You can bail out the lenders and/or the investors. You can default and inflate. But somehow, someone, sometime is going to take a loss. That's when you need gold. Every other asset could have bad debt behind it...in it...or standing so close beside it that a blow-up would be damaging. The correction that began in '07 was needed to address all the bad debt built up in the bubble years. The feds tried to stop it. Since they didn't have any money they had to fight it by borrowing more money - that is, by increasing the level of debt! We knew that wasn't going to work. And now, there's bad private debt...and bad public sector debt too. And now we're approaching a Keynesian "endpoint" when lenders are growing wary. They've already cut off Greece. They've warned the rest of Europe. And when they stop lending...then, all your props fall down...along with the economy...and the markets too... And more thoughts... The people running America's fight against the Great Correction have no idea what they are up against. Here's Ben Bernanke, as reported by the Associated Press:

Bernanke pretends that the problem is in Europe. It's not. It's in America. Total debt levels in the US are higher than in Europe. What's more, Europe is already tackling its bad debt problems. America is not. Meanwhile, Larry Summers says Obama is having great success in "restoring the United States to strong economic fundamentals...while there remains much to do, the US economy is growing." Money is flowing to the US now. Because America is thought to be a safe haven. This makes it possible - even easy - for US authorities to go even deeper in debt. As the Chinese philosopher Laozi put it, long before the birth of Christ, "a nation is never so poor as when it appears to be overflowing with riches." *** Investment pundits are talking about a bubble in the gold market. And, yes, a bubble will develop in gold. But it's not there yet. You'll know there's a bubble in gold when the people who are now warning you against it begin urging you to buy it. Until then, we're still in the second stage of the bull market. Smart investors are accumulating gold. Most investors barely know it exists. In the first stage, gold is a bargain. It is out-of-whack with the rest of the markets. That's what happened at the end of the '90s. It had been going down for nearly 20 years and was severely undervalued in comparison to other assets. In 1980, you could have bought the entire Dow for one ounce of gold. But by 1999, you would have needed 43 ounces to buy the Dow - a huge fall-off in the price of gold. Today, gold is no longer a bargain. It's about where it ought to be. Maybe even a little on the high side. Not too long ago, a large cache of golden objects dating from the 8th century was found buried in England. It looked like booty from a raiding party. It had been hidden in the ground...but the raiders never returned to claim it. Why? Maybe they were captured or killed. Or maybe they were driven out of the territory. It's hard to track prices back over the centuries. But when Roy Jastram did it in his book, The Golden Constant, he discovered little difference in gold prices over the centuries. In today's money, gold was always in the $800-$1,200 range. But when modern paper currencies were cut loose from gold - in 1971 - they lost value fast. In Britain, for example, the pound lost as much purchasing power in the last 40 years as in the previous 7 centuries. The post-'71 paper-backed money system tricked out everyone. The credit markets went wild. Total debt in the US is 10 times higher than it was then. Almost every major developed nation is nearly bankrupt...yet practically every household in Europe and America now depends on the state to provide essential support. Retirees count on Social Security and socialized medicine. Homeowners depend on government-backed mortgage markets. In America, 40 million people collect food stamps. Millions more collect unemployment or other forms of income support. It is no wonder the markets are getting edgy. There's a whiff of disaster in the air...like the smell of an approaching storm. Stocks are prices for sunny skies...and there's a hard rain coming. The US dollar is priced for stability...and there's a whole lot of shakin' coming. People are putting money into US bonds as if you could trust them...and they long ago crossed over to the cheatin' side of town. What do you buy when you suspect that the monetary system is a scam and a shambles? Gold. Anything else is a promise. A company promises to pay you a dividend. A renter promises to pay you rent. A homeowner promises to make a mortgage payment. The government promises to pay you interest. And each one of them depends on some other debt-bent promisor. Gold makes no promises. It is what it is. Not perfect money. But the best kind of money ever discovered. Regards, Bill Bonner | ||

| How to Profit from a High Risk Market Posted: 09 Jun 2010 05:24 PM PDT The US markets are now teetering on the edge of a very important technical level. The low in February of 1044 has been tested twice in the past couple of weeks and another attempt to breach this level could see some significant downside. S+P 500 daily chart Last night's price action was fairly bearish with an early triple digit rally in the Dow Jones vanishing in the afternoon and closing with a half a percent loss. BMO capital markets are certainly stepping up to the plate and making a big call by telling clients to go to cash. A June 8 report by their Quant/Technical research team said: We advocate switching out of equity positions and going to cash. The European sovereign debt crisis appears to be nowhere near over. The global credit environment is worsening. Cost of capital is going up and availability is going down. There are large gaps between where the credit market prices risk and where the equity market is priced. Equity is lagging the deterioration in credit conditions. Moves in currency, equity and commodity markets are mirroring the moves in the credit market. Global growth, in a credit-constrained environment, will slow. Profits will be squeezed by the higher cost of capital. If this level can hold we should see a short squeeze back to the 35 day moving average which comes in around 1110 in the S+P. If we were to see that occur I would be a seller there because I expect this downtrend to continue for the foreseeable future. If we turn to the situation in Australia it is interesting to note a recent survey by the financial sector union which showed that 29 percent of its members "felt uncomfortable about their customers' ability to meet their financial obligations with new debt products." About 43% said they were "under pressure to sell debt products, even if customers don't ask for them and may not be able to afford them". So it appears that the risk levels in the market at the moment are still quite high. As a trader the idea of risk is a very important one to grasp. What exactly is risk? I think it is the most difficult thing to understand in finance. Academia has come up with a number to describe the volatility of returns over time and that number comes to represent the word "risk". But does it really make you understand what the volatility of YOUR earnings will be over time. I don't believe it does. Investors lost 50% of their equity in a year during the crash. Does it really help to know that a crash was only supposed to happen once in a blue moon according to the academics? No not really. End result is that you are down 50% in a year. As a trader the main thing that you need to manage is the volatility of your returns over time. It doesn't mean much to be up 100% in a year if you are then down 50% in the next. You are back to where you started, just a lot more stressed out. The actual volatility of stocks is incredible. Their prices can move 30-50% without too much effort and the so called "blue" chips aren't immune from the constant gyrations either. In the last few years BHP has gone from $50 down to $20 and then back up to $45. It has since fallen 17% in the last couple of months. If you are entering the markets as a trader, with the desire to trade a finite number of stocks looking for superior returns, then you have to come up with a plan that manages to duck and weave its way between these skyscraper sized levels of volatility. It is imperative that your eye is always on the volatility within your account, because it is the volatility of your account that will be affecting your mental state and thus the decisions that you make in the market. Whether the market itself is more or less volatile is really irrelevant. There is more opportunity in a volatile market but also more danger. Conversely in a low volatile market there can be fewer opportunities to make money, which can lead to frustration. The frustration can cause you to look for opportunities where none exist and this can lead to bad losses. So what can we do to manage the volatility of our account, regardless of what the market is doing? The first key is the thing that we all know about money management and I am not teaching you anything by saying it. We must limit our capital at risk per trade to 2-3%. At 2% risk per trade (my preferred amount) we are able to have 50 wrong trades in a row before we have lost our dough. With 3% risk per trade that figure falls to 33 trades. The next thing we can do to lower our account volatility is to trade long and short. (Simplest way I can explain this is that being long means you have bought the stock and make money when it goes up, whereas when you are short you make money when it goes down.) This opens up a whole new world of risk management. We can trade our portfolio with a market neutral stance when we are feeling unsure about future direction. This can help to mitigate the risk of overall market gyrations while still exposing us to trading stocks based on our technical trading system. There is also a lot of optionality that can open up once we are able to go long and short stocks. If you have made money being long some stocks, then instead of having to get out of the positions when you fear a pullback in the market, you can short some stocks against the position. Then you have the ability to either make some money on the pullback, or cut the long positions and let the shorts ride if the market falls over from there. Every position still needs to fit into your technical trading criteria but by increasing the options at your disposal you can really start to ratchet down the volatility of your P+L. There is also something else that can help to manage your risk while still exposing you to significant upside. My technical system is based on taking some profit off the table very quickly and adjusting my stop losses so that I am not risking any of my initial capital from that point on. This is incredibly important for managing your mental state, which I believe is the most important thing to achieve in trading. It is the unstable mind that is thrown around like a ragdoll by the market. If you can ensure that a high percentage of your trades get to this first level of profit taking, you are well on your way to lowering the overall volatility of your account. Since starting Slipstream we have reached this profit target 70% of the time, meaning that only 30% of our trades have gone straight to our stop loss level. This makes it much easier to make up those losses with the other trades. The markets are an incredibly tempting proposition with the promise of huge gains if you can unlock their secrets. Unfortunately the path to unlocking them is never as easy as it seems and it is usually our own behaviour that gets in the way. This is why our technical strategy, trading and money management rules are so vital. Especially in these once in a generation markets that we face currently. The next month or so is going to be very difficult to predict and the volatility will still be large, so tread very carefully. Murray Dawes | ||

| Posted: 09 Jun 2010 04:28 PM PDT Michael Pento's expectation of a major double dip in housing is starting to come through. RealtyTrac reported that even as foreclosure filings declined marginally, by 3% in May, to 322,920 (1% higher YoY), bank repossessions (REOs) hit a record monthly high for the second month in a row, with 93,777 properties repossessed by lenders. It appears banks are finally starting to pick up backlogged housing currently in foreclosure. And as this REOed inventory goes back on the market, the so-called shadow inventory will tide will wash over the markets and flood existing artificially propped up supply levels, pushing prices much further down. James J. Saccacio, CEO of RealtyTrac confirmed this observation: "The numbers in May continued and confirmed the trends we noticed in April: overall foreclosure activity leveling off while lenders work through the backlog of distressed properties that have built up over the past 20 months. Defaults and scheduled auctions combined increased by 28 percent from 2007 to 2008 and another 32 percent from 2008 to 2009 — creating a build-up of delayed bank repossessions. Lenders appear to be ramping up the pace of completing those forestalled foreclosures even while the inflow of delinquencies into the foreclosure process has slowed.” This is precisely the event that CNBC's Diana Olick was warning about a month ago. Housing is about to take fresh new turn lower. More from RealtyTrac:

| ||

| All Currencies Will Collapse Gold To $7000 Posted: 09 Jun 2010 04:10 PM PDT The "real move" in gold is to come, predicted Egon von Gruyerz, founder of precious metals investment and storage company GoldSwitzerland.com, on Monday.

He told CNBC he sees the inflation-adjusted price of gold [XAU=X 1230.4  0.05 (+0%) 0.05 (+0%) "Adjusted for real inflation (as per shadowstats.com) the 1980 gold peak in today's prices corresponds to around $7,200 today. So gold could easily go up 6 times from the current price of $1,220 and still be within normal parameters," von Gruyerz's latest report for GoldSwitzerland.com said. But von Gruyerz told CNBC gold could go higher if the world encounters hyperinflation. The fears stemming from the European debt crisis will enhance gold's safe haven appeal, according to von Gruyerz. "Gold is at this point not a bubble," he added. "It is not overbought." An important barrier for gold is $1,220 an ounce and that barrier will be broken and it's "going to shoot up by probably $100 very quickly," von Gruyerz told CNBC. "There will be nowhere near sufficient gold to satisfy demand at current prices. We had been expecting gold to start its acceleration in March 2010 and this is exactly what is happening. We expect the move to be relentless during most of this year with very few major corrections but with high volatility. Moves of $100 in one day could easily happen. So gold is likely to make a top in the next few years between $5,000 and $10,000," his report stated. | ||

| New Gold (NGD) Showing Great Relative Strength To Gold Posted: 09 Jun 2010 04:08 PM PDT After following and investing in the gold mining sector since 2000 I have tried to identify the major leaders in each run and greatest candidates for my capital. I am looking at great relative strength to the price of gold. | ||

| Gold Seeker Closing Report: Gold and Silver Fall Over 1% Posted: 09 Jun 2010 04:00 PM PDT Gold fell about 1% in Asia and London and then dropped even further in late morning New York trade to as low as $1221.85 by about 11:30AM EST before it bounced back higher in the last couple of hours of trade, but it still ended with a loss of 1.19%. Silver fell to as low as $18.07 before it also climbed back higher in late trade, but it still ended with a loss of 1.3%. | ||

| Posted: 09 Jun 2010 03:55 PM PDT Arianna Huffington was interviewed on Tech Ticker on Wednesday discussing America's shrinking middle class:

But income inequality isn't just an American problem, it's pretty much a global problem. Nowhere is poverty growing more rapidly than with our elderly population, and the problem is getting worse. Consider this:

As you listen to the interview below, you get a sense that we're heading down the wrong road. When foreclosure lawyers are busier than manufacturers, it's the sign of a sick economy. And while fundamentals are improving, serious long-term structural issues remain. Pension poverty is one of the issues that far too many will struggle with. Wonder if it will be discussed at the G-20 (don't hold your breath). | ||

| Posted: 09 Jun 2010 03:33 PM PDT

The August Gold is leaving little "technical" gaps all over the place. Classical technical analysis suggests that gaps on a chart will be filled. (It doesn't specify when though.) I will not worry about the gap on the downside being filled and instead, focus on the upside.

Should the Gold attempt another high, I will tentatively focus on the 1267.0 area to initiate a short position with an initial profit objective of perhaps the 1257.3 area. If the Gold moves up rather soon, I could imagine a $20 – $30 fall from its highs, similar to the one from 1254.5 down to 1223.1.

That's why it's so hard to buy a dip or stay on a trend- the corrections can be pretty deep. I prefer to sell to someone who wants to buy at semi-outrageous new highs and ride his 'slap on the wrist' down a little ways. I'm more comfortable when I'm on the other side of someone's trade when I believe they are most likely doing the wrong thing. (In this case, chasing the market).

Long term Trading is a whole 'nother ball game.

The 60 minute bar chart below is making an 'upside down' bear arm formation (thought you'd heard 'em all, huh?). Translation: The formation is bullish. Bear Arms can produce big moves from where the shoulder turns. In this case, since it's an upside down Bear Arm, we could see a move (perhaps rapid) well beyond the recent highs of 1254.5 Call with questions……Silver analysis to follow.

Sean E. Blair FASTMKTFOCUS@gmail.com

| ||

| John Taylor On A Schizophrenic Europe - A Must Read Posted: 09 Jun 2010 03:25 PM PDT John Taylor's most brilliant letter to date. MARKET INSIGHT REPORT Managing an investment portfolio in Europe can put you on the fast track to a mental asylum. Only a playwright like Luigi Pirandello, who lived with a schizophrenic wife and wrote plays like Henry IV with its multiple levels of reality, could cope with the financial landscape in today’s Europe. Unfortunately, with the powerful political elite so committed to the EMU process, which they see as critical to the survival of the European Union, these economic distortions will only become more severe. Eventually it will either end badly, as in Henry IV with violence and death, or well, as in a crucible-like reordering and re-characterization of the European nation states. I expect to be writing about this fascinating process for the rest of my life – and I hope to live a long time. Differences within the Eurozone are extreme. Ireland saw its nominal GDP drop by 10.2% last year, a decline similar to those experienced in the Great Depression, while the German economy recently grew at a nominal rate above 3%. An independent economist calculated that the value of the euro would have to be $0.31 to balance Greece’s international position, and the number for Spain was $0.34, while Germany could effectively compete in the international marketplace with a euro over $1.80. Despite the ECB pegging the refinancing rate at 1.00%, two-year benchmark government rates for Germany are way below that at 0.48%, but way above it at 7.91% for Greece, Ireland 3.37%, and 3.20% for Spain. Ireland has been living with annual deflation for the last 16 months, while German lawmakers are worried about inflation. These differences have become more dramatic in the past few months and most independent observers forecast that trend to continue. By any economist’s measure this is not an optimal currency zone. But the economists are not in charge, the politicians are, and these politicians have spent their entire careers following their conception of the European currency. Their reputations and the European myth depend on the survival of the euro, and those who doubt its viability are enemies who deserve to be ground into dust. There is one overarching problem that the defenders of the euro cannot overcome: in its current form, the euro’s survival is economically impossible. Prior to the Greek crisis, the market did not understand this, but now it does. And you cannot put the genie back in the bottle. If part of the euro is worth $1.80 and another part is worth $0.31, how do you value this currency today, while it’s still in one piece? That is the crux of the matter. The uncertainty around this issue is what has caused billions of euros to flee into the security of the Swiss franc. The Swiss authorities have intervened, buying so many euros that their reserves expanded by 45% of their GDP since the start of this year. Despite that massive intervention, the Swiss franc has climbed by 10% against the euro since mid-December. There is no sign of change. As the politicians are completely in control, the schizophrenic euro could go on for years with the economic dislocations becoming more and more intense. Little explosions are likely. Certainly, the Swiss are in a terrible position (see Switzerland Surrounded Again, April 29, 2010) as the euros will keep flowing in. The Swiss franc might gain another 10%, destroying its export base, but the Swiss could change the rules to protect themselves. Although the European political elites are totally committed to the euro, the man on the street is different. The European political peace is a compromise between entrenched elites and the highly entitled masses first formulated by Bismarck over 120 years ago. The withdrawal of those entitlements in order to save the euro could easily upset this historic deal. If those in power continue to ignore the needs of the people, neither the euro nor the current political structure will survive in its current form. h/t Teddy KGB | ||

| Posted: 09 Jun 2010 02:34 PM PDT The deleveraging pain for mutual funds is never ending. Today ICI reported the fifth consecutive week of domestic equity outflows, which while not as bad as last week's unprecedented $13.4 billion in redemptions was still a massive $1.1 billion in outflows. This amounts to $25 billion in redemptions in the past 5 weeks alone, and increasing pressure for already cash-strapped mutual funds to accelerate liquidations of positions in a feedback loop. And if you have used leverage in this environment, good luck. Total 2010 outflows now amount to -$23 billion: how anyone can claim with a straight face that retail is in any way a factor for the market doing all it can to defend the 10k barrier is beyond comprehension. Once banks realize there are no reinforcements coming from the slow money brigade, watch for the selling to hit the afterburners as prop desks grasp that the first one out may be the only one not to lose it all. | ||

| Cramer Goes From Buy To Bye Bye On BP, Loses Fans 33% In Two Weeks Posted: 09 Jun 2010 02:02 PM PDT Another day for Cramer, another loss for his viewers. After telling his fans to Buy BP on May 21, Cramer, "mesmerized" by its fall, pulls the plug. The cost to those who followed his advice: -33%. This out from the Mad Money master earlier.

Indeed, and assuming Jim pulled the plug on BP today, he lost over 30%. Too bad that on May 21, Cramer advised readers and viewers "that BP is a buy." Fast forward to 3'40" in the clip below, which shows the kind of irresponsible advice that Cramer continues providing to CNBC's catatonic viewers. Catatonic, because if they had followed his advice and bought at the open on May 28 at $43.64 and sold today at $29.20, they lost 33% in two weeks. "Stick with BP... Stick with Cramer" the comedian intones. And lose a third of your investable capital in half a month. And we were just starting to like Cramer after for once he actually was telling his viewers to be at least a little bearish. But at least this was not as bad as his call to buy Bear in advance of the bank losing 95% of its value, his defenders will intone. And we would agree.

h/t Nolsgrad | ||

| Posted: 09 Jun 2010 01:41 PM PDT Ed. Note: This is an excerpt from Whitney Tilson's presentation to the Value Investing Congress in Pasadena, California on May 5, 2010. Whitney Tilson is the founder and Managing Partner of T2 Partners LLC and the Tilson Mutual Funds. Two years ago, we stood up here on this exact stage and delivered a very downbeat presentation on the US housing market. We return today to provide an update...and a new forecast. In early May of 2008 housing prices had already been declining for two years. The Bear Stearns hedge funds had blown up a year earlier. NovaStar and New Century Financial had also blown up a year earlier. The subprime crisis was well upon us. And many, many people thought that this was going to be contained to subprime. But we announced that the data led us to believe the contrary and we delivered our analysis in a presentation entitled, "Why We're Still in the Early Innings of the Bursting Housing and Credit Bubbles." We concluded that things were terrible and that there was no sign of a bottom. Obviously, that forecast was on target. So where are we today? Two thirds of American homes have mortgages - 56 million mortgages outstanding. A little over half are owned or guaranteed by government entities. 35% are held on the balance sheets of banks and thrifts, and 15% are so-called private label securities that went to Wall Street. This last piece was the sub-prime stuff that was some of the very worst mortgage debt ever written. It's very easy to get complacent about the mortgage market, as housing prices have stabilized and foreclosures have stabilized, you know, 'we don't have to worry about that anymore.' But I'd argue to the contrary, let me show you why. Fourteen percent of America's 56 million mortgages are already delinquent or in foreclosure. So if you multiply 56 million by 14%, that means that 7.8 million people right now are not paying their mortgages. 7.8 million homeowners have been delinquent for 30, 60 or 90 days...or are in foreclosure already. 91% of the people who are currently not paying are never going to get back to current, according to recent statistics. So that means that of 7.8 million people not paying their mortgage, 7.2 million are never going to get back. So that's a problem. 7.2 million homes. 7.2 million mortgages will go into foreclosure...eventually.  And the real story is even worse than the nearby chart suggests. Because of loan modification programs, the government, banks and servicers have dramatically slowed down the foreclosure process. The banks have been modifying everybody, slowing down the foreclosure pipeline and not taking properties onto their books. So what this means is that the rate of NON-foreclosure on delinquent borrowers is climbing sharply. As the nearby chart illustrates, 24% of the people who have not made a mortgage payment during the last two years have still not been foreclosed on. That's how clogged the foreclosure pipeline is.  So what's going on? Well, there are a lot of modifications going on the past year. But modifications don't really work very well. It turns out that even when you cut someone's mortgage payment by 50% or more, half of them still default within 12 months. The re-default rate is astronomical...even when you cut the monthly payments dramatically. So why is that? Because the real driver is people being under water, people who have no 'skin in the game.' Basically what we did in this crisis is we gave American homeowners a $2 trillion "call option" on home price appreciation. But when the value of their properties fell below their debt levels, they handed the keys to the lender; that's what people do. And that's what American homeowners have done. To some extent American homeowners are now minimizing the human toll of losing homes and so forth. Purely as a group, on an economic basis, they're the only rational players in this bubble. They've pocketed $2 trillion in cash and now, when the value of the property falls below their debt, they're walking away. As it turns out, the unemployment rate isn't really much of a driver of default rates. Instead, it's all about home equity...or the lack thereof. So what does the future hold? Foreclosures are starting to spike back up as the trial 'mods' are failing and moving into foreclosure. If we're very lucky, home prices will stabilize here. But if interest rates go up, and if we don't properly deal with those 7.85 million people who aren't paying their mortgages and those delinquent mortgages turn into foreclosures, look out below! Today about 17.2% of homeowners are underwater. But if home prices drop 10% from here, 27% of homeowners would go underwater. In other words, a 10% drop in home prices would cause a 56% increase in the number of people underwater...which would almost certainly lead to another surge in defaults. So I really think the housing market is on a precipice right now, where we need some very strong intervention by the government, by the banks and the servicers to offset what, in the absence of strong action, would be a resurgence of foreclosures, which would lead to a fresh drop in home prices, which will lead to even more defaults... And you can get into the vicious cycle that we were in back in '07 through '08. One big problem in all of this is second liens. You have $842 billion in second liens outstanding and the majority of them are owned by the Big 4 banks. And you have this bizarre situation where American consumers are not making the $1,200 monthly payment on their first lien, but maybe just to prevent harassing phone calls from debt lenders, they are paying the $150 second lien. Well, that means that the banks are looking at this and they're holding all of these second liens at par, even if the first lien has already gone bad. This situation makes the banks very reluctant to approve a short sale, since that would completely wipe out the second lien. Because if you write down the first lien, the second lien is a zero. Of course, banks just don't want to do that because it's a huge amount of money that would wipe out the equity of these Big 4 banks, if they were to mark these second liens to zero. This is a big problem. Then there's commercial real estate. The majority of commercial real estate loans that are coming due, nothing is happening on them. They don't get refinanced, but they don't get foreclosed on either. It's "extend and pretend" or "delay and pray." That's what's going on with commercial real estate. Net-net, there's more pain to come in the real estate market. Whitney Tilson

| ||

| Posted: 09 Jun 2010 01:30 PM PDT One of the oddest phenomena over the past two years has been the relative outperformance of European bank CDS compared to their transatlantic counterparts. Well, this peculiar relationship has now ended. European banks are finally, on average, riskier than American ones. Investors have finally realized that "regulatory capitalization" in Europe is an even more ephemeral concept than in the US. Furthermore as JPM pointed out yesterday, not only do European banks use more leverage, but the "the larger size of Europe’s banks argue against using simple GDP weights to assess potential risks to global markets. Due to a buyer’s strike over the last month, European banks now have 3.5x as much debt to issue than U.S. banks over the remainder of the year." Also, as we have been pointing out every single day for the past week, European banks, or at least those that have excess liquidity, have been storing more and more of their euros with the Central Bank, instead of lending it out. Add to this the relentless rise in EUR Libor, and this trade should have been a no-brainer for months. Bank of America adds some more perspective, and some more bias for their Long US Banks trade:

Alternatively, now that the boat is shifting from port to starboard, the real question is when will enough people scream that the US financial sector has no clothes loud enough, to get the investing community excited enough to go from a European to a US financial short once again. Although with banks allowed to avoid all of the important accounting rules in the US, we don't think this will happen for a long, long time. | ||

| More Than 1 In 5 American Children Are Now Living Below The Poverty Line Posted: 09 Jun 2010 01:26 PM PDT

Part of the reason is because an increasing number of parents can't find work. According to a U.S. Labor Department report, the average duration of unemployment in the United States hit 34.4 weeks in May, which was a big increase from 33 weeks during April. To give you some perspective how incredibly bad that is, the average duration of unemployment was only 16.5 weeks in December 2007. The truth is that when U.S. workers lose their jobs they are finding it exceedingly difficult to find new ones. In fact, 45.9% of those currently unemployed in America have been out of work longer than six months. That is the highest percentage since the Labor Department began keeping track of this statistic back in 1948. So is there much hope that things will turn around soon? No, not really. In fact, Federal Reserve Chairman Ben Bernanke says that unemployment is likely to remain "high for a while". That means a lot of children are going to continue to suffer. According to one shocking new study, 21 percent of all children in the United States are living below the poverty line in 2010. That means that more than 1 in 5 American children are now living in poverty. That is a national disgrace. Not only that, but the same report estimates that up to 500,000 children may currently be homeless in the United States. Perhaps we should all think about that while we are enjoying our nice dinners tonight. But most of us don't think that it is our job to do anything about it. Most of us have been trained that it is the job of the government to fix people's problems. We have created a monolithic welfare state and record numbers of Americans are now dependent on it. In fact, for the first time ever, more than 40 million Americans are on food stamps. 40.2 million Americans received food stamps in March, which was a whopping 21 percent increase from a year earlier. But it is bad enough that 1 out of every 8 Americans is on food stamps. What is far more tragic is that one out of every four U.S. children is now on food stamps. In fact, as mentioned previously, experts tell us that half of all U.S. children will be on food stamps at some point before they turn 18. So is anyone still not convinced that the U.S. economic system is broken? So who is doing well these days? The wealthy. In 2009, the number of millionaires in the United States rose 16 percent to 7.8 million. Wall Street bonuses for 2009 were up 17 percent when compared with 2008. The rich are getting richer as the poor are getting poorer. According to the United Nations, the United States has the highest level of income inequality of all of the highly industrialized nations. The poor are left with an increasingly smaller slice of the pie to divide among themselves. In fact, those in the bottom 40 percent now collectively own less than 1 percent of the nation's wealth. But the truth is that as the U.S. economy continues to fall apart, we are all going to experience some very difficult times. In particular, when the U.S. economy finally completely implodes, it is those who are almost entirely dependent on the "system" that will suffer the most pain. The vast majority of Americans live month to month, don't grow any of their own food and could only last a couple of weeks on the food that they currently have in their homes. So what will happen to those people when the system fails? And in case you think that this kind of talk is fearmongering, perhaps you should start listening to what some of the top financial analysts around the world are saying. For example, Anthony Fry, the senior managing director at Evercore Partners, recently told CNBC that things are getting so bad out there that he is "considering investing in barbed wire and guns". Yes, things are really getting that bad. Years ago the old timers would warn us that someday we would see Americans standing in bread lines. Well, today food stamps are the new bread lines, and 40 million Americans a month find themselves dependent on the U.S. government for the food that they need to survive. If that doesn't send a chill down your spine perhaps you should check your pulse. When a government has to feed 40 million people a month that means that the system is badly broken. How many tens of millions of people have to be on food stamps before we can all agree that we are in a complete and total economic nightmare? If you know of family or friends that are hurting, please consider helping them out. The truth is that in the end we are all in this together. The government is not going to save us. The collapsing U.S. economy is not going to save us. But if we all roll up our sleeves and work together perhaps we can make it through the difficult years that are coming. | ||

| HFT Takes Over Vegas? April Vegas Performance Disappoints As Luck Runs Out Posted: 09 Jun 2010 12:17 PM PDT We are initiating our most recent monthly overview piece, which will provide a digested analysis of Las Vegas gaming trends. And while we develop a working model, we will crib a little here and there from Goldman's Kevin Coyne who is probably one of the best analysts on the street in the space (with a credit bent, of course). Incidentally we picked a month when the double dip in the general economy is starting to seep into the ultimate gambling mecca. "Total Nevada gaming revenue was down 5.7% yoy in April, a drop-off from the 3% yoy increase in 1Q2010." And an interesting observation: it appears MIT has sent a crack team to rob Vegas silly once again. That or the HFT brigade has abandoned the NYSE and is now operating out of collocated servers next to the Bellagio fountains. A last possibility is that the recent dramatic growth in Boaz Weinstein's Saba hedge fund was due entirely to counting cards - "Bacarrat win percentage was only 8.5% in April, the second consecutive month of worse-than-expected performance for the house. March Bacarrat win was 8.4%, which is well below the trailing twelve month average of 12%." That's ok, Vegas - just invite Goldman Sachs to teach you how to get 100% win percentage on every single table. From Goldman Sachs

And some pretty charts: | ||

| Gold Daily Chart: Update of the Cup, and the Long Term Golden Bowl Posted: 09 Jun 2010 12:16 PM PDT |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment