Gold World News Flash |

- Welcome To the Jumble

- Implications of the GOLD-SILVER DIVERGENCE...

- Bear Market Race Week 138: Welcome Back Mr Bear!

- Tickerguy Drinks Two Beers

- Jim?s Mailbox

- In The News Today

- Re-Animating a Debt Dog

- Charles Oliver: Gold Headed to $2,000 in Two Years

- Articles Point To A Higher Gold Price

- Watch Out for Contango in Commodity ETFs

- Implications of the Gold-Silver Divergence…

- Three Debt Free Stocks With Lots of Cash and a High Yield

- Still Just a Baby Bull

- International Forecaster June 2010 (#2) - Gold, Silver, Economy + More

- If 1 + 1 Still Equals 2 Then Gold Will Explode!

- Gold Heading Higher and Silver Lower as Stock Market Crashes?

- ETF Winners From a Down Market

- Peter Brimelow: Does gold know something gold shares don't?

- Peter Brimelow: Does gold know something gold shares don't?

- Gold Headed to $2,000 in Two Years - Sprott Asset Managements Charles Oliver

- Goldman Bashing Is The New Chinese Black

- Baidu vs. Google: Positioning for Future Growth

- Gold vs. Real Assets

- College Students This Is Your Future: High Unemployment And Student Loan Hell

- Buckle Is Belted, Creating Another Buy Opportunity

- Honohan, Meet Havenstein

- Jim's Mailbox

- Getting Begotten

- On The Stealthy Doubling In Chinese 7-Day Repo Rates

- The SP 500 and Gold Update, a Bear and a Bull cycle- June 5th, 2010

- International Forecaster June 2010 (#2) – Gold, Silver, Economy + More

- Hints of a Bottom in U.S. Stocks and Euro

- Broad Market Internals Are Pointing To Higher Prices

- Mark Leibovit: Is gold manipulated?

- Economists in Telegraph survey see euro dying within five years

- Euros for dollars and gold trade denied by Iranian central bank

- Gold Prices Have a Long Way to Go Before Reaching Bubble Territory

- The Top Five Gold Producing Countries

- On FX – Who to Trust?

- Erik Nielsen's Latest European Stick Save Attempt

- Safe Havens are Shining but are Equities about to Rocket Higher?

- Plungorama: EURUSD Under 1.19, EURJPY Under 109

| Posted: 06 Jun 2010 06:57 PM PDT www.preciousmetalstockreview.com June 6, 2010 It’s now begun. Countries are falling, in economic speak, at an increasing rate. We will see currencies fail sooner rather than later. Gold remains the ultimate currency and must be a part of everyones portfolio. We’ve had a good run in the markets for a year, but that is done. There are many ways to make money as markets fall though, but there is risk. From risk comes a great opportunity though. Quick, wise, lucky and brave traders will come out of this crisis wiser, richer and with a proud sense of self confidence that only comes from surviving times of great stress turmoil. Metals review Gold rose a paltry 0.44% for the week and remains in the handle forming mode of the potential cup and handle chart pattern. There really isn’t much to add to this chart at the moment. We could see further downside to test the $1,190 level, but chances are good that the late week move testing $1,200 is the low... |

| Implications of the GOLD-SILVER DIVERGENCE... Posted: 06 Jun 2010 06:57 PM PDT Clive Maund In this article we are going to consider the implications of gold’s new highs of late last year and a month or so ago not being confirmed by new highs in either silver or the Precious Metal stock indices, and consider other factors having an important bearing on the outlook. Normally such a non-confirmation results in a reversal, if it persists, which is why it is a focus of concern at this time. By sequencing the 3-year charts of gold, silver and the HUI index one beneath the other below, we can readily compare and contrast them. From this comparison the marked and persistent non-confirmation of gold’s breakout to new highs and continued progress is obvious, which can otherwise be described as silver and PM stocks having been weak compared to gold. What does this mean? - it means that something is not right - to put it crudely it smells. Either silver and Precious Metals break out to new highs soon or gold is going to stumble and fall. By ... |

| Bear Market Race Week 138: Welcome Back Mr Bear! Posted: 06 Jun 2010 06:57 PM PDT The 1929 & 2007 Bear Market Race to The Bottom Week 138 of 149 Welcome Back Mr Bear! DJIA’s Valuation Models Gold & DJIA’s Bull Markets: Week 479 Mark J. Lundeen [EMAIL="mlundeen2@Comcast.net"]mlundeen2@Comcast.net[/EMAIL] 04 June 2010 Color Key to text below Boiler Plate in Blue Grey New Weekly Commentary in Black Below is my BEV chart for the Bear Race. Welcome Back Mr Bear! The best way of following Mr Bear’s labors is by tracking his progress via a “Bear’s Eye View Plot” (BEV). The percentage values on these plots are all based on * the Last * All-Time High, or in BEV Lingo, the “Terminal Zeros” of their respective Bull Markets. It’s important knowing that after the March 2009 Lows, the 2007-10 DJIA’s BEV Plot first broke above its BEV -30% Line in Wk 104 (last October). Then for the next 28 weeks, the Bull took his sweet time walking up to the BEV -20% Line. But in Wk 132, the Bull just couldnR... |

| Posted: 06 Jun 2010 06:57 PM PDT Market Ticker - Karl Denninger View original article June 06, 2010 10:59 AM With Steve! [INDENT] It Ain't Over - Karl Denninger on the Markets Denninger discusses the Federal Reserve, Congress, the financial markets, inflation/deflation, and whether or not gold is a safe haven. This interview starts out with Karl Denninger recounting his days as CEO of an internet company during the go-go 90's. Karl recalls the stress of betting the company every 18 months to keep in line with the latest technologies and that it was understood by everyone in the industry that we were clearly in a bubble at the time. The bubble promptly busted, but by then Karl had already exited stage left. [/INDENT] Enjoy! ... |

| Posted: 06 Jun 2010 06:57 PM PDT |

| Posted: 06 Jun 2010 06:57 PM PDT View the original post at jsmineset.com... June 05, 2010 03:17 PM Dear CIGAs, This puts an entirely new meaning to being "on hand." Jim Sinclair’s Commentary A crisis anywhere is a crisis everywhere in this Global economy. Wherever a financial problem occurs gold finds willing and eager buyers. This is why the hedgies and the dirty tricksters will not take the day this time. Nothing has been fixed. All that has happened in the West is "Extend and Pretend" with the money bunnies of F-TV acting as the great pretenders. Kicking the can of problems down the road has finally run into a dead end. OTC derivatives continue to grow as they destroy all things financial in their unholy demonic path. The West’s financial system is broken. Like Humpty Dumpty, all the kings men cannot put it back together again, nor do they really seem to care. The answer to the last question is "QE to Infinity" as it requires NO economic foundation to create money out of thin air. Thr... |

| Posted: 06 Jun 2010 06:57 PM PDT I have discovered that I am never, ever too drunk not to be instantly angry at the mere mention of the neo-Keynesian halfwit morons who are, despite mountains of evidence proving its complete failure, still clinging to that same, silly meth-based economic theory which I originally meant to write as "same, silly math-based economic theory" but, due to a typo, came out as "same, silly meth-based economic theory." "Meth-based economic theory" is, of course, an accident of the keyboard, now that I think about it, but the horrors of methedrine addiction and overdoses are probably much more descriptive, and would have more impact, than the terrific editorial cartoon I had just drawn, where I had depicted an old, ugly dog, which was obviously a Frankenstein-monster that had been reanimated after being stitched together out of pieces of various other dogs, and it had bare electrical wires leading to its ugly, misshapen head, and they were making sputtering noises like "Zzzzt! Zzzzzzzzzzzt" a... |

| Charles Oliver: Gold Headed to $2,000 in Two Years Posted: 06 Jun 2010 06:57 PM PDT Source: Brian Sylvester of The Gold Report 06/04/2010 Sprott Asset Management's Charles Oliver not only makes some bold predictions in this exclusive interview with The Gold Report, he backs them up. "I expect gold to be at $2,000 roughly two years from today. . .if I'm wrong I'll shave the hair off my head," Oliver says. As an unwavering believer in the yellow metal, Oliver is well positioned as co-manager of several Sprott investment funds, some of which hold bullion. One of those—Sprott's Gold and Precious Minerals Fund—climbed 114% in 2009, and claimed the 2010 Lipper Fund Award for Best Fund Over One Year in the precious metals category. Oliver shares some of the secrets of his success in this one-on-one interview. The Gold Report: What's your view on the European bailout? Charles Oliver: The big problem that's going on is that there's too much leverage, too much debt, and people spending beyond their means. We had the financial crisis in 2008; the ... |

| Articles Point To A Higher Gold Price Posted: 06 Jun 2010 06:45 PM PDT In conclusion, the first of the above-mentioned Barrons articles is gold-bullish because it reflects a belief that a lot more monetary inflation will be needed to support the economy in the future, while the second is gold-bullish because it reflects gross misunderstandings of gold, money, and what a real "gold bubble" would look like. Such misunderstandings are usually prevalent in the early or middle stages of bull markets, but never near the ends of bull markets. |

| Watch Out for Contango in Commodity ETFs Posted: 06 Jun 2010 06:38 PM PDT Kevin Grewal submits: The debt crisis looming in Europe and a slowdown in China’s growth have driven commodity prices to their biggest slump since the demise of Lehman Brothers, enabling some to believe that a rally in the alternative asset class may be in the near future. Whether or not a rally is in the near future for commodities, it is important to be aware of their inherent risks. As the appeal of exchange traded funds has magnified, so has that of commodity based ETFs and exchange traded notes. One inherent characteristic of many commodity based ETFs and ETNs is contango. Contango arises when the front-month futures contracts are cheaper than second-month futures contracts. To simplify it, it is when the price of a commodity for future delivery is higher than the spot price (the opposite phenomenon occurs as well, and this is known as backwardation). Complete Story » |

| Implications of the Gold-Silver Divergence… Posted: 06 Jun 2010 06:22 PM PDT |

| Three Debt Free Stocks With Lots of Cash and a High Yield Posted: 06 Jun 2010 06:12 PM PDT Stockerblog submits: Anyone who has read many of my articles know that I am a big fan of stocks that don't have any debt. I am also a fan of stocks that pay high dividends. When you look at these two criteria and add a third, lots of cash, you come up with an interesting list of stocks. WallStreetNewsNetwork.com just updated its list of High Cash No Debt High Yield Stocks, and includes over 25 companies, showing the stock symbol, market cap, forward price-to-earnings ratio, cash per share, yield, and cash per share as a percentage of price. Cato Corp. (CATO) is one example, a fashion specialty retailer in the southeast. This $677 million market cap company has a forward price to earnings ratio of 12, has no debt, and has $7.48 in cash per share, amounting to about a third of the stock price. On top of these great financials, the stock pays a yield of 3.2% payable quarterly, and last month increased their quarterly dividend by 12%. Complete Story » |

| Posted: 06 Jun 2010 06:11 PM PDT |

| International Forecaster June 2010 (#2) - Gold, Silver, Economy + More Posted: 06 Jun 2010 06:09 PM PDT Austerity is the new go to word in Europe. Unfortunately Europe doesn't know the meaning of the word. Greece, Spain and Portugal have already announced big spending cuts, as did Ireland and even the UK. All of the cuts are residual and not worth the volume to take into serious consideration. Cuts of $9.5 billion by the US and $12.3 billion by Germany, are a drop in the bucket. Who do they think they are fooling? |

| If 1 + 1 Still Equals 2 Then Gold Will Explode! Posted: 06 Jun 2010 06:07 PM PDT If 1+1 still equals 2 then gold will explode. It's really that simple! Once you tune out the white noise of the main stream media, recognize Keynesian economics for the claptrap it is, and come to terms with the painful reality that policymakers and financial elites navigate the ship of state to their benefit, not yours, the basic truth of this premise should resonate with you. |

| Gold Heading Higher and Silver Lower as Stock Market Crashes? Posted: 06 Jun 2010 06:06 PM PDT |

| ETF Winners From a Down Market Posted: 06 Jun 2010 05:53 PM PDT Dan Pritch submits: With the S&P500 losing over 3% on the week on a poor jobs report, further implosion of the eurozone (check out country by country EU Austerity Measures) and the realization that the disaster in the Gulf is likely going to start to have long term implications outside the scope of whatever legal bills BP is served with, most of last week’s winning ETFs were short sector ETFs, leverage or tied to volatility. For the prior week, here are some top winners amongst the wreckage: Non-Leveraged ETFsUNG - US Natural Gas Fund – Up 12% - In a somewhat bizarre twist (to sideline bystanders), even though energy was down last week on global slowdown concerns, natural gas was up – big. This is what an endorsement from Obama does during a speech. As oil spews in the gulf, finally, the administration makes mention of the enormous natural gas deposits domestically that may help shift us away from importation of foreign oil (since there isn’t a heck of lot of promise in new offshore oil leases in the near future). Complete Story » |

| Peter Brimelow: Does gold know something gold shares don't? Posted: 06 Jun 2010 05:46 PM PDT By Peter Brimelow http://www.marketwatch.com/story/gold-knows-something-gold-shares-dont-2... NEW YORK -- Gold jumps as stocks slump. Gold bugs are increasingly confident -- even though gold shares continue oddly weak. The yellow metal bounced off the ropes ferociously on Friday. After two weak days, the metal slipped below $1,200 spot as New York was opening. Then, as it became clear how ghastly the day was going to be in the financial markets generally, a powerful $20+ rally set in. From a relative strength point of view, this was a spectacular performance. Everything else was down horrifically, except U.S. Treasurys and the U.S. dollar -- usually gold's adversary. ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Gold in other currencies did even better. In fact, gold in euros closed at a record high. This will greatly delight The Gartman Letter, which can claim to have pioneered trading gold in this way, and which was expanding its positions this week. Can gold really be a safe haven at present? Dow Theory Letters' Richard Russell answers emphatically yes -- in fact, his anti-stock market and pro-gold advocacy this week is the most strident I can remember. And Friday repaired a lot of technical damage. At veteran gold observer Jim Sinclair's JSMineset site, correspondent "Trader Dan" said in his daily analysis: "Gold rebounded sharply ... through the 10-day and 20-day moving average and ... above all the moving averages once again. "Price action indicates the presence of strong buying support on dips with the usual suspects active on the rally...this price action is giving the physical market buyers time to become acclimated to the new and higher price level above $1,200." This conforms to the position taken at Bill Murphy's LeMetropoleCafe webzine, which among many other things watches Eastern gold prices as measure of physical market vitality. A piece posted on Friday was laconically entitled "India buys," and noted that Vietnam, an interesting newly-significant gold market, appeared to have moved to the buy side as well. Stories about strong gold buying by European Central Bank-despising Germans have been appearing here and elsewhere for several days. All of this gives resonance to the remarks of another old gold hand, Harry Schultz, in his Gold Charts 'R' Us service on Wednesday morning: "Bullion's capacity to shrug off the shackles of intervention at this crucial chart point ... invites a near term retest of the May 2010 high -- with a possible overshoot towards the $1,345.00 measured target ... and $1,425 theoretical upside target. On the downside, a sustained break below bullion's March uptrend line (now $1,178) would be necessary to destabilize what appears to be the energetic resumption of gold's primary uptrend." An Ugly Feature/Big Problem (?) marring this happy scene: the wretched performance of gold shares. The NYSE Arca Gold Bugs Index (HUI) and the Philadelphia Gold & Silver Index (XAU) both finished the week down. A correspondent on LeMetropoleCafe notes sourly that heavy losses on Friday happened in the afternoon only -- exonerating the general stock market as a possible cause, because it was plunging all day. No one seems to understand gold shares' malaise. Unlike gold, they have yet to approach, let alone exceed, their last December highs. Some blame the rise of the gold ETFs like SPDR Gold Trust ETF, which expanded its bullion holdings to a record this week) and the closed-end gold funds like Central Fund of Canada (CEF) and Sprott Physical Gold Trust (PHYS). But these are not leveraged to gold, which has been the gold shares' traditional appeal. Could gold shares just be the last train to leave the station? Join GATA here: World Resource Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Coming Friday-Sunday, June 11-13, at the Dallas-Fort Worth Airport Marriot: The conference will explore the dangers and opportunities in today's bullion markets and the need for investors to diversify bullion holdings outside of bullion banking and commodities markets. Speakers will include David Morgan of Silver-Investor.com, Gold Anti-Trust Action Committee Chairman Bill Murphy, and Duncan Cameron and Philip Judge of Anglo Far-East Bullion Co. The earliest conference attendees on Saturday will be able to schedule one-on-one interviews for personal consultation with Anglo-Far East's experts on Sunday. To learn more about and register for the Anglo Far-East Bullion conference, please visit: http://www.anglofareast.com/seminar-registration/ |

| Peter Brimelow: Does gold know something gold shares don't? Posted: 06 Jun 2010 05:46 PM PDT By Peter Brimelow http://www.marketwatch.com/story/gold-knows-something-gold-shares-dont-2... NEW YORK -- Gold jumps as stocks slump. Gold bugs are increasingly confident -- even though gold shares continue oddly weak. The yellow metal bounced off the ropes ferociously on Friday. After two weak days, the metal slipped below $1,200 spot as New York was opening. Then, as it became clear how ghastly the day was going to be in the financial markets generally, a powerful $20+ rally set in. From a relative strength point of view, this was a spectacular performance. Everything else was down horrifically, except U.S. Treasurys and the U.S. dollar -- usually gold's adversary. ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Gold in other currencies did even better. In fact, gold in euros closed at a record high. This will greatly delight The Gartman Letter, which can claim to have pioneered trading gold in this way, and which was expanding its positions this week. Can gold really be a safe haven at present? Dow Theory Letters' Richard Russell answers emphatically yes -- in fact, his anti-stock market and pro-gold advocacy this week is the most strident I can remember. And Friday repaired a lot of technical damage. At veteran gold observer Jim Sinclair's JSMineset site, correspondent "Trader Dan" said in his daily analysis: "Gold rebounded sharply ... through the 10-day and 20-day moving average and ... above all the moving averages once again. "Price action indicates the presence of strong buying support on dips with the usual suspects active on the rally...this price action is giving the physical market buyers time to become acclimated to the new and higher price level above $1,200." This conforms to the position taken at Bill Murphy's LeMetropoleCafe webzine, which among many other things watches Eastern gold prices as measure of physical market vitality. A piece posted on Friday was laconically entitled "India buys," and noted that Vietnam, an interesting newly-significant gold market, appeared to have moved to the buy side as well. Stories about strong gold buying by European Central Bank-despising Germans have been appearing here and elsewhere for several days. All of this gives resonance to the remarks of another old gold hand, Harry Schultz, in his Gold Charts 'R' Us service on Wednesday morning: "Bullion's capacity to shrug off the shackles of intervention at this crucial chart point ... invites a near term retest of the May 2010 high -- with a possible overshoot towards the $1,345.00 measured target ... and $1,425 theoretical upside target. On the downside, a sustained break below bullion's March uptrend line (now $1,178) would be necessary to destabilize what appears to be the energetic resumption of gold's primary uptrend." An Ugly Feature/Big Problem (?) marring this happy scene: the wretched performance of gold shares. The NYSE Arca Gold Bugs Index (HUI) and the Philadelphia Gold & Silver Index (XAU) both finished the week down. A correspondent on LeMetropoleCafe notes sourly that heavy losses on Friday happened in the afternoon only -- exonerating the general stock market as a possible cause, because it was plunging all day. No one seems to understand gold shares' malaise. Unlike gold, they have yet to approach, let alone exceed, their last December highs. Some blame the rise of the gold ETFs like SPDR Gold Trust ETF, which expanded its bullion holdings to a record this week) and the closed-end gold funds like Central Fund of Canada (CEF) and Sprott Physical Gold Trust (PHYS). But these are not leveraged to gold, which has been the gold shares' traditional appeal. Could gold shares just be the last train to leave the station? Join GATA here: World Resource Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Coming Friday-Sunday, June 11-13, at the Dallas-Fort Worth Airport Marriot: The conference will explore the dangers and opportunities in today's bullion markets and the need for investors to diversify bullion holdings outside of bullion banking and commodities markets. Speakers will include David Morgan of Silver-Investor.com, Gold Anti-Trust Action Committee Chairman Bill Murphy, and Duncan Cameron and Philip Judge of Anglo Far-East Bullion Co. The earliest conference attendees on Saturday will be able to schedule one-on-one interviews for personal consultation with Anglo-Far East's experts on Sunday. To learn more about and register for the Anglo Far-East Bullion conference, please visit: http://www.anglofareast.com/seminar-registration/ |

| Gold Headed to $2,000 in Two Years - Sprott Asset Managements Charles Oliver Posted: 06 Jun 2010 05:42 PM PDT |

| Goldman Bashing Is The New Chinese Black Posted: 06 Jun 2010 05:16 PM PDT And you thought Goldman had it bad in the US. The FT reports: "Many people believe Goldman Sachs, which goes around the Chinese market slurping gold and sucking silver, may have, using all kinds of deals, created even bigger losses for Chinese companies and investors than it did with its fraudulent actions in the US,” read the opening lines of an article in the China Youth Daily, a state-owned daily newspaper, last week." Matt Taibbi - you have met your match, and the outcome is picturesque indeed - a vampire squid that slurps and sucks its way to every loose ounce of gold and silver. But fear not, all those millions of ounces in GLD are perfectly safe and sound. The article continues:

Did anybody tell these people how many "losing" trading days Goldman had in the latest quarter/year? Joking aside, we do find it somewhat ironic that the company which brought capitalism (or at least the Goldman-centric version thereof) to China is now being openly attacked for being "too successful." It really is time for Buffett to MBO the squid and get the public company farce over with (that means only another $30 in GS downside before the Oracle announces his true intentions). We are sure that Goldman can pull enough strings where even as Buffett's last hypocritical hurrah, it will still have full discount window access, even as a fully private hedge fund. Because the last thing Goldman needs is to be the primary scapegoat of a better way of life gone horribly wrong for 1.3 billion angry Chinese. On the other hand, look for the American Idol empire to promptly move to Beijing with Goldman's blessings and venture funding - when all else fails, prime time distraction with moronic entertainment for an increasingly lazy middle class always seems to get the job done. |

| Baidu vs. Google: Positioning for Future Growth Posted: 06 Jun 2010 05:16 PM PDT Third Party Feed: Media Tech Analyst submits: Baidu (BIDU) enjoys a near monopoly position in online search in China due to Google's (GOOG) de facto exit. Couple that with its success in transitioning advertisers to its new platform named Phoenix Nest, the company is positioned to capture upside to current growth expectations. BIDU shares could rally by 50% over the next 6 months as Street estimates for the company increase. Complete Story » |

| Posted: 06 Jun 2010 05:08 PM PDT Fred Wilson submits: A lot of wealthy people I talk to are building up sizable gold assets in their portfolios. They look at the long term fundamentals of the US economy and don't like what they see. So they are accumulating gold as both a hedge and to some extent a capital gains play. Here's a price chart of gold over the past five years (click to enlarge):

Complete Story » |

| College Students This Is Your Future: High Unemployment And Student Loan Hell Posted: 06 Jun 2010 04:47 PM PDT

So needless to say, the first six months after graduation can be a complete shock for many college graduates. In a piece recently published on MSN Money, journalist Joe Queenan described the tough environment that 2010 college graduates are being thrown into as they enter the real world.... They will enter an economy where roughly 17% of people aged 20 through 24 do not have a job, and where two million college graduates are unemployed. They will enter a world where they will compete tooth and nail for jobs as waitresses, pizza delivery men, file clerks, bouncers, trainee busboys, assistant baristas, interns at bodegas. But waiting tables, delivering pizzas or greeting customers at the local Wal-Mart is not what most college graduates signed up for when they invested tens of thousands of dollars and four years (if not longer) of their lives in an education. Unfortunately, that is where our economy is at today. "Good jobs" are very few and far between and those freshly graduating from college are finding themselves suddenly thrust into an extremely competitive job market. According to the Bureau of Labor Statistics, in March the national rate of unemployment in the U.S. was 9.7%, but for Americans younger than 25 years of age it was 18.8%. In fact, according to a recent Pew Research Center study, approximately 37% of all Americans between the ages of 18 and 29 have either been unemployed or underemployed at some point during this recession. But what makes things even worse for college graduates is that so many of them are coming out of school with absolutely crushing student debt loads. Today, approximately two-thirds of all U.S. college students graduate with student loans. But it isn't just that they have student loans. The loan balances that many of these students are graduating with these days are absolutely obscene. The Project on Student Debt estimates that 206,000 U.S. college students graduated with more than $40,000 in student loan debt in 2008. Using 2008 dollars as a baseline, that represents a ninefold increase over the number of students graduating with that amount of debt in 1996. Most college students don't think much about all of the debt that they are accumulating while they are in school. But once they get out, the sudden realization that they have gotten themselves into student loan payments that they cannot possibly handle can be completely demoralizing. The New York Times recently profiled Cortney Munna - a recent college graduate who has not been able to get a "good job" and who now finds herself in student loan hell. She recently told the New York Times that she would be more than glad to give back her education if she could just get out of all this debt.... "I don't want to spend the rest of my life slaving away to pay for an education I got for four years and would happily give back." In recent years, millions of young college graduates have found that the "great education" that they thought they were getting actually doesn't get them very far at all in the real world. In fact, they often find themselves taking jobs where they work right next to other people their age who never even went to college. So a lot of young college graduates find themselves wishing that they could just "return" their education and get all that money back. But there is no walking away from student loan debt. The truth is that federal bankruptcy law makes it nearly impossible to discharge student loan debts. Basically, once you get into student loan hell there is no escape. So now we have hundreds of thousands of college graduates that can't get good jobs and that have brutal student loan payments that they can't possibly handle. No wonder so many of them seem so angry and depressed. But the funny thing is that so many that are still in college are so unbelievably optimistic about the future. Edwin Koc, director of research for the National Association of Colleges and Employers says that those approaching college graduation are an extremely confident bunch.... "Over 90 percent think they have a perfect résumé. The percentage who think they will have a job in hand three months after graduation is now 57 percent. They're still supremely confident in themselves." So have we done a good job of teaching them to have confidence in themselves or have we done them a disservice by allowing so many of them to live in complete denial? The truth is that the U.S. economy is in the process of collapsing, and we need to prepare our young people for the tough times that are ahead. Life is going to require an extreme amount of hard work and discipline in the years ahead, and unfortunately those qualities are not in great supply among young Americans right now. Actually, the "real world" is not going to be getting easier for any of us. We are all going to require an attitude adjustment if we are going to successfully navigate the difficult times that are coming. So let's not be too hard on new college graduates and other young Americans. The truth is that the vast majority of us are "soft" at least to some degree because of the decadent society in which we live. Let's just hope that somehow we can all find enough inner strength to endure the great challenges that are going to confront us in the years ahead. |

| Buckle Is Belted, Creating Another Buy Opportunity Posted: 06 Jun 2010 04:45 PM PDT One of the worst same-store-sales results relative to expectations last week was from Buckle (BKE), which reported a decline of over 5% compared to expectations of roughly flat. The company, which doesn't provide guidance, also had posted a weak April number, but it explained on its 1st Quarter conference call a few weeks ago that the weakness had been due to a lack of inventory, especially in accessories. At this point, it's unclear whether those problems persisted in May. In any event, the stock lost about 8% of its value over the next two days (click to enlarge):

Complete Story » |

| Posted: 06 Jun 2010 03:53 PM PDT One of the most puzzling questions from history is why smart people do such moronic things. Bonaparte was warned; it seemed obvious to anyone who knew the lay of the land that the Russian campaign was foolhardy. In WWI, both sides should have called it quits by 1917. And what was Rudolf von Havenstein thinking? The president of the Reichsbank printed up billion-mark notes; surely he must have known they would cause trouble. But people come to think what they must think when they must think it. One decision leads to another one. Each one is rational, as far as it goes. But put them together and you are on your way to hell. Von Havenstein was just trying to keep the economy from collapsing. In the pageant of unwelcome possibilities, he judged inflation less ugly than a Bolshevik uprising. The US central bank had its Havenstein moment last year, in March, when it began buying private sector securities - effectively adding billions to the world's money supply. A worldwide bull market followed. Equities rose about 70%. At the end of March a year later, the "quantitative easing" program came to an end. After spending $1.2 trillion, the feds withdrew and the bull market ended. Since then, the S&P has lost 8% of its value. The Shanghai stock market has just hit a 12-month low and is now down 60% below its January 2008 high. Now we see both how our modern monetary system began...and how it will end. In the sunny days of August, 1971, Richard Nixon was merely solving another problem caused by another solution. The solution to the world's problems in the '60s was to spend money on the war in Vietnam and the War on Poverty. The spending of the '60s created the debts that Nixon had to reckon with - particularly to the French. Rather than pay the foreigners in gold, as had been customary for hundreds of years, the Nixon team defaulted. They changed the world's monetary system, beginning the monetary equivalent of Napoleon's march on Moscow. They thought they were doing the world a favor. A more 'flexible' currency system would give financial authorities another powerful weapon with which to fight downturns. Instead of holding gold as their main monetary reserve, nations switched to holding each other's paper. Henceforth, one's reserve assets were another's liabilities - all netting out to zero. With this new weapon in their hands the feds won every battle - from the Latin American debt crisis of the '80s to the mini recession of 2001. But the trouble with money that grows on trees is that you are soon raking it off your lawn. The pile of international reserves, other than gold, grew from under $300 billion in 1971 to more than $8.5 trillion today. Prices rose too. As measured in Britain, consumer prices rose as much in the last 40 years as in the entire preceding 700. According to Alan Newman, daily trading volume has ballooned more than 25 times since the 1970s. The financial industry has gone from a minor activity representing only 3% of GDP in the '70s, to a substantial 7.5% of GDP today...and its single major source of profits. This financial dervish produced plenty of dust but less and less forward motion. Net private investment in the US hit a high in 1978 at about 8% of GDP. It has been declining ever since, recently hitting zero. After WWII, wages and real GDP increased steadily. But without investment in new plants and equipment, hourly wage gains stopped in the 1970s, while real GDP gains declined. People kept up appearances by borrowing heavily. But that only caused another problem. The private sector is now solving the problem of too much debt by cutting back. Consumer credit is falling. Commercial and industrial loans are falling. The money supply, as measured by M3, is deflating at the fastest rate since the Great Depression - more than 9% annually. And prices - as measured by the US core CPI - are going up at the slowest paces since 1966. This correction is natural and normal. But the feds want to stop it anyway. What can they do? ECB council member Patrick Honohan, from Ireland, has the answer. He applauds an "important new weapon," referring to the very same hot cannon that blew up in Rudolf von Havenstein's face 9 decades ago. The ECB has begun its own program of quantitative easing. It bought 35 billion euros of bonds in the first 3 weeks of the program. "Restoring market confidence in the solidity of governments' finances is absolutely crucial," Honohan said. Mr. Honohan is neither evil nor stupid. He is merely putting one foot in front of the other. He judges the need for confidence greater than the risk of inflation. Reasonable...as far as it goes. But where does it lead? The Rhine, the Niemen, and the Volga have all been breached. Sooner or later, he will be on the banks of the Berezina. Bill Bonner |

| Posted: 06 Jun 2010 03:49 PM PDT Jim Sinclair's Commentary CIGA Marc, reporting from the nuts and bolts of real business, shares his views. I believe that Marc is more accurate than any talking head or government economist I have heard. Dear Jim, Here is the latest update from the trenches. Generally speaking store traffic and the number of transactions are at or slightly above last year's level, however overall sales remain significantly lower than even 2009 to the tune of approximately 14%. This is being reflected by lower average transaction sizes primarily within the business to business category. In the hardware industry approximately 20% of our inventory consists of 80% of sales. I would say this is now more than ever true as customers appear to only be purchasing exactly what they need. A significant amount of inventory across various departments is simply not turning. Business and contractors alike seem to be doing more with less in terms of the amount of materials they would need to complete a project (in terms of drop cloths or paint roller covers for a painting project). Customer sensitivity to price is at a level I have never before experienced. Much of my time is spent establishing special pricing for an inordinate amount of requests for discounts. Margins at the retail level are being squeezed by the categories that are experiencing the highest levels of sales (paint) and as vendors have slowly but consistently increased prices across a broad assortment of departments. To sum up business I would say that it is "erratic" and totally unpredictable, forecasting is simply a waste of time for me at this point. Pricing has been volatile. All fasteners have increased in price and more specifically nails have gone up dramatically (over 15-20%). Drywall screws and various masonry anchors have experienced more tepid increases. Drop cloths and plastic sheeting has increased by 10-15% in the last 30 days and I was told that another increase might be coming shortly. PVC pipe and fittings prices have increased about 10% and we are being told this is due to increased transportation costs and a volatile resin market. Steel and copper pipe have also been volatile with prices often changing weekly. Generally our vendors would be hesitant to change prices so often as they know how it affects our business, particularly any business which is within longer term contracts or with specific clientele which purchase related goods over and over again but it appears the markets have left them with no choice. This week our merchandising letter contained a significant amount of price updates – their additional comments were: -Manufacturers are reporting increased costs of production and raw materials. Many of our vendors also appear to be carrying reduced inventory which also seems to be contributing to their more frequent price changes. Our paint representative informed me that two competitive national paint brands recently increased their prices by 4% and 4.5% respectively and that the dispersants being used in the Gulf of Mexico oil cleanup efforts are further restricting the market as these surfactants are generally used in paints. He expects possible supply disruptions within the sector. That's about all I have for now. Best Regards,

Dear Jim, They have not figured out that you cannot spend your way out of a deficit situation without destroying the whole world currency system. The Western world is playing bailout follow the leader off a cliff and no one dared to ask what if the whole premise of a bailout is wrong. Worse yet, they are exacerbating the situation by increasing debt! All Western nations are in lockstep, walking off the cliff in succession! So to encourage those naught savers to spend, they are going to print money so fast that it will lose value eventually on a day to day basis. They must think (erroneously) printing will encourage spending that will fuel demand. The world is already broke when net liabilities are greater than net assets. A depression is in order to correct the debt, but the politicians will print money as you have said time and again. It is and always has been a currency event. The people who got us into this mess cannot extract us from this 1.14 quadrillion OTC mountain of garbage crap paper. It's like people arguing on the Titanic about who is gonna bail water with a 5 gallon bucket. Gold protects oneself from incompetence such as this. Simply put, there is just not enough gold to go around at the present price, possibly at any price! I refuse to read any more of this mainstream crap as that is what it is! Best, (This is laughable. How, when they are all broke????) "In a letter that he sent to ministers on Thursday, U.S. Treasury Secretary Timothy Geithner said global growth would fall short of potential unless other countries made up for a drop in demand as debt-strapped households tighten their belts. Geithner singled out the need for Japan and "European surplus countries" — code principally for export powerhouse Germany — to boost domestic demand." After a struggle G20 agrees on need for deficit cuts BUSAN, South Korea (Reuters) – The Group of 20 leading economies reached an uneasy compromise on Saturday over the speed of budget cuts needed to calm global financial markets rattled by a spreading debt crisis in Europe. G20 finance ministers sought to bolster market confidence by declaring themselves ready to safeguard recovery and stressing the importance of putting their public finances in order. Without referring specifically to the euro zone's debt troubles, the G20 said recent volatility in financial markets served as a reminder that significant challenges remained despite a faster-than-expected, though uneven, global economic recovery. "Those countries with serious fiscal challenges need to accelerate the pace of consolidation. We welcome the recent announcements by some countries to reduce their deficits in 2010 and strengthen their fiscal frameworks and institutions," the G20 said in a communique issued after two days of talks. The euro plunged to a four-year low on Friday, partly on concerns that Hungary could be facing a debt crisis similar to that of Greece, which had to turn to fellow euro zone members last month for a 110 billion euro bailout. |

| Posted: 06 Jun 2010 03:32 PM PDT And Bear begat Lehman. And Lehman begat Dubai. And Dubai begat Greece. And Greece begat Spain. And Spain begat Italy. And...hold on! Who begat Hungary? North American markets tanked on Friday on a double barrel of strange and disappointing news. First was a comment from a spokesman for the Hungarian president that the country faced a "grave" economic situation. Debt begat that. But the 3.15% fall in the Dow Jones Industrials and the 3.44% fall in the S&P 500 were generally blamed on a disappointing U.S. jobs report. That report showed that the U.S. economy added 431,000 jobs in May, which seems like a lot of jobs. But the median forecast from, ahem, economists was for exactly 536,000 shiny new jobs. The more discouraging news was that the private sector added only 41,000 jobs in the month, and that's assuming the numbers are accurate and can be trusted. All the other jobs were related to temporary census workers in the U.S. working on the Federal dole. That's not much cause for encouragement. The bigger weekend story is that Europe and America are at odds over whether they should continue spending money they don't have. That is, according to news reports, U.S. Treasury Secretary wants countries like China and Germany - countries with current account surpluses - to unleash private sector demand! Spend money, he says, because we Americans are flagging, and already have too much debt. The Europeans apparently knocked Geithner back on the suggestion. This prompts the question: has official Europe really chosen the route of austerity? And if so, will they stick to it? Will their populations let them if it means lower growth and higher unemployment and fewer government services? It will be a very stern test for public finances in a modern democracy. And in the meantime, the Euro is getting sicker against the dollar (which may not bother German exporters too much). Geithner reportedly told the Europeans that the road back to public sector fiscal sanity is long and winding and that they could put off the journey for a day or two. We didn't see him anywhere advocating larger public spending and stimulus. But still, in the sense that he sees aggregate demand as the key to a global recovery, Geithner flew the flag of Keynes in South Korea this weekend. The result is a policy stalemate, at least if you were expecting a coordinated global economic strategy, complete with a tax on banks. Come to think of it, that isn't a bad result after all, is it? It's certainly welcome in Australia, where the locals have argued the banking sector is better regulated and capitalised than in the North Atlantic economies. It looks to us like the global bank tax is the developed world's way of getting the developing world to pay for bank failures. So it's no wonder it was opposed by China, Brasil, and Australia. Mind you, we have our own reservations about the quality of bank assets domestically. And it's clear that no matter how sound Australia's financial system may be, it would be affected by a capital crisis in Europe. "Australia's banks are reliant upon global capital markets to fund a significant share of their balance sheets, including rolling over growing volumes of maturities. In 2009 around two-thirds of bond issues by Australian banks were into the offshore markets," says' Westpac's Chief economist Bill Evans in today's Australian. Bloomberg reports that cost of insuring Australian corporate bonds from default went up the most in two weeks. Evans say that, "The inevitable response to an extended tightening of global liquidity will be tighter domestic credit conditions. Proposed new regulations through the G20 on liquidity and term funding must be scaled back considerably if Australia and New Zealand are to avoid a credit crunch." Hmm. According to the chart below from CMA Market last week, the next most urgent stage of Europe's debt and credit crisis is the East. The largest widening spreads, an indication of credit deterioration, were in Austria, Hungary, Slovenia, and Romania. Crisis on the Eastern Front of the Credit Wars? But Evans point is well taken. The Australian government correctly argues that in comparison to other countries, the debt and deficit-to-GDP ratios here are small. That's true. But for the country, the total level of household and private sector debt is large and growing. And a lot of that borrowing is done overseas. Take it away, and what do you have? You have a much higher cost of capital and another credit crunch. The flow of credit to small businesses and households would be the most affect. Big firms might have trouble selling bonds (hence the higher credit default swap rates). They could, assuming investors are not spooked about sovereign risk, sell equity as they did last year. But you can see that Australia IS affected both directly and indirectly by what happens in Europe. And that's just Europe! Ultimately, we reckon the biggest bubble of them all is in the U.S. bond market. But we'll save that analysis for another day. Until then. By the way, in the beginning, before the great credit deluge of fiat money, the nature of the business cycle was not boom and then bust. It may not have been a Garden of Eden. But the cost of capital was set by the market, with a natural rate of interest. Bad investments were made and the loan losses were taken by the lenders, with the prudent surviving and the reckless perishing. In this economic paradise, capital moved from weak and inefficient and wasteful hands into strong ones. Recessions were short and sharp. Growth was slower in the absence of credit above the rate of available savings. But money was sound and investments could be valued. It's hard to say if John Law was serpent or merely a scoundrel. But he succeeded in convincing the French regent to open a national bank whose primary capital was government debt. It was the birth of modern central banking, where the government effectively sells the right to print (not coin) money to a private corporation or cartel in exchange for reliable lending at favourable interest rates. How Law turned the debt of the French government into the equity of the Mississippi Company is also a story for another day. But in his ability to convince the investing public that liabilities and promises to pay are the same thing as real money, Law Begat Greenspan and Greenspan Begat Bernanke. And to channel the Mogambo Guru, we're all begatted now. Dan Denning |

| On The Stealthy Doubling In Chinese 7-Day Repo Rates Posted: 06 Jun 2010 03:29 PM PDT Even as most investors are focusing on Europe, Libor, Euribor, Ted Spreads, the ECB, etc, many have noticed that over the past 10 days China's seven-day interbank rates have doubled from 1.8% to 3.2%. Is this latest episode of liquidity turmoil indicative that the PBoC is becoming less successful at communicating an "all clear" to the domestic (and international) markets? Or are there more troubling undercurrents in the sea of (previously) excess Chinese liquidity? The primary driving force behind the BRIC (re)growth story of the past year has been the mirroring by China of the US excess liquidity policy, coupled with an extremely loose fiscal policy. Which is why every minor blip in any of the liquidity metrics in China tends to be analyzed under a microscope, due to huge implications on the commodity (and thus every other) trade. As the chart below highlights, in the last week, there has been a very disturbing move in the Chinese seven-day repo rate. What may be the reasons for this surprising move? Bank of America's Ting Lu ventures one explanation:

The most immediate reason for the spike according to Lu, are imminent IPO and Convertible Bond issuances by the BoC:

The reason for the RMB40 billion Convertible Bond issuance, as BusinessWorld explains, is the desire by the BoC to shore up liquidity against "bad debt." Since this is something China has a lot of, we anticipate many more such liquidity lock-ups. The problem, however, facing the PBoC is that such confidence restoring measures go directly against the ongoing desire to reliquify the market. As BofA further explains:

Indeed, as the chart below shows, the US is not the only country experiencing curve flattening, a bearish signal. Further demonstrating the quandary facing the the PBoC is the increasingly erratic direction of recent liquidity injections and withdrawals: in this volatile environment, it is amazing 7 day repo rates have moved to only 3.2%. Another very troubling trend is the drop in excess reserves held by banks: the commercial bank excess reserve ratio has dropped from 3.13% at the end of 2009 to 1.96% by end of Q1, 2010. And the last factor leading to liquidity distrubances in Shanghai, completely independent of what may be happening in Europe, is the increasing volatility in RMB-USD forwards, courtesy of the groupthink moving from one near revaluation certainty, having hit a multi-year tight in late April, pushing back to January 2010 level as shortly as a month later. With so much endogenous liquidity volatility occuring in China, it is no wonder Shanghai is at 52 week lows. It is only a matter of time before the broader market puts two and two together and links up the suddenly volatile liquidity environment in China to what is happening in the entire world. And as these things tend to be self-sustaining in feedback loops, keep an eye on the Chinese 7 day interbank rate, together with the European Commercial Paper and repo market, which, if history is any guide, is where the next liquidity shock will strike. |

| The SP 500 and Gold Update, a Bear and a Bull cycle- June 5th, 2010 Posted: 06 Jun 2010 01:42 PM PDT By David A. Banister, The Technical Trend Traders Back in mid April on Kitco.com I wrote a market forecast calling for a top in the SP 500 index and an ABC correction. Since that time I had one intervening update on both Gold and the SP 500 index, and this is a June 5th follow-up. Gold should continue to back and fill as I postulated around the 1200-1235 area's, until the next surge taking it up to 1300-1325 US per ounce. The burning matches we call currencies are getting hotter, and fingertips are getting burned in Europe a little at a time. The Elliott Wave patterns I use as my underlying basis for forecasting are continuing to look bullish for the precious metal. In addition, it's a darn good alternative to fiat paper during this period of the Kondratiev winter where debt is repudiated and washed out of the system. The SP 500 index or the US broader markets if you will, continue to unfold in my predicted A B C correction. I forecasted in pre market on May 25th that a "3-3-5" ABC low pattern was completing that morning from the April highs, with an intervening bounce likely. The problem is this "Bounce" as it were, has only recovered a 38% re-tracement of the April highs to May lows. The upward correction was mild in percentage terms, and the gap down in the SP 500 index and markets on Friday morning portends lower lows to come. A weak bounce and a solid thud is not near term bullish. My ultimate forecast called for 92-97 on the SPY ETF by mid September 2010, and I am continuing to stick with that as the likely outcome before the Bull can resume the advance in earnest. This would be a 50% re-tracement of the 13 Fibonacci month rally from March 2009 to April 2010. I look for the summer to be choppy and volatile with a likely downside bias. As I thought in April, it's a sell in May and go away year until the summer ends. Trading profits could be made on the 2x/3x bear and bull ETF's, and we plan to work with those this summer in my paid website services. If you think you may benefit from my Market, Gold, and other big picture forecasts, you can learn more at www.themarkettrendforecast.com, and all of our services at www.thetechnicaltrendtraders.com David A. Banister |

| International Forecaster June 2010 (#2) – Gold, Silver, Economy + More Posted: 06 Jun 2010 01:38 PM PDT By Bob Chapman, The International Forecaster US MARKETS Austerity is the new go to word in Europe. Unfortunately Europe doesn't know the meaning of the word. Greece, Spain and Portugal have already announced big spending cuts, as did Ireland and even the UK. All of the cuts are residual and not worth the volume to take into serious consideration. Cuts of $9.5 billion by the US and $12.3 billion by Germany, are a drop in the bucket. Who do they think they are fooling? In America there is no restraint – deficits of $1.5 trillion over each of the next two years. This year alone will be $1.6 to $1.8 trillion with $1 trillion a year in deficits as far as the eye can see. This doesn't sound like restraint to us. We see no responsible behavior here. In America the president says he wants $20 billion in cuts in budget, which is ludicrous and will never happen. Even if passed it would be considered chump change in Washington and NYC. The world is inundated with unsound money – fiat currency. The intelligent are buying gold and silver. The run in India and China is large, but Europe has gone crazy. There is very little supply on the Continent as well as in the UK. The long 11-year first stage of the gold and silver bull market has been completed. The second stage should move up to $2,500 to $3,000. Stage three should take gold to $7,100 to $7,500 based just on real inflation since 1980. The speculative processes have begun as fiat currencies are abandoned. The Keynesian approach is finally being seen for what it is and that is the creation of money to make the system function, every time the system fails. This creates inflation, which robs individuals of the value of their assets. A subtle and secret tax that most people don't understand. It is perpetual wealth destruction. This concept of economics is aided by conspicuous consumption, which is incompatible with sound money. This concept of economics, which has been with us for some 90 years, is in the process of ending. How quickly we return to sound money at this point remains to be seen. The credit crisis, which we are still deeply enmeshed in, is the result such economic policies and has only been masked because the US dollar is the world's reserve currency. You have just seen the swift market judgment of the euro, which doesn't enjoy the same protection. This is despite the fact that on August 15, 1971 the dollar lost its hard money advantage by abandoning the dollar's gold backing. In spite of one recession after another the system survived up until the failures of Bear Stearns and Lehman Brothers. Those failures marked the exposure of a failed system, perpetuated by the use of derivatives. The solution to this credit crisis was to print more money and issue more credit by the Federal Reserve. Both Bear Stearns and Lehman were not bailed out, because Fed members wanted their assets. They did not recognize the terrible damage that would follow. Then there was the failure of AIG, which they had to rescue, after seeing the aftermath of Bear Stearns and Lehman and the terrible damage to the system that it caused. We are now beset by a sovereign debt crisis that will prove far more destructive than the previous ongoing crisis. It is now centered in Europe, but in time will engulf the entire world, due to interconnection from country to country of business, trade and the sale and distribution of debt by nations and corporations. In each instance what has happened will eventually bring about grave consequences, irrespective of what Wall Street, banking and Washingtonhave to say. In the US what seems to have been generally overlooked is that in reality only the financial sector has been bailed out and not the general economy. The taxpayers have not been bailed out and they will get to pay for Wall Street and banking's losses. It sounds like, and is similar to a feudal system. The problem is these half measures are not going to work – they only buy time, which makes the final collapse far worse than it would have been otherwise. The demise of Europe was a planned set piece. The conditions in Greecewere known for many years. For whatever reason, the creation of the elitists the euro, was to be destroyed and perhaps the EU as well. Internal factionalism obviously exists. The euro had become a viable threat to the supremacy of the dollar. Those in power in the US decided the euro and the strength of the euro zone and the EU had to be impaired. The destruction was potentially deliberate. The result is as we have seen, a new crisis that will take a few years to paper over. A rival to US supremacy has been crushed before it could proceed. We believe in this process that 19 nations will go into bankruptcy and that will affect all nations. That is only the beginning as many more will follow. Almost all are buried in upayable debt. They must if they are to survive, and bypass revolutionary changes, cut expenses by 1/3rd, as a beginning. In that process they have to hope that their currencies do not collapse and that their nations do not collapse in turmoil. What has made Europe's situation worse than the fallout after the Lehman episode is that the Europeans took too long to start moving on the problem, some five months, which is ridiculous. This shows you how muscle-bound politically and financially Europe really is. Europe's problem is structural deficits and the US has the same problems – socialist or fascist welfare states. They all lack revenue to fund commitments, so they issue debt, usually bonds to fund today's benefits, which will never be repaid. The promise of these benefits help keep government in office and power in the hands of the elitists. These benefits entrap the recipients in long-term dependency and servitude. When austerity enters the picture benefits are diminished and so is the politicians and elitists' power over the people. More often then not there is only a reduction in the growth of programs, no real austerity. That is what is going on now in Europe, England and the US. It doesn't fool anyone. Is it any wonder citizens are buying gold and silver coins, bullion and shares hand over fist? They envision a currency of lower value and an increased extraction of wealth. The next step is the guarantees fall away and revolution begins. In America, those making under $40,000 a year control 1% of assets. We'd call that a tinderbox. Forty-two percent of income comes from private sources and 28% from government sources. The rest belongs to the rich that clip coupons. This is a perfect example of an economy completely out of whack; a nation of indentured slaves. The Blitzkrieg attack on the UScredit crisis has neutralized the problem for now, but just wait awhile. A repeat is in the wings. We have recently heard from Spain and the news is not good. Next we imagine is England, which is close behind Japan and Greece in the debt hit parade. They like the others, Greece, Portugal, Ireland and Spain are about to under go austerity and at the same time increase taxes. That may look good, but it is a deadly combination, that can only lead to deflation, depressions and collapse. You can even throw in France for good measure. For those of you who do not know France is in serious trouble. A rare occasion indeed as we reported in our last issue – the head of the "Black Nobility" of the Illuminati, the Queen of England, has made sure the first piece of legislation to be introduced into Parliament by the new government will be a bill abolishing ID Cards, which the Labor government had introduced. The Queen wants freedoms and civil liberties restored. These plans were years in the making and for them to be pulled is a very important reversal of policy. The elitists have to be in serious trouble for this to happen. We already have ideas why and we will keep you abreast of what we find out. There is no question that over the almost last three years that the finance of the global recovery has been unsound, unstable and unsustainable. The Fed and other central banks and fiscal deficit spending gave banks, insurance companies, Wall Street and hedge funds leverage that some had just recently cashed out of. When the Dow was 6,550 we projected a technical and short covering move to 8,500, not knowing that the Fed was going to create more than $13 trillion in additional credit. The idea was to drive the stock markets higher and so they did. The poster child was the TARP (Troubled Asset Relief Program), which out of $700 billion some $600 billion is outstanding – money at near zero interest rates to leverage and gamble with. That is why world stock markets rallied far beyond where they should have – in the Dow the gap between 8,500 and 11,200. Why would government want to do that? Because it was the only place left to create wealth to keep the financial structure from collapsing. Needless to say, the "Plunge Protection Team" was employed continually over that 14-month period. That liquidity is still out there trying to hold the market up to keep the public believing all is well, when in fact all is not well. The Dow is at 10,000 and poised to go lower. Bonds are at all-time highs and interest rates have nowhere to go but up, resulting in bond losses. The banks, insurance companies, Wall Street and hedge funds are again de-leveraging, but this time the big losers won't be the hedge funds, it will be the banks, such as JPMorgan Chase, Goldman Sachs, Citigroup and Deutsche Bank. This has been the result of extraordinary stimulus in the financial sector. After this past month's 1,200 point Dow drop panic is setting in. Once the dollar triple tops to complete a head and shoulders at 89 the bottom will come out, particularly in the dollar carry trade. What has happened is the market rallies ran into another reality, the sovereign debt problem, generally emanating from Europe. We also had the fall in Chinese markets and a punctured real estate bubble in China. $2.1 trillion wasn't enough to rebuild the Chinese dream. In fact, as we speak more money is pouring from their Communist government into what will eventually be a failed economy. De-leveraging is underway worldwide – again. What this is all about is making money for the financial structure and it has little or nothing to do with helping the US economy. The debt crisis in Greece, and the rest of the PIIGS, plus England and the US, is not going away anytime soon. Bank de-leveraging has a long way to go. In Europe everything is done by committee, so no one gets blamed for any failures. A slow, bumbling stupid process that seldom brings positive results. Politicians and bureaucrats do not understand markets. They only know how to perpetuate themselves, thus Europe has compounded the problem and missed the boat. They do not even understand that the gambling and derivatives are gambling without funds, and if the player loses, innocent parties are destroyed. We believe the Greeks will default on their debt. It will be interesting to see who gets paid and who does not. European debt markets are upside down. It is really a sight to behold. Many bankers and governments made dreadful decisions and now they will have to pay the piper. Then there will be contagion, which will run rampant through Europe and spread worldwide. Will the euro hold at $1.20? Probably but it is a guess. It is up to the criminals in NYC who created this monster. As you have already seen the banks and hedge funds were on the wrong side of these markets, and have taken heavy hits. Wait until you see the second quarter numbers late in July, they'll be terrible. Worse yet, banks are still leveraged 40 to 1. The European stock markets continue to fall and the only reason the Dow is not at 8500 is that the US government is holding it up and other indexes as well. Liquidity has dried up and were it not for money creation by the Fed, Europe would be in a state of strangulation. The flipside is the US benefits, as the dollar strengthens, which if you noticed is not worth the paper it is written on. It is like 1998 to 2000, all over again, in spite of LTCM. These events just did not happen – they were created. This is all the work of Wall Street and the Fed. As you can see, the benefits of dollar revaluation and euro devaluation are at least temporarily coming to an end. If the dollar does not now break out to a new high we could see a sharp correction, as gold takes over as the world's only real currency. – This was a section from the most recent issue of the International Forecaster. You can read the full 35 page issue by using the information below to subscribe. THE INTERNATIONAL FORECASTER P. O. Box 510518, Punta Gorda, FL 33951-0518 Published and Edited by: Bob Chapman CHECK OUT OUR WEBSITE 1-YEAR $159.95 U.S. Funds US AND CANADIAN SUBSCRIBERS: Make check payable to Robert Chapman (NOTInternational Forecaster), and mail to P.O. Box 510518, Punta Gorda, FL 33951-0518. Please include name, address, telephone number and e-mail address. Or: We accept Visa and MasterCard charges. Provide us with your card number and expiration date. We will charge your card US$159.95 for a one-year subscription. You can email us in two separate emails (1- the Credit Card Number with full name, address and your telephone number and (2- the Expiration date on the card.

NON US OR CANADIANS SUBSCRIBERS: Due to the time that it takes for your mail to arrive to us from a foreign country, we would like for you to email us as above the CC information in two separate emails.

Note: We publish twice a month by surface mail or twice a week by E-mail. bob@intforecaster.com RADIO APPEARANCES: To check out all of our radio appearances click on this link below: |

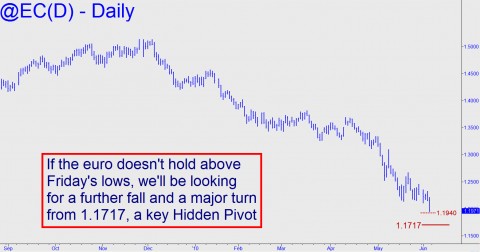

| Hints of a Bottom in U.S. Stocks and Euro Posted: 06 Jun 2010 01:28 PM PDT By Rick Ackerman, Rick's Picks The mirage of economic recovery conjured up by our political leaders and a credulous news media dimmed and flickered in the harsh light of reality on Friday, when grim employment figures for May sent stocks into one of their steepest dives of the year. Although 431,000 jobs were added last month, most of the workers were census-takers hired temporarily by the government. Even that figure evidently was ginned-up, since it appears that many of the workers had been laid off during intervals when there was little to do, only to be rehired later and recounted. But the bottom line for private-sectoremployment was a paltry 41,000 new hires, the smallest increase since January. Wall Street did not exactly take the news in stride, and the broad averages fell as though the data had caught most traders by surprise. Index futures had head-faked overnight to trap bulls, but by day's end the blue chip Dow Average was down 323 points. We would caution bears against becoming overly confident, however, since there are several technical factors coming into alignment that augur a potentially sharp reversal in the broad averages and some important trading vehicles that we track. For one, at Friday's low of 1059, the E-Mini S&Ps was within 37 points of a longstanding "Hidden Pivot" target of ours at 1022. That's equivalent to about 300 more points in the Dow, and it could easily be reached this week if sellers continue to hit stocks on Monday morning as they did on Friday. Bullion 'Vulnerable' The euro may also be close to an important turn after having been savaged since mid-April, when the currency hovered just above $1.37. On Friday, heavy selling drove it below 1.20 for the first time since 2005. The precise intraday low on the June Comex contract was 1.1955 — 0.0015 points from our downside target of 1.1940 – so the bottom could already be in. However, this week's action is still needed to confirm a bottom, since even a small overshoot of the 1.1940 target or a close below it would imply additional risk all the way down to exactly 1.1717. A rally in the euro would imply at least a respite for the U.S. dollar, which has pushed steadily higher since December and recently accelerated to the upside. We also see potentially corresponding weakness in bullion prices – silver relatively more so than gold. If you're interested in a detailed analysis of both but don't subscribe, consider taking a free week's trial to Rick's Picks by clicking here. Get this commentary delivered via email each morning at 7AM. Rick's Picks is a trading newsletter for stock, gold, silver and mini-indexes. All trades are based on the proprietary Hidden Pivot technical analysis method. © Rick Ackerman and www.rickackerman.com, 2010. |

| Broad Market Internals Are Pointing To Higher Prices Posted: 06 Jun 2010 01:21 PM PDT By Chris Vermeulen, TheGoldAndOilGuy It was another extremely volatile week sharp rallies followed by sharp sell offs. Fear is in no doubt controlling the market. The bulls and bears continue to battle it out. The charts below cover some important trends and market internals I pay attention to on a daily basis. US Dollar Index – Daily ChartThe past two months the dollar as been in rally mode. The last 14 days we have seen a large bullish pennant form and this pattern typically marks the half way point for the current tend. The measured move for the USD is pointing to 93 over the next few months. Gold Futures Prices – Daily ChartGold as we all know is seen as the major safe haven and the price per ounce has been steadily climbing. Friday we saw the major indexes sell down very hard but both the dollar and gold posted some solid gains. Gold does looks as though it needs some time to digest the recent move higher and this could take a week or two before anything exciting happens but I am on the lookout for low risk setups. VIX – Volatility Index – 60 Minute ChartThis index measures the fear in the market. When fear is high and everyone is selling their positions we see the VIX jump in price. Over the past month we can see a possible Head & Shoulders pattern forming. If this pattern unfolds like it should then we will see the price of equities bottom in the coming week with the VIX dropping below the blue neckline. The old saying is "When the VIX is High is time to Buy, when the VIX is low its time to Go". Put Call Ration – 60 Minute ChartIn short, when the put/call ration is over 1.00 then there are more traders/investors buying Put Options than Call Options. Put options are when people are buying leverage to take advantage of lower prices. My thought/opinion about this is when more people are trading with leverage anticipating lower prices, I figure they have sold all their long positions and are now using leverage to profit from lower prices. Well if the majority of individuals have sold everything then in reality there should not be much left to be sold… So I feel this correction which started in April is almost finished. NYSE Advance/Decline Line – 60 Minute ChartThis is one of my favorite charts to look at. While there are several indicators, market internals and technical analysis needed to clearly determine if the market is currently overbought or oversold, this chart is one that can help give you a good idea if you should be looking to buy, short or just stay in cash for the time being. SP500 Futures Prices- 2 Hour ChartThe SP500 has been up and down like a yo-yo with some very dramatic moves. Up 2+% day down 2+% the next… very sharp and powerful moves can be both every profitable or costly if not traded correctly. Last week we caught a nice 2% gain in less than 24 hours which was an exciting trade. It looked at though the market was about to breakout to the upside and possibly reach the 1150 level but early Friday morning there were rumors about some Euro bank having serious problems and that was just enough to cause a domino effect sending the market lower throughout the entire session closing on a very strong negative note for the day/week. That being said the market internals are indicating that equities are oversold at these current prices and a bounce is due any time. With the panic selling on the NYSE Friday reaching 119 sell orders for every 1 buy order I think we will see some follow through next week with lower prices, then a rebound once investors finish selling everything they own at which point we will be looking to get involved again. Weekly Trading Conclusion:In short, money continues to flow into the safe havens (Gold & US Dollar). The major indices are showing extreme panic selling and look ready to in the next few days. There is a possibility that the market could break down and start another major leg lower which is a big concern to me. I will be glued to the market internals and support levels for the major commodities and equity sectors in hopes to catch the bottom or to avoid another melt down. If you would like to receive my Daily Pre-Market Videos and Trading Alerts please checkout my website at: www.FuturesTradingSignals.com Chris Vermeulen Get My Free Weekly Technical Updates Free Below: |