Gold World News Flash |

- Jim?s Mailbox

- Gold and silver progress report

- Trend Trading Gold, Silver, Oil & SP500

- EU Spins Out of Control... Aliens, the Next Fear-Based Meme?

- Lose Your Illusions

- Both China & India Want To Buy IMF Gold

- Mr. Denninger and Gold or Why the Dollar-Deflationists Are Wrong

- Report From Europe: Stocks Seek Direction in Holiday Thinned Trading

- Gold And the Budget Deficit

- Europe's Coming Summer Of Discontent

- Zero Hedge Video Analysis Reveals Paintball Guns, Secret Turkish Weapon

- Asian Metals Market Update

- Franklin Sanders Talking On Silver And...

- May's Top Five ETFs

- Guarding Your Money from Government Onslaughts

- There Are More Millionaires in China Than France

- The $5 Trillion Debt Tsunami

- Will Canada Lead G7 Rate Hikes?

- European Cross Country Bond Spreads

- James Turk: Is gold in a bubble?

- Bank Of International Settlements Warns To Ignore Banker "Doomsday Scenario" Fearmongering And Racketeering

- Brink Of Collapse Coming Faster Than Expected

- Presenting A Dutch Proposal To Stop GoM Oil Spill "Within Days"

- Jeff Gundlach Warns Massive Asset Managers Like PIMCO And BlackRock Are Greater TBTF Risk Than Citi

- Jim's Mailbox

- Gold and Silver's Daily Review

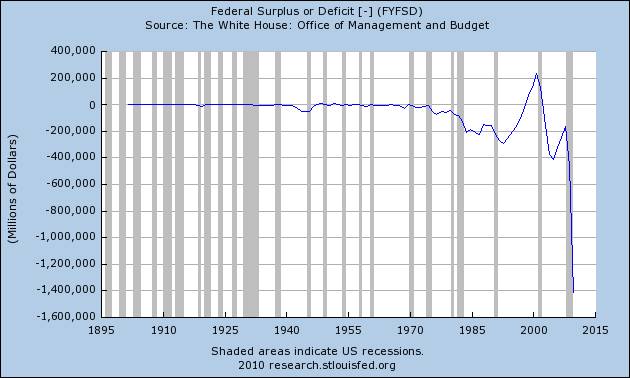

- Worst Deficit in 100 Years

- State Pensions: I'll Buy Your Bonds if You Buy Mine

- Coming Soon To A Theatre Near You

- Was AIG Chronically Underreserved in Its Property and Casualty Lines? (Part II)

- Following the Smart Money Into General Electric

- Facebook Hottie Has a Dark Side

- Bernanke Fiddles While U.S. Burns

- Austria 2010 50€ Gold Coin Commemorates Physician Clemens von Pirquet

- Everyone now knows gold is suppressed, but what’s the difference?

- Jim Willie explains how infinite money can take gold down in secret

- Two replies to Brett Arends’ disparaging of gold in The Wall Street Journal

- Gold Up 3% in May as Commodities and Stocks Fall Sharply

- ETF Trends' May ETF Performance Report

- Dead Global Economy Walking

- ECB Conducts Third Sterilization Procedure, To Withdraw Another €35 Billion In Liquidity

- Bank Failures: The U.S. Economic Contagion

- Investment Strategy for Volatile Markets – Embrace Volatility

- Proof Media in Total Moral Hazard When Forbes Compares BP with Goldman

- Its Coming To America

- Faber: U.S. Inflation to Approach Zimbabwe Level

| Posted: 31 May 2010 07:36 PM PDT View the original post at jsmineset.com... May 31, 2010 02:14 PM Dear LT, It is kind of a lopsided cup but it puts 1650 or so in range very soon. What are your thoughts on the formation? Best, CIGA BT Dear BT, The price is right at $1650. The time is on or before January 14th 2011 or as Armstrong says, June of 2011. Regards, Jim Jim Sinclair’s Commentary A question that weights heavily on my mind. Notes From Underground: NEWSFLASH-we are downgrading FITCH! By Yra We couldn't resist taking this shot at the late-Friday news that Fitch downgraded Spanish debt to AA+ from AAA, which left us dazed and confused. Why did this ratings agency decide to release this on the Memorial Day weekend when the markets were thin and subject to a very volatile reaction? This decision is not of consequence as S&P downgraded Spanish debt in April. Could this ratings release not have waited until Tuesday when the markets were back at full strength and had ... | ||||

| Gold and silver progress report Posted: 31 May 2010 07:36 PM PDT The debate currently taking place between gold bulls and gold bears is whether or not the central banks of the world are adding to the money supply of the world, or if money supply is contracting. If bankers are increasing the supply, then the price of gold will rise in terms of this inflated money, (although gold does not really rise in price, it simply holds its value while fiat money loses value, thereby giving the appearance of rising). One way to determine whether or not money supply is increasing is to look for reasons why the money supply would be increasing. This is because we are not sure if we can trust governments to tell us ‘the truth, the whole truth and nothing but the truth’ when they publish their reports. We know for sure the US CPI and unemployment reports are continually ‘under-reported’, so why not the money supply? After all the FED refuses to open its books to Congress. This chart courtesy Federal Reserve Ban... | ||||

| Trend Trading Gold, Silver, Oil & SP500 Posted: 31 May 2010 07:36 PM PDT Last week looked and felt like a pivotal week for both stocks and commodities. The past two weeks have had investors and traders in a panic as they try to find safe investments for their money. After watching and reviewing the panic selling in the market it looks as though the majority decided to sell everything and be in cash for the time being. This is bullish for the stock market. I will admit it has been tougher to trade recently because of increased risk levels due to the large 2-4% sell offs and rallies happening within minutes… While this is amazing for disciplined and experienced traders who are able to pull the trigger getting in and out with quick profit in the matter of minutes, this same price action can blow up trading accounts of those who do not have a trading strategy, money management and the discipline to take profits and cut losses very quickly. The speed of the rallies and sell offs is the matter of being up or down thousand of dollars in ... | ||||

| EU Spins Out of Control... Aliens, the Next Fear-Based Meme? Posted: 31 May 2010 07:35 PM PDT EU Spins Out of Control Monday, May 31, 2010 – by Staff Report Jose L. Zapatero Euro under new pressure after Spain's debt rating is downgraded ... Markets set to fall after ratings agency Fitch strips Spain of AAA score ... French debt rating also threatened, says budget minister Francois Baroin ... Spain's Jose Luis Rodriguez Zapatero (left) struggled to gain support for austerity measures. His government may also face a general strike. ... The euro is expected to come under further pressure tomorrow as Spain's minority government teeters on the brink of collapse and traders fear contagion throughout the eurozone after a senior French minister admitted that his country's top-notch credit rating was under threat. Stock and debt markets are likely to take a battering after the decision on Friday by the ratings agency Fitch to strip Spain of its coveted AAA credit score, the second downgrade in a month. Fitch's decision was announced after the markets ... | ||||

| Posted: 31 May 2010 07:35 PM PDT www.preciousmetalstockreview.com May 29, 2010 It was a strange week indeed as markets appeared to move higher, only to lose gains near the end of the day giving false confidence to market participants. The question remains whether this is the start of the second leg of the bear market. The week culminated with a loss for the month in most markets worldwide as Spain followed Greece down the road to downgrade hell. Portugal will likely be next on the list which is growing. And yes, the US is on that list. I don’t know why they announce these decisions near the end of the trading week when they could have waited until the markets were closed. It sent the US markets reeling into the long Memorial Day weekend, not that I really mind, but it could be seen as manipulative. Metals review Gold rallied back from support and finished the week off with a 3.18% gain. As usual, the options expiry that I neglected to mention last week came and went on May 25, which just... | ||||

| Both China & India Want To Buy IMF Gold Posted: 31 May 2010 07:35 PM PDT Stop listening to what the idiots on the financial news say and start paying attention to what the movers and shakers of this world are doing. George Soros says gold is "the ultimate-bubble", but goes and buys a bunch of gold. In the world of trading, this is called "talking your book." China and India are desperately looking to diversify out of their failing fiat currency holdings and the only logical option is gold. The dollar will fail, the euro will fail... all paper currencies will reach their intrinsic value of zero. Gold, at this point, is not a commodity. It's trading patterns indicate that it is now being treated as the ultimate currency. As the stability of the world degenerates into cyclical chaos gold will increasingly be sought-after as an anchor in an uncertain world. Remember that we are in a paradigm-shift in power. The west is in decline and the east is on the ascent. The dollar, which used to be "as good as gold" is now a relic of the past. Gold is now taking on t... | ||||

| Mr. Denninger and Gold or Why the Dollar-Deflationists Are Wrong Posted: 31 May 2010 06:03 PM PDT Those who know Mr. Denninger know that he, well, for lack of a better word, hates Gold. It only goes to show the level of disinformation and ignorance prevalent in our society when even smart people like Karl fail to get it. From what I hear anybody even mentioning the word Gold runs the risk of being permanently banned from one of his "forums". In a recent commentary entitled "Ten Things for 2010" he was at it again bashing Gold. | ||||

| Report From Europe: Stocks Seek Direction in Holiday Thinned Trading Posted: 31 May 2010 05:52 PM PDT The Mole submits: Friday looked to be a calm day after the large rise in global stock markets, Thursday's volatility had drifted lower, stocks were mixed to small better and credit spreads were tighter, but then the genius rating agency Fitch thought that the market needed a small present to liven things up, so Spain was downgraded at 17.35 BST ahead of a long liquidity drained holiday weekend in the UK and US from AAA to AA+ and this sent Dow Jones down 120 points in a few minutes. Sure, don’t get me wrong, I think Fitch is right – Spain isn’t AAA anymore and haven’t traded like a AAA sovereign for many months, in fact Spain trade wider in CDS and in govt spread than many much lower rated sovereigns. Rating agencies are backward looking modelling guys, that can’t see trends coming. But it’s just their timing is as ever pants. The problems for Spain started in 2007 and back then it was easy to see that this might cause huge changes to Spain’s property markets and banking industry, but now Spain is actually trying to reform the banking sector i.e. consolidation of Caja’s or savings banks (12 of 45 of which have begun merger talks and a 13th has been rescued by the central bank) reform the labour market in close cooperation with unions, and furthermore just announced and ratified the largest austerity plans in the countries history. I must admit that I have lost the respect for the rating agencies long ago and I don’t think I’m alone, politicians across the globe seem to be in the same camp and if the investor base would lobby for a change as well, then I think the glory days for S&P, Moody's and Fitch would be over very, very soon. Complete Story » | ||||

| Posted: 31 May 2010 05:39 PM PDT | ||||

| Europe's Coming Summer Of Discontent Posted: 31 May 2010 05:18 PM PDT

You see, most Europeans have become very accustomed to the social welfare state. Tens of millions of Europeans aren't about to let anyone cut their welfare payments or the wages on their cushy government jobs. In most of the European nations that are experiencing big financial problems there are very powerful unions and labor organizations that do not want anything to do with austerity measures and that are already mobilizing. As the IMF and the ECB continue to push austerity measures all over Europe this summer, the chaos that we witnessed in Greece could end up being repeated over and over again across the continent. This could truly be Europe's summer of discontent. The following are just a few of the countries that we should be watching very carefully in the months ahead.... Spain In many ways, the economic situation in Spain is now even worse than the economic situation in Greece. Spain's unemployment was already above 20 percent even before this recent crisis. There are now 4.6 million people without jobs in Spain. There are 1.6 million unsold properties in Spain, six times the level per capita in the United States. Total public/private debt in Spain has reached 270 percent of GDP. But this past week things really started to spin out of control in Spain. Ambrose Evans-Pritchard of The Telegraph describes the current situation in Spain this way.... For Spain it has been a horrible week. The central bank seized CajaSur and imposed draconian write-down rules on banks to restore confidence. The Spanish Socialist and Workers Party (PSOE) of Jose Luis Zapatero then rammed a 5pc cut in public wages through the Cortes by a single vote, shattering consensus. The government cannot hope to pass a budget. Its own trade union base is planning a general strike. The austerity measures that Spain has been pressured to implement have proven so unpopular in Spain that many are now projecting that Spain's socialist government will be forced to call early elections. Spain finds itself in a very difficult position. They have a debt that they cannot possibly handle, the IMF and the ECB are pressuring Spain to implement austerity measures which are wildly unpopular with the public, and if Spain does implement those austerity measures it may send the Spanish economy into a downward spiral. In addition, the fact that Fitch Ratings has stripped Spain of its AAA status has pushed Spain to the edge of financial oblivion. A recent editorial inEl Pais spoke of the "perverse spiral" that Spain's economy is entering.... "The Fitch note drives home the apparently unsolvable contradiction in which the Spanish economy finds itself. To maintain debt solvency Spain must squeeze public spending: yet this policy undermines the chances of recovery which itself causes further loss of confidence." And Spain's very powerful labor organizations are not about to take these austerity measures sitting down. In fact, the two largest trade unions in Spain are already calling for a general strike. So could Spain end up being the next Greece? France France admitted on Sunday that keeping its top-notch credit rating would be "a stretch" without some tough budget decisions. But French citizens are not too keen on belt-tightening. We all remember the massive riots in France a few years ago when it was proposed the the work week should be shortened. It certainly seems unlikely that the French will accept "tough budget decisions" without making some serious noise. Italy The Italian government recently approved austerity measures worth 24 billion euros for the years 2011-2012. But the Italian public is less than thrilled about it. In fact, Italy's largest union has announced that it will propose to its members a general strike at the end of June to protest these measures. Portugal Under pressure from the IMF and the ECB, Portugal has agreed to impose fresh austerity measures that include much higher taxes and very deep budget cuts. And the truth is that Portugal desperately needs to do something to get their finances under control. Recent EU data shows that Portugal's total debt is 331 percent of GDP, compared to only 224 percent for Greece. So will the Portuguese public accept these austerity measures? It doesn't seem likely. In fact, Fernando Texeira dos Santos, Portugal's finance minister, says that he expects "violent episodes" comparable to those in Greece but insists that there is no other option. So it promises to be a wild summer in Portugal. The CGTP trade union federation in Portugal has promised to mobilize their members.... "Either we come up with a very strong reaction or we will be reduced to bread and water." Romania They have already been rioting in the streets in Romania. Tens of thousands of workers and pensioners recently took to the streets in Romania to protest the harsh austerity measures that the Romanian government is imposing at the request of the International Monetary Fund. The Romanian people have been through incredibly hard times before, and they aren't about to let the IMF and the ECB impose strict austerity measures on them without a fight. Germany It is being reported that Germans are bracing themselves for a "bitter" round of government budget cuts. It seems that even Germany has some belt-tightening to do. In addition, resentment is rising fast in Germany as the population there realizes that it is Germany that is going to be the one funding a large portion of the bailouts for these other European nations. How long will the German people be able to control their tempers? Ireland The Wall Street Journal is warning that Ireland could be Europe's next financial basket case. Why? Well, the Irish have gotten into a ton of debt, and they are now finding it very expensive to finance new debt. The Irish government is now paying approximately 2.2 percentage points more than Germany is to borrow money for 10 years, while Spain (even with their economy in such a state of disaster) only has to pay 1.6 percentage points more than Germany. But if "austerity measures" come to Ireland, how do you think the public will react? It likely would not be pretty. The United Kingdom The exploding debt situation in the U.K. was a major issue in the most recent election. David Cameron promised the voters to get the U.K.'s exploding debt situation under control. But the coming budget cuts are likely to be incredibly painful. In fact, Bank of England governor Mervyn King has even gone so far as to warn that public anger over the coming austerity measures will be so painful that whichever party is seen as responsible will be out of power for a generation. But it isn't just national governments that are in trouble in Europe. The European Central Bank is warning that eurozone banks could face up to 195 billion euros in losses during a "second wave" of economic problems over the next 18 months. The truth is that almost everyone is expecting the next couple of years to be very tough economically all across Europe. But the vast majority of the European public is not going to understand the economics behind what is happening. All most of them are going to know is that the budget reductions, tax increases and pay cuts really, really hurt and that is likely to result in a whole lot of anger. When Europeans get really angry it isn't pretty. If what happened in Greece is any indication, this upcoming summer and fall could be a really wild one throughout Europe. "Euroland, burned down. A continent on the way to bankruptcy" | ||||

| Zero Hedge Video Analysis Reveals Paintball Guns, Secret Turkish Weapon Posted: 31 May 2010 05:10 PM PDT Tellingly, a number of commentators on the recent "Gaza Flotilla" kerfuffle, including some right here on Zero Hedge, appear to have fallen prey to the seductive wiles of the Palestinian (and now Turkish) propaganda ministry, painting the Israeli Defense Forces as a "go in guns blazing" murder squad victimizing a few, poor, international protesters on an innocent blockade runner on a diplomatic mission that absolutely, positively did not intercept those transmissions. True, it seemed quite unlikely that the IDF would board a blockade runner ("Darth Vader. Only you could be so bold.") with just paintball guns, but exclusive Zero Hedge analysis can now reveal that not only did IDF forces board the Mavi Marmara with sidearms holstered and only paint ball guns as their primary weapons, but, in what must be the most significant Israeli intelligence failure in decades, they were unwittingly lured into facing a historic and potent enemy they could not hope to vanquish with colored ink. We refer, of course, to Turkish cavalry.

While surely unconventional to deploy at sea, Turkish cavalry has commanded fear and respect since the Battle of Bapheus in 1302, and, in more contemporary times, in the Greco-Turkish war between 1919 and 1922, most notably in the Battle of Dumlup?nar, finally vanquishing the Greek presence in Anatolia. Indeed, had we not seen the video with our own eyes, it would be difficult to credit the addition of Marine Cavalry units to the asymmetric order of battle facing the IDF, but the video evidence is incontrovertible. Our frame by frame analysis of IDF provided video clearly shows the presence of feared Turkish Marine Cavalry on board the Mavi Marmara.

Frame-by-Frame Slow Motion Analysis

IDF Member with Paintball Gun

Dreaded Turkish Cavalry | ||||

| Posted: 31 May 2010 05:04 PM PDT Rise in geopolitical risk after the Israeli raid at Gaza strip on a ship carrying aid resulted in gold rising. The rise in geopolitical risk will only result in gold rising further and nothing else. After North Korea its Israel now. Technically gold looks headed for $1256 and $1356. Over the past few years after 7/7 geopolitical risk has failed to support gold but I do not expect history to repeat itself. | ||||

| Franklin Sanders Talking On Silver And... Posted: 31 May 2010 05:00 PM PDT | ||||

| Posted: 31 May 2010 04:50 PM PDT Dan Pritch submits: After one of the most tumultuous months in stocks investors have seen since the financial collapse, it’s instructive to take a look back and see which ETFs fared well through the flash crash, an imploding EU, an environmental disaster in the gulf unfolding before our eyes and a possible war brewing in the Koreas. For perspective, during the month of May, the broad-market S&P500 (SPY) lost 8%. I’ve included both some leveraged and non-leveraged ETFs to cover the gamut of sectors and types of ETFs in each bucket: May’s Hottest ETFs:SCO – UltraShort Oil – Up 36% - Oil started to crash hard during the month, perhaps not so much due to the BP disaster in the gulf, but more so due to concerns about a global economic contraction stemming from the troubles in Europe. As such, this ETF benefits from a declining crude trend, which while welcome to consumers, is often an indicator of the prospects for future global economic growth. Complete Story » | ||||

| Guarding Your Money from Government Onslaughts Posted: 31 May 2010 04:40 PM PDT Grandfather-economic-report.com is famous for presenting whole constellations, in graphic form, of horrors about the mess that fiat money and government, in the hands of incompetent do-gooders, has allowed. He writes that, in 2009, people worked, "3 times longer per year to pay all taxes more than they pay for food, housing and clothing combined." Yikes! This is where I learned that the combined onslaught of government (from local corruption to Congressional corruption) consumes half of all income in the USA! And this grasping, gobbling government colossus spends half of GDP, which to this day - to this day! - makes me have nightmares full of every post-apocalyptic horror movie I ever saw, pervasive darkness and gloom, dripping in despair and suffering, where government goons and killer robots relentlessly track down "undesirable" citizens, who, you gotta admit, are always the best looking men and the hottest hubba-hubba women of the whole bunch, which gives rise to the lesson that if you have to go down, these are the people to be with until then! Of course, there are many lessons in these movies beyond this timeless philosophical gem, such as not trusting anybody because they are probably aliens from outer space or government killer goons. Or both. Anyway, I thought I had made peace with myself about our system of governments consuming half of everything, but I entered a whole new land of fear and loathing (as Hunter Thompson might have termed it), when Grandfather goes on, "Increased government (at all levels) not only consumes national income by its spending, but their employees continually issue new regulations aimed at the reduced private sector, with the cost of compliance passed to the private sector as un-funded mandates to the tune of 15% of national income." By this time you are hardly paying attention, and are saying to yourself "Yeah, yeah, yeah. Tell me something new" in a kind of bored, I've-seen-it-all, "we're screwed" ennui, but without yawning. I was the same way! So, like you, I was not ready for him going on to say "Adding this 15% to the 49% spending ratio increases government's control-share of the economy to 64%", which bring our taxpayer's share of income down to 36%." Wow! The government consumes two-thirds of my income! And so we learn that in 2009, people worked, "3 times longer per year to pay all taxes, more than they pay for food, housing and clothing combined" when, in reality, the taxpayer is left with much, much, much less than that paltry estimate of 36% of gross income, and everyone is getting lesser and lesser, too, since taxes are rising and there is talk of, and the certainty of, new taxes, while inflation (which has the same effect as a tax) is rising and rising, and destined to rise some more, and then more and more until the very life is being crushed out of you by inflation in prices, which will happen because inflation in prices is caused by inflation in the money supply, which is caused by the monstrous Federal Reserve creating the extra money, which it does so that the despicable federal government can borrow and spend the extra money, which drives up the proportion of the economy that the government consumes, making it all worse and worse in a big, ugly spiral, spinning a round and around, spinning, spinning, spinning until you are so dizzy that you are think you are going to throw up, and then you realize that you are not puking your guts out because of vertigo, but because the government has destroyed the country! Of course, there is much, much more at grandfather-economic-report. How? The answer is that the Austrian school of economics - found free at Mises.org - makes it easy! So easy, in fact, that it makes you squirm in delight and exclaim, "Whee! This investing stuff is easy!" The Mogambo Guru | ||||

| There Are More Millionaires in China Than France Posted: 31 May 2010 04:21 PM PDT Imagine the looks on their faces, when Deng Xiaoping sold them out. The old commies in China had tried to make steel in backyard barbecues. They'd carried the fat Mao on a litter, on a long march to nowhere. They'd pretended his Little Red Book was more than drivel. They'd endured one absurdity after another...purges, starvation, and misery...all for the cause. And now this... "To get rich is glorious..." Xiaoping is alleged to have said.

Whether he said it or not, millions of Chinese took it to heart. They got richer, faster than any people ever had. The economy is now 10 times larger than it was then; it grew 300% just in the last 10 years. Incomes rose every year. There are now more millionaires in China than in France. Three times as many as in Britain. And more people are becoming millionaires there than anywhere else on earth. Three decades ago, the world's hinge creaked. Deng Xioaping opened a door in 1979. He announced a new oddity, a "socialist market economy." We can imagine the looks on faces in Washington and London too. And why shouldn't they gloat? They had won the Cold War; they had no idea that their victory would be fatal. China took the capitalist road in 1979. Russia was not far behind. By the mid-'80s, it was already spending half its entire output on its military. And then the Americans started talking about neutron bombs and a "star wars" program. Leonid Brezhnev had a stroke. His successors faced the challenge, first with perestroika and finally with capitulation. Meanwhile doors opened and shut in England, France and America, too. Maggie Thatcher moved into #10 Downing St. in 1979. Ronald Reagan brought 'Morning in America' to the White House in 1980. Like Thatcher and Xioaping, Reagan was determined to reduce the government's role in the economy. And in 1981, Francois Mitterand entered the Elysee Palace in France. His stated goal was the opposite - to increase state involvement in the economy. No matter what direction they claimed to be going, all the western economies ended up in more or less the same place - on the road to debt serfdom. While China got rich by encouraging (or perhaps merely allowing) capital formation, western nations got poorer, relatively, by consuming capital. In France, and much of the rest of Europe, government led the consumption boom. While households continued saving at relatively high levels, Mitterand raised the cost of the welfare state. Minimum wages went up 10% immediately. Then, he cut the workweek and added so many benefits for the workingman that the system barely worked at all. French government debt rose from 20% of GDP in 1980 to 80% now; in a couple more years, the government will have spent an entire year's output that France had not yet put out. In Britain and America, government spending rose too. But household spending went up even faster. The resulting boom was almost magical; the effects were diabolical. Britain went from a debt/GP ratio of 43% in 1980, to over 65% today. Its deficits rose up too and now are projected to be the highest in the European Union - as much as 13% of GDP. But the big expansion in both Britain and America was in private household debt. Combined with government borrowing, it pushed total debt from about 150% of GDP in the mid-'80s to as high as 400% today. Japan - the other major 'western' economy - has total government debt of nearly 200% of GDP. Its deficit is now so large that it must borrow an amount equal to the total it collects in income taxes. It is said, of course, that Japan has much debt but also much savings. The trouble is, the savings and the debt are largely the same money. Households saved. Government borrowed the money. The savings that are supposed to offset the debt have already been spent. All together, Europe, America and Japan have total government debt of about $32 trillion, compared to total output of $34 trillion. Add $50 trillion or so of private debt, and you begin to see the bottom of the hole. In other words, the developed economies have borrowed nearly 3 years' worth of future output. At 5% interest, (investors recently wanted Greece to pay 16%!) this means the western world must give up all the output from January 1st to the end of February just to stay in the same place. Meanwhile, back in China, last week's visit to Beijing revealed a glorious transformation. In the early '80s, a visit to China was a hardship. The streets were drab. The people were drabber, in their grey clothes and grey towns. They stared at tourists as they had never before seen a capitalist. Minders still accompanied tourists. Most of the country was off-limits. There were few private automobiles and few roads deserving of them. In just 3 decades Beijing has become one of the world's most dynamic, forward-leaning cities, with new Audis and Mercedes bumper to bumper...as far as the eye can see. There are sparkling office towers with millions of earnest workers...and gleaming hotels with sleek prostitutes in the lobbies. Chinese entrepreneurs hustle deals at every table. China is still an emerging economy. Europe, Japan and the USA, on the other hand, are submerging - sinking in a sea of debt. Getting rich is glorious. Getting poor is a damned shame. Bill Bonner | ||||

| Posted: 31 May 2010 04:06 PM PDT Bubbles, bubbles everywhere. And not a stock to buy. Even emerging economy stocks are expensive, according to Nouriel Roubini, the New York University professor who is famous for calling the U.S. housing bubble and the global financial crisis. Roubini is now warning that even in the places of the world where things grow, you should be on your guard. "In Brazil, like in many other emerging market economies," he told Bloomberg, "there is now evidence of overheating of the economy...Expected and actual inflation is starting to rise, and that implies that over the next few quarters there has to be a tightening of monetary policy, gradually but progressively, in order to make sure that inflation expectations remain anchored." This is the monetary tightening we expect to pop the Chinese real estate bubble. That is our proposition, anyway. It could be wrong. Chinese GDP grew by 11.9% in the first quarter. "China is struggling to contain the threat of an overheating economy in the face of rising house prices, inflationary wage increases and a continuing surge in money supply," reports the U.K.'s Telegraph. The rest of the world is trying to figure out how to get rid of rotting bank collateral without destroying the banks in the process. Meanwhile, Chinese banks continue their lending boom on real estate assets. Money supply (M1) grew up by 31% from last year, according to Guo Shuqing, the chairman of China Construction Bank. Remember, in 2009, Chinese banks lent out nearly US$1.5 trillion into the economy. The regulators in China have raised capital adequacy ratios at banks and introduced measures to try and drive speculators out of the real estate market. But it's not like bank lending is drying up. Total loans outstanding in the Chinese economy are on pace to grow by 18% this year, with another US$1 trillion in loans to hit the books. Yes. $1 trillion is less than $1.5 trillion. But it's more than half a trillion, which is about the amount of yuan loans made out in 2008 - before China's lending bubble went Nasdaq. As inflation is always and everywhere a monetary phenomenon, you don't increase the money supply that much without unleashing inflation. And inflation is afoot in China. Not in the stock market, though. The Shanghai Index is down 27% year-to-date. That may foreshadow the slowdown in the real economy to come. But in the meantime, Mr. Guo says that property prices have risen by 40% this year in some Chinese cities. "Property prices are definitely seeing something of a bubble," but it differs from city to city. Ah yes. All real estate is local. But all mortgage bubbles are national. This is true especially in markets - and we won't name names - where most of the lending is concentrated in just a few issues. This tells you where lending risk resides in a financial system. In the U.S. subprime bubble, that risk was transferred from the loan originator to investors, via Wall Street's securitisation machine. Lately, the risk has migrated back on to the public balance sheet via the nationalisation of the U.S. mortgage market by Fannie Mae, Freddie Mac, and the FHA. The ultimate repository of U.S. housing risk is now the United States government. How's that credit rating boys? In Europe, the risk of bad loans made during the boom now calls the euro home. That is, the euro stands the most to lose from Europe's version of a bad debt epidemic. But spare a thought for many of Europe's banks. Overnight, the European Central Bank warned that euro-zone banks may have to write off as much as $238 billion in bad loans over the next eighteen months. In this case, for the most part, the bad collateral has nothing to do with mortgages. Instead, its deadbeat sovereign debt that will be rescheduled, marked down, or defaulted on. But as bad as that loss figure is, and as much pressure as it would put on bank balance sheets, take a look at the chart below from International Monetary Fund's Global Financial Stability Report published in April. It shows that global banks have nearly $5 trillion of debt maturing in the next 36 months. Can you see what this means?  The problem for the banks - and for sovereign governments - is that there borrowing needs exceed the capacity of global savers to fund. The alternatives are deleveraging for the private sector and debt monetisation for the public sector. In other words, the banks will have to reduce the amount of debt and new credit issued in the economy (which leads to lower real growth rates) and central banks will have to buy debt issued by governments who cannot fund their deficits in public bond markets. We'll get to the consequences of that in just one minute. But you can see the problem of borrowing short-term when interest rates are low. The maturity schedule of bank debt and public sector debt is biased toward very short terms, when rates are low. This creates big problems when you have long-term assets (like mortgages) at fixed interest rate, but you borrow short term at variable rates (which are rising). Sure, it's also an interesting case study in how centrally rigged interest rates - which distort the cost of capital - create huge misallocations of capital in the real economy that ruin plans and lives. But you can see what's coming: a global contest for scarce capital. In that fight, we'd expect smaller regional banks that are not politically connected to either fail or be swallowed up by larger ones that enjoy government backing (including loan guarantees). But the general trend is not good. It is the continued concentration of risk in a smaller number of large and complex organisations whose chief assets are someone else's liabilities. Now you may be thinking that in a world of fiat money, there can be no capital crisis. The central bank can print more money to buy government debt. How can there ever be scarcity when you own a printing press. Or a helicopter? It's a fair point. But it prompts this rejoinder: do you think the supply of gold and other precious metals will grow as fast as the supply of paper money and government debt in the coming years? Do you? Australia's banking sector will have to weather the storm like all the rest. But it too, borrows short term and must roll over a lot of debt. You can see now that Australian institutions are competing with other global banks and governments for savings and capital. That should push up the cost of capital for Aussie banks, even if the Reserve Bank of Australia sits pat and does nothing. A higher cost of global capital probably wouldn't be such a good thing for the Aussie market, we reckon. Housing finance fell last month, according to data from the Reserve Bank of Australia. And house prices have finally stopped rising on the ocean of credit, according to the RP Data Rismark Hedonic National Home Value Index. Right then. Over the last 16 months national home prices have risen by an average of 12%. Late last week an IMF economist named Prakash Loungani said that house prices were still "well above historical values" in some places in the world, on a price-to-income basis. He included Australia in a list of those countries where prices are "misaligned" with incomes. Naturally, his analysis was rubbished by Australian property analysts who say that property remains affordable here because interest rates are low. ANZ property analyst Paul Braddick said the price-to-income ratio is fundamentally flawed because it, "explicitly ignore a key component of the housing affordability equation - interest rates." Well. Hmm. It's true that the amount of debt you can service is the key component of affordability. And the amount of debt to be serviced is a function of the interest rate. That's true. But the total amount of debt required to get into a house is a function of prices. And relative to incomes, Australian house prices are nuts. Besides, would you say that a drug addict is not an addict if he doesn't have access to smack? Are Australian houses affordable because credit is accessible, for now? Determining the affordability of something based on your ability to borrow money seems a little dubious. This makes the Mona Lisa and Ferraris affordable too, provided you can find a banker to lend to you. But obviously that's rubbish. At an intuitive level, most people understand that affordability is not based on whether you can get the loan from the bank. It's based on whether you can carry the loan without breaking the back of your financial plan. Obviously the banks and the real estate industry are keen to put you into debt. It's good for their business. But it might not be good for your life...at least when prices are this high. Dan Denning | ||||

| Will Canada Lead G7 Rate Hikes? Posted: 31 May 2010 03:32 PM PDT Reuters reports, World trade growth slows in 1st qtr:

The CPB report also showed a pickup in world industrial production:

Robust global trade helped Canada register a record 6.1% gain in Canadian GDP during Q1. Phred Dvorak of the WSJ reports, Canada's Growth Sets Stage for Rate Increase:

I think Mr. Porter is right, the Bank of Canada will likely raise rates on Tuesday. I met up with one of the best economists in Canada during lunch on Monday and he told me that he sees the Bank raising rates as well. As far as the US is concerned, he told me that strong productivity growth is allowing the Fed to remain on the sidelines "till September", but after that they too will start raising rates. In fact, he told me that policy rates around the world "are way too accommodating" and that too many bears are focused on events in Europe without understanding the improving fundamentals in the US. He's waiting for a payroll figure of over 500,000 on Friday, and I think it might even be higher. Anyway you slice it, fundamentals are improving, and rate hikes need to take place to remove some of the excess stimulus that was put in place to fight off the recession. It looks like Canada will be the first among the G7 to start hiking rates. It will be gradual, but expect more rate hikes ahead in Canada and elsewhere. | ||||

| European Cross Country Bond Spreads Posted: 31 May 2010 03:32 PM PDT As we embark on what will likely be another painful week for European markets, here is where all the cross country spreads are as of this moment. As compared to the stable German 10 year benchmark, the worst 5 continue to be the PIIGS, in the following order - Greece, Ireland, Portugal, Spain and Italy. The tightest spreads are for Finland, Holland, France, Austria, and Belgium. We anticipate some further divergence between the PIIGS and the rest of Europe by the end of the week. | ||||

| James Turk: Is gold in a bubble? Posted: 31 May 2010 01:26 PM PDT 9:25p ET Monday, May 31, 2010 Dear Friend of GATA and Gold: GoldMoney founder James Turk, editor of the Freemarket Gold & Money Report and consultant to GATA, notes several recent references to a bubble in gold and argues that gold can't be in one yet because its value remains less than its price. Turk's commentary is headlined "Is Gold in a Bubble?" and you can find it at the GoldMoney Internet site here: http://goldmoney.com/is-gold-in-a-bubble.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: World Resource Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Coming Friday-Sunday, June 11-13, at the Dallas-Fort Worth Airport Marriot: The conference will explore the dangers and opportunities in today's bullion markets and the need for investors to diversify bullion holdings outside of bullion banking and commodities markets. Speakers will include David Morgan of Silver-Investor.com, Gold Anti-Trust Action Committee Chairman Bill Murphy, and Duncan Cameron and Philip Judge of Anglo Far-East Bullion Co. The earliest conference attendees on Saturday will be able to schedule one-on-one interviews for personal consultation with Anglo-Far East's experts on Sunday. To learn more about and register for the Anglo Far-East Bullion conference, please visit: http://www.anglofareast.com/seminar-registration/ | ||||

| Posted: 31 May 2010 01:24 PM PDT Over the past two years, the one strategy that has elicited the greatest amount of anger in the general population has been the traditional resolution to the "lowest common denominator" strategy of fearmongering or racketeering by the financial elite, any time it was faced with a status quo extinction event. The primary example is the Fed and Clearinghouse Association's threat that should the Fed be forced to disclose the details of its bailout of various banks (as two courts have already ordered it to do), the result would be the greatest run on US banks in history: "If the names of our member banks who borrow emergency funds are publicly disclosed, the likelihood that a borrowing bank's customers, counterparties and other market participants will draw a negative inference is great." This is nothing but the patronizing of the broader population by those who seek to preserve their millions in bonuses, while disguising their hypocrisy in bluster, and hoping that the topic will be promptly forgotten. Curiously one entity that has decided to take on this "fire and brimstone" head on and to warn the general population to ignore the bankers "doomsday scenarios" is the bankers' bank, the BIS. As the FT reports, according to a soon to be released report by the bank's Chief Economic Advisors Stephen Cecchetti, "Banks are exaggerating the economic effects of the regulations they are likely to face in the coming years." While his focus is on the implications of the passage of the Basel III treaty, and to preempt counter lobbying by the bank themselves, his argument can be extended to ever instance in which banks present scenarios of collapse should they not get their way: as Cecchetti points out: "the banks’ “doomsday scenarios” were based on their assuming “the maximum impact of the maximum change with the minimum behavioural change.” This is a huge point, as it means that even the failure of the TBTF banks could have been mitigated in the context of a controlled (and even uncontrolled) bankruptcy, and the only reason they were bailed out was to preserve the equity interests and the existing management team, period. This also means that the Fed and Treasury are nothing but vehicles for perpetuating Wall Street's status quo, as we have claimed from the very beginning. More from the FT:

Cecchetti continues:

If even the expert bankers of the Central Banks' Central Bank are saying enough to banking fearmongering, it is time our own politicians followed suit. But here is where the core problem arises: politicians are nothing but bought and paid for puppets of the financial system. And by consistently siding with the Fed and Wall Street in their baseless threat, the public's anger should be just as focused on Congress and Senate as it is on Wall Street. And while a purge of Wall Street can not occur within the confines of our legal system, as noted keenly by "The International", politicians can at least be voted out. Which is why we are confident there will be an incumbent bloodbath come November, as D.C. is nothing more than a lighting rid for all the pent up anger from years of patronizing (not to mention robbery) by the financial "elite" which always knows what is best for the US middle class, especially if that something involves getting even deeper in debt-facilitated slavery. | ||||

| Brink Of Collapse Coming Faster Than Expected Posted: 31 May 2010 12:41 PM PDT Euro under new pressure after Spain's debt rating is downgraded ... Markets set to fall after ratings agency Fitch strips Spain of AAA score ... French debt rating also threatened, says budget minister Francois Baroin ... Spain's Jose Luis Rodriguez Zapatero (left) struggled to gain support for austerity measures. His government may also face a general strike. ... The euro is expected to come under further pressure tomorrow as Spain's minority government teeters on the brink of collapse and traders fear contagion throughout the eurozone after a senior French minister admitted that his country's top-notch credit rating was under threat. Stock and debt markets are likely to take a battering after the decision on Friday by the ratings agency Fitch to strip Spain of its coveted AAA credit score, the second downgrade in a month. Fitch's decision was announced after the markets in closed, so traders will have their first chance tomorrow to react, although London and New York will be sidelined by bank holidays. – UK Guardian Dominant Social Theme: Things are tough and demand austerity. Free-Market Analysis: What a mess. As can be seen by the article excerpt above, the European Union threatens to come apart at the seams. The debt "contagion" is obviously not stopping, nor can it, given the monstrous overhang that is now being presented to world markets. Spain has been downgraded and other countries teeter on the precipice. We predicted recently that France was in bad shape, and events seem to be moving even faster than we expected – with French officials admitting that French credit ratings could also soon drop. More Here.. The Looming Financial Holocaust - Is Closer Than We Thought ... More Here.. This posting includes an audio/video/photo media file: Download Now | ||||

| Presenting A Dutch Proposal To Stop GoM Oil Spill "Within Days" Posted: 31 May 2010 12:23 PM PDT The Netherlands has experience with controlling water: 2,000 miles of dykes preventing the sea from flooding the country's nether regions have taught the Dutch a thing or two about hydroisolation and spillover control. Unfortunately, as the last 40 days or so demonstrate so amply, neither the US nor the UK have the faintest clue how to stop the GoM oil spill which is now entering into the realm of the surreal. Which is why it may be time to learn from those who do know something about the matter. Zero Hedge has received the following proposal from Van Den Noort Innovations BV, which asserts it can get the GoM oil spill under control within days, and it doesn't even involve nuking the continental shelf. From Johann H.R. van den Noort:

We are the first to admit we know nothing about the feasibility or practicality of the attached proposal, which is why we post it here and hopefully those who are experts on the topic can voice in. As the situation is indeed hopeless and getting worse, it may be time to consider every proposal, no matter how far-fetched it sounds. Stop the BP Oil Spill in the Gulf of Mexico:

This posting includes an audio/video/photo media file: Download Now | ||||

| Jeff Gundlach Warns Massive Asset Managers Like PIMCO And BlackRock Are Greater TBTF Risk Than Citi Posted: 31 May 2010 11:51 AM PDT In this brief interview with Morningstar, Doubleline's star MBS analyst, and the bane of TCW's existence, Jeff Gundlach, points out the glaringly obvious: i.e., that "if Citigroup was too big to fail, then so much greater is the risk for asset managers at a multiple of that market cap." Obviously the mortgage expert here is contemplating asset manager behemoths such as PIMCO and BlackRock, which have quietly become even more institutionalized within the fabric of the financial markets, than some of the TBTF banks. And without access to the Fed's discount window, liquidity threats to firms like PIMCO are exponentially greater than even for a bankrupt POS like Citigroup. No wonder Gross was offloading European sovereign debt with gusto as of last check. With total assets of over $1 trillion, saying that a failure by PIMCO, and by extension its Fed-unmoderatable counterparty risk, would have huge implications on the US financial system, is so obvious, that it is completely understandable that there is not one single provision in the Senator from Countrywide and the Congressman from Fannie's FinReg proposals on how to tackle this most recent threat to capital markets. From the Gundlach interview:

| ||||

| Posted: 31 May 2010 10:14 AM PDT Dear LT, It is kind of a lopsided cup but it puts 1650 or so in range very soon. What are your thoughts on the formation? Best, Dear BT, The price is right at $1650. The time is on or before January 14th 2011 or as Armstrong says, June of 2011. Regards,

Jim Sinclair's Commentary A question that weights heavily on my mind. Notes From Underground: NEWSFLASH-we are downgrading FITCH! We couldn't resist taking this shot at the late-Friday news that Fitch downgraded Spanish debt to AA+ from AAA, which left us dazed and confused. Why did this ratings agency decide to release this on the Memorial Day weekend when the markets were thin and subject to a very volatile reaction? This decision is not of consequence as S&P downgraded Spanish debt in April. Could this ratings release not have waited until Tuesday when the markets were back at full strength and had deeper liquidity? Would Fitch's reputation have suffered if they had waited another few days to make this inconsequential change? This action raises more questions about the rating agencies at a time when they are undergoing intense scrutiny. We at NOTES are always trying to find the illogic of markets and this is one of those instances. It leaves one to wonder if some of the "objective" actors in the markets are as objective as the markets want to believe? For the supreme idiocy of this Friday's action, we are downgrading FITCH, a company so removed from the reality of market action that it does not deserve the respect they have previously been accorded. It is time to reign in the power of the raters! | ||||

| Gold and Silver's Daily Review Posted: 31 May 2010 08:22 AM PDT "With a holiday today in the States and U.K. many will be assessing the near future of the market, particularly the €' future. With Spain being downgraded on Friday, the gold price held strong at $1,214, at the same level as the p.m. Fix in London. While the media says that opinions are divided on the future of the globe's monetary system, prudence points the way to invest." | ||||

| Posted: 31 May 2010 07:26 AM PDT (snippet) If bankers are increasing the supply, then the price of gold will rise in terms of this inflated money, (although gold does not really rise in price, it simply holds its value while fiat money loses value, thereby giving the appearance of rising). One way to determine whether or not money supply is increasing is to look for reasons why the money supply would be increasing. This is because we are not sure if we can trust governments to tell us 'the truth, the whole truth and nothing but the truth' when they publish their reports. We know for sure the US CPI and unemployment reports are continually 'under-reported', so why not the money supply? After all the FED refuses to open its books to Congress.  This chart courtesy Federal Reserve Bank of St. Louis shows the US government is running the worst deficits in more than 100 years. If the Federal Government were a family or a business faced with this kind of a deficit it would have to reduce spending and increase revenue or go bankrupt. A family or business has no other options. (Borrowing money only delays the inevitable). The US government, along with many other governments, decided years ago that they would not consider a reduction in spending. The most important goal for the average politician is to get re-elected. Spending keeps the voters happy and happy voters tend to re-elect. "When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it." Frederic Bastiat. The central banks oblige the politicians by printing the money and then loaning it to the government so the politicians can spend it. Since we cannot count on governments to reign in spending, would it be possible for them to increase revenue in order to reduce the deficit? Historically governments almost always raise taxes when they can justify it to the voters by claiming: "we have no other options", or "it's for the good of the country." Unfortunately a deficit as large as the one facing the US and a dozen other countries cannot be covered by increased taxation. Since governments have the ability to print money (an option not available to families and businesses), we can reach the conclusion that governments will continue to print money. To stop doing so would mean the end of a lucrative career for a good many politicians who have never had a job outside of public service. Since the financial problems facing the US and Europe cannot be solved without extreme and unpopular hardships, and since the 'solution' to this point has been to 'print baby print', we can be almost certain that the printing presses will continue to 'print away'. More Here..(summary) More and more people (worldwide) are becoming aware of the fact that 'all is not well' with the financial system. Fraud and corruption are evident in government and the banking industry. Gold will be seen as a beacon of safety. Recently in Greece people were willing to convert paper money for gold sovereigns at $399.00 ea, (the equivalent of $1,700.00 US dollars per ounce). The bull market in gold is barely underway and will move higher for many years! BUY ONLINE SILVER AND GOLD: Scottsdale Silver | ||||

| State Pensions: I'll Buy Your Bonds if You Buy Mine Posted: 31 May 2010 07:08 AM PDT | ||||

| Coming Soon To A Theatre Near You Posted: 31 May 2010 06:32 AM PDT By Captain Hook, Treasure Chests Make no mistake about it, what is happening in Greece and Thailand right now will be coming soon to a theatre near you as well, with a war between our bloated bureaucracy and the public at center. It's important to understand that the weaker periphery states in the Western alliance is just the beginning in a global affair, as Martin Armstrong points out in his latest, and that while being 'big daddy' of the sovereign debt debacle will postpone crisis in the US briefly as capital seeks safety in her markets, once this reaction is exhausted the U$$ Titanic America will be going down too. Therein, after the panic into US bonds (and stocks as a result of artificially lower rates) is done, rates will rise in the States as well, forcing the same budget cuts and austerity measures now being imposed on what is being described by the Western media sources (in justifying trading action) as the economic basket case, better known as Europe. Of course upon closer inspection of just who's who in terms of economic basket cases in the world as measured by the deficits a country is running, it might surprise some (people who live in a vacuum) that the idiot child Obama has the US right up near the top in this regard, meaning once the panic money runs out for Treasuries, rates will go through the roof overnight here too. This is naturally why we school getting out of debt as soon as possible, as when this trend begins, it will be both relentless and merciless, and in the end reveal the insolvency of America as well. It's only a matter of time in this regard. And again, it's coming to a theatre near you soon – to the stock exchanges, banks, and larger economy – so be prepared. Pay off your debts. Don't keep much money in the banks. Get stock certificates for precious metals shares you intend to keep. And buy as much gold and silver bullion as you can safely store. (i.e. in physical and allocated accounts.) With all this it's difficult believing in Martin Armstrong's call for new highs in stocks before a more severe collapse comes, however as you would know in reading these pages for sometime, if sentiment conditions remain favorable (bearish), anything is possible in our faulty and fraudulent markets. All we need is for US index open interest put / call ratios to begin trending higher and stocks would begin to rise as they are squeezed by liquidity and buying spurred by our price managing bureaucracy. Remember, it's there job to deceive the public in furthering their own interests (so they can tax you to death), and they will perform this function in borg like fashion until they ruin the economy long-term. This of course has now occurred, which is why they must work harder at it, but are still failing. The European Union's recent attempts to revive the euro is perhaps the best example of this we have had in some time, where after bailout measures to stabilize the PIGS failed to stabilize markets, along with yesterday's short selling ban, it's now anticipated a currency intervention will be announced prior to the weekend to goose the currency, bonds, and stocks higher in an effort to avoid a complete loss of confidence from developing. And the threat of currency intervention has been working into options expiry this week, as can be seen here, however one does need to wonder how long this will last once bearish euro speculators are squeezed out and / or options expire. And the same holds true for stocks in the States. Again, if the downtrends in US index open interest put / call ratios persist, which are updated here, while a bounce may arise, it's difficult see stocks getting much traction here all things considered. Side note: Remember, open interest put / call ratios are more important and can trend counter to those that simply measure volume, as positions are held overnight, making them a far stronger indication of true sentiment. What's more, not many traders / speculators are either aware and / or appreciate their importance in gauging sentiment today, which is why they still work while most other indicators have become redundant. Further to this, because of the present open interest configuration that has good put option related support for the S&P 500 (SPX) at 1100, which can be seen here in the May SPY option series, further price declines might not be possible until next week. It should be remembered however this might be exactly what the doctor ordered in terms of further tracing a potentially developing head and shoulders pattern in the trade, which can be seen below in the attached chart of the Dow. In terms of putting the larger picture together right now, you will remember from our last meeting the Dow / TSX (TSE) Ratio is possibly in the throws of triggering a monthly breakout above the 21-month exponential moving average (EMA), which Dr. Copper (a strong leading indicator) is suggesting will happen with its recent collapse. (See Figure 1) This is of course suggestive that despite the best laid plans on the part of the bureaucracy, that underneath it all, what's really happening is the economy is crashing again, led by round two of a real estate credit related collapse. What's more, as you can see in the attached data it's happening in real time, which when coupled with the likelihood bearish speculators are now exhausted on an intermediate-term basis, brings the curious mind to the conclusion stocks could be heading lower here, perhaps substantially lower. How much lower is substantially lower? Well, if the larger degree head and shoulders pattern in the Dow pictured below traces out, as you can see the 'crash zone' target is between 3,000 and 4,000, which is where one should expect to see the Dow / Gold Ratio (pictured in Figure 1) hitting a ratio of 1. Please note that in both Figures 1 and 2 the time lines are suggesting a turn lower is due right now as well. (See Figure 2) Unfortunately we cannot carry on past this point, as the remainder of this analysis is reserved for our subscribers. Of course if the above is the kind of analysis you are looking for this is easily remedied by visiting our web site to discover more about how our service can help you in not only this regard, but also in achieving your financial goals. As you will find, our recently reconstructed site includes such improvements as automated subscriptions, improvements to trend identifying / professionally annotated charts, to the more detailed quote pages exclusively designed for independent investors who like to stay on top of things. Here, in addition to improving our advisory service, our aim is to also provide a resource center, one where you have access to well presented 'key' information concerning the markets we cover. And if you are interested in finding out more about how our advisory service would have kept you on the right side of the equity and precious metals markets these past years, please take some time to review a publicly available and extensive archive located here, where you will find our track record speaks for itself. Naturally if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line. We very much enjoy hearing from you on these matters. Good investing all. Captain Hook The following is commentary that originally appeared at Treasure Chests for the benefit of subscribers on Thursday, May 20th, 2010. Copyright © 2010 treasurechests.info Inc. All rights reserved. Treasure Chests is a market timing service specializing in value-based position trading in the precious metals and equity markets with an orientation geared to identifying intermediate-term swing trading opportunities. Specific opportunities are identified utilizing a combination of fundamental, technical, and inter-market analysis. This style of investing has proven very successful for wealthy and sophisticated investors, as it reduces risk and enhances returns when the methodology is applied effectively. Those interested in discovering more about how the strategies described above can enhance your wealth should visit our web site at Treasure Chests. Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. We are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence. | ||||

| Was AIG Chronically Underreserved in Its Property and Casualty Lines? (Part II) Posted: 31 May 2010 05:54 AM PDT  David Merkel submits: David Merkel submits: One of the things you learn as a fundamental investor is that the quality of accounting derived from accrual entries is always lower than that for cash entries. There is an implicit assumption behind every accrual entry that someone will make good in the future to pay cash, whether the amount is fixed or estimated. Accruals vary in quality. Accounts Receivable are more reliable than inventories. Who knows what fixed assets, property, plant and equipment are worth? Pension obligations are squishy, the assumptions can be manipulated within reason. Deferred tax assets rely on the ability to earn more money, but most companies with the deferred tax assets have lost significant money in the past. Will the company bounce back? | ||||

| Following the Smart Money Into General Electric Posted: 31 May 2010 05:54 AM PDT Tom Armistead submits: General Electric (GE) was for many years an iconic company, considered good as gold in the glory days when Jack Welch was at the helm. The company's strength was seriously questioned during the meltdown in early 2009, and the last time I looked into buying it, shares were trading at 6.66, on 3/6/09. I didn't buy any. It has since recovered to close Friday at 16.35. At the current price, GE represents a chance to follow the smart money into financials, with substantial gains if the company can regain its former performance and stature. Buffett and GE - the smart money in this case would be Warren Buffett. Here is an excerpt from the 8-K, from October 2008: Complete Story » | ||||

| Facebook Hottie Has a Dark Side Posted: 31 May 2010 05:35 AM PDT By Rick Ackerman, Rick's Picks Quite the hottie, isn't she? That's "Rita Wilson" pictured below, and we didn't think twice about adding her as a Facebook friend when she sent us a request a while back. We figured we'd find out later who she was, but we were wrong. She doesn't answer e-mail queries, and Googling the name brings up only the actress Rita Wilson who is married to Tom Hanks. This Rita Wilson's Facebook biography says she lives in San Francisco. Because we lived there ourselves for more than 20 years, we thought that maybe there was a connection through some mutual friend or acquaintance. Alas, as far as we've been able to determine, Rita Wilson doesn't exist in the flesh. Rather, she appears to have been concocted by some PR firm tasked with hyping the shares of publically traded companies. This wasn't so obvious to us at first, since Rita's long list of Facebook friends comprises actual people from all over the world – people with eclectic interests and quirky things to say. There's Claire Louise Hay, for one, who wonders why her fish have been going haywire: "Why [do] my barb fish have such a life-defeating reaction to stress? When startled, they leap out of the water, usually hitting the lid, but sometimes hitting the kitchen surface or the floor. It's a wonder they're not extinct." This is not the kind of stuff you can make up, even if Rita Wilson is. Rita's Corporate 'Likes' As the weeks went by, however, the ever-expanding list of "Likes and Interests" linked from Rita's Facebook page began to look more and more like the client list of a public relations firm. Many of the companies are based in China, mainly in energy and resource-related businesses, but there are also some American firms, including Dreamworks and a Los Angeles Chevy dealer. The list has been growing by the week, so one can only surmise that Rita has been producing results for her clients. She even knows to flash a "Stop Your Tinnitus" ad at us when we visit her Facebook page. The condition has plagued us for years, but it's a little creepy to think that Rita somehow knew about this. Lately, Facebook founder Mark Zuckerberg has come under fire for trashing members' privacy online. Amidst all of the controversy, the point appears to have been lost that Facebook exists solely to collect information on all of us that it can peddle to advertisers and retailers. With the emergence of Rita Wilson, however, and who-knows-how-many other cyberagents like her to siphon up consumer data, the insidiousness of Zuckerberg's business model has been laid bare. It seems likely that he will be forced to retreat all the way on this issue. It should be interesting to see whether Facebook can survive if the company is unable to fulfill its primary mission of finding out all that can possibly be known about its members' shopping habits. (Update: I awoke Monday morning to discover that I had been de-Friended by "Rita".) (If you'd like to have Rick's Picks commentary delivered free each day to your e-mail box, click here.)

More articles from Rick Ackerman…. | ||||

| Bernanke Fiddles While U.S. Burns Posted: 31 May 2010 05:33 AM PDT By Jeff Nielson, Bullion Bulls Canada In 64 AD, the Great Fire of Rome occurred. It lasted for five days, and roughly half the city was seriously damaged or destroyed. This event took place during the rule of Emperor Nero Claudius Caesar Augustus Germanicus, more commonly known as "Nero".

There are serious doubts that Nero actually "fiddled" while Rome burned, particularly given the fact that the fiddle wouldn't be invented for another thousand years. Instead, his historical infamy appears to be mainly the product of his extravagant spending which threatened to bankrupt the Empire, combined with the ruthless persecution (and execution) of his enemies. He was also apparently prone to spreading rumors and propaganda among the citizenry, to cover-up his misdeeds and maintain his popularity.

Given the metaphor implied by the title, I'm sure there are many readers who believe it should have read "Obama fiddles" or "Democrats fiddle". Rest assured there is no error here. Barack Obama is only the President of the United States. The Democrats merely control the White House, and the two legislative chambers. Meanwhile, Ben Bernanke and the Federal Reserve control the money supply of the U.S.

The United States has an economy which is both saturated with debt, and dependent on ever-increasing injections of new debt in order to function – in other words it is a debt-addict. Given that every new U.S. dollar which is "printed" can only be created through inventing new debt (ever since the U.S. abandoned the "gold standard"), this makes Ben Bernanke and the Federal Reserve the originator of most U.S. government debt, and thus the "pusher" for this junkie-economy.

In pursuing the analogy of the Federal Reserve as drug-pusher, we must remember there are three ways in which the "pusher" exploits (and ultimately destroys) the addict. It is the pusher who first gets the addict "hooked", and then continues to supply the debilitating drug. It is the pusher who makes enormous profits off of this dependency. And it is the pusher who assures the addict that everything is fine, even as the addict's life spirals out of control. It is only when we understand the junkie-pusher relationship that we can understand the inherently malicious and parasitic nature of the Federal Reserve.

Given that the Federal Reserve was created in 1913, it took a relatively long time for the Fed to get the U.S. hooked on debt, as the graph below illustrates. However, now that the addiction has clearly taken hold, Bernanke (and the rest of the private bankers who own and operate the Federal Reserve) have created such a lethal addiction that a fatal debt-overdose (i.e. a default) is now the only possible outcome.

More articles from Bullion Bulls Canada…. | ||||

| Austria 2010 50€ Gold Coin Commemorates Physician Clemens von Pirquet Posted: 31 May 2010 05:30 AM PDT The commemorative series in gold "Celebrated Physicians of Austria" concludes with a coin for the renowned Viennese doctor, Clemens von Pirquet (1874-1929). Clemens von Pirquet was born in 1874 just outside Vienna. His father had been a member of the imperial parliament, and had proposed Bertha von Suttner for the Nobel Peace Prize (which she received in 1905). His son would be nominated for the Nobel Prize for Medicine five times, unfortunately without the same success. (…) © Austrian Mint for Coin News, 2010. | | ||||