Gold World News Flash |

- A tribute to Jeff Christian, loyal soldier in the battle against gold

- The Great Deceit

- Peeling Back the Layers of the Golden Ponzi Scheme

- Jim?s Mailbox

- How Money Works

- Total Fed Credit Takes Credit for Inflationary Nightmares

- An American Concept: Crushing Debt

- Manic Market, Innovation Cycle, Alzheimer’s Blockbuster, Reader Outrage, and More!

- Stock Markets & Gold. Tactical Update

- Client Update – Silver Quest Resources

- 'Goldman Sachs is the Undeclared Enemy of the State' - Jim Rickards

- Critical Juncture - Update on the euro, Australian dollar and Japanese yen

- Hidden Dollar Swap Hammer

- LGMR: Gold Bullish, Well Supported as Risk Eases. US Hits Frightening Deflation

- United Mining Group Poised For Production in Idaho’s Silver Valley

- But, You Sputtered, I'm Just A Hack....

- Gold Stock Trades on Taseko Mines

- Litigation Killing What Derivatives Aren?t

- If 1 + 1 Still Equals 2 Then Gold Should Explode!

- Make your Silver Years Golden

- The Gold & Silver Precious Metals Correction

- Why Deleveraging Is Necessary For Economic Recovery

- Insights about China and Nicaragua

- US Government to Kill Its Own Economy

- Gold Seeker Closing Report: Gold and Silver End Mixed While Stocks and Oil Surge Higher

- Miners Don't Gotta Mine

- Easy Money, Hard Truths?

- Will The USD Be Replaced By The SDR Or The CNY As The Next Reserve Currency?

- Guest Post: New to FINREG - Financial Equalization Proposal Gaining Momentum

- ‘Top Kill’ Effort Must Succeed or Else…

- Did JP Morgan Assassinate Lehman Brothers?

- Clang! Clang! $400 Gold Warning

- Gold Edges Lower, Silver Rises 0.9%

- 2010 US Quarters Silver Proof Set Issued

- Judy Shelton: The recovery starts with sound money

- Sentiment on Gold Deserves Some Tarnish

- Capital Gold Group Report: Why Gold Is a Sure Long-Term Bet

- Today's Action Hints the Gold Price Will Break Upwards

- Big Upswing Brings Nasdaq Green For 2010

- Japan Sliding Into Dodecatuple Dip Recession

- The Depression Of 2011? 23 Economic Warning Signs From Financial Authorities All Over The Globe

- In The News Today

- Forecasting U.S. Stock Returns

- Will French Minister's Announcement That Bailout Is Prohibited By Bailout Clause Lead To New EUR Weakness

- What Credit Ratings Are For

| A tribute to Jeff Christian, loyal soldier in the battle against gold Posted: 27 May 2010 06:16 PM PDT | ||||

| Posted: 27 May 2010 06:11 PM PDT It is the paper money created out of thin air that creates the unfair distribution of wealth that is making the middle class fall more behind and the poor more poor. Newly created money and credit in a paper money system benefits those that can access the money first and buy capital goods and real property at one price before the new money circulates and makes all prices go up. Wages also do not keep up with inflation and that creates another squeeze on the middle class. | ||||

| Peeling Back the Layers of the Golden Ponzi Scheme Posted: 27 May 2010 06:05 PM PDT | ||||

| Posted: 27 May 2010 06:03 PM PDT View the original post at jsmineset.com... May 27, 2010 03:57 PM Posted by CIGA Eric in April of 2010: "Many have observed that the money supply, now buried by the Fed, has been steady contracting since 2009. The continuation of M3, a broad money supply measure, indicates a negative year-over-year contraction. Many observers cite these trends as a precondition of deflation. Quite the contrary, this could be a precondition of aggressive inflation as keenly described in The Mystery of Banking. When prices are going up faster than the money supply, the people begin to experience a severe shortage of money, for they now face a shortage of cash balances relative to the much higher price levels. It the Fed’s response to the contraction, likely print money money, that will affect confidence in the dollar." More… Dear Jim, The end of the article appears to contain a bit of MOPE, but the "facts" contained herein regarding the FHA and the amount of loans they are backi... | ||||

| Posted: 27 May 2010 06:02 PM PDT View the original post at jsmineset.com... May 27, 2010 04:01 PM Dear CIGAs, What makes something a standard is because there is a restricted supply of it. From money.howstuffworks.com We have all seen those movies with rooms full of gold. Well this is far from reality. In fact there is very little gold around. Below is a metric tonne of gold. It is only 15 cubic inches. Only slightly larger than a milk crate! If you collected all the gold ever extracted from the earth and stacked it up in a column with the same base size as the Washington Monument you would get this. ALL THE GOLD IN THE WORLD!!! How big is a tonne of gold? Gold is traditionally weighed in Troy Ounces (31.1035 grammes). With the density of gold at 19.32 g/cm3, a troy ounce of gold would have a volume of 1.61 cm3. A metric tonne (equals 1,000kg = 32,150.72 troy ounces) of gold would therefore have a volume of 51,762 cm3 (i.e. 1.61 x 32,150.72), which would be equivalent to a cube of side 37.27cm (Appr... | ||||

| Total Fed Credit Takes Credit for Inflationary Nightmares Posted: 27 May 2010 06:02 PM PDT I was having another nightmare about how the inflation in consumer prices that is guaranteed by the Federal Reserve creating so much money (so that the loathsome Obama administration can borrow and spend it) was some kind of weird replay of The Lord of the Flies, which seems kind of odd since I haven't read, or thought about, that book since the '60s when I was required to read it for English class, and I really don't remember much about it except that there was a pig (which I assume was a metaphor for the Federal Reserve), and everyone reverted to acting like tribal savages, killing each other in gruesome fashion, which I assume was because inflation in prices was raging across the island and food cost so much that everybody was starving, which would explain angry people killing each other! Hey! This economics stuff is easy! I don't remember my teacher stressing this obvious metaphor, although, now that we are suffering due to the utter failure of the Federal Reserve, maybe he should... | ||||

| An American Concept: Crushing Debt Posted: 27 May 2010 06:02 PM PDT By David Galland, Managing Director, Casey Research Commenting on the European crisis – because this has gone well past being one that can be termed “Greek” – the New York Times cited a senior U.S. official on the significant role the U.S., including Obama himself, played in getting Europe’s leadership to agree to a bailout approaching one trillion. One particularly telling quote… The U.S. officials began talking to their counterparts about an American concept: overwhelming force. “It’s all about psychology,” said the senior official. Funny how these things work, isn’t it? In response to its own debt crisis, the U.S. mirrors the failed Japanese experiment in quantitative easing, except that we look to “fix” the flaw in that experiment with the overwhelming force of trillions upon trillions of unsupported spending, in the process making the idea of unleashing a money flood an “American concept... | ||||

| Manic Market, Innovation Cycle, Alzheimer’s Blockbuster, Reader Outrage, and More! Posted: 27 May 2010 06:02 PM PDT The 5 min. Forecast May 27, 2010 01:40 PM by Addison Wiggin & Ian Mathias [LIST] [*]Why Mr. Market is going manic [*]Oh, to be 28-years-old again: How one company is aiming to make it happen [*]The "innovation cycle" in a down economy [*]The Alzheimer's "blockbuster" dial an organ and a cure for deafness [*] Our “detachment from all that is decent”… readers outraged by our take on BP… our candid response [/LIST] An increasingly bipolar Mr. Market, to borrow a phrase from the inimitable James Grant, is having one of his manic episodes today. The Dow opened up 1.5% in the first half-hour of trading. China denied rumors that it’s about to bail out of its forex reserves held in euros. First-time jobless claims fell last week. And the Coast Guard says BP’s “top kill” effort to plug the oil blowout in the Gulf of Mexico appears to be working. All’s well with the world… until Mr. Market enters one of hi... | ||||

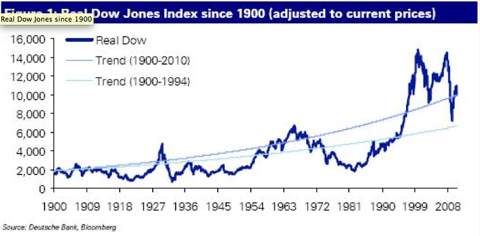

| Stock Markets & Gold. Tactical Update Posted: 27 May 2010 06:02 PM PDT Graceland Updates 4am-7am www.gracelandupdates.com Email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] May 27, 2010 1. Those sure that Tuesday's Dow action marked the bottom, (the "hammer" on the candle charts) were shocked 24hrs later, as the Dow posted a mirror image reversal day to the downside. This morning the Dow is once again surging, stunning the bears. 2. This is classic whipsaw action, a saw operated by the banksters, cleaning both shorts and longs off the stock market souvlaki stick. It is also only example number 800 billion, of why you must allocate your capital in a pyramid formation, not a huge price plop. 3. I have noted the danger of obsession in the market, and the greatest obsession in the gold community is: shorting the Dow. 1987, 1990, 1998, 2000, and 2007 are the 5 major shorting opportunities that have occurred since the great secular bull of the 1980s began, and has since been replaced by the secular bear i... | ||||

| Client Update – Silver Quest Resources Posted: 27 May 2010 06:02 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 27, 2010 10:11 AM Re-ignition of the Yukon – A step closer to the golden glow Yukon News Yesterday, Kaminak Gold announced drill results that have given new life to the Yukon Gold plays.* Kaminak intersected 15.5 metres of 17.1 g/t gold in their first drill hole of the season.* Their second drill hole, drilled from the same location but at a steeper angle intersected 2 significant gold bearing intersections including 1.26 g/t of gold over 60.23 metres and 1.15 g/t gold over 51.32 metres.* These results are promising for the entire Dawson Range district, including Silver Quest's Boulevard property which is located directly south and contiguous to Kaminak's Coffee project.* Boulevard has many geological similarities to both the Supremo Zone at Coffee and the Golden Saddle Deposit on Underworld's (Kinross') White Gold Property. Boulevard Status The Boulevard project has been exten... | ||||

| 'Goldman Sachs is the Undeclared Enemy of the State' - Jim Rickards Posted: 27 May 2010 06:02 PM PDT Gold didn't do much of anything in Far East trading on Wednesday... up just a few dollars from its New York close on Tuesday. And, as I mentioned in my closing comments in yesterday's column, once London opened, the activity level picked up quite a bit... with the London high in gold coming around 11:00 a.m. local time... which was 6:00 a.m. in New York. But that was it for the day, as gold basically traded sideways all through the rest of London trading, plus all of New York. Gold's high of the day [$1,217.80 spot] occurred shortly before 11:00 a.m. Eastern time. Volume was extremely light for the second day in a row... with no big buyers or sellers lurking about. But the roll-over and switching volume in gold is enormous... as today is the last day of trading for the May contract. Silver's price, as usual, was more 'volatile'... but generally followed the gold price. The high price point for silver occurred at the same time as gold's high... and that price... | ||||

| Critical Juncture - Update on the euro, Australian dollar and Japanese yen Posted: 27 May 2010 06:02 PM PDT Axel Merk, Portfolio Manager, Merk Mutual Funds May 27, 2010 Our long-term outlook on the euro remains more positive than that of many market participants. There are numerous reasons for our view, amongst others because it is more difficult to print and spend money in the eurozone. Fiscal coordination is rapidly improving in the eurozone, addressing the euro area's key deficiencies. Since the announcement of the $1 trillion credit line less than 3 weeks ago, Spain, Portugal and Italy have all passed substantial fiscal consolidation measures. Germany is also seizing the opportunity, proposing to reform labor markets. That said, the market is demanding more substantial changes that not only cut costs, but provide a catalyst for future growth. To achieve this, true reform of the labor markets is needed, including increasing the retirement age. Germany may be the leader in imposing austerity, but the country's bizarre approach to capital market reform ... | ||||

| Posted: 27 May 2010 06:02 PM PDT [FONT=Times New Roman]by Jim Willie CB May 26, 2010[/FONT] [FONT=Times New Roman]home: Golden Jackass website[/FONT] [FONT=Times New Roman]subscribe: Hat Trick Letter[/FONT] [FONT=Times New Roman]Jim Willie CB, editor of the “HAT TRICK LETTER” [/FONT] [FONT=Times New Roman]Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.[/FONT] [FONT=Times ... | ||||

| LGMR: Gold Bullish, Well Supported as Risk Eases. US Hits Frightening Deflation Posted: 27 May 2010 06:02 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:40 ET, Thurs 27 May Gold "Bullish, Well Supported" as "Risk Eases" But US Hits "Frightening" Deflation in Money-Supply THE PRICE OF PHYSICAL GOLD in wholesale dealing slipped from an early 6-session high in London on Thursday, ticking back to $1207 an ounce but remaining 3.1% higher for May-to-date. World stock markets rallied further, cutting more than a third of this month's 8% losses. Government bonds retreated and the Euro reversed Wednesday's losses – briefly trading above $1.23 – after the Beijing authorities said that reports they are reviewing China's Eurozone bond holdings were "groundless". US crude oil contracts jumped sharply once more, hitting $73 per barrel. Both the gold price in Sterling and in Euros dropped 1.7% from 1-week highs hit overnight. Silver investment bars held unchanged from the start of May near $18.40 an ounce. "There are increased signs of risk easing," n... | ||||

| United Mining Group Poised For Production in Idaho’s Silver Valley Posted: 27 May 2010 06:02 PM PDT By Claire O'Connor and James West MidasLetter.com Thursday, May 27, 2010 On May 10th 2010, United Mining Group (CNSX:UMG), formerly Scarlet Resources Ltd., began trading on the CNSX under the stock symbol UMG. UMG is an exploration group with a difference; not only does the company own and operate a lucrative mine services company, they’ve also entered into an earn-in agreement to earn an 80% interest in the Crescent Mine – a past producing silver mine in North Idaho’s “Silver Valley”. Perched loftily in a position of financial stability that most juniors can only dream of, UMG is aiming for phase one production with Crescent in Q4 2010 - Q1 2011. All permits and financing are already in place. Located in Northern Idaho’s historic Coeur d’Alene district - famously referred to as “The Silver Valley... | ||||

| But, You Sputtered, I'm Just A Hack.... Posted: 27 May 2010 06:02 PM PDT Market Ticker - Karl Denninger View original article May 27, 2010 06:21 AM That is, with all my pesky math and charts like this: Remember that I've been preaching for a while that we embedded a roughly $500-600 billion structural deficit into the economy post-2000? And that now, in response to this recession (and in a refusal to admit that we have been playing credit drunk) we've now embedded a roughly 10% structural deficit - three times the former? Before you consider me a chucklehead for having the temerity to look at the math you might take it up with the BIS - the Bank of International Settlements, or the "bankers's bank" - which agrees with me: [INDENT]According to the Bank for International Settlements, the United States' structural deficit — the amount of our deficit adjusted for the economic cycle — has increased from 3.1 percent of gross domestic product in 2007 to 9.2 percent in 2010. [/INDENT]Gee, you mean they looked at the same chart I've been ... | ||||

| Gold Stock Trades on Taseko Mines Posted: 27 May 2010 06:02 PM PDT | ||||

| Litigation Killing What Derivatives Aren?t Posted: 27 May 2010 06:02 PM PDT View the original post at jsmineset.com... May 26, 2010 07:50 PM Dear CIGAs, Whatever OTC derivatives do not do to the investment banks, litigation will. Litigation is both civil and criminal. No civil suit based on derivatives can ever go to judgement by jury because it will be a stone cold loser. Even a bench trial would present significant risk to the defendant. OTC derivatives are the basic problem about which nothing has been done and nothing will be done. That secures the final end which is gold as the only standard, measure and storehouse of value functioning as a medium exchange. By definition that is what money is. Gold is the only money that can be trusted as debt is being added to debt in a ridiculous plan to cure a problem. The fiat system is cooked, and there is simply no good paper currency. The face of this world is about to change. Sir Richard Russell is correct. Please protect yourselves because you must. I can point you in the right direction. It is you must ta... | ||||

| If 1 + 1 Still Equals 2 Then Gold Should Explode! Posted: 27 May 2010 05:49 PM PDT | ||||

| Posted: 27 May 2010 05:47 PM PDT | ||||

| The Gold & Silver Precious Metals Correction Posted: 27 May 2010 05:35 PM PDT | ||||

| Why Deleveraging Is Necessary For Economic Recovery Posted: 27 May 2010 04:49 PM PDT From The Daily Capitalist A Plan For Recovery While bank closures and high foreclosure and mortgage default rates are universally seen as negative impacts on the economy, it is closures and foreclosures that we need for a recovery. The bearers of such news are usually ignored as doom-sayers, bears, or Cassandras: no one wants to hear bad news. A fear of "bad news" is what has been driving the government's recovery policies and that is why this recession is not over. In fact those same policies may be leading us to a renewed period of decline. It is of course unfortunate and sad to see banks close and people lose their homes. But when put in the context of the boom years when personal, corporate, bank, and government debt went off the charts, deleveraging has the effect of creating the conditions needed for a recovery. We have not recovered. We see people still saddled by high personal debt. We see most banks weighed down by bad loans from commercial real estate, residential development, and consumer loans. We see deflation continue to drive residential real estate and commercial real estate down, further magnifying the the impact. As a consequence, credit is still largely frozen for most individual and business borrowers, money supply continues to shrink, the economy appears to be headed to stagnation, and unemployment remains disturbingly high. While very large corporations and perhaps the ten largest money center banks have access to credit, it hasn't helped most Americans or the majority of businesses. In fact, last quarter's profits for those large financial institutions were at impossible record levels based on the lucrative carry trade/arbitrage opportunity provided them by the Fed. The answer to this conundrum is to withdraw government programs that support lenders and borrowers who are essentially bankrupt. It would be nice to see individual borrowers pay off their loans, but since most of the debt created in the boom phase originated from home equity, the continuing decline of home prices makes that a moot point. Likewise, while it would be nice to see banks raise more capital, sell off bad loans and assets, and clear their balance sheets, they have been reluctant to do that, waiting as it were for more government bailouts. However, the amount of problem loans related to commercial real estate and residential real estate development is huge and much of what they lent on is fundamentally unsound because of overbuilding. In an attempt to keep this debt rolling forward in the hope that the next cycle or inflation would bail lenders and borrowers out, policies such as TARP, HAMP, HARP, HAFA, extend and pretend, delay and pray, mark-to-make-believe, bailouts of Fannie and Freddie, lowered lending requirements, massive Fed purchases of mortgage backed securities known as "toxic assets," and many others have tried to keep the debt barge afloat. It hasn't worked. If it had worked, as the Fed and the government believes it should have, then we would see credit expanding, money supply growing, asset prices rising, consumer consumption increasing, and jobs going up and unemployment going down. Presently the FDIC has 775 banks listed as "problem institutions." Bank closings are at 73 this year, and at 238 since 2008. Lending declined for the seventh straight month (accounting changes created an anomaly that falsely indicated an increase last month). The combined percentage of residential loans in foreclosure or at least one payment past due was 14.01% last quarter. Morgan Stanley just reported that this "shadow inventory" could be as high as 8 million homes and take 47 months to liquidate, assuming current rates experienced by REO departments. Morgan Stanley's is the highest estimate I have seen. Others are 3.5 million. 4.7 million. and 5.5 million. Whichever number you pick, it still high. CRE debt is getting critical for most banks. This is the main reason credit is frozen, excess reserves are high, and money supply is shrinking. Between 2010 and 2014, about $1.4 trillion in commercial real estate loans are expected to reach the end of their terms. CRE asset values are still falling. Studies by McKinsey Global Institute and research by Romer and Reinhardt show that history is not kind in cycles with resulting high debt: on the average it can take six to seven years to deleverage, and can take as much as 25% off the top of GDP. It is painful and unavoidable, but understandable. This cycle is the biggest cycle in history and debt reached historic proportions, worldwide. Understand that mortgage backed securities, both residential and commercial, were distributed worldwide to banks, pension funds, insurance companies, hedge funds, and endowment funds. How we could we fix this problem: 1. Require banks to mark-to-market the assets securing their loans, and raise more capital or go out of business. 2. Remove federally funded or guaranteed residential mortgage lending. This would include Fannie Mae, Freddie Mac, and the FHA. 3. End all Fed lending programs created at the beginning of the crisis, such as TARP. 4. End all programs to help home mortgage borrowers, such as HAMP and HAFA. 5. Require the Fed to auction its portfolio of mortgage backed securities. 6. Establish a program similar to the Resolution Trust Corporation (RTC) to quickly dispose of the assets of failed banks. 7. End tax policies that require borrowers to incur phantom income as a result of real estate debt relief. 8. End taxes on interest and dividend income to encourage savings. 9. Immediately raise the Fed Funds rate. Many of these solutions seem counter-intuitive, but one must question the path our government has taken to stimulate a recovery. We need to look at this crisis in an entirely different way: the boom was the real problem and the bust is the cure. The harm was done in the boom phase as a Fed induced credit expansion and various government programs misdirected capital to businesses that, but for this government action, would not have been otherwise profitable. In economic terms this is called "malinvestment." As in all booms, reality, usually in the form of a tightening of money supply by the Fed, brings asset value back to the ground, and even under the ground as we find these malinvestments unprofitable. That is what we are seeing now. The bust phase is a process of redirecting capital from these failed investments back into more profitable ventures. It is obvious that large amounts of capital will be lost. But by liquidating these bad assets, banks eventually go back to normal, credit loosens, people save more money because of financial uncertainty and to reduce their debt, thus creating the new capital needed for a true economic expansion. If this liquidation phase is thwarted, as we have seen, we get stagnation and zombie banks. This is what Japan has experienced for the past 20 years. Take the bitter pill, endure the inevitable pain, and we will recover quicker. | ||||

| Insights about China and Nicaragua Posted: 27 May 2010 04:17 PM PDT In a recent edition of The Daily Reckoning, Bill Bonner observed, "The world turned against them at the beginning of the Industrial Revolution. But if the world turns long enough, it comes back to where it began." He was writing about India. But he could have been writing about China...or Nicaragua...or any one of a number of emerging markets. In the next 1,618 words, I'll share few insights about both China and Nicaragua. These insights share no particular connection to one another, other than the observation that economies do not stand still. The "emerging markets" of one generation are the "developed markets" of the next generation, and vice versa. Change is the one of the great constants in investing. Opportunity makes its nest like a tramp pigeon, never in the same place for very long. There is always something new happening. Asked about his worldview, Mark Mobius, the famous emerging markets investor, once replied: "Things change... You know, that's it in a nutshell." And in this swirl of change lies some big chances at profits. For example, last year China passed the US as the world's largest market for automobiles. First time ever that's happened. There were 13.5 million vehicles sold in China last year - a 40% increase. There are now over 40 million vehicles in China. According to the China Economic Review, over 2,000 cars roll onto the road every day in Beijing alone. China's steps seem to mirror what happened in the US in the 1950s. China wants to use roads to knit the country together and open up trade between its distant provinces and cities. To that end, the Chinese are laying highways like nobody's business. By the end of 2008, China had an estimated 60,000 km of highway. The US has 75,000 km. Over the next few years, China plans to have 85,000 km of roads. This is having some amazing effects. For instance, China recently built a highway from Lhasa, Tibet, which runs all the way to the Nepali border. Along this road is the city of Shigatse, a formerly sleepy town where tourists may stop to gaze at ancient monasteries on their way to Mount Everest. But today, it is also a place where people get rich running freight services along the 515-mile highway. An Economist correspondent traveling this way recently wrote: In the past few years, hundreds of millions of dollars have been spent improving the road. This has included covering its gravel sections with asphalt, which has greatly facilitated cross-border trade. On the Lhasa-Shigatse section, which winds along a valley lined by sand dunes and spectacular peaks, Han Chinese from the interior have opened little Sichuanese restaurants catering to the lorry drivers. The easy mixing of peoples and the freedom to pursue their own ends leads people to trade. Business expands. The quality of life rises. The roads are doing their work. The cars and trucks are coming. Where are the opportunities? The first thing most people think of is the automakers. GM, for all its struggles, is having no trouble selling cars in China. Sales were up 67% in 2009, to a record 1.83 million units. Other carmakers are having similar success. The problem here is it doesn't make much sense to buy, say, GM, because you like its car business in China. There is too much else going on there. I'm more interested in investment ideas that are a step removed from actually building the cars. All those cars will eat up a lot of metals of all kinds, for example. They will also burn a lot of fuel. Dig deeper and you'll find China loves methanol as an alternative fuel to blend with gasoline to lower emissions. China blends more than a billion gallons of methanol in gasoline annually. And its appetite for methanol is growing more than 16% a year. Methanol, made from coal or natural gas, is China's ethanol. Such thinking led us to our methanol play, Methanex (NASDAQ:MEOH). I recommended this stock one year ago to the subscribers of Capital & Crisis, when US methanol prices hit a temporary low of $200 a ton. Today, the price is about $350 a ton. Not surprisingly, therefore, the MEOH stock price has more than doubled during the last year. But the stock is still relatively cheap. At current methanol prices, Methanex could generate over $800 million in EBITDA (earnings before interest, taxes, depreciation and amortization). The total enterprise value - or the theoretical price to buy the whole company on the market - is only $2.9 billion. So it trades for only 3.6 times this potential EBITDA. That's pretty cheap. Another way to look at it is to think about replacement costs - or what it would cost you to build Methanex from scratch. Methanex trades for just under $400/tonne of methanol capacity. That's less than replacement cost of about $700/tonne. There is still a lot of upside here. Shifting to another continent, and another type of observation entirely, change is also unfolding rapidly in Nicaragua. Nicaragua has always been a place of intrigue, mostly because of geography. Before the Panama Canal, this was the place where people thought of building a canal. As a result, American involvement in Nicaragua goes way back. Militarily, the first Marines landed here in 1912 and occupied it until 1933. And the Somoza regime, a dictatorship created and supported by the US, ran the country until the Sandinistas took over in 1979. (If you are interested in learning more, I encourage you to read Nicaragua: Living in the Shadow of the Eagle by Thomas Walker.) As a result of the Sandinista era, most Americans probably have a poor opinion of Nicaragua. But it is a beautiful country with its volcanoes, lakes and a lush tropical climate. The people are friendly, and Nicaragua is safe to travel through. The food is great and so are the beaches. It's also a young country with more than half of the population under 25 years old. (Nicaragua also makes one of the world's best rums, Flor de Caña - "flower of the [sugar] cane." I enjoyed it neat and in the national drink, el macua, made with guava juice.) I recently visited Nicaragua and saw a bit of the country - Leon, Managua and Granada - before settling in at Rancho Santana. The latter is a development project on a spectacular 3,000-acre property on the Pacific Coast near Rivas. Stretches of it remind me of Big Sur with its dramatic coastline. The sad thing is that Nicaragua ought to be a rich country. Nicaragua was once a prosperous place of some renown. In the 19th century, for example, Granada was the most prominent city in Central America, a rich trading city holding down a key spot in global commerce. But the country's economic trajectory took a turn for the worse during the 20th century. Nevertheless, the country's rich natural resources remain. Nicaragua has lots of good land for growing things. The soil supports a wide variety of crops and livestock. Coffee in the north. Bananas, papayas, mangoes, sugar cane and more grow everywhere else. Nicaragua is also the largest country in Central America and among the least densely populated. Nicaragua has another special resource: It is among the most water-rich countries in the world. (I've been making my way through Steven Solomon's new book Water, which is a fat tome on the history of water from ancient times to the present day). In a world where water scarcity is an issue, Latin America stands out for its water wealth. It has 28% of the world's renewable water and only 6% of its population. Solomon writes that the "super Water-Have countries such as Brazil, Russia, Canada, Panama and Nicaragua [have] far more water than their populations can ever use." Lake Nicaragua, one of the largest lakes in the world, is the future water supply of Central America. There are many rivers and lakes, which make useful internal waterways. And Nicaragua has access to both the Pacific and Atlantic oceans. Nicaraguan waters are also great for fishing. Nicaragua holds great potential for wind, geothermal - from volcanoes all along the western half of the country - and hydroelectric power. In fact, Rancho Santana is trying to become self-sufficient in energy. There are ridges there where the wind blows constantly. A wind feasibility study done there lately scored as high as it could. The conditions are ideal. Finally, Nicaragua has great timber resources, as well as mineral resources such as silver and gold. Present-day Nicaragua also illustrates one of the global trends we've been examining during the last few months: the "penthouse gypsy" trend. This term refers to people with money who go where they (and their money) are treated best, wherever in the world that may be. Increasingly, they are no longer in the US or Europe. It may be hard to believe, but there are plenty of penthouse gypsies down in Rancho Santana. Why not? They are able to diversify out of the US, where tax rates are surely going much higher. They get cheap, stunning real estate. Property taxes are hardly anything. You can live very well down here on not much money. I have a good friend who moved to Nicaragua five years ago for this reason. Most Americans worry about confiscation of property. But that risk seems remote after talking to people here. Tourism is the No. 1 cash cow of what is still a poor country. Even Ortega doesn't want to do anything to upset that cash flow. (He owns several hotels.) As far as enforcement of contracts, the IMF and World Bank rank Nicaragua third among all Latin American and Caribbean countries. Foreign direct investment in Nicaragua is soaring - up fourfold since 2000. I can't say my trip to Nicaragua yielded a hot stock tip or big investment insight. But I learned a lot about a part of the world I hadn't explored before. Hopefully, my notes here help you see the opportunities that are out there in this great big world - if only we look at it with fresh eyes. Chris Mayer | ||||

| US Government to Kill Its Own Economy Posted: 27 May 2010 04:11 PM PDT Hey, is this a great recovery...or what? Stocks fell again yesterday. The Dow went down 69 points, closing below 10,000. Gold rose $15...closing above $1,200. The two are still $8,800 apart. But give them time. They've been working their way closer for the last ten years. They'll get there... Single family house prices fell for the 6th month in a row, reports The Washington Post. And get this: "Private pay shrinks to historic lows as government payouts rise," says USA Today. This is the big story. As a share of personal income, never before has the private sector contributed so little. Thank god for the government. Without those checks from the feds, we'd all be broke. The story as told by USA Today: "Paychecks from private business shrank to their smallest share of personal income in US history during the first quarter of this year, a USA Today analysis of government data finds. "At the same time, government-provided benefits - from Social Security, unemployment insurance, food stamps and other programs - rose to a record high during the first three months of 2010. "Those records reflect a long-term trend accelerated by the recession and the federal stimulus program to counteract the downturn. The result is a major shift in the source of personal income from private wages to government programs. "The trend is not sustainable, says University of Michigan economist Donald Grimes. Reason: The federal government depends on private wages to generate income taxes to pay for its ever-more-expensive programs. Government-generated income is taxed at lower rates or not at all, he says. 'This is really important,' Grimes says." That's the trouble, isn't it? The feds don't really have any money. They don't make anything. They don't create any wealth. So they can only send us checks by taking the money from us - one way or another. And that, dear reader, is the story of the most important trend of our time. The feds are taking a bigger and bigger share of the economy. And the bigger the share they get, the less the rest of it is worth. Because an economy run by politicians and bureaucrats is not a healthy economy. It's a sick economy...it limps along. It wheezes and coughs. And if the trend towards more and more federal control continues...the economy finally dies. If you want the government to take care of you, said Jefferson, "you will soon want bread." He didn't say it exactly that way. We improved it. The feds don't make decisions on the basis of fair play and rational economic choices. Instead, they're political choices - such as bailing out the big banks because they are said to be "too big to fail," or bailing out the big auto companies because they employ too many voters, or bailing out the mortgage industry because too many people would lose their houses if the mortgage industry were allowed to go whither it should. Even in the best of times an investment is a risky thing. Sometimes it will produce a positive return (above the real cost of funds). Sometimes it won't. Imagine what happens when decisions are made by functionaries, political appointees and GS-12s? Capital is then allocated to the wrong projects for the wrong reasons...which result in the wrong outcomes. Bad economic decisions produce bad economic results. Bad economic results lower the value of capital assets...and make almost everyone in the economy poorer. We say, "almost everyone," because the government's employees, lobbyists, and contractors are in a class apart. They are the ruling party and its apparatchiks. While everyone else gets poorer, they get richer. And more thoughts... "Tax increases. Spending cuts." That's the name of the game in Europe. The OECD is calling for them. The IMF is requiring them. Politicians are promising them. Just yesterday, Italy came forward with $30 billion worth of spending cuts. Reading the paper, you might think Europe's leaders have the matter under control. Every day seems to bring fresh promises. But remember, these are the same people who failed to keep within Europe's fiscal targets 57% of the time - even when the going was good. How will they do with their backs against the wall? Better, most likely. But not good enough. The euro-feds will make plenty of gestures. But in the end, it just won't make sense for people to give up present benefits in order to respect promises made by a generation of spendthrift politicians to a ruthless bunch of speculating bankers. The political left, which is leading the opposition to 'austerity' measures, will become more and more attractive to more and more voters. It will be harder and harder to cut spending. This will force governments in the direction of least resistance. They will "print money...go bust...and go to war," says Marc Faber. "We are doomed." *** Oil is still spilling into the Gulf of Mexico at an unknown rate. "Plug the damn hole," says the nation's chief executive to his aides. Why does he bother? His aides don't know anything about plugging oil leaks under the ocean. And those people who do know something about it have been unable to fix the leak. Mr. Obama is not only America's president. He also presides over the biggest single user of oil in the world - the US military. The pentagon uses twice as much oil as the entire nation of Ireland. It sends soldiers in oil-burning airplanes to places of no apparent importance where they drive around in oil-burning machines for no apparent reason. Naturally, oil becomes not just another commodity, but a strategic commodity...worth fighting for. Then, foreign wars use up the oil they were expected to protect. But geopolitics is far beyond our understanding...and even farther out of our range of interest. We will just observe that the law of diminishing returns applies to just about everything. The farther offshore the roughnecks go...the deeper the sea and the higher the waves...the more the costs, the greater the risks and the lower the marginal returns. The return from Deepwater Horizon must be starkly negative... The farther afield US armies go, too, the greater the costs, the higher the risks, and the lower the marginal returns. "Why not just buy oil on the open market?" Well, it's clear you don't know anything about geopolitics either, dear reader...don't you know that our enemies might try to cut us off from vital oil supplies? That's why Germany and Japan lost WWII! We were able to cut of their fuel... "But weren't Germany and Japan fighting for access to oil? Didn't their politicians say they had to invade Poland...and the Philippines...to protect their vital supplies?" No...they were aggressors. They were bad people... "But if they hadn't been the aggressors they wouldn't have been bad people, right?" That's right... "Then, we wouldn't have cut off their access to oil!" Oh, never mind. You'll never understand geopolitics, will you? Regards, Bill Bonner | ||||

| Gold Seeker Closing Report: Gold and Silver End Mixed While Stocks and Oil Surge Higher Posted: 27 May 2010 04:00 PM PDT Gold climbed $5.13 to as high as $1218.23 in Asia before it fell back in London to as low as $1205.60 by about 8:30AM EST and then rallied back higher for most of the morning in New York, but it then fell back off in the last couple of hours of trade and ended with a loss of 0.05%. Silver climbed to as high as $18.548 by about 11:15AM EST before it also fell back off into the close, but it still ended with a gain of 0.82%. | ||||

| Posted: 27 May 2010 03:59 PM PDT Here is a question to begin this Friday's Daily Reckoning: can there be financial stability in Europe if the assets of Europe's banks are the liabilities of Europe's governments and some of Europe's governments are going broke? We'll get back to that question a bit later. But warming to today's task, we'll look at the mega-rally in U.S. stocks overnight and the big fight back/smack down by the leader of the nation's bureaucratic class. But first, there's nothing like the smell of a short-squeeze in the morning, is there? Slipstream Trader Murray Dawes was calling for it all week. And he was busy getting into trades to profit from it should it arrive. Overnight it seems to have arrived with monster truck force. The big blue chip Dow stocks were up 284 points, or 2.85%. But in the tech and small cap sectors, the gains were even bigger. For example, the Russel 2000 index of U.S. small cap stocks was up 4.34%. That's a good day's work. It reminded us of the old adage that small caps tend to lead the market up when things are bullish and fall hardest when they are bearish. With that in mind, take a look at the chart below. The ASX/200 vs. U.S. Small Caps and Blue Chips  Australian Small-Cap Investigator editor Kris Sayce and your editor were talking about the advisability of making new recommendations in a market like this earlier in the week. Ultimately, along with Diggers and Drillers editor Alex Cowie, we decided that they ought to publish their best investment ideas regardless of the market. This means you focus on good companies - but you're fully conscious the market you're investing is dangerous. Both Kris and Alex published their new recommendations last night. And according to the chart above, the timing could be good. Since mid-April Aussie stocks have fallen further and risen less fast than U.S. counterparts. The chart above includes Thursday's U.S. trading session. But depending on how today's session goes in Australia, that little green line at the bottom could be a lot higher. Both Kris and Alex spent a lot of time in their respective reports talking about risk because there' so much of it going around. You've got political risk in Europe. Geopolitical risk in North Korea. Sovereign risk here in Australia. And that's all on top of the normal risk you take as a common stock investor in public companies engaged in enterprises with inherently unpredictable outcomes. To be perfectly candid, with so many external forces whipsawing market prices, it is very difficult to be an investor in this market. It is more of a traders and speculators market. In our own newsletter, Australian Wealth Gameplan, we have a few core positions leveraged to a rising gold price and a falling Aussie dollar. Our value investing sleuth Greg Canavan pointed out earlier this week than in a market like this, the best strategy is to buy companies selling at a discount to book value to give yourself a margin of safety. So, from the speculator to the bargain hunter to the generally risk averse (conscious of the possibility of the systemic collapse of leveraged global financial system), the market requires you to make a decision. Doing nothing is a decision, too. Yes, yes, it sounds post-modern, that inaction is a form of action. But in financial terms, being in cash because you prefer liquidity is a position too. Our view is that the sense of relief over Europe's sovereign risks is fundamentally stupid. Or ignorant. Or obtuse. Or wilful self-deception. The banks of Europe are stuffed with government debt. And when one man's asset is another man's liability, both parties are the poorer if the debtor cannot realistically repay. His credits must be written down. His debts must be restructured. And the public balance sheet must be shrunk the same way private and non-financial corporate balance sheets have shrunk. Liquidate the bad investments and move on to a frontier of economic possibilities. That's the future. For the present, we seem mired in the past. "Whatever yardstick you care to choose," writes Edmund Conway in the U.K.'s Telegraph, "share-price moves, the rates at which banks lend to each other, measures of volatility - we are now in a similar position to 2008. Europe's problem is that the unfortunate game of pass-the-parcel came at just the wrong moment. It resulted in a hefty extra amount of debt being lumped on to its member states' balance sheets when they were least-equipped to deal with it." So what if Europe's problems haven't really gone away? Does that mean rallies like this should be sold before the next leg of the Global Financial Crisis, where national governments really do default on their debt? And in the meantime, Europe's panic attack has obscured very real structural problems in the U.S. and Chinese economies, both related to housing prices and the role they play with bank collateral. Hmm. If it turns out the global balance sheet in the age of globalisation and securitisation was over-leveraged and debt-laden, then the next round of the GFC is going to make the first one look like a tea-party. Not THAT kind of tea-party, although it's fair to see that when a nation's state finances collapse, the probability for social instability goes up a lot. Inflation and warfare are old bedfellows and campaigners. They know how to have a bad time. Yet all of this might seem terribly far-fetched or unlikely to policy makers in Canberra and miners in Perth. The two continue to publicly quarrel in front of international capital markets to the detriment of Australia's reputation as a safe destination for foreign investments. In order to save Australia, it was first necessary to castrate the mining industry. Speaking to the Senate yesterday, Treasury Secretary Ken Henry knocked backed claims that the mining industry saved Australia from the worst of the GFC (which he apparently thinks is over). He said, "Suggestions that the Australian mining industry saved the Australian economy from recession are curious to say the least…. These statements are not supported by facts." We couldn't find a quotation in which the Treasurer gave credit to Canberra for accounting for up to 60% of Australia's exports in the last two years, by dollar value. But if he was referring to, say, the volume of words belched out by the government giving itself credit for being so smart, he's probably right. Really the most worrying words the Treasurer uttered, in our mind, were these: "Frankly, there is more than enough investment in train in the mining sector. The limit is access to labour and the capital needed to undertake the projects." He was apparently responding to the claim that the new resource tax will lead to less investment, not more, as both he and the government claim. The one factor in all this that Dr. Henry and the government seem to be leaving out is free will. Project decisions in the mining industry are not compulsory. The miners can't walk away from projects that are already producing. This accounts for some of the fury over a tax that is retrospective. But it's as if the government believes many many mining projects will go ahead regardless of the policy…just because. As if the companies will stop making investment decisions based on the rate of return and the cost of the capital. They'll just keep digging and drilling because that's what they do, and if they don't the government won't have any profits to tax. Beavers must dam. Fish gotta swim. Birds gotta fly. But miners don't gotta mine in Australia. In the real world of the private sector, decisions about what to produce are not determined by abstract public policy goals, which are themselves based on personal prejudices about the "appropriate" level of profit. In the real word, final investment decisions are determined by what consumers want and whether a firm can deliver what the market wants at a profit. There is no requirement that Australia export iron ore or coal because it has them. If the miners can't do it a profit that satisfies shareholders, they won't do it at all, at least not here. Perhaps that's what the government wants in the end, to drive the mining companies from Australia, but not before confiscating as much revenue as possible. Perhaps the government wants the mining companies to hand back all their leases and turn the business of producing mineral wealth over to the people who really know how to do it: public servants and elected officials. We'll see how that works out. But it's looking more and more like an international capital strike against Australia is a real possibility. For one, there's a brewing credit crunch coming from an inevitable sovereign debt default in Europe. Secondly, Australia's public officials are looking anything but reasonable and sensible in the court of international capital market opinion. They are looking like grasping, blundering, bullying, but well-meaning dunderheads who have demonstrated a first-class ignorance of how wealth is created. The Rudd government has wanted to lead the world on a lot of issues. It's well on its way. Dan Denning | ||||

| Posted: 27 May 2010 02:36 PM PDT I want to share with you comments on my last entry on a pension chief's exit. A senior pension fund manager emailed me with some important observations which I will share with you (some comments are edited out):

The comments above come from one of the wisest people in the pension industry. He is absolutely right to say that too much focus goes on internal compensation and not on external fees.

As Congress weighs a pension bailout, I fear that they're past the point of thinking about that risk. In my mind, it's crystal clear. Financial oligarchs and their political puppets are doing everything in their power to reflate risk assets hoping that it will translate into moderate (or severe) inflation for the economic system. Their biggest fear is debt deflation, and if their gambles don't work, they're going to get get it sooner than they think. | ||||

| Will The USD Be Replaced By The SDR Or The CNY As The Next Reserve Currency? Posted: 27 May 2010 02:32 PM PDT Jim O'Neill, who did not make any friends within the bear community earlier today, has written an interesting paper on the IMF's Special Drawing Rights, and whether this hypernational currency can ever become a reserve currency as is, and/or with the CNY as a constituent member. While O'Neill as usual focuses on the angle of the "next paradigm" BRICs, and how they will increasingly dominate global economics, he does pose an important question: with the dollar likely to suffer the side effects of either hyperdeflation, hyperinflation, or hyperstagflation, will the next reserve currency be a diluted melange of other flawed fiat constructs (i.e., the SDR), or the currency of the one country, which for all its flaws, still has the cleanest balance sheet backing its own fiat construct. On the other hand, the question of whether this analysis is moot to begin with, and the world will revert to the gold standard as the ongoing crisis of confidence in all paper money flares up, is not raised even once... We wonder (not really) what Jim O'Neill would have to say on that particular issue. Here are the main bullets:

The paper is a critical follow up to anyone who found Albert Edward's earlier analysis of collapsing global FX reserves relevant.

This posting includes an audio/video/photo media file: Download Now | ||||

| Guest Post: New to FINREG - Financial Equalization Proposal Gaining Momentum Posted: 27 May 2010 02:06 PM PDT Submitted by Jack New to FINREG - Financial Equalization Proposal Gaining Momentum Thus far unreported, but quietly gaining momentum in the polls is the provision for Financial Equalization. Spurred on by the recent announcement of the SEC's inquiry into Goldman Sachs, legislators and soccer moms are gathering behind a system proponents claim will finally bring fairness and equality to the financial system. At the heart of the matter is both the "amount" and "accuracy" of information in the possession of certain Wall Street firms. The Government is attacking Goldman for its participating in prominent hedge fund Paulson & Co's recently disclosed theft from the hapless counterparties ACA Capital Management and IKB Deutsche Industriebank. The facts clearly display how Paulson's alleged "comprehensive diligence" into areas such as the "economy, housing market, and specifically the credit quality of the ABACUS 2007-AC1 CDO" gave them a material, unfair, and in the opinion of many, criminal advantage over the counterparties. Paulson, Goldman and their cronies have made the claim that it was common practice for broker-dealers to seek input from market participants when assembling synthetic collateralized debt obligations (CDO's). Goldman and Paulson have dug themselves into a hole here and set a standard for which they do not want to be held. Their idea of "common practice" comes right back to bite them in the ass, for Paulson's illicit practice of gathering and analyzing relevant information was certainly not common practice - and rightfully so. It is being argued that Goldman had an obligation to inform ACA and IKB "directly and explicitly" that their counterparty not only (1) understood the properties and functions of CDO's in general, but furthermore (2) had actively assessed the value of this particular CDO based on the probability of various cash flow scenarios. Unfortunately, I think many of my humanitarian brethren are still failing to see the forest for the trees. Requiring explicit disclosure to ACA and IKB or other counterparties in similar scenarios is not the solution. First of all, these companies obey the letter of the law and not the spirit, putting the explicit disclosure in the same documents containing the structure and risks of the investment itself. The very same documents they already know their exploited customers don't read! Secondly, even if the SEC required the disclosure to be sufficiently conspicuous, painted across a life-size cutout of Nancy Pelosi kissing Lindsey Lohan for example, what would the disclosure really accomplish? The majority of investors and public money managers are honest, hardworking Americans - not some arrogant group of yuppies with the leisure to sink hours of time into research. Requiring nuanced diligence of investments panders to the plutocrats of this society who garnered the education, intelligence, and experience necessarily to evaluate these securities at the expense of the common man. Think of the massive inequality, the enormous burden on both corporations and individuals if Investors, individual or institutional, had to restrict themselves to investments they understand in order to get a fair shake in the markets. I loathe to even speculate what the overall cost to the system might be in such a dystopia. It simply cannot be allowed. Enter, running, the proposal for Financial Equalization. In a stroke of brilliance, legislative aides have designed a system that prevents further abuses of information asymmetry without the enormous costs associated with a pervasive adoption of research and diligence. Given that the majority of investors and investment firms have neither the resources, desire, nor capacity for understanding basic classes of financial products (Stocks, Bonds, Derivatives), nor their individual investments within such categories, the logical solution is to "equalize" every firm and individual with even the slightest capacity for abuse of this type of information. Individuals will be assessed on a sliding scale and categorized based on their potential danger to the fairness and equality of the marketplace. While the full equalization criteria are still being discussed, there are already several items on the table. One example, individuals demonstrating a potential for abuse through "inference and logical reasoning" will be required to attend weekly seminars on topics such as "astrology", "faith healing", and "healthcare re-imbursement". Those with a tendency to analyze events in the global marketplace and see the larger mosaic shall have all channels restricted save the FOX business channel, and so on and so forth. Most importantly, the proposal will also firmly establish that any transaction in which one party gains advantage over another will constitute prima facie evidence of a violation of the equalization guidelines. With this measure in place we can avoid situations akin to the current spectacle, where these pompous firms have the audacity to stand there and debate the case on points of law. Fortunately, even before the equalization legislature becomes law, these modern day robber barons will find no refuge in the law, as the judicial branch has also donned the colors of equality and anti-elitism. Chief Justice Roberts demonstrated his firmly anti-elitist position last week when he asked the poignant and thought -provoking question "What is the difference between email and a pager?" Clearly, a scathing and well deserved critique of the technocrats and their other erudite ilk. With all three branches of government and the majority of Americans lined up behind this proposal, the country seems poised to take an important step toward truly becoming a land of tolerance, acceptance, and equality - by finally kicking out those greedy capitalist pigs. | ||||

| ‘Top Kill’ Effort Must Succeed or Else… Posted: 27 May 2010 02:00 PM PDT By Rick Ackerman, Rick's Picks We may all be breathing a sigh of relief by the time you read this, but it remained uncertain at press time whether British Petroleum's efforts to plug a massive oil leak in the Gulf of Mexico would succeed. Earlier in the day, the company began pumping a heavy fluid called "mud" into the damaged well, but the process was temporarily halted because the high-powered flow of oil and gas from the well was causing too much of the mud to escape. BP said such delays had been expected but that they hoped to resume the sealing operation by late tonight. The effort came amidst reports that oil has been gushing from the well at a rate much greater than what BP had first estimated. The company originally said that about 5,000 barrels of oil were escaping per day, but the latest estimates suggest that the true number is somewhere between 12,000 and 19,000 barrels. Converted into gallons, that implies that as much as 760,000 gallons of oil per day are flowing into the Gulf. Last week, we linked at Rick's Picks a very scary article from rense.com that said the "top kill" procedure being used to plug the well was the world's last hope to get the disaster under control. The author, who sounded like he knew a thing or two about drilling platforms, explained that abrasive material contained in the gushing oil could eventually widen the well-hole so that virtually unlimited quantities of oil and explosive methane would be released into the water and atmosphere. We would strongly suggest that you read the article to understand what is at stake if BP's effort fails. The only alternative at that point would be to drill an additional well to relieve the pressure. This procedure is already under way, but it will still take another two months to complete. During that time, nature could take a catastrophic course on its own, according to the author, who was identified only by the initials "SHR". If BP reports that the "top kill" attempt has failed, it will be grave news indeed for Planet Earth. (Get this commentary and a free Hidden Pivot forecast each day via email.)

More articles from Rick Ackerman…. | ||||

| Did JP Morgan Assassinate Lehman Brothers? Posted: 27 May 2010 01:57 PM PDT By Jeff Nielson, Bullion Bulls Canada In the fall of 2008, global markets suffered their worst collapse in nearly 80 years. Regular readers will be familiar with my own position on these events: this was a "crisis" engineered by Wall Street Oligarchs, for two reasons. First, with all their paper empires on the verge of imploding as their multi-trillion Ponzi-schemes blew-up, they needed to frighten Washington politicians to give in to their blackmail demands: a $10 trillion bail-out, composed of direct hand-outs, unlimited zero-interest "loans", and "guaranteeing" Wall Street's derivatives 'black hole'.

The other part of Wall Street's agenda was to destroy commodities markets, by manipulating these markets into the largest commodities-collapse in the history of human commerce. In that respect, their machinations were rumored to focus upon two targets. Hank "Bazooka" Paulson purportedly went to CalPERS, the world's largest pension fund (and a huge commodities-bull in 2008) and begged them to suddenly and dramatically bail-out of their positions because, said Paulson, soaring commodity prices threatened to destroy the U.S. economy via hyperinflation.

Their other vehicle for sabotaging commodities markets (according to rumors) was to assassinate Lehman Brothers, since it held one of the largest (and most-leveraged) commodities portfolios on the planet. The latter "tool" was of far more importance to Wall Street, since unlike CalPERS, if Wall Street gained control over Lehman's portfolio they would be able to directly manipulate commodities markets.

An article written by Forbes at the time of Lehman Brothers' collapse makes that clear:

While everyone knows the U.S. government is looking to bail out Wall Street banks, few people realize that it's also bailing out speculative commodities traders in the process, fueling a sharp rise in energy prices.

Lehman Brothers and AIG held enormous trading positions in commodities markets. If these positions had been liquidated suddenly, the price of everything from wheat to oil would have collapsed [emphasis mine]. The Commodity Futures Trading Commission, the main regulator of U.S. commodity markets, allowed Wall Street investment banks and trading companies to take control of massive positions in commodities markets called swaps held by Lehman and AIG.

I chose to reference this particular article for two reasons. First, it was written by a Wall Street media "insider": Forbes Magazine. Second, the article was written based upon the clear premise of the author that the U.S. government had given Wall Street's cannibal-oligarchs control over those positions to protect commodity markets. In fact, the reality was the exact opposite of that. More articles from Bullion Bulls Canada…. | ||||

| Clang! Clang! $400 Gold Warning Posted: 27 May 2010 01:57 PM PDT Bullion Vault "Gold has become the favored hedge against financial and monetary uncertainty," said Niall Ferguson, Harvard University and Business School's financial history professor, on Monday. "It's certainly a time-tested way of coping with really turbulent markets." Oh crikey! Niall Ferguson – our tenured contrarian gold indicator – now says gold is a proven defense against investment stress. It's taken 11 years and 356% gains in gold, but he's finally got it. That's the top. Sell! Oh, hold on… "But a lot of the upside is already there," Ferguson went on, live by video-link to the Wall Street Journal. "The time to buy was in 1999, not 2010." Phew! As you were, then, bloody-minded gold buyers. And as you relax, safe in the knowledge that Professor Wrong still says you shouldn't buy, let's remind ourselves just what it was he advised 11 years ago – back in 1999 – the "time to Buy Gold" as he now puts it… "The twilight of gold appear[s] to have arrived. True, total blackout is still some way off…Gold has a future, of course, but mainly as jewelry." Fast forward to late 2008 – some $445 higher per ounce for gold, slap-bang amid the post-Lehmans Crash crisis – and Professor Ferguson was at it again. "I have been debating today whether Gold Bars really are the answer," Ferguson confessed to the New York Magazine when quizzed about his portfolio for one of many puff pieces that November. But "they probably aren't," he decided…thereby leaving another $470 per ounce on the table over the last 18 months. Now he says early summer 2010 is not the time to Buy Gold either. So, given what happened when he rejected the idea in mid-1999 and then in late 2008, expect another $400-or-so on the price before the Laurence A.Tisch Professor of History next weighs in with his forecast. And meantime, the man whose last TV-and-book blockbuster, The Ascent of Money, concluded that "the state-owned bank [was] now close to extinction"…just as the UK nationalized one-third of its finance sector, and the US Fed bought $2 trillion of failing bank assets…now advises that "There are other ways to protect yourself, and maybe somewhat smarter ways." Missing the point entirely again, Ferguson recommends – instead of gold – buying Norwegian and Swiss government debt as protection against…ummm…the sovereign debt crisis. Clang! Clang! Everyone out! | ||||

| Gold Edges Lower, Silver Rises 0.9% Posted: 27 May 2010 01:57 PM PDT

News of China's denial that it was reviewing its investments in European bonds was cited at a catalyst in prompting rallies in crude futures and in U.S. stocks, with oil soaring 4.3 percent and major stock indexes jumping between 2.85 percent and 3.73 percent. (…) © CoinNews.net for Coin News, 2010. | | ||||

| 2010 US Quarters Silver Proof Set Issued Posted: 27 May 2010 01:57 PM PDT

The offering is the first to include America the Beautiful Quarters that are struck in 90 percent silver, which is a reason the set is priced substantially higher than the clad quarters version that launched on May 13, 2010 for $14.95. In fact, the silver set's five proof coins are composed of 0.904 ounces of silver. At the current silver spot of $18.47 an ounce, their intrinsic value alone is presently worth $16.70. (…) © CoinNews.net for Coin News, 2010. | | ||||

| Judy Shelton: The recovery starts with sound money Posted: 27 May 2010 01:56 PM PDT By Judy Shelton http://online.wsj.com/article/SB1000142405274870402620457526625191553020… The euro is beset with fiscal calamities that threaten its downfall, and markets in the U.S. are roiled by uncertainty over the government's financial regulatory legislation. But don't worry. Treasury Secretary Timothy Geithner meets with European finance officials today to discuss the economic situation. According to a Treasury Department statement, they will focus on "measures being taken to restore global confidence and financial stability." So everything is under control. Right. What government policy makers in the U.S. and Europe fail to realize is that far from being seen as capable of delivering economic salvation, they are increasingly perceived as primary contributors to global financial ruin. Whether it's the fiscal recklessness of spendthrift politicians or the refusal of government officials to acknowledge failings — distorting mortgage markets through Fannie Mae and Freddie Mac, skewing assessments of credit risk through loose monetary policy — the influence of government over the real economy is proving disastrous. No wonder people are flocking to gold as they flee government-supplied money. Neither the dollar nor the euro inspires much global confidence; despite the dollar's relative safe-haven status, neither currency holds out the promise of financial stability. How can the real economy, i.e., the private sector, where genuine wealth is actually produced, continue to function in the absence of reliable money? Europeans will be wary of the euro from now on, given that the European Central Bank has relaxed its standards for safeguarding monetary integrity by absorbing Greek debt. Meanwhile, the perilous fiscal condition of the U.S. has convinced many that our government will resort to future inflation to reduce its own untenable debt burden. It's hard to see how economic recovery can proceed when citizens suspect that the monetary foundation beneath them is crumbling away. The willingness to work and sacrifice for the sake of future prosperity is a universal human quality — the hallmark of entrepreneurial faith — but people must believe there is a link between effort and reward. Money forges that link by providing a dependable store of value; in doing so, it performs a vital social function. The private sector is fully capable of recovering from economic downturn if individuals have a meaningful tool of measurement for evaluating alternative choices in a competitive environment. Comparisons based on accurate, free-market price signals yield optimal economic outcomes. But what we are witnessing today is a clash between the real economy's will to resurrect itself and the persistent failure of government, here and abroad, to deliver an appropriate platform of sound money based on sound finances. Even as the first inklings of rebounding growth can be discerned — increased retail sales, higher corporate profits — it takes only the latest headline about government failure to come to grips with deficit spending and accumulating sovereign debt to snuff out any potential market rally. Pledges to achieve balanced budgets by some distant future date do little to convince people that anything has really changed. Tough rules to enforce fiscal discipline were part of the original plan for persuading Europeans to abandon national monies in favor of adopting a common currency. Limits on deficit spending and government debt were clearly stipulated in the Stability and Growth Pact — no more than a 3% budget deficit, maximum debt equal to 60% of GDP. But these criteria were quietly jettisoned years ago and have now been flagrantly breached en masse by European nations responding to the financial crisis with bailout packages and fiscal stimulus. In the U.S., frustrations over Washington's seeming inability to resist fiscal profligacy have found voice in the tea party movement. As national sentiment grows in favor of limited government and constrained powers, legislation has been introduced in nine states to nullify federal legal tender laws; the Fed's monopoly on supplying the money U.S. citizens must use is being challenged by authorizing payment in gold and silver. Invoking the 10th Amendment strictures of the Constitution, proponents argue that the Founding Fathers never intended to grant federal government both the right to borrow money as well as the power to manipulate the value of the monetary unit of account. Money linked to gold and silver retains its value, which prevents the medium of exchange from falling victim to the federal government's inherent conflict of interest if it can fund its own debt with money created from thin air. Updated for our times, a number of the legal tender proposals specify that citizens would be allowed to tap electronic exchange-traded funds (ETFs) backed 100% by gold or silver to conduct digital transactions with state government. The idea of rising above the administrative dictates of fallible government to reclaim the virtues of sound money is profoundly liberating — and could prove economically empowering. Who believes that officials in Brussels or Frankfurt will safeguard the value of euro-denominated savings in the face of political pressures? Who expects the "Financial Stability Oversight Council," led by the Treasury secretary as prescribed in the regulatory overhaul bill, to spot the next asset bubble before it ruptures with catastrophic financial consequences for American retirement accounts? The transition to a firmer monetary footing to support entrepreneurial capitalism could be initiated by linking major global reserve currencies to gold and silver — commodities long associated with monetary functions. It would logically begin with the dollar. As a first step, U.S. citizens could ask Congress to authorize the limited issuance of gold-backed Treasury bonds that would provide for payment of principal at maturity in either ounces of gold or the face value of the security, at the option of the holder. The level of public confidence in fiat dollar obligations versus gold would be revealed through auction bidding, with yield spreads clearly reflecting aggregate expectations of their comparative values. In the same way that inflation-indexed Treasury bonds measure expectations about future changes in the Consumer Price Index, gold-backed Treasury bonds would provide a barometer of the Fed's credibility. By linking the dollar to gold, Americans would establish a vital beachhead for sound money and provide a model that other nations could emulate. —– Ms. Shelton, author of "Money Meltdown" (Free Press, 1994), is a senior fellow at the Atlas Economic Research Foundation and co-director of the Atlas Sound Money Project. * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Sentiment on Gold Deserves Some Tarnish Posted: 27 May 2010 01:56 PM PDT Macro Man submits: In the wake of the great inflation/deflation debate, we had better take a look at gold, which appears to be denying the deflation leg of the argument and is now leaping directly to the "inflation should occur somewhere down the road and metal is only currency they aren't printing and so is store of value, etc." argument. Even though all of that makes sense, I still can't quite come to grips with buying the stuff now, as I have just had my TDI (Taxi Driver Indicator) triggered on the way home last night, "you gotta be long gold innit." This came right after having my DPI (Dinner Party Indicator) triggered about a month ago. | ||||

| Capital Gold Group Report: Why Gold Is a Sure Long-Term Bet Posted: 27 May 2010 01:56 PM PDT by Porter Stansberry May 25 2010 4:33PM What a spectacle… In an This Readers This For And What

If Now… To At the In The Meanwhile, Will The Unfortunately, Remember…

Capital Gold Group, gold group, gold, gold prices, gold news, gold coins, gold bullion, gold IRA, IRA | ||||

| Today's Action Hints the Gold Price Will Break Upwards Posted: 27 May 2010 01:43 PM PDT Gold Price Close Today : 1211.90Change: -1.50 or -0.1%Silver Price Close Today : 18.457Change 16.2 cents or 0.9%Platinum Price Close Today: 1559.10Change: 37.80 or 2.5%Palladium Price Close Today:... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! | ||||

| Big Upswing Brings Nasdaq Green For 2010 Posted: 27 May 2010 01:38 PM PDT  Andy Wang submits: Andy Wang submits: The market jumped out of the gate today on China's show of confidence in European debt, even though the latest jobs report may not have been inspiring. Investors rushed back in to pick up tech stocks, sending Nasdaq roaring up +81.8 points and into the green for 2010. Google (GOOG) added $15 to close above $490. GOOG has completed its $750 million acquisition of mobile advertising network AdMob and will start buying $750 million of its stock on the open market. High-flyers back in April were flying again: SanDisk (SNDK) +7.55%, Broadcom (BRCM) +6.25%, F5 Networks (FFIV) +6.59%. Apple (AAPL) added +9.24 to close at $253.35. Baidu (BIDU) vaulted +8.74%, trading at $73.5 (that's back to $735 pre-split)! Amazon (AMZN) and Research in Motion (RIMM) also made nice gains, up +2.83% and +4.05%, respectively. Miners were very strong. In my Sector Watch for this week, we discussed the coal stocks bouncing with the market. This sector was among the strongest today: Walter Industries (WLT) +6.45%, Cliffs (CLF) +8.32%, Peabody (BTU) +5.82%, Arch Coal (ACI) +6.05%. Complete Story » | ||||