Gold World News Flash |

- High Conviction: An Info Systems Stock With Low Debt and Cash for Acquisitions

- Kyle Bass on Currency Devaluation, Higher Inflation Ahead

- Goldman Sachs: Commodity Outlook 'Strikingly Positive'

- $700 Billiion...$1 Trillion...What's It Really For?

- Special GSR Gold Nugget: Kevin Kerr and Chris Waltzek

- Gold $1,236 – A Pause That Refreshes is Welcomed 10:00PM EST

- Cash is King, Cash Flow is Queen

- The Power of Two: A Primer for the Lay Investor

- Shock Events & Gold Breakout

- Quick Update

- Gold’s New Records, Audit the Fed Lives On, An Oil Spill Opportunity and More!

- Bud Conrad: Beyond the Point of No Return

- Doug Casey on The Return of the Crisis Creature - May 12, 2010

- Hourly Action In Gold From Trader Dan

- In The News Today

- Deficit Landmines Dead Ahead!

- Gold: The World’s #1 Asset Class

- Gold and Silver Parabola Update

- Central Fund Takes Another 7.8 Million Ounces of Silver Out of Circulation

- Gold & Silver: The Only Game in Town 2010-2011

- The Worst $1 Trillion Ever Spent

- LGMR: Gold's New Record Highs "Tell of Inflation Threat" from Sovereign Debt Crisis

- Breakout

- Wednesday ETF Wrap-Up: VXX Tumbles, IWN Soars

- Stat of the Day: California in Top Ten for Highest Government Default Probabilities - Globally

- China: Looking for past parallels and bringing forward resource demand

- Bailout Shmailout

- When the Euro Disintegrates

- Shock Events & Gold Breakout

- Ira Epstein's Weekly Metal Report

- Eurozone Slowdown Coming; Can the Euro Survive?

- Reducing Carbon the Old Fashioned Way

- The Coming Financial Tsunami

- Greek Bailout: The Cost of Letting a Crisis Happen

- Overview of Current Economic Themes

- Hyperinflation or Hyperdeflation?

- In Era of the Destruction of Fiat Money: Euro to Parity, Gold to $1500 - Bob Janjuah

- Peter Brimelow: Gold has bugs gasping, gloating -- but still bullish

- Why the Euro Must Die (To Save the Eurozone)

- Gold-Silver Ratio (sorry, but here it is again…)

- Gold to Short-Term Target…Now What?

- Gold Seeker Closing Report: Gold Climbs to New Record Highs and Silver Gains Over 2%

- Join GATA at the Vancouver conference June 6 and 7

- Eating Gold

- Shipping Shows Continued Improvement

- IMF plots world money issuance without accountability, Rickards tells King

- Imminent power centralization within the EU

- Time to Update Canada's Pension System!

- True North strong but not free yet as Barrick blocks mining book

- 5 Signs The American Consumer Will Save The World

| High Conviction: An Info Systems Stock With Low Debt and Cash for Acquisitions Posted: 12 May 2010 07:16 PM PDT Conestoga Capital submits:

Complete Story » |

| Kyle Bass on Currency Devaluation, Higher Inflation Ahead Posted: 12 May 2010 07:15 PM PDT Kurt Brouwer submits: Quotation of the day is from Kyle Bass, who runs the hedge fund Hayman Advisors. This is from a recent client letter from Haymarket that I found at the market folly web site [emphasis added]:

Complete Story » |

| Goldman Sachs: Commodity Outlook 'Strikingly Positive' Posted: 12 May 2010 07:10 PM PDT The Pragmatic Capitalist submits: Goldman has been very bullish on commodities (in addition to the stock market) since the beginning of the year (see their 2010 commodity outlook here) and their current outlook is little changed. In fact, they see the recent sell-off in commodities as an opportunity for investors to jump back in. They see markets ignoring strong fundamental data:

Complete Story » |

| $700 Billiion...$1 Trillion...What's It Really For? Posted: 12 May 2010 07:07 PM PDT Antonio Fatas submits: It seems that large bailouts are becoming the norm these days. TARP was 700 Billion, the recent agreement to support European governments is larger than $1 Trillion. Are these reasonable numbers? How large will the next one be? There is still some confusion about what these bailouts do. In their design, they deal with a situation of financial distress that some see as a problem of liquidity (short-term financing) but others see as a problem of solvency (the business or the government will never be able to generate enough funds to pay for the current debt). Policy makers are uncertain about whether liquidity or solvency is the true problem but they might see reasons under both scenarios to still go for the bailout. If it is liquidity, the reasons are clear, you do not want a large institution, a large government or the whole financial system to collapse and drag others into financial distress. In the case of solvency, it is less obvious but there are still economic (or political) reasons to keep some companies or governments alive (as in the case of the car industry in the US). If liquidity is the real problem, the cost should be minimal or one could even imagine a profit from the lending. If solvency is the problem, there will have to be a transfer from taxpayers to the company or government in trouble. In the case of TARP, the plan to buy toxic assets in the US, there was always an understanding that some of the purchases would constitute a transfer to the financial institutions holding those assets but there was a lot of uncertainty about its financial amount. Today's estimates are more optimistic than some of the earlier ones with a total cost somewhere around $90 billion. In the case of Greece, we are talking about loans that do not imply a direct transfer to the Greek government. It could, of course, be that the interest rate charged to the Greek government is seen as below market and this could be considered a transfer -- but if the final goal is achieved and the Greek government does not default, then the market interest rates were simply overestimating the true risk and there is no transfer implied in the interest rate set by the loans. If Greece defaults and this default affects the bonds purchased by this rescue plan then there is a cost to the taxpayer. The reaction of financial markets (both the stock and bond market) to the plan is difficult to understand. The plan does not involve a direct transfer to the Greek government (or any of the other European governments that might need the funds). If the reaction was so positive it must either mean that the market believes that this was a liquidity problem that was just solved or the market reads more into the plan than what you see in the statement by the ECOFIN. Maybe they see the promise of a future transfer if liquidity problems turn into insolvency for the Greek government. My interpretation is that a direct transfer (not a loan) to the Greek government from other European countries is unlikely to happen. So the $1 Trillion plan looks more like a way to send a strong message (a number that was much higher than what most expected) and, at the same time, ensure liquidity over the months to come. It seems that the number matters more to the markets than the details. In practice, not much has changed. The government of Greece still needs to find the necessary revenues (taxes) to cover their spending and service the debt. They have bought themselves some time but the fundamental imbalance remains and it needs to be addressed. There will be other crises and I wonder if this is a trend of designing larger and larger bailouts to make sure that they provide the necessary reassurance to financial markets. And if you want to look at the less serious side of bailouts, you can always play the bailout game (click here to access the game).  Complete Story » |

| Special GSR Gold Nugget: Kevin Kerr and Chris Waltzek Posted: 12 May 2010 07:00 PM PDT |

| Gold $1,236 – A Pause That Refreshes is Welcomed 10:00PM EST Posted: 12 May 2010 06:51 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 12, 2010 05:54 PM Please don’t confuse a desire for some consolidation and new base-building with anything more than it is. Yes, it would be great to continue a straight up move but the history of this “mother” of all secular bull markets has been two steps up and one step back. This pattern has killed the perma-bears and bulls turned bears hoping to buy back in at significant lower levels. Gold has often traded in some nicely defined channels and if it does it again, we can see a pullback here to as low as $1,185 and mean absolutely nothing to the bigger picture. I continue to believe my 2010 target of $1,300 to $1,500 is very doable. Besides, I love watching Tokyo Rose wiping off the blood and saying for the umpteenth time – “gold is not in a bull market and this pullback is the beginning of the end.”* What an indicator! [url]http://w... |

| Cash is King, Cash Flow is Queen Posted: 12 May 2010 06:51 PM PDT Saskatchewan Cash Flow& Australian Bluesky Richard (Rick) Mills Ahead of the Herd As a general rule, the most successful man in life is the man who has the best information There are three things every energy investor needs to know about oil: Firstly, since the early 1980s new discoveries have failed to keep up with the global rate of oil consumption. The second thing is: China’s General Administration of Customs published figures showing imported oil in December hit a record 21.3 million tons which pushed the country's 2009 total oil imports to 204 million tons.Imported crude oil accounted for 52 percent of the country's total oil consumption last year. Third production is already rapidly declining from some of the world's largest fields. Oil production from the world’s top +200 projects peaked in 2009 and production levels are seen to be falling for the forseeable future. To summarize: ·Goldman Sachs says 2010 oil demand growth will deplete... |

| The Power of Two: A Primer for the Lay Investor Posted: 12 May 2010 06:51 PM PDT [FONT=Times New Roman]A Monday Morning Musing from Mickey the Mercenary Geologist[/FONT] [EMAIL="Contact@MercenaryGeologist.com"][FONT=Times New Roman]Contact@MercenaryGeologist.com[/EMAIL][/FONT] [FONT=Times New Roman]May 10, 2010[/FONT] [FONT=Times New Roman]The most important concept of my investing philosophy in the junior resource sector is the Power of Two. It was first discussed in slightly different terms shortly after I launched my website a little over two years ago (Mercenary Musing, May 19, 2008).[/FONT] [FONT=Times New Roman]The Mercenary Geologist investing philosophy requires actively trading stocks. There are no “buy and hold” scenarios in my portfolio. That said, there are trades and there are investments but that’s a subject to be tackled in a future musing. My trading methodology employs a very conservative strategy to speculate in a very high risk market sector. [/FONT] [FONT=Times New Roman]As I have reiterated time and time agai... |

| Shock Events & Gold Breakout Posted: 12 May 2010 06:51 PM PDT by Jim Willie CBMay 12, 2010 home: Golden Jackass website subscribe: Hat Trick Letter Jim Willie CB, editor of the "HAT TRICK LETTER" Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. The events of the last 12 to 18 months have been as shocking as they have been instrumental in reshaping the global financial structures. In fact, the event... |

| Posted: 12 May 2010 06:51 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 12, 2010 02:35 PM Stepping out for the evening but an update on some news of the day was needed. First, the U.S. stock market appears to have weathered yet another storm and my bear suit remains in the closet (but is still available for immediate use). Gold is in need of a consolidation and even a 3-5% correction. Whether it does or doesn’t, my target for 2010 remains $1,300 to $1,500. Anooraq Resources reported first quarter results and held a conference call that can still be heard for the next two days. The turnaround gathers more strength and the wind behind their back can be even better in the coming quarters. Donner Metals had a nice write-up on Minesite.com. June is just around the quarter now. Evolving Gold held a conference call today. At the risk of losing my working relationship with the company, I expressed my disappointment with it both in a letter to managem... |

| Gold’s New Records, Audit the Fed Lives On, An Oil Spill Opportunity and More! Posted: 12 May 2010 06:51 PM PDT The 5 min. Forecast May 12, 2010 12:52 PM by Addison Wiggin & Ian Mathias [LIST] [*] Gold hits another record in U.S. dollars… two ways you can play the breakout [*] Byron King identifies an oversold oil-spill stock just off “a near-term bottom” [*] Government gets it right: Senate approves watered down “Audit the Fed”; SEC investigates Moody’s [*] Plus, Patrick Cox offers a worthy anecdote on the power of stem cell technology [/LIST] And away we go again: Gold shot past its old record-high of $1,226 an ounce yesterday. It’s still making history as we write, at a fresh all-time high of $1,246 and change. “Gold's strength,” the Wall Street Journal offers, “indicates investors view the European Union and International Monetary Fund rescue package as a short-term fix that doesn't reduce uncertainty on how governments will reduce their high debt levels.” ... |

| Bud Conrad: Beyond the Point of No Return Posted: 12 May 2010 06:51 PM PDT Source: Brian Sylvester and Karen Roche of The Gold Report 05/12/2010 "We're heading toward government devaluing its currency to devaluate its debt in order to survive. That means you need to protect yourself. You can't just have savings accounts paying no interest. You need to go and buy gold," says Bud Conrad, chief economist with Casey Research, in this exclusive Gold Report interview. Despite the grim outlook for the U.S. dollar and other paper currencies worldwide, Conrad believes he and other speakers at the recent Casey Research 2010 Crisis and Opportunity Summit have information you need to both prosper and protect yourself during the coming economic storm. TGR: Today we are talking with Casey Research Chief Economist Bud Conrad who recently presented a riveting talk during Casey Research's 2010 Crisis and Opportunity Summit. Here are four major points from his talk: [*]The world economy is in a calm between a credit crisis turning into a currency crisis a... |

| Doug Casey on The Return of the Crisis Creature - May 12, 2010 Posted: 12 May 2010 06:51 PM PDT Conversations With Casey May 12, 2010 | Visit Online Version | www.CaseyResearch.com • About Casey • Forward this email • New? Free sign up for Conversations With Casey • CaseyResearch.com L: Doug, on March 3, you and I spoke about how to profit from the coming collapse of the euro. Prior to that, we talked about a major market correction on the way this year. Just last week, we saw a major confidence crisis hit the eurozone and the Dow drop 1,000 points in one day's intra-day trading. It looks to me like the beginning of a sequel to the film we saw in 2008: Return of the Crisis Creature. How do you see the latest market developments? Doug: All of the problems we're confronting today were completely predictable - and, actually, were predicted by people watching the trends 30, 40, and even... |

| Hourly Action In Gold From Trader Dan Posted: 12 May 2010 06:51 PM PDT |

| Posted: 12 May 2010 06:51 PM PDT View the original post at jsmineset.com... May 12, 2010 10:37 AM Jim Sinclair’s Commentary This says it correctly. The problem is the Western world as a whole. Investors are still in denial but that is starting to change. Gold will trade at $1650. The Western world keeps spending its way to disaster Neil Reynolds The Swiss-based Bank of International Settlements (BIS), the oldest international financial institution in the world, has functioned as the central bank of central bankers for 80 years. In a working paper written by three senior staff economists ("The future of public debt: prospects and implications"), released in March, BIS warns that Greece isn't the only Western economy with hazard lights flashing. Indeed, it names 11 more: Austria, France, Germany, Ireland, Italy, Japan, the Netherlands, Portugal, Spain, Britain – and the United States. Without "drastic measures," BIS says, all of these countries will hit a wall of debt. When the senior economis... |

| Posted: 12 May 2010 06:51 PM PDT By Chris Wood, Jake Weber, and Vedran Vuk, The Casey Report Hearing President Obama’s economic peptalks, you might be under the impression that the U.S. needs to keep spending for just a little while longer to stimulate the economy – but then will swear off big deficits. Reinforcing the point, to address concerns stirred by a Congressional Budget Office (CBO) forecast that the U.S. government will accumulate total deficits in excess of $6 trillion over the next decade, in February President Obama issued an executive order to create a bipartisan fiscal commission. The commission’s task is to deliver recommendations to the president by December 1 for limiting future deficits to 3% of GDP. (The FY 2009 deficit approached 10% of GDP. The FY 2010 deficit will probably go even higher.) It’s our contention that the president’s fiscal commission is mostly for show; the 3% limit is just a hoop for the clowns to jump through. U.S. go... |

| Gold: The World’s #1 Asset Class Posted: 12 May 2010 06:51 PM PDT Bob Hoye Institutional Advisors Posted May 11, 2010 The current tension in financial markets is providing an additional lift to gold prices. Targets based upon the 1980 to 2007 consolidation continue to point to levels above $2,000. In the short term, the mid-March bottom suggested strength would be seen through late-May or early-June with a pause at the 7/8th speedline. Previous April-May rallies have concluded with daily RSI(14) readings of 79 to 85 (currently 72) or upside Exhaustion Alerts caused by a solid week of urgency in buying pressure. The pullback to test the breakout of $1160 on May 4th and 5th alleviated the ‘urgency’ leaving the market free to rally once again. Upside targets for the next few weeks start at $1236 with the most common advance being 19% ($1290) from mid-March, but surprises could be to the upside so we recommend waiting for overbought readings before lightening up on trading positions. ... |

| Gold and Silver Parabola Update Posted: 12 May 2010 06:51 PM PDT Stewart Thomson email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] May 11, 2010 1. Michael Crook from Barclays Wealth (Transfer) Management says he knows gold is going to $800. That’s an interesting name he has, “Mr. Crook”. The Crook argues that after all the liquidity has been extracted from the system, the fair price for gold is $800. 2. That’s like saying that as 100 nuclear bombers fly towards their targeted cities, “after all the radiation is gone I expect the cities to do well, that’s my prediction”. 3. Sorry Mr. Crook, but here’s my message to you: quantitative easing is not ending, liquidity is not being extracted. QE is being ramped up, and exponentially. The Crook apparently is based in England, which in my view is the leading candidate to take centre stage next, in the great global govt paper money crisis. I hope he’s prepared, because if the pound takes the kind of b... |

| Central Fund Takes Another 7.8 Million Ounces of Silver Out of Circulation Posted: 12 May 2010 06:51 PM PDT The gold price, which had been ruler flat in early Far East action on Tuesday morning, began to rally shortly after 1:00 p.m. in Hong Kong trading... which was midnight in New York. For the next ten hours, gold rose steadily... and then, starting around the London p.m. gold fix at 10:00 a.m. in New York trading, the price traded sideways before heading higher minutes before 2:00 p.m. Eastern time... four hours later. Gold's high tick of the day was recorded as $1,235.30 spot around 3:20 p.m.... a new record high... and gold closed the New York trading session only a few dollars below that price. Silver had a mind of its own yesterday. Starting from the Far East open, silver spent the next 13 hours losing a whole ten cents. This all ended at the London silver fix... which is at noon in London... 7:00 a.m. in New York. From that point, silver gained 20 cents going into the New York open, and then promptly added another 40 cents to that gain in less than 15 minute... |

| Gold & Silver: The Only Game in Town 2010-2011 Posted: 12 May 2010 06:51 PM PDT Jordan Roy-Byrne, CMT There are numerous reasons both fundamental and technical as to why the precious metals complex will surge over the next 18 months. The sector’s surge will be reinforced by the lack of an obvious trend in most other markets. Gold, Silver and the mining stocks will surge while other markets languish. First let us look at a chart of Gold and Silver along with the major asset classes. Before I analyze it, what do you notice? We see that the other asset classes (Commodities, Stocks, Gov Bonds) have run into significant resistance. The CCI index (and I prefer to use this instead of the CRB) has major resistance at 500, which is about 20% below the all time high. The S&P 500 has heavy resistance at 1250 to 1400, a zone that lies below the all-time high. Meanwhile, Treasuries are encountering heavy resistance. Even if US T-Bonds break to the upside, its hard to see them continuing that much higher. Meanwhile, Gold has broken out... |

| The Worst $1 Trillion Ever Spent Posted: 12 May 2010 06:51 PM PDT By Dr. Steve Sjuggerud Wednesday, May 12, 2010 Just under $1 trillion… That's what the European Union promised in an emergency rescue package to stabilize the euro currency and Europe's financial woes. The result? NOTHING. On Friday, the euro hovered around $1.27 all day. As I write… $1 trillion later… the euro is hovering around $1.27. Like I said, nothing. In fact, the result turns out to be worse than nothing… It may prove to be the worst $1 trillion ever spent. To me, this $1 trillion spells the end of the euro as a credible "threat" to the U.S. dollar. And it brings gold one step closer to being at least the world's No. 2 reserve "currency" (behind the U.S. dollar). You see, before the $1 trillion promise (along with new promises from the European Central Bank to spend money to prop markets up), the euro currency had some semblance of credibility… The euro's credibility goes back to the predecessor of the European Central ... |

| LGMR: Gold's New Record Highs "Tell of Inflation Threat" from Sovereign Debt Crisis Posted: 12 May 2010 06:51 PM PDT London Gold Market Report from Adrian Ash BullionVault 09:45 ET, Weds 12 May Gold's New Record Highs "Tell of Inflation Threat" from Sovereign Debt Crisis THE PRICE OF PHYSICAL GOLD in London's wholesale market jumped to new all-time highs against all-but-three of the world's major currencies on Wednesday morning, breaking US$1245 an ounce by lunchtime. German and US government bonds slipped as world stock markets rallied together with crude oil and base metals. British gilts rose further however – and the Pound jumped towards a 17-month high in terms of the Euro – as further details of the UK's new Conservative-led coalition government were announced. Gold priced against the European Euro broke above €980 an ounce (€31,500 per kilo), extended its 2010 gains to 28%. "Spot gold in Euros is getting ever closer to the €1000 mark," says Axel Rudolph at Commerzbank in Luxembourg. "We remain long-term bullish as long as the gold price in Euros trade... |

| Posted: 12 May 2010 06:51 PM PDT Gold’s break out to new highs has very bullish connotations going forward. It puts the odds squarely in favor of a C-wave continuation. I will go over expectations and cyclical structure for a second leg of the C-wave in tonight’s report for subscribers. For those of you thinking about getting side tracked by a meaningless daily cycle low that is coming due, let me tell you from bitter experience the one thing you don't want to do is lose your position at the beginning of a C-wave or C-wave second leg. At this point the daily cycle corrections aren't profit taking opportunities. That will come as we near the end of the C-wave. At this time a daily cycle low is a last chance opportunity to get invested. Don't forget in bull markets and especially during aggressive C-wave advances the surprises come on the upside. Daily cycles can and often do run exceptionally long as a C-wave starts to gain momentum so losing one’s position in an attempt to "time... |

| Wednesday ETF Wrap-Up: VXX Tumbles, IWN Soars Posted: 12 May 2010 06:49 PM PDT ETF Database submits: Equity markets rose modestly in Wednesday trading, with the Dow gaining close to 1.4% and the Nasdaq gaining more than 2%. This sharp boost came after the Commerce Department reported that U.S. exports rose 3.2% in March to their highest level since October 2008. Among Dow components, Cisco Systems saw its shares rise by 3% after it reported a 63% jump in net income compared to a year ago. In the commodity markets, gold continued its unprecedented ascent higher, nearly reaching a level of $1250 an ounce as investors feared that the bailout in Europe would create higher levels of inflation.

Complete Story » |

| Stat of the Day: California in Top Ten for Highest Government Default Probabilities - Globally Posted: 12 May 2010 06:45 PM PDT Edward Harrison submits: With the liquidity crisis surrounding the rollover of Greek debt subsiding, the probability of default for that country has plummeted from nearly even odds to just over one in three. Last Week’s Numbers: 06 May 2010 Complete Story » |

| China: Looking for past parallels and bringing forward resource demand Posted: 12 May 2010 06:41 PM PDT One of the enduring justifications for the bullish China view is that it is an emerging superpower. 'The 21st Century belongs to China' is the mantra, in the same way that the US dominated the 20th Century. This is a plausible assumption. But should you base your investment decisions on a big picture trend spanning 90 years into the future. We don't think so. It is worth looking briefly at the experience of the US in the 1920s to show how a nation's rise to great power status is anything but linear. There are some interesting parallels between China today and the US in the early 1900s. To borrow a phrase from Mark Twain; history doesn't repeat, but it sometimes rhymes. In the early 1920s the US was emerging from a short sharp depression. (They were short in those days because governments didn't try to fix the problem). At the same time, the British were in poor economic shape. They were emerging from WWI and (unwisely) preparing to go back to the pre-war gold standard rate for the pound sterling, which was dramatically above the market rate prevailing at the time. In order to achieve this, the British needed to increase interest rates to deflate their economy and increase the value of the pound sterling. Instead, they pursued an easy credit policy, which led to gold flowing out of the bank of England and into the US. So the Brit's turned to the US for help. Bank of England boss Montagu Norman and NY Fed Chief Ben Strong were close allies. Back then, the NY Fed was in charge of monetary policy and the Board of Governors operating out of Washington (where Ben Bernanke resides today) had little say in monetary matters. The British convinced the US to inflate its money supply in order to support the pound's return to a pre-war gold standard parity. An inflationary policy in the US in1924 helped achieve this aim. But the British economy remained woefully uncompetitive because of the high value of the pound and unemployment persisted. Furthermore, gold was again flowing out of the Bank of England. This loss of reserves dictated that credit should have contracted. But instead, the British again turned to the US for help. In July 1927, Norman and Strong organised an inter-central bank conference in New York. Representatives from the Bank of France and the German Reichsbank also attended. (Strong did not permit his own Chairman to attend the meeting. Nor was the Fed Board of Governors invited!) The intention of the conference was to get all four central banks to expand credit and inflate their money supply. This was intended to help the global power at the time, Britain). Germany and France were having none of it. Germany had just endured hyperinflation and France was a creditor nation and didn't want to print money to help Britain out. This left Norman and Strong alone to agree on a massive US inflationary attempt. Unbelievably, at the conference Strong told French Representative Charles Rist that he was going to give a little 'coup de whiskey to the stock market'. Indeed he did. As a result of the credit binge he unleashed, the US stock market exploded in a speculative bubble. By mid-1928 though, he appeared to be having second thoughts about the inflationary policy. In the words of his assistant:

The penalty was heavier than he could have imagined. The bubble popped and the whole British/US scheme was uncovered for what it was, a series of short-term remedies designed to paper over large structural cracks in the monetary system. The US' fledging emergence as a dominant global power was halted. The world turned insular and protectionist. Those betting on the US as being the place to be in the 20th Century were right…they just had to wait many years for the predictions to pay off. China's role in the recovery The parallels with China today are of course very different. Unlike the US and UK last century, the US and China are not close allies. They are economically mutually dependent. But China's position is similar. It is the emerging power that other nations see as having the ability to bring the world out of its economic malaise. And like the US last century, it is inflating (expanding money supply and credit) in order to do so. But China is inflating for its own benefit, and certainly not to help the US. As an export dependent country, China was hit very hard by the 2008 credit collapse in the US, Britain and Europe. Its response to the crisis was equally massive. According to a recent World Bank Report, Chinese government led spending equalled 5.9% of GDP in 2009. The economy's total growth for the year was 8.7%. So government stimulus was responsible for nearly 70% of China's economic growth last year. More concerning for longer term stability, bank lending accounted for two-thirds of the stimulus. Total net new lending for 2009 amounted to RMB 9.6 trillion, or nearly 30% of GDP, compared to new lending of around RMB 2.5 trillion in 2008 (RMB means renminbi yuan, the Chinese currency). That's the equivalent of the Australian government telling the banking sector to increase loans by around $300 billion in a year! For some perspective, total credit in Australia in the year to February 2010 expanded by just $26 billion. As the accompanying World Bank chart shows, most of the lending went to local government run infrastructure projects. Given the raw material needs of such projects, it is little wonder commodity prices have increased so much. This is especially the case for the steel making inputs of iron ore and metallurgical coal.  The chart indicates only a modest portion of the bank lending stimulus went to real estate. But if you consider the growth in lending to the sector, you will understand why fears of a property bubble are emerging. The total stock of real estate related loans rose 38% in 2009 to a total of RMB 7.3 trillion. Such a surge in credit has obviously pushed prices rapidly higher, which is bringing more speculators into the market. The chart below (source: World Bank) shows that property prices in 36 big cities have increased by 32% year-on-year. At a national level price rises have been far more modest. But in a country with the size and variation of China, the big city index looks more representative of recent credit excesses. As does growth in floor space sold. The three month moving average has surged by around 70%. No wonder there is so much anecdotal evidence of empty housing blocks in China!  Returning to the increase in infrastructure spending, there is a disturbing trend occurring in China. That is the continuing increase in fixed asset investment as a share of GDP. (See chart. Source: GMO) As GMO consultant Edward Chancellor points out in 'China's Red Flags':

As we saw above, infrastructure accounted for a large portion of this spending. But while this might be good for Australia's raw material producers, we question the productiveness of the investment. Chancellor again:

All this stimulus spending has had a major impact on the Australian economy, obviously through the massive boost to commodity prices but also through the flow-on effects to employment, incomes and consumer confidence. Just as importantly, a strong China signals to the rest of the world that Australia is a sound investment destination. As a capital importer, the confidence of our lenders is extremely important. China's growth provides this confidence because Australia is seen as a low risk play on China. When will the cracks appear? One of the main problems we have with China's stimulus, as effective as it was in the short term, is that it was forced lending. This type of lending tends to be totally unproductive. There is little time or consideration given for the risks involved in the projects being undertaken. Money is simply advanced with little regard for the future economic return on that money. In recent commentary on China, strategic forecasting group Stratfor stated:

The result is a massive increase in non-performing loans (NPLs). It doesn't take long for loans backing 'no-consequence' projects to go bad. The projects simply do not generate enough cash flow to service the debt. A recent story appeared on the ChinaStakes website indicating that the domestic banks are looking to raise capital to offset these emerging NPLs:

Some of the banks looking to raise capital include Bank of China, Bank of Communication, Industrial and Commercial Bank of China and China Merchant Bank. So as far as we are concerned the cracks are already starting to appear. Massive credit growth (see accompanying chart, source: GMO) rarely ends well. New lending of nearly RMB 10 trillion in 2009 saw credit growth surge 30%. The government is attempting to reign in growth to RMB 7.5 trillion in 2010, implying total credit growth of around 18% for the year. Contracting credit growth usually leads to deflating asset prices. But we doubt the government will be successful in limiting the growth in credit this year. Many projects already underway will need more credit to see them through to completion.  With credit growth remaining buoyant in the short term at least, there does not appear to be a catalyst to pop China's credit bubble. But all credit bubbles have their aftermath and China will be no different. We don't buy the argument that China's central planners will be able to 'manage' credit growth lower. Most people point to China's huge foreign exchange reserves as a source of wealth and firepower to deal with any emerging problems. As we have stated in previous reports, we do not agree with such an assessment. China based economist Michael Pettis says that only twice before in history have nations built up foreign exchange reserves similar in size (as a proportion of global GDP) to China's current hoard. Those two lucky countries were the US in the late 1920s (despite Britain's attempts to stop the US accumulating gold) and Japan in the late 1980s. Pettis says rapid expansion of domestic money and credit were responsible for these two countries' subsequent malaise.

This doesn't mean China will suffer a decade or so of deflation and falling asset prices. But it does mean you should be cautious about the country's prospects and the expected impact on your investments. Another area of concern for China is the approaching trade antagonisms with the US. Like Britain last century, the US is now 'top dog'. It will use this position to pressure China into opening its markets and strengthening its currency. Stratfor argues that the Bretton Woods currency system that has allowed the US to be consumer to Japan, Germany, and Asia's producers is coming to an end. The US' trade policy will therefore change and become more protectionist. Conclusion At a guess, we would expect China to feel the effects of much slower credit growth and lower government involvement in the economy by the final quarter of the year, if not before. None of this expected risk is priced into the Australia equity market at the moment. And that is not surprising. All we hear is how the Chinese are on the hunt for resource projects, and how demand for steel inputs is going through the roof. But that demand is the result of past stimulus. Meanwhile, inventories of most base metals are at or near their peaks (and above 2008 peaks) suggesting that basic raw material supply is more than adequate to satisfy demand. After all, the global economy is only just emerging from recession and is not expected to bounce back strongly. The biggest concern for Australia is that China has brought forward much of its raw material demand via the 2009 stimulus measures. When the impact wears off, commodity prices may correct and give back some of the very large gains achieved since the 2009 lows. For this reason we are avoiding the resource sector until prices move back to more favourable valuations. This may take months, and we may look like idiots in the meantime, but we view preservation of capital as more important that jumping on momentum trades. When the inevitable correction comes and good value appears, we look forward to making some quality recommendations. We are not predicting China to endure a nasty, drawn out depression like the US and Japan experienced previously. But it will go through a post credit boom hangover. The result will likely be another round of extreme equity market volatility. Be sure you have cash on hand to take advantage. Greg Canavan |

| Posted: 12 May 2010 06:37 PM PDT Oh la la...that was fast! We've had headaches that lasted longer... One day the world is convinced that the central bankers and financial meddlers of Europe have the secret to success. The next day, they change their minds. Turns out, the euro feds don't seem to have the problem solved after all. The euro is going down again. The problem is not the fickleness of the marketplace. It is not the cupidity of politicians, nor even the stupidity of the voters. Nor is the problem a lack of regulation or coordination or integration. It is none of those things discussed in the media. In a word, it is debt. Eventually, the euro feds - along with their American counterparts - will discover what everybody else already knows. You can't really cure a debt problem with more debt. At least investors seem to be able to put two and two together. After running up stocks and bonds on Monday, investors had a chance to think it over and on Tuesday they decided that maybe the euro bailout was not quite as good as they imagined it. "European Bailout Optimism Cools," announced a headline on Bloomberg. For one thing, the plan is hard to figure out. Exactly who is paying for what? Already, the euro itself was enough of a mystery. In America, at least you know who is responsible for destroying the dollar. In Europe, you're not sure. The dollar is, after all, an IOU issued by the world's biggest debtor. What's the euro? It's an IOU too. But nobody is too sure who the 'I' is. The bailout plan is a mystery on a mystery. The plan calls for a little of this and a little of that...and maybe it won't happen at all if some nations vote against it...and who knows what they're really going to do? For another thing, no one really knows what the risk is or how much it should cost to protect against it. Yes, Greece, Portugal, Ireland, Spain and Italy all COULD go broke. But how? And when? So what? No one knows. But, yesterday, investors felt that maybe they didn't want to be holding quite so many pricey stocks or quite so many euros when they finally found out. The Dow fell 36 points. The euro went down too...to close at $1.26 - even cheaper than before the rescue was announced. What was really amazing was the price of gold. It went up $19 during trading hours. Later in the day, it was up to a new record, over $1,220. How do you like that? Why would gold go up? After all, when stocks go down, it is signaling LESS faith in the growth, prosperity and inflation forecast. A falling stock market is a sign of growing pessimism...that haunting fear that people may actually get what they've got coming after all. Meanwhile, in America, Governor Arnold Schwarzenegger is preparing the people of California. Hard times are a-comin'. They're going to have to tighten their belts. "Terrible cuts," are on the way, said the governor. How will Californians react? Will they close ranks, like the Koreans after the Asian debt crisis of the late '90s? Will they take it with good humor and Guinness, like the Irish now? Or will they start to riot, like the Greeks of the debt crisis of 2010? You remember what the Koreans did? They turned in their gold jewelry so that the state could pay its bills to foreign lenders. The Greeks, on the other hand, seem to be looking for a rumble. They figure they're entitled to the Good Life. They figure its part of what you get when you join the European Union. It must be in the constitution somewhere...that you have the right to life, liberty and a good time. They're used to being taken care of. And they don't like giving it up. They'd probably like it even less if they realized that it is all so that a group of French bondholders can be bailed out of their bad bets. But what's the alternative? You either pay your debts...or you go broke. If you go broke, no one will lend to you - so you'll have to make do on what you actually earn. On the other hand, if you do pay your debts, you'll have to take money out of earnings...leaving you with less money to spend. Oh me, oh my...there's no easy way out. Milton Friedman was right; there is no free lunch after all. And more thoughts... People don't realize it, but these macro economic issues have real, personal consequences, said our French MoneyWeek editor. Simone calculated that keeping the debt under control, at 2009 levels, would cost the average Greek nearly $2,500 per year. That's just the cost, per capita, of keeping up with the interest, while holding other expenses even with government revenues. Not many Greeks want to pay that amount. Not many will be able to. And more than a few will think they're being treated like chumps. They'll imagine that it's all a conspiracy of the elites...or some kind of fraud on the part of the governing classes. And they'll be right! The ruling classes want to keep everything under control. Like governing elites everywhere, they want to prevent change - at all costs. So, they prop up the old industries...reward the bad banks...and protect failed companies and bad speculators. Why? They're on the top of the heap...and they want to stay there. They own the present. The future be damned! So, what's their strategy? It's to squeeze the working classes and the middle classes...and everybody else. Anything and everything to preserve the old order. Scrape the barnacles from the hull? Not a chance. They are the barnacles! But the big news yesterday was the price of gold. It appears to us that gold may now be getting ready to prepare to commence the beginning of its final stage. You will notice that there is more fudging in that last sentence than in a birthday cake. Why? Because even if we are right about the general flow of events, it is almost impossible to get the timing right. Still, you gotta guess. And our guess is that gold is beginning to move up - on good news AND bad news. Inflationary? Deflation? It doesn't seem to matter. Gold is beginning to act more and more like real money, not just like a speculation. When inflation increases what do you want? Well, real money...something that maintains your purchasing power even as the paper currency goes down. Traditionally, that's gold. Because they can't make more of it easily. Gold is not perfect money. But it's the best thing we've got. And when consumer prices start to move up people look for ways to protect themselves. In the past, they could move to euros or to the dollar. Now, both the euro custodians and the dollar custodians have decided to sacrifice the integrity of their currencies in order to bailout bondholders. That leaves gold as the best choice for inflation protection. What about deflation? In deflation, prices go down. But that means that the value of real money goes up. You can buy more with less money when you are in a deflationary cycle. Trouble is, in deflation, the backers of asset prices tend to go broke. You have a piece of paper. It says you own a share in a department store. Come a deflation and people stop buying - they'll wait to see how low prices go before spending their money. So, the poor department store goes bust and you lose all your money. Or, take a bond from a sovereign country, such as Greece or the USA. In deflation tax revenues go down too. This leaves the country unable to pay the interest on its bonds. It misses payments. The value of the bonds collapses. What can you buy that has no one on the other side who might go broke? Gold! The yellow metal went up in the last great depression. It will go up in the next one too... Regards, Bill Bonner |

| Posted: 12 May 2010 06:33 PM PDT Last week's right hook to markets with the Rudd Resource Rent Tax (RRRT) was followed up yesterday with a stiff left lawsuit jab to the jaw of Australian banks. "Shares in major banks including Commonwealth Bank and ANZ fell by about 1 per cent after BusinessDay reported they faced one of Australia's biggest class actions for overcharging on penalty and late fees," reports Eric Johnston in the Age. Thus, in a matter of ten days, seven of the ASX/200's ten largest companies by weighting has had a huge cloud of uncertainty descend on their future earnings prospects. For the materials company (BHP Billiton), it's the RRRT. For the banks, the $400 million claim against them amounts to 1% of profits, according to Goldman Sachs analyst Ben Koo. Top Ten ASX/200 Stocks Weighed Down But as important as those two stories are to local stock values - and they ARE important - the biggest story going in the financial world is the possibility that Europe's common currency could literally disintegerate. Noted economist Nouriel Roubini said Europe's laggard economies need a weaker currency to spur growth and may have to abandon the project. "I would not even rule out in the next few years one or more of these laggards of the euro zone might be forced to exit the monetary union," Roubini told Bloomberg. Jim Rogers got on the television in Singapore and said the ECB's decision to put together a $1 trillion bail out is a "nail in the coffin for the euro." Rogers said, "This means that they've given up on the euro, they don't particularly care if they have a sound currency, you have all these countries spending money they don't have and it's now going to continue." Meanwhile the gold price nearly made U.S. $1,250 in the spot market and A$1,400 here in Australia. The move by the ECB to essentially devalue the euro came after the huge disruption to Aussie share prices from the RRRT. You essentially had to two separate unpredictable events, one of which was bearish for precious metals stocks, the other of which was extremely bullish. How to deal with both forces? Our view, and the view of Diggers and Drillers editor Alex Cowie, is that the ECB action is a monetary game changer. It makes inflation the single largest threat for the rest of the year. And it means the desire to hedge portfolios against depreciating paper currencies will be the single biggest driver of precious metals prices for the rest of this year. You don't get official confirmation of the intention to devalue a major reserve currency every day. So after careful consultation with Alex, we took the unusual step of re-recommending several of his previous precious metals stocks in an intra-day alert to Diggers and Drillers readers. By the way, this is normally something we'd avoid doing because we know not everyone gets their emails at work and can act on them in a timely matter. But we - and here I lapse into first person and say I - made the judgement that our first obligation was to tell paying readers that we concluded something very important had changed in the precious metals market and that it required action. We'll keep you posted on how things develop. Meanwhile...here are two important questions that came in from readers recently;

What happens when two uncertainties collide? It makes valuation very difficult, for one thing. And it makes it unclear what is exactly the best way to profit from an underlying trend, especially when you're not sure which trend is dominant. The underperformance of Australian gold equities relative to the gold price is perplexing. But Alex has taken a specific approach which he believes will reward Aussie investors. It involves having production assets outside the country. Next question, and it's a long one. In fact, we won't answer it. It's another viewpoint on China. In today's essay section, we publish an essay from Greg Canavan from his Sound Money. Sound Investment report of several weeks ago. --Hi, I thought you might find this interesting - Dan Denning might anyway. Having been worried about the current state of affairs I've taken my $$ off the table in Aust stocks, particularly resources. I asked a professional friend who's been based in Shanghai for the last 10 yrs his thoughts on the bubble: Response below: Hi Mate, Here's my take on the China market. 1. The population is still growing. It will probably peak at around 1.5 billion in the next twenty years. Up from 1.35 billion now, so that's an extra 150 million people who will need a house and a job. 2. The economy continues to grow at around 10% a year, and a lot of that is infrastructure led - like all the new interstate highways, inter-city 'very fast' rail links, subway systems and airports. All in all, that's a lot of steel rebar ... 3. Cities here are growing, too with massive building and re-building programs that will need to house and provide work space for the people who are migrating from the country to the towns ... around 200 million in the past 10-15 years, and forecasts of another 150-200 million to follow in the next 15-20 years. That's bigger than the population of the US. That's a lot of rebar, too ... 4. On top of that, all these people are earning enough money to buy stuff: home appliances to start with, but they're dreaming of a car as well. Car sales have gone from under 100,000 in the late 90's to around 14 million this year (bigger than the US). And car ownership is still under 5% of households. That's a lot of rolled steel on top of all the rebar ... All in all, the China boom has at least another twenty years to run before it starts to run out of steam and slows down to be a rather poorer version of Japan (static and ageing). If I were you, I'd stop worrying about a 'credit bubble' and look at the underlying dynamics and demographics. Then I'd think about buying back in to BHP, Rio Tinto, and Woodside, pronto Heard the Australian Ambassador at lunch last week talking about the 40% Tax. He seemed to think it was fair enough, given that you can only dig the stuff up once. The country needs to get better value for its resources. Like Norway did with their North Sea Oil. He was also talking about China and Oz getting together in joint ventures to do some of the processing in Australia before it gets sent to China. Makes sense, really: why ship iron ore and coal separately when you can ship pig iron to China. Good for the environment too, when you're only shifting half the quantity of 'dirt'. Similar Posts: |

| Posted: 12 May 2010 06:12 PM PDT The events of the last 12 to 18 months have been as shocking as they have been instrumental in reshaping the global financial structures. In fact, the events have pointed out the fracture of the global monetary system and banking systems. The steady stream of events is accelerating in scope and intensity. The fractures are finally being recognized. |

| Ira Epstein's Weekly Metal Report Posted: 12 May 2010 06:06 PM PDT I don't see gold falling out of favor for a very long time. In my opinion gold has taken on a "reserve currency" status in the minds of those who have become disenchanted with the ability of governments to control spending. The days of the Eurocurrency to survive as a quasi reserve currency are in my opinion over at this point in time. |

| Eurozone Slowdown Coming; Can the Euro Survive? Posted: 12 May 2010 06:00 PM PDT Edward Harrison submits: The news out of Spain that the government is taking drastic action to avoid debt revulsion is a clear indication that the eurozone is entering a new phase of economic weakness. All across Europe from the UK to Greece to Spain to Germany, governments are now cutting spending. And while these moves are necessary in the face of crisis, they will be a negative for growth in 2010 and 2011. Ultimately, all of this creates a market sentiment which weakens the Euro, and as I said on BNN Tuesday, this is exactly what Europe wants (see video here; the second part on the global economy is here). Obviously the eurozone is not an optimal single currency area. It serves more to deepen political union than as an economic union given the lack of harmonisation between countries and the absence of a federal treasury. Nevertheless, many countries still want to get in. For example, Estonia has been granted permission for inclusion starting in January 2011. Complete Story » |

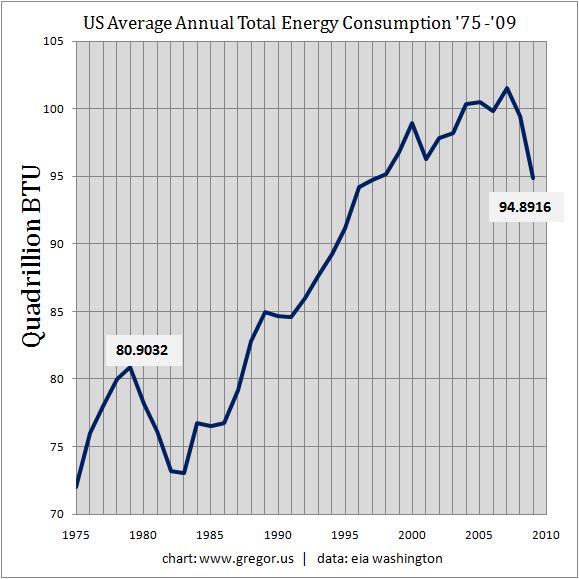

| Reducing Carbon the Old Fashioned Way Posted: 12 May 2010 05:56 PM PDT Gregor Macdonald submits: The EIA has reported that 2009 carbon dioxide emissions in the United States experienced their largest decline–on both an absolute and percentage basis–in 60 years. If you consider the chart I’ve included here (click to enlarge), it’s not hard to see why. Measuring total energy consumption from all sources–oil, coal, natural gas, nuclear, hydro, and renewables–US energy consumption fell from a high in 2007 at 101.5652 quadrillion BTU, to 94.8916 quadrillion BTU last year. A financial crisis and its attendant industrial collapse is a very effective way to reduce emissions. Complete Story » |

| Posted: 12 May 2010 05:51 PM PDT

In light of what’s happening right now (and the fact that I never posted it on ZH before), I thought it relevant to post this article that I wrote in the February of 2009 as a primer for friends and family to help them become aware of what was happening (and prepare for what I saw coming). Remember – this was written for people who were very much enmeshed in the MSM propaganda world and had no clue of the reality behind our economic, financial and monetary system. The idea was to gently introduce them to the truth and give a brief overview, so you won’t find me going into the full technical and gory details; plus I wanted to keep the length manageable so as to not put them to sleep. If you find it worthwhile, feel free to forward it to your near and dear ones who are still entrapped in The Matrix. Here it is:

Brief Opinion: Massive PM Demand in Europe As an aside, ZH just reported that bullion dealers in Europe were sold out, with many such as Kronwitter having to shut shop temporarily due to their inability to meet the massive demand [sure, they might open back up ala 2008 with or without massive premiums above the spot price, but they just as easily might not if there starts a real run on the PM’s with unlimited demand (i.e. the beginning of hyperinflation) - which WILL be the case at some point in the not too far off future].

Here is what a potential run on bullion looks like:

Kronwitter Sold-out page (translated using Google translate) Here is one of the bigger dealers Proaurum:

(Translated using Google translate) Another one Westgold sold out:

(Translated using Google translate)

Tell me, what good is the paper price if you can’t buy the real metal at it? The only thing providing credibility to the paper/futures price is its link to the physical metal. If there is no metal available at that price then it’s just a worthless paper ticket with the words Gold/Silver printed on it. You think that was silver you just bought in the futures market? Nope. More likely a WORTHLESS contract to deliver and it’s not even paper, just some bits in a computer somewhere! (This is practically true even right now for certain corrupt exchanges like the COMEX, considering how hard it is to obtain delivery there). If there is no metal available at the “displayed” price, then it’s just a government dictated price level (ala price controls), with an illusion of free trading thrown in to draw the retail suckers into the casino – just like the stock market. What’s more, due to these hidden price controls created by massive government interference in various markets, we have no price discovery in ANY market right now.

Got Gold?

|

| Greek Bailout: The Cost of Letting a Crisis Happen Posted: 12 May 2010 05:49 PM PDT Eric Falkenstein submits:

So, it's a trade-off, and its benefits would depend a lot on intrinsically subjective probabilities. Reasonable people can disagree. Complete Story » |

| Overview of Current Economic Themes Posted: 12 May 2010 05:41 PM PDT Vega submits: The general themes right now: -Collapse of the eurozone -US banking bill that could dramatically reduce financial sector profits Complete Story » |

| Hyperinflation or Hyperdeflation? Posted: 12 May 2010 05:28 PM PDT |

| In Era of the Destruction of Fiat Money: Euro to Parity, Gold to $1500 - Bob Janjuah Posted: 12 May 2010 04:59 PM PDT Edward Harrison submits: RBS’ Chief Market Strategist Bob Janjuah is one of the more bearish prognosticators in global finance. He takes a fairly anti-fiat currency position and couches what he sees with the present financial crisis as the era of the destruction of fiat money. This is bearish for bonds and bullish for gold. Let’s put Janjuah in the inflation camp of the inflation-deflation debate (I am in the deflation camp along with the likes of David Rosenberg). Now I haven’t seen Janjuah making hyperbolic claims of hyperinflation which I don’t find particularly credible. However, he does underline the weaknesses in fiat currency and the seduction of central banks to print money as a remedy for economic woe. These are credible arguments that have investment implications in the face of the eurozone crisis. Complete Story » |

| Peter Brimelow: Gold has bugs gasping, gloating -- but still bullish Posted: 12 May 2010 04:51 PM PDT By Peter Brimelow http://www.marketwatch.com/story/gold-has-bugs-gasping-and-gloating-2010... NEW YORK -- Gold made new highs Wednesday, and the victorious bugs think more is to come ... eventually, and maybe now. In the latest issue of the Aden Forecast, which came in Tuesday night, Mary Anne and Pamela Aden summarized their long-standing fundamental and inflationist arguments for gold. But they added in chart-speak: "Now that gold has broken into record high ground, above $1,218 on a close, it could jump up to $1,300 or higher, to possibly the top of the channel during the current rise. Gold's leading indicator has jumped up, and it has room to rise further. This tells us that gold is headed higher. The long-term indicator backs this up. ... It's signaling that the rise we call 'C' is still ongoing on a bigger-picture basis. That is, the rise since November 2008 is still under way, in spite of its already 73% gain from $705 to $1,220 today." ... Dispatch continues below ... ADVERTISEMENT Prophecy Resource Corp. Appoints Rob McEwen to Advisory Board Prophecy Resource Corp. (TSX.V: PCY, OTC: PCYRF) is pleased to announce the appointment of Rob McEwen to the company's Advisory Board. McEwen is a leading Canadian mining industry entrepreneur. He is the chairman and CEO of U.S. Gold Corp. and Minera Andes Inc. McEwen was the founder and former chairman and CEO of Goldcorp Inc., whose Red Lake Mine in northwestern Ontario, Canada, is considered to be the richest gold mine in the world. During his tenure at Goldcorp, McEwen transformed the company from a collection of small companies into a mining powerhouse, growing its market capitalization from $50 million to approximately $8 billion. For Prophecy Resource Corp.'s complete statement: http://www.prophecyresource.com/news_2010_mar11b.php This is a change, because when gold slumped in late winter, the Adens thought the "C wave" was over. But even then they predicted that the yellow metal would rebound. Dow Theory Letters' Richard Russell, a friend of the Adens, doesn't even bother with these details. He says flatly: "Do not trade your gold or gold shares. The third phase for gold lies ahead. The central banks do not want to see a new high in the price of gold, and they will do anything they can to keep the price of gold down. But the primary trend of gold is more powerful than all the world's central banks taken together." "There is nothing more powerful than an idea whose time has come. The idea -- gold is the only money that's safe from the world's clueless governments, and their obsession to escape a recession or a depression." This is a change for Russell too -- he used to deride the claim that gold's price has been long manipulated. Bill Murphy and his fellow radical gold bugs at his Lemetropolecafe Web site are the leading proponents of the manipulation thesis, which they blame on what they call the "Gold Cartel." Murphy was in full cry last night (and his cry is pretty loud): "After all these years, what fun to watch gold and silver trade like real markets. For a change, there is true ebb and flow ... and a refreshing change from Gold Cartel-inflicted patterns." "There is growing talk, which is also quite normal, about the gold ebullience ... too much froth. What these people who talk this way aren't dealing with is that the price of gold ought to be $2,300+ and would be without the price-suppression scheme. These prices are terrific but are nothing compared to what is coming down the pike." Murphy added in his conspiratorial way: "I am not at liberty in any way to go into further detail, but I can say there are growing developments behind the scenes which are going to send the prices of gold and silver sharply higher ... and they relate directly to what [the radical gold bugs have] been saying for 11+ years!!!" He may sound conspiratorial -- but gold is a lot higher than when I first wrote about Murphy on MarketWatch, nearly 10 years ago. I sense somewhat less concern that the gold shares, widely regarded as a leading indicator of gold's price, have been relatively sluggish. But let the record show that Murphy's Lemetropolecafe does supply one (short-term) cautionary note: India has just stopped importing gold -- not an unusual response to the metal's move, but sometimes a sign that it's due for a breather. Join GATA here: World Resource Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Preliminary Feasibility Study Completed for Seabridge Gold's KSM Project Study Reports Reserves of 30.2 Million Oz. Gold, 7 Billion Lbs. Copper, Base Case Life of Mine Cash Operating Costs Estimated at $144/oz. Gold Produced Toronto -- Seabridge Gold Inc. has announced results from a National Instrument 43-101 compliant preliminary feasibility study of its 100-percent owned KSM project in northern British Columbia, Canada. The study was prepared by Wardrop, a Tetra Tech company, a major international engineering and consulting firm. Seabridge President and CEO Rudi Fronk says, "The study confirms that the KSM project now hosts the largest gold reserve in Canada and one of the largest in the world. KSM is projected to provide an extraordinary mine life of more than 35 years with estimated cash operating costs well below the current average of the major gold producers. Estimated capital costs are in line with those of comparable, large-scale, undeveloped gold-copper projects and KSM has the advantage of being located in a low-risk jurisdiction." For the complete Seabridge Gold statement: http://www.seabridgegold.net/readmore.php?newsid=283 |

| Why the Euro Must Die (To Save the Eurozone) Posted: 12 May 2010 04:20 PM PDT

Written By: Justice Litle, Editorial Director, Taipan Publishing Group Source: http://www.taipanpublishinggroup.com/taipan-daily-050710.html

"Politicians like to gloss over reality, but we confront them with the facts." Some ways back in these pages, we questioned whether the Federal Reserve, in trying to plug a massive credit contraction hole, might be tossing a mattress into a volcano. It turned out to be the right analogy, but the wrong tosser. The eurozone is the region with serious volcano issues (and not just by way of Iceland). It wasn't supposed to be this way (according to the powers that be). Last weekend, European heads of state finally got their acts together in offering up a Greek rescue package. The proposed rescue – which the U.S. taxpayer had a hand in too, by way of IMF commitment – was supposed to restore calm and show a fiscally united front. The actual effect was the opposite. Instead of calm, there was fresh panic. The sovereign debt volcano, rather than being sated by last-minute terms for a Greek bailout, grew angrier. The euro hit new 12-month lows on the panic… then broke even further through the psychologically key $1.30 level… and is plumbing fresh new depths as I write to you. Nor was it just the euro that took a wallop. Risk assets all over the world went into freefall. For a brief window of time, everything seized up, like a middle-aged man clutching his chest on the tennis court. The scary thing, when it comes to Greece, is less about "present pain" and more about "future precedent." What is happening there could happen in other countries too – on a larger scale. Weare witnessing a template for sovereign debt destruction. Taipan Daily warned readers of this possibility in late January, dubbing 2010 (if you'll recall) "the year of political risk." As your editor wrote in that missive, "2001 Will Be the Year of Political Risk" some months ago: For $150, You Can Own The Top 100 Companies On The S&P 500 If the S&P moves 100 points, you could make 4 times your money ($1,500 could turn into $6,000)! These are the secrets Wall Street's professional traders use to rack up fortunes – even while they're telling you to buy stocks that are going to plummet! Get all the details in this special report from WaveStrength Options Weekly. HOT SPOT #2: EUROPE. Skeptics have long argued that the euro is not actually a currency. It is an experiment. The hope of the euro experiment was that 16 different countries could band together, under one united monetary policy, while yet preserving wholly separate cultures, political structures, and economic climates. This was always a nutty idea, and the experiment is now under severe stress. With the Greek sovereign debt crisis consistently getting Page One headlines in financial newspapers worldwide, investors have awakened to the utter helplessness of the ECB (European Central Bank). What happens if Greece implodes? What if happens if Spain or Portugal is next? If Germany and the other rich countries refuse to help (i.e. whip out the checkbook), will the PIIGS (Portugal, Italy, Ireland, Greece, Spain) simply be left to die in the abbatoir? How could German political leaders even think of writing a check to Greece without a deluge of outrage at home? According to Greek economics professor Savvas Robolis, Greece now has "explosive unemployment" in its future. "Panic is slowly taking hold in the minds of the [Greek] people," he says. Robolis further fears the harsh austerity measures of the IMF threaten to put Greece "on ice," meaning that severe cutbacks and punitive measures could kill off any chance of growth in the weak Greek economy. In more ways than one, the troubles for Greece are troubles for us all… Nein! (No More!)To add some further color, the whispered word on trading desks is that Germany is to blame for this week's big freak-out. Initially, investors reacted negatively out of concern that the Greece rescue package was too little, too late… out of fear that the Greek populace (of whom a very large portion are civil servants) would not accept it anyway… and out of conviction that far more money would have to be spent. The negative "concern" became full-blown panic, though, at least partially on rumor that German politicians were drawing a bright hard line that said: "No more bailouts after this one." Teutonic stubbornness reduced the odds that Portugal or Spain would see a rescue check – which, of course, increased the risk that they might fail. The prudent investor's attitude is "better safe then sorry" with these things, and credit default swaps on Portuguese and Spanish debt thus exploded higher on talk of German intransigence. (Credit default swaps, or CDS, are a sort of catastrophe insurance; the higher the swap, the greater the implied odds of catastrophe.) The troubles this week also trace back not just to sovereign debt contagion – with Greece a sort of patient zero – but leveraged hedge fund contagion. It seems that some clever funds – too clever for their own good – were caught by surprise trying to pick a bottom in the Greek bond market. Having gotten their fingers smashed, these funds suddenly had to sell other assets from the portfolio to reduce overall risk. Along with fresh bad news from China, this then set off a domino chain of forced selling that stretched all the way to Brazil, Japan and parts beyond.

Greek protesters, many thousands strong, have already rioted in the streets, throwing makeshift firebombs at police. Sadly, three people have died thus far. In Spain, the bankers tremble as fearful investors dump their shares – getting out ahead of time in case of a full-on bank run. In both Germany and the United States, taxpayers are seething that they didn't want to throw more rescue money down a rat hole, but feel coerced and left without a choice. It's a horrible situation… everyone is angry. The Greeks are angry at being put on a brutal starvation diet. The Germans are angry at the perception of having to be their profligate brother's keeper. Other eurozone nations are angry at being caught up in a downward debt spiral, as fears of continent-wide insolvency threaten to become a self-fulfilling prophecy. Diversify with a CD that's closely tied to the price of commodities Why do EverBank customers choose this Commodity Basket CD? It's one CD featuring 4 currencies from countries with resources that are in demand. So as demand for these commodities continues growing, the value of these currencies could increase. Learn more and apply for the Commodity Basket CD. Roll Out the PressesThere is perhaps just one thing left to do: Destroy the euro. Jean-Claude Trichet, the head of the ECB (European Central Bank), should swallow hard… admit his failure… and print like a madman, devaluing the currency in order to "monetize" the vulnerable eurozone countries' debts. The ECB does not want to do this, of course. Trichet is such an inflexibly stiff rod, a directive like that could snap him in half. For such paragons of fiscal rectitude as the keepers of the euro, the idea of intentionally vaporizing the currency (in the name of monetizing toxic debt) is an awful one. But the palatable choices have essentially run out now. It is too late to play the fiscal responsibility card. One cannot play at prudishness and moral rectitude after sobriety and virginity are already long lost. If something is not done, the vulnerable eurozone countries could be crushed under the weight of their ill-accumulated debts like a field mouse beneath a cinder block. The Austrians Called ItWhat we are seeing now for the eurozone is a clear instance of the Von Mises prophecy. (Ludwig Von Mises is the father of Austrian economics. We have quoted him – and his prophecy – many times in these pages.) To go to the well one more time – and probably not for the last time! – many decades ago Von Mises taught and predicted as follows (emhasis mine): There is no means of avoiding the final collapse of a boom expansion brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved. Note the Hobson's choice presented, i.e. a choice that isn't really a "choice" at all. Once past the point of no return in terms of accumulated debt, the only real options are to destroy the economy or destroy the currency (in the name of saving the economy from debt-laden doom). The currency destruction comes about as the authorities "monetize" debt that would otherwise crush them. Another way to put it is "inflate or die." The eurozone is now faced with the compact directive to "inflate or die." Japan will eventually face the same music. And so too will the United States… An 18-Year FlashbackThere is also a bit of déjà vu here as far as the United Kingdom is concerned. That's because Britain went through a phase some 18 years ago with similarity to what the eurozone faces now. In 1992, Britain was part of something called the ERM, or European Exchange Rate Mechanism. The ERM was a kind of fiscal strait jacket. As a member of the ERM, Britain had to keep its currency, the Pound sterling, within a certain agreed-upon range. The trouble was that the prescribed range for the ERM meant Britain's currency was too strong. An overly strong pound was killing the weak British economy. (Sound familiar yet?) Back then, British politicians were just as pig headed as the talking heads in the broader eurozone today. They swore up and down that Britain would not drop out of ERM… that the British pound would not be devalued… that the pound would hold its value, no matter what. Well, those politicians didn't know what they were talking about. They didn't understand that fiscal strength requires preventative maintenance – that you keep a strong currency by avoiding debt build-up in the first place, not irrationally denying it after the fact. And so – we are still talking about 1992 now – along came a speculator named George Soros, looking for trades to make in his legendary Quantum fund. In a nutshell, Soros saw that the British politicians were being stupid. He saw that the British pound would have to be devalued, for the sake of the weak British economy… and that stubborn British politicians wouldn't be able to maintain membership in the rigid ERM band just because they wanted to. And so Soros shorted the daylights out of the pound… and made a billion dollars in a single day doing so, earning the nickname "The Man Who Broke the Bank of England." The tabloids hated Soros after that – they accused him of taking 12 pounds sterling from every man, woman and child in Britain – but really all he did was do the country a favor. (Some British economists admitted that, had they stuck to the artificially strong ERM trading band even longer, much greater damage to the British economy would have been done.) The euro, and the eurozone, are now in a similar place as to 1992 Britain (on a much larger scale). Europe's pols are just too dimwitted and stubborn to see it. When politicians try to deny reality on too large a scale or for too long a time, reality always wins out. No matter how big and powerful the government entity in question, gravity wins out in the end. That is why traders and speculators can make a great deal of money through tactical alliance with the right side of history. A Lesson in Financial PhysicsVon Mises' prophecy – in which the accumulation of debt over massaged credit cycles leads ultimately to destruction of the economy or destruction of the currency, with no third option to choose from – is not a grand morality exercise. It is more akin to a keen observation as to the effects of gravity and the laws of financial physics. The inevitability of financial physics further explains why your humble editor – and plenty of others – saw the euro's fate written on the wall quite some time ago. (The late Milton Friedman, for example, predicted the euro would not survive its first true crisis, for the same essential reasons we see in play today.) Don't forget to follow us on Facebook and Twitter for the latest in financial market news, company updates and exclusive special promotions. Article brought to you by Taipan Publishing Group. Additional valuable content can be syndicated via our News RSS feed. Republish without charge. Required: Author attribution, links back to original content or www.taipanpublishinggroup.com.

Other Related Topics: Currency Investments , Euro Currency , European Investments , Justice Litle , Macro Trader Also By This AuthorOther Related Sources |

| Gold-Silver Ratio (sorry, but here it is again…) Posted: 12 May 2010 04:16 PM PDT |