Gold World News Flash |

- European Crisis and the Difficulty in Learning From Past Mistakes

- Trading Week Outlook: May 9 - 14, 2010

- Three Things I Think I Think About the Markets

- What Caused Yesterday's Crash?

- Brief Thoughts on the ECB's Statements

- Deflation Investing Strategy: Five Things You Should Know

- Finding the Right Safe Haven for This Crisis

- Trading Lessons From Thursday's Market

- Ira Epstein's Weekly Metal Report

- Why the Crash Is More Important Than You Think

- Offshore Miners Not Directly Affected

- US Deficit Spending: Greenspan and the Government Giveaway

- Why Job Growth Will Accelerate

- Fear, Mr. Bond, takes Gold out of circulation…

- Letterman: Brian Williams On The Stock Market Collapse

- The dangers of Quant Trading models; Dow’s 1000 point drop a prime example

- The Goldman Sach’s ‘Disease’ (it’s contagious)

- Panic Subsides, But for How Long?

- Victor Gonçalves: Betting on the Raw Materials

- Mr. President: Unplug the F*ing Computers

- Euro weakens as investors shun Greece debt

- Jim?s Mailbox

- Stock Market Micro Intraday Crash Shows Us Where The Safe Havens Are

- Hourly Action In Gold From Trader Dan

- In The News Today

- Market Commentary From Monty Guild

- Things

- Titanium Metals Corporation (NYSE:TIE) — Up 16% on “Spanking Good Earnings”

- The 25 Minute Panic

- The Silver Price Spiral, Part III: tomorrow

- Global Deflation, Global Inflation and Australia's Gold Tax Grab

- Uranium – A Place to Hide

- The Achillies Heal of Financial Markets

- Algoholics Anonymous

- A Clear Understanding of Hyperinflation, Money Demand & the “Crack-Up Boom”

- Gold Seeker Closing Report: Gold Gains Over 2% While Silver Falls Slightly; Stocks Tumble

- Bonds and Gold: Worth Watching!

- British Pound in for a Sharp Fall?

- Ticky Toc Clock: Gold/SPX

- Physical Bullion vs. Paper: Get Your Paper Bullion Converted to Physical ASAP

- James Turk looks at housing prices through a golden lens

- Another Quiet Day in the Markets

- Currency Devaluation 101: Japan Pumps Liquidity For First Time Since December To Punish Surging Yen

| European Crisis and the Difficulty in Learning From Past Mistakes Posted: 06 May 2010 07:05 PM PDT Alicia Damley submits: As predicted by Reinhart and Rogoff’s sequencing of the crisis, default on sovereign external and/or domestic debt is unfolding as expected. Despite this, EU political constituencies continue to be unable to formulate a viable rescue plan for Greece even with contagion to other weak countries already evident. As an aside, this lack of reaction is not dissimilar to initial the US Congressional rejection of the sub-prime bailout package not that long ago – in Sep 2008. Market reaction to each event is thus far similar: cautious optimism (about a viable solution) - increasing skepticism - disbelief - loss of confidence – mass sell-off. The market’s own five stages of dealing with tragedy. Historically, the PIGS have had a poor experience following default or restructuring of external public debt. Amongst the four, Spain and Greece stand out in particular, with the latter having spent most of the 20th century mired in difficult times. According to Reinhart and Rogoff’s analysis, in comparison to all countries, Greece is bested only by Angola, Ecuador and Honduras. Complete Story » | ||||||||||

| Trading Week Outlook: May 9 - 14, 2010 Posted: 06 May 2010 07:04 PM PDT All Things Forex submits: As the world’s financial markets continue to focus on the sovereign debt crisis in Europe and “digest” the outcome of the U.K. elections, the main gauges of economic growth and industrial activity in the euro-zone, the U.S. and the U.K., coupled with the Bank of England’s interest rate announcement and inflation report, promise to deliver another exciting week ahead. Complete Story » | ||||||||||

| Three Things I Think I Think About the Markets Posted: 06 May 2010 06:57 PM PDT The Pragmatic Capitalist submits:

Complete Story » | ||||||||||

| What Caused Yesterday's Crash? Posted: 06 May 2010 06:51 PM PDT The Pragmatic Capitalist submits: There’s all sorts of speculation over what caused the crash today. The answer is simple. Pure unadulterated fear. Everyone is looking for someone to blame, but we’ve seen this happen in markets for hundreds of years. It happened before there were computers and it now happens that there are computers. Today was a classic fear filled day. We saw huge downside in many debt and forex instruments before the crash and the equity markets were the last to capitulate. The bids fell off the board and the sellers just continued to hit the bids. There might have been some “fat finger” trades or some electronic trading that contributed, but this was primarily fear. Good old fashioned fear. This has always happened in markets and will always happen in markets. It’s as simple as that as far as I’m concerned. Complete Story » | ||||||||||

| Brief Thoughts on the ECB's Statements Posted: 06 May 2010 06:39 PM PDT The Pragmatic Capitalist submits: I was a little surprised to hear the statements by Jean-Claude Trichet yesterday morning. In essence, it sounded like he is in total denial over the situation that is unfolding in Europe. Trichet says the surrounding nations are not in danger of default. While it might be true that they are in a less dire financial situation I think Mr. Trichet is underestimating the pressure that higher rates and continuing budget cuts will impose on these nations. Remember, this is a CURRENCY problem that can only truly be fixed by total dissolution of the EMU. Until then, there will always be deficit nations that are subservient to Germany’s surplus. I’m going to speculate here a little bit, but Trichet said in the morning’s testimony that they had not even discussed the option of buying bonds on the secondary market, i.e., implementing quantitative easing. Trichet said: Complete Story » | ||||||||||

| Deflation Investing Strategy: Five Things You Should Know Posted: 06 May 2010 06:33 PM PDT Brett Owens submits: It’s looking more and more apparent by the day that deflation is returning to the financial markets – and with a vengeance. Yes sir, deflation is back – it’s out to kick ass and chew bubble gum, and apparently it has just run out of gum. Complete Story » | ||||||||||

| Finding the Right Safe Haven for This Crisis Posted: 06 May 2010 06:22 PM PDT Dude, where's the Dharma? submits: "Is it safe?" That question still brings shivers up my spine as I recall the 1976 movie, Marathon Man, starring Dustin Hoffman, Roy Scheider, and Laurence Olivier. If you haven't seen the film, here's the scene in question on YouTube. Complete Story » | ||||||||||

| Trading Lessons From Thursday's Market Posted: 06 May 2010 06:19 PM PDT Stephen Rosenman submits: It doesn't matter why the market dropped 900 points mid day on Thursday. Probably, a combination of trading errors, mindless computer selling, and just sheer panic. The plunge clearly was not based on the fundamentals of the market: 500 points of the DJIA collapse lasted only 25 minutes. What mattered was how to benefit from the action. After all, you could have grabbed stocks at unbelievable prices between 2:45 to 3:00 P.M. However, most investors didn't have time to act. You couldn't get into your trading accounts in time. The investment firm computers were overrun, their phones were busy. And besides, the trading window was too short. For instance, AAPL dropped to $199 for a blink of the eye; it traded under $230 only minutes before buyers bid it up to more rational levels. It wasn't the daring investor who made the most money yesterday, who saw the opportunity and took it. No, it was the guy who placed an absurdly low bid weeks earlier and it executed. So what do you take away from Thursday? Always leave bids out there for stocks you love at outrageously low crazy prices, far below you would have thought you could ever execute. A great deal is written about the benefits of stop losses (yesterday, those stop losses probably got somebody out of AAPL at $200). Unfortunately, not enough is written about setting up trades far below the market price. Those who set a bid for AAPL at $205 were richly rewarded. Placing those low bids gives you a chance to make a once in a lifetime trade at almost no risk. That's what happened to those investors who made 20% on AAPL in 20 short minutes. Complete Story » | ||||||||||

| Ira Epstein's Weekly Metal Report Posted: 06 May 2010 06:11 PM PDT Over the past month or so I have been pointing out in this Report that gold's near term fate lies with how the European Union (EU) and International Monetary Fund (IMF) handle the Greek sovereign debt issue. Unfortunately as of this writing there has been no real resolution. In my opinion the EU has allowed contagion to spread to other parts of the EU and world financial markets. | ||||||||||

| Why the Crash Is More Important Than You Think Posted: 06 May 2010 06:10 PM PDT Jesse Felder submits: click to enlarge I was in the car most of yesterday so I largely bypassed the commotion in the markets. Without Bloomberg radio on Sirius (SIRI) I would have missed all of it. (I can't recommend the stock but Sirius radio is a great investment opportunity; I heartily endorse the product). Last week I wrote that, "The Goldman Case Is More Important Than You Think," arguing that investors may begin to lose their appetite for risk after experiencing the pain of the bursting of the internet bubble, housing bubble and the meltdown surrounding the financial crisis. The past decade has been one of the worst ever for risk assets. History shows that after periods like this one entire generations swear off the source of risk that caused them so much pain. Complete Story » | ||||||||||

| Offshore Miners Not Directly Affected Posted: 06 May 2010 06:06 PM PDT It has been a hectic week here educating clients about global capital flows and debt cycles. One of the really interesting factors at play Down Under has been the unwinding of the carry trade which accelerated last night. The message it not always understood so I will be preparing a file to explain how this works as further education in the Members area of my site as soon as time allows. | ||||||||||

| US Deficit Spending: Greenspan and the Government Giveaway Posted: 06 May 2010 06:02 PM PDT I have long maintained that there is, actually, nothing new under the economic sun for (checking my watch for the precisely correct time) the last few thousand years or so, and if you look deep into my Serious Mogambo Eyes (SME), you will see, as the acronym suggests, total sincerity when I tell you that there have always been the usual few things; income, taxes, spending, saving, borrowing and debt, and something along the lines of interest, which is not to forget, of course, money itself. | ||||||||||

| Why Job Growth Will Accelerate Posted: 06 May 2010 05:56 PM PDT ChartFacts submits: Nonfarm payrolls will be announced today. Most estimates are for an increase of between 150,000 and 200,000 jobs. This will be the first reading of back-to-back quarters of positive growth since 2007. And, while many discussions will be had about the specific number and the component of government hiring, the larger story is the trend going forward. There are many reasons to believe that, minus a spreading European meltdown, the fundamentals are in place for job growth to accelerate and the unemployment rate to fall. Complete Story » | ||||||||||

| Fear, Mr. Bond, takes Gold out of circulation… Posted: 06 May 2010 05:30 PM PDT | ||||||||||

| Letterman: Brian Williams On The Stock Market Collapse Posted: 06 May 2010 05:18 PM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||

| The dangers of Quant Trading models; Dow’s 1000 point drop a prime example Posted: 06 May 2010 05:16 PM PDT By Sol Palha, Tactical Investor Build a system that even a fool can use, and only a fool will want to use it. The initial trigger for drop in the Dow was probably due to fears that the Greek crisis was going to spread. One could credit this for 300 or maybe even a 400 point drop in the Dow; however, a 1000 point drop is quite another matter. At 2.20Pm the Dow was at 10,460 and then suddenly in 7 minutes it shed another 600 points. Humans could never move that fast. There are rumours that a trader entered billion instead of million and this triggered the massive sell off. Whatever the cause the main wave of selling was initiated by computers. A simplified look at quant model A Quant (Quantitative) programme is a computer model which determines which investment strategy is going to yield a superior rate of return; to simplify matters let's assume the programme decides when to go long or short.. It is assumed that because computers have no emotions, they should be better at trading as they can move in and out of the markets extremely rapidly. The scary part is that the computer renders the final decision. There is one problem, these computers are programmed by humans and one glitch in the programme can cause havoc. Let's not forget the old saying junk in junk out. Today's wild action is indicative of what can go wrong when computers take over. These quant programs now make the vital function of market marker almost obsolete and this is a very dangerous situation if left unchecked. Today Treasuries, SP500 and other indices were moving so fast it was hard to manually follow them. Computers took over the markets for a few minutes and in that time they wrecked total havoc. What happens if the glitch is not spotted immediately, then a cascade of sell orders could be triggered pushing the Dow down until the circuit breakers kick in. However, if the glitch was not found then computers would resume selling after the markets opened again. Let's not forget that big firms can still sell via Dark pools. They are basically electronic networks that allow big firms to sell stocks without tipping their hand; in other words, they can sell these stocks anonymously without the public ever knowing. This is a separate topic, and we will try to cover it another day. Two examples of firms offering such services are Liquid net Inc., Pipeline. Quant strategies are becoming extremely popular. They are now accepted in the investment community and even mutual funds are now using these models. These models are also known as alpha generators, or alpha gens. These programs are often set up in advance so that the computer can react instantaneously to moves in the market. For example, if the Dow drops below a certain level, the programme can unleash a massive sum of sell orders and in doing so trigger other quant programs. This could potentially trigger a market meltdown as was experienced today. Indeed by some counts computers are responsible for as much as 70% of daily trading volume. These models are now a real threat to the health of the financial markets and should be eliminated or closely monitored and regulated. Exchanges should not cater to firms that are using these programs and openly allow computers to place orders for millions and or billions of dollars. Exchanges should place a dollar limit on trades that can be initiated by such programs. One can only imagine what would happen if the computer mistakenly places a trillion dollar sell order. Today's action is a warning, next time things could be infinitely worse. At one point ACN fell from 42.30 to 4 cents, that is 4 cents; it ended the day at 41.08 down $1.08. PG shed $23 dollars in a heartbeat but closed the day down only $1.41. In between someone could have had a heart attack. Imagine you had 1 million dollars in ACN, and then suddenly watched your portfolio shrivel right in front of your eyes as ACN fell to 4 cents from 42 dollars. One of our first warnings came from Long term capital (LTC). LTC founded in 1994 was one of the most famous Quant based funds and it was run by two noble prize winning economists: The Quant model did not foresee the Russian government defaulting on its own debt and this triggered a series of events that destroyed LTC. In less than 4 months in 1998 LTC lost 4.6 billion dollars. If the Feds had not stepped in, things could have really turned ugly. These quant trading programs need to be regulated and not allowed to freely take over the markets; they are destroying the vital role market makers play to maintain financial stability in the markets. Today's action should serve as a wake up call for those who have turned a blind eye to risks these programs pose to the markets. Next time round we might not be so lucky. On a separate note we warned individuals about the dangers poised by the extremely low volume in an article that was just published one day ago and at that time suggested opening up positions in DOG and or QID. Precipitously Low Market Volume a Sign That Correction Is Imminent 7 comments

The key to the age may be this, or that, or the other, as the young orators describe; the key to all ages is — Imbecility; imbecility in the vast majority of men, at all times, and, even in heroes, in all but certain eminent moments; victims of gravity, custom, and fear.

No positions in the mentioned investments More articles from the Tactical Investor…. | ||||||||||

| The Goldman Sach’s ‘Disease’ (it’s contagious) Posted: 06 May 2010 05:16 PM PDT By Jeff Nielson, Bullion Bulls Canada In the animal kingdom, when there is a sick or wounded member of the "herd", it inevitably becomes an inviting target for a pack of hyenas. It's important to note that if the herd-animal was healthy, or if there was only a single hyena targeting it, that the herd-animal could likely survive the attack. It is only when an unhealthy animal is targeted by a group of hyenas that the possibility of survival plummets to zero.

In the world of humans, no group of people is as closely epitomized by the metaphor of a "pack of hyenas" as the legal profession. Indeed, it is not merely coincidence that one of the most common derogatory terms for lawyer is "ambulance-chaser". These "professionals" are true "scavengers", in that they are capable of generating no business or economic activity by themselves, but must rely upon the opportunities provided by others – and generally by the misfortunes of others.

I'm excluding the branch of law dealing with what is termed "solicitor" tasks: conveyances, and other "paper work". This area of law is not only very dreary to those outside of the legal profession, but it is not the area of legal practice where lawyer's have acquired the reputation of being voracious scavengers. That aspect of law is known as litigation law, or more specifically "personal injury" law.

Anyone who has become a "victim" (in the eyes of the law) becomes a potential "client" of the litigation-lawyer, subject to satisfying a set of criteria which make representing a client a worthwhile investment of the lawyer's time/effort, or more simply "a good bet". There are a number of signals to litigation-lawyers which make them more likely to take on new clients – and initiate additional litigation.

At the top of the list of any lawyer who practices personal injury law is the "ability to pay" of the potential defendant, more typically known in legal circles as "deep pockets". Where there is not a defendant with "deep pockets", then there is no obvious way for a lawyer to recoup his compensation. In that scenario, it is the client who must have the "deep pockets": being ready/willing/able to fully fund the litigation themselves. Needless to say, there is very little litigation conducted under such terms.

Once there is a tempting target for these legal "hyenas", the litigation-lawyer looks for signs that this target is not "healthy". Among the most obvious symptoms of "ill health" is other pending litigation. There are three, related reasons why lawyers will tend to "pile on" to entities who are being threatened with litigation.

First of all, during the "discovery" phase of each and every trail, large amounts of previously confidential information usually emerge and become public knowledge. This constitutes free "ammunition" for other lawyers to use in other litigation (assuming even a minor amount of overlap). Secondly, there is the old adage of "where there's smoke, there's fire". When one lawyer sees one (or more) other lawyers sinking their teeth into a particular defendant, the "pack" mentality of these scavengers truly comes to life. More articles from Bullion Bulls Canada…. | ||||||||||

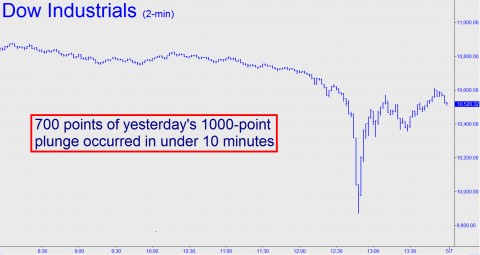

| Panic Subsides, But for How Long? Posted: 06 May 2010 05:15 PM PDT By Rick Ackerman, Rick's Picks The panic we've all been waiting for hit like a tsunami yesterday, sending the Dow Industrials into a thousand-point dive, 700 of it occurring in under ten minutes. We'd warned of this just a few days ago when we wrote that the market was "vulnerable to a sudden, even spectacular, selloff." Yesterday's selling was indeed so ferocious that it might have gone on for another thousand points if not for Mr. Market's addiction to round numbers. With the Dow down almost exactly a thousand points, the broad averages turned from their lows like a cattle stampede encountering a wall of fire. We should consider it a warm-up for the real panic that surely lies ahead. Thursday's hysteria will be just a sound bite by the time it is replayed on the evening news, but when a truly destructive panic finally hits, it will run its course on Main Street as well as Wall Street. Safeway shelves will be stripped bare as quickly as stocks were stripped of value yesterday afternoon, and branch banks will run out of dollars before even a half-dozen customers have had a chance to deplete their accounts. In this scenario, it's hard to imagine that things would return to hunky-dory the next day. Grocery stores would find it impossible to keep certain crucial items, such as toilet paper and batteries, in stock. The same goes for the banks, which hold but one crucial item in inventory. But what of the stock market? Although the Dow had recouped 650 points of yesterday's losses by day's end, even the chirpiest news anchor would not deign to suggest that this warrants a sigh of relief. Anyone who watched the stock market come unraveled on a monitor yesterday could only have been infected with a sense of foreboding. Under the circumstances, asking the question "Will it happen again?" is like asking whether Greece's intractable financial problems are likely to erupt anew. The Babson Break It was nearly 81 years ago that the so-called "Babson Break" occurred on Wall Street – a signal event that marked the beginning of the end for the Roaring Twenties. On September 5, 1929, Roger Babson, a leading entrepreneur of the time, warned in a speech that "Sooner or later a crash is coming, and it may be terrific." Stocks fell 3% that day, as much in agreement with Babson's outlook as caused by it. He was ahead of his time, but because he was just two months ahead of it, we remember him for his prescience. This time around, perhaps Bob Farrell, the legendary Merrill Lynch analyst, will qualify for a Babson Timing Award. He took a firm stand on April 11 with a forecast headlined "As Good as It Gets?" We'll know in a month, if not sooner. Until then, we'd sooner trust Ahmadinejad and spring weather in Colorado than any rally on Wall Street. (If you'd like to have Rick's Picks commentary delivered free each day to your e-mail box, click here.) Related posts:

© Rick Ackerman and Rick's Picks, 2010. | More articles from Rick Ackerman…. | ||||||||||

| Victor Gonçalves: Betting on the Raw Materials Posted: 06 May 2010 05:14 PM PDT Source: Tim McLaughlin and Karen Roche of The Energy Report 05/06/2010 Equities and Economics Report writer Victor Gonçalves says the cobalt story is still yet to come. In this exclusive Energy Report interview, Victor also explains how to tell the real rare earth companies from the wannabes. The Energy Report: Victor, one of the big headlines since we last spoke is the loan that Europe is giving Greece. Some are calling it an EU bailout. As an economist, how do you see this move? Victor Goncalves: I think it's a positive thing actually, given the parameters. A lot of your Austrian guys would say this is the devil's work and you don't do that kind of thing. Given the economic policies of the European Union, that's probably one of the only options it has. TER: What impact is that going to have on the markets? VG: It'll have a positive impact because what it basically says is we're not having a country go into default. That's the short-term impact. The longer-term i... | ||||||||||

| Mr. President: Unplug the F*ing Computers Posted: 06 May 2010 05:14 PM PDT Market Ticker - Karl Denninger View original article May 06, 2010 11:51 AM Shall we talk about RISK the markets and in particular high-frequency trading and direct-exchange connected computers? What started this? Right here: That trade appears to be what set it off. Here's the problem: As soon as that hit the DOW it dropped the index hard. The response in the computers connected directly to the exchanges was instantaneous and produced this: Computer-triggered and the result was a more than 1,000 point selloff, about half it organic and the rest on a bid-collapse driven entirely by the HFT computers that took less than a minute. There is absolutely no protection against this sort of thing in the market for the average investor, or anyone other than the HFT boys. Stops don't work as there's "no bid" during these events - there was LITERALLY no bid in the futures for about 30 seconds, then no offer on the way back up. This sort of thing has to be ... | ||||||||||

| Euro weakens as investors shun Greece debt Posted: 06 May 2010 05:14 PM PDT | ||||||||||

| Posted: 06 May 2010 05:14 PM PDT View the original post at jsmineset.com... May 06, 2010 09:36 AM Jim Sinclair’s Commentary Pretend and Extend has its limits. This observation is inherent in Yra’s presentation. Notes From Underground: Audacity of Hope to Sheer Audacity (Dec. 27, 2009) Yra Harris As the markets cope with the ECB’s decision to leave rates as is and the U.K. elections, we must call attention to a story that appeared on the Washington Post website last night. After reporting a massive first-quarter loss, Freddie Mac is asking the government for $10.6 billion in aid. We will write more on this [...] More… Technical Notes Gold & Silver ETF CIGA Eric I know the bears are growling, but this pessimism is misplaced. The correct description is mistimed. Time is right for the bulls rather than bears. When time is right, price will follow. Silver ETF (SLV): Silver Silver, SLV, looks good. The 3/29 gap held the decline. The energy of the test was strong, so it ha... | ||||||||||

| Stock Market Micro Intraday Crash Shows Us Where The Safe Havens Are Posted: 06 May 2010 05:14 PM PDT By Chris Vermeulen, TheGoldAndOilGuy WOW…. Now that was an exciting day in the market!! On a more serious note, a member in the chat room had a good point… Who would create a program that can not only bankrupt the company in one key stroke but also crash the entire broad market in 10 minutes losing millions of investor's hard earned money?? I will keep this short with my Cole Notes Version on a few opinions of mine. Banks – Good for taking your money and crashing the marketsAll we have heard about in the past year is bank this, and bank that…. They take our money, bet on crazy investments, lose it, then get free money from the Feds to replace that lost money and they keep it for them selves…. Well today the market crashed because of a bank which should not be a surprise after everything else they have messed up. But to add more to the fire I had a lot of subscribers and followers today tell me they tried to trade with their brokers and they could not get orders to be executed. When I asked these individuals who they are using I got the same response… They were trading through a bank… like TDWaterhouse and many others… This really makes my upset as I hate watching the bad guys (banks) keep winning/taking everyone's money….. Stock Market Circuit Breakers FailedI find it amazing how the financial system has circuit breakers to protect investors from a market crash yet today they did not get triggered… Rule is (and dumb one in my opinion) is that a circuit breaker (halts trading on the stock market for a set period of time) can only be triggered before 2:30pm ET. Funny thing is that the crash happened 7 minutes after 2:30. Manipulation??? 2-3 Week Market Correction, Corrected in One DayA pullback in the broad market which normally would have taken a few weeks at the most happened in one afternoon which is amazing really. Don't get me wrong, I thought what happen today was very interesting, profitable and a lot of fun. But a move this drastic does throw a wrench into everyone technical analysis and it will be a few days before we get enough price action to start piecing this market back together for what looks most likely to unfold in the coming days and weeks. Gold & US Dollar Rally TogetherThe past 2 weeks we have seen gold and the dollar move up together. This is very strong for gold. Even if we see the dollar roll over and head south that would help boost the price of gold… The short term charts for gold are looking tired be sure to watch the video below. Market Video on Today's Price Action and what's NextClick Here: http://www.thegoldandoilguy.com/articles/may-6th-stock-market-crash/ End of week Trading Conclusion:This week was a crazy one with gold and the dollar moving higher together and the stock market crashing over 9% in one day… It will take a few days for all this extreme price action to smooth out as we try and grasp if this is a bottom or the beginning of a major meltdown. If you would like to receive my Trading Analysis and Signals please checkout my website: www.TheTechnicalTraders.com Chris Vermeulen | ||||||||||

| Hourly Action In Gold From Trader Dan Posted: 06 May 2010 05:14 PM PDT View the original post at jsmineset.com... May 06, 2010 09:54 AM Dear CIGAs, Once again it was Euro gold (gold priced in Euro terms) which was the real standout today. It made yet another brand new all time high at the PM fix coming in at €928.807. Gold in British Pound terms also notched another all time high fixed at £787.385. Even Dollar priced gold made its best showing at the PM fix since December of last year. Clearly, there is a wholesale flight in Europe to gold as a safe haven as fears surrounding the stability of the Euro intensify. So strong is the demand that there have been some anecdotal reports that dealers are having difficulty keeping gold bars and coins in stock. Once again, it is this strong showing in terms of the European currency prices, that is generating the buying in Dollar priced gold and it is that which is making life for the Comex bears extremely challenging to say the least. They simply cannot hold it down with all the buying of physical metal originatin... | ||||||||||

| Posted: 06 May 2010 05:14 PM PDT View the original post at jsmineset.com... May 06, 2010 10:21 AM Thought For The Day The Crimex got clobbered by the bullion market yet again. This is a must for the run to $1650. The knuckle draggers there will get the message, it just takes them longer. All Western currencies are under attack, just some more than others. Gold is the leading currency. Mrs. Merkel has made an ass out of herself by making the EU action look like kids playing in kindergarten. Please re-read Armstrong on the Euro at $1.29. Jim Sinclair’s Commentary Regarding A Pocketbook of Gold, when you get to the section on meditation, I am serious. Select one concept daily and when you are relaxing simply focus on it. You will be amazed at the result. Jim Sinclair’s Commentary Reintroduce quantitative easing? It never stopped. The banks have been the beards for the Fed buying US Treasury auctions. Fed Faces Deflation With Few Weapons, Rosenberg Says: Tom Keene By Mary Childs and Tom K... | ||||||||||

| Market Commentary From Monty Guild Posted: 06 May 2010 05:14 PM PDT View the original post at jsmineset.com... May 06, 2010 10:37 AM Dear CIGAs, GREECE WILL RECEIVE A BAILOUT, AND THE BAILOUT WILL BE AIMED AT STRUCTURING FINANCIAL SECURITY FOR EUROPE AS A WHOLE European financial officials from sixteen nations and some supra-national organizations met last weekend and announced that Greece will get a package of loans to be delivered to them over three years. Why is this happening? This is happening because if Europe does not support Greece, the government debt contagion that we have been discussing in recent memos will continue and spread. It will spread to Spain and Portugal and later to many countries in Europe including Italy and possibly France. Because they fear the spreading contagion, Europe wants to stop the crisis as soon as possible. In other words, Europe is getting a bailout, not just Greece. In addition, Greece already owes several European nations a great deal of money, and they do not want Greece to go b... | ||||||||||

| Posted: 06 May 2010 05:14 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 06, 2010 06:22 AM [LIST] [*]$5,000 Gold causes TOUT-TV senior anchor to resort to gold perma-bear status. Here’s what gold is saying to all the perma-bears [*]The class clown among the gold perma-bears has long claimed gold wasn’t in a bull market but that the U.S. Dollar was in a bear market. How do you explain this Tokyo Rose? [*]The ultimate balls [*]Sadly, the when not if is getting closer [*]I’ve been engaged by Alderon Resource Corp. It will remain on model portfolio list but is now a client of mine. [*]Taseko Mines appears it was a gift from God buy under $5 yesterday. The Prosperity can make it a double-digit stock in next 12-24 months in my biased but honest opinion. [/LIST] [url]http://www.grandich.com/[/url] grandich.com... | ||||||||||

| Titanium Metals Corporation (NYSE:TIE) — Up 16% on “Spanking Good Earnings” Posted: 06 May 2010 05:05 PM PDT Titanium Metals Corporation (NYSE:TIE), the Dallas-based titanium producer with operations in Europe and the US, just released substantially higher than expected earnings. Chris Mayer, editor of Agora Financial's Capital & Crisis newsletter, describes the gap: "Titanium Metals' (NYSE:TIE) shares are up 16% on spanking good earnings. "Earnings were much better than Wall Street expected. The Street had TIE earning 3 cents per share this quarter and 14 cents per share for the whole year. I knew they would be wrong. TIE earned 9 cents this quarter. "TIE is one of several stocks for which sentiment is lukewarm at best. But that is changing. Following a strong earnings report today, Longbow Research initiated TIE with a "neutral" rating. Heh. "Bobby O'Brien, TIE's CEO, said in the under-stated earnings release: 'Our operating results for the first quarter of 2010 reflect stronger demand than we have seen in the last several quarters as customer inventory levels within the commercial aerospace sector are beginning to stabilize and the global economy continues to show early signs of recovery.'" According to Mayer, Titanium Metals expects 2010 volumes to top 2009, a notable turning point in the titanium business. Mayer's been able to see the earnings potential of TIE despite the fog of a market that vastly underrated its performance. To get more details from Chris Mayer on Titanium Metals Corporation, as well as other specific investment recommendations, you can visit the Agora Financial research page to sign up for Capital & Crisis. You can also join us in Vancouver to see Chris Mayer speak live at the Agora Financial Investment Symposium. You can find more information about registering for the July event here. Best, Rocky Vega, [Nothing in this post should be considered personalized investment advice. Agora Financial employees do not receive any type of compensation from companies covered. Investment decisions should be made in consultation with a financial advisor and only after reviewing relevant financial statements.] Titanium Metals Corporation (NYSE:TIE) — Up 16% on "Spanking Good Earnings" originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." Check out our new special report Investing in Offshore Oil | ||||||||||

| Posted: 06 May 2010 05:01 PM PDT From The Daily Capitalist I have no real explanation for market behavior which caused the twenty-five minute 700 point DJIA drop and 600 point gain. I'm a macro guy. Let the traders figure it out. The most plausible explanation is that (1) the market is overvalued, (2) the markets are nervous, and (3) trading technology got way ahead of the exchanges. I don't buy the story going around that a trader typed in "billion" instead of "million" and brought the market to its knees. I do recall several panics over the years which left people scratching their collective heads. In 1962 the market cratered and went down about 25%. My mother told me sometime later that she had sold her stocks because she remembered the depression 30 years ago. I thought she overreacted and told her that we'd never have a depression again because the government was in charge. I believe I was reading Paul Samuelson's book in Freshman Econ 101. In 1973-1974 the market went down 37%, but took a huge 33% plunge in H2 1974. This was the beginning of stagflation, Vietnam was still going on, and people were confused. For some reason people couldn't understand why we could have inflation and stagnation at the same time. It's kind of funny looking back because we had low industrial capacity during the 1974 recession yet we had inflation. That's confusing to Keynesians. Then there was Black Monday (October 19) 1987: a 22% drop. Ultimately the market dropped about 37%. This one really felt like a crash. I recall a senior broker telling me about computer program trading that allowed funds to go liquid in an instant. So maybe it all started then. I don't really recall a good explanation of that crash. But I do recall the panic and the feeling: "what's happening?" It was one of those things that you just waited to see how it played out. Beginning of the End? Momentary blip? It's hard to know in the middle of it. The one thing that is kind of interesting about The Great Crash of 2:42 p.m. is that it was only twenty-five minutes long. In Olden Days it would have cratered the market. But program trading, technology if you will, immediately saw the advantages of the decline and corrected the mistake (if it was one) and the market only closed down 3.2%. Not to say that program traders can prop up a market falling on fundamentals, but it did provide liquidity. Unfortunately, liquidity works both ways. | ||||||||||

| The Silver Price Spiral, Part III: tomorrow Posted: 06 May 2010 04:57 PM PDT In Part I of this series, I introduced readers to the idea that the price of silver could soar to levels which would even surprise most silver-bulls. In Part II of this series, I pointed out that when our "paper inventories" of silver are exposed that this, alone, sets up the silver market for an enormous price-shock. In Part III of this series, I will discuss how silver has perhaps the most-bullish demand fundamentals of any commodity in history. As I stated at the beginning of this series, a "three-digit price" for silver is assured, while over the long term, that price could rise close to, or above the $1000/oz-mark…but I am getting ahead of myself. This series is all about studying the dynamics of the silver market, so what I will focus on is what we can expect to happen in the silver market (on the demand side) as silver rises to, and then above $100/oz. The first general point to make about the market for any commodity (or any "goods") is that markets typically have a "self-correcting" mechanism for when supply and demand are badly out of balance. If supply greatly exceeds demand, prices typically fall until demand is stimulated enough by the falling price to equal supply. Conversely, when demand grossly exceeds supply, prices rise – until that rise in price either discourages demand, or encourages new "supplies" to come onto the market to create an equilibrium. What has gotten me so excited about silver is that such "self-correcting mechanisms" are almost totally absent from the silver market. As I have already discussed on the supply-side, a quadrupling of the price of silver has resulted in a very muted supply-response. This suggests one of two scenarios: either we have already reached some sort of "peak silver" equation (where supply cannot be ramped-up dramatically – at any price-level), or else silver simply needs to rise to a much higher price to begin to lead to increased mine supply. The other component of supply which we cannot ignore is the "scrap market". With silver having been mined for nearly 5,000 years (along with gold), at one time there were enormous global "stockpiles" of silver – silver that is either stored/held by governments, or hoarded by private entities. However, according to the research of noted silver authority, Ted Butler, somewhere around 90% of those stockpiles have been "consumed" over the last 50 years. Thus, no matter how high the price of silver goes, we cannot see any major growth in supply from "scrap sales", simply because that silver is already gone. It's now time to examine demand more closely, and what we find here is that as with supply, there is no self-correcting mechanism to moderate the price of silver as it moves higher and higher. In economics, when we talk about supply or demand, we refer to the concept of "elasticity". Goods which respond dramatically to changes in price are said to be very "elastic" with respect to price. Goods where price-changes cause little change in demand are said to be very "inelastic". In the case of silver, we are very possibly looking at the most inelastic demand of any commodity which is broadly used/traded in our economies. In other words, even extreme rises in the price of silver will have only a very modest impact on demand. There are two, totally separate reasons why demand for silver is more inelastic than that for any other commodity. First of all, as I mentioned in Part I (and discuss frequently), silver is not only the most versatile of all metals, but with several of its chemical/metallurgical properties it is essentially unique – meaning that there are no "substitutes" which are available to replace it. Similarly, with some of its properties it is so much superior to other metals that it is effectively irreplaceable. In the first category is silver's use as an anti-bacterial agent. Silver is unique in possessing chemical properties which make it impossible for bacteria to reproduce. There are two extraordinary implications for this chemical property. First of all, it is impossible for bacteria to ever develop "immunity" to silver anti-bacterial products – unless they literally evolved into a new species (a process generally requiring at least thousands of years). This means that our health-care systems can use existing products (and develop an infinite amount of new anti-bacterial products) without any fear of such capital expenditures being rendered obsolete/ineffective. And because this is a chemical property unique to silver, there is no possibility of any other commodity being substituted for it – at any price. At a time when silver inventories are virtually gone, we have a new application for silver (in its very infancy) where there are a virtually infinite number of potential applications, which are certain to remain in demand for centuries (and likely longer) and where there is no possible substitute for silver. As an example of the demand-pressures on silver from this one application, I saw an interesting article on a U.S. government initiative to punish U.S. hospitals which have high levels of deaths/injuries from "medical mistakes" and "preventable" causes. "Preventable re-admissions" alone cost the U.S. health-care system $25 billion/year With the entire U.S. medical system being crushed by the burden of totally unsustainable costs, no hospital can afford to be "punished" for poor safety/quality of care, and at the top-of-the-list among "preventable" conditions are the vast number of "secondary" bacterial infections which are epidemic in hospitals all over the world. As an example of this enormous carnage in our hospitals, 30,000 Americans die every year just from "catheter-related blood stream infections". While I lack the medical expertise to conclude that this problem could be solved or abated with some sort of "silver catheter" being used, given the vast array of silver anti-bacterial products already created, a "silver catheter" would seem to be a very straightforward innovation. A great place for investors to learn about some of these uses is at The Silver Institute. Searching through its "news" and "uses" sections will give people a general idea of the extraordinary range of possibilities in this single application. I lack the space to even summarize all the uses which have either already been developed, or are being currently researched. Instead, I will simply speak of the one, particular use which immediately caught my attention when I first heard about it: silver upholstery. It would already seem to be a "done deal" that we will see silver-upholstery being used for all furnishings in hospitals. In addition to formal "pressure" being exerted on hospitals to reduce preventable infections (i.e. the new U.S. initiative), potential legal liability for any hospital which does not utilize this innovation will likely be a much stronger factor in compelling hospitals to act. Consider how the issue of "liability" operates in our legal system. While the number of "preventable deaths" in our hospitals is atrocious (more than 10,000 Canadians die every year as a result of "medical mistakes"), holding hospitals and medical personnel responsible for these deaths hinges on whether there were/are any practical alternatives to prevent the "harm" in question. If merely choosing a different fabric for furnishings could potentially reduce such bacterial infections (and deaths), this is a "practical alternative" which our courts would not hesitate to impose on our health-care systems…and the day after hospitals begin to systematically switch to silver furnishings, there will be lawyers looking for new avenues of "liability" in this regard. The next likely "targets" to face pressure to switch to silver upholstery would be every doctor's office and medical clinic. After that, "transportation" and public schools would seem to be part of a natural progression. The spread of diseases around the world through passengers transmitting diseases to other passengers is perhaps the greatest risk with respect to the fear of "global pandemics". While much of those fears are related to viruses (which are not affected by silver), bacterial infections are still a very serious issue with respect to disease-transmission – especially given the "super-bugs" which have become nearly completely resistant to antibiotics. The other factor which favors the rapid spread of silver anti-bacterial applications is that the silver is only used in trace amounts. This is another enormously important aspect of silver's "price inelasticity". When a commodity is only used in tiny amounts, even enormous leaps in price will have only a tiny impact on demand. To illustrate this in crude fashion, let's look at the use of silver in polyester sportswear, an application which regular readers have seen me discuss on several occasions. As I have mentioned previously, silver is used in polyester sportswear because of its anti-bacterial properties. However, in this case, the silver kills bacteria not to prevent disease but to reduce odor. It is the bacteria which are contained in our perspiration which are responsible for odor. Kill the bacteria and you greatly reduce odor. What is remarkable about this application is that (by weight) silver only represents 1/40,000th of total inputs. I'm sure that some newer readers out there are thinking that while the use of silver in this application isn't sensitive to price (because of the tiny quantities involved), that such tiny amounts would be irrelevant to total, global demand. Wrong. With over 20,000,000 tons of polyester sportswear being manufactured every year (as of 2008), that one use "consumes" over 1,200 tons of silver per year, or 38 million ounces per year – and this application is also in its infancy. Apart from the growing sportswear market, obviously there is enormous additional potential for silver throughout the clothing industry. Don't you think that people spending large amounts of money for their "designer clothes" would want (or expect) that the manufacturers of those garments would also make them odor-resistant? All it takes is for one major designer to "go silver", and we can expect a host of "copy-cats" following in their footsteps. The other important point to make here is that if silver can be used in tiny quantities as an anti-bacterial agent in sportswear, then it is reasonable to assume that all of silver's anti-bacterial products will use silver in similarly small amounts – and the number of such potential anti-bacterial products is only limited by our imaginations. Let me illustrate, through a hypothetical example, just how "inelastic" is such demand. I have no data on the cost of the other inputs in polyester sportswear, but I can afford to be "generous". Let's assume that silver is (on average) 400 times more expensive than the other inputs of this product. It's likely an over-estimate of the cost of silver, but it's a very handy, "round" number. With silver representing 1/40,000th of inputs by weights, and if silver was 400 times more expensive than those other inputs, this would result in silver accounting for 1% of production costs for this product. This means that even if the price of silver increased ten-fold, it would only result in the cost of silver becoming a mere 10% of production costs, and represent roughly a 9% increase in the price of the end-product. Let me repeat this. Using the numbers above, a 1000% increase in the price of silver would result in a 9% increase in the price of this anti-bacterial product. And it is perfectly reasonable to assume that most of silver's anti-bacterial applications employ silver in similar ratios. What this translates to in current prices is that silver could rise to close to $200/oz and have (at worst) only a minor impact on silver's use in this one application. Keep in mind that this entire discussion revolves around only one of silver's multitude of "industrial" applications. Silver is also used in such low-tech manufacturing such as silverware, soldering, mirrors, electronics and photographic film, while its higher-tech applications include next-generation batteries, high-precision bearings, chemical catalysts, solar energy, and water purification (in addition to the infinite number of medical/hygiene applications). Obviously, some of these applications use larger quantities of silver, and thus not only are they more sensitive to price, but the silver is used in greater amounts (and thus can be recycled). However, we cannot forget about silver's superior properties. Silver is (by far) the best metal for use in solar energy, due to both its chemical properties and its higher "brilliance" than any other metal. In order for solar power to truly become an effective source of power, we need to use the best solar cells we are capable of designing. Thus, for this entire field, there is essentially no substitute for silver at any price. The other "industrial application" which I want to focus upon is another "low-tech" use which has been all-but-forgotten: silver jewelry. I have tried (in a previous commentary) to get silver-bulls enthused about silver's potential in the future as the next premier metal to be used as jewelry. Currently, silver "jewelry" is confined primarily to men's cuff-links and tie-clips, and as "junk jewelry" (primarily for younger women). When it comes to "women's jewelry", silver is almost completely snubbed – totally due to its low price. With silver being the most "brilliant" of all metals, there are no objective reasons to prefer gold jewelry to silver jewelry – except for price and rarity. Silver jewelry has had little appeal for adult women in recent decades because it was so "common", and (in a related criticism) cheap. Silver is roughly 17 times as common as gold in the Earth's crust. This differential has been exaggerated by the grossly disproportional price ratio between silver and gold – which is currently greater than 60:1, and has remained at or above 50:1 for most of the last two decades. However, as I have discussed previously, one of those two parameters has already changed dramatically. With somewhere around 90% of global stockpiles of silver gone, the amount of (above-ground) silver versus gold is nowhere near that historical, 17:1 ratio. While no firm numbers exist to quantify this, estimates I have seen range from there being six times as much silver as gold, while some commentators are already maintaining that the amount of available gold in the world now exceeds the amount of silver. Given such parameters, the current 60:1 price ratio is absolutely ridiculous – even without factoring-in all the demand fundamentals which I have mentioned previously. When we include those factors, it becomes safe to conclude that (at current prices) silver is the most-undervalued of all commodities in the world, today, and arguably the most-undervalued commodity in modern economic history. Thus, an "explosion" in the price of silver is coming – and coming soon…and when that explosion takes place, it will be the re-discovery of silver as jewelry which will be the additional variable in propelling silver toward or above the $1000/oz-mark. In economic terms, silver jewelry is considered an "inferior good". Let me clarify this. In economics, such a reference is purely with respect to price. Because silver is the cheapest jewelry (today), it is considered economically (not qualitatively) "inferior" to other jewelry. I mention this point only to observe a basic principle of economics regarding "inferior goods": as the price for such goods increases, so does demand. Let me reiterate this point, as it is of crucial importance. As silver rises all the way up to and above $100/oz in price, demand for silver as jewelry will steadily increase not decrease. This is an even more-bullish fundamental than the use of silver in trace-amounts in other industrial applications. With even the most "inelastic" of those uses, demand will decrease at least slightly as the price of silver soars. Thus, when it finally becomes public knowledge that our silver "inventories" are 2/3 paper (or even more than that), there will be a price-explosion in this market. With the supply of silver grossly insufficient to meet demand, all the "industrial users" will be competing for limited supplies – and the inevitable economic result will occur: hoarding. At the same time that silver's army of industrial users will be competing with each other to lock-up as much silver as possible for themselves, these users will have to compete for that silver with jewelry buyers and investors. Over the short-term, those industrial users will pay almost any price for that silver – and as that price soars higher and higher, so will jewelry demand. Similarly, investors who have studied this market will not be dumping their silver onto the market at $50/oz, or $80/oz, or even $100/oz. While obviously traders and short-term speculators will be cashing-in and taking profits at these price-levels, I fully expect net investment demand to keep increasing at least until silver hits $100/oz. At some point above $100/oz, silver investors can be expected to stop accumulating more silver, and similarly, once silver is above $100/oz, we will begin to see a change in attitude among silver jewelry-buyers (and wearers). At somewhere around this price-level, silver will no longer be regarded as "junk jewelry" (and as an "inferior" good). While this will mean that an increasing price for silver will not also increase jewelry demand, instead a different dynamic will materialize. When it is no longer regarded as "inferior" jewelry, at that point supply/demand fundamentals become more normal: a rising price discourages demand while a falling price increases it. Thus after silver is propelled well above $100/oz, silver jewelry becomes a "price support mechanism", where any drop in the silver price spurs new demand. What these dynamic fundamentals represent, when viewed in aggregate terms is the following picture. Once the silver market "blows up", due to the extreme/disconnect between supply and demand (and rampant fraud with respect to inventories), the price of silver will go straight up. Indeed, it can be expected to rise from five times to ten times current prices with little to no effect on demand. This is a demand "picture" which is unprecedented in the history of commodities. Then, once the price of silver reaches some new price-plateau (at some three- or four-digit number), new fundamentals will evolve (specifically with respect to silver as jewelry) which will serve to keep silver at an elevated price – and not suffer some sickening collapse, as would normally be expected with a commodity which had "spiked" in this manner. To keep this series to a minimal length, I have been forced to briefly summarize a large number of fundamentals which (as I have stressed) are essentially unparalleled in the history of commodity markets. This means that the reaction which will take place in the silver market when rampant fraud and depleted inventories are exposed will also be unlike anything we have ever witnessed before in our personal experience. And every day that silver remains so grossly under-priced, all of these fundamentals simply get stronger. As a precious metals commentator, I would never discourage investors from adding to their gold-holdings. For many different reasons, gold also remains under-priced – and as the perfect "monetary" metal, all investors should have some gold holdings in their portfolio. However, at Bullion Bulls Canada, we have been first-and-foremost "silver bulls". Today, silver is one of only two forms of "good money" (along with gold) – at a time in history when all the "bad money" (i.e. un-backed "fiat currencies") is in grave danger of plunging to zero. However, even if silver had never been used as "money", or even if there was not a great need for "good money" today, the merits of silver in terms of basic supply/demand fundamentals represent an unprecedented investment opportunity. While those investors who have been accumulating silver for many years may curse the continued market-rigging of the bullion-banks, for newer investors, the nefarious deeds of these miscreants can be thought of as "keeping the train at the station". Today, investors still have one, last opportunity to buy silver at (literally) "once in a lifetime" prices. When silver explodes above $100/oz, it will never return to current, absurd price levels. All aboard! | ||||||||||

| Global Deflation, Global Inflation and Australia's Gold Tax Grab Posted: 06 May 2010 04:32 PM PDT The world is changing rapidly, but it is not descending into unpredictable chaos. Instead, as we will review in this article, three separate but intertwined economic themes that will dominate the 2010s are emerging into the headlines. | ||||||||||

| Uranium – A Place to Hide Posted: 06 May 2010 04:23 PM PDT A.J. Liebling, the famed New Yorker writer, once wrote about how boxers frequently "rediscover" old truths about boxing. An innovation, though seemingly new, may instead have first seen the prize ring through the fists of some 19th-century pug. "These rediscoveries are common among philosophers," Liebling wrote. "The human mind moves in a circle around its eternal problems." So too does the investor's mind grapple with ancient problems. One of his eternal problems is figuring out when to buy what commodities. Every generation spins its own new version of old truths on the matter. Robert Mitchell, a general partner at Portal Capital, gives us the 21st-century version of some timeless investing advice. "In the world of commodities, demand is rarely the compelling reason to get long," Mitchell begins. "Instead, you want to own a commodity where supply is incapable of responding to even a small bump in bids." In other words, buy the commodities where it is most difficult to produce more. Though hardly a new insight, it's one that investors sometimes forget. One commodity that aces this simple test is uranium. Sometimes it's hard to tell, because the data in the uranium world are unreliable. Trying to grab facts can be like trying to catch butterflies without a net. The market is surprisingly elusive. There are a lot of facts and figures, but the quality of this information is pretty bad. As a for instance, Mitchell points to Ux and Tradetech. These are two big pricing publications based in North America. TradeTech says 38 million pounds of uranium traded on the spot market last year. Ux says it was 50 million pounds. That's a big difference! The true number is a mystery. It's almost like you have to see the mines and piece together your own story. When you do start digging into these micro stories - Kazakhstan, Niger, Namibia - you start to doubt the world's ability to meet uranium demand at current prices. Mitchell recently visited Namibia, which is the fourth largest producer of uranium in the world. Mitchell reported his findings to readers of Marc Faber's excellent Gloom Boom & Doom Report. His notes shed some light on this opaque market. And he also adds to a pile of evidence that will warm the hearts of all investors in this sector. Let's start with Namibia, which seems a difficult place to be. "Unemployment approximates 36%, and 15% of citizens have HIV," Mitchell writes. Yet is it mining friendly, so far. Mining makes up 13% of the economy. Namibia has two uranium mines. One is a biggie - Rio Tinto's Rossing Mine, which kicks in 8% of the world's uranium production all by itself. This is an old mine. It's been producing for 34 years. As with dog years, that's a lot older than it seems. It's getting tougher to massage the ore out of the Earth's crust. Labor costs are rising. Water and electricity are also getting expensive. And the geology of the mine itself is changing - worsening as it goes deeper. "The Rossing Mine is clearly strained," Mitchell writes, "approaching the current pit's end of life and marginally profitable at today's term prices and highly unprofitable if dependent upon today's spot." The spot price, meaning the price for immediate delivery, is about $42 a pound. Term prices are the longer-term prices and hover around $60. Mitchell estimates all-in costs for Rossing are north of $50 per pound. Meaning it's barely profitable as is. And those costs have doubled in the last five years. (That spot market, by the way, is artificially held down by foolish sellers, he argues. The Uzbeks sell 6.5 million pounds a year into the spot market because the term market is closed to them. They didn't honor their contracts a few years ago and no one has forgotten it. The market for spot uranium is thin. And he argues that buyers are holding producers hostage by referring to this spot price. Sooner or later, uranium producers will realize the folly of selling uranium in the spot market.) Namibia is also supposed to be an important source of new supply with a number of new projects. Yet these suffer from the same issues. Electricity is costly and unreliable. "Electricity demand in sub- Saharan Africa has doubled during the last 20 years while the capacity has grown 10%," Mitchell notes. Water is hard to find. No surprise there, as most of Namibia is a desert. Then there is the matter of the quality of the deposits. Grades are low, meaning you have to chomp through an increasing amount of ore to get the uranium out. That means high costs. "In summary," Mitchell concludes, "Namibia's current uranium mine production has unfavorable economic metrics..." It is barely profitable at best, or not profitable at worst. We'll need to see a lot higher price to make these projects a go. Kazakhstan - the No. 2 producer - has problems too. Kazakhstan is one we talked about before, but Mitchell confirms what we found. Most industry observers were surprised Kazakhstan produced as much uranium as it did in 2009 - about 13,900 metric tons. But as Mitchell points out, the Kazakhs' "own analysis suggests their marginal cost of production rises to well above $55 per pound once 12,000 metric tons of total production is breached to the upside." Again, like Namibia, Kazakhstan is a big current producer - it is No. 2. And it is also a large source of potential supply, with one-sixth of global reserves. Yet here again we find that it is not economic to produce more uranium at current prices. So in summary, lots of issues on the supply side make responding to increased demand difficult - even with a big boost in prices. These are fine conditions for investors in low-cost uranium mines to make a lot of money. Let us consider one final reason. For years, the mines have produced uranium well short of demand. The difference has been made up by existing inventories - those old Cold War stockpiles. Most of these are from Russia. Mitchell makes a good case that these stockpiles are about gone. "It is likely that the Russians don't have much usable material left, which is why they have the right to purchase 6,000 metric tons of uranium per annum from the Kazakhs. Further suggestive of their poor ore position, they have purchased 20% of Uranium One so as to access additional material." The US has a stockpile, too. Mitchell points out that this is less than it seems. The US has about 59,000 metric tons, but mostly made of tails (or spent fuel). The usable quantity is only 16,538 metric tons. And much of the tails are "held in a variety of cylinders, many of which can't be moved because they no longer comply with DOT. The DOE doesn't even know what the assays are for most of their tails - they guess." My guess is the stockpiles run out sooner than expected, leaving a yawning gap for the industry to make up. And the industry will only do that if prices rise to make these marginal projects in Namibia and elsewhere economic. As Mitchell sums up: "Uranium is well below cost of production, with a superb demand curve." We've made the demand case before, too, and we won't rehash it here. Suffice it to say that a slate of new nuclear plants means a robust demand for uranium for years to come. There are few commodities positioned as well for the next several years. Chris Mayer | ||||||||||

| The Achillies Heal of Financial Markets Posted: 06 May 2010 04:16 PM PDT The Dow fell 59 points yesterday. It looks to us as though the stock market is finally rolling over...it's finally putting in a big top after a long, long bounce. But it could be just another temporary setback. We won't know for a while. In the meantime, readers are advised to floss their teeth and stay out of stocks. The bounce may or may not be over. It hardly matters. There's not much upside at these prices...and a lot of downside. Flossing helps protect your teeth. Staying out of stocks might help protect your money. There are too many sticky things that could go wrong. For example: "Eurozone debt fears deepen," says the front page of yesterday's Financial Times. According to the papers, the Greeks have spooked the world's stock markets. "The sell-off in global markets accelerated [Tuesday] amid fears that the eurozone debt crisis would worsen and that China's recovery was faltering." As to the Greek bailout, there are two points of view - both of them insufficient. One group thinks the bankers should get their money. The other thinks the public employees should get the money. 'Stiff them both' is our advice. A nation is like a ship. Over time - especially when the weather is nice - it accumulates barnacles. They attach themselves to the hull, weigh it down, and slow the boat. Barnacles need to be scraped off from time to time. That's what revolutions and corrections are for. But, naturally, the barnacles don't like it. They live on pensions, public sector jobs, handouts, government contracts - and debt. And the barnacles have a way of fighting back. They vote, threaten and demonstrate. Yesterday, government employees shut down schools, airports and hospitals. Gray- haired retirees took to the streets, too, trying to prevent pension cuts. The bankers made their threats too - quietly warning France and Germany that if the Greeks didn't pay, their banks could be in trouble...which could lead to a financial meltdown all over Europe. The rescue plan calls for deep cuts in public spending - 20% of the Greek government budget. And that means scraping a lot of crusty parasites off the hull. So much the better, as far as we're concerned. Of course, some of them do useful work. Government payrolls include teachers, nurses and firemen. But there are plenty of do-gooders, bureaucrats, meddlers, paper-pushers, lobbyists, chiselers and layabouts on the payroll too. But what about the debt barnacles? The bankers speculated on Greek debt. The debt went bad. Now, they should stand up, admit their mistake, and take their losses. Advice to Greece: Haul the boat out of the water...fire one out of every five government workers, cut the budget by 20%, and default on your loans too. Advice to the US: Follow the Greeks. Advice to investors: Take a long vacation. The "Euro-feds" have turned the sovereign debt market into a 'price hiding' mechanism. Not even Mr. Market knows what the stuff is worth. A couple months ago, he thought Greek bonds might be A-OK. Now he's not so sure. Recently, Mr. Market has been turning over some other rocks...Portuguese debt...Spanish debt. He's finding slimy critters and creepy crawlers under all of them. But then, the Euro-feds stepped in. They said they'd bail out Greece. Now what's Greek debt worth? Nobody knows. Will the guarantors make good on their promises? Will the Greeks get their financial house in order? Will the IMF, Germany and France stand behind the Greeks even if they don't bring their deficit down to 3% (currently 13%)? Nobody knows. And then, the head of the European Central Bank pulled a Bernanke-style stunt to further confuse everyone. Jean-Claude Trichet announced that Greek bonds could still be used as collateral at the bank, even though the bonds do not meet their quality requirements. So, let's see...what are they worth now? This additional information from the feds is misleading. It suggests the bonds are good credits. And the bailout itself suggests that lenders have nothing to worry about - they're going to be repaid. Uh...we wouldn't count on it. David Rosenberg: "Back to Greece - the fiscal future is really messy. Latest projections show that by 2013, public debt-to-GDP will approach 150%. Debt-service charges will absorb 9% of GDP and 25% of tax revenues will be siphoned to bondholders outside the country. Government spending is 50% of GDP and the civil service does not seem willing to accept even a freeze - not a cut - to wages, benefits, and pensions. It is not difficult to see the Euro-area going the way of the Latin Monetary Union a century ago." This is just another example of rolling up small debts into big ones. Mr. Market can't tell who's on the hook, exactly. So he doesn't know where the 'good' debt ends and where the 'bad' debt begins. One thing is pretty sure. Even with the bailout and the support from the ECB, the Greeks are still going to default. They have more debt than they can carry. The bailout just muddies the waters...postpones the inevitable...and makes the situation worse for almost everyone. The proposed solution is just slow torture before the coup de grace. The debt grows...and becomes so large the Greek economy can't support it. Plus, efforts to keep paying back the bankers (mostly French and German) severely damage the Greek economy. It's easy to see how. In very broad terms, the Greeks are going to have to go from fiscal party to a fiscal hangover without a good night's sleep. That's what happens when you suddenly stop borrowing and begin paying back. And that means a shrinking economy. Instead of borrowing 10% of GDP and adding to the economy, not only are you NOT borrowing, you're also taking OUT 10% of GDP to pay the interest on the money you borrowed for the party. That's a depression-size decrease in GDP...which cuts into tax revenues and makes the country's finances even worse! Does that mean the end of the euro? We don't think so. Bill Bonner | ||||||||||

| Posted: 06 May 2010 04:07 PM PDT Your editor's phone began buzzing this morning shortly before 6am with texts asking us to turn on CNBC. There we saw what you saw: the Dow Jones had its largest-ever intra-day decline since 1987. The index fell nearly 1,000 points and almost ten percent as about $1 trillion in market value briefly got wiped out. By the end of the day the loss was just under 347 points or 3.2%. And CNBC was reporting that the whole affair was trigged by a trader entering the wrong number on a trade, probably in Procter & Gamble stock, which fell nearly 37% at one point. CNBC said that, "The erroneous trade may have involved E-Mini contracts - stock market index futures contracts that trade on the Chicago Mercantile Exchange's Globex trading platform. The composition of the E-Mini is similar to the stocks in the S&P 500." So maybe it was all just a misunderstanding. But it was a costly one. When computers take over decision making for human beings via program trading, then the catalyst for a given event can be erroneous and still have real world consequences. Program traders use algorithms that trade automatically buy and sell the market based on resistance and support levels determined by models. Program trading accounted for about 24% of the trading volume every day for the most recent week for which data were kept, according to the NYSE. During the last week in April, that meant nearly 700 million shares a day were trading hands based on algorithms. It's not hard to see what happened last night. A featherless biped made a keystroke error on a P&G trade and erased $60 billion from the company's market cap. The decline in P&G triggered automated sell orders which drove the Dow below 10,000. The very crossing of the Dow below 10,000 most likely triggered a flurry of buy orders. Voila! Chaos! Well, not chaos. But certainly volatility. And you thought stock prices were determined buy buyers and sellers with live brains deciding the discounted current value of future earnings. Nope. To us, the big takeaway from yesterday's US episode is how, in the rush to digest and reprice news and information constantly, the market now appears susceptible to runaway feedback loops that swing prices and trigger buy and sell decisions automatically. This does not seem like an improvement in efficiency. It seems like a systemic vulnerability that could be exploited in the future deliberately to cause mass panic and wealth destruction. Expect an investigation, although don't expect anything to change...until next time. The fact that traders freaked also shows you how uncertain investors now are. Just minutes before CNBC began going bananas over the fall in the Dow, Pimco's Mohamed El-Erian wrote in a note to customers that the Greek crisis was leading to tighter inter-bank lending in Europe and "going global." Specifically, El-Erian said, "The transmission mechanisms for this latest round [of volatility] include disruptions in European inter-bank lines, a flight to quality, and market illiquidity...the Greek crisis tells you is debt and deficits matter... What you see is the system slowly starting to have cascading failures. It's like a pipe that you need to be free-flowing and it starts to clog, and that's a concern...This is a shock to the system and it's going to have an impact on valuation." This resurrects the debate from 2008 over whether the GFC (which has morphed into a Sovereign Debt Crisis) is a liquidity crisis, a solvency crisis, a confidence crisis, all of the above, or none of the above. So which is it? If the impending Greek debt-default isn't contained, it WILL be a liquidity crisis soon enough. That's partly what made New York traders so nervous after Europe's session. In a leveraged world with falling asset values, liquidity issues become solvency issues. And none of that is good for confidence. The only people we know that are loving this are traders and value investors. For the better part of three months Swarm and Slipstream Trader Murray Dawes has kept his powder dry. Today he's firing new trades with both barrels. If you're a punter, this is precisely the time to capture gains from mis-priced assets (those too cheap AND those too expensive). It is frustrating for small cap and resource investors who are, if they're being disciplined, getting stopped out of nearly all of the open positions recommended by Kris Sayce and Alex Cowie since the March lows of last years. Most, although not all, of these positions are getting sold at a profit. But it's a lot of selling. What next? The sliver lining to corrections and liquidations is that investors who've preserved their capital and cash can go shopping. What you want to buy is up to you. But prices (and generally valuations) are a lot more attractive after big falls. Both Alex and Kris may re-enter some of the same resource companies they've been forced to issue sell recommendations on this week. We'll keep you posted. As for our new project at the Australian Wealth Gameplan, it's worked out well, although not for exactly the reasons we expected. Yesterday we recorded a 15-minute video analysing the effects of resource super profits tax and the Greek crisis on the Aussie market. China - whose real estate bubble we pegged as the big catalyst for the revaluation of Aussie stocks - was also discussed. But no one saw a human trading error leading to complexity catastrophe of cascading sell orders on Wall Street happening this week. Not us anyway. But it did. And here we are, with a full-blown sovereign debt crisis in Europe, a manic market in America, and China's falling stock market and metals prices indicating that its property bubble is deflating - slowly thus far. That's our story, anyway. And the plan-two specific investments designed to profit from the fall of the Aussie dollar and resource prices - is working out okay so far. The third thing going up now - volatility - is also tradeable, but a lot riskier. If you want to read more about the big picture gameplan, you can read the full "Exit the Dragon" report here. Until Monday... Dan Denning | ||||||||||