Gold World News Flash |

- Greeks Rise Up, Euro Plunges, Pound Rallies, Investors Head East

- VNQ: What's Driving the Real Estate ETF?

- Short ETFs the Only Winners as Markets Plunge Again

- Special GSR Gold Nugget: John Williams & Chris Waltzek

- The Coming Collapse of Occult Economics and the USD Based System

- John Williams: A Hyper-Inflationary Great Depression Is Coming

- Euro plunges as Club Med debt fears spread

- The Fed Must Be Audited Because It Has Taken Numerous Actions Which Are Far Beyond Its Authorized Powers

- On the Future of Social Security

- Most Americans Concerned About Inflation

- Another mysterious IMF gold sale -- plugging the London leaks?

- Tuesday ETF Wrap-Up: VXX Soars, EWZ Sinks

- Consumer Spending: Let's Get This Party Started...No, Wait

- Another mysterious IMF gold sale - plugging the London leaks?

- Is the Deepwater Horizon the Offshore Oil Industry’s Three Mile Island?

- Lost in the Zeroes of Government Finance

- Jim?s Mailbox

- Hourly Action In Gold From Trader Dan

- Does Anyone Remember 1931?

- Mainstream Media Critical of the Fed?.. Polish Plane Crash Stirs Internet

- Newcrest and Lihir Finally Tie the Knot

- Happy Creek Advancing Highland Valley Copper Projects in BC

- Things

- Violating the No-Ponzi Condition

- LGMR: Gold "Remains Safe Haven" as Euro Sinks, Commodities Fall with Stocks

- Time To Whistle A Bit.....

- Airing Dirty Laundry

- The Great Reflation

- Gold Seeker Closing Report: Gold and Silver Fall Over 1% and 5%

- The Investment Secrets of T. Rowe Price

- The Lies That Bind…

- To Trade the Resources Rent Tax or Not?

- Cheap-o Greek Bailout Is Not Calming Markets

- Continuous strength in the precious metals sector; a sign that all is not well

- A Rate Hike For Australia

- Coin Monday on a Tuesday: Collecting the Atlanta Commemoratives

- Gold Prices Falls From Five-Month High, Silver Plunges

- 2010 Boy Scouts Silver Dollars Slow, Sales at 96.7% Max

- China, the gorilla in the Third Gold War

- Another mysterious IMF gold sale — plugging the London leaks?

- Contagion 'Madness'?

- Do I Hear the Death Knell Tolling for Silver and Gold Prices?

- IMF sold 18.5 T of gold in March vs 5.6 T in Feb

- China - the Gorilla in the 3rd gold war

- Congress and Their Families Bet On Economy Collapse

- Trader Dan Comments On The Nationalizing Of 401(k)s

- How Is The U.S. Economy Supposed To Succeed When Our Politicians And The Big Banks Are Making Billions Of Dollars Betting Against It?

- An Even Better Trade of the Decade, Part II

- TUESDAY Market Excerpts

- Ammo Can Rules of Thumb

| Greeks Rise Up, Euro Plunges, Pound Rallies, Investors Head East Posted: 04 May 2010 07:28 PM PDT Stacy Summary: Good morning, y'all. I found a better photo (via Huffingtonpost) of the "Peoples of Europe Rise Up" banner. Two of our major themes as we laid out in our first Keiser Report of the year are in the headlines this morning – sovereign debt crises and currency volatility. There will be many more mornings like this before the year is out. Anyway, how are things where you are at? In Paris, I see no sign of Depression or Recession with ordinary people, but huge quantities of commercial real estate are suddenly becoming vacant in the 8th and 16th near our office. Nearly every day sees another 800 or 1500 square meters open up.

| ||

| VNQ: What's Driving the Real Estate ETF? Posted: 04 May 2010 07:11 PM PDT Michael Johnston submits: After more than almost 14 months of a relatively stable recovery effort, many equity ETFs have climbed to within shouting distance of their pre-recession highs, as consumers have regained their swagger and companies are once again delivering solid earnings reports. Even the sectors that were closest to the economic implosion in late 2008 are showing signs of strength. Despite concerns over the potential regulatory impact, financials ETFs have been among the best performing sector ETFs to date in 2010. And real estate ETFs, some of which lost nearly 70% of their value in less than six months, have surged as well (see ETFs Claw Back To Pre-Recession Levels). Once seen as a critical component of any well-diversified portfolio, some investors have abandoned real estate as an asset class following its dismal performance during the recent economic collapse and strong correlation with domestic and international equities. But those who stuck with their real estate investments through the turmoil have been rewarded in 2010, as many of the ETFs in the Real Estate ETFdb Category have been among the year’s best performers. The Vanguard Real Estate ETF (VNQ), the largest fund in the category, has gained almost 10% since the middle of April, shooting higher as a number of positive developments have combined to give a major boost. Complete Story » | ||

| Short ETFs the Only Winners as Markets Plunge Again Posted: 04 May 2010 07:06 PM PDT Peter Cooper submits: The fall out from the Greek debt crisis refused to die down yesterday with markets fearing similar debt crises in Spain and Portugal. The euro fell below $1.30 and acted as a transmission mechanism taking the mayhem across the Atlantic to give markets their biggest sell-off since January. Only the short exchange traded funds enjoyed big rises yesterday. The basket of 10 short ETFs recommended in the May edition of the ArabianMoney newsletter jumped by 4.5 per cent. Short ETFs Complete Story » | ||

| Special GSR Gold Nugget: John Williams & Chris Waltzek Posted: 04 May 2010 07:00 PM PDT | ||

| The Coming Collapse of Occult Economics and the USD Based System Posted: 04 May 2010 06:48 PM PDT Dude, where's the Dharma? submits: I see bad libor rising Complete Story » | ||

| John Williams: A Hyper-Inflationary Great Depression Is Coming Posted: 04 May 2010 06:44 PM PDT View the original post at jsmineset.com... May 04, 2010 04:13 PM Courtesy of The Gold Report ([URL]http://www.theaureport.com[/URL]) ShadowStats’ John Williams has done his math and believes his numbers tell the truth. He explains why the U.S. is in a depression and why a "Hyper-Inflationary Great Depression" is now unavoidable. John also shares why he selects gold as a metal for asset conversion in this exclusive interview with The Gold Report. The Gold Report: John, last December you stated, "The U.S. economic and systemic crisis of the past of the past two years are just precursors to a great collapse," or what you call a "hyper-inflationary great depression." Is this prediction unique to the U.S., or do you feel that other economies face the same fate? John Williams: The hyper-inflationary portion largely will be unique to the U.S. If the U.S. falls into a great depression, there’s no way the rest of the world cannot have some negative economic impact. TGR: How wil... | ||

| Euro plunges as Club Med debt fears spread Posted: 04 May 2010 06:44 PM PDT | ||

| Posted: 04 May 2010 06:43 PM PDT In March 2004, when Alan Greenspan was Fed chairman, he suppressed the opinions of those Fed officials who knew that there was a housing bubble. Congressman Alan Grayson points out that - because the Fed unilaterally decided to hand out half a trillion to foreigners without any Congressional oversight, and that Bernanke testified that he didn't know who got the loot - the Fed must be subject to an audit. Yves Smith and Tom Adams - in analyzing the Fed's lack of full disclosures regarding its extraordinary rescue operations - conclude:

The Fed argues that an audit would interfere with its monetary policy decisions. That is incorrect for at least two reasons. | ||

| On the Future of Social Security Posted: 04 May 2010 06:35 PM PDT Brad DeLong submits: If the Social Security program remains as specified in current law, then sometime between 2032 and 2070--call it a 50% chance of happening by 2042--the Social Security Administration's trust fund balance at the U.S. Treasury hits zero. Click to enlarge: Complete Story » | ||

| Most Americans Concerned About Inflation Posted: 04 May 2010 06:25 PM PDT  Michael Panzner submits: Michael Panzner submits: As a contrarian and a cynic, my inclination is to fade "the crowd." But when it comes to the state of the economy, the American public has proved to be spot-on, at least in recent years. Under the circumstances, the fact that they have an altogether different view of the outlook for prices than the nation's central bank, as detailed by Gallup in "Inflation Worries Permeate U.S.," suggests that policymakers continuing an easy-money stance is set to make things a whole lot worse than they already are.

Complete Story » | ||

| Another mysterious IMF gold sale -- plugging the London leaks? Posted: 04 May 2010 06:11 PM PDT Another unexplained sale of gold by the International Monetary Fund turned up today in another Reuters story based on another statement from the World Gold Council. This time the sale is said to have been 18.5 tonnes unloaded in March. Two weeks ago the WGC reported that the IMF had sold 5.6 tonnes in February. | ||

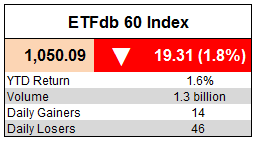

| Tuesday ETF Wrap-Up: VXX Soars, EWZ Sinks Posted: 04 May 2010 06:02 PM PDT ETF Database submits: U.S. markets took their cues from Europe in Tuesday’s trading, sending major benchmarks sharply lower on the day. Britain, Germany, and France all saw their equity markets fall by more than 2.5%, which led to a sharply lower opening on Wall Street. The S&P 500 sank by close to 30 points while the Nasdaq slid by almost 3%. Additionally, oil tumbled lower on demand fears as the commodity lost more than 4% on the day. This sharp decline continued the rough, choppy market that many have been experiencing as of late as Europe agreed on a $144 billion bailout package for the highly indebted nation of Greece. Although many were glad that a bailout came, investors grew concerned that the bailout would make it more difficult to help Spain and Portugal should they need assistance in the near future (see Six ETFs To Play Turmoil In Greece).

Complete Story » | ||

| Consumer Spending: Let's Get This Party Started...No, Wait Posted: 04 May 2010 05:41 PM PDT Annaly Salvos submits: Consumer spending data for March were released Monday, and the 0.6% increase was the highest in five months, with strength in durable goods helping to drive the number. To state the obvious, for a consumption-based economy, this bodes well. Anecdotal evidence is accumulating of rosier cheeks and a jauntier step for segments of the economy, and objective market participants have to consider the possibility that the consumer is finally bellying up to the punchbowl. Nevertheless, we have to ask the following question: Whence came this consumption? Personal income gained in the month, up 0.3% (versus +0.1% in February, +0.4% in January), but it was flat without transfer payments. Currently, consumer debt is not a likely source….it’s been falling since July 2008….nor is home equity withdrawal. (Aaahhh, the good old days.) Complete Story » | ||

| Another mysterious IMF gold sale - plugging the London leaks? Posted: 04 May 2010 04:49 PM PDT | ||

| Is the Deepwater Horizon the Offshore Oil Industry’s Three Mile Island? Posted: 04 May 2010 04:32 PM PDT Besides developing some great gas wells costing $1/MCF when it was selling for $2, the fruit of my four years of wildcatting in the Barnet shale was many great relationships in the energy industry. Over the years, I have not been wanting for great steaks at Nick & Sam’s in Dallas (thanks Billy Bob), skyboxes at Dallas Cowboys games, (thanks Jim Bob), and personally signed 8 X 10 glossy photographs of George W. Bush (thanks Rufus). Not only have these good old boys kept me in touch with the goings on in the hydrocarbon industry, they have also provided insights that help me understand the world at large. I have to tell you that the grumblings coming out of the oil patch these days are not happy ones. British Petroleum’s (BP) Gulf disaster could well do for the offshore oil industry what Three Mile Island did for nuclear energy. At the very least, regulations are going to get tougher, inspections more rigorous, and taxes higher. The Oil Spill Liability Trust Fund, which is funded by an eight cent per barrel tax, is going to have to be replenished with higher fees. It will also raise the production and insurance cost of what is already the world’s most expensive oil, now around $80/barrel. The Senate is almost certain to raise the liability limit for these projects from $75 million to as much as $10 billion. A populist wave could revive cap & trade, until last week thought dead on arrival. It didn’t help that BP was a notorious “green washer,” its $300 million budget for alternative energy going entirely into advertising. The big oil companies themselves have to be asking themselves if these ultra high risk, high return projects are really worth it. The massive oil spill could not have come at a worse time. Just as the Obama administration was finally opening up new offshore tracts for lease, this had to happen. All new licenses for deepwater wells have been frozen, pending an investigation into the causes of the current blow out. The 5,000 barrels a day that is leaking is, so far, just a tiny fraction of the 75,000 barrels that washed ashore in Santa Barbara in 1969, which I personally helped clean up myself. But its magnitude will surpass the 1989 Exxon Valdez disaster in a matter of days. I haven’t heard Sarah Palin say “drill baby drill” since last week, possibly because four red states are about to see their tourism industries destroyed by fouled beaches just as summer vacations begin (see map below). Ooops! Maybe all those tourists are now headed for California? There goes my parking spot at the beach. Today’s cleanup estimate is at $4.6 billion. No doubt (BP), the lease holder, and Transocean (RIG), the subcontractor, will get absolutely taken to the cleaners over this. The insurers for the rig, probably Lloyds of London, will take a multibillion dollar hit on claims. Shipping rates for Suezmax crude carriers are already climbing, as the prospects of greater offshore supplies recede into the future. Some one third of total US oil production is offshore. It is clear that either a blowout preventer valve was missing from this site, an insane cost cutting risk at this depth, or malfunctioned. It has long been a dirty little secret that offshore drillers routinely ignore regulations that are strictly enforced by the states on the US mainland. Anyone who has worked closely with these wells, as I have, knows that they can blow up at any time, and that you can’t spend enough on safety. Too bad for RIG, which is a first rate company, with about half of its offshore rigs on long term leases to Brazilian oil company. Petrobras (PBR). As for BP, may they roast in hell. Not only is their safety record deplorable, I am still smarting from the $75,000 I lost as my personal underwriting share when Morgan Stanley took them public in 1987. But for the rest of us, this will mean more expensive gas at the pump. To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on the “Today’s Radio Show” menu tab on the left on my home page.

| ||

| Lost in the Zeroes of Government Finance Posted: 04 May 2010 04:18 PM PDT Henry CK Liu, writing at atimes.com, has, unlike the Securities and Exchange Commission, apparently not been spending his days downloading pornography on his computer, and instead has looked at the sheer amount of money that was lost worldwide since October 31, 2007, when "the total market value of publicly traded companies around the world reached a high of $63 trillion. A year and four months later, by early March 2009, the value had dropped more than half to $28.6 trillion." To add a little perspective, "The lost $34.4 trillion in wealth is more than the 2008 annual gross domestic product (GDP) of the US, the European Union and Japan combined." The upshot is that this money ain't never comin' back, as "This wealth deficit effect would take at least a decade to replenish, even if these advanced economies were to grow at mid-single digit rates after inflation and only if no double-dip materialized in the markets." He goes on that "At an optimistic compounded annual growth rate of 5... | ||

| Posted: 04 May 2010 04:18 PM PDT View the original post at jsmineset.com... May 04, 2010 09:03 AM First-time tax credit jolts housing market CIGA Eric "To know that we have a place to call home, it's a very satisfying feeling to have," said Brown. "So definitely having that $8,000 tax credit spurred me to look a little harder and (buy) a house earlier." The nominal (U.S. Dollar) housing index illustrates this liquidity-driven bounce. It’s an impressive bounce on paper. Unfortunately, this bounce like many other media perceptions is embedded with the devaluation illusion. When the index is priced in a stable currency such as gold, impressive quickly fades into mediocre. Nominal Housing Index: Gold Adjusted Housing Index: Granted, the tax credits and other free money programs have generated some new, marginal demand in real estate. But has anything really changed other than recognition that a problem exists? A large chunk of today’s sales are nothing more than pulling forward future de... | ||

| Hourly Action In Gold From Trader Dan Posted: 04 May 2010 04:18 PM PDT View the original post at jsmineset.com... May 04, 2010 09:47 AM Dear CIGAs, Gold priced in Euro terms, or Euro Gold as I prefer to call it, notched a brand new all time high at today's PM fix finally clearing the 900 level as it was fixed at €907.281. Yen gold also made another high at the PM Fix as did Sterling gold. This was prior to the selling barrage that swamped the commodity world in New York as the hedge funds were busily disengorging themselves of anything that was remotely tangible and rushing wildly into the safety of, (drum roll here), paper bonds. Yessiree Bob, that is what I call a nice, "let me sleep comfortably" trade. Uncle Sam is issuing these scraps of paper by the trillions and investors can't get enough of them throwing away gold in the process. Exchanging gold for paper scraps whose yields are dropping off a cliff – excuse me while I shake my head as I marvel at this display of mental acumen by the boy wonders of the hedge fund world. One computer algorithm to ... | ||

| Posted: 04 May 2010 04:18 PM PDT Market Ticker - Karl Denninger View original article May 04, 2010 08:45 AM Of course not. In 1930 there were all sorts of statements about how it was "all under control" and "prosperity was returning." Some examples of the 1929 and 1930 idiocy: [INDENT]"Financial storm definitely passed." - Bernard Baruch, cablegram to Winston Churchill, November 15, 1929 "I see nothing in the present situation that is either menacing or warrants pessimism... I have every confidence that there will be a revival of activity in the spring, and that during this coming year the country will make steady progress." - Andrew W. Mellon, U.S. Secretary of the Treasury December 31, 1929 "I am convinced that through these measures we have reestablished confidence." - Herbert Hoover, December 1929 "[1930 will be] a splendid employment year." - U.S. Dept. of Labor, New Year's Forecast, December 1929 "For the immediate future, at least, the outlook (stocks) is bright." - Irving Fisher, Ph.D. in Econ... | ||

| Mainstream Media Critical of the Fed?.. Polish Plane Crash Stirs Internet Posted: 04 May 2010 04:18 PM PDT Mainstream Media Critical of the Fed? Tuesday, May 04, 2010 – by Staff Report Ben Bernanke The credit bubble, the recession and what the Federal Reserve should have done ... No, Goldman Sachs did not single-handedly launch the financial crisis, no matter what many lawmakers are saying. The turmoil that struck the markets in 2008 also had very deep roots in another powerful institution: the Federal Reserve. One of the most troubling questions in the aftermath of the crisis is why the Fed didn't intervene to deflate – or "prick" – the credit bubble, especially in home mortgages, before it got so big that its burst would threaten to take down the economy. William Dudley, president of the Federal Reserve Bank of New York, recently suggested that the Fed was mistaken on that score. "The costs of waiting to respond to an asset bubble until after it has burst can be very high," he told the Economic Club of New York. "... A proactive approach is app... | ||

| Newcrest and Lihir Finally Tie the Knot Posted: 04 May 2010 04:18 PM PDT Despite a rising dollar, gold didn't do a heck of a lot in Far East trading during their Monday trading session. But once London opened, gold caught a bit of a bid. Then, at 9:00 a.m. in New York, a serious buyer showed up and gold took off to its high of the day [$1,189.00 spot] an hour or so later at the London p.m. gold fix. Then, a resolute seller showed up and drove the price right back down within a dollar of its 9:00 a.m. low... and every subsequent rally attempt after that [regardless of size] was firmly reversed. Silver had a somewhat more interesting time of it... selling off to its low of the day, around $18.50 spot, early in Hong Kong trading. But once it started trading in London, the silver price rallied right into the London silver fix around noon in London, before selling off a bit into the same 9:00 a.m. New York low as gold. Silver rose until the London p.m. gold fix was in... got sold off hard... and then recovered almost all those losses to ... | ||

| Happy Creek Advancing Highland Valley Copper Projects in BC Posted: 04 May 2010 04:18 PM PDT By Claire O'Connor MidasLetter.com Tuesday, May 4, 2010 In the complex world of junior mining exploration, adopting a particular strategy regarding property acquisition is a critical one. Happy Creek Minerals Ltd. (TSX.V: HPY) is a BC based exploration company whose strategy involves 100% owned mineral properties that are close to existing and past-producing mines. The company’s flagship property, The Highland Valley Property adjoins Teck Resources’ Highland Valley Copper mine and it looks like positioning themselves in such close quarters to this particular property, could prove quite beneficial to Happy Creek in the near future. Since its establishment in 2006 Happy Creek has accumulated 6 properties in total, all located in British Columbia. However, it’s the aforementioned Highland Valley flagship properties that has them... | ||

| Posted: 04 May 2010 04:18 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 04, 2010 06:33 AM [LIST] [*]Significant up and down days in U.S. stock market suggests correction/consolidation at hand. It has gone virtually straight up for months so this comes as no surprise. There’s one potential factor that could come out of left field that at this time only needs to be noted and may turn out to be nothing. President Obama is being accused of having an affair while married. This surfaced in his run for the White House but never turned into anything. Right now it’s limited to the rags, but if it gets legs, could become a nightmare so just keep this way back in your mind for now. [*]U.S. Dollar Index has reached the lower end of my 83-84 target. There’s no sign of a top and I may raise my target so stay tuned. Ironically, this was one of the big bad factors the gold perma-bears touted as a death blow to gold yet gold has $1,200+ written all ov... | ||

| Violating the No-Ponzi Condition Posted: 04 May 2010 04:18 PM PDT Excerpt from the Hussman Funds' Weekly Market Comment (5/3/10):[INDENT]The credit picture remains mixed at present, though the next several months are likely to provide significantly more clarity. The Greek debt concerns are interesting in the lesson that investors are hoping to be taught, which is that all debt, no matter how foul, should be considered risk-free and can be counted on to be bailed out, so that market discipline need not provide any impediment to the poor allocation of the world's financial resources. The basic problem is that Greece has insufficient economic growth, enormous deficits (nearly 14% of GDP), a heavy existing debt burden as a proportion of GDP (over 120%), accruing at high interest rates (about 8%), payable in a currency that it is unable to devalue. This creates a violation of what economists call the "transversality" or "no-Ponzi" condition. In order to credibly pay debt off, the debt has to have a well-defined present valu... | ||

| LGMR: Gold "Remains Safe Haven" as Euro Sinks, Commodities Fall with Stocks Posted: 04 May 2010 04:18 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:15 ET, Tues 4 May Gold "Remains Safe Haven" as Euro Sinks, Commodities Fall with Stocks THE PRICE OF GOLD in wholesale dealing rose against all major currencies on Tuesday, hitting new record highs for European investors as stock markets and raw materials sold off worldwide. The Euro sank through $1.31 for the first time in 12 months, dropping as traders in London – back from the UK's May Bank Holiday weekend – reacted to Sunday's Eurozone-IMF deal to lend €110 billion to Greece. "At some point, it's going to become evident that the crisis we should be worried about is not the credit crisis, not a financial crisis...but a crisis of high unemployment, low to zero inflation, and very low growth for the foreseeable future," says Michael Crook, a vice president and strategist at Barclays Wealth in New York, in an interview with TheStreet.com. "All of those things are bad for gold," reckons Crook, for... | ||

| Posted: 04 May 2010 04:18 PM PDT Market Ticker - Karl Denninger View original article May 04, 2010 05:04 AM As we walk down memory lane back to the first of the year.... [LIST] [*]One or more of the PIIGS (Portugal, Ireland, Italy, Greece, Spain) either defaults technically or is forced into austerity by the ECB. Further, Eastern Europe becomes dangerously destabilized. There is a real possibility of outright hostilities in that part of the world next year. Let's hope not. The ECB has a nasty problem on their hands; I have said for quite some time that the Euro is likely to trade at PAR down the road. This year is probably not the year for it, but the cracks in the dam that ultimately could destroy the European Union should become very apparent in 2010. [/LIST]Hmmmmm... May have nailed that one eh? Recognition is starting to show up too: [INDENT]May 4 (Bloomberg) -- Greece's bailout "might collapse" and the nation's debt crisis makes it "hard to see" how the euro will surviv... | ||

| Posted: 04 May 2010 04:18 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 04, 2010 04:42 AM I’ve written about gold perma-bears and have noted one in particular – the “Senior Analyst at Kitco.* I’ve done this in part because it’s my opinion (and apparently that of many, many others), no one has been more wrong about gold and it’s direction for almost a decade. Myself and others in my industry have challenge him numerous times to public debates and even Canada’s BNN offered to host it- but he always put his tail between his legs and hides. I would not publicly discuss this if being wrong was the only factor since I’ve been wrong enough times over twenty five years and could write a book about it. Why I do discuss it publicly is the arrogance and continuous misinformation he spews and how many investors end up voicing their dismay that they unfortunately followed his advice. Among the emails I received abou... | ||

| Posted: 04 May 2010 04:18 PM PDT Let me start this week's Outside the Box by venting a little anger. It now looks like almost 30% of the Greek financing will come from the IMF, rather than just a small portion. And since 40% of the IMF is funded by US taxpayers, and that debt will be JUNIOR to current bond holders (if the rumors are true) I can't tell you how outraged that makes me. What that means is that US (and Canadian and British, etc.) tax payers will be giving money to Greece who will use a lot of it to roll over old bonds, letting European banks and funds reduce their exposure to Greece while tax-payers all over the world who fund the IMF assume that risk. And does anyone really think that Greece will pay that debt back? IMF debt should be senior and no bank should be allowed to roll over debt and reduce their exposure to Greek debt on the back of foreign tax-payers. I don't think I signed on for that duty. Why should my tax money go to help European banks? This is just wrong on so many levels a... | ||

| Gold Seeker Closing Report: Gold and Silver Fall Over 1% and 5% Posted: 04 May 2010 04:00 PM PDT Gold saw slight losses in Asia before it rose in London to see an almost $10 gain at as high as $1192.08 by about 9AM EST, but it then fell off rather markedly for most of the rest of trade in New York and ended near its late session low of $1166.65 with a loss of 1.21%. Silver traded only slightly lower in Asia and London before it also fell off further in New York and ended near its late session low of $17.78 with a loss of 5.16%. | ||

| The Investment Secrets of T. Rowe Price Posted: 04 May 2010 03:55 PM PDT Buy early and hang on. Such was the investment process of Thomas Rowe Price. Price is most famous for founding the investment firm that bears his name. But he was a very successful investor in his own right. He was an advocate of buying obscure or out-of-favor growth stocks. In general, Price bought growth stocks only when they were cheap. He knew price paid was the most important consideration. In fact, twice in his career, Price closed his fund because he thought the market was too expensive, based on his inability to find cheap growth stocks. Once he closed it from October 1967-June 1970. And the other time was from March 1972-September 1974. During both periods, the market slumped. Keep in mind that when he closed these funds, he could have been taking in more than $1 million a day in new money from investors wanting to get in the market. Few fund managers today would have the integrity to close their fund when so much money - the source of their fees - was coming in. But this integrity enabled Price to invest when stock prices were reasonable. Ironically, when Price reopened his fund near the market bottoms - when things were cheap - investor interest was minimal. So there you go. Some things never change. Price's idea was very simple on the surface. He thought the best way for an investor to make money in stocks was to buy growth - and then hang on for the long haul. He defined a growth stock this way: "Long- term earnings growth, reaching a new high level per share at the peak of each succeeding major business cycle and which gives indications of reaching new high earnings at the peak of future business cycles." Note, by Price's definition, you could own cyclical stocks, which many growth investors these days shun. Where Price turned Wall Street on its head was in what he thought was the least risky time to own such stocks. Price thought the best and least risky time to own a growth stock was during the early stages of growth. Most people think that larger, more mature companies are less risky than younger, faster-growing ones. Not so for Price, who looked at companies as following a life cycle, like people do. There was growth, maturity and, finally, degradation. Here is Price in his own words, from a 1939 pamphlet: "Insurance companies know that a greater risk is involved in insuring the life of a man 50 years old than a man 25, and that a much greater risk is involved in insuring a man of 75 than one of 50. They know, in other words, that risk increases as a man reaches maturity and starts to decline... "In very much the same way, common sense tells us that an investment in a business affords great gain possibilities and involves less risk of loss while the long-term, or secular, earnings trend is still growing than after it has reached maturity and starts to decline... The risk factor increases when maturity is reached and decadence begins..." Price went on to show that investing his way during the Great Depression would've produced a 67% gain, whereas the rest of the market lost money. In the 1930s, people focused on current dividends, and that meant they were reluctant to invest in a growth stock (which typically pays no dividend). Price thought that was a mistake. "High current income," he wrote, "is obtained at the sacrifice of future income..." He wasn't just talking. Price did very well by his own ideas. He is somewhat forgotten today, probably because he did not write a book that people can refer to now as a classic. But maybe it's time for some publisher to cobble together Price's work. (Hmm...) In his day, Price was a force of nature. He was known as "Mr. Price" to nearly everyone. He was passionate about investing and still came to the office at the age of 83, rising at 5 a.m. every day. If you want to read more about Price, I would recommend John Train's The Money Masters, which includes a chapter on Price, along with chapters on many other great investors. Chris Mayer | ||

| Posted: 04 May 2010 03:52 PM PDT News Flash: WASHINGTON (AP) - Consumer spending rose in March by the largest amount in five months but the gains were financed out of savings, which fell to the lowest level in 18 months. A slight rise in incomes added to concerns that the recovery could weaken unless income growth increases more rapidly. This is supposed to be a recovery. Everyone thinks it's a recovery. All the papers say so. Investors are betting on it. Politicians and economists are congratulating themselves for it. The only trouble is, the things that need to recover so that there can be a genuine recovery are not recovering. On the surface... Monster.com says the job situation is improving. Case & Shiller say the housing market is improving. Yesterday's news also told us that Europe has agreed to bail out its problem child, Greece. The New York Times: ATHENS - Greece announced on Sunday that it had reached agreement on a long-delayed financial rescue package that would require years of painful belt-tightening, but the deal might not be enough to stop the spread of economic contagion to other European countries with mounting debts and troubled economies. The bailout, which was worked out over weeks of negotiations with the International Monetary Fund and Greece's European partners, calls for 110 billion euros, or $146 billion, in loans over the next three years intended to avoid a debt default. And so, on the back of this good news, the Dow recovered what it had lost on Friday. Oil traded at $86. And gold edged up 2 bucks. Up, down, up, down - suddenly, the stock market seems nervous. Maybe it is beginning to realize that the recovery story is a lie...a fake- out... We have a feeling that the present volatility is going to be resolved by a decisive move to the downside. So, we'll keep our 'Crash Alert' flag up the pole for a bit longer. Of course, we've been wrong about the timing before. And if we're wrong this time, don't bother to send us an email. Some of the world's most important fortunes have been preserved by selling too soon. We won't mind being a bit premature again. "This recovery has nothing in common with typical post-war recoveries," we told our audience in Las Vegas on Saturday, "because the recession has nothing in common with the garden-variety recessions of the post- war period. This time it's different..." Which is to say, this time it's the same...it's coming back to normal...not getting more bizarre. In the meantime, unemployment benefits have been extended three times. Now, they're going to expire with some 15 million people out of work. The first-time house-buyer credit has expired too. And the feds have already shot off their monetary and fiscal ammunition... They've already used more stimulus than any time government ever used. And what did we get for it? After $8 trillion worth of banking and financial guarantees...plus deficits greater than any the country has seen since WWII... ..all we get is a small upturn in the key figures. They're still terrible. They're just not getting terribler...at least, not right now. What do you expect? The figures can't do down forever. They've got to turn up. But they look more consistent with a zombie economy and a long, drawn-out correction than with a real, robust recovery... But wait. The government keeps track of these things, doesn't it? And it reported on Friday that the US GDP grew at an annual rate of 3.2% during the first quarter. Well, well, well...guess that settles it. We are wrong again. Recession is over. Break out the champagne. That makes three quarters in a row with positive GDP growth. But hold on... The GDP number is just another one of the lies that bind investors and consumers to bad ideas and keep them coming back to bad habits. More on that later in the week... And more thoughts... "This country is turning into a police state, and no one seems to notice," said a young voice over the weekend. "Mom and I were having dinner in Charlottesville. I thought I'd have a glass of wine with dinner. But the waitress asked to see my ID. It hadn't occurred to me that I needed to be 21 to have a glass of wine with dinner. I thought that was just for alcohol, like whiskey. "Mom told the waitress that it was okay, because I was with her. But she said she couldn't serve me... "So Mom said, 'okay, just bring me a class of wine and I'll share it with him.' And the waitress said, 'you better not let me see you doing that.' "The waitress had somehow turned into a police agent...trying to prevent a college student from having half a glass of wine with his mother..." More on the police state of things...tomorrow... Part II of our speech in Las Vegas, in which we explain why the US will go broke: What does it mean when the financial intelligentsia seems to have no idea what is going on? It means they've got the wrong idea about the way things work...and probably no incentive to have the right one. Goldman Sachs had 21 billion reasons to think it was a good idea to bail out AIG. The bankers who hold Greek debt have 146 billion reasons to like the bailout announced yesterday. And the US government has about 2 trillion reasons to believe the economy is growing. [As we explained yesterday], there were 8,000 billion numbers between Hank Paulson's estimate of how much taxpayers' money would be put at risk rescuing Wall Street and the actual fact. But Hank Paulson is by no means the only major authority or financial celebrity to be wrong. The folks running money for Harvard and Yale - the crème de la crème of financial managers - were spectacularly wrong too. And so were the people running major banks. But today I will mention just one of them...someone who had already settled up when the financial crisis of '07-09 arrived. Walter Wriston was the Chairman of Citibank...the bank that eventually got taken over the federal government in the general panic of 2008...he remarked that: "Governments can't go broke." And here I'll do a little speculation - I bet that Citibank would NOT have had to seek government support if it had been run by a historian. Financial history is full of government bankruptcies. The first modern nation to go broke was Spain - which did so 4 times in the 16th century. The book by Ken Rogoff and Carmen Reinhardt has a nice list of these state bankruptcies. You'll see there are dozens of them. Some countries seem to be bankrupt all the time. Greece, for example. According to Rogoff and Reinhardt, Greece has been in default about every other year since it gained its independence in the 1820s. And I'll offer you a prediction, before this decade is over...or perhaps the next one...dozens of countries will go broke, including the United States of America. I don't mean they will close down and go out of business. But they will default on their debts - either by ceasing payment, by forced restructuring, or by intentional inflation. How do I know that? Well, I don't. It's just a guess. And it's a guess that comes from reading history...not from doing mathematics. Generally, as I told an audience in India, we seem to be at some major inflation point. I call this period the Great Correction, because it appears that there are several things that are in the process...or perhaps only the very beginning...of being corrected.

All of these things are connected. The common thread is the 5th thing that needs to be corrected...and the thing I'm going to focus on here today. It's the rise of a body of thought concerning the way the world works - at least the world of money - which began in England and then was developed in the United States... ..on Friday, I called it "Fab Finance" after the Frenchman who got charged with fraud by the SEC. The idea is to put together slimy packages of debt and sell them to people who don't know what's in them. "Lumps for Chumps," you might call it. Poor Fabulous Fab got stuck in the hot seat, but he was only following the logical development of a whole body of thinking that dates back almost 100 years.... ..and which now seems to be leading the world to something much bigger and much more dangerous than just blowing up a few hedge funds and German banks... Now, practically all the world's countries are using Fab Finance. They're gradually absorbing all the world's financial risks and putting them on the public accounts...ultimately backed by the full faith and credit of the United States of America. This year, governments around the globe will issue $4.5 trillion in debt - three times the average over the last 5 years. About $2 trillion of that will be issued by the US. What's more, there is NO EXIT from this debt build up. Only about 10% of these deficits is really caused by the financial downturn. Most of it is structural. That is, it is the result of programs that have been in place for years... These programs just grow and grow...year after year...until they become unsupportable. And most of these programs are sold as Fab Finance...they transfer small, individual risks onto the balance sheet of the whole country. In fact, if you had to sum up the entire effect of Fab Finance - the whole body of ideas and theories of modern, anglo-saxon economics in the 20th century - you could say that they took small problems and turned them into big ones. Instead of running the risk that a few people will retire without sufficient funds, we now face the risk that the whole country will run out of money. Instead of taking the risk that some people will not be able to afford health care, we now run the risk that the whole nation will be bankrupted by public health care costs. Instead of allowing a few badly managed financial institutions to go under, the feds have put the entire credit of the United States of America at risk. And in Europe, we see the same thing. Instead of allowing tiny little Greece to go bust, the Europeans are spreading the risks out all over the Eurozone. I'm sure other speakers will talk about this, so I won't go into details. It's the most important economic event of our time. After a huge run up in debt in the private sector, now the public sector is having a go at it...and rolling it up into bigger and heavier balls. And what happens when the government spends too much and borrows too much? History tells us what happened in the past. Philosophy tells us what should happen. Governments go broke. Always have. Always will. But I'd like to share with you a headline from The Washington Post on Wednesday. The Post is the paper the politicians and bureaucrats read. So you can imagine how penetrating its insights are. Well, the headline that made me laugh was this: "Task force to tackle National Debt." Not many things are certain in this life. But I can guarantee you that the bipartisan task force will not get close enough to the National Debt to read the number on its jersey, let alone tackle it. The Great Depression convinced economists that they needed to be more activist. Now, our economy is responding to economic activism. And it will be destroyed by these modern ideas...and then, and only then, will new ideas arise. We're going to see a correction...a regression to the mean of a number of things...including the way people think. It is not normal to think you can spend your way out of debt. It's not normal to think you can consume capital and get richer. It's not normal to believe that central economic planning will make the world a better place. The Soviets proved that central planning doesn't work. We got to see that experiment. But instead of learning from it...we seem destined to repeat it. More tomorrow... Regards, Bill Bonner | ||

| To Trade the Resources Rent Tax or Not? Posted: 04 May 2010 03:46 PM PDT Let's leave off with the underlying economic debate about the resource rent tax and talk about the market. It's getting shellacked. Our colleagues Kris Sayce and Alex Cowie are finding many of the positions they've recommend in their publications since the March lows are declining and hitting suggested trailing stop levels. These are designed to limit your capital losses in a market like this, where the proverbial merde is hitting the policy fan. Whatever you think about the equity of the tax, its practical effect has been to drop a giant uncertainty bomb on Australian markets in the form of political risk. If you were an international hedge fund trader parking money in Aussie stocks as a currency/commodity/yield/emerging markets/China play, you were already probably getting a bit nervous with the sovereign melt down taking place in Europe. Falling commodity prices - copper at seven week lows, oil down three dollars over night, and Comex gold off $14 at one point - would have spooked you that China's pricking of its real estate bubble could take the wind out of resource-related trades. And let's not forget stocks have had a great run since the March lows of last year. In other words, foreign capital in the Aussie market would already have been nervous. But when the government unleashes a giant uncertainty bomb on you on a Sunday afternoon, about twelve hours before markets open, you don't really need any more reason to head for the exits. But for a nimble trader and an investor who uses stop losses, this could turn out okay. That is, further falls in the market would drive you out of stocks if you observe trailing stops 15-25% below the high or entry price. Resource stocks are volatile enough. This kind of news produces big moves that can trigger stops quickly. But what happens if and when the foreign hot money departs? We'd reckon that most Aussie institutions aren't going anywhere because they can't. They're in the market for better or for worse, for richer or for poorer. That means that at some point, the selling will exhaust itself. What will remain is the uncertainty over which firms will benefit or suffer the most under a resource rent tax regime. But - and we're only thinking out loud here - what if the share market wipe-out (which is hitting the super savings of ordinary Australians) makes the resource rent tax politically toxic for the Rudd government? What if they kill the tax or postpone it so far out in time that it's unlikely for years? Will the lingering uncertainty act as weight on Aussie stock prices? Or would the revision or suspension of the tax trigger a quick and sudden rebound in stock prices? If it was the latter, you might actually be able to lower your average purchase price on Aussie resource stocks. Not that the introduction of capricious uncertainty is ever good for markets. But it IS the sort of thing that makes trading profits possible. And if you're a trader, it IS the sort of you thing you might want to think about. One man who thought about it weeks ago was our own Murray Dawes. Murray came to mind yesterday when we're discussing the explanation for unleashing a so much uncertainty on the market by not telegraphing a major tax that would impact a major industry and millions of investors. Was it calculated interference by a government that feels entitled to take what it wants when it wants it or just your run of the mill incompetence and ignorance of how markets work? Take your pick! But the only people we can think of who would deliberately make a market-changing announcement capable of wiping billions off share prices the next day, and do it at the last minute, are people who are already SHORT the major stocks most likely to be affected. And the only person we know who was ALREADY short one of the biggest resource stocks in Australia was Murray, who went short said stock on April 13th. Of course Murray didn't know anything about the resource rent tax. As far as we know, nobody but the Henry review people and the Feds knew. But this is the funny thing about technical analysis and a little fundamental understanding of credit markets: the charts tell you what they tell you. Murray is up 14% on that short with more, perhaps, on the way. Earlier today he sent out the update below. We've replaced the ticker symbol details with an XXX but otherwise left the rest of commentary unchanged:

Later this week we'll try and give you a video insight into what he was seeing two weeks ago that led him to the trade. But based on the spring in his step this morning, there's at least one trader in our shop who sees these sorts of markets as tremendous opportunities to capture profits from uncertainty, whether it emanates from Athens or Canberra. Your editor is less sanguine about trading these markets. We're more interested in a long-term wealth building plan. That's why we've taken over the helm of the Australian Wealth Gameplan. Regardless of what you think of the policies, its clear government is having a big effect on the economy and the stock market. Our view is that your best offense/defence against an uncertain world is to gain a measure of financial independence. That doesn't mean money has to become the only objective or most important thing in your life. But financial independence does give you some personal freedom too. --Right now, to be fair, not losing money seems to be the primary objective in a market filled with major risks. If you can preserve your capital now, you can do something with it later, like buy stocks when they're cheap again. But you can't do it if you lose your money now. All of this artificially induced uncertainty in the market comes at a bad time anyway. The S&P 500 fell 2.4% in New York overnight. It's still up 5.2% for the year and 73% from its March lows. But the worry is again the debt. Rather than bombard you with numbers, check out the chart below, courtesy of the venerable New York Times:

Source: www.nytimes.com It's appropriate that this devilish image looks like both a pentagon, or, if you invert it, a pentagram. It shows you why Spain is suddenly the new Greece, but spicier. Spain's debt is much larger than Greece's debt, and the Spanish own almost one-third of Portugal's debt, which has lately been under pressure from the ratings agencies. It makes you wonder if prosperity is really prosperity when it's purchased with borrowed money. It also makes you wonder if there's enough money or confidence in the world for the European Union to guarantee the solvency of various member governments. Hmmn. Finally, Wayne Swan has said, by way of defending the new resource rent tax that, "Our resources belong to all Australians and Australians do deserve a fair share." Thus is revealed the face of the entitlement mentality at the highest levels of government and bureaucracy. And it was done unselfconsciously and proudly. It's a fair enough debate about who benefits the most from Aussie resources. But keep in mind that nobody has to open a mine at all. Businesses do it to make a profit. And without a profit you can't have a tax. If you believe that Australian resources are so valuable that miners will extract them no matter what the tax rates and the Chinese will buy them no matter what the price, then the best thing to do would be to just leave them all in the ground and let them grow even more valuable over time. If you leave scarcity enough time to do its work, you'll have the most valuable unmined resources in the world in a few decades (give or take). But as with many things in life, it all turns on how you define value. If it's romance, a kiss is only a kiss if you share it. It economics, value is only determined when there's an exchange between two parties. One demonstrates what he's willing to pay for a good or service and another demonstrates what he's willing to sell it for. The price indicates the value both parties place. But the value is only revealed when an exchange takes place. In that context, Aussie resources are worthless unless private sector enterprise raises shareholder capital to find them, extract them economically, and sell them at a profit to interested parties. They may belong to everybody in Swan's world, but they will profit no one if Australia becomes the most highly-taxed mining industry in the world. Fifty seven percent of zero is zero. And if you're a policy maker counting on the sheer abundance of resource wealth (coal, iron ore, mineral sands) to guarantee that someone is going to produce them so you can tax them, you may want to consider two other handy ideas from the real world markets and economics: comparative advantage and substitution. Aussie resource customers like China can find substitute suppliers, which they are already doing in Africa. Aussie-listed enterprises can substitute Aussie projects with political uncertainty for foreign projects with political uncertainty, but a more transparent and lower tax burden. International investors can substitute Australia as a destination for capital and replace it with Indonesia, Brazil, or Guinea. That is not to say Australia has suddenly become third-world soviet republic (if you can still use those terms these days). But it is to say that when you raise prices on a project - and introducing a resource rent tax changes the plans and economics and profitability of many mines - you cause people to seek substitutes and alternatives. When, for the purposes of looting big profits, you change the rules midstream, you also change the conditions that created those profits. If it had tried, the government could not have come up with a better way to sabotage its own prosperity. There IS a good argument about whether Australia's main comparative advantage in the global economy - low-value added resource extraction - can produce diversified national wealth. But that's not the issue the government has tackled with its strategy (and it IS a huge issue that deserves a real public argument). Instead, the government has revealed that it believes it's entitled to change the rules on mining taxes because it knows better how to spend wealth even if it has no idea how to create it. Also implied is the moral superiority of government to the market. Also implied is that the people making policy think they are smarter and thus entitled to chose for the rest of us how to redistribute wealth created by the private sector. But now we are drifting to a bigger debate. We'll close with the simple idea that a normal return in the bond market - 5.7% according to the Henry Review - is normal because the government confiscates its revenue with the threat of imprisonment. Bond investors correctly surmise that all things being equal, governments will always be able to pay interest on their bonds because taxpayers don't want to go to jail. But is 5.7% a "normal" return for someone who undertakes to go into the bush and find an economic concentration of metals or minerals, raise the money to build a mine, build the mine, dig up the resource with expensive capital equipment and scarce human capital, and sell it before more producers come in and bring down the price? For that kind of uncertainty with so many variables, wouldn't you demand a higher rate of return in order to make it worth your while at all to take the risk? And if the reward for your risk taking was the theft of your profits, would you even bother to take the risk at all? We're about to find out. Similar Posts: | ||

| Cheap-o Greek Bailout Is Not Calming Markets Posted: 04 May 2010 03:25 PM PDT By Rick Ackerman, Rick's Picks Bruised and bloodied bears must have felt a rare sense of exhilaration yesterday as trading on the NYSE drew to a close. That, and a twinge of anxiety about whether U.S. stocks could actually fall for two days running. Some traders evidently decided not to bet on it, and so short-covering drove the best rally of the day in the final half-hour. After all, who would have had the guts to take a short position overnight in a market that has been on a wilding spree for 14 months? Some short-covering is bound to occur at the tail end of any day on which the Dow has fallen more than 200 points, as it did yesterday. But the fact there wasn't more of it, and that the lows penetrated some key supports identified in yesterday's commentary, suggests there is more selling to come. Bear in mind that Tuesday is a dangerous time of the week for an all-day selloff to occur, since it leaves three days for the selling to mutate into panic. The ostensible reason for yesterday's decline, which saw the Dow down nearly 300 points at its lows, was news of fresh trouble in euroland. But decide for yourself whether this is really news: "Global markets tumbled as investors questioned the viability of plans to bail out Greece and fretted about knock-on effects in other nations." That's how the Wall Street Journal saw it, but the story is getting to be so "dog-bites-man" that its impact on the markets is probably overrated at this point. Make no mistake, an historical day of reckoning awaits euroland and its politically synthetic currency when Greece's fatal debt disease is suddenly discovered to infect all of Europe. But for the moment, we can only stifle a yawn when we read on one day about how such and such sum of money has been advanced Greece; and on the next, about how this sum is feared to be inadequate. A Global Blood Supply As we already know from the U.S. real estate/bank meltdown, it takes a good trillion dollars or so of supposed bailing out to delude the masses into thinking, if but for a brief moment, that the "system" has been "saved." Since everyone understands that Greece's financial problems are not Greece's alone, and that Spain and the other PIGS are next, it is absolutely dumbfounding that the rescuers have tried to conjure up a bailout of Athens on-the-cheap. Could they have learned nothing from watching Bear Stearns' difficulties metastasize until they almost took down the entire U.S. banking system? Some might say this is comparing apples to oranges and that the problems of banks are different from those of sovereign entities. We see the two entities as not merely joined at the hip, but of sharing the same heart, brain and blood supply. Too big too fail no longer means big banks, but rather the entire global financial system. Fallout from a Greek bankruptcy will be felt initially in Brussels, Frankfurt, Paris and London, but eventually – though perhaps not long afterward — in Topeka, Auckland, and Cape Town. Will you be ready if, say, your bank were to limit daily withdrawals to $200? That might be as good as it gets when the dominoes start to fall. (If you'd like to have Rick's Picks commentary delivered free each day to your e-mail box, click here.) Related posts:

© Rick Ackerman and Rick's Picks, 2010. | More articles from Rick Ackerman…. | ||

| Continuous strength in the precious metals sector; a sign that all is not well Posted: 04 May 2010 03:24 PM PDT By Sol Palha, Tactical Investor

The dollar has just rallied to a new 11 month high and will soon put in a new 52 week high; in contrast Gold has refused to trade below its Feb 5 low of 1045. In Feb 2010 the Dollar was trading much lower and so by logic Gold should have easily dipped below its Feb 2010 lows, instead we find that Gold is just a hop and skip away from testing its old highs. Gold has now put in new highs in all major currencies. The strongest out of the bunch has been Palladium, which went on to put in a series of new highs in the face of a rising dollar. These extreme divergences indicate that the precious metal's market is sensing another crisis in the not too distant future; our guess would be another currency crisis. Watch the 83 level on the Dollar index; a close above this level on a monthly basis will indicate that the dollar is ready to test the 90 ranges and the euro will most likely trade down to the 120 ranges. Gold has rallied to new highs in the Euro, and it continues to defy the dollar; instead of pulling back it continues to put in higher lows, a very long term bullish pattern. It has also just closed above $1175 on a weekly basis and has thus set the base for a test of its old highs. The entire precious metal's sector appears to be sensing some sort of future disaster for it simply refuses to correct strongly even in the face of a very strong dollar. If you have no position in the precious metal's sector, use pull backs to open up a position. If you already have positions, then use strong pull backs to add to them. A major currency crisis is going to strike, it's just a matter of time and precious metals thrive in such conditions

Obviously, the best hedge against a currency crisis and an inflationary environment is to own physical bullion. ETF players can purchase SLV, GLD, CUT, GDX, PALL, etc.

Disclosure: We have positions in Gold, Silver and Palladium bullion. More articles from the Tactical Investor…. | ||

| Posted: 04 May 2010 03:23 PM PDT Front and center this morning is the fact that the NY boys and girls didn't like the Greek bailout one iota yesterday, sending the single unit below 1.32… When the traders in Asia and London returned last night and this morning, they too did not like what they saw and sent the euro (EUR) even lower. The euro's problems are beginning to really be a drag on the other currencies, which had resisted the drag previously, but are now succumbing to the drag. To me, this just simply illuminates the Blue Light Special light, for such commodity rich countries like Australia and Canada… But, like I said, that's just to me… Speaking of Australia… The Reserve Bank of Australia (RBA) did hike rates last night, as I suspected long ago, that they would… The RBA lifted rates 25 BPS (1/4%)… More on this in a bit… Getting back to the euro's problems… I'm reminded of March 2008, when Bear Stearns hit the skids and had to be rescued… This followed what was a liquidity crunch here in the US that began in August of 2007… And from there, the wall came crumbling down, as we all know too well… I'm reminded of this because of the problems the European Central Bank (ECB) is going to have to face, if they want to "save" the euro… The ECB is going to have to provide liquidity so that the likes of Greece & Spain (among others) do not, ever, feel the strains of a liquidity crunch like we saw here in the US. This will be a real difficult thing for the ECB to do, and not because they don't know how… The reason it will be difficult is that it's really against the ECB's rules to deal with country by country. But, better to have broken a rule or two, than to lose the currency… I don't like any of this, folks… I didn't like it when the US went through it, and is still dealing with it, as the Fed's balance sheet continues to grow… But this is about the Eurozone, not the US… And I don't like it… But… We haven't really seen the ECB at work just yet… So, it remains a question as to what they will do. I personally do not believe the ECB will stand idly by while the euro gets punished. The single unit's loss to the dollar this year has been 9%… That's a long way from the 50%+ the euro gained versus the dollar in the last 8 years, but 9% is significant… There's no two ways about it. One currency that bucked the trend yesterday was the Brazilian real (BRL)… Again, the 3/4% rate hike by the central bank last Thursday is fueling a monster… And that's just 3/4% of a percent, folks… You may recall me telling you a few months ago that I believed the Brazilian Central Bank would raise interest rates at least 3% this year! So, there's more where that 3/4% came from. Is the Brazilian government happy with this strong move in the real? NO! Not one bit! But… The move in the past week since the rate cut has had a governor placed on it, by central bank intervention… That's what a currency trader that wants to move a currency higher wants to see… They want to see the central bank come out early and often in their attempt to weaken the currency, for their pockets will run dry long before those of the markets. So… In my opinion, the way to deal with the real going forward is to look to move into the currency on dips, which are caused by central bank selling. The other "currency" to buck the trend yesterday was gold… Yes, gold added another $4 to its price… And why not? I think I talked about this last week, folks, but still a reminder is a good thing, as long it doesn't become nagging, eh? Anyway… Gold, began going higher last week, while risk aversion was all through the markets… This was contra to what we had seen in the past couple of years… And here's the skinny… The US has problems, the Eurozone has problems, Japan has problems, and the big 800 lb. gorilla in the corner (China) is seeing some problems… With all these problems comes uncertainty… And gold IS THE UNCERTAINTY HEDGE! Gold is nearing $1,190… That's a greater-than-5% gain versus the dollar in the past month! Annualized that would be 60%, and in price that would be a whole lot closer to what I personally believe gold should be trading… But, that's dreaming… I always get a kick out of guys on TV trying to sell something and talk about "annualized" returns. OK… We're finished dreaming now, right? OK… I always check the currency returns on my screens just to get a feel for the trends. And this morning, I was surprised to see the 1-month returns with New Zealand dollars/kiwi (NZD) at the top of the list… Seems that more than just little old me (yeah, right!) is thinking that the Reserve Bank of New Zealand (RBNZ) is nearing the time they will wet their powder, and hike interest rates. Yesterday here in the US data prints were very strong, and surprising… One that wasn't surprising to me, but disappointing nonetheless, was the Personal Spending, which was more than double the Personal Income in March… Here we go again, folks… Spending more than we make! The data print that was really surprising was the ISM Index (manufacturing), which printed at 60.4, the highest figure this index has seen since June 2004! WOW! This is the 9th month of increases in manufacturing, and securely places manufacturing in the expansionary mode. I'm going to have to go back and re-think this increasing manufacturing… Maybe I have had the blinders on too long, here… But, this is a good report for the US economy… It's still a long, very long way from the go-go days of a decade ago, when ISM was over 80… But, from where it came from, it has come a long way… Construction spending here in the US was up 0.2% in March, and was positive for the first time in 5 months… So, again, that's a good print, only if April's number adds to it… Otherwise, it was simply a blip… Today, we get Factory Orders for March, and Pending Home Sales… And now, back to Australia… Usually, a rate hike would be signal for a rise in a currency… Unfortunately, even after singing the praises of the Australian economy, and the prospects for better times, the RBA caught the markets off-guard with this statement… "As a result of today's decision, rates for most borrowers will be around average levels." That's central bank parlance for… The rate hikes are over for now… And that sent the Aussie dollar (AUD) to the woodshed… I know, exactly what the RBA was doing here, folks… They were throwing the markets off the scent of future rate hikes, and keeping the Aussie dollar from going to the moon! We may have seen the highs for the Aussie dollar for now, given this statement, but, I do believe that the RBA will be back to the rate hike table later this year… So… Better to be in the markets buying before that time comes. Then there was this… That was quite the scary situation in Times Square this weekend, eh? Apparently, a suspect has been caught attempting to leave the country last night. I shiver with fear when this stuff happens… And… Again, there should be no question as to why gold continues to move higher. To recap… The Reserve Bank of Australia hiked rates 25 BPS, but apparently put a lid on rate hikes for now, causing the Aussie dollar to lose ground. The euro continues to get battered even with the bailout of Greece now looking as though it will sail through the German Parliament. Data was strong in the US yesterday, and gold continues to book profits versus the dollar. Chuck Butler A Rate Hike For Australia originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." Check out our new special report Investing in Offshore Oil More articles from The Daily Reckoning…. | ||

| Coin Monday on a Tuesday: Collecting the Atlanta Commemoratives Posted: 04 May 2010 03:22 PM PDT Heritage Auction Galleries The Central States auction is in the books, though Post Auction Buys are still available for a limited time. The catalogers' attention has been focused on the next auction, coming up in June at Long Beach.

One of the most interesting and unusual lots I have handled for Long Beach is of recent vintage: a complete set of U.S. commemorative coins struck for the Atlanta Olympics. (There aren't any pictures yet for the set, but an example of the design—offered as a different lot in the same auction—illustrates this post.) The Summer Olympics of 1996, held in Atlanta, Georgia, were the site of many personal and team successes, but from a numismatic perspective, they were also the inspiration for one of the most ambitious failures in recent U.S. Mint history: the Games' commemorative coin program. The modern era of commemorative coinage had begun in 1982. Before the 1980s, two separate eras had caused scandals that led to a suspension of commemorative coins. First, the 1930s saw some commemoratives struck on flimsy pretenses, and other designs were struck for several years, changing only the date. A change in law put a temporary stop to the latter abuse. There were no commemoratives made from 1940 to 1945. From 1946 to 1954, a new sequence of commemorative issues came out. One, honoring the centennial of Iowa's statehood, was a well-run success, but the other major program dragged out from 1946 to 1954, honoring first Booker T. Washington alone and then alongside George Washington Carver. That experience led to a 28-year moratorium on new issues. U.S. commemoratives designed to honor the Olympic Games had tempted fate before: the Los Angeles Olympics were honored with three different designs in 13 different date, mintmark, and proof/Mint State combinations, and this profusion was puny compared to at least one of the original proposals! The Seoul and Barcelona Games were honored with more basic programs, but for Atlanta, the authorizing legislation pulled out all the stops. Coins were struck in two years, 1995 and 1996; for each year, there were eight different designs, two of them in gold; and for each design, there were two different formats, proof and Mint State. Multiplied out, that makes 32 distinct coins to collect, and eight of them were gold! Credit is due for ambition if nothing else, but the organizers' sales projections were wildly off-target. Two coins—the 1996-W Flag Bearer and Cauldron five dollar gold coins in Mint State—had net mintages in the four-figure range, and other coins also had embarrassingly low mintages. What's worse, the Atlanta Olympics coins affected collector purchases of other commemorative coins in 1995 and 1996, so that none of the campaigns was particularly successful. In the wake of the Atlanta commemoratives, new rules were laid down to limit the number of commemorative programs and design types that could be struck in any one year, and the post-1996 commemoratives have been much easier to collect on a year-to-year basis.

For collectors looking to the past, the Atlanta coins offer an interesting challenge if collected one at a time. Then again, Long Beach will offer the opportunity to just buy the whole set at once. For potential bidders with deep pockets, it's all a matter of ambition.

To leave a comment, click on the title of this post.

-John Dale Beety | ||

| Gold Prices Falls From Five-Month High, Silver Plunges Posted: 04 May 2010 03:21 PM PDT

Other metals declined as well, with silver falling 5.3 percent, palladium dropping 6.0 percent and platinum retreating 2.5 percent. European area debt issues remained in the news, which helped strengthen the greenback and weakened financial markets. U.S. stocks tumbled, with the major indexes retreating between 2 and 3 percent. New York precious metal figures follow: (…) © CoinNews.net for Coin News, 2010. | | ||

| 2010 Boy Scouts Silver Dollars Slow, Sales at 96.7% Max Posted: 04 May 2010 03:21 PM PDT

Although demand has been declining ever since their March 23 release, their weekly gains through most of April managed to hover close to the 20,000 range. It would appear last week's Scouts uncirculated coin sellout did not pull many fence-sitters into the buying camp. (…) © CoinNews.net for Coin News, 2010. | | ||

| China, the gorilla in the Third Gold War Posted: 04 May 2010 03:20 PM PDT 8:19p ET Tuesday, May 4, 2010 Dear Friend of GATA and Gold: MineWeb's Lawrence Williams tonight describes a fascinating new issue of Paul Mylchreest's occasional financial letter, the Thunder Road Report, which explains what Mylchreest calls the "Third Gold War." Williams reports: "Mylchreest reckons we are now in the 'Third Gold War' since the Second World War and this is being waged between the United States in conjunction with other Western countries/institutions, notably the International Monetary Fund, and various opposing sectors worldwide. In his contention, the United States and its allies lost the first of these 'gold wars' to the French (then under De Gaulle) and the second to the Middle East, helped significantly by the then-pro-gold stance and purchasing power of the German Deutsche Bank. "This latest gold war has been/is being fought covertly. 'High-profile sales of physical gold have, for the most part, been replaced by sales of 'paper gold' in the form of futures, OTC options, and unallocated gold, etc.,' asserts Mylchreest. But this time he reckons that the veil has been lifted and the whole charade is beginning to unravel. Instead of France or Arab nations, the opponent this time is China — the 800-pound gorilla — potentially an even more formidable opponent, with a huge treasury of trillions of dollars with which to back its moves." Williams' report is headlined "China — the Gorilla in the Third Gold War" and you can find it at MineWeb here: http://www.mineweb.co.za/mineweb/view/mineweb/en/page72068?oid=103871&sn… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||