Gold World News Flash |

- The Eurozone Disaster Will Happen in Three Waves

- Paulson's Hedge Fund Now Holds 15.5% Stake in American Capital

- Euro Down: Is the Greek Bailout Enough?

- Weekly Market Notes: Said the Fed to the People 'Speculate and Be Prosperous'

- General Motors: Doing the TARP Shuffle

- Sterling gold price hits new high

- In The News Today

- Jim?s Mailbox

- Exit The Dragon

- One Step Closer to the End of the Yellow Brick Road

- Weekly ETF Rewind: What Will Happen With This Dip?

- On Auditing the Fed: The Doddering Senate

- Moving On Out

- Greek Debt Woes Like a Bad Penny

- The Moment of Truth is Upon Us

- No, It's Not A Done Deal (Greece)

- On the Verge of an Inflation Surge

- The Madness of Fibonacci Levels

- Gold: Needed Now More Than Ever

- Gold & SP500 Day Trading Gone Wild & What’s Next?

- Talbott on Banks and the Fed: The Trillion Dollar Fraud

- Why I Write Tickers And Run A Forum

- Sunday Thought

- The Future of Public Debt

- Greenspan, Summers, Tungsten Fakes, and the Secret Gold Standard

- Mining shares tumble on Australian tax plan

- 4 Currency ETFs for Hedging a Reversing Dollar

- Roger Lowenstein: The Fed Should Burst Our Bubbles

- The One Bright Spot in Real Estate

- Businesses Embrace Trading For Goods Instead of Laying Out Cash

- Bank of Nova Scotia 1.7 tonnes from COMEX

- Economy To Collapse Due To Oil Spill?

- More Bonus + Less Lending = The March on Wall Street

- Why Do So Many Bad Things Keep Happening To The United States?

- Fixing the Dollar Machine

- 321gold.com site - nice knowin' ya...

- Full, Unabridged And Totally Hilarious G-Pap Speech To Cabinet

- Investor Sentiment: Time To Pay Attention!

- Australia looks at 40 percent tax on mining profit

- The Gulf Oil Spill Tragedy - A Nuclear Accident Equivalent

- Greece Bailed Out To Get In Even More Debt

- Thoughts On The Intermediate Trend And On An Excess-Liquidity Driven Market, By Claasen Research

- Jim's Mailbox

- Movie Gallery Announces Full Liquidation, To Shutter All 2,415 Outlets

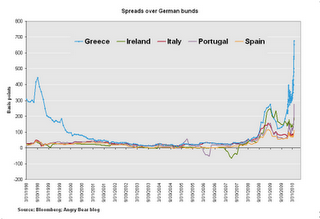

| The Eurozone Disaster Will Happen in Three Waves Posted: 02 May 2010 06:59 PM PDT Rebecca Wilder submits: Greece is now “high yield”, “junk”, “below investment grade”, at least according to S&P. What I mean by that is S&P now rates Greece’s foreign and local currency sovereign debt at the BB+ level (with a negative outlook), below the sometimes-coveted investment grade status; BBB- is the minimum. Why did S&P feel the need to do this now? Just covering its _ss – Greek debt was rated A- as recently as December 2009. Complete Story » | ||||

| Paulson's Hedge Fund Now Holds 15.5% Stake in American Capital Posted: 02 May 2010 06:59 PM PDT Market Folly submits: Due to activity on April 19th, 2010, John Paulson's hedge fund firm Paulson & Co has filed a 13G with the SEC regarding shares of American Capital (ACAS). John Paulson's fund has disclosed a 15.5% ownership stake in American Capital with 43,725,000 shares. The vast majority of shares are held in the firm's Recovery Fund and Advantage Plus Fund. Regular readers of Market Folly will already be aware of this position because we previously reported that Paulson would be acquiring a new ACAS stake. This is not new information, but it does confirm what we already knew. Complete Story » | ||||

| Euro Down: Is the Greek Bailout Enough? Posted: 02 May 2010 06:45 PM PDT The Pragmatic Capitalist submits: Interesting divergence in equities and forex overnight. The news of the Greek bailout is providing no support to the euro as the currency has now tanked after originally trading 0.35% higher on the Greek bailout news. It’s quite clear that investors are feeling less than reassured about the future of the eurozone on the back of the bailout. Updated: The euro is now trading down -0.75%. Investors were expecting a larger package so surprise over the size of the package could be adding to euro concerns. Erik Nielsen at Goldman Sachs says the package is not big enough: Complete Story » | ||||

| Weekly Market Notes: Said the Fed to the People 'Speculate and Be Prosperous' Posted: 02 May 2010 06:20 PM PDT Ned Brines submits:

Complete Story » | ||||

| General Motors: Doing the TARP Shuffle Posted: 02 May 2010 06:15 PM PDT Kid Dynamite submits: I wrote about GM's shenanigans where they claimed to have "paid back the taxpayers, in full, with interest, ahead of schedule" a few weeks ago. Then I saw the ad they were airing on TV - it's so brazenly wrong that it even made my wife gasp at the audacity. Take a look, and make sure you enjoy the multimedia extravaganza I've put together for you in this blog post (potentially NSFW language ahead): Whoa whoa, GM (MTLQQ.PK) - in the immortal words of The Wolf in Quentin Tarantino's Pulp Fiction: "Let's not start sucking each others d***s quite yet." I am writing about this again because the NY Times's Gretchen Morgenson wrote an article about it yesterday, with the tagline, "Fair Game: At GM, Repaying Taxpayers With Their Own Cash." Of course, that header immediately made me think of Teddy KGB in Rounders: "It's a f**king joke anyway, after all, I'm paying you with your money." Amazingly, GM's CEO, Ed Whitacre didn't clarify, "your money: I'm still up $45Billion from the last time I stick it in you." I was excited to see that Morgenson was trying to explain the "TARP money shuffle" to her readers, but I think she missed the absurd simplicity of these accounting shenanigans. I want to make sure everyone understand this, so I'll try to simplify.

Voila - the TARP shuffle. At least we can feel good that GM is spending money bragging about its "payback," while the American Taxpayer is still $45Billion in the hole on this transaction. Complete Story » | ||||

| Sterling gold price hits new high Posted: 02 May 2010 06:15 PM PDT | ||||

| Posted: 02 May 2010 06:12 PM PDT View the original post at jsmineset.com... May 02, 2010 01:49 PM Jim Sinclair’s Commentary All Western states, be that New York State or Greece, will be bailed out. QE to infinity is omnipresent in the West. Eurozone OKs $145 billion bailout for Greece Loans, with aid of International Monetary Fund, spread across three years By Elena Becatoros and Raf Casert BRUSSELS – Finance ministers from the 16 countries that use the euro agreed Sunday to rescue Greece with €110 billion in loans over three years to keep it from defaulting on its debts. The loan package with the International Monetary Fund is also aimed at keeping Greece’s debt crisis from spreading to other financially weak countries such as Spain and Portugal — just as Europe is struggling out of a painful recession. In return, Greece had to agree to an austerity program that will impose painful spending cuts and tax increases on its people for years to come. The plan will still need approval by... | ||||

| Posted: 02 May 2010 06:12 PM PDT View the original post at jsmineset.com... May 02, 2010 01:45 PM Jim, The "Oracle of Omaha" himself now sounds the alarm that the shares of fiat empires are about to collapse. You were always years ahead of the curve for those who listened. We thank you for your service. Remember the final pillar Jim has told you about! The stage is set .the act will come to a final curtain call and gold in hand is your ultimate lifeline. CIGA "The Gordon" Buffett bearish on currencies holding value Greek crisis will produce ‘high drama,’ Berkshire chairman predicts May 1, 2010, 1:08 p.m. EDT OMAHA , Neb. (MarketWatch) — Warren Buffett said Saturday that he’s bearish about the ability of all currencies to hold their value over time because of massive deficits being run up by governments in the wake of the global financial crisis. The Berkshire Hathaway Inc. chairman also warned shareholders attending the company’s annual meeting that the Greek debt cri... | ||||

| Posted: 02 May 2010 06:09 PM PDT "The Greek debt's connected to the Spain debt. The Spain debt's connected to the Portugal debt. The Portugal debt's connected to the, big debt. Now hear the word of the Lord!" There's a lot of ground to cover in today's Daily Reckoning. The Henry Tax Review was unveiled yesterday. Depending on who you listen to is either a huge boon for super annuation, or the death knell of Australian mining investment. And finally, China has again tightened bank lending; leading to unknown consequences for the world's hottest running economy and its satellite economy here in Australia. But first a quick update on the Greek situation. Late last night—before Asian markets opened—Eurozone finance ministers agreed to a $158 billion (€110b) emergency loan package for Greece. In return for the loan package, which includes loans from the International Monetary Fund, the Greeks have agreed to cut public sector salaries, pensions, raise taxes, and reduce the deficit to GDP ratio from 13.6% now to 3% by 2014. The Greeks have also agreed to cap public sector debt at 140% of GDP. There are two questions now: will the austerity measures stick in the craw of the Greek public and will the bond market settle down because it believes this puts a final end to the crisis. On the first question the jury is still out. The deal raises the retirement age from 53 to 67, raises taxes on alcohol, tobacco, and petrol by 10%, and puts a three-year wage freeze on public sector wages. None of that will be popular. In the futures markets, traders are betting that this is not the end of the sovereign debt crisis but the beginning. Businessweek reports that, "Hedge funds and other large speculators raised net wagers on a euro drop by 25 percent to 89,013 contracts in the week ended April 27, Commodity Futures Trading Commission data shows. The euro was at $1.3316 at 8:53 a.m. in Sydney after falling to a one-year low of $1.3115 on April 28 as Standard & Poor's lowered Greece's debt to junk and cut Portugal and Spain." Of course that data preceded the bailout announced Sunday night. So maybe traders will have a change of hearts. Or maybe not. Our view is that Greece is the Bear Stearns of the sovereign debt crisis. That is, it's a clear and obvious sign of things to come, but probably not "the big one" in terms of sovereign debt defaults. Locally, the Henry Review was finally made public on Sunday. The two big items are an increase in compulsory super contributions from 9% to 12% by 2019-2020 and a 40% "resource super profits tax." If you had to summarise it in a sentence you might say it increases the exposure of Australians to equities while reducing the return on those equities at the same time. There is plenty of commentary on both issues and we don't have much to add. It does seem strange that the government is going to decide to tax "super profits." It has to define them first, of course. And who can define what is an "adequate" return on a project and what is an "excessive" return. Of course the main assumption in the "resource super tax" is that the resource industry can afford it because things are so good and will continue to be good for so long. This is precisely the issue we took aim at this weekend when we published our "Exit the Dragon" report. The report questions the fundamental assumption behind the resources boom: China's insatiable appetite for Australian commodities. By the way, apologies if you signed up and failed to receive your copy of the report right away. We had a programming error on our end that meant the report failed to deliver as scheduled. We've worked all morning to iron out. But sincere apologies if you experienced a delay in getting what you paid for. As an on-line buyer of information, we know that nothing is more frustrating than paying for something and not getting it right away. So again, our apologies. As to the report itself, well, we expected a mixed review, and that's what we got. The argument, we hope, is valuable to you even if you don't choose to subscribe to the Australian Wealth Gamelan (the newsletter we've become the full-time editor of). The argument is that China's bubble has ALREADY begun deflating with the restrictions on credit imposed by banking authorities. Earlier this morning Bloomberg reports that, "China's third increase of bank reserve ratios this year left benchmark interest rates and the Yuan's peg to the dollar unchanged, risking the need for more concerted effort to contain property prices and inflation in coming months... The latest move adds to a government crackdown on property speculation after record price increases in March and came on a holiday weekend, with Chinese markets shut today." Dow Jones newswires ads to the story by reporting that, "In recent weeks and months, Chinese regulators have stepped up their tightening measures on the domestic property market, including urging banks to watch their lending risks and boost their capital adequacy ratios, while also increasing mortgage and house buying requirements." Our basic argument is that Chinese GDP is being driven by a credit bubble that found its way into real estate speculation, forcing up demand for Aussie resources. Aussie resource prices, then, are a derivative of this China credit bubble. We think it's prudent that Aussie investors at least consider this possibility and prepare for it. And maybe you'll find the idea thought-provoking, even if you don't agree, in which case...mission accomplished! Not everyone was happy with that message, as you can see below. You'll find our response below the letter.

Nice to hear from you James. For the record, we're on a 457-B Visa that expires in 35 months (if you'd like to begin an unofficial countdown). You lost us with your argument somewhere outside the outskirts of Ardmore, Oklahoma. But it sounds like you're general complaint is a) we have a product to sell, b) the way in which we sell it, c) we're an American. Ideas matter. We give away ideas everyday in the Daily Reckoning. The practical ideas—how to turn this world view into an investment strategy—we sell through our newsletters. If you like the world view, you might buy the practical ideas (a newsletter). If you don't, you don't. What's the problem? Maybe it's the style, then? We hear this all the time. But if you haven't noticed, it's a crowded marketplace for ideas out there. We never take anyone's attention for granted. We put our messages out there in the way we do so that people can't help but read them. And besides, most of what we right about in the investment world relates to "Black Swans." These are high-impact low probability events that would change your investment world if they came true. You may not like it, but at least if they get your attention you'll be more aware than you otherwise would have been. But if you never read the argument, you'll never know or think about it, or take the time to write a long letter impugning our motives. But we've got a thick skin so don't worry. We'd rather err on the side of being thought a kook and preacher/snake oil salesman than being too embarrassed about what other people think to say what we really mean. Obviously you didn't like the argument—or the general admonition that Aussie investors ought to be very careful about relying on the China story. Okay. More power to you. But if you're expecting us to repent for the way in which we make our case, think again Brother! And peace be upon you. Here's another note about China and our "Exit the Dragon" report.

And another...

Dan Denning | ||||

| One Step Closer to the End of the Yellow Brick Road Posted: 02 May 2010 06:06 PM PDT Well, Technicolor changed the unforgettable color of Dorothy's shoes from silver to ruby red, but Baum's work had multiple interpretations, including an allegory for sound money. The silver shoes danced on the "yellow brick road" made of solid gold to the Emerald City of Oz, where everything seen was faked through green glasses (the greenback or dollar) run by the little man behind the screen (the FED/Congress). | ||||

| Weekly ETF Rewind: What Will Happen With This Dip? Posted: 02 May 2010 06:04 PM PDT Jeff Pietsch submits: Last week we speculated that the market was nearly overbought, and Goldman Sachs (GS) certainly lent a strong catalyst towards that thesis. In fact, the market fought its most difficult trade since early in the year, leaving the S&P 500 (SPY) down -2.5% with the Small-Cap Value Index (PWY) down further still at -4.1% on the week. On one hand, the market is hardly oversold and it is difficult to gauge whether this news cycle has run its course. I doubt it, but the market has had such a very short memory for these negative events. Click to enlarge: Complete Story » | ||||

| On Auditing the Fed: The Doddering Senate Posted: 02 May 2010 06:04 PM PDT Retiring Senator Chris Dodd's financial reform bill is now open for debate in the U.S. Senate. For the next few weeks, the public will be treated to media sound-bite snippets of Senatorial debate on various aspects of the Senate version of the reform bill. The bill is supposedly designed to prevent a replay of the 2008 crisis, in which 75 years of Federal financial reform laws proved utterly useless in preventing the crisis. | ||||

| Posted: 02 May 2010 06:03 PM PDT Joel Bowman, reporting from Taipei, Taiwan... Against a backdrop of heated immigration disputes along its border According to the Federal Register, the government institution charged For some, the decision of their fellow countrymen and women to "Let's be clear about something," opined Lew Rockwell, founder of the Indeed. It is helpful here to inquire as to what, precisely, this band "American expats have long complained that the United States is the In addition to onerous taxes (which some expats have taken to calling In fact, not since a brief spike circa WWII has government expenditure Because politicians don't typically spend other peoples' money as Why is this important? Because an increase in the size and cost of Unsurprisingly, Uncle Sam is cracking down. One only need consider the "The provision," The 5 continued, "outlines new rules on 'Foreign What's more, with trillion dollar annual deficits as far as the eye can Perhaps it is useful here to consider freedom as a concept, not an Joel Bowman | ||||

| Greek Debt Woes Like a Bad Penny Posted: 02 May 2010 06:00 PM PDT Europe was putting the finishing touches on yet another bailout for Greece over the weekend, even as new scrutiny fell upon the growing problems of Spain and Portugal. Under the latest rescue package, the IMF and 15 nations – presumably including Spain and Portugal – will pony up $133 billion to keep Greece from defaulting. Will that be enough to do the job? | ||||

| The Moment of Truth is Upon Us Posted: 02 May 2010 05:47 PM PDT Via Stoppani 220 Milan, Italy E-mail: [EMAIL="iteam@thestockmarketbarometer.com"]team@thestockmarketbarometer.com[/EMAIL] Web site: www.thestockmarket barometer.com MONTHLY NEWSLETTER (5/02/10) We started out the week with a bang when it was announced that Goldman Sachs was being charged with fraud by the SEC. This sounds ominous at first glance, but in the end it’s a civil matter and will result with no more than a fine and a slap on the wrist. Then toward the middle of the week when the ratings agencies began to write down sovereign debt, first with Greece and then a day later with Spain and Portugal. It seems to me that these agencies no longer serve a purpose as these downgrades are nothing more than an acknowledgement of a situation that we all know existed for quite some time. These countries didn’t fall deep into debt overnight; rather it’s a process that began years ago. The idea of the ratings agencies is supposedly to... | ||||

| No, It's Not A Done Deal (Greece) Posted: 02 May 2010 05:47 PM PDT Market Ticker - Karl Denninger View original article May 02, 2010 07:48 PM Despite the crooning from Bloomberg: [INDENT]May 3 (Bloomberg) -- Euro-region ministers agreed to a 110 billion-euro ($146 billion) rescue package for Greece to prevent a default and stop the worst crisis in the currency's 11-year history from spreading through the rest of the bloc. [/INDENT]The people who negotiated did not actually have authority: [INDENT] [/INDENT]Sorry, but there's no deal yet. There might be one, but as of today, there isn't one. Despite what you're being told by every pump monkey in the media. This now has to be voted upon by both cabinets and Parliaments in several nations, Germany included. Some will have to sell more debt to fund this - and they're already over-levered. Oh, and this does nothing about Spain and Portugal, which are next - while the cash pile that can be assembled for these sorts of things is already being raided. Don't put on the party hats yet folks.... | ||||

| On the Verge of an Inflation Surge Posted: 02 May 2010 05:47 PM PDT I'm going to start off by stating that I don't think Bernanke is going to "get away" with the insane monetary policy he's chosen. Printing trillions of dollars, cutting rates to zero, trying to manipulate the bond market and generally tampering with the natural market forces is going to have consequences. There is a price that will have to be paid for this madness. Just like there was a price we had to pay for Greenspan's reckless attempt to avoid a recession when the tech bubble burst. Greenspan certainly bought some time and a brief period of illusionary prosperity. But he did it by creating a housing and credit bubble. When those burst, as all bubbles do, the fallout was much worse than if we had just weathered the recession to begin with. Ultimately all of Greenspan's and Bernanke's efforts have just loaded the nation with a monstrous debt burden that we will never be able to repay and soaring unemployment that isn't going away anytime soon. Now I’m afraid Ber... | ||||

| The Madness of Fibonacci Levels Posted: 02 May 2010 05:47 PM PDT www.preciousmetalstockreview.com May 2, 2010 Markets in the US hit the last line of Fibonacci Retracement levels this past week, and gyrated like a bucking bronco. Where they’ll go from here is debatable. There are strong arguments for them to continue higher, fall, or even trade within a range for a while. This weeks letter is a bit shorter than usual since I’m rushing to catch a plane. Where to? Well I can’t give away the exact location of these top secret meetings, but suffice to say, there will be good rum, better cigars...and not may Americans.Due to this, there will be no letter next week. Metals Review Gold rose 1.87% for the week and broke out, again. Moving above the $1,172 level was the last hurdle before testing all-time highs again. Here we go, are you loaded up? Trading entry points are now, while long-term investors would be best to wait for a good sized pullback that will come inevitably. The best way to collect precious met... | ||||

| Gold: Needed Now More Than Ever Posted: 02 May 2010 05:47 PM PDT April 30, 2010 - Greece’s debt troubles are well known. Less recognized is the worrying truth that Greece is just the tip of the iceberg. There have been plenty of warnings. These include, for example, the recent downgrades of the debts of Spain and Portugal. By highlighting the risks, the debt rating agencies have sent a signal with one certain outcome. Heightened awareness over sovereign credit risk will grow, and rightly so. A report released just last month by the Bank for International Settlements, entitled “The future of public debt: prospects and implications”, made some startlingly frank and sobering conclusions. The BIS report began earnestly: “Since the start of the financial crisis, industrial country public debt levels have increased dramatically. And they are set to continue rising for the foreseeable future.” After a through and well-researched analysis complete with detailed documentation, the BIS walked carefully th... | ||||

| Gold & SP500 Day Trading Gone Wild & What’s Next? Posted: 02 May 2010 05:47 PM PDT The past couple weeks we have seen sellers control the price of gold. This can be seen on the charts by the light volume drifts up then heavy volume sell selling sending this metal sharply lower. This type of price action provides some excellent intraday shorting opportunities. On the other hand the SP500 has been doing quite the opposite providing some very profitable intraday buying opportunities for those who have the time to trade during the day. Below I show a couple of low risk intraday trading opportunities which lasted a couple days providing massive gains, tiny down side risk and immediate price action. But what I think is about to happen in the next week or so will turn the tables with gold providing great buying opportunities and the SP500 with some great shorting opportunities, opposite to what is happening now. Two Shorting Opportunities in Gold Making 210% Return in 3 Days The fist two weeks of April gold had formed an excellent mini head & sh... | ||||

| Talbott on Banks and the Fed: The Trillion Dollar Fraud Posted: 02 May 2010 05:47 PM PDT The above title is used by John R. Talbott for a new article at Salon.com. Talbott describes the transfer of $1.2 trillion in assets from banks onto the Fed balance sheet, about $1 trillion of this in MBSs (mortgage backed securities). The actual value of these securities is unknown because there is no accounting surveillance. Without an accounting there is no way to know if any of these MBS assets are as toxic as the synthetic CDOs that went into the Abacus 2007-AC1 securities offering by Goldman Sachs that quickly lost all value and are the subject of the civil case SEC vs. Goldman Sachs. William K. Black has testified that, as a class, the so-called "liar loan" sub prime mortgage issuance has resulted in losses between 50% and 85%. How much of the MBS related securities acquired by the Fed have resulted in (as yet unrecognized) losses of more than 50%? How many toxic assets were acquired at nominal value when they contained large current and future unrealized lo... | ||||

| Why I Write Tickers And Run A Forum Posted: 02 May 2010 05:47 PM PDT Market Ticker - Karl Denninger View original article May 02, 2010 11:53 AM On Sunday April 1st, 2007, I began publication of The Market Ticker. I've expounded a few times on Blogtalk as to why; in short, this is the second time around that our government and its "regulatory apparatus" has conspired with private interests to fleece this nation, and yet nobody wants to talk about it - or what it means going forward. If you read the first several postings, you will find they all deal with the housing market in some form or fashion. This should be no surprise, since that's where the bubble was - just like it was in Tech Stocks back in 1999. Likewise, I set up Tickerforum on the 26th of June 2007 because there simply wasn't any place that I was comfortable with as a "home" to talk about the capital markets in a "multi-way" format. I had been using the Yahoo forums and got exasperated with the idiocy - the drive-by "Countrywide is going to the moooooooon!" commentary that... | ||||

| Posted: 02 May 2010 05:47 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 02, 2010 05:41 AM After watching this you’ve my permission to give me a boot where the sun don’t shine if you hear me seriously complaining about anything (with the exception of gold perma-bears and my favorite one, Tokyo Rose) in my life. I know many reading this are struggling physically, mentally and/or financially and feel it can’t be overcome. I pray today after watching this video you and I realize we must never give up no matter how impossible it may seem. [url]http://www.grandich.com/[/url] grandich.com... | ||||

| Posted: 02 May 2010 05:47 PM PDT There Had to Be a Short How Should Our Institutions Invest? The Future Of Public Debt The Future Public Debt Trajectory Debt Projections Montreal, New York, Connecticut, and Italy Everyone and their brother intuitively knows that the current government fiscal deficits in the developed world are unsustainable. They have to be brought under control, but that requires some short-term pain. Today we look at a rather remarkable piece of research from the Bank of International Settlements (BIS) on what the fiscal crisis may morph into in the future, how much pain will be needed, and what will happen if various countries stay on their present courses. Some countries could end up paying north of 20% of GDP just on the interest to serve their debt, within just 30 years. Of course, the markets will not allow that to happen, long before it ever gets to that level. And what makes this important is that this is not some wild-eyed blogger, it's the BIS, a fairly s... | ||||

| Greenspan, Summers, Tungsten Fakes, and the Secret Gold Standard Posted: 02 May 2010 05:41 PM PDT | ||||

| Mining shares tumble on Australian tax plan Posted: 02 May 2010 05:34 PM PDT | ||||

| 4 Currency ETFs for Hedging a Reversing Dollar Posted: 02 May 2010 05:32 PM PDT Joseph L. Shaefer submits: The US dollar has been on a tear lately – but let’s not lose sight of what that means. Relative to other currencies, the dollar has been rising. But, then, that’s sort of like damning with faint praise. The Brazilian real is declining, the Chinese yuan is barely holding its own, the Japanese yen has slipped a bit, and the euro is in shambles. But if we compare the dollar’s purchasing power in something more constant, as I did recently in an article on the median value of US homes over the last 40 years priced in gold rather than in dollars (here), a somewhat different picture emerges. Whether you want to compare the dollar to gold, timber, mineral rights, unimproved land, water rights, Old Masters, rare stamps, Faberge eggs or the 52-year-old Jaguar XK150 I’ve been restoring for 25 years and now drive spring, summer and fall (with 250,000 miles on it,) some things keep up with inflation and some don’t. Complete Story » | ||||

| Roger Lowenstein: The Fed Should Burst Our Bubbles Posted: 02 May 2010 04:58 PM PDT Ravi Nagarajan submits:

Complete Story » | ||||

| The One Bright Spot in Real Estate Posted: 02 May 2010 04:55 PM PDT After my weekly dump on residential real estate yesterday, I feel obliged to reveal one corner of this beleaguered market that might actually make sense. By 2050 the population of California will soar from 37 million to 50 million, and that of the US from 300 million to 400 million, according to data released by the US Census Bureau and the CIA fact Book (check out the population pyramid below).

The trend towards apartments also fits neatly with the downsizing needs of 80 million retiring Baby Boomers. As the age, boomers are moving from an average home size of 2,500 sq. ft. down to 1,000 sq ft condos and eventually 100 sq. ft. rooms in assisted living facilities. The cumulative shrinkage in demand for housing amounts to about 4 billion sq. ft. a year, the equivalent of a city the size of San Francisco. In the aftermath of the economic collapse, rents are still falling and vacancies are historically high. Fannie and Freddie financing is still abundantly available at the lowest interest rates on record. Institutions combing the landscape for low volatility cash flows and limited risk are starting to pour money in. To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on the “Today’s Radio Show” menu tab on the left on my home page.

| ||||

| Businesses Embrace Trading For Goods Instead of Laying Out Cash Posted: 02 May 2010 03:58 PM PDT Over the past 30 years, Columbia artist Jeff Donovan has bartered for artwork, tuition for his daughter's private school, a custom-made suit and, most recently, a couple of visits to the dentist. Bartering gives Donovan a way to use his talent - instead of having to pay cash - to get things he might never buy for himself. Bartering, trading goods or services rather than charging cash, is an ancient practice. But it has gained popularity during the economic meltdown that left many short on cash but rich in talent or treasures. The number of online barter ads has increased 100 percent since 2008, according to published reports. In 2008, about 250,000 North American companies conducted barter transactions worth more than $16 billion, according to the International Reciprocal Trade Association, based in Portsmouth, Va. Columbia-area businesses also are using barter - trading a meal for carpet cleaning or trophies for landscaping and painting. Donovan, the artist, uses bartering every few years. One of his paintings titled "Handout," an oil pastel on canvas, recently caught the eye of a dentist in the gallery where it was hanging. The gallery owner suggested a trade - painting for dental work. "I couldn't tell you the last time I had been to a dentist, and I felt like it was time," said Donovan, who is self-employed and has a part-time job but no health insurance. The dentist paid $325 to the gallery for the painting and gave Donovan a $325 credit at her office. He got his first cleaning last week and will go back in six months for a follow-up. "It worked out very well," he said. "Both parties were satisfied, which is I guess the ideal." But Donovan has had a bad experience with barter too, overpromising and failing to negotiate the terms upfront. Donovan, who also has contracting experience, traded a bathroom remodeling project for tuition. The problem? Donovan didn't realize the extent of the project and took six months to complete a job he had promised in six weeks. Plus, he did not agree on a tuition amount before starting the project. Luckily, he ended up with three years' of paid tuition for the job. "That one was a little hairy," he said. "It needs to be stated upfront what each person is going to get out of the deal, and they have to agree to it willingly." Hennessy's owner Sharon May barters her restaurant's meals for coffee service, carpet cleaning and even vacation rentals as a member of Atlanta-based The Barter Co. "You don't have the cash outlay, and then, in turn, other members come and have dinner with us," she said. "It's been very beneficial. You're just trading with your neighbors." Read more: Here.. | ||||

| Bank of Nova Scotia 1.7 tonnes from COMEX Posted: 02 May 2010 02:59 PM PDT http://jessescrossroadscafe.blogspot...7-tons-of.html Its delivery time for the May Gold contract on the Comex, and the statistics yesterday showed some interesting buying. Bank of Nova Scotia 'stopped' 699 big contracts, and issued 100 contracts, for a net takedown of roughly 1.7 tons of gold, the bulk of which was supplied by J.P. Morgan. As you may recall, the Canadian bullion bank Scotia Mocatta is a subsidiary of Bank of Nova Scotia. Socita Mocatta was recently involved in a bit of a scandal when some investors went to visit 'the vault where their gold was stored' and found it to be surprisingly, perhaps shockingly, undersupplied. Is BNS acting to back up their paper, or are large investors asking for their bullion in advance? Either way, its an act of good faith on the part of BNS to take the delivery, and probably very smart to do it now. While cash settlement may be an option, it is not ethical, and BNS is known for its high ethical standards towards its customers, unlike some of its more famous American cousins in the gangs of New York. Nothing to see here, move along. Its all perfectly normal. No one really has to have what they sell and store for you anymore. Unless they are honest. h/t Denver Dave | ||||

| Economy To Collapse Due To Oil Spill? Posted: 02 May 2010 01:31 PM PDT NOTE: Map of closed fishing area (left) David Kotok of Cumberland Advisors is out with some very gloomy comments about the economic ramifications of the Deepwater Horizon oil spill, and what it will cost. First he notes the ugliest case scenario: This spew stoppage takes longer to reach a full closure; the subsequent cleanup may take a decade. The Gulf becomes a damaged sea for a generation. The oil slick leaks beyond the western Florida coast, enters the Gulfstream and reaches the eastern coast of the United States and beyond. Use your imagination for the rest of the damage. Monetary cost is now measured in the many hundreds of billions of dollars. As for numbers:Usually, the first estimates in any crises are too low. That is true here. 1000 barrels a day is now 5000, and some estimates of spillage are trending higher. No one knows exactly. The containment and boom mechanism is subject to weather cooperation as we can see this weekend. Soon we are entering the hurricane season. The thoughts of a storm stirring up the Gulf, hampering any cleanup or remediation drilling effort and creating a huge 10,000 square mile black stew is frightening to every professional in the business. As for the economy beyond BP...This will be a financial calamity for many firms, not just BP and its partners and service providers. Their liabilities are immense and must not be underestimated. The first estimate of $12.5 billion is only a starter. Thousands of small and independent businesses as well as larger public companies in tourism are hurt here. This is not just about the source of half the nation's shrimp. That is already a casualty. It's also about the bank loans for the $200,000 shrimp boat and the house the boat owner and/or his employees live in and the fact that this shock piles on a fragile financial system that is trying to recover from a three-year financial crisis. Case study, my fishing guide in the Everglades splits his time between Florida and Louisiana. His May bookings in LA have cancelled. His colleagues lost theirs and their lodge will be empty. They are busy trying to find work in the clean up. For him, his wife and eleven year old daughter, his $600 a day guide fees just went "poof". When I asked him if he thought he had a legal claim on BP, he said he hadn't thought about it yet but it gave him pause. As we suggested above, the $12.5 billion loss estimate is only a starter. And the taxpayer...Federal deficit spending will certainly rise by tens, and maybe hundreds, of billions as emergency appropriations are directed at larger and larger efforts to clean up this mess. At the same time, federal and state revenues tied to Gulf-region businesses will fall. My colleague John Mousseau will be discussing the impact on state and local government debt in a separate research commentary. We expect that the Federal Reserve will extend the timeframe that we have come to know as the "extended period" in the making of its monetary policy. We do not expect the Fed to raise interest rates at all for the rest of this year, and maybe well into next year. We expect to see the deterioration of the economic statistics for the US to reveal the onset of this oil-slick crisis in May, and the negative impact will intensify during the summer months. A "double-dip" recession probably has been made more likely by this tragedy. Read more: Here.. This posting includes an audio/video/photo media file: Download Now | ||||

| More Bonus + Less Lending = The March on Wall Street Posted: 02 May 2010 01:26 PM PDT By Static Chaos Excluding mortgage refinancings, consumer lending dropped by about one-third between October and February. Commercial lending slumped by about 40% over that period, the data indicates. All but three of the 19 largest TARP recipients originated fewer loans in February than they did at the time they received federal infusions. Basically, after unloading their toxic assets onto the Fed / taxpayers' balance sheet, Wall Street is able to increase bonus partly through less lending, because with the free money from the government, banks have discovered that lending to businesses and consumers does not give them as high returns as other activities such as juicing up stock markets and commodities. | ||||

| Why Do So Many Bad Things Keep Happening To The United States? Posted: 02 May 2010 01:11 PM PDT

Consider just a few of the major disasters that the U.S. is having to deal with.... *The Gulf Of Mexico Oil Spill Industry experts are now saying that the oil spill in the Gulf of Mexico could be increasing at a rate of 25,000 barrels a day - five times the U.S. government's current estimate. In fact, Barack Obama is calling the massive oil spill in the Gulf of Mexico a potentially unprecedented environmental disaster. So how much is this disaster going to cost? Well, estimates vary at this point, but it is being reported that some analysts are already projecting that the costs related to the oil spill drifting toward Louisiana from a well operated by BP in the Gulf of Mexico could exceed 14 billion dollars. The cost to the fishing industry in Louisiana alone could top 3 billion dollars, and it is being projected that the tourism industry in Florida could lose even more than that. This is rapidly shaping up as one of the biggest environmental nightmares (perhaps the biggest) that the United States has ever had to face. In fact, there are some who are saying that this incident has already eclipsed the 1989 Exxon Valdez incident as the worst U.S. oil disaster in history. Louisiana Governor Bobby Jindal is warning that the oil spill in the Gulf threatens the very way of life of people in his state. As bad as Hurricane Katrina was, there are those who are already claiming that this disaster will be worse than Hurricane Katrina for the region, because it will literally take years for this mess to be cleaned up. In fact, there is a very real possibility that the fishing industry may be crippled for generations by this disaster. *The Disappearance Of The Honeybees For the fourth year in a row in the United States, more than a third of all bee colonies have failed to survive the winter. To be more precise, according to the annual survey by the Apiary Inspectors of America and the U.S. government's Agricultural Research Service, the number of managed honeybee colonies in the United States fell by 33.8% last winter. Needless to say, this is not a good trend. In fact, it could quickly turn into an unmitigated disaster as it is estimated that a third of all that we eat depends upon honeybee pollination. Are you starting to get the picture? Most flowering plants require insects for pollination. The most effective insect for pollination is the honeybee. Without honeybees, we are going to be in a world of hurt. According to WorldNetDaily, the following is a list of just some of the crops that depend on honeybees: almonds, apples, apricots, avocados, blueberries, boysenberries, cherries, citrus fruits, cranberries, grapes, kiwi, loganberries, macadamia nuts, nectarines, olives, peaches, pears, plums, raspberries, strawberries, asparagus, broccoli, carrots, cauliflower, celery, cucumbers, cantaloupe, honeydew, onions, pumpkins, squash, watermelon, alfalfa hay and seed, cotton lint, cotton seed, legume seed, peanuts, rapeseed, soybeans, sugar beets and sunflowers. In fact, Ohio State University's honeybee specialist, James Tew, recently told the following to the Dayton Daily News.... "The average person should care. Bees of all species are fundamental to the operation of our ecosystem." So what happens if they all die off? You don't even want to think about that. But certainly our scientists can find a solution, right? Well, the World Organization for Animal Health announced on Wednesday that the huge die off of bees worldwide is not due to any one single factor. Some of the factors for the honeybee deaths the World Organization for Animal Health included in its report include parasites, viral and bacterial infections, pesticides, and poor nutrition. Other researchers claim that genetically modified crops and cell phone transmissions are also playing a role in the disappearance of the honeybees. But the truth is that a "solution" seems to be very far away right now and we are running out of time. *The Deadly Tornadoes Which Have Ravaged The Southeast Last Sunday saw an unprecedented outbreak of tornadoes across the southeast United States. Officials said 61 tornadoes erupted as a massive storm marched across states such as Mississippi, Florida and South Carolina. Winds inside some of the tornadoes were clocked as high as 160 mph, and one of the tornadoes had a base one and a half miles wide. The tornadoes killed at least 12 people, and it is estimated that the damage that they caused could reach into the billions of dollars. *The Drying Up Of The Ogallala Aquifer Most Americans have never heard of the Ogallala Aquifer, but it is absolutely critical to food production in many areas of the United States. The water from this massive underground lake is used to irrigate much of America's Great Plains. But it is being drained at a rate of approximately 800 gallons per minute and it is starting to dry up. So why is that a bad thing? Well, the Ogallala Aquifer is a gigantic underground lake that stretches from southern South Dakota all the way through northern Texas, covering approximately 174,000 square miles. If it gets depleted, the era of "pivot irrigation" in the region will be over. That would mean that the Great Plains could quickly turn into the Great American Desert. America could very well see a return to the Dust Bowl days of the 1930s. Are you prepared for that? Even if agricultural production continues to grow normally, scientists are telling us that the world is heading for a massive global food shortage. So what happens if our food production does not increase or is even reduced? Sadly, the United States has only enough grain stored up to give about a half a loaf of bread to every man, woman and child in the United States. How long do you think that is going to last in the event of a major emergency? The truth is that "the good times" we have all grown up with are not going to last forever. The United States is in big trouble economically, and all of these natural disasters and environmental problems are not helping things one bit. We are not entitled to endless wealth and prosperity just because we are Americans. In fact, we have recklessly squandered the wealth that prior generations have left for us. But even as the economy crumbles around them, millions of Americans will remain in denial until the day they have to cook a dinner of "mouse soup" for their starving family. | ||||

| Posted: 02 May 2010 12:00 PM PDT This Washington Post story is a great example of how the mainstream media goes about supporting a power elite dominant social theme. In this case the fear-based promotion is that there will be another financial meltdown if "reform" isn't enacted. And to put the reform into context, the Post presents an admirably hard-hitting article about what went wrong and what can set it right. The Post then complicates the analysis slightly by explaining that while the problem and solution are simple | ||||

| 321gold.com site - nice knowin' ya... Posted: 02 May 2010 11:48 AM PDT | ||||

| Full, Unabridged And Totally Hilarious G-Pap Speech To Cabinet Posted: 02 May 2010 10:55 AM PDT “Ladies and Gentlemen, I have convened this Cabinet today to an historic meeting. All the citizens of Greece feel the crucial nature of these moments and the burden of historical responsibility. Avoiding bankruptcy is a red line for the Nation. “I would like to make it absolutely clear to everybody — I have done and will always do whatever it takes for the country not to go bankrupt. We are waging together a difficult and relentless battle dealing with the problems — the dimensions of which one could never have imagined. It is true, we were the first to speak of the crisis — a crisis of politics, a crisis of institutions, a crisis of values which in turn led to the huge economic crisis. “No citizen of Greece could however ever have imagined the size of the debt and the deficit which the former government had caused and hid upon its exit. This is not the time for accusations, however. The people of Greece are fully aware of where they lie. The consequences however are manifold. “First of all, the lack of trust that Greek citizens have in their institutions and the present political system, the lack of credibility of our political system is so great that citizens even show distrust to us and to this government. From the first day however I personally and all of us here have fought battle after battle trying to finally make those profound changes and create a society where justice prevails, where the money of the Greek people is put to good use and where the democratic state protects the rights of its citizens. “For the first time in years a government is working with such dedication to the task assigned to it by the citizens of this country. “In all sincerity, we are a different government. Despite this long battle with the crisis of debt and lending, day by day, we are “This is something we will continue to do ceaselessly as we round the cape of economic crisis in order not to find ourselves in this situation again. “Our first concern was to regain credibility with our citizens. We have been honest from the very first moment with the Greek people. “A second objective was to regain credibility internationally and chiefly with Europe, because in October 2009 nobody would listen to us. Nobody would believe us. We have struggled to this end because we knew that without credibility we would find no understanding — let alone support. We would be in a vacuum. We would be struggling alone, abandoned to our enormous debts. These are our debts. We would have been alone face to face with our creditors and speculators. “We could not have rallied support due to our previous lack of credibility. The only possible help — and this would have been an even more difficult route — was the 10-20 billion Euros which at best the IMF would have ensured, at a time when the state needed 60 billion Euros in loans annually. “We have waged a battle of credibility and have won and today present a programme for a different Greece, along with immediate emergency measures in order to convince people that these were not just empty words. We have moved ahead with radical changes to the tax system, in transparency and the structure and functioning of the state. “We have taken austere and painful measures which were however necessary to increase revenue, to restrict expenditure, to continue to function as a state, to ensure the maximum, to be able to continue paying salaries and pensions. “To show that the citizens of Greece have not fled the battle we have run a marathon of contacts and negotiations. It is with this “Thus, the European Union decided to set up a completely new mechanism to support Greece. The decision of the European Union on the 25th March was decisive and historic for Greece but also for Europe. Just think where we would be today without this European support mechanism — our problems would be unsurpassable. “We had sincerely believed, both we and our European partners, that the existence of this mechanism would in itself be enough to facilitate the borrowing needs of Greece. Unfortunately that was not the case. “From the first moment, the first E.U. Council of Ministers I attended as Prime Minister of Greece — and without once shirking the responsibility of Greece — I stated that the problem was greater and more serious. “I stated that it concerned the stability of the financial system of Europe and the Euro, that it concerned the functioning of the “We however undertake this responsibility despite the decisions of the European Union, positive decisions. Ambiguities gave a signal to the market that there was a lack of decisiveness. Some have targeted Greece which through its own actions became the weak link and guinea-pig. Greece continued to be the target and guinea-pig in an unfavourable international economic climate. It was a weak link and easy prey to speculators. “Today the problem has assumed greater proportions. We see that the fire threatens to spread harming Greece even more, but also spreading to other countries and economies of the Eurozone and even further afield. “The cost of putting out the fire is expected to be much greater, as unfortunately will be the burden that Greek citizens have to bear. The need to have recourse to the mechanism unavoidably means additional and more immediate efforts and sacrifices sought by creditors and our partners in order to guarantee financing our needs and for us to move out of the crisis safely. “I know that with the decisions today our citizens must suffer greater sacrifices. The alternative however would be catastrophe and greater suffering for us all. This is why we have decided not to yield one step. This is not a pleasant decision for me or for anybody. We are here however to take the correct decisions for our country. This was and is our responsibility. “This is the responsibility that I personally have undertaken to serve. This is a responsibility towards the common interest of “We have set up this mechanism from scratch. We sought its activation a few days ago and today we ratify the agreement. This is an unprecedented agreement and an unprecedented support package for an unprecedented effort by the Greek nation.” “Critics and even our well-intentioned friends say: ‘There will be political fallout. PASOK is turning its back on its policies. You will “My answer is: PASOK always has a red line — the interest of our nation and nothing else. “I have said it and I will say it again — I have never sought to come to power for powers sake, only to contribute. I stake nothing by sacrifices, my only interest is when I hand over that I will have done what is right and for us to create together a different and much better Greece. That is why I will take whatever decision is necessary. “At the end of my term of office, Greece will not be bankrupt — it will be reborn. “It was not our choice to take measures against the just and unjust. It was our choice to put order in the affairs of the state, to revive our economy in a socially just manner. Economic reality however obliges us to take very tough decisions. This is recognized the world over. “At the same time the first positive results can already be seen. The budget deficit has been reduced for the first quarter by 40% against last year. “Ladies and Gentlemen, we know that these are hard sacrifices, but they are necessary. This is the only way that we will be able to finance the 300 billion Euros debt we have. If we do not finance this debt, Greece will go bankrupt. “Tomorrow, as we come around the cape, we can dedicate ourselves to the task of creating a different Greece. I convened the Cabinet meeting for it to give its initial approval to these commitments we are called upon to make. Many of the measures are perfectly feasible because we too wish to build a new competitive Greece, a Greece which is financially viable and independent, which can take its fate into its own hand. A Greece that decides its own future. “Many of the measures are also emergency measures we are called upon to take. We could have avoided them had we the freedom of choice-especially if we had the time we needed and could have put to good use, had we not found ourselves faced with this huge economic crisis. “This is why these sacrifices are being made today: to enable us to have the breathing space we need, to find the time needed as well as peace of mind to make the historic changes in our country which our nation has entrusted to the Panhellenic Socialist Movement. “We are shaping a truly new patriotism, which means that we change practices and conceptions. We are to highlight whatever best Greece and Hellenism has: ‘meraki’ (dedication to effort), ‘filotimo’, (sense of duty) solidarity, humaneness, hospitality, uprightness, imagination,creativity, alacrity of wit needed for productivity. This is our Greece of values. “New patriotism means that we do not only praise symbols and history, but take care of our fellow citizen, and the common interest, we take care of our environment, take care of Greece which belongs to all of us. New patriotism means a new collective Greek conscience. “This message goes out to all. We send it to the European Union and to the International Community watching us — who will be watching us, not only over the next few days but the coming months. They will be watching and evaluating our reactions, watching Greek society. We want to show a Greece that is changing, that is being reborn, a Greece of which we are proud. “We are talking of historic changes for citizens, historic changes which will take Greece definitively out of the crisis. At this historic “What is positive is that employees in the private sector are not affected. We have had, however, to take additional painful measures which affect pensioners and civil servants because the ’sick man’ is the public sector and the sooner we change it the faster we will revive our economy and regain lost ground being yielded by Greeks today. “As the Minister of Finance has explained, we have tried to save whatever we could and tried to ensure that consequences for the weaker in society are minimal. This is our philosophy, these are the principles of PASOK as a movement. “I wish to stress that this national effort requires the political system to set an example. This is why I will ask of the President of the Parliament to undertake initiatives for the Parliament to head the effort and for Members of Parliament to participate in the burden and forsake their bonuses. This is only a small taste of overall change in the way the political system we are trying to implement will function. “I have ordered the Minister of Finance to speed up the procedure for drawing up the new electoral law so that the political system will be established on new sound basis. We must say in all sincerity to the citizens of Greece that we have trying times ahead. We are seeking a new meaning to our values however, such as quality, humanness, democracy, solidarity between us — we are opening up a new road. “I want to thank you all for the courage and the feeling of responsibility that you have all shown all this time. We have stood and “We must perform great feats. We will see difficult times, but we will succeed by making a new start in everything. We will seek out our values and give them a new meaning, such as quality, humanness, solidarity “We do not promise to have an easy or painless time over the next few years. I do however promise three basic things: first of all that we will do everything to protect the weakest in this crisis. “Secondly: that the feeling of justice will be consolidated since this has been lost and obviously there is anger. This is something we feel, we all understand. Something I understand. This is the rage of citizens today who have to pay for the sins of others. Justice, equality in the eyes of the law, the just distribution of burden and wealth are for us a daily battle and commitment. “Thirdly: I promise to fight alongside all of you and to make this crisis an opportunity for change. We must change, Greece must change, we must think and dream differently, and make Greece different. This is a new beginning which will make us proud of our country and of our work. “I would like to thank you once again for the feeling of responsibility that you have all shown. I must stress again that Greeks have always come through difficulties stronger and victorious. This is the case today too. This is why I have every confidence in the strength of Greece. If we all work together, all together for the Greece we deserve and dream of — we will succeed. We will go through difficult times but we will be successful. In this battle, I will always be at the forefront.” | ||||

| Investor Sentiment: Time To Pay Attention! Posted: 02 May 2010 10:38 AM PDT After 8 months of indifference to the constant and persistent rise in stock prices, the "smart money" has finally turned bearish. It is time to pay attention. Currently, the value of the indicator is 67.14%. Values greater than 58% (arbitrarily chosen) are associated with market tops, and the red dots over the price bars indicate such. | ||||

| Australia looks at 40 percent tax on mining profit Posted: 02 May 2010 10:22 AM PDT Australia looks at 40 percent tax on mining profit By ROD McGUIRK, Associated Press Writer Rod Mcguirk, Associated Press Writer Sun May 2, 7:18 am ET CANBERRA, Australia – Australia would heavily tax the booming profits of its mining companies under a tax system overhaul proposed Sunday that also would invest in infrastructure to support mining operations and reduce corporate taxes. The new 40 percent tax on resource profits targets industries that have grown rapidly as they've produced the raw materials that feed burgeoning Chinese and Indian manufacturing demand. Mining royalties currently paid to Australian state governments do not reflect rising commodity prices. The government says mining profits rose by 80 billion Australian dollars ($74 billion) in the past decade, yet government revenues from resources increased by only AU$9 billion. The government would introduce the so-called Resource Super Profits Tax in July 2012. The company tax rate would be cut from 30 percent to 29 percent in July 2013 and to 28 percent a year later. The government forecasts that the cut in company tax combined with the mining tax would increase Australia's gross domestic product by 0.7 percent a year. "These changes will not be welcomed by every business or every interest group, but they are the considered, responsible changes we need if we are to turn our success during the global recession into enduring gains for our economy, our people and our nation," Prime Minister Kevin Rudd said in a statement. Treasurer Wayne Swan told reporters he could not say whether tax legislation would be introduced to Parliament before national elections are held at a date to be set late this year. The legislation would need the support of some opposition senators to pass the upper house, where Rudd's center-left Labor Party government only holds a minority of seats. The main opposition Liberal Party said the tax would cost mining companies AU$9 billion a year and devalue blue chip shares in global giants including BHP Billiton and Rio Tinto. "If you are determined to kill the mining boom stone dead, who could hardly have more precisely calculated a measure to achieve it," opposition leader Tony Abbott told reporters. The mining boom was the main reason Australia had avoided recession during the global financial crisis, he said. Mitch Hooke, chief executive of the Minerals Council of Australia which represents mining companies, warned that mining investment could stall or shift to other countries. Australia already had the highest-taxed mining industry in the world, he said. "There is real risk that many of these taxation gains that the government is banking on may prove illusory if the secondary round impacts are a deterrent to investment," Hooke told reporters. Under the tax overhaul, resource-rich states would continue to reap mining royalties, but the federal government would refund those costs to mining companies before calculating their federal tax debt. The tax would be levied on profits after all the costs of mining operations, capital investment and dividends to shareholders are deducted. Marginally viable mine companies would potentially be better-off in cases where the costs of extracting minerals barely cover royalty charges because of a price downturn or when the ore deposit is almost exhausted. About AU$5.6 billion of the mining tax revenue would be spent over a decade on public infrastructure critical to the industry such as ports, rail and roads. The government argues the tax shift would prevent a "two-speed economy" emerging in Australia where non-resource industries such as manufacturing, construction and tourism cannot attract investment or staff because they cannot afford to match the lucrative wages offered by the mining industry. Also as part of the tax overhaul, the government would increase the proportion of salaries that Australian workers must save for their retirements from the current rate of 9 percent to 12 percent by 2020. http://news.yahoo.com/s/ap/20100502/..._australia_tax | ||||

| The Gulf Oil Spill Tragedy - A Nuclear Accident Equivalent Posted: 02 May 2010 10:14 AM PDT All I can say about this is that the unintended consequences will be enormous. Presumably British Petroleum is carrying full insurance coverage. The costs involved - all encompassing, not just the direct clean-up costs - will run into the $100's of billions. If you think I'm nuts, please read this analysis: Beyond Catastrophic. Not factored into that author's cost analysis is the likelihood that massive insurance company OTC derivatives - credit default swaps, etc. - will likely be triggered as insurance coverage is maxed out. I'm positive none of BP's insurers ever anticipated or reserved properly for something like this. This disaster will trigger many bankruptcies, large and small. BP itself is likely toast, if the U.S. Government exercises proper justice. The market cap of BP as of Friday's close was $165 billion. If Obama is doing the job he should be doing here, he should seize BP's operations, freeze all of its bank accounts and those of its senior management and board of directors. The U.S. Government should effectively takeover the BP and seek to manage it for the goal of squeezing all possible economic value out of the Company and use that money to manage this disaster. Take a look at the graphic in the above-linked article. If you own real estate anywhere along the Gulf Coast or the East Coast, your property has just lost a lot of value. That this happened is beyond unimaginable, especially since the technology to prevent this was available and widely used throughout Europe. There should be no mercy for BP and it's senior executives. | ||||

| Greece Bailed Out To Get In Even More Debt Posted: 02 May 2010 10:09 AM PDT Does anyone have a problem with the attached chart? Ignore for a second the sheer lunacy of anyone who thinks that the Greek government can grow GDP and decline the budget deficit in a straight line now that the country will see crippling strikes and rolling riots (not to mention blackouts) on a daily basis. But do note the black line, which shows the projected Debt/GDP ratio for the country as part of the bailout package. In essence Greece will go from having "only" a 133% Debt/GDP ratio to an insane 149% in 2013 before presumably dropping to 144% lower in 2014, still a good 11% higher than currently. Greece just got bailed out so it can get into even more debt! What psychopath of the Keynesian school thinks that this unbelievable trajectory is anything but a complete and utter waste of money? German, and US taxpayers, are merely giving Greece money so it can increase it debtor status with French and a few other European banks. To say that this is a viable solution is something that only those who bow at the altar of Alan Greenspan can do. | ||||

| Thoughts On The Intermediate Trend And On An Excess-Liquidity Driven Market, By Claasen Research Posted: 02 May 2010 09:48 AM PDT Thoughts On The Intermediate Trend, by Claasen Research

h/t Fiat Currency

This posting includes an audio/video/photo media file: Download Now | ||||

| Posted: 02 May 2010 09:45 AM PDT Jim, The "Oracle of Omaha" himself now sounds the alarm that the shares of fiat empires are about to collapse. You were always years ahead of the curve for those who listened. We thank you for your service. Remember the final pillar Jim has told you about! The stage is set .the act will come to a final curtain call and gold in hand is your ultimate lifeline. CIGA "The Gordon" Buffett bearish on currencies holding value OMAHA , Neb. (MarketWatch) — Warren Buffett said Saturday that he's bearish about the ability of all currencies to hold their value over time because of massive deficits being run up by governments in the wake of the global financial crisis. The Berkshire Hathaway Inc. chairman also warned shareholders attending the company's annual meeting that the Greek debt crisis will produce "high drama" and said it's unclear how it ultimately will be resolved. The financial crisis was stemmed by massive monetary and fiscal intervention in developed economies like the U.S. and the U.K. That's shifted a private-sector debt mountain on to governments, increasing concern about sovereign risks. One concern is that governments will print lots of new money to pay debts, undermining the value of currencies and triggering a damaging bout of inflation. "Events in the world over the last few years make me more bearish on all currencies in terms of holding their value over time," Buffett said. | ||||

| Movie Gallery Announces Full Liquidation, To Shutter All 2,415 Outlets Posted: 02 May 2010 09:28 AM PDT Movie Gallery's Chapter 22 just turned into a 7. The WSJ reports that the firm has decided to shutter all of its 2,415 stores and liquidate completely. Previously, the bankrupt movie rental chain had hoped to continue operating with a trimmed down asset base, and close just half of its stores. Alas, the melting of the icecube could not be stopped. This is nonetheless good news for liquidating advisor Gordon Brothers which just saw its bill double. As for main competitor Blockbuster, which itself is on the verge of bankruptcy (yes, those still do occur in the US, but the business must be really atrocious plus have no unionized workers anywhere within 50 miles of its operations), it is unclear whether the liquidation of Movie Gallery will be beneficial or merely too late. Tangentially, businesses all over America and the world which otherwise would benefit from the bankruptcy of their weaker competitors and flourish, are suffering just as much, courtesy of the no-risk/no-failure doctrine recently instituted by the administration, which has made Survival of the Fittest irrelevant.

We dare you to guess which firm refinanced Movie Gallery in early 2007, with the firm filing for bankruptcy before even one coupon payment on its new notes was ever made. |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Roger Lowenstein is the author of five books covering financial markets. His latest book,

Roger Lowenstein is the author of five books covering financial markets. His latest book,

No comments:

Post a Comment