Gold World News Flash |

- Greatest Opportunity In The War In The Gold & Silver Markets

- Insider Exposes Shocking Truth On German Gold Repatriation

- Jim Otis: An open letter to monetary metals mining executives

- German gold repatriation movement is going strong, Peter Boehringer tells KWN

- Gold and Silver Supply Is VERY Tight!

- The Gold Price Closed Up 1.16 Percent at $1,196.70

- This Crisis Was Foreseeable … Thousands of Years Ago

- Precious Metals: Timing and flexibility is the key to a successful trade

- This is Real and It's Happening with Breathtaking Speed

- 60% Of Households Get More Benefits Than They Pay In Taxes

- Harry Dent : Greatest Debt Bubble Doom In Our History

- Coast To Coast AM - November 17, 2014 Machinations Of The Illuminati

- Why the BIGGEST Stock Market Crash in History Can't be Avoided!

- Swiss Gold Referendum: Impressions Of The Latest TV Debate

- How Gold And Silver’s Price Decline And Short Covering Was Manufactured

- 2 Ways to Play the Coming Return to Nuclear Power

- Gold Daily and Silver Weekly Charts - Close But No Cigar

- Greatest Opportunity In The War In The Gold & Silver Markets

- NAV Premiums of Certain Precious Metal Trusts and Funds - Ukraine Admits Its Gold Is Gone

- Gold: Bull Flag In Play

- How the Private Bankers Are Using the Financial Crisis to Reshape World Government | Murphy

- One way or another, Ukraine's gold reserves have gone away

- Platinum miners realize that their metal is money

- Why the Current Global Depression Looks Nothing Like the 1930s

- ECB Buy Gold Bullion? Japan's Monetary Policy Dubbed "Ponzi Scheme"

- Gold, Silver, Crude and S&P Ending Wedge Patterns

- Breakout Alert: Junior Gold Miner In Nevada Discovers Impressive New Gold Zone

- The Stunning Reason Why Silver Is Set To Skyrocket

- Why Bretton Woods Ended

- GOLDZILLA

- NWO and the United States: hiding in the mountains for the Apocalypse

| Greatest Opportunity In The War In The Gold & Silver Markets Posted: 18 Nov 2014 09:30 PM PST from KingWorldNews:

Below are the two key charts sent to KWN by David P. out of Europe, along with his brief commentary. "The chart below shows that gold stocks vs gold trades at the lowest ratio ever — i.e gold stocks priced in real money have never been cheaper.” | ||||||||||||||||||||||||||||

| Insider Exposes Shocking Truth On German Gold Repatriation Posted: 18 Nov 2014 09:02 PM PST  Today the original architect of Germany's gold repatriation movement stunned King World News with the truth about what is really happening with the effort to get Germany's gold back onto German soil. What he had to say will surprise readers around the world. Today the original architect of Germany's gold repatriation movement stunned King World News with the truth about what is really happening with the effort to get Germany's gold back onto German soil. What he had to say will surprise readers around the world.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||

| Jim Otis: An open letter to monetary metals mining executives Posted: 18 Nov 2014 08:59 PM PST 12:01a ET Wednesday, November 19, 2014 Dear Friend of GATA and Gold: In an essay posted at Kitco, blogger Jim Otis itemizes the simple ways monetary metals mining companies could fight suppression of the price of their product in the futures markets. Otis' advice is headlined "An Open Letter to Mining Company Executives" and it's posted here: http://www.kitco.com/ind/Otis/2014-11-14-An-Open-Letter-to-Mining-Compan... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit USAGold.com. USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||

| German gold repatriation movement is going strong, Peter Boehringer tells KWN Posted: 18 Nov 2014 08:54 PM PST 11:55p ET Tuesday, November 18, 2014 Dear Friend of GATA and Gold: Contradicting propaganda from mainstream financial news organizations, German Precious Metals Society founder Peter Boehringer, a leader of Germany's gold repatriation movement, tells King World News tonight that the movement is going strong and that citizen action will return the nation's gold reserves to its own soil. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/19_I... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||

| Gold and Silver Supply Is VERY Tight! Posted: 18 Nov 2014 07:51 PM PST by Bill Holter, Miles Franklin:

| ||||||||||||||||||||||||||||

| The Gold Price Closed Up 1.16 Percent at $1,196.70 Posted: 18 Nov 2014 07:38 PM PST

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||

| This Crisis Was Foreseeable … Thousands of Years Ago Posted: 18 Nov 2014 07:35 PM PST We’ve known for 5,000 years that mass spying on one’s own people is always aimed at grabbing power and crushing dissent, not protecting us from bad guys. We’ve known for 4,000 years that debts need to be periodically written down, or the entire economy will collapse. And see this. We’ve known for 2,500 years that prolonged war bankrupts an economy. We’ve known for 2,000 years that wars are based on lies. We’ve known for 1,900 years that runaway inequality destroys societies. We’ve known for thousands of years that debasing currencies leads to economic collapse. We’ve known for millennia that torture is a form of terrorism. We’ve known for thousands of years that – when criminals are not punished – crime spreads. We’ve known for hundreds of years that the failure to punish financial fraud destroys economies, as it destroys all trust in the financial system. We’ve known for centuries that monopolies and the political influence which accompanies too much power in too few hands are dangerous for free markets. We’ve known for hundreds of years that companies will try to pawn their debts off on governments, and that it is a huge mistake for governments to allow corporate debt to be backstopped by government. We’ve known for centuries that powerful people – unless held to account – will get together and steal from everyone else. We’ve known for hundreds of years that standing armies and warmongering harm Western civilization. We’ve known for 200 years that allowing private banks to control credit creation eventually destroys the nation’s prosperity. We’ve known for two centuries that a fiat money system – where the money supply is not pegged to anything real – is harmful in the long-run. We’ve known for 200 years that a two-party system quickly becomes corrupted. We’ve known for over a century that torture produces false and useless information. We’ve known since the 1930s Great Depression that separating depository banking from speculative investment banking is key to economic stability. See this, this, this and this. We’ve known for 80 years that inflation is a hidden tax. We’ve known for 79 years that war is a racket that benefits the elites but harms everyone else. We’ve known since 1988 that quantitative easing doesn’t work to rescue an ailing economy. We’ve known since 1993 that derivatives such as credit default swaps – if not reined in – could take down the economy. And see this. We’ve known since 1998 that crony capitalism destroys even the strongest economies, and that economies that are capitalist in name only need major reforms to create accountability and competitive markets. We’ve known since 2007 or earlier that lax oversight of hedge funds could blow up the economy. And we knew before the 2008 financial crash and subsequent bailouts that:

Postscript: Those who fail to learn from history are doomed to repeat it … and we’ve known that for a long time.

| ||||||||||||||||||||||||||||

| Precious Metals: Timing and flexibility is the key to a successful trade Posted: 18 Nov 2014 07:04 PM PST Background Gold has not glistened since the summer of 2011 when a substantial rally took it to an all-time record price of $1900/oz. Since then however it has been a one way trek south punctuated by an occasional weak rally or head fake. Gold’s inability to sustain a meaningful move to higher ground has been damaging to any portfolio that has acquired gold, silver or the associated mining stocks over the last 3 years or so. Gold’s bull market lasted for 10 years from 2001 to 2011 before its rally came to an end. One can be forgiven for expecting such a rally to continue indefinitely as the same data which supported the precious metals surge were more or less still in place. Gold’s fall from grace can be attributed to | ||||||||||||||||||||||||||||

| This is Real and It's Happening with Breathtaking Speed Posted: 18 Nov 2014 05:50 PM PST By: Chris at www.CapitalistExploits.at I've long since argued that democracy isn't necessary for prosperity. Rather than railing against democracy I merely am making the point that economic liberty is more important to wealth creation than political liberty. It is a market economy that is the key to unlocking wealth. The reason this is so is because humans are, well, human.

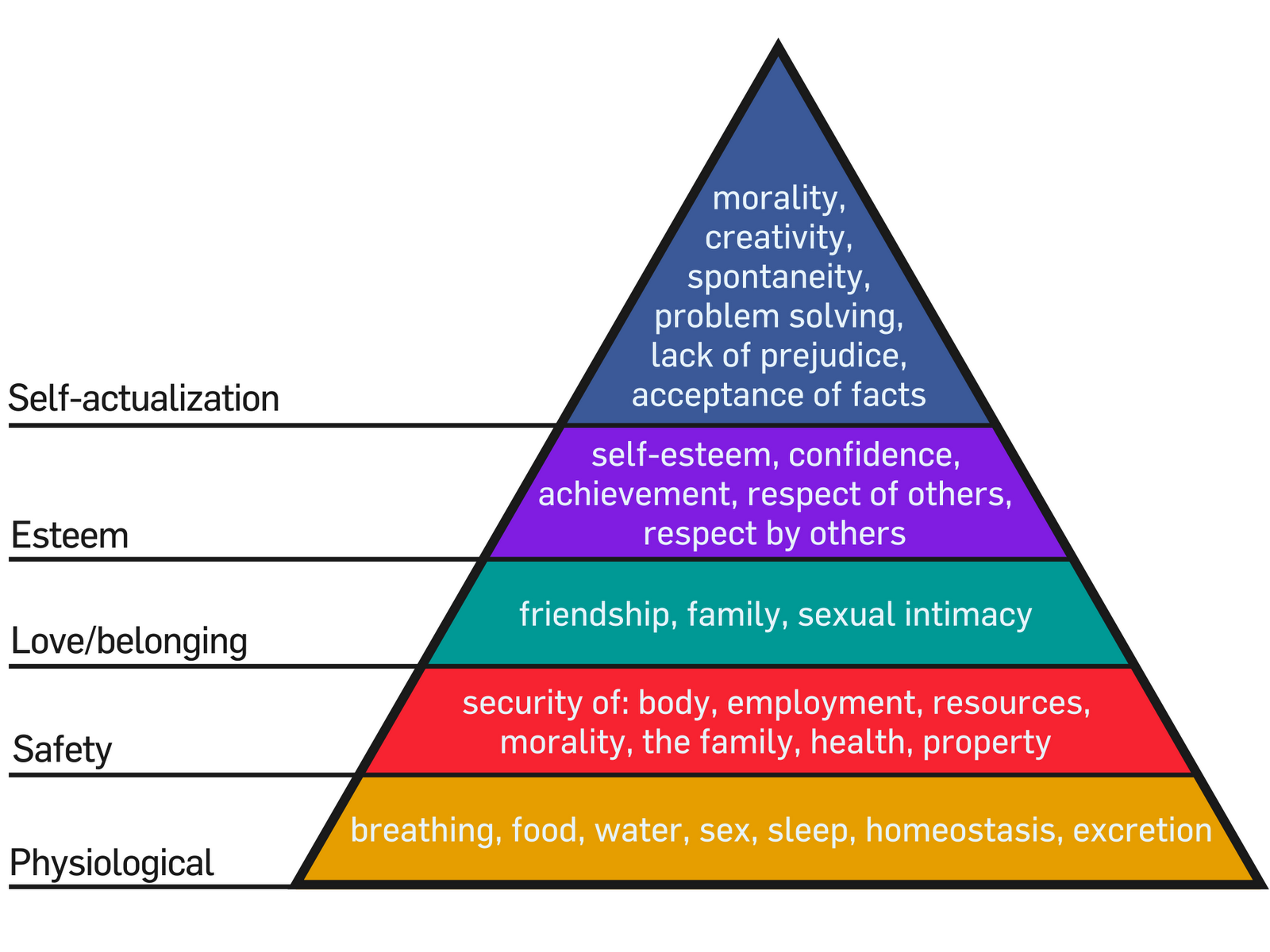

Part of being human involves looking out for our own best interests, and accordingly Maslow's hierarchy of needs provides a good starting point. Any system that halts the progress of any stage in the above diagram will simultaneously halt wealth creation and any system that assists or allows humans to pursue their own needs, ideas, passions and wants will foster wealth creation. Over the last 100 years or so Europeans and Americans have been fortunate enough to have been born with their bum in the butter so to speak. They have enjoyed:

This superior status has led to all sorts of ludicrous assumptions being made from those who typically know little of history, geopolitics and economics, which typically includes congress, the Troika and entire swathes of the media fed populace. It is how once great powers wither into the dust bowl of history. The populace blissfully unaware of what has happened, or worse yet believing that something has happened to make their lives miserable which is completely divorced from reality. The media is so astonishingly powerful over a populace fast asleep and trusting. I present one such example: I still come across people telling me about global warming. Haven't they heard of climate gate? Haven't they figured out that Al Gore duped the world? Yes, the ice caps are safe and smiling polar bears are to be found frolicking with their little cubs. Turn the heat up. Looking at the recent G20 meeting it's astonishing that an air of superiority remains. You can see it written all over the faces of western leaders: "We do things differently" or "we're smarter, more sophisticated, it's in our genes". I can see how it happens. I recall the first time I visited the Pyramids in Giza. I thought to myself, how the hell did Egyptians build these amazing buildings when today they clearly can't put up anything that will last more than a few short years? The place is now falling apart. I'm sure at some point Egyptians were nodding appreciatively to one another over a hooka pipe saying "We're Egyptian, of course we're smarter, of course we're better". This is what is happening in the West today. Try starting up and running a new business in Europe. Heck, I've a friend who is simply trying to build a home. When you see the enormous barriers to economic activity you begin to understand how this happens. By the time you've complied with the hundreds of asinine laws, hired yourself your tradespeople who typically can only now do very specific jobs, for fear of being caught wiring a plug without the correct license to do so, then it's not hard to see how Europe is decaying with such breathtaking speed. The punitive tax system together with regulation of staggering magnitude have quenched any entrepreneurship, while concessions for what is left are awarded to large corporations in multiple fields of activities. The ability for small business, which is coincidentally the lifeblood of any and every vibrant economy, is stymied. The truth, as always, lies in the facts. The West is in its death throes and we see this in Western powers pressuring Russia or striking out in the Middle East. This is an attempt to remain relevant and establish hegemony. Why this desperation? Consider that in 1990 the combined GDP of the G7 countries stood at US$14.4 trillion. At the same time the "emerging 7" (China, India, Russia, Brazil, Indonesia, Mexico and South Korea) sported a GDP of US$2.3 trillion. Last year the figures stood at US$32 trillion for the G7 and US$35 trillion for the "emerging 7". These are massive global shifts that are taking place right in front of us. What this looks like in 10, 20 years time is a factor of that which it is today. Within 15 years the Asian middle class alone will make up over 2/3rds of the global middle class. Today it is 1/3rd. Our friend Doug Casey likes to joke that Europeans are going to be predominantly used as housemaids for the Chinese. When he says it in front of Europeans and Americans they still laugh. They shouldn't. It's happening. Western politicians, as thick as they may be, can see their power ebbing away at every turn and their reaction has been to drive the dagger deeper into their economies increasing regulation, cramping entrepreneurship, raising taxes, taking on obscene debt loads and centralizing rather than decentralizing their economies. Consider the points 1 through 5 I've made above.

The fact is that the West used to be superior to the rest of the world but the competitive advantage has eroded substantially. At the same time emerging economies have embraced the market economy, strengthened judicial systems, enhanced education and most importantly of all managed to increasingly get out of the way of individuals looking to transact with one another. Gratefully the world is an incredibly multi cultural place and with a little effort we can invest globally, we can domicile globally and in many instances live in places which please us and these various choices need not be the same. When it comes to investing capital the trends in motion are hard to ignore and this is but one reason that we're focused on emerging markets and Asia in particular. Given the balance of world population together with the growth and increasing dominance of the emerging markets it is I believe pure folly to ignore. - Chris

"History is filled with the sound of silken slippers going downstairs and wooden shoes coming up." - Voltaire | ||||||||||||||||||||||||||||

| 60% Of Households Get More Benefits Than They Pay In Taxes Posted: 18 Nov 2014 05:15 PM PST Authored by Mark Perry at AEI via Contra Corner blog, The Congressional Budget Office (CBO) just released its annual report on “The Distribution of Household Income and Federal Taxes” analyzing data through 2011 on American household’s: a) average “market income” (a comprehensive measure that includes labor income, business income, and income from capital gains), b) average household transfer payments (payments and benefits from federal, state and local governments including Social Security, Medicare and unemployment insurance), and c) average federal taxes paid by households (including income, payroll, corporate, and excise taxes). Some additional analysis and commentary will be provided here that reveal a yet-to-be discussed major implication of the CBO report – almost the entire burden: a) of all transfer payments made to American households and b) of all non-financed government spending, falls on just one group of Americans – the top one-fifth of US households by income. That’s correct, the CBO study shows that the bottom three income quintiles representing 60% of US households are “net recipients” (they receive more in transfer payments than they pay in federal taxes), the second-highest income quintile pays just slightly more in federal taxes ($14,800) than it receives in government transfer payments ($14,100), while the top 20% of American “net payer” households finance 100% of the transfer payments to the bottom 60%, as well as almost 100% of the tax revenue collected to run the federal government. Here are the details of that analysis. The figures in the graph above show the amount of federal taxes paid by the average household in each income quintile minus the average amount of government transfers received by those households in 2011. For each of the three lower income quintiles, their average government transfer payments exceeded their federal taxes paid by $8,600, $12,500, and $9,100 respectively, and therefore the entire bottom 60% of US households are “net recipients” of government transfer payments. Averaged across all three lower income quintiles, we could say that the lowest 60% of American households by income received an average transfer payment of about $10,000 in 2011. And because the government has no money of its own, where did those transfer payments come from to finance the “net recipient” households? Where else, but from the top two income quintiles, and realistically almost exclusively from Americans in the highest quintile. Specifically, the average household in the fourth quintile paid slightly more in federal taxes ($14,800) than it received in transfer payments ($14,100) in 2011, making the average household in the second-highest income quintile a “net payer” household in the amount of $700 in 2011. Basically, households in the fourth income quintile paid enough in taxes to cover their transfer payments, and then made a minor contribution of $700 on average to help cover the transfer payments of the “net recipient” households in the bottom 60% and make a small contribution to the federal government’s other expenditures. But the major finding of the CBO report is that the households in the top income quintile are the real “net payers” of the US economy. The average household in the top one-fifth of American households by income paid $57,500 in federal taxes in 2011, received $11,000 in government transfers, and therefore made a net positive contribution of $46,500. The second-highest income quintile basically just barely covers its transfer payments, so it’s really the top 20% of “net payer” households that are financing transfer payments to the entire bottom 60% AND financing the non-financed operations of the entire federal government. Here’s another way to think about the burden of the “net payer” top income quintile. The average household in that income quintile made a contribution net of transfers in 2011 in the amount of $46,500. That would be equivalent to the average household in the top quintile writing four checks: 1) one check in the amount of $8,600 that would cover the average net transfer payments of a household in the bottom quintile, 2) another check for $12,500 to cover the average net transfers of a household in the second lowest quintile, 3) a third check in the amount of $9,100 to cover the average net transfer payments to a household in the middle income quintile, and 4) then finally writing a check for the balance of $16,300 that would go directly to the federal government, which for the households in the quintile as a whole would have covered almost 100% of the non-financed federal government spending in 2011. So except for a small contribution net of transfers in the amount of $700 from the average household in the fourth quintile, the highest income quintile is basically financing the entire system of transfer payments to the bottom 60% AND the entire operation of the federal government. And yet don’t we hear all the time that “the rich” aren’t paying their fair share of taxes and that they need to shoulder a greater share of the federal tax burden? Hey, they (the top 20%) are already shouldering almost the entire federal tax burden along with almost the entire system of entitlements and transfer payments! And that’s not “fair” enough already? The chart above shows another way that the CBO data reveal an extremely unequal distribution of government transfer payments and federal taxes by displaying the ratio of “dollars received in government transfers per dollar paid in federal tax revenues” by income quintile in 2011 (these data are from row 8 in the table above). The average household in the lowest quintile received $9,100 in government transfer payments in 2011 and paid only $500 in federal taxes, for a ratio of $18.20 in transfer payments for every $1.00 paid in federal taxes that year. In contrast, the average household in the top income quintile received $11,000 in government transfers in 2011, but paid $57,500 in federal taxes, for a ratio of 19 cents in government transfer payments per dollar paid in federal taxes. This analysis is a further illustration that the bottom three quintiles are “net recipient” households that received more than $1 in government transfer payments for every $1 paid in federal taxes in 2011, while households in the fourth quintile were minor “net payers” in 2011 and received slightly less than a dollar in transfer payments on average ($0.95) for every $1 paid in federal taxes. “Net payers” in the top quintile received only $0.19 in government transfer payments per $1 paid in federal taxes in 2011. This final chart shows average tax rates by quintile in 2011, both before and after government transfer payments. The blue bars in the chart show the average tax rates by income quintile from the CBO report (Table 4) and are also displayed in the top table above in row 5, calculated by dividing federal taxes paid (row 4) into “Before Tax Income” (row 3, Market Income + Government Transfers). Adjusting for government transfers received, the brown bars in the chart are calculated by dividing “federal taxes paid minus government transfers received” (row 6 in the table) into Before-Tax Income (row 3), and show average tax rates by income quintile after government transfers. For example, the average “net recipient” household in the lowest income quintile received a “negative tax” payment of $8,600 in 2011, had an average before-tax income of $24,600, for a negative tax rate of 35%. Reflecting their “net recipient” status, all three lower income quintiles had negative average tax rates in 2011, and only the “net payer” households in the top two income quintiles had positive after-transfer tax rates of 0.7% for the second-highest quintile and 18.9% for the top quintile. This further demonstrates that after transfer payments, households in the bottom 60% are “net recipients” with negative income tax rates, while only the top two “net payer” income quintiles had positive tax rates after transfers in 2011……. | ||||||||||||||||||||||||||||

| Harry Dent : Greatest Debt Bubble Doom In Our History Posted: 18 Nov 2014 05:13 PM PST Alex Jones talks with expert economist Harry Dent about the coming economic collapse and how to prepare for it. In his book The Great Boom Ahead, published in 1992, Mr. Dent stood virtually alone in accurately forecasting the unanticipated "Boom" of the 1990s. Today he continues to... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||

| Coast To Coast AM - November 17, 2014 Machinations Of The Illuminati Posted: 18 Nov 2014 04:43 PM PST Coast To Coast AM - November 17, 2014 Machinations Of The Illuminati The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||

| Why the BIGGEST Stock Market Crash in History Can't be Avoided! Posted: 18 Nov 2014 02:59 PM PST Systematically, our politicians have not only been complacent to the criminality of the technocratic elite, they're been a party to this! We don't even have to wait for a derivatives COLLAPSE. There is a guaranteed COLLAPSE due to economic fundamentals. Simply put, there is not enough money coming... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||

| Swiss Gold Referendum: Impressions Of The Latest TV Debate Posted: 18 Nov 2014 02:58 PM PST Past Friday, a TV debate was broadcasted in Switzerland about the gold referendum. The debate was organized by the Swiss channel SRF. The full show is available online: Abstimmungs-Arena: Gold-Initiative (mind this is in Swiss and there is no transcript or summary available in English). It was mainly a political debate mainly. On the pro-side of the debate was Lukas Reimann and Ulrich Schlüer. Mind that the young guy Lukas Reimann was recently lecturing the Parliament about Rothbard’s theories. On the contra-side was Finance Minister Eveline Widmer-Schlumpf and National Councillor Karin Keller-Sutter. The discussion by the featured guests was interspersed wih comments from citizens who were attending in the studio. Claudio Grass, Managing Director at Global Gold Switzerland, provided some comments on the TV debate. He first noted that the authorities are increasingly showing a “need” to use the government owned TV stations to push the message that the gold backing would be a big mistake. He feels that authorities are becoming increasingly nervous. Moreover, based Karin Keller-Sutter seemed to have some concerns about the macro situation, based on the opinions she expressed, but she clearly does not understand how the monetary system works and how the ongoing wealth destribution works. Another impression worth sharing was that Claudio Grass had heard from several people that they were not able to join the studio (the Arena). It is a pitty because they were very well informed about the matter, with a good understanding of Austrian Economics and the monetary system. Those were the people between the audience who would have been able to comment insightfully. It feels like those type of people were not really welcome. The polls from a month ago still reflect the status between yes and no voters: approximately 45% are pro and 39% against the gold initiative. Also, a recent study revealed that the lower the citizens in the hierarchy, the more they are in favour of the gold initiative. In closing, Claudio Grass brought up the point that the Swiss people are already the big winners, whatever the outcome of the votes. Over the last few weeks and months, the Swiss citizens have opened their mind towards gold, its fundamental value, the monetary system and the wealth redistribution issues. Even with a “no” vote, the referendum will prove to be a good starting point with an increasing number of people questioning the monetary system and the policy of its central planners. Listen to the full interview, courtesy of The Daily Coin: | ||||||||||||||||||||||||||||

| How Gold And Silver’s Price Decline And Short Covering Was Manufactured Posted: 18 Nov 2014 02:23 PM PST This is an excerpt from Ed Steer’s daily gold and silver newsletter (recommended to subscribe): The analysis by Ted Butler of last week’s Commitment of Traders Report (for the period Wednesday November 5th till Tuesday 11th) revealed an usual evolution.

Commercials induced the selling and it was followed by short covering, as is always the case according to Ted Butler. The big difference is that the large commercials have not been acting in accordance with the small commercials. Let’s revisit the manipulation mechanism which Ted Butler has explained a while ago on this site in JP Morgan's Perfect Silver Manipulation Cannot Last Forever (October 2013):

Now let’s fast forward to today. It is key to watch the futures positions from JP Morgan. Interestingly, JP Morgan seems to have reduced its silver short positions to a historical minimum. This is also from Ted Buter’s latest commentary (November 15th):

You got the point? Watch how JP Morgan will add or not to their short positions as prices start rising to know how much fuel the rally has. | ||||||||||||||||||||||||||||

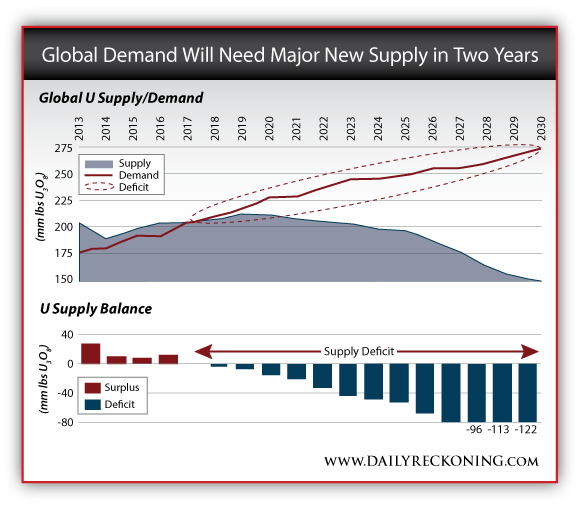

| 2 Ways to Play the Coming Return to Nuclear Power Posted: 18 Nov 2014 01:51 PM PST This post 2 Ways to Play the Coming Return to Nuclear Power appeared first on Daily Reckoning. [Ed. Note: The global return to nuclear power appears to be building to an unstoppable trend. By investing in uranium plays now, investors could see big gains as demand for yellowcake returns to pre-2011 levels. Byron King explains in detail, below, and relates some eye-opening facts he learned from the 40th New Orleans Investment Conference.] I was on the road last month, visiting companies and scrubbing ideas. At one point, the airliner landed at Louis Armstrong New Orleans International Airport (MSY). Next thing I knew, I was at the Hilton Hotel, where Poydras and Canal Streets meet the Mississippi River, attending the 40th New Orleans Investment Conference; aka the "Gold Conference," started by the late, great guru of precious metals, Jim Blanchard… Looking back, during years when precious metals were red hot, and buyers felt richer every day/week/month, the Blanchard Gold Conference pulled attendance in the range of 5,000 investors. Blanchard packed 'em in, to be sure. "Laissez les bon temps roullez," as they say down in the Big Easy. Let the good times roll. Everybody loves winners, right? But this year, attendance at the Gold Conference was under 1,000, by my eyeball view of the crowd. Of course, investor morale is low across the hard asset space; it's difficult to find many recent winners in this particular investment arena. After all, we've endured three years of price declines and stagnation for physical gold, silver, platinum and more; "real" metal isn't making much money for long-term holders. Then again, one holds physical metal long-term for wealth protection, too. "… globally, there's no U.S.-style gas glut. Energy is dear in most places." Despite the attendance decline, this year's Gold Conference drew a high-quality audience — savvy, knowledgeable investors, including many of my readers who walked up to say hello. It was truly a pleasure to talk with people in New Orleans, to get a feel for what they believe is important, and where they hope to go with the markets. Up on stage, this year's Gold Conference did not lack for great speakers. The roster included an array of presenters, ranging from "marquee" names like columnist Charles Krauthammer and former Fed Chairman Alan Greenspan; to other well-known movers and shakers in the resource space, like Rick Rule and Doug Casey. Plus, the Gold Conference boasted a long list of superb writers and investment advisers, like Mark Skousen and Frank Holmes. Other speakers included executives and technical staff from exhibitor companies, with many truly insightful comments on what they see from their end of the development and supply chain. I picked up many great takeaway ideas at the Gold Conference. There's plenty to tell you; but for this note, let's focus on one very beaten down, but promising, sector. As with the gold sector, share prices for uranium companies have suffered in the past three years. The trigger was the Fukushima disaster in Japan, in March 2011, which pushed investments in nuclear power over a cliff. That is, post-Fukushima, everybody in the world who deals with nuclear power had to look hard in the mirror, and perform a top to bottom review to determine if any of Japan's problems might impact their own situation. Quite a bit of new investment simply froze in place, if it wasn't cancelled. As you can imagine, this hiatus extended to the exploration and development side of the uranium yellowcake business. Now, apparently, after three-plus years, the Fukushima logjam is beginning to break, as I'll discuss in a moment. Let's begin with some overarching facts:

Here in the U.S., with our recent abundance of natural gas from fracking, it's easy to allow these important facts about nuclear power to fade into background. Yet globally, there's no U.S.-style gas glut. Energy is dear in most places. In Japan, for example, utility companies pay over $17 per thousand cubic feet (mcf) for liquefied natural gas (LNG), versus about $3.75 per mcf at the wellhead for gas here in the U.S. In other words, countries without ample gas supplies pay big bucks for energy, and thus still have their eye on nuclear power. Indeed, Japan is on the cusp of reopening many of its closed nuclear plants in the next two years. Globally, the installed nuclear base is large, very significant and growing — if not vital to the energy supply of certain nations. Pull the plug on nuclear power, and lights will start going out in many places. Now consider that each nuclear reactor has a useful life of 50 to 80 years. It's clear that there's future uranium demand well through this century. How much? And are current mining operations and supply chains sufficient to feed these nuclear units? Consider this chart, from one of the New Orleans convention's most intriguing up and comers… As you can see from the chart, current supplies of uranium are destined to go into deficit, as against demand, by 2017. That's a mere two years from now, which is essentially nothing in the time span of exploration, development, permitting and production — especially for anything nuclear. Indeed, we've recently seen movement in the "spot price" of yellowcake. Prices moved from the $28 range, per pound, to over $35 — a 25% move in a matter of months. Meanwhile, in the much larger "contract" space (outside the daily-reported spot pricing regime), several producers report higher long-term prices for yellowcake. What does this mean for uranium producers? Well, it's always dangerous to "call a bottom," so to speak, but I believe we've seen it for uranium. Looking forward, I foresee a recovery in uranium pricing and share prices for producers — although it's hard to predict the pace. Some things simply happen in their own way. As for investments, consider Cameco (CCJ: NYSE), for example. Shares trade in the $16.50 range, just off a 52-week low, and far below five-year numbers. Note, however, that Cameco earnings more than support the dividend, which is a not-bad 2.1% just now. It's worth buying Cameco shares at these levels, in anticipation of the market perception catching up to reality in the industrial space. Or look at Uranium Energy Corp (UEC: NYSE). Shares trade just over $1.00, slightly more than the 52-week low and far off of past highs. In the past few years, UEC was the only truly new producer to hit the market, with its in situ recovery (ISR) system in the "roll front" deposits of central and eastern Texas. Right now, UEC shows nominal losses, but the fact is that management has determined not to sell perfectly good uranium yellowcake at distress prices. Looking ahead, those prices will improve and benefit UEC. In uranium, as with miners of many elements across many sectors, share prices have been beaten down, with tough losses to many an investor. It's been extremely frustrating, to be sure, yet the pain in the mining space has also served to shake out many a weak hand — certainly amongst the surviving "junior" firms. Out in the small cap side of the mining space — the junior explorers and developers, many of whom were at the Gold Conference last week — survivors are hanging on by their fingernails. But do you know what? That's actually a very good thing, if you have a long-term horizon. "Globally, the installed nuclear base is large, very significant and growing…" That is, these are guys who know how to pinch pennies. There's no fat on any bones, so to speak. The groups that still stand have money, can raise money, have assets, have released strong exploration or development news, have solid management and technical teams, have a strong and patient business plan, have tight share structure, and/or patient money backing them, and several other in-the-weeds strong points. All in all, there's hope across the hard asset space, but we're seeing good things take root in the uranium side, earlier than others. Yes, I know…. share prices have been beaten down and are low. Yet, as I discussed above, now is a good time to add uranium to your positions, to bulk up on previous purchases, and to watch the space with a keener eye for more promising developments. Things are getting better, it appears. Best wishes… Byron W. King Ed. Note: Ever wonder how you can make a lot of money from oil without owning a well? Or whether or not you should buy gold and silver? Or whether fracking is just a “flash in the pan” idea? Get insight, insider scoops and actionable investment tips twice a week with Daily Resource Hunter? Just click here for a FREE subscription! The post 2 Ways to Play the Coming Return to Nuclear Power appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Close But No Cigar Posted: 18 Nov 2014 01:48 PM PST | ||||||||||||||||||||||||||||

| Greatest Opportunity In The War In The Gold & Silver Markets Posted: 18 Nov 2014 12:37 PM PST  Today KWN is putting out a special piece which features two remarkable charts revealing the greatest opportunity in the war in the gold and silver markets. These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the two key charts along with his commentary. Today KWN is putting out a special piece which features two remarkable charts revealing the greatest opportunity in the war in the gold and silver markets. These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the two key charts along with his commentary.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||

| NAV Premiums of Certain Precious Metal Trusts and Funds - Ukraine Admits Its Gold Is Gone Posted: 18 Nov 2014 12:21 PM PST | ||||||||||||||||||||||||||||

| Posted: 18 Nov 2014 11:02 AM PST Graceland Update | ||||||||||||||||||||||||||||

| How the Private Bankers Are Using the Financial Crisis to Reshape World Government | Murphy Posted: 18 Nov 2014 11:00 AM PST Archived from the live Mises.tv broadcast, this lecture was presented by Robert P. Murphy at the Mises Circle in Houston on 14 January 2012. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||

| One way or another, Ukraine's gold reserves have gone away Posted: 18 Nov 2014 10:23 AM PST 1:23p ET Tuesday, November 18, 2014 Dear Friend of GATA and Gold: Zero Hedge reports today that one way or another, Ukraine's gold reserves have disappeared: http://www.zerohedge.com/news/2014-11-18/ukraine-admits-its-gold-gone A report about their supposed removal from Kiev in the dead of night last March is posted at GATA's Internet site here: http://www.gata.org/node/13754 The refusal of the gold-vaulting Federal Reserve Bank of New York to disclose to GATA in March whether it had taken custody of the Ukrainian reserves is here: http://www.gata.org/node/13761 The U.S. State Department never responded to GATA's inquiry. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||

| Platinum miners realize that their metal is money Posted: 18 Nov 2014 09:54 AM PST Maybe gold miners will figure it out for their own metal eventually as well. * * * Platinum Producers Launch Trade Body to Attract Asset Investors By Arthur England JOHANNESBURG, South Africa -- The world's top platinum producers have joined forces to launch an industry promotional body on Tuesday in an effort to increase demand for the precious metal as an investment asset. The World Platinum Investment Council will be based in London and funded by Anglo American Platinum, Impala, Lonmin, and three smaller mining companies. The launch comes at a time when the industry is grappling with rising costs and a weak price environment, which is in part blamed on oversupply in the market coupled with increased recycling. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/cb2a1b7e-6e44-11e4-bffb-00144feabdc0.html... ADVERTISEMENT Own Allocated -- and Most Importantly -- Zurich, Switzerland, remains an extremely safe location for storing coins and bars of the monetary metals. If you do not own segregated physical coins and bars that you can visit, inspect, and take delivery of, you are vulnerable. International diversification remains vital to investors. GoldCore can accomplish this for you. Read GoldCore's "Essential Guide to Gold Storage In Switzerland" here: http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44 (0)203 086 9200 -- U.S.: +1-302-635-1160 -- International: +353 (0)1 632 5010 Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||

| Why the Current Global Depression Looks Nothing Like the 1930s Posted: 18 Nov 2014 09:30 AM PST This post Why the Current Global Depression Looks Nothing Like the 1930s appeared first on Daily Reckoning. [Ed. Note: Whether people know it or night, the world is in an economic depression. Today, Jim Rickards explains how that can be the case despite positive growth and declining unemployment, and why this depression looks nothing like the 1930s. Read on...] Andrew Robertson: As Joe Hockey calls on G20 leaders arriving in Brisbane to focus on growth, at least one leading economist thinks much of the world is in a depression, but we just haven't noticed yet. Jim Rickards is the author of Currency Wars and The Death of Money and I spoke with him in New York… Jim Rickards, welcome to the program again. Jim Rickards: Thank you Andrew. Andrew Robertson: We've just had the APEC meeting in China which put out a communique saying there was a strong momentum for growth in the Asia Pacific region; we've got the G20 summit in Brisbane this weekend, which will probably say a similar thing… Where do you see that growth coming from? Jim Rickards: Well it's a little difficult right now… I mean, there is a lot of potential and some good things did come out of the APEC summit. There's progress on a couple of free trade areas… there's a lowering of tariffs on technology between the United States and China… Some of the good news actually came out of a China-U.S. bilateral — meaning that was sort of following on the APEC summit. So that's the good news… The bad news is you look around the world right now… Japan has hit a wall; Europe is probably in recession, technically; the U.S. growth is much weaker than a lot of analysts assume. I know we had a couple good GDP numbers, but one of them was fraudulent (the third quarter GDP). The Commerce Department failed to make a seasonal adjustment in defense spending. So that was sort of a pre-election gimmick. And then second quarter, I think, was swollen by inventory. So, I expect the U.S. numbers will come in a lot weaker. So, you look all around the world growth is pretty weak all around the world. This is just a continuation of the global depression that we've been in since '07. Andrew Robertson: Well you talk about a "depression" but I've also heard you argue that the symptoms of that depression are being hidden by all the money printing that's going on at the moment. Can you explain that? Jim Rickards: Sure, well just on the depression point, a lot of people say, "Well hey, we've been in a recovery since 2009." And economies have been recording growth. But you can have growth in a depression. You can have declining unemployment and rising stock prices in a depression. What defines a depression is not continuous decline in growth, it's growth below potential. So if your potential is 3.5% or higher (which it is) and your actual is about 1.5% or 2% (which it is), the gap between the 3.5 and the 2, let's say, that's depressed growth. That's a depression. That's exactly what the world's in. By the way… Best John Maynard Keynes definition (I happen to think it's a good one)… But I didn't invent that, that's his definition. Andrew Robertson: When you use the word "depression" I'm sure people watching this program tonight will be thinking back to the 1930s, and also thinking we're a long way from that now, aren't we? Jim Rickards: I don't think we are at all. First all you do have to think back to the 1930s. That's the last time there was a global depression. So I think the viewers are right to kind of reflect on that. And what I hear a lot when I have this discussion is — they look at these old black and white grainy photographs of the 1930s, and they say, "Where are the soup lines?" And I tell them the "soup lines" are in Whole Foods or the upscale supermarkets, 'cause at least in the United States when you're on assistance (food stamps), they give you a debit card and you go into the fancy supermarket you like and just swipe your debit card. Now I'm not saying there shouldn't be relief; I'm not saying there shouldn't be aid. There should be in needy cases. I'm just saying the "soup lines" are now at the checkout counter in the supermarket with a debit card. So that's your 21st century soup line. Andrew Robertson: Now, you talk about economic growth, and there's been endless speculation about Chinese economic growth in recent times, and you seem to be very much a China "bear"… You argue that China's economic growth at the moment is 4% when the official figure is 7.5%. How do you get to that figure? Jim Rickards: There is a real growth story in China but it's not nearly as strong or robust as outsiders believe, and when the credit crisis hits a lot of those chickens will come home to roost. Andrew Robertson: Well given that Australia's economy is so heavily leveraged to China you must see some tough times ahead for Australia. Jim Rickards: Well, I'm very bullish on Australia. You know, I've had discussions with government officials down there and a lot of investors and businesspeople. One of Australia's problems, of course, is that there was strong demand for the Aussie dollar. It was almost a "safe haven" going back a year ago or so. And the Reserve Bank of Australia, I think, foolishly decided to join the currency wars. What happens is that the central banks become prey to the export sector and the tourism sector. We saw the same thing in Brazil earlier, and it's always a blunder. So RBA started cutting rates to cheapen the Aussie dollar… You didn't get the growth you wanted all you got was inflation, which is exactly what you would expect. So my recommendation is Australia could issue long-term bonds at very low rates. If the world wants Aussie dollar assets… give it to them. Give them bonds. But then take the money and put it to good use… Build natural gas pipelines… improved highways… I recently got back from Australia. I was in Alice and Uluru and drove 700 miles through the outback… Had a wonderful time. It's a beautiful, beautiful country. But you could use a few new roads out there. So I think there are smart things Australia could do. Andrew Robertson: Well there's a lot of people here that agree with that view. But the end of QE3 in the United States has weighed heavily on the Australian dollar. But it's the U.S. dollar that you're concerned about. And you can actually see the end of the greenback as the world's reserve currency. Jim Rickards: Well, first of all, a lot of people are trying to get out. It's easier said than done. It's one thing to say, "I want to get out of dollar hegemony." We hear this from Russia and China and the BRICS and elsewhere around the world. But it's not so easy to do, but they're all working on it… China's piling up thousands of tons of gold. I mean, there are only about 35,000 tons of official gold in the whole world, and China has bought some number — we don't know exactly what it is… But we can reasonably estimate three or four thousand tons in the last five years. That's 10% of all the official gold in the world. Russia has doubled its gold reserves… So we see concrete steps towards getting rid of the dollar. It won't happen overnight, but we're on the way. On the U.S. side… Of course, all the money printing is undermining confidence in the U.S dollar. Now, we just tapered QE3, but remember… The U.S. ended QE1 and we had to go back to QE2… We ended QE2, and we had to go back to QE3… Now that they've ended QE3, nothing has changed. I expect them to have to come back to QE4, maybe late in 2015. I certainly don't see rate increases next year. The U.S. economy is fundamentally weak. I don't know how they raise rates in the face of that weakness. They may even go to QE4 late next year, or early 2016. But there comes a time when you print that much money, you undermine confidence. Andrew Robertson: Well, Jim Rickards, as always you've given our viewers a lot to think about. Thank you very much for your time. Jim Rickards: Thanks. The post Why the Current Global Depression Looks Nothing Like the 1930s appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||

| ECB Buy Gold Bullion? Japan's Monetary Policy Dubbed "Ponzi Scheme" Posted: 18 Nov 2014 09:12 AM PST Concerns about deflation, recession and a return to the Eurozone debt crisis, may see the ECB follow Japan and print money to buy assets including shares, exchange traded funds and physical gold. Counter intuitively, gold prices fell on the quite bullish news. In marked contrast to the sharp falls gold saw on the mere rumour of small Cyprus selling their miniscule gold reserves. Such odd trading leads to continuing concerns that the precious metals markets are still being manipulated. | ||||||||||||||||||||||||||||

| Gold, Silver, Crude and S&P Ending Wedge Patterns Posted: 18 Nov 2014 09:05 AM PST Gold and silver prices have been trading in declining wedge patterns since 2011. Crude has traded in a flat to down wedge pattern for five years, and the S&P has been moving inexorably higher since early 2009 in a contracting wedge. | ||||||||||||||||||||||||||||

| Breakout Alert: Junior Gold Miner In Nevada Discovers Impressive New Gold Zone Posted: 18 Nov 2014 09:01 AM PST For several weeks I have been expecting a major secular bottom in precious http://goldstocktrades.com/blog/2014/09/23/strong-accumulation-may-follow-selling-capitulation-in-junior-gold-miners/ For about the two past months, we have witnessed panic selling in precious Canamex Resources (CSQ.V or CNMXF) was affected by the capitulation as it 2014 on great results from its high grade Bruner Gold Project in Nevada. Canamex just announced drill results and have just discovered a new gold Canamex President Greg Hahn said in the news release, “The discovery of See the full news release by clicking on the following link: I expect Canamex to regain the 200 day moving average at $.14 as the precious metals sector bottoms and could breakout $.25 in 2015. Remember Hecla (HL) and Gold Resource Corp (GORO) who are both shareholders and current producers on the NYSE may soon take a run for the whole company. M&A is increasing and Canamex may be one of the best takeout targets in Nevada. See my last interview with Canamex (CSQ.V or CNMXF) President Greg Hahn by https://www.youtube.com/watch?v=oeAAlJzNkLE

Disclosure: I am a shareholder and the company is a website sponsor. I may ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… To send feedback or to contact me click here… Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. | ||||||||||||||||||||||||||||

| The Stunning Reason Why Silver Is Set To Skyrocket Posted: 18 Nov 2014 08:48 AM PST  Today an acclaimed money manager spoke with King World News about the stunning reason why the price of silver is set to skyrocket, and what he had to say will shock KWN readers around the world. Stephen Leeb also discussed what this means for investors who are positioned in physical silver and the companies that mine silver. Today an acclaimed money manager spoke with King World News about the stunning reason why the price of silver is set to skyrocket, and what he had to say will shock KWN readers around the world. Stephen Leeb also discussed what this means for investors who are positioned in physical silver and the companies that mine silver.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||

| Posted: 18 Nov 2014 08:00 AM PST … or at least one of the major reasons why the “gold-backed U.S. dollar” post-World War II monetary system met with a speedy demise in 1971 after the U.S. government embarked on a “guns and butter” spending spree back in the 1960s. Courtesy of Nick Laird at Sharelynx who once again has managed to produce a [...] | ||||||||||||||||||||||||||||

| Posted: 18 Nov 2014 07:26 AM PST “History shows again and again how nature points out the folly of man” –Blue Oyster Cult, Godzilla I would have written off the gold sector long ago in its ongoing bear market had I thought for one moment that gold’s utility as insurance against the acts of monetary madmen/women in high places had been compromised in any way. On the contrary, the monetary metal is simply having its price marked down in a bear market while its value, especially given its current price and all that has gone on in the financial system over the last 3 years remains just fine. | ||||||||||||||||||||||||||||

| NWO and the United States: hiding in the mountains for the Apocalypse Posted: 18 Nov 2014 06:39 AM PST Revelation 6:15 says, And the kings of the earth, and the great men, and the rich men, and the chief captains, and the mighty men, and every bondman, and every free man, hid themselves in the dens and in the rocks of the mountains. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Today KWN is putting out a special piece which features two remarkable charts revealing the greatest opportunity in the war in the gold and silver markets. These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the two key charts along with his commentary.

Today KWN is putting out a special piece which features two remarkable charts revealing the greatest opportunity in the war in the gold and silver markets. These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the two key charts along with his commentary. I mentioned earlier that I wanted to revisit the current GOFO rate situation and also the huge anomaly which occurred on the COMEX not once, but two days in a row to end last week. I have written several times regarding "GOFO" which is the lease rate for London gold. The last time I did this was back in May of this year, rather than writing another explanation I will copy and paste what was written then. I will comment further after the

I mentioned earlier that I wanted to revisit the current GOFO rate situation and also the huge anomaly which occurred on the COMEX not once, but two days in a row to end last week. I have written several times regarding "GOFO" which is the lease rate for London gold. The last time I did this was back in May of this year, rather than writing another explanation I will copy and paste what was written then. I will comment further after the

No comments:

Post a Comment